Rowsley Ltd. Annual Report 2016

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report (Jan 2011—Mar 2012)

FOOTBALL ASSOCIATION OF SINGAPORE ANNUAL REPORT (JAN 2011—MAR 2012) 30th FAS ANNUAL GENERAL MEETING JALAN BESAR STADIUM 30 JULY 2012 FAS Annual Report (Jan 2011—Mar 2012) CONTENTS Page A. Significant Events 3 B. The Administraon 12 C. Standing Commiees 16 D. Affiliaon / Membership 17 E. S.League Review 22 F. Football Excellence 39 G. Grassroots & Community Outreach 63 H. Compeons 65 I. Referees 69 J. Disciplinary 80 K. Women’s Football 83 L. Medical 87 M. Appendix 91—156 (Full Results of Regional, Internaonal Compeons, Matches & Training Tours and Other Local Compeons) N. Financial Report 157—188 Page 2 F A S A n n u a l R e p o r t ( J a n 2 0 1 1—M a r 2 0 1 2 ) SIGNIFICANT EVENTS 1st January 2011—31st March 2012 INTRODUCTION 2011 marked the second year of the implementaon of the FAS Strategic Plan 2010- 2015, and FAS are pleased to inform members, partners and stakeholders, that together we have made progress in the implementaon of this Plan both on and off-the-field. On the field, our Naonal ‘A’ Team met the target of qualifying for the Third Round of the 2014 FIFA World Cup Asian Qualifiers while our Naonal Youth teams performed well in the 23rd Lion City Cup tournament that was held at the Jalan Besar Stadium in June 2011. Off the field, FAS was recognised by FIFA for its various development programmes and iniaves aimed at taking Singapore football to the next level as envisaged by our FAS Strategic Plan 2010-2015. -

Public Relations and Sport in Sabah, Malaysia: an Analysis of Power Relationships

Public Relations and Sport in Sabah, Malaysia: An Analysis of Power Relationships Che Ching Abd Latif Lai 1719445 Declaration This thesis has been composed by Che Ching Abd Latif Lai. The work the thesis embodies has been done by Che Ching Abd Latif Lai and has not been included in another thesis. Che Ching Abd Latif Lai ii Abstract The central theme of this thesis is about ‘power’. This thesis is an endeavor to explore how ‘power’ could affect the dynamic of communication and relationships between actors. Power has been chosen as the central theme as a way of building new theory about public relations as proposed by Curtin and Gaither (2005). The same thing can be seen from the sports studies literature, particularly in the relationship between the three main actors in sports; NGB, Media and Sponsors. The investigation of public relations activities in sports is due to the fact, as shown in the sports studies literature, that there was a lack of recognition of the role of public relations in sports. To provide answers for the above aims, this thesis employed the critical, cultural research approach. Bourdieu (1991) conception of capital together with Berger’ (2005) dimension of power relations were used to frame the study. Using a semi-structured interviews, data of this research gathered from respondents based on a purposive sampling technique. The data was analysed using a thematic analysis approach where seven central themes emerged. The findings in this research suggest that power or capital does affect the dynamics of communication and relationship between actors. The implications of this thesis is that it managed to map the dimension of power relations based on the capital possessed by the actors. -

