Public Announcement

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Wtm/Mpb/Mrd/160 /2018 Securities and Exchange

WTM/MPB/MRD/160 /2018 SECURITIES AND EXCHANGE BOARD OF INDIA EXIT ORDER IN RESPECT OF AHMEDABAD STOCK EXCHANGE LIMITED 1. Ahmedabad Stock Exchange Limited formerly known as ‘The Stock Exchange – Ahmedabad’ (hereinafter referred to as “ASEL”) was constituted as a Public Charitable Trust in 1894. ASEL was recognized as a stock exchange by the Central Government on September 16, 1957 under the provisions of Securities Contracts (Regulation) Act, 1956 (hereinafter referred to as “SCRA”). ASEL was granted permanent recognition under the provisions of section 4 of SCRA on March 01, 1982 by the Central Government. 2. SEBI, vide Circular No. MRD/DoP/SE/Cir-36/2008 dated December 29, 2008, issued Guidelines laying down the framework for exit by stock exchanges whose recognition is withdrawn and/or renewal of recognition is refused by SEBI and Regional Stock Exchanges (“RSEs”) who may want to surrender their recognition. These Guidelines were reviewed and modified by SEBI vide Circular No. CIR/MRD/DSA/14/2012 dated May 30, 2012 (hereinafter referred to as "Exit Circular"). In terms of clause 2.2 of the Exit Circular, a stock exchange where the annual trading turnover on its own platform is less than Rs. 1000 crores, can apply to SEBI for voluntary surrender of recognition and exit at any time before the expiry of two years from the date of issuance of the said Circular. On July 05, 2014, the shareholders of ASEL passed a resolution during their Extra Ordinary General Meeting, for exiting as a stock exchange through voluntary surrender of recognition. Consequently, ASEL made a request to SEBI for its exit as stock exchange vide letter dated July 11, 2014 thereby informing SEBI that the shareholders of ASEL at the Extra Ordinary General Meeting held on July 05, 2014, opted for voluntary exit from the business of Stock Exchange and surrender its recognition as per the Exit Circular, 2012. -

FIRE Project Notes Compilation

Indo-US Financial Institutions Reform and Expansion Project - Debt Market Component FIRE(D) FIRE Project Notes Compilation February 2004 INTRODUCTION The Indo-USAID Financial Institutions Reform and Expansion (FIRE-D) project, a joint initiative of the United States Agency for International Development and the Government of India, assists municipal and state governments in India to develop safe and sustainable urban environmental services (water, sewerage, and solid waste) and to ensure that the poor have access to them. Based in New Delhi, the project aims to achieve this goal in three ways. First, by increasing participation of municipalities, the private sector, and community organizations in the development and delivery of commercially viable urban infrastructure services. Secondly, by improving the ability of municipal and state agencies and other urban professionals to manage urban growth, mobilize resources, and improve environmental services. Thirdly, by supporting the development of a market-based urban infrastructure finance system. page 1 Called the FIRE-D project – the “D” refers to “debt” – the project helps cities mobilize resources by issuing bonds, obtaining loans from financial institutions, or using other debt financing mechanisms for urban infrastructure. The project staff, primarily Indian professionals, assists central, state and local government officials. Partner organizations also provide technical assistance, financing, training, and policy advocacy. The policy advocacy work with central and state agencies aims to create a supportive environment for cities to make vital reforms. The project assists Indian cities with project development and financing, resource mobilization, decentralization, and capacity building. The project has achieved significant results in the ten years since its beginning in 1994. -

