WALMART INC. (Exact Name of Registrant As Specified in Its Charter) ______

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Is Wal-Mart Good for America?

Frontline Is Wal-Mart Good for America? One, Two, Three, Four … We Don’t Want Your Superstore Across the country communities weigh the costs and benefits of opening their doors to the nation's largest discount retailer. Wal-Mart has made billions selling toaster ovens and polo shirts for pennies less than its competitors; after all, the company motto is "Always low prices." And who wouldn't want cheaper goods? Yet some communities are fighting to keep the retail giant out of their neighborhoods, claiming that Wal-Mart's low prices could damage their quality of life. In Vermont, Wal-Mart's opponents argue that the state's economy and culture would be damaged by the retailer's presence. In California, opponents say the company has cost taxpayers millions by shortchanging its employees on healthcare. Here is a roundup of some instances of community backlash against Wal-Mart and the company's response. Superstore vs. small business Activists regularly argue that competition from Wal-Mart destroys small businesses, particularly the "mom and pop" stores that they say make their communities unique. This criticism has become even more vocal since Wal-Mart began moving into additional retail areas, such as groceries, opticals and flowers. In an article in the Los Angeles Times, one small businesswoman, Bonnie Neisius, owner of a UPS franchise in Las Vegas, Nev., described how she has watched surrounding businesses close and her own business decline since Wal-Mart moved in down the road. "I'm probably down 45 percent," Neisius said. "I just don't get the foot traffic anymore." More recently, the retailer has come under attack in Vermont, where preservationists say the character, culture and economy of the entire state is under threat from an influx of superstores, particularly Wal-Mart. -

2014-Global-Responsibility-Report.Pdf

So many opportunities to make a difference 2014 Global Responsibility Report About this report Content materiality Currency exchange The scope and boundaries of the 2014 Walmart In addition to tracking media activity and Foreign currency conversions have been made Global Responsibility Report encompass our customer feedback, we engage with internal using the average exchange rate from corporate efforts related to workplace, and external stakeholders, including government Feb. 1, 2013–Jan. 31, 2014. As a global company, compliance and sourcing, social and and NGOs, to define the content included in we highlight the performance of our global environmental responsibility, while also this report. We incorporate this input prior to markets, as well as the efforts taking place providing snapshots into each of our individual and during editorial development to ensure throughout our supply chain. markets around the globe. The report reviews continuous dialogue, relevancy and transparency. our progress and performance during FY2014, For example, this engagement resulted in the reflects areas where we’ve achieved tremendous expansion and positioning of our Workplace positive results and specifies areas of opportunity section, influenced our decision to turn we continue to focus on. The social and Compliance and Sourcing into its own section, environmental indicators were obtained by and to detail our commitment and progress internal survey and checks without the related to water stewardship. participation of external auditing. The reporting timeline -

FIC-Prop-65-Notice-Reporter.Pdf

FIC Proposition 65 Food Notice Reporter (Current as of 9/25/2021) A B C D E F G H Date Attorney Alleged Notice General Manufacturer Product of Amended/ Additional Chemical(s) 60 day Notice Link was Case /Company Concern Withdrawn Notice Detected 1 Filed Number Sprouts VeggIe RotInI; Sprouts FruIt & GraIn https://oag.ca.gov/system/fIl Sprouts Farmers Cereal Bars; Sprouts 9/24/21 2021-02369 Lead es/prop65/notIces/2021- Market, Inc. SpInach FettucIne; 02369.pdf Sprouts StraIght Cut 2 Sweet Potato FrIes Sprouts Pasta & VeggIe https://oag.ca.gov/system/fIl Sprouts Farmers 9/24/21 2021-02370 Sauce; Sprouts VeggIe Lead es/prop65/notIces/2021- Market, Inc. 3 Power Bowl 02370.pdf Dawn Anderson, LLC; https://oag.ca.gov/system/fIl 9/24/21 2021-02371 Sprouts Farmers OhI Wholesome Bars Lead es/prop65/notIces/2021- 4 Market, Inc. 02371.pdf Brad's Raw ChIps, LLC; https://oag.ca.gov/system/fIl 9/24/21 2021-02372 Sprouts Farmers Brad's Raw ChIps Lead es/prop65/notIces/2021- 5 Market, Inc. 02372.pdf Plant Snacks, LLC; Plant Snacks Vegan https://oag.ca.gov/system/fIl 9/24/21 2021-02373 Sprouts Farmers Cheddar Cassava Root Lead es/prop65/notIces/2021- 6 Market, Inc. ChIps 02373.pdf Nature's Earthly https://oag.ca.gov/system/fIl ChoIce; Global JuIces Nature's Earthly ChoIce 9/24/21 2021-02374 Lead es/prop65/notIces/2021- and FruIts, LLC; Great Day Beet Powder 02374.pdf 7 Walmart, Inc. Freeland Foods, LLC; Go Raw OrganIc https://oag.ca.gov/system/fIl 9/24/21 2021-02375 Ralphs Grocery Sprouted Sea Salt Lead es/prop65/notIces/2021- 8 Company Sunflower Seeds 02375.pdf The CarrIngton Tea https://oag.ca.gov/system/fIl CarrIngton Farms Beet 9/24/21 2021-02376 Company, LLC; Lead es/prop65/notIces/2021- Root Powder 9 Walmart, Inc. -

