Milk Fat – What Is Behind Its Resurgence and Will It Last?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

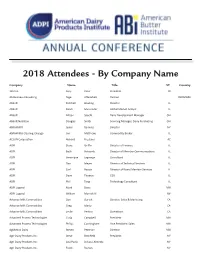

2018 Attendees - by Company Name

2018 Attendees - By Company Name Company Name Title ST Country 101 Inc. Cory Peter President IN 3A Business Consulting Tage Affertsholt Partner DENMARK Abbott Mitchell Bowling Director IL Abbott Randi Muzumdar Global Market Analyst IL Abbott Allison Specht Dairy Development Manager OH Abbott Nutrition Douglas Smith Sourcing Manager, Dairy Purchasing OH ABN AMRO Javier Ramirez Director NY ABN AMRO Clearing Chicago Jim Matthews Commodity Broker IL ACSON Corporation Richard Freeland AZ ADPI Steve Griffin Director of Finance IL ADPI Beth Holcomb Director of Member Communications IL ADPI Veronique Lagrange Consultant IL ADPI Dan Meyer Director of Technical Services IL ADPI Carl Roode Director of Board Member Services IL ADPI Dave Thomas CEO IL ADPI Phil Tong Technology Consultant IL ADPI Legend Mark Davis MN ADPI Legend William Merrick III NV Advance Milk Commodities Don Dortch Director, Sales & Marketing CA Advance Milk Commodities Greg Marty CA Advance Milk Commodities Leslie Perkins Operations CA Advanced Process Technologies Craig Campbell President MN Advanced Process Technologies Philip Cunningham Vice President: Sales MN AgMotion Dairy Steven Peterson Director MN Agri-Dairy Products Inc. Steve Bronfield President NY Agri-Dairy Products Inc. Ana Paula DeLuca Almeida NY Agri-Dairy Products Inc. Frank Reeves NY Company Name Title ST Country Agri-Mark Whey & Dairy Proteins Peter Gutierrez Vice President - Global Ingredient Sales WI Agri-Mark, Inc. Matt Mason Director Product Strategy VT Agri-Mark, Inc. Jessie Rogers Category Manager VT Agri-Mark, Inc. Rich Stammer Senior Executive Vice President MA Agri-Mark, Inc. Scott Werme Manager/Member Services MA Agropur Vic Grimm National Sales Director WI Agropur inc. -

New Zealand Delegation Member Companies' Profiles

New Zealand Delegation Member Companies’ Profiles DELEGATE Profile 1. Mark Clarkson ANZCO Foods Managing Director www.anzcofoods.com [email protected] ANZCO Foods is a processor and marketer of beef and lamb products. The company operates seven New Zealand slaughter and boning facilities, three manufacturing foods plants and has eight +64 274328896 offshore marketing offices. As well as an innovation centre, ANZCO also has three local retail outlets in the South Island. The annual turnover of ANZCO Foods is NZ$1.5 billion and they employ over 3,000 people globally. ANZCO Foods is jointly owned by Itoham Foods, Nissui, and the directors and management of ANZCO Foods. A dynamic multinational company, ANZCO Foods has four core business activities: • To procure the best beef and lamb grown year round on New Zealand’s lush, green pastures • To process prime New Zealand beef and lamb in state-of-the-art, accredited facilities • To design and create sophisticated food, healthcare and ingredient solutions • To market and guarantee year-round delivery of premium beef and lamb products to more than 80 countries around the world. • ANZCO's core business activities are seamlessly integrated, ensuring high quality beef and lamb products are delivered to exact standards, on time and in full from our farmers' pastures to the plate of the consumer. In addition, ANZCO operates three Wakanui Grill restaurants in Japan and Singapore, showcasing our premium beef and lamb. 2. Akbar Ghobakhlou Auckland University of Technology Research Fellow, Electrical Engineering http://www.aut.ac.nz/ Faculty AUT is a contemporary New Zealand university focused on providing exceptional student [email protected] opportunities and learning experiences, and graduate success in a context stimulated by impactful research and industry connectivity. -