Live.Streaming-} Selangor FA X Perak TBG Live Broadcast Tv Hockey

Malaysia. Super League Selangor FA - Perak TBG Dila v Saburtalo predictions can be derived from the H2H stats analysis. You could check the H2H stats based on Dila home ground. Alternatively, you could view the past results based on Saburtalo home ground. See also: Iraklis vs Irodotos live score for In-Play soccer results. Hear sound alert whenever there is a goal or red card. Hear sound alert whenever there is a goal or red card. Iraklis vs Irodotos 1x2 odds ФК ; НОСТА; - ФК ;Нефтехимик;, 14 тур ОЛИМП-Первенства России по футболу 2018-2019 nosta2010 194 watching Live now Live Streaming PERAK TBG vs SELANGOR FA MALAYSIA SUPER LEAGUE 2018. The 2018 season is Perak The Bos Gaurus Football Club's 15th consecutive season in Malaysia Super League.The team is competing in Malaysia Super League, the Malaysia FA Cup, and the Malaysia Cup Perak TBG, Ipoh, Perak. 68K likes. Laman Media Rasmi Perak FA. Jump to. ... Perak The Bos Gaurus Channel Live. Amateur Sports Team. Arena Seladang. Media/News Company. ... FA Selangor. Sports Team. JOHOR Southern Tigers. Sports Club. PERAK All Star. Zaprešić is the home to several influential sports clubs, such as NK Inter Zaprešić football, KK Fortuna Zaprešić basketball, RK Zaprešić handball, KK Zaprešić bowling and others. [41] [42] NK Inter Zaprešić currently plays is a Lebanese football soccer club based in Zgharta which competes in the اﻟﺴﻼم زﻏﺮﺗﺎ :in the top tier Hrvatski Telekom Prva Liga . Salam Zgharta Arabic Lebanese Premier League. The clubs fan-base comes from the town of Zgharta and the region of North Lebanon. -

3 2 N D FAS Annual General Meeting 12/9/2014

ANNUAL REPORT 32nd FAS ANNUA L GENERA L MEETING 12/9/2014 Cover - Pg 48 & Pg 70 - Pg 103 Grassroots to Medical Comm.indd 1 11/1/14 11:12 AM SINGAPORE “A” TEAM MISSION Our Mission is to enhance lives by leading innovative development of competitive and recreational football in Singapore together with all our partners. VISION Our Vision is Excelling in Asia and Competing in World Football: • Our National Team succeeds at every level • Our Game is commercially viable • Our Game ethics and tradition are maintained • Our Game is growing at every level VALUES • Inclusiveness • Innovative • Openness • Teamwork • Dare FAS Annual Report (Apr 2013 - Mar 2014) Cover - Pg 48 & Pg 70 - Pg 103 Grassroots to Medical Comm.indd 2 11/1/14 11:12 AM ANNUAL REPORT April 2013 - March 2014 FAS Annual Report (Apr 2013 - Mar 2014) 1 Cover - Pg 48 & Pg 70 - Pg 103 Grassroots to Medical Comm.indd 1 11/1/14 11:12 AM FAS Annual Report (Apr 2013 - Mar 2014) 2 Cover - Pg 48 & Pg 70 - Pg 103 Grassroots to Medical Comm.indd 2 11/1/14 11:12 AM FAS Annual Report (Apr 2013 - Mar 2014) 3 Cover - Pg 48 & Pg 70 - Pg 103 Grassroots to Medical Comm.indd 3 11/1/14 11:12 AM PRESIDENT’S MESSAGE It is with great pleasure that I present to you the Football Association of Singapore’s (FAS) Annual Report for Financial Year (FY) 2013/2014. I am pleased to report that we have achieved good progress over the past year, and have fulfilled several key footballing objectives as spelt under the FAS Strategic Plan 2010-2015. -

