Uganda Microfinance Sector Effectiveness Review for 2014

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Digital Finance for Energy Access in Uganda

DIGITAL FINANCE FOR ENERGY ACCESS IN UGANDA: PUTTING MOBILE MONEY BIG DATA ANALYTICS TO WORK Mayank Jain, Robin Gravesteijn, Arne Jacobson, Emily Gamble, Nicola Scarrone ABSTRACT Access to clean energy is a basic need that directly supports people’s livelihood, yet more than 30 million Ugandans live without electricity. Pay-as-you-go (PayGo) is a promising and innovative financing solution that can make clean energy affordable for low-income people. However, there remains significant knowledge gaps regarding the digital energy finance market’s size, outreach, growth and impact. This study leverages anonymized mobile money data of PayGo solar energy users in Uganda to gain insight on digital energy financing in Uganda. It also draws from a customer phone survey that assesses solar product adoption and quality of life improvements. We find that the Uganda solar market is growing rapidly and currently has around one million active customers. Around 12 percent of the Ugandan households own a solar home system and there is opportunity for further market expansion, especially in areas with high levels of mobile money penetration. The clean energy market is becoming more inter-connected with the digital finance market. In fact, digital energy financing through PayGo has promoted wider financial inclusion around 110,000 new mobile money customers. Likewise, when Uganda’s implemented a temporary mobile money tax it caused an immediate slow-down in PayGo uptake and new mobile money activations indicating it negatively impacted the country’s access to clean energy and formal finance. The customer survey result indicates that poorer customers seem equally able to purchase larger solar systems as compared to richer customers because of mobile money financing. -

Public Notice

PUBLIC NOTICE PROVISIONAL LIST OF TAXPAYERS EXEMPTED FROM 6% WITHHOLDING TAX FOR JANUARY – JUNE 2016 Section 119 (5) (f) (ii) of the Income Tax Act, Cap. 340 Uganda Revenue Authority hereby notifies the public that the list of taxpayers below, having satisfactorily fulfilled the requirements for this facility; will be exempted from 6% withholding tax for the period 1st January 2016 to 30th June 2016 PROVISIONAL WITHHOLDING TAX LIST FOR THE PERIOD JANUARY - JUNE 2016 SN TIN TAXPAYER NAME 1 1000380928 3R AGRO INDUSTRIES LIMITED 2 1000049868 3-Z FOUNDATION (U) LTD 3 1000024265 ABC CAPITAL BANK LIMITED 4 1000033223 AFRICA POLYSACK INDUSTRIES LIMITED 5 1000482081 AFRICAN FIELD EPIDEMIOLOGY NETWORK LTD 6 1000134272 AFRICAN FINE COFFEES ASSOCIATION 7 1000034607 AFRICAN QUEEN LIMITED 8 1000025846 APPLIANCE WORLD LIMITED 9 1000317043 BALYA STINT HARDWARE LIMITED 10 1000025663 BANK OF AFRICA - UGANDA LTD 11 1000025701 BANK OF BARODA (U) LIMITED 12 1000028435 BANK OF UGANDA 13 1000027755 BARCLAYS BANK (U) LTD. BAYLOR COLLEGE OF MEDICINE CHILDRENS FOUNDATION 14 1000098610 UGANDA 15 1000026105 BIDCO UGANDA LIMITED 16 1000026050 BOLLORE AFRICA LOGISTICS UGANDA LIMITED 17 1000038228 BRITISH AIRWAYS 18 1000124037 BYANSI FISHERIES LTD 19 1000024548 CENTENARY RURAL DEVELOPMENT BANK LIMITED 20 1000024303 CENTURY BOTTLING CO. LTD. 21 1001017514 CHILDREN AT RISK ACTION NETWORK 22 1000691587 CHIMPANZEE SANCTUARY & WILDLIFE 23 1000028566 CITIBANK UGANDA LIMITED 24 1000026312 CITY OIL (U) LIMITED 25 1000024410 CIVICON LIMITED 26 1000023516 CIVIL AVIATION AUTHORITY -