Westland D7 Land Use Consent Application - Westland Hokitika Rev 2.Docx 24 January 2014 Revision 2

Application for Land Use Consent: Reference: 237947 Proposed Nutritional Milk Powder Prepared for: Westland Co-operative Dairy Dryer 7, Hokitika Company Limited Revision: 2 Assessment of Environmental Effects 24 January 2014 Westland Co-operative Dairy Company Limited Document control record Document prepared by: Aurecon New Zealand Limited Unit 1, 150 Cavendish Road Casebrook Christchurch 8051 PO Box 1061 Christchurch 8140 New Zealand T +64 3 366 0821 F +64 3 379 6955 E [email protected] W aurecongroup.com A person using Aurecon documents or data accepts the risk of: a) Using the documents or data in electronic form without requesting and checking them for accuracy against the original hard copy version. b) Using the documents or data for any purpose not agreed to in writing by Aurecon. Document control Report title Application for Land Use Consent: Proposed Nutritional Milk Powder Dryer 7, Hokitika Document ID final Project number 237947 P:\237947 - Westland - Hokitika Dryer 7\docs\Westland D7 Land Use Consent File path Application - Westland Hokitika Rev 2.docx Westland Co-operative Dairy Client Client contact Antony Michalik Company Limited Prepared Rev Date Revision details/status Author Verifier Approver by Draft Land Use Consent 0 13 December 2013 D Thorne D Thorne M Allan M Allan Application – For Client Review Draft Land Use Consent 1 8 January 2014 Application – For Council D Thorne D Thorne M Allan M Allan Feedback Land Use Consent Application – 2 24 January 2014 D Thorne D Thorne M Allan M Allan For Lodgement Current -

Westland's Wpc Analyze

4555 WPC80 Description and Applications Ingredients 4555 WPC80 is an agglomerated, soluble, spray dried whey protein Whey Protein. concentrate powder produced from fresh pasteurised skim milk. It has excellent functionality and a bland profile making it suitable for use in protein rich applications. Allergens Shelf Life Pack Sizing Contains Milk. 24 months if stored under 20 kg bag size available. specified conditions. 56 bags per pallet. Halal & Kosher Certification Storage Conditions Packaging Westland Milk Products certifies Store in a cool, dry, well The standard export pack is a 2 that this product is manufactured ventilated, odour free area, away ply Kraft bag incorporating an under Halal and Kosher from direct contact with floors inner polyethylene liner. conditions. Halal and Kosher or walls. Packages are printed with ID certificates are available on Code, manufacturing and expiry request. Temperature should not exceed date. No staples or metal 25 ºC and relative humidity fasteners are used. should be below 65%. Regulatory Information Westland Milk Products certifies that this product is manufactured using milk sourced from New Zealand dairy cows which contains no preservatives, antioxidants or food additives. It is also free of rBST, which is not licensed for use in dairy cows by the New Zealand's Ministry of Primary Industries. Quality Assurance Strict quality control procedures are enforced during the manufacture of this product. The manufacturing environment is subject to regular monitoring and control. Final product is sampled and tested for chemical, sensory and microbial parameters using internationally recognised procedures in an ISO 17025 certified laboratory. During storage and shipment, precautions are taken to ensure that product quality is maintained. -