Dopuna 11.05. Subota

Dupla Prvo Poluvreme-kraj Ukupno golova STAR BET Serbia 1 šansa poluvreme 2+ 1 X 2 1X 12 X2 1-1 X-1 X-X X-2 2-2 1 X 2 0-2 2-3 3+ 4+ 5+ 1p. Sub 16:00 3132 Mladost Lučani 2.50 3.05 2.55 Čukarički 1.42 1.31 1.45 4.20 6.20 4.65 6.30 4.35 3.05 2.00 3.25 2.95 1.75 1.95 1.93 3.55 7.30 Sub 16:00 3133 Napredak Krusevac 2.70 3.35 2.25 Radnički Niš 1.55 1.26 1.40 4.55 6.80 5.45 5.90 3.65 3.25 2.15 2.75 2.55 2.05 2.00 1.67 2.75 5.25 Sub 16:00 3134 Vojvodina 8.25 4.45 1.30 Partizan 3.10 1.15 1.03 15.0 17.0 7.00 3.90 1.90 7.00 2.30 1.78 2.55 2.05 2.00 1.67 2.75 5.25 Sub 16:00 3135 Voždovac 1.43 3.85 7.40 Bačka Palanka 1.05 1.21 2.60 2.15 4.00 5.50 15.0 14.0 1.96 2.15 7.00 2.95 1.76 1.98 1.95 3.55 7.30 Sub 16:00 3136 Dinamo Vranje 1.28 4.45 9.25 Spartak Subotica 1.02 1.16 3.25 1.88 3.70 6.60 19.0 17.0 1.80 2.20 7.80 2.80 1.85 1.96 1.83 3.25 6.50 Sub 16:00 3137 Mačva Šabac 4.65 3.55 1.60 Rad 2.12 1.23 1.14 8.25 10.0 5.25 4.30 2.55 4.90 2.02 2.28 3.00 1.71 1.93 2.00 3.70 7.75 Sub 16:00 3138 Zemun 1.30 4.15 10.0 Radnik Surd. -

Mediaportal Report

FRI 04 MARCH 2016 Mediaportal Report Utusan Malaysia (3 items) Shahrom gesa rakan hapuskan tabiat lepas gol awal Utusan Malaysia, Malaysia, Sukan 04 Mar 2016 Page 31 • Ad Value: MYR 6,897.74 • Size: 349.00 cm² • KL • Malaysia • Pihak Berkuasa Tempatan (PBT) • Language: Malay • Colour: Full Color • PR Value: MYR 20,693.22 • Language: Malay • ID: MY0025413029 View original - Full text: 304 word(s), ~1 min Discovered Brand: Majlis Perbandaran Selayang Company: Majlis Perbandaran Selayang Industry: Political & Government > Government Agency & Department & Statutory Body Category: Government-Related News > General Mentions Brand: Malaysia FA Cup Company: Football Association Of Malaysia (FAM) Industry: Sport > Football & Soccer Category: Company News > Market Support & Sponsorship News Brand: Malaysia Super League Company: Football Association Of Malaysia (FAM) Industry: Sport > Football & Soccer Category: Company News > Market Support & Sponsorship News Kecoh MPK halang penjaja berniaga Utusan Malaysia, Malaysia, Dlm Negeri 04 Mar 2016 Page 27 • Ad Value: MYR 4,684.14 • Size: 237.00 cm² • KL • Malaysia • Pihak Berkuasa Tempatan (PBT) • Language: Malay • Colour: Full Color • PR Value: MYR 14,052.42 • Language: Malay • ID: MY0025413238 View original - Full text: 256 word(s), ~1 min Discovered Brand: Majlis Perbandaran Klang (MPK) Company: Majlis Perbandaran Klang (MPK) Industry: Political & Government > Government Agency & Department & Statutory Body Category: Government-Related News > General Mentions COPYRIGHT This report and its contents are for the internal research use of Mediaportal subscribers only and must not be provided to any third party by any means for any purpose without the express permission of Isentia and/or the relevant copyright owner. For more information contact [email protected] DISCLAIMER Isentia makes no representations and, to the extent permitted by law, excludes all warranties in relation to the information contained in the report and is not liable for any losses, costs or expenses, resulting from any use or misuse of the report. -