WAL-MART STORES, INC. (Exact Name of Registrant As Specified in Its Charter) ______

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 ___________________________________________ FORM 10-K ___________________________________________ Annual report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 for the fiscal year ended January 31, 2013, or ¨ Transition report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934 Commission file number 1-6991. ___________________________________________ WAL-MART STORES, INC. (Exact name of registrant as specified in its charter) ___________________________________________ Delaware 71-0415188 (State or other jurisdiction of (IRS Employer incorporation or organization) Identification No.) 702 S.W. 8th Street Bentonville, Arkansas 72716 (Address of principal executive offices) (Zip Code) Registrant's telephone number, including area code: (479) 273-4000 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock, par value $0.10 per share New York Stock Exchange Securities registered pursuant to Section 12(g) of the Act: None ___________________________________________ Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No ¨ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for at least the past 90 days. -

Wal-Mart Stores Inc at William Blair & Company, LLC Growth Stock

FINAL TRANSCRIPT WMT - Wal-Mart Stores Inc at William Blair & Company, LLC Growth Stock Conference Presentation Event Date/Time: Jun. 15. 2011 / 1:00PM GMT THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us ©2011 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. FINAL TRANSCRIPT Jun. 15. 2011 / 1:00PM, WMT - Wal-Mart Stores Inc at William Blair & Company, LLC Growth Stock Conference Presentation CONFERENCE CALL PARTICIPANTS Mark Miller William Blair - Analyst Bill Simon Wal-Mart Stores, Inc. - President & CEO Walmart U.S. PRESENTATION Mark Miller - William Blair - Analyst I think I©ll go ahead and get started so as not to cut in on management©s time. For those of you that I©ve not met, my name is Mark Miller; I follow the broadlines food, drug and e-commerce space at William Blair. I©m required to inform you that for a complete list of disclosures and potential conflicts of interest please see WilliamBlair.com. Following this presentation we will have a breakout in the Bellevue Room which, I think most of you know, is through at the restaurant. It is my pleasure this morning to introduce to you the management of Walmart. Walmart has presented now at our conference for nine of the ten years that I©ve been covering the Company. Carol, I appreciate the Company is back again this year. -

Large Supermarkets (Co-Op, Morrisons)

Useful information for new students – including tips from current students On-line shopping options: The delivery services are more expensive but can deliver quickly. Deliveroo https://deliveroo.co.uk/– take away food and also pairs with small and large supermarkets (Co-op, Morrisons) UberEats – https://www.ubereats.com take away and grocery deliveries from smaller super markets/local shops and a few of the larger supermarkets e.g. Asda Amazon pantry and Morrisons https://www.amazon.co.uk/ Student tip: You can get a free amazon prime membership for 6 months with your student account, so you can order a lot of necessities on there the day you arrive and it’ll deliver the next day usually, this might help to free up space in your suitcase. Large supermarkets (cheapest to most expensive) Lidl: no online service currently Aldi: click and collect service but no on-line delivery Asda https://www.asda.com/ Tesco https://www.tesco.com/ Morrisons https://groceries.morrisons.com/ Sainsbury's https://www.sainsburys.co.uk/ Ocado (paired with Marks and Spencer) https://accounts.ocado.com/ Student tips: It is worth signing up for a few supermarkets so you have options if you can’t get a slot you want. Remember to book before you completely run out as you will likely have to wait for a slot. On the first day you move in, I’d say book an online slot to get your groceries delivered to halls by Tesco, Asda or Sainsbury’s. You usually have to book a slot a week or two earlier and you can do it from home. -

