WALMART INC. (Exact Name of Registrant As Specified in Its Charter) ______

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2019 Retail Outlook

RETAIL OUTLOOK 2019 TRENDS IMPACTING RETAIL M & A +1 212 508 1600 www.pjsolomon.com New York | Houston [email protected] JANUARY 2019 PJ SOLOMON GLOBAL RETAIL, CONSUMER, FOOD RETAIL & RESTAURANTS GROUPS MARC S. COOPER DAVID A. SHIFFMAN CATHY LEONHARDT [email protected] [email protected] [email protected] +1.212.508.1680 +1.212.508.1642 +1.212.508.1660 JEFFREY DERMAN SCOTT MOSES MICHAEL GOTTSCHALK GREG GRAMBLING [email protected] [email protected] [email protected] [email protected] +1.212.508.1625 +1.212.508.1675 +1.212.508.1649 +1.212.508.1674 The wave of disruption to the retail industry continues, but retailers and stakeholders now have a clearer vision of where the industry is headed. Against the backdrop of the strongest consumer market in over a decade, supported by near 50 year-low unemployment, robust consumer spending and strong 18 year-high consumer confidence, the 2018 holiday season brought healthy results for a select number of retailers, particularly those executing a strategy designed for the new world order of retailing. It also amplified the ongoing narrative of the industry’s big getting stronger – one of the themes highlighted in this paper. Despite this reasonably positive setting, we have entered 2019 amidst market volatility, a nascent trade war with China and the prospects of a slowdown in global growth, particularly in China and Europe. Any combination of such factors could once again cloud the retail sector picture and challenge retailers less prepared for change. With an eye towards these developing factors, we evaluate the trends shaping retail today and spotlight the critical themes we believe will impact retail deal-making in 2019. -

FIC-Prop-65-Notice-Reporter.Pdf

FIC Proposition 65 Food Notice Reporter (Current as of 9/25/2021) A B C D E F G H Date Attorney Alleged Notice General Manufacturer Product of Amended/ Additional Chemical(s) 60 day Notice Link was Case /Company Concern Withdrawn Notice Detected 1 Filed Number Sprouts VeggIe RotInI; Sprouts FruIt & GraIn https://oag.ca.gov/system/fIl Sprouts Farmers Cereal Bars; Sprouts 9/24/21 2021-02369 Lead es/prop65/notIces/2021- Market, Inc. SpInach FettucIne; 02369.pdf Sprouts StraIght Cut 2 Sweet Potato FrIes Sprouts Pasta & VeggIe https://oag.ca.gov/system/fIl Sprouts Farmers 9/24/21 2021-02370 Sauce; Sprouts VeggIe Lead es/prop65/notIces/2021- Market, Inc. 3 Power Bowl 02370.pdf Dawn Anderson, LLC; https://oag.ca.gov/system/fIl 9/24/21 2021-02371 Sprouts Farmers OhI Wholesome Bars Lead es/prop65/notIces/2021- 4 Market, Inc. 02371.pdf Brad's Raw ChIps, LLC; https://oag.ca.gov/system/fIl 9/24/21 2021-02372 Sprouts Farmers Brad's Raw ChIps Lead es/prop65/notIces/2021- 5 Market, Inc. 02372.pdf Plant Snacks, LLC; Plant Snacks Vegan https://oag.ca.gov/system/fIl 9/24/21 2021-02373 Sprouts Farmers Cheddar Cassava Root Lead es/prop65/notIces/2021- 6 Market, Inc. ChIps 02373.pdf Nature's Earthly https://oag.ca.gov/system/fIl ChoIce; Global JuIces Nature's Earthly ChoIce 9/24/21 2021-02374 Lead es/prop65/notIces/2021- and FruIts, LLC; Great Day Beet Powder 02374.pdf 7 Walmart, Inc. Freeland Foods, LLC; Go Raw OrganIc https://oag.ca.gov/system/fIl 9/24/21 2021-02375 Ralphs Grocery Sprouted Sea Salt Lead es/prop65/notIces/2021- 8 Company Sunflower Seeds 02375.pdf The CarrIngton Tea https://oag.ca.gov/system/fIl CarrIngton Farms Beet 9/24/21 2021-02376 Company, LLC; Lead es/prop65/notIces/2021- Root Powder 9 Walmart, Inc. -