Fas-Annual-Report-20

FAS Annual ReportAnnual Football Association Of Singapore (April 2015 - March 2016) ANNUAL Football Association Of Singapore REPORT 100 Tyrwhitt Road, April 2015 - March 2016 Jalan Besar Stadium Singapore 207542 Tel:(65) 6348 3477 / 6293 1477 Fax:(65) 6348 6477 / 6293 3728 109904 FAS AR 2015_Cover_7.5mm.indd 1 9/19/16 2:45 PM 109904 FAS AR 2015_Cover_7.5mm.indd 2 9/19/16 2:45 PM Football Association Of Singapore ANNUAL REPORT April 2015 - March 2016 FAS Annual Report (Apr 2015 - Mar 2016) 3 109904 FAS AR 2015_Cover_7.5mm.indd 2 9/19/16 2:45 PM 4 FAS Annual Report (Apr 2015 - Mar 2016) FAS Annual Report (Apr 2015 - Mar 2016) 5 PRESIDENT’S MESSAGE Since coming onboard, Sablon has been working closely with his team to identify key gaps in our system as well as practical solutions aimed at overcoming the key challenges and constraints. An enhanced youth development structure for Singapore was unveiled by Sablon in the first half of 2016. The blueprint is broken down into 11 components, which were presented in a 4-3- 3 formation, including an overall development philosophy, coach education, and specialised training and development. Some of the initiatives have already been rolled out, such as the launch of the Grassroots Coaching Manual which teaches football and life skills in a fun way to children aged six to 13, and the Elite Development Manual which will hone the Dear Members and Affiliates, technical, tactical, mental and physical abilities of youths aged between 14 and 20. Another key On behalf of the Football Association of Singapore programme introduced earlier this year is the (FAS), I am pleased to present to you our Annual Goalkeeper Academy Singapore which aims to Report for the Financial Year (FY) ended 31 March educate and train promising young goalkeepers 2016. -

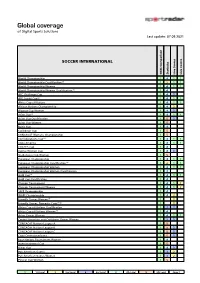

Sportradar Coverage List

Global coverage of Digital Sports Solutions Last update: 07.09.2021 SOCCER INTERNATIONAL Odds Comparison Statistics Live Scores Live Centre World Championship 1 4 1 1 World Championship Qualification (1) 1 2 1 1 World Championship Women 1 4 1 1 World Championship Women Qualification (1) 1 4 AFC Challenge Cup 1 4 3 AFF Suzuki Cup (6) 1 4 1 1 Africa Cup of Nations 1 4 1 1 African Nations Championship 1 4 2 Algarve Cup Women 1 4 3 Asian Cup (6) 1 4 1 1 Asian Cup Qualification 1 5 3 Asian Cup Women 1 5 Baltic Cup 1 4 Caribbean Cup 1 5 CONCACAF Womens Championship 1 5 Confederations Cup (1) 1 4 1 1 Copa America 1 4 1 1 COSAFA Cup 1 4 Cyprus Women Cup 1 4 3 SheBelieves Cup Women 1 5 European Championship 1 4 1 1 European Championship Qualification (1) 1 2 1 1 European Championship Women 1 4 1 1 European Championship Women Qualification 1 4 Gold Cup (6) 1 4 1 1 Gold Cup Qualification 1 4 Olympic Tournament 1 4 1 2 Olympic Tournament Women 1 4 1 2 SAFF Championship 1 4 WAFF Championship 1 4 2 Friendly Games Women (1) 1 2 Friendly Games, Domestic Cups (1) (2) 1 2 Africa Cup of Nations Qualification 1 3 3 Africa Cup of Nations Women (1) 1 4 Asian Games Women 1 4 1 1 Central American and Caribbean Games Women 1 3 3 CONCACAF Nations League A 1 5 CONCACAF Nations League B 1 5 3 CONCACAF Nations League C 1 5 3 Copa Centroamericana 1 5 3 Four Nations Tournament Women 1 4 Intercontinental Cup 1 5 Kings Cup 1 4 3 Pan American Games 1 3 2 Pan American Games Women 1 3 2 Pinatar Cup Women 1 5 1 1st Level 2 2nd Level 3 3rd Level 4 4th Level 5 5th Level Page: -

Dodatok Za 03.04. Sreda Хендикеп Хендикеп 1 Хендикеп 2 Полувреме - Крај Sport Life NBA Regular Season (Основен) 1X2 Хен