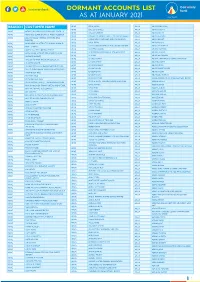

1612517024List of Dormant Accounts.Pdf

DORMANT ACCOUNTS LIST AS AT JANUARY 2021 BRANCH CUSTOMER NAME APAC OKAE JASPER ARUA ABIRIGA ABUNASA APAC OKELLO CHARLES ARUA ABIRIGA AGATA APAC ACHOLI INN BMU CO.OPERATIVE SOCIETY APAC OKELLO ERIAKIM ARUA ABIRIGA JOHN APAC ADONGO EUNICE KAY ITF ACEN REBECCA . APAC OKELLO PATRICK IN TRUST FOR OGORO ISAIAH . ARUA ABIRU BEATRICE APAC ADUKU ROAD VEHICLE OWNERS AND OKIBA NELSON GEORGE AND OMODI JAMES . ABIRU KNIGHT DRIVERS APAC ARUA OKOL DENIS ABIYO BOSCO APAC AKAKI BENSON INTRUST FOR AKAKI RONALD . APAC ARUA OKONO DAUDI INTRUST FOR OKONO LAKANA . ABRAHAM WAFULA APAC AKELLO ANNA APAC ARUA OKWERA LAKANA ABUDALLA MUSA APAC AKETO YOUTH IN DEVELOPMENT APAC ARUA OLELPEK PRIMARY SCHOOL PTA ACCOUNT ABUKO ONGUA APAC AKOL SARAH IN TRUST FOR AYANG PIUS JOB . APAC ARUA OLIK RAY ABUKUAM IBRAHIM APAC AKONGO HARRIET APAC ARUA OLOBO TONNY ABUMA STEPHEN ITO ASIBAZU PATIENCE . APAC AKULLU KEVIN IN TRUST OF OLAL SILAS . APAC ARUA OMARA CHRIST ABUME JOSEPH APAC ALABA ROZOLINE APAC ARUA OMARA RONALD ABURA ISMAIL APAC ALFRED OMARA I.T.F GERALD EBONG OMARA . APAC ARUA OMING LAMEX ABURE CHRISTOPHER APAC ALUPO CHRISTINE IN TRUST FOR ELOYU JOVIN . APAC ARUA ONGOM JIMMY ABURE YASSIN APAC AMONG BEATRICE APAC ARUA ONGOM SILVIA ABUTALIBU AYIMANI APAC ANAM PATRICK APAC ARUA ONONO SIMON ACABE WANDI POULTRY DEVELPMENT GROUP APAC ANYANGO BEATRASE APAC ARUA ONOTE IRWOT VILLAGE SAVINGS AND LOAN ACEMA ASSAFU APAC ANYANZO MICHEAL ITF TIZA BRENDA EVELYN . APAC ARUA OPIO JASPHER ACEMA DAVID APAC APAC BODABODA TRANSPORTERS AND SPECIAL APAC ARUA OPIO MARY ACEMA ZUBEIR APAC APALIKA FARMERS ASSOCIATION APAC ARUA OPIO RIGAN ACHEMA ALAHAI APAC APILI JUDITH APAC ARUA OPIO SAM ACHIDRI RASULU APAC APIO BENA IN TRUST OF ODUR JONAN AKOC . -

UGANDA BUSINESS IMPACT SURVE¥ 2020 Impact of COVID-19 on Formal Sector Small and Mediu Enterprises

m_,," mm CIDlll Unlocking Public and Private Finance for the Poor UGANDA BUSINESS IMPACT SURVE¥ 2020 Impact of COVID-19 on formal sector small and mediu enterprises l anda Revenue Authority •EUROPEAN UNION UGANDA BUSINESS IMPACT SURVEY 2020 Contents ABBREVIATIONS ............................................................................................................................................. iii ACKNOWLEDGMENTS ................................................................................................................................. iv EXECUTIVE SUMMARY .................................................................................................................................. v BACKGROUND ................................................................................................................................................ 1 Business in the time of COVID-19 ............................................................................................................ 1 Uganda formal SME sector ........................................................................................................................ 3 SURVEY INFORMATION ................................................................................................................................ 5 Companies by sector of economic activity ........................................................................................... 5 Companies by size ..................................................................................................................................... -