23Rd Annual Report 2018 - 2019

7771st Annual Report 2018-19 Governing Board Mr Vijay Bhushan Chairman Mr Mahender Kumar Gupta Director Mr Vinod Kumar Goel Director Mr. Hans Raj Kapoor Director Company Secretary Mr Sunil Bhatia Auditors P. Bholusaria & Co. Chartered Accountants Bankers: Canara Bank HDFC Bank Registered Office: DSE House, 3/1, Asaf Ali Road New Delhi-110 002 Registrar & Transfer Agent : Abhipra Capital Limited Dilkhush Industrial Estate A-387, G. T. Karnal Road, Azadpur New Delhi-110 033 1 Delhi Stock Exchange Limited CIN:U91120DL1947PLC001239 CONTENTS Governing Board 1 Directors’ Report 3 Corporate Governance Report 6 Form AOC-2 10 MGT-9 11 Independent Auditors’ Report 20 Balance Sheet 25 Profit & Loss Account 26 Cash Flow Statement 27 Notes 28 Form AOC-1 47 Consolidated Financial Report Independent Auditors’ Report 48 Balance Sheet 54 Profit & Loss Account 55 Cash Flow Statement 56 Notes 57 Delstox Stocks And Shares Ltd. (Formerly DSE Financial Services Ltd.) Governing Board 78 Notice 79 Directors’ Report 80 Corporate Goverance Report 84 MGT-9 86 Form AOC-2 93 Independent Auditors’ Report 94 Balance Sheet 99 Profit & Loss Account 100 Cash Flow Statement 101 Notes 102 Proxy 115 Map 116 2 7771st Annual Report 2018-19 DIRECTORS’ REPORT Dear Shareholders, Your Directors take pleasure in presenting 71st Annual Report on the operations of the Company and the audited accounts for the year ended March 31, 2019. The financial highlights including consolidated results of the Company for the year are as under:- FINANCIAL HIGHLIGHTS (` in lacs) Particulars Stand-alone -

Sebi Registered Depository Participants of Cdsl As on 29-02-2012

SEBI REGISTERED DEPOSITORY PARTICIPANTS OF CDSL AS ON 29-02-2012 SR. NO. NAME OF THE DP REGN. NO. ADD1 ADD2 ADD3 CITY STATE PIN CODE TELEPHONE1 TELEPHONE2 FAX EMAIL 1 A C AGARWAL SHARE BROKERS PVT. LTD. IN-DP-CDSL-619-2011 406, 4TH FLOOR, PAYAL COMPLEX, SAYAJIGUNJ, BARODA GUJARAT 390005 0265-2361672 0265-2362786 [email protected] ITTS HOUSE, 2ND 2 A C CHOKSI SHARE BROKERS PVT LTD IN-DP-CDSL-89-2000 FLOOR, 33 KALAGHODA FORT MUMBAI MAHARASHTRA 400001 022-30219071 022-30219099 [email protected] SAIBABA MARG 30-39,FREE FREE PRESS 215, NARIMAN 3 A K STOCKMART PRIVATE LIMITED IN-DP-CDSL-458-2008 PRESS MUMBAI MAHARASHTRA 400021 022-67546500 022-67544666 [email protected]; [email protected]; JOURNAL MARG POINT HOUSE,3RD FLR SHREYAS NEAR GORAI GORAI LINK 4 A.S. STOCK BROKING & MANAGEMENT PVT. LTD. IN-DP-CDSL-338-2006 BUNGLOW BRIDGE BUS ROAD, BORIVALI MUMBAI MAHARASHTRA 400092 022-28676040 022-28676041/42 022-28676044 [email protected] NO.70/74 STOP, (W), DR. 5 ASL CAPITAL HOLDINGS PVT. LTD. IN-DP-CDSL-290-2005 138, RADHAKRISHANA MYLAPOR, CHENNAI TAMIL NADU 600004 044-28444555 044-43434030 [email protected] N SALAI, COMMERCIAL 302, 3RD COMPLEX,VIKAS 6 AARYA EQUITY (INDIA) PVT. LTD. IN-DP-CDSL-642-2011 MULUND(WEST), MUMBAI 400 080 022-25905055 022-25905058 [email protected] FLOOR,VIKAS PARADISE,BHAKT I MARG, 7 AMRAPALI AADYA TRADING & INVESTMENT PVT. LTD. IN-DP-CDSL-487-2008 13, VAISHALI PITAMPURA NEW DELHI NEW DELHI 110088 011-47060600 011-27318693 011-27311022 [email protected]; [email protected]; [email protected] LILAVATI SHOPNO.11, HOSPITAL, [email protected]; 8 ABANS SECURITIES LTD. -