Whey Protein Concentrate: a New Zealand Success Story

1 WHEY TO GO 2 Whey to go WHEY PROTEIN CONCENTRATE: A NEW ZEALAND SUCCESS STORY Edited by John MacGibbon Authors: Robin Fenwick Jim Harper Peter Hobman Lee Huffman Ken Kirkpatrick John MacGibbon Kevin Marshall Mike Matthews Arthur Wilson Dave Woodhams MARTINBOROUGH 3 WHEY TO GO Ngaio Press PO Box 153, Martinborough 5741, New Zealand [email protected] • www.ngaiopress.com Copyright © Editor & contributors 2014 First published in 2014 This book is copyright. Apart from any fair dealing for the purpose of private study, research, criticism or review, as permitted under clause 96 of the Copyright Act 1994 (NZ), no part may be reproduced by any process without the permission of the publishers. National Library of New Zealand cataloguing-in-publication data: Whey to go : whey protein concentrate : a New Zealand success story / John MacGibbon, editor. ISBN 978-0-9864685-7-5 1. Whey. 2. Whey products—New Zealand—History. 3. Dairy products industry—New Zealand. I. MacGibbon, John, 1945- II. Title. 637.3—dc 23 The authors are grateful for financial assistance provided for production of this book by Dairy Division of the New Zealand Institute of Food Science & Technology; Foundation for Research, Science & Technology (now part of the Ministry of Business, Innovation and Employment (MBIE)); Ministry of Agriculture and Forestry New Zealand (now part of the Ministry of Primary Industry); Ministry of Research Science and Technology (now part of MBIE); New Zealand Trade and Enterprise; W J Harper. Trade marks of The Coca-Cola Company are used with permission. The Coca-Cola Company has had no authorial nor editorial input to this book, nor does it endorse the contents. -

The Application of Cost-Based Value Stream Mapping to a Container Loading Analysis

Lincoln University Digital Dissertation Copyright Statement The digital copy of this dissertation is protected by the Copyright Act 1994 (New Zealand). This dissertation may be consulted by you, provided you comply with the provisions of the Act and the following conditions of use: you will use the copy only for the purposes of research or private study you will recognise the author's right to be identified as the author of the dissertation and due acknowledgement will be made to the author where appropriate you will obtain the author's permission before publishing any material from the dissertation. The Application of Cost-Based Value Stream Mapping to a Container Loading Analysis A Dissertation submitted in partial fulfilment of the requirements for the Degree of Bachelor of Commerce with Honours at Lincoln University by Tiffany McIntyre Lincoln University 2014 Abstract of a Dissertation submitted in partial fulfilment of the requirements for the Degree of Bachelor of Commerce with Honours. Abstract The Application of Cost-Based Value Stream Mapping to a Container Loading Analysis by Tiffany McIntyre Lean production emerged in the 1990’s as an academic term, with the publication of the book ‘The Machine that Changed the World’. The philosophy was born out of the Toyota Production System, with the objective to eliminate waste within firms. Originally applied to the manufacturing industry, the philosophy has been applied to other industries such as services and healthcare with varying levels of success. However, to date, very little research has been conducted in the agricultural sector. The aim of the study is to use the Lean tool Value Stream Mapping to determine its ability to improve performance within a logistics setting, through conducting a cost analysis on container utilisation for an existing New Zealand dairy company. -

The Effectiveness of DIRA in Fostering Competition and Economic

PUBLIC VERSION The Effectiveness of DIRA in Fostering Competi tion and Economic Efficiency in New Zealand Dairy Markets Robert D. Willig Meg Guerin -Calvert Andres V. Lerner Compass Lexecon 20 July 2011 PUBLIC VERSION TABLE OF CONTENTS I. Introduction and Executive Summary ................................ ................................ ............. 1 A. Introduction ................................ ................................ ................................ .................. 1 B. Executive summary ................................ ................................ ................................ ...... 2 II. Economic Objectives of the Dairy Industry Restructuring Act (DIRA) ....................... 6 A. Competitive concerns addressed by DIRA ................................ ................................ 6 B. Principa l components of DIRA ................................ ................................ ................... 6 1. Provisions that facilitate switching between Fonterra and rival processors ............ 7 2. Raw Milk Regulation ................................ ................................ ............................... 8 III. The Farm Gate Milk Price ................................ ................................ ................................ 8 A. Fonterra’s incentive s to set a competitive farm gate milk price .............................. 9 1. Fonterra’s incentive to set a farm gate milk price that is “too low” ........................ 9 2. Fonterra’s incentives to foreclose rival processors by setting -

1) 1973 2) Mid 1990S 3) 2001 (1)