Bernard Bahemuka

Resume: Bernard Bahemuka Personal Information Application Title CHIEF CREDIT OFFICE First Name Bernard Middle Name N/A Last Name Bahemuka Email Address [email protected] Cell Nationality Uganda Gender Male Category Banking/ Finance Sub Category Private Banking Job Type Full-Time Highest Education University Total Experience 16 Year Date of Birth 27-03-1977 Work Phone +2560782366689 Home Phone N/A Date you can start 01-10-2020 Driving License Yes License No. 10143096/2/1 Searchable Yes I am Available Yes Address Address Address Hoima District City Hoima State N/A Country Uganda Institutes Institute Kampala International University City Kampala State N/A Country Uganda Address Kampala,Uganda Certificate Name Bachelors Degree in Business Administration Study Area Accounting & Management Institute Institute Of Teachers Education Kyambogo City Kampala State N/A Country Uganda Address Kampala, Uganda Certificate Name Diploma in Business Education Study Area Business Education Employers Employer Employer Encot Microfinance Limited Position Credit Manager Responsibilities Maintain and preserve Credit Operations policies , manage Credit Operations activities,Manage Credit Risk and grow the portfolio and clientele qualitatively Pay Upon Leaving 5,000,000 uganda Shillings Supervisor Chief Operating Officer From Date 01-10-2017 To Date N/A Leave Reason Carrier Growth City Kampala State N/A Country Uganda Phone N/A Address P.O.Box 389 Masindi Employer Employer Finance Trust Bank Position Branch Manager Responsibilities Over seeing general Branch -

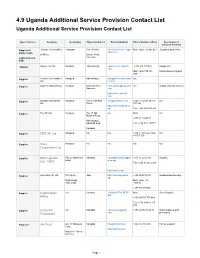

4.9 Uganda Additional Service Provision Contact List Uganda Additional Service Provision Contact List

4.9 Uganda Additional Service Provision Contact List Uganda Additional Service Provision Contact List Type of Service Company Location(s) Physical Address Email & Website Phone Number (office) Description of Services Provided Supplier of Sunrise Commodities Kampala Plot 163/165, Monteirovincent711@y Mob: +256 712 624 624 Suppliers and millers maize, beans, ahoo.com & Millers Bombo Road, maize flour and Kawempe CSB Supplier Aponye (U) Ltd Kampala Nalukolongo aponyeonline@gmail. +256 414 270 526 Supply and com Mob: +256 772 603 transportation of grains 909 Supplier Premier Commodities Kampala Nalukolongo info@premiercommodit n/a Ltd ies.com Supplier Export Trading Group Kampala Industrial Area info.uganda@etgworld. n/a Supply of grains and oils Namanve com http://www.etgworld. com Supplier Byinzika Enterprises Kampala Plot 3, Johnston [email protected] +256 414 259 519/312 n/a Ltd Street, 277 221 http://www.biyinzika.co. ug/ Fax: +256 414 343 268 Supplier Tiny Mirrors Kampala Plot 17 Old n/a Mob: n/a Masaka Road, +256-712-666453 Nalukolongo industrial area, Fax: +256-414-274777 Kampala Supplier SRS (U) Ltd Kampala n/a n/a +256 41 285 282 +256 n/a 41 505 723 Supplier Diary Kampala n/a n/a n/a n/a Corporation Ltd Supplier MTN Uganda Plot 22 Hanninton Kampala customerservice@mt +256 31 221 2333 Supplier Road n.co.ug Ltd - VSAT Fax: +256 31 221 2233 http://mtn.co.ug/ Supplier Agro ways (U) Ltd Plot 34-60 Jinja http://www.agroways. +256 454 479 381 Supplies/warehousing ug/ Kyabazinga Mob: +256 712 Way, Jinja 404245, +256 782 391354 Supplier Capital Reef- n/a Kampala HK@CAPITALREEF. -

Has the Privatization of Uganda Commercial Bank Increased Competition and Extended Outreach of Formal Banking in Uganda?” Abstract

DEPARTMENT OF ECONOMICS Uppsala University Bachelor’s Thesis Authors: Oscar Karlsson & Erik Malmgren Supervisor: Ranjula Bali Swain Spring 2008 “Has the Privatization of Uganda Commercial Bank Increased Competition and Extended Outreach of Formal Banking in Uganda?” Abstract: Financial sector development can reduce poverty and promote economic growth by extending access to financial services in developing countries. Traditionally, banking in Sub-Saharan Africa has been conducted by state-owned banks. Although, evidence has shown that severe government involvement in the banking sector has proved to cause low profitability and inefficiency. During 2001, Uganda Commercial Bank, the dominant provider of banking experienced financial problems; as a result, the government had to privatize the bank. The aim of this thesis is therefore to investigate if the privatization prevented the banking sector from collapse and if it made the sector more competitive and outreaching. The main conclusion is that the privatization strongly prevented the banking sector from collapse. Since privatization, competition has increased sufficiently in urban areas of Uganda while rural areas have not experienced any significant increase in competition. Finally, we conclude that the outreach of banking has increased somewhat since the privatization, but it is still relatively poor. Key Words: Sub-Saharan Africa, Uganda, Financial Development, Financial Structure, Access to Finance, Banking, Bank Competition, Bank Privatization, Outreach of Banking 2 Abbreviations Mentioned -