Elixir Journal

50958 Garima saxena and Rajeshwari kakkar / Elixir Inter. Law 119 (2018) 50958-50966 Available online at www.elixirpublishers.com (Elixir International Journal) International Law Elixir Inter. Law 119 (2018) 50958-50966 Performance of Stock Markets in the Last Three Decades and its Analysis Garima saxena and Rajeshwari kakkar Amity University, Noida. ARTICLE INFO ABSTRACT Article history: Stock market refers to the market where companies stocks are traded with both listed Received: 6 April 2018; and unlisted securities. Indian stock market is also called Indian equity market. Indian Received in revised form: equity market was not organized before independence due to the agricultural conditions, 25 May 2018; undeveloped industries and hampering by foreign business enterprises. It is one of the Accepted: 5 June 2018; oldest markets in India and started in 18th century when east India Company started trading in loan securities. During post-independence the capital market became more Keywords organized and RBI was nationalized. As we analyze the performance of stock markets Regulatory framework, in the last three decades, it comes near enough to a perfectly aggressive marketplace Reforms undertaken, permitting the forces of demand and delivers an inexpensive degree of freedom to Commodity, perform in comparison to other markets in particular the commodity markets. list of Deposit structure, reforms undertaken seeing the early nineteen nineties include control over problem of Net worth, investors. capital, status quo of regulator, screen primarily based buying and selling and threat management. Latest projects include the t+2 rolling settlement and the NSDL was given the obligation to assemble and preserve an important registry of securities marketplace participants and experts. -

01 Index1 to 2

Our Vision Be an entrepreneurial globally preferred business associate with responsible concern for ecology, society and stakeholders’ value. Our Mission To develop, assimilate and manage knowledge; to apply the acquired expertise across the globe, for benefit of stakeholders’; to do so profitability. Business of success www.reportjunction.com BOARD OF DIRECTORS Shri Gautam S. Adani, Chairman Shri Rajesh S. Adani, Managing Director Shri Vasant S. Adani Shri Pradeep Mittal, Whole time Director Shri C. R. Shah Shri Jay H. Shah Dr. Pravin P. Shah Dr. A. C. Shah AUDITORS M/s. Dharmesh Parikh & Co. Chartered Accountants Ahmedabad. BANKERS State Bank of India, Ahmedabad. Bank of India, Ahmedabad. State Bank of Travancore, Ahmedabad. State Bank of Hyderabad, Ahmedabad. The Jammu & Kashmir Bank Ltd., Ahmedabad. State Bank of Saurashtra, Ahmedabad. Bank of Baroda, Ahmedabad. Punjab National Bank, Ahmedabad. Andhra Bank, Ahmedabad. Canara Bank, Ahmedabad. Uco Bank, Ahmedabad. Syndicate Bank, Ahmedabad. Oriental Bank of Commerce, Ahmedabad. ICICI Bank Ltd., Mumbai. Standard Chartered Bank, Mumbai. Allahabad Bank, Ahmedabad. REGISTERED OFFICE ‘Adani House’ Nr. Mithakhali Six Road, Navrangpura, Ahmedabad - 380009 SHARE TRANSFER AGENT Pinnacle Shares Registry Pvt. Ltd. Nr. Ashoka Mills Ltd., Naroda Road, Ahmedabad - 380025 Tel. No.: +91-79 - 2220 4226, 2220 0591, 2220 0582 Fax : +91-79- 2220 2963 SHARES LISTED AT National Stock Exchange, Mumbai. The Stock Exchange, Mumbai. Ahmedabad Stock Exchange Annual Report // 2006 - 2007 www.reportjunction.com -