BACKGROUND New Zealand faced the challenge of rapidly increasing milk flows three times in recent decades: 1) 1973 2) Mid 1990s 3) 2001 (1) The UK became a full member of the EEC (now the EU) in 1973. The 12 years of negotiation leading up to this gave New Zealand an opportunity to diversify its dairy production away from butter and cheese. Wholemilk powder production ramped up from zero in 1972 to over 400,000 tonnes by 1999. Total production of milkpowders nearly reached 700,000 tonnes. (1) Historical Trends – NZ Milkpowder Production 1938-2000 TOTAL WMP SMP NUT BMP (1) 30.0 Capacities of the largest 27.0 tph tph New Zealand dairy spray 25.0 23.0 tph driers commissioned tph in 5-year periods (tonnes/hour) 12.0 tph 8.0 5.0 tph 3.2 3.4 tph tph tph 1971 1976 1981 1986 1991 1996 2001 2006 2011 to to to to to to to to to 1975 1980 1985 1990 1995 2000 2005 2010 2015 (1) The large capital requirements encouraged amalgamations: - to help raise the capital - to exploit economies of scale in drying plants All dairy companies were co-operatives operating a single-desk selling system for the 95% of their production that was exported. The continual building of ever larger plants built up domestic engineering and construction capabilities. (2) As the number of co-operatives dwindled and their milk flows increased, the price of farm land increased. The mid 1990s saw mass migration of dairy farmers and herds to cheaper South Island traditionally sheep farming areas. -

One Generation Supporting the Next

Annual Report 2017 Report Annual One generation supporting the next. Sustainable Success 1 Here’s what we’ve been doing to help deliver a sustainable future. Contents Chairman’s Report 2-4 CEO’s Report 6-11 Customer Profile – Ausnutria 12-13 Categories and Products 14-15 Redefining Westland’s Purpose 16-17 Shareholder Case Study 18-20 Our Team 22-23 Looking forward to another 80 years 24-27 Environmental Highlights 30-31 Health and Safety 32-34 Five Year Trends 36-37 Board of Directors & Senior Management 38-39 Corporate Governance Report 40-41 Audit Report 42-43 Directors’ Declaration 45 Financial Statements 46-49 Notes to Financial Statements 50-76 Statutory Information 78-79 Directory 80 1 Chairman Pete Morrison We have worked very hard to build The 2016-17 financial year for At the time of writing, the shareholder- Westland Milk Products was initiated governance review process a great future for characterised by challenge and was still underway. It was scheduled change, with new leadership at for presentation to a special meeting Westland. Board and management levels. of shareholders in October 2017. With Westland finishing the 2015-16 year in the unenviable position of Shareholders at the 2016 Annual offering its shareholders the lowest General Meeting, and district meetings payout of any New Zealand dairy in March 2017, asked the Board and company, we began the new financial management team to improve year under considerable financial communications with them. It’s pressure. Understandably, our good to report that recent feedback shareholders were demanding answers suggests this has much improved and and calling for both the Board and shareholders are appreciating receiving management to do much better. -

Westland-Milk-Products-2016-Annual-Report.Pdf

ANNUAL REPORT ANNUAL Our future, is made by us Securing our future Season Highlights 2-3 Five Year Trends 4-5 Chairman’s Report 6-9 Shareholder Case Study 10-11 Board of Directors & Senior Management 12-13 Corporate Governance Report 14-15 Audit Report 16 Directors’ Declaration 17 Financial Statements 18-21 Notes to Financial Statements 22-49 Statutory Information 50-51 Directory 52 CONTENTS OUR FUTURE IS MADE BY US 1 Season Highlights Supplying farms 9 Cows milked 129, 131 Blocks of Westgold Sachets of butter packed EasiYo packed 11,200,00o 14,900,000 2 3 Five Year Five Year Trends Trends 2016 2015 2014 2013 2012 Milk Received From Suppliers [M litres] 743 765 753 621 587 Milk Fat - Own Supplier [M kgs] 39.164 40.286 39.574 32.785 31.086 Protein - Own Supplier [M kgs] 29.260 30.065 29.531 24.363 22.962 Milk Solids Received from Suppliers [M kgs] 68.424 70.351 69.105 57.14 8 54.048 Average Milk Solids per Farm [kgs] 159,495 163,607 161,085 139,726 136,141 Average Milk Fat % 5.27 5.27 5.26 5.28 5.30 Average Protein % 3.94 3.93 3.92 3.92 3.91 TOTAL EQUITY PAYOUT TO MILK SOLIDS Protein : Fat Ratio % 74.71 74.63 74.62 74.31 73.87 Incl. shares classified as SHAREHOLDERS (Million kilograms) Finest Milk % 98.50 98.70 98.80 98.80 98.60 liabilities. (Cents/kgms) (Dollars in millions) Production [Tonne] - Powder 78,664 69,997 74,020 65,426 57,777 Production [Tonne] - Butter 32,973 34,394 33,696 30,700 32,123 242* 208* 230 212 194 388 485 727 604 604 68.42 70.35 69.11 57.15 54.05 Production [Tonne] - Protein 6,741 7,0 62 6,465 5,169 5,008 Production [Tonne] - AMF 10,753 11,631 10,506 7,0 03 5,089 Turnover [$Million] 588 639 830 566 534 Total Assets [$Million] 571 538 478 430 379 Total Equity [$Million] (incl. -