Presents Children of Uganda Tuesday, April 25Th 10Am

Presents Children of Uganda Tuesday, April 25th 10am and noon, Concert Hall Study Guides are also available on our website at www.fineartscenter.com - select Performances Plus! from Educational Programs, then select Resource room. The Fine Arts Center wishes to acknowledge MassMutual Financial Group for its important role in making these educational materials and programs available to the youth in our region. About this Guide The Children of Uganda 2006 Education Guide is intended to enhance the experience of students and teachers attending performances and activities integral to Children of Uganda’s 2006 national tour. This guide is not comprehensive. Please use the information here in conjunction with other materials that meet curricular standards of your local community in such subjects as history, geography, current af- fairs, arts & culture, etc. Unless otherwise credited, all photos reproduced in this guide © Vicky Leland. The Children of Uganda 2006 tour is supported, in part, with a generous grant from the Monua Janah Memorial Foundation, in memory of Ms. Monua Janah who was deeply touched by the Children of Uganda, and sought to help them, and children everywhere, in her life. © 2006 Uganda Children’s Charity Foundation. All rights reserved. Permissions to copy this Education Guide are granted only to presenters of Children of Uganda’s 2006 national tour. For other permissions and uses of this guide (in whole or in part), contact Uganda Children’s Charity Foundation PO Box 140963 Dallas TX 75214 Tel (214) 824-0661 [email protected] www.childrenofuganda.org 2| Children of Uganda Education Guide 2006 The Performance at a glance With pulsing rhythms, quicksilver movements, powerful drums, and bold songs of cele- bration and remembrance, Children of Uganda performs programs of East African music and dance with commanding skill and an awesome richness of human spirit. -

LETSHEGO-Annual-Report-2016.Pdf

INTEGRATED ANNUAL REPORT 2016 AbOUT This REPORT Letshego Holdings Limited’s Directors are pleased to present the Integrated Annual Report for 2016. This describes our strategic intent to be Africa’s leading inclusive finance group, as well as our commitment to sustainable value creation for all our stakeholders. Our Integrated Annual Report aims and challenges that are likely to impact to provide a balanced, concise, and delivery of our strategic intent and transparent commentary on our strategy, ability to create value in the short, performance, operations, governance, and medium and long-term. reporting progress. It has been developed in accordance with Botswana Stock The material issues presented in Exchange (BSE) Listing Requirements as the report were identified through well as King III, GRI, and IIRC reporting a stakeholder review process. guidelines. This included formal and informal interviews with investors, sector The cenTral The requirements of the King IV guidelines analysts, Executive and Non- are being assessed and we will address Executive Letshego team members, Theme of The our implementation of these in our 2017 as well as selected Letshego reporT is Integrated Annual Report. customers. sUstaiNAbLE While directed primarily at shareholders A note on diScloSureS vALUE creatiON and providers of capital, this report We are prepared to state what we do and we offer should prove of interest to all our other not disclose, namely granular data on stakeholders, including our Letshego yields and margins as well as on staff an inTegraTed team, customers, strategic partners, remuneration as we deem this to be accounT of our Governments and Regulators, as well as competitively sensitive information the communities in which we operate. -

Absa Bank 22

Uganda Bankers’ Association Annual Report 2020 Promoting Partnerships Transforming Banking Uganda Bankers’ Association Annual Report 3 Content About Uganda 6 Bankers' Association UBA Structure and 9 Governance UBA Member 10 Bank CEOs 15 UBA Executive Committee 2020 16 UBA Secretariat Management Team UBA Committee 17 Representatives 2020 Content Message from the 20 UBA Chairman Message from the 40 Executive Director UBA Activities 42 2020 CSR & UBA Member 62 Bank Activities Financial Statements for the Year Ended 31 70 December 2020 5 About Uganda Bankers' Association Commercial 25 banks Development 02 Banks Tier 2 & 3 Financial 09 Institutions ganda Bankers’ Association (UBA) is a membership based organization for financial institutions licensed and supervised by Bank of Uganda. Established in 1981, UBA is currently made up of 25 commercial banks, 2 development Banks (Uganda Development Bank and East African Development Bank) and 9 Tier 2 & Tier 3 Financial Institutions (FINCA, Pride Microfinance Limited, Post Bank, Top Finance , Yako Microfinance, UGAFODE, UEFC, Brac Uganda Bank and Mercantile Credit Bank). 6 • Promote and represent the interests of the The UBA’s member banks, • Develop and maintain a code of ethics and best banking practices among its mandate membership. • Encourage & undertake high quality policy is to; development initiatives and research on the banking sector, including trends, key issues & drivers impacting on or influencing the industry and national development processes therein through partnerships in banking & finance, in collaboration with other agencies (local, regional, international including academia) and research networks to generate new and original policy insights. • Develop and deliver advocacy strategies to influence relevant stakeholders and achieve policy changes at industry and national level. -