Final Dividend for the Year 2013-2014 As on 31-03-2021

Oriental Carbon & Chemicals Limited Unpaid Dividend Details for Final Dividend for the Year 2013-2014 As on 31-03-2021 -------------------------------------------------------------------------------------------------------- NAMES & ADDRESS OF THE SHARE NO. OF Amount HOLDER SHARES (RS.) SR NO FOLIO NO. WARRANTNO --------------------------------------------------------------------------------------------------------. 1 B090156 2 BANWARI LAL GOYAL 300 1500.00 C/O GOYAL OIL MILL IND. NEAR BUS STAND CHOMU DIST. JAIPUR 2 C000281 3 SURESH KUMAR PRABHUDAS 34 170.00 CHUDASAMA C/O P.N.CHUDASAMA DHANJI BLDG MANI BHAI CHOWK SAVARKUNDALA 3 G000163 5 RAM CHANDRA GAUR 8 40.00 GAYATRI NILAY 78-79,CHURCH ROAD VISHNUPURI,ALIGANJ LUCKNOW 4 M000426 6 MAHENDRA MANSUKHLAL MODY 10 50.00 B/61, GANGA NAGAR SOCIETY NR. TECKARAWALA SCHOOL PALANPUR PATIA, RANDER ROAD SURAT-9 5 M005151 7 MAFATLAL TRIBHOVANDAS PATEL 100 500.00 16A, TRIDEV PARK SOCIETY MADHEVNAGAR, TEKARA VASTRAL ROAD AHMEDABAD 6 M090099 8 JAGAT RAM MOTWANI 2000 10000.00 C/O SHARDA CYCLE AGENCY, CONGRESS COMPLEX, SHOP NO. 2, BUGHAR ROAD SHAHDOL 7 N000160 9 LALITA NATANI 4 20.00 C-56,PUNCH SHEEL COLONY BH.BAKE HOME NEAR OLD OCTROI NAKA AJMER ROAD JAIPUR 8 V000420 11 NEELU VARMA 4 20.00 C/O MR SURAJ PRAQSAD RASTOGI 2/419 KHATRANA FARURKHABAD U P 9 A000026 12 GULABCHAND AJMERA 52 260.00 RAJPATH CHHOTA BAZAR P O SAMBHAR LANE RAJASTHAN 10 A000120 13 RAVI KRISHANA AGARWAL 50 250.00 PREM KUNJ MAIN ROAD MOTIHARI CHAMPARAN 11 A000150 14 SUBASH CHANDER AGGARWAL 4 20.00 C/O KASHMIRI LALL AGGARWAL & BROS ENGINEERS -

Earnings Deck

28 April 2021 Presented by: Ashank Desai | Vice Chairman and Managing Director, Mastek Limited Abhishek Singh | President Designate, UK Business of Mastek Arun Agarwal | Group Vice President, Finance, Mastek Limited Umang Nahata | Co-founder, Evosys Table of Contents 01. Highlights of the Quarter 02. Financial Performance 03. Operational Performance 04. Key Wins for the Quarter 05. Evosys Advantage 06. Acquisition Updates Mastek Limited | Investor Presentation 2021 | Presentation title in footer 2 Highlights 01 of the Quarter 02 03 04 05 06 Highlights of FY21 Mastek crossed $230m revenue in Enrichment in Operating PAT grew by 121.2% YoY FY21 EBITDA margin of 667 bps YoY 14.4% PAT margin, FY 60.7% YoY 21.2% Operating FY 21 21 416 bps revenue growth EBITDA margin improvement YoY Increase in 12Month order backlog to Added 187 new clients during Total headcount of 3,792 in March 21 $154.6m the year 639 active 388 headcount 42.0% YoY Growth customers (LTM) added (net of attrition) Mastek Limited | Investor Presentation 2021 | 4 Highlights of Q4FY21 Mastek crossed $65m revenue mark PAT grew by 7.7% QoQ UK Government & Health in the Q4 sector witnessed strong growth in Q4FY21 Q1 Q2 Q3 Q4 15.6% PAT margin Q4 • 3-year multi-million dollar deal FY 21 in Q4FY21 signed to provide secure National 9.1% QoQ revenue growth Biometrics Exchange, Integration & DNA Services to the UK’s Home Office Added 45 new customers during Recommended final dividend of 180% • 1-year multi-million dollar deal the quarter and 190 employees signed to provide secure Live -

SEC/43/2021-22 July 15, 2021 Listing Department BSE Limited 25Th Floor, Phiroze Jeejeebhoy Towers Dalal Street, Fort Mumbai-400