Asia Focus Newsletter January 2019

Asia Focus Update January 2019 祝大家春节快乐 NEW ZEALAND - GENERAL BUSINESS UPDATE Both the New Zealand Dollar and the New Zealand Stock Exchange have been slowly recovering after taking large hits in October. Despite global unease, New Zealand’s economic outlook remains positive with business confidence relatively stable, albeit more subdued than 12 months ago. The Government’s financial statements for 2018 report rising forecasted surpluses and falling core Crown net debt. Against this background, New Zealand’s economy is forecasted to grow faster than that of its major trading partners. Since the coalition government came into power just over a year ago, it has enacted several of its election campaign policies, demonstrating a strong focus on environmental protection and regional development. The Prime Minister’s focus on environmental protection and climate change was again highlighted at Davos of the World Economic Forum last week. We expect this to be a key theme this year. It also established a Tax Working Group, chaired by former Finance Minister Sir Michael Cullen, which is due to report back in February this year and is expected to recommend some form of capital gains tax. Agribusiness is expected to perform well in the coming months, with dairy production off to a good start and favourable weather conditions foreshadowing a bountiful season for produce. To boost potential growth, New CONTACTS Zealand will need to tackle pressing concerns in the forestry and dairy sectors. One of the greatest issues facing the Robert McLean government is subdued business confidence over the last year. However, New Zealand Institute of Economic DDI: +64 9 977 5077 Research’s Quarterly Survey of Business Opinion showed Mobile: +64 21 987 050 business confidence recovered slightly in the fourth quarter [email protected] of 2018, signalling a more positive business confidence outlook for 2019. -

Product Catalogue

Product Catalogue Crafted for Food Service 02 Quick facts 04 Our heritage 08 Our unique source 10 Master’s Series 12 Our butter 16 Our whole milk 18 Our whipping cream 20 Chef Liu 2 Westgold’s parent company, The Westgold brand was Westland Milk Products, was established in 2004 founded in 1937 from a number 1937 of small regional producers More than 8 Westland Milk Products million blocks of is New Zealand’s second 430 farms Westgold butter are largest dairy co-operative with over packed each year mill 175,000 cows 8 Westgold took home medals for both salted 735 million litres 2 0 1 7 and unsalted butter at the prestigious NZ Champion of milk collected of Cheese Awards 735 each year million Exported to over 4 million 50 countries litres of Westgold UHT 5o Whipping Cream countries produced annually 2 3 Our heritage Westgold products have been perfected over generations. From humble beginnings on the West Coast of New Zealand’s South Island, almost 150 years ago, our parent company Westland Milk Products continues to craft high-quality dairy products for markets around the globe. We are proud of our past. The courageous decisions and pioneering spirit of previous generations have shaped our company into today’s successful, independent, entirely dairy farmer-owned business. Arahura, West Coast 1905 4 5 The journey begins in our West Coast heartland. 6 7 Our unique source Our delicious, high-quality products are crafted from healthy cows on lush pasture. This, combined with our beautiful West Coast landscape, where fertile soils and high levels of rainfall and sunshine are abundant, make for one of the best dairy farming environments in the world.