AVC Field Inspection Form

Date of Inspection: _________________ Inspector Name or ID #:____________________________________ AVC Field Inspection form Store Name: ______________________________________________________________________________________ Address: ___________________________________________________ Store #: ______________________ City: ___________________________________________________ State: _____ Zip: ______________________ Store Type: (circle one) Gas Station (including gas island of grocery store) Convenience Store Grocery Store Drugstore Other: ____________________________________________ Tobacco Displays (circle one) 1. Are tobacco products available for purchase? Yes No 2. Are all tobacco products displayed in a single area of the store? Yes No If NO, please provide a description or image: ____________________________________ 3. Are tobacco products available for purchase in vending machines? Yes No If YES, please provide a description or image: _____________________________________ 4. Can a customer pick up a tobacco product without the clerk’s assistance? Yes No If YES, please provide a description or image: _____________________________________ 5. Are cigarette papers, pipes or other tobacco paraphernalia accessible without the clerk’s assistance? Yes No If YES, please provide a description or image: _____________________________________ 6. Are cigarettes available in quantities less than a pack? Yes No (single sticks, two for a dollar, or similar) If YES, please provide a description or image: _____________________________________ Agency/Group: -

China's E-Commerce Market Leapfrogged

05 August 2015 Asia Pacific/India Equity Research India Internet Primer #2 Connections Series Ten lessons from China Figure 1: E-commerce in India is 4-10 years behind China on several parameters Organised retail Online shopping penetration penetration Online Internet shoppers penetration China (1999): ~10% China (2007): 0.6% India (2014): 9-10% India (2014): 0.7% China (2006): 43 mn China (2008): 23% India (2014): 38 mn India (2014): 20% Urbanisation GDP per-capita (US$) Spend per online Smartphone The Credit Suisse Connections Series buyer (US$) penetration China (1997): ~33% China (2004): 1,498 India (2014): 32% India (2014): 1,487 leverages our exceptional breadth of China (2007): 135 China (2010): 13% macro and micro research to deliver India (2014): 104 India (2014): 14% 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 incisive cross-sector and cross-border (-17) (-16) (-15) (-14) (-13) (-12) (-11) (-10) (-9) (-8) (-7) (-6) (-5) (-4) thematic insights for our clients. Year (years from 2014) Source: Credit Suisse research Research Analysts Anantha Narayan ■ India at the 'tipping point', based on the China experience. While there 91 22 6777 3730 are differences, the two internet markets are similar in many ways—a large [email protected] population, growing middle class, and an underdeveloped organised market. Nitin Jain 91 22 6777 3851 From 0.2% of GDP in 2007, the Chinese e-tailing market rose to about 5% in [email protected] 2014, an 80% CAGR from US$7.4 bn to US$458 bn. -

Walmart Inc. Takes on Amazon.Com

For the exclusive use of Q. Mays, 2020. 9-718-481 REV: JANUARY 21, 2020 DAVID COLLIS ANDY WU REMBRAND KONING HUAIYI CICI SUN Walmart Inc. Takes on Amazon.com At the start of 2018, Walmart faced critical decisions about its future as e-commerce continued to explode. Walmart just lost its long-held crown as the most valuable retailer in the world to online leader Amazon. With Amazon’s recent acquisition of Whole Foods for $13 billion, Amazon moved aggressively into the offline world to challenge Walmart in its biggest business, grocery. Walmart was not standing still, making moves like buying Jet.com for $3 billion in 2016. While Walmart’s U.S. e- commerce revenues grew to $11.5 billion in 2017, there was no debate in Bentonville, AR: Walmart remained far behind. The question for Walmart CEO Doug McMillon and Walmart.com head Marc Lore was how to respond to its most aggressive competitor ever (Exhibits 1a and 1b).1 Amazon The Early Years (1994–2001) Jeff Bezos founded Amazon in 1994 to exploit the Internet, still a relatively nascent technology. He determined that selling books online was most promising, because the number of titles available was greater than even the largest brick-and-mortar store could stock. Bezos and his wife drove west to start “Earth’s Biggest Bookstore” in Seattle, WA. Amazon offered 1 million titles for sale on its opening day in July 1995. Next year, the company had over 2.5 million book titles for sale, with revenue doubling every quarter (Exhibit 2). -

NOW ACCEPTING GROCERY COMPETITOR COUPONS and ALL MANUFACTURER COUPONS ARE NOW WORTH up to $1.00 Competitor Coupons