Mastek Limited T +91 22 6722 4200 #106,107 SDF-IV Seepz, Andheri (East), F +91 22 6695 1331 Mumbai 400096, Maharashtra, India W www.mastek.com SEC/43/2021-22 July 15, 2021 Listing Department Listing Department BSE Limited The National Stock Exchange of India Limited 25th Floor, Phiroze Jeejeebhoy Towers Exchange Plaza, C-1, Block G, Dalal Street, Fort Bandra Kurla Complex, Mumbai-400 001 Bandra (E), Mumbai – 400 051 Tel No. 022- 22723121 Tel No.: 022- 26598100 Fax No. 022- 22721919 Fax No. 022-26598120 SCRIP CODE: 523704 SYMBOL: MASTEK Dear Sir(s)/Ma’am(s), Sub: Certificate under Regulation 74(5) of the SEBI (Depositories and Participants) Regulations, 2018 for the quarter ended June 30, 2021. Pursuant to Regulation 74(5) of SEBI (Depositories and Participants) Regulations, 2018, we are enclosing herewith certificate issued by KFin Technologies Private Limited, Registrar and Share Transfer Agent of the Company confirming the compliance of Regulation 74(5) of SEBI (Depositories and Participants) Regulations, 2018. Request you to take the above on your records. Yours faithfully Encl: AA CC: 1. Central Depositary Services (India) Limited 2. National Securities Depository Limited Marathon Futurex, Unit No. 2501, Trade World, 4th Floor, Kamala Mils 25th Floor, A-Wing, Mafatlal Mills Compound, Compound, Senapati Bapat Marg, Lower N M Joshi Marg, Lower Parel, Mumbai – 400 013. Parel, Mumbai – 400013. Regd. Off.: 804, 805 President House, Opp. C.N. Vidyalaya, Near Ambawadi Circle, Ambawadi, Ahmedabad - 380 006. Gujarat, India. Tel No: +91-79-2656--4337 E-mail: [email protected] CIN-l74140GJ1982PLC005215 KFPL/MAST/74(5)/6 Date: 08/07/2021 To, To, Bombay Stock Exchange Limited National Stock Exchange of India Ltd. -

MUTUAL FUNDS: Comparison of Various Schemes Under Equity ”

A Project Report On “MUTUAL FUNDS: Comparison of various schemes under equity ” Submitted By: Yashika Sharma In partial fulfillment of the award of the degree of Master of Business Administration University School of Management Kuruksheta University Kurukhetra CERTIFICATE This is to certify that this project report “Mutual Funds: Comparison of various schemes under equity” is the bona fide work of Yashika Sharma who carried out the project under my supervision Date: (Signature) Anil Kumar Kapoor Manager- financial Planning Master Trust Ltd. ACKNOWLEDGEMENT It gives me immense pleasure to present the project report entitled “MUTUAL FUNDS: Comparison of various schemes under equity” Preservation, inspiration and motivation have always played a key role in the success of any venture. In the present world of competition and success, training is like a bridge between theoretical and practical working; willingly I prepared this particular Project. I am highly indebited to Mr. Chawla, Ms. Rinkoo Vashisht & Mr. Kapoor for their guidance and constant supervision as well as for providing necessary information regarding the project and also for their support in completing the project. I am also thankful to all the friends and family members. Yashika Sharma TABLE OF CONTENT S.NO. PARTICULERS PAGE NUMBER 1. Executive Summary 2. Objective 3. Introduction of the company – Master Trust LTD. 4. Mutual funds : Basics, History, Types & pros and cons 5. Equity funds explained 6. Fund houses: ICICI prudential Reliance SBI 7. Comparison of Various schemes under equity 8. Conclusion 9. Latest Amendments in Mutual Funds 10. References EXECUTIVE SUMMERY The Mutual Fund is an untapped area which is bound to be the next growth story. -