List of URA Service Offices Callcenter Toll Free Line: 0800117000 Email: [email protected] Facebook: @Urapage Twitter: @Urauganda

List of URA Service Offices Callcenter Toll free line: 0800117000 Email: [email protected] Facebook: @URApage Twitter: @URAuganda CENTRAL REGION ( Kampala, Wakiso, Entebbe, Mukono) s/n Station Location Tax Heads URA Head URA Tower , plot M 193/4 Nakawa Industrial Ara, 1 Domestic Taxes/Customs Office P.O. Box 7279, Kampala 2 Katwe Branch Finance Trust Bank, Plot No 115 & 121. Domestic Taxes 3 Bwaise Branch Diamond Trust Bank,Bombo Road Domestic Taxes 4 William Street Post Bank, Plot 68/70 Domestic Taxes Nakivubo 5 Diamond Trust Bank,Ham Shopping Domestic Taxes Branch United Bank of Africa- Aponye Hotel Building Plot 6 William Street Domestic Taxes 17 7 Kampala Road Diamond Trust Building opposite Cham Towers Domestic Taxes 8 Mukono Mukono T.C Domestic Taxes 9 Entebbe Entebbe Kitooro Domestic Taxes 10 Entebbe Entebbe Arrivals section, Airport Customs Nansana T.C, Katonda ya bigera House Block 203 11 Nansana Domestic Taxes Nansana Hoima road Plot 125; Next to new police station 12 Natete Domestic Taxes Natete Birus Mall Plot 1667; KyaliwajalaNamugongoKira Road - 13 Kyaliwajala Domestic Taxes Martyrs Mall. NORTHERN REGION ( East Nile and West Nile) s/n Station Location Tax Heads 1 Vurra Vurra (UG/DRC-Border) Customs 2 Pakwach Pakwach TC Customs 3 Goli Goli (UG/DRC- Border) Customs 4 Padea Padea (UG/DRC- Border) Customs 5 Lia Lia (UG/DRC - Border) Customs 6 Oraba Oraba (UG/S Sudan-Border) Customs 7 Afogi Afogi (UG/S Sudan – Border) Customs 8 Elegu Elegu (UG/S Sudan – Border) Customs 9 Madi-opei Kitgum S/Sudan - Border Customs 10 Kamdini Corner -

Banking Sector Liberalisation in Uganda Process, Results and Policy Options

Banking Sector Liberalisation in Uganda Process, Results and Policy Options Research report Editors: Madhyam & SOMO December 2010 Banking Sector Liberalisation in Uganda Process, Results and Policy Options Research report By: Lawrence Bategeka & Luka Jovita Okumu (Economic Policy Research Centre, Uganda) Editors: Kavaljit Singh (Madhyam), Myriam Vander Stichele (SOMO) December 2010 SOMO is an independent research organisation. In 1973, SOMO was founded to provide civil society organizations with knowledge on the structure and organisation of multinationals by conducting independent research. SOMO has built up considerable expertise in among others the following areas: corporate accountability, financial and trade regulation and the position of developing countries regarding the financial industry and trade agreements. Furthermore, SOMO has built up knowledge of many different business fields by conducting sector studies. 2 Banking Sector Liberalisation in Uganda Process, Results and Policy Options Colophon Banking Sector Liberalisation in Uganda: Process, Results and Policy Options Research report December 2010 Authors: Lawrence Bategeka and Luka Jovita Okumu (EPRC) Editors: Kavaljit Singh (Madhyam) and Myriam Vander Stichele (SOMO) Layout design: Annelies Vlasblom ISBN: 978-90-71284-76-2 Financed by: This publication has been produced with the financial assistance of the Dutch Ministry of Foreign Affairs. The contents of this publication are the sole responsibility of SOMO and the authors, and can under no circumstances be regarded as reflecting the position of the Dutch Ministry of Foreign Affairs. Published by: Stichting Onderzoek Multinationale Ondernemingen Centre for Research on Multinational Corporations Sarphatistraat 30 1018 GL Amsterdam The Netherlands Tel: + 31 (20) 6391291 Fax: + 31 (20) 6391321 E-mail: [email protected] Website: www.somo.nl Madhyam 142 Maitri Apartments, Plot No.