Wal-Mart Stores Inc at William Blair & Company, LLC Growth Stock

FINAL TRANSCRIPT WMT - Wal-Mart Stores Inc at William Blair & Company, LLC Growth Stock Conference Presentation Event Date/Time: Jun. 15. 2011 / 1:00PM GMT THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us ©2011 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. FINAL TRANSCRIPT Jun. 15. 2011 / 1:00PM, WMT - Wal-Mart Stores Inc at William Blair & Company, LLC Growth Stock Conference Presentation CONFERENCE CALL PARTICIPANTS Mark Miller William Blair - Analyst Bill Simon Wal-Mart Stores, Inc. - President & CEO Walmart U.S. PRESENTATION Mark Miller - William Blair - Analyst I think I©ll go ahead and get started so as not to cut in on management©s time. For those of you that I©ve not met, my name is Mark Miller; I follow the broadlines food, drug and e-commerce space at William Blair. I©m required to inform you that for a complete list of disclosures and potential conflicts of interest please see WilliamBlair.com. Following this presentation we will have a breakout in the Bellevue Room which, I think most of you know, is through at the restaurant. It is my pleasure this morning to introduce to you the management of Walmart. Walmart has presented now at our conference for nine of the ten years that I©ve been covering the Company. Carol, I appreciate the Company is back again this year. -

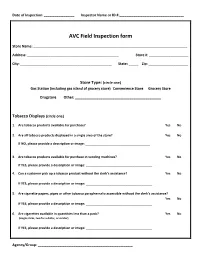

AVC Field Inspection Form

Date of Inspection: _________________ Inspector Name or ID #:____________________________________ AVC Field Inspection form Store Name: ______________________________________________________________________________________ Address: ___________________________________________________ Store #: ______________________ City: ___________________________________________________ State: _____ Zip: ______________________ Store Type: (circle one) Gas Station (including gas island of grocery store) Convenience Store Grocery Store Drugstore Other: ____________________________________________ Tobacco Displays (circle one) 1. Are tobacco products available for purchase? Yes No 2. Are all tobacco products displayed in a single area of the store? Yes No If NO, please provide a description or image: ____________________________________ 3. Are tobacco products available for purchase in vending machines? Yes No If YES, please provide a description or image: _____________________________________ 4. Can a customer pick up a tobacco product without the clerk’s assistance? Yes No If YES, please provide a description or image: _____________________________________ 5. Are cigarette papers, pipes or other tobacco paraphernalia accessible without the clerk’s assistance? Yes No If YES, please provide a description or image: _____________________________________ 6. Are cigarettes available in quantities less than a pack? Yes No (single sticks, two for a dollar, or similar) If YES, please provide a description or image: _____________________________________ Agency/Group: -

Walmart Inc. Takes on Amazon.Com

For the exclusive use of Q. Mays, 2020. 9-718-481 REV: JANUARY 21, 2020 DAVID COLLIS ANDY WU REMBRAND KONING HUAIYI CICI SUN Walmart Inc. Takes on Amazon.com At the start of 2018, Walmart faced critical decisions about its future as e-commerce continued to explode. Walmart just lost its long-held crown as the most valuable retailer in the world to online leader Amazon. With Amazon’s recent acquisition of Whole Foods for $13 billion, Amazon moved aggressively into the offline world to challenge Walmart in its biggest business, grocery. Walmart was not standing still, making moves like buying Jet.com for $3 billion in 2016. While Walmart’s U.S. e- commerce revenues grew to $11.5 billion in 2017, there was no debate in Bentonville, AR: Walmart remained far behind. The question for Walmart CEO Doug McMillon and Walmart.com head Marc Lore was how to respond to its most aggressive competitor ever (Exhibits 1a and 1b).1 Amazon The Early Years (1994–2001) Jeff Bezos founded Amazon in 1994 to exploit the Internet, still a relatively nascent technology. He determined that selling books online was most promising, because the number of titles available was greater than even the largest brick-and-mortar store could stock. Bezos and his wife drove west to start “Earth’s Biggest Bookstore” in Seattle, WA. Amazon offered 1 million titles for sale on its opening day in July 1995. Next year, the company had over 2.5 million book titles for sale, with revenue doubling every quarter (Exhibit 2). -

NOW ACCEPTING GROCERY COMPETITOR COUPONS and ALL MANUFACTURER COUPONS ARE NOW WORTH up to $1.00 Competitor Coupons