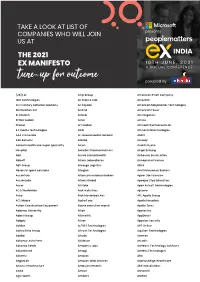

Partial List Ex Conference 20

Artemis Health Institute Bharat Serums & Vaccines Carrier CP Milk & Food Products Discovery FCDO GlaxoSmithkline Henkel India Shelter Finance Corporation Kadtech Infraprojects LSEG MIND NIIT Paytm Money PT Bank BTPN RTI Shyam Spectra Stryker ThoughtWorks ValueMined Technologies Y-Axis Solutions Arth Group Bharti Axa Life Insurance Cars24 CP Plus Dksh FE fundinfo Glenmark Pharmaceuticals Herbalife Nutition IndiaMART Kaivalya Educatiion Foundation LTI MindTickle Nineleaps technology solutions PayU PT. Media Indra Buana Ruby Seven Studios Shyam Spectra STT Global Data Centres Thryve Digital Valuex Technologies Yamaha Motor Arvind Fashions Bhel Caterpillar CP Wholesale DLF Fedex GlobalEdge Here Technologies Indigo Kalpataru Luminous Power Technologies Mindtree Nippon Koei PCCPL PTC Network Rustomjee Sidel Successive Technologies Tierra Agrotech Varroc Engineering Yanbal Asahi India Glass BIC CDK Global CPI DMD ADVOCATES Ferns n Petals GlobalLogic Herman Miller Indmoney Kama Ayurveda Luthra Group MiQ Digital NISA Global PCS Publicis Media S P Setia Siemens Sulzer Pumps Tifc Varuna Group Yanmar TAKE A LOOK AT LIST OF Ashirvad Pipes Bidgely Technologies CEAT Creditas Solutions DP World Ferrero GMR Hero Indofil industries Kanishk Hospital Luxury Personified Mizuho Bank Nissan Peak Infrastructure Management PUMA Group S&P Global Sigma AVIT Infra Services Summit Digitel Infrastructure TIL Vastu Housing Finance Corpora- Yara COMPANIES WHO WILL JOIN Asian paints Bigtree Entertainment Celio Cremica Dr Reddy's Ferring Pharmaceuticals Godrej & Boyce -

SEC/03/2021-22 April 13, 2021 Listing Department BSE Limited 25Th Floor, Phiroze Jeejeebhoy Towers Dalal Street, Fort Mumbai-400

Mastek Limited T +91 22 6722 4200 #106,107 SDF-IV Seepz, Andheri (East), F +91 22 6695 1331 Mumbai 400096, Maharashtra, India W www.mastek.com SEC/03/2021-22 April 13, 2021 Listing Department Listing Department BSE Limited The National Stock Exchange of India Limited 25th Floor, Phiroze Jeejeebhoy Towers Exchange Plaza, C-1, Block G, Dalal Street, Fort Bandra Kurla Complex, Mumbai-400 001 Bandra (E), Mumbai – 400 051 Tel No. 022- 22723121 Tel No.: 022- 26598100 Fax No. 022- 22721919 Fax No. 022-26598120 SCRIP CODE: 523704 SYMBOL: MASTEK Dear Sir(s)/Ma’am(s), Sub: Certificate under Regulation 74(5) of the SEBI (Depositories and Participants) Regulations, 2018 for the quarter ended March 31, 2021. Pursuant to Regulation 74(5) of SEBI (Depositories and Participants) Regulations, 2018, we are enclosing herewith certificate issued by KFin Technologies Private Limited, Registrar and Share Transfer Agent of the Company confirming the compliance of Regulation 74(5) of SEBI (Depositories and Participants) Regulations, 2018. Request you to take the above on your records. Yours faithfully Encl: AA CC: 1. Central Depositary Services (India) Limited 2. National Securities Depository Limited Marathon Futurex, Unit No. 2501, Trade World, 4th Floor, Kamala Mils 25th Floor, A-Wing, Mafatlal Mills Compound, Compound, Senapati Bapat Marg, Lower N M Joshi Marg, Lower Parel, Mumbai – 400 013. Parel, Mumbai – 400013. Regd. Off.: 804, 805 President House, Opp. C.N. Vidyalaya, Near Ambawadi Circle, Ambawadi, Ahmedabad - 380 006. Gujarat, India. Tel No: +91-79-2656--4337 E-mail: [email protected] CIN-l74140GJ1982PLC005215 KTPL/MAST/TBS/75E/5 Date: 06/04/2021 To, To, Bombay Stock Exchange Limited National Stock Exchange of India Ltd.