Двојна Прво Полувреме-крај Вкупно голови Sport Life Montenegro 2 шанса полувреме 2+ 1X2 1X 12 X2 1-1 X-1 X-X X-2 2-2 1X2 0-2 2-3 3+ 4+ 5+ 1п. Сре 15:30 3186 Mladost Lješkopolje 1.97 2.95 3.65 Otrant Ulcinj 1.20 1.30 1.67 - --------1.65 1.98 2.02 3.75 7.50 Двојна Прво Полувреме-крај Вкупно голови Sport Life Albania Cup шанса полувреме 2+ 1/4 финале 1X2 реванши 1X 12 X2 1-1 X-1 X-X X-2 2-2 1X2 0-2 2-3 3+ 4+ 5+ 1п. Сре 14:00 3200 KF Laçi 032.03 2.75 3.55 KF Tirana 1.21 1.34 1.62 - --------1.45 1.86 2.40 4.90 11.0 Сре 17:00 3710 Kukësi 221.92 2.90 3.65 Teuta Durrës 1.20 1.31 1.70 - - ----- - - 1.60 1.85 2.10 4.05 8.25 Двојна Прво Полувреме-крај Вкупно голови Sport Life Brazil Cearense шанса полувреме 2+ 1/2 финале 1X2 реванш 1X 12 X2 1-1 X-1 X-X X-2 2-2 1X2 0-2 2-3 3+ 4+ 5+ 1п. Чет 02:30 4269 Fortaleza CEIF 101.50 3.65 5.60 Guarany de Sobral 1.08 1.21 2.25 2.35 4.20 5.40 12.0 10.0 2.05 2.10 5.50 2.62 1.82 2.00 1.81 3.20 6.10 Двата тима Двата тима Комбиниран Тим 1 голови Тим 2 голови Комбинирани типови ППГ Sport Life даваат гол даваат гол комб. -

Newcastles News

Newcastles News Over sixty delegates from 10 different “Newcastles” gathered in Nové Hrady in South Bohemia, Czech Republic from 28 April to 4 May. We thank Mayor Vladimir Hokr and his organising team for their tremendous hospitality and for putting on a strong programme of workshops and cultural activities. The Newcastles of the World alliance emerges from the conference stronger and with clearer priorities and firm commitments for funding our future activities. Some photographic images from the conference can be seen on page 5 of this newsletter. The conference declaration is set out on page 6 and the priorities for sharing information and best practice on page 7. Information on youth activities is on page 8 but we would welcome offers from youth council members to prepare future youth pages and to maintain the youth section of our website. CHARITY fund-raiser Mike Stubbs (email - [email protected] ) is the new leader of Newcastle-under-Lyme Borough Council after his predecessor's surprise defeat in the local elections in May. The 39-year-old who works for the Royal British Legion, has only been a member of the council for two years. Meanwhile, the new Mayor of the Borough is Councillor Mrs Linda Hailstones; she takes over from Newcastles of the World veteran Councillor Eddie Boden who has completed his year. We wish them both well in their new roles. GLOBAL NEWCASTLES SET FOR TELEVISION Three of our Newcastles are to be featured in an exciting new television series called “Global Towns”. Australian television/film production company Neutral Bay Media has been commissioned to produce a new series “Global Towns” for national broadcast by Channel 9 – and Newcastle in New South Wales, together with Newcastle, South Africa and Newcastle upon Tyne, UK have been picked for the first programme! The company will also be promoting to other TV networks around the world. -