NOW ACCEPTING GROCERY COMPETITOR COUPONS AND ALL MANUFACTURER COUPONS ARE NOW WORTH UP TO $1.00 Competitor Coupons We will gladly accept grocery competitor coupons from Albertsons, Safeway, Basha’s, Fresh & Easy, Sunflower, Sprouts, Walmart Marketside, Walmart Neighborhood Market, Whole Foods, Target, AJ’s, Trader Joes, Food City and Ranch Market. All limits and restrictions apply. All competitor amount-off total order coupons will be redeemed after all other discounts and coupons have been applied, as long as the requirements of the coupon have been met. Only one competitor amount-off total order coupon from the same competitor may be used per shopping visit. Customers may use more than one Competitor. Example: A Fresh & Easy $5 off with a $50 required purchase plus an Albertsons $10 off with a $100 required purchase, for a total required purchase of $150, after all other discounts and coupons have been applied. • Competitor coupons will be accepted on identical items, no substitutions. • For competitor brand items use our comparable brand item. • Sorry, no rain checks. • We accept Print at Home Competitor coupons. o Competitor coupons printed from the internet may be printed in black & white. All Manufacturer Coupons Are Worth Up To $1.00! During this promotion we will make all paper manufacturer coupons up to $1.00, even those that state “Do Not Double” or “Not Subject to Doubling.” o Digital coupons downloaded onto a shopper’s VIP card are not subject to doubling Limit one manufacturer and one competitor coupon per item. Coupons Under $1: We will make up to three of the same coupon for like items up to $1.00. -

Bernstein's 36Th Annual Strategic Decisions

Corrected Transcript 27-May-2020 Walmart, Inc. (WMT) Bernstein Strategic Decisions Virtual Conference Total Pages: 22 1-877-FACTSET www.callstreet.com Copyright © 2001-2020 FactSet CallStreet, LLC Walmart, Inc. (WMT) Corrected Transcript Bernstein Strategic Decisions Virtual Conference 27-May-2020 CORPORATE PARTICIPANTS Brett M. Biggs Chief Financial Officer & Executive Vice President, Walmart, Inc. ..................................................................................................................................................................................................................................................................... OTHER PARTICIPANTS Brandon Fletcher Analyst, Sanford C. Bernstein & Co. LLC ..................................................................................................................................................................................................................................................................... MANAGEMENT DISCUSSION SECTION Brandon Fletcher Analyst, Sanford C. Bernstein & Co. LLC Good morning, everybody. Hi. Welcome to the Bernstein Strategic Decisions Conference. We're very happy today to have Brett Biggs join us for a second showing at the conference. Of course, he's the master of ceremonies and the CFO for Walmart, Inc., the big boss job. And I've known Brett for a long time. I have immense respect for him and the work that he and his team do all the time. Obviously Walmart has done an incredible job now and we're very happy to have them -

WALMART INC. (Exact Name of Registrant As Specified in Its Charter) ______

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 ___________________________________________ FORM 10-K ___________________________________________ ☒ Annual report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended January 31, 2020, or ☐ Transition report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 Commission file number 001-6991. ___________________________________________ WALMART INC. (Exact name of registrant as specified in its charter) ___________________________________________ DE 71-0415188 (State or other jurisdiction of (IRS Employer Identification No.) incorporation or organization) 702 S.W. 8th Street Bentonville, AR 72716 (Address of principal executive offices) (Zip Code) Registrant's telephone number, including area code: (479) 273-4000 Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol(s) Name of each exchange on which registered Common Stock, par value $0.10 per share WMT NYSE 1.900% Notes Due 2022 WMT22 NYSE 2.550% Notes Due 2026 WMT26 NYSE Securities registered pursuant to Section 12(g) of the Act: None ___________________________________________ Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No ý WorldReginfo - ddf1e3e1-b7d7-4a92-84aa-57ea0f7c6df3 Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for at least the past 90 days. -

Houchens Industries Jimmie Gipson 493 2.6E Bowling Green, Ky

SN TOP 75 SN TOP 75 2010 North American Food Retailers A=actual sales; E=estimated sales CORPORATE/ SALES IN $ BILLIONS; RANK COMPANY TOP EXECUTIVE(S) FRancHise STORes DATE FISCAL YEAR ENDS 1 Wal-Mart Stores MIKE DUKE 4,624 262.0E Bentonville, Ark. president, CEO 1/31/10 Volume total represents combined sales of Wal-Mart Supercenters, Wal-Mart discount stores, Sam’s Clubs, Neighborhood Markets and Marketside stores in the U.S. and Canada, which account for approximately 64% of total corporate sales (estimated at $409.4 billion in 2009). Wal-Mart operates 2,746 supercenters in the U.S. and 75 in Canada; 152 Neighborhood Markets and four Marketside stores in the U.S.; 803 discount stores in the U.S. and 239 in Canada; and 605 Sam’s Clubs in the U.S. (The six Sam’s Clubs in Canada closed last year, and 10 more Sam’s are scheduled to close in 2010.) 2 Kroger Co. DAVID B. DILLON 3,634 76.0E Cincinnati chairman, CEO 1/30/10 Kroger’s store base includes 2,469 supermarkets and multi-department stores; 773 convenience stores; and 392 fine jewelry stores. Sales from convenience stores account for approximately 5% of total volume, and sales from fine jewelry stores account for less than 1% of total volume. The company’s 850 supermarket fuel centers are no longer included in the store count. 3 Costco Wholesale Corp. JIM SINEGAL 527 71.4A Issaquah, Wash. president, CEO 8/30/09 Revenues at Costco include sales of $69.9 billion and membership fees of $1.5 billion. -