NOW ACCEPTING GROCERY COMPETITOR COUPONS AND ALL MANUFACTURER COUPONS ARE NOW WORTH UP TO $1.00 Competitor Coupons We will gladly accept grocery competitor coupons from Albertsons, Safeway, Basha’s, Fresh & Easy, Sunflower, Sprouts, Walmart Marketside, Walmart Neighborhood Market, Whole Foods, Target, AJ’s, Trader Joes, Food City and Ranch Market. All limits and restrictions apply. All competitor amount-off total order coupons will be redeemed after all other discounts and coupons have been applied, as long as the requirements of the coupon have been met. Only one competitor amount-off total order coupon from the same competitor may be used per shopping visit. Customers may use more than one Competitor. Example: A Fresh & Easy $5 off with a $50 required purchase plus an Albertsons $10 off with a $100 required purchase, for a total required purchase of $150, after all other discounts and coupons have been applied. • Competitor coupons will be accepted on identical items, no substitutions. • For competitor brand items use our comparable brand item. • Sorry, no rain checks. • We accept Print at Home Competitor coupons. o Competitor coupons printed from the internet may be printed in black & white. All Manufacturer Coupons Are Worth Up To $1.00! During this promotion we will make all paper manufacturer coupons up to $1.00, even those that state “Do Not Double” or “Not Subject to Doubling.” o Digital coupons downloaded onto a shopper’s VIP card are not subject to doubling Limit one manufacturer and one competitor coupon per item. Coupons Under $1: We will make up to three of the same coupon for like items up to $1.00. -

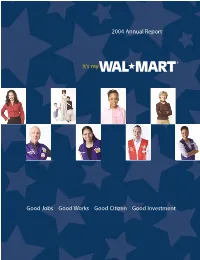

2004 Annual Report

2004 Annual Report It’s my Good Jobs # Good Works # Good Citizen # Good Investment Senior Officers Financial Highlights M. Susan Chambers (Fiscal years ending January 31,) Executive Vice President, Risk Management, Insurance and Benefits Administration 04 $256.3 Robert F. Connolly Executive Vice President, Marketing and 03 $229.6 Consumer Communications, Wal-Mart Stores Division 02 $204.0 Net Sales (Billions) Thomas M. Coughlin Vice Chairman of the Board 01 $180.8 Douglas J. Degn 00 $156.2 Executive Vice President, Food, Consumables and General Merchandise, Wal-Mart Stores Division David J. Dible 04 $2.03 Executive Vice President, Specialty Group, Wal-Mart Stores Division 03 $1.76 Linda M. Dillman Diluted Earnings Per Share 02 $1.44 Executive Vice President and Chief Information Officer From Continuing Operations Michael T. Duke 01 $1.36 Executive Vice President, President and Chief Executive Officer, Wal-Mart Stores Division 00 $1.21 Joseph J. Fitzsimmons Senior Vice President, Finance and Treasurer Rollin L. Ford 04 9.2% Executive Vice President, Logistics and Supply Chain 03 9.2% David D. Glass Chairman of the Executive Committee of the Board 02 8.4% Return On Assets James H. Haworth Executive Vice President, Operations, 01 8.6% Wal-Mart Stores Division Charles M. Holley 00 9.8% Senior Vice President and Corporate Controller Craig R. Herkert Executive Vice President, 04 21.3% President and Chief Executive Officer,The Americas Thomas D. Hyde 03 20.9% Executive Vice President, Legal and Corporate Affairs and Corporate Secretary 02 19.4% Return On Shareholders’ Equity C. Douglas McMillon Executive Vice President, Merchandising, 01 21.3% SAM’S CLUB 00 22.9% John B. -

POMS Practitioner Forum / UCLA Global Supply Chain Blog

POMS Practitioner Forum / UCLA Global Supply Chain Blog Yihaodian’s co-founder and CEO and 2012 POMS MKS Practice Excellence Winner Gang Yu (于刚) shares his insights about “his career path and e- commerce in China” Interview conducted by Christopher Tang in Shanghai November 1, 2012 Founded in 2008, Yihaodian.com is China’s fastest growing company – a B2C retailer selling over 900,000 SKUs to consumers online. In addition to winning the first prize for Deloitte Technology Fast500 Asia Pacific in 2011 with 19,200% growth in three years, its success has motivated Walmart to strategically invest in Yihaodian in both 2011 and 2012. The success of Yihaodian is phenomenal because Chinese consumers are prudent about online purchases especially when consumer protection laws are not fully enforced in China and making home deliveries in China can be Photo of Gang Yu a logistical nightmare. To learn more about the success recipe, I interviewed Yihaodian’s Chairman Gang Yu in Shanghai. 1. Knowing Chinese consumers are prudent about online purchases, how does Yihaodian overcome this hurdle? The major concerns Chinese consumers have about online shopping are centered on the following: a) authenticity and quality of products; b) safety of online payments; c) reliability of delivery; d) quality of post-sale services. Yihaodian has adopted the following strategies to win customers’ trust: i) We build the foundation of our corporate culture on Integrity, Customers, Execution, and Innovation. We enabled “no questions asked” free return policy, and implemented a very rigorous quality control process with severe penalties to merchants and suppliers who supply fake products.