Dodatok Za 03.04. Sreda

Dupla Prvo Poluvreme-kraj Ukupno golova STAR BET Montenegro 1 šansa poluvreme 2+ 1 X 2 1X 12 X2 1-1 X-1 X-X X-2 2-2 1 X 2 0-2 2-3 3+ 4+ 5+ 1p. Sre 15:30 3181 Lovćen 4.65 3.55 1.60 Zeta Golubovci 2.07 1.21 1.12 8.50 10.0 5.20 4.25 2.55 4.85 2.00 2.28 3.00 1.67 1.98 2.05 3.85 7.40 Sre 15:30 3182 Mornar Bar 5.80 3.60 1.50 Grbalj 2.28 1.21 1.07 11.0 12.0 5.10 4.00 2.35 5.75 2.00 2.12 3.10 1.62 1.98 2.15 4.00 8.00 Sre 15:30 3183 OFK Petrovac 2.45 3.00 2.65 OFK Titograd 1.37 1.30 1.44 4.10 6.00 4.40 6.40 4.55 3.00 1.93 3.35 3.10 1.63 1.98 2.05 3.90 7.90 Sre 15:30 3184 Rudar Pljevlja 2.50 2.80 2.75 Iskra Danilovgrad 1.35 1.33 1.42 4.30 5.90 3.95 6.30 4.75 3.15 1.82 3.55 3.60 1.46 2.00 2.40 4.95 11.0 Sre 16:30 3185 Sutjeska 2.50 2.95 2.60 Budućnost P. 1.38 1.30 1.41 4.25 6.10 4.35 6.25 4.45 3.10 1.91 3.30 3.15 1.61 1.98 2.15 4.00 8.25 Oba tima Oba tima daju Kombinacije Tim 1 golova Tim 2 golova Kombinacije VG STAR BET daju gol gol kombinacije golova GG GG GG1& GG1/ 1 & 2 & T1 T1 T1 T2 T2 T2 1 & 2 & 1 & 2 & 1-1& 2-2& 1-1& 2-2& 1+I& 1+I& 2+I& GG 1>2 2>1 &3+ &4+ GG2 GG2 GG GG 2+ I 2+ 3+ 2+ I 2+ 3+ 3+ 3+ 4+ 4+ 3+ 3+ 4+ 4+ 1+II 2+II 2+II 3181 Lovćen Zeta G. -

Terengganu F.C. I

Terengganu F.C. I Jersi Terengganu FC pada musim ini masih lagi menggunakan jenama tempatan iaitu Kobert. Design jersi home bagi aku menarik ada inspirasi ala-ala jersi Juventus. Untuk jersi away pula pada bahagian atas diberikan sedikit sentuhan corak batik. Terengganu FC Kits Home. URL : https://i.imgur.com/bhwsQo6.png. Terengganu FC Kits Away. URL : https://i.imgur.com/lETGpS8.png. Terengganu FC Kits Goalkeeper Home. URL : https://i.imgur.com/AV4mx3Q.png. Terengganu FC Kits Goalkeeper Away. Kuchalana assumes no responsibility for errors or omissions in the contents on the Service. All stuff on this blog is a non-commercial purpose. 7 Komen untuk "Terengganu FC Kits 2018 - Dream League Soccer Kits". Balas. iman syamil. Terengganu Football Club , is a professional football club based in Kuala Terengganu, Terengganu, Malaysia, that competes in Malaysia Super League, the first division of the Malaysian League. Nicknamed "The Turtles", the club was founded as Terengganu Football Association in 1972, changed its name to Terengganu Football Club in 2017. Terengganu F.C. I. Connected to: {{::readMoreArticle.title}}. Terengganu F.C. I - Wikipedia Terengganu Football Club is a professional football club based in Kuala Terengganu, Terengganu, Malaysia, that competes in Malaysia Super League, the first division of the Malaysian League.Nicknamed The Turtles, the club was founded as Terengganu Amateur Football Association on 22 November 1956, changed its name to Terengganu Football Association in 1972 and Terengganu Football Club in 2018. Terengganu - Wikipedia Bahasa Melayu, ensiklopedia bebas Kerajaan كراجا ٔن. Sultan Negeri Terengganu merupakan Ketua Perlembagaan Negeri.Dibawah perlembagaan negeri, kuasa per Terengganu Football Club, is a professional football club based in Kuala Terengganu, Terengganu, Malaysia, that competes in Malaysia Super League, the first division of the Malaysian League.