Feature Advertising by U.S. Supermarkets Meat and Poultry

United States Department of Agriculture Agricultural Feature Advertising by U.S. Supermarkets Marketing Service Meat and Poultry Livestock, Poultry and Seed Program Independence Day 2017 Agricultural Analytics Division Advertised Prices effective through July 04, 2017 Feature Advertising by U.S. Supermarkets During Key Seasonal Marketing Events This report provides a detailed breakdown of supermarket featuring of popular meat and poultry products for the Independence Day marketing period. The Independence Day weekend marks the high watershed of the summer outdoor cooking season and is a significant demand period for a variety of meat cuts for outdoor grilling and entertaining. Advertised sale prices are shown by region, state, and supermarket banner and include brand names, prices, and any special conditions. Contents: Chicken - Regular and value packs of boneless/skinless (b/s) breasts; b/s thighs; split, bone-in breasts; wings; bone-in thighs and drumsticks; tray and bagged leg quarters; IQF breast and tenders; 8-piece fried chicken. Northeast .................................................................................................................................................................. 03 Southeast ................................................................................................................................................................. 21 Midwest ................................................................................................................................................................... -

Battle of the Titans in Phoenix, Arizona

SPECIAL REPORT Wal-Mart Pricing ReportRound XIX Battle Of The Titans In Phoenix, Arizona Wal-Mart’s trifecta — the Supercenter, Neighborhood Market and Marketside — rules the roost in Phoenix. BY JIM PREVOR ome believe that the future of American retailing well represented in the marketplace with its Fry’s division. can be glimpsed in Phoenix, AZ. Between its large Tesco, the behemoth from across the sea, also used Phoenix as senior citizen population and large Hispanic popula- a launching grounds for its Fresh & Easy small store concept. tion, one can argue that this is what retailing in In addition to these national chain concepts, we included in America will look like in not all that many years. our comparison a strong independent: Basha’s Supermarkets. SSo we traveled down to Phoenix for the 19th iteration of our What can we surmise from the outcome of our produce pric- Wal-Mart Pricing Study, seeking not just our usual quest — the ing competition among this array of retailers in Phoenix? low price champion in one city — but also seeking enlighten- Many things to be sure, but as a first order, this: If Phoenix ment as to what the future might bring for retailing all across is the future of American retailing, and if price for a cus- the country. tomer walking in off the street is the key variable, then One thing is certain: Phoenix is, in fact, a place where a bat- the future belongs to Wal-Mart. tle of the Titans is playing out. It is the only market in America Not only was the Wal-Mart Supercenter the low price leader where one has a representation of three separate Wal-Mart con- in Phoenix, but the Wal-Mart Neighborhood Market concept cepts — the Wal-Mart Supercenter, the Wal-Mart Neighborhood came in number two, and Wal-Mart’s Marketside concept came Market and the new, small-store Wal-Mart concept known as in third! A trifecta! It hardly seems possible. -

Walmart to Acquire Bonobos for $310 Million in Cash

June 19, 2017 Walmart to Acquire Bonobos for $310 Million in Cash 1) Walmart announced the signing of an agreement to acquire Bonobos, Inc., a leading apparel brand built on the Internet, for $310 million in cash. 2) Following the closing, Bonobos will report to Marc Lore, President and CEO of Walmart U.S. eCommerce. The Bonobos and recently-acquired ModCloth brands will be offered on Jet.com and in a variety of countries over time. 3) The acquisition, subject to regulatory approval, is expected to close toward the end of the second fiscal quarter this year, or the beginning of the third quarter. 4) Bonobos offers a young and loyal male millennial customer base, which is less price-sensitive and focuses greatly on quality. 5) Although the acquisition is likely to hurt profitability slightly in the short term, it can offer major benefits over the long term as Walmart scales up the brand. Walmart Enters into Agreement to Acquire Bonobos Walmart announced the signing of an agreement to acquire Bonobos, Inc., a leading apparel brand built on the Internet, for $310 million in cash. Following the closing, Bonobos will report to Marc Lore, President and CEO of Walmart U.S. eCommerce. The Bonobos brand and recently-acquired ModCloth will be offered on Jet.com and in a variety of countries over time. The acquisition, subject to regulatory approval, is expected to close toward the end of the second fiscal quarter this year, or the beginning of the third. Deborah Weinswig, Managing Director, Fung Global Retail & Technology [email protected] US: 917.655.6790 HK: 852.6119.1779 CN: 86.186.1420.3016 1 Copyright © 2017 The Fung Group.