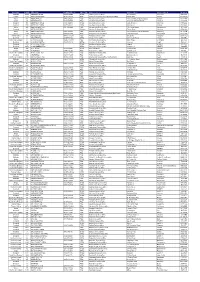

Finance Dashboard for the Parish of Potterspury W Furtho & Yardley

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Potterspury Lodge School

Potterspury Lodge School Welfare progress monitoring inspection report for a residential special school Df E registration number 928/6039 Unique reference number for social care SC012962 Unique reference number for education 122136 Inspection dates 09/05/2012 Inspector Gwen Buckley School address Potterspury Lodge School, Potterspury Lodge, TOWCESTER, Northamptonshire, NN12 7LL Telephone number 01908 542912 Email [email protected] Headteacher Mrs Christine Haylett The Office for Standards in Education, Children's Services and Skills (Ofsted) regulates and inspects to achieve excellence in the care of children and young people, and in education and skills for learners of all ages. It regulates and inspects childcare and children's social care, and inspects the Children and Family Court Advisory Support Service (Cafcass), schools, colleges, initial teacher training, work-based learning and skills training, adult and community learning, and education and training in prisons and other secure establishments. It assesses council children’s services, and inspects services for looked after children, safeguarding and child protection. If you would like a copy of this document in a different format, such as large print or Braille, please telephone 0300 123 1231, or email [email protected]. You may reuse this information (not including logos) free of charge in any format or medium, under the terms of the Open Government Licence. To view this licence, visit www.nationalarchives.gov.uk/doc/open-government-licence/, write to the Information Policy Team, The National Archives, Kew, London TW9 4DU, or email: [email protected]. To receive regular email alerts about new publications, including survey reports and school inspection reports, please visit our website and go to ‘Subscribe’. -

June 20162016

JuneJune 20162016 www.bugbrookelink.co.ukwww.bugbrookelink.co.uk 2 The Bugbrooke “LINK” Committee Published bi-monthly. Circulated free to every household within the Parish boundary of Bugbrooke. The “LINK” Management Committee is elected in accordance with the Constitution and Rules at the AGM in May. Chairman Paul Cockcroft, 31 Pilgrims Lane Secretary Barbara Bell, 68 Chipsey Avenue Treasurer/Vice Chairman Jim Inch, 16a High Street Production & Website Geoff Cooke, 1 Browns Yard Advertising Sheila Willmore, 31 Oaklands Adverts Production Gwynneth White, 1 Homestead Drive Submissions Pat Kent, 1 High Street E-mail to [email protected] Web site address www.bugbrookelink.co.uk Deadline for August issue 4th July 2016 Whilst we check the information for grammar and spelling on articles supplied by our contributors, the LINK magazine can accept no responsibility for errors or omissions in the factual content of the information. The views expressed in these articles are those of the contributors and are not necessarily shared by the LINK Management Committee. Advertisements are used to fund the LINK, and their services are not necessarily endorsed by the LINK Management Committee. 3 4 5 5 6 Bugbrooke LINK Magazine (Issue 198), June 2016 Chairman: Paul Cockcroft I’m delighted that the LINK management committee was re-elected at our AGM on 4th May 2016; we look forward to continuing our efforts in drawing together all of the components of a successful village magazine. The backbone of the publication is the revenue that’s received from our numerous and varied advertisers, without whose generous support the printing costs could not be met. -

Office Address Details.Pdf

Area Name Identifier Office Name Enquiry office no. Office Type Address Line 2 Address Line 3 Address Line 4 Postcode Midlands 2244 ABBERLEY SPDO 01299 896000 SPDO Abberley Delivery Office The Common Worcester WR6 6AY London 1116 ABBEY WOOD SDO 08456 112439 PDO Abbey Wood & Thamesmead Delivery Office Nathan Way London SE28 0AW Wales 871 ABERCARN DO 01495 245025 PDO Abercarn Delivery Office Prince Of Wales Industrial Estate Newport NP11 4AA Wales 236 ABERDARE DO 01685 872007 PDO Aberdare Delivery Office Aberaman Industrial Estate Aberdare CF446ZZ Scotland 985 ABERFELDY SPDO 01887 822835 SPDO Aberfeldy Delivery Office Dunkeld Street Aberfeldy PH152AA Scotland 1785 ABERFOYLE SPDO 01877 382231 SPDO Aberfoyle Delivery Office Main Street Stirling FK8 3UG Wales 880 ABERGAVENNY DO 01873 303500 PDO Abergavenny Delivery Office 1 St. Johns Square Abergavenny NP7 5AZ Scotland 12 ABERLOUR SPDO Wayside Aberlour Delivery Office Elchies Road Aberlour AB38 9AA Wales 874 ABERTILLERY DO 01495 212546 PDO Abertillery Delivery Office Unit 5 Cwmtillery Industrial Estate Abertillery NP131XE Wales 1257 ABERYSTWYTH DO 01970 632600 PDO Glanyrafon Industrial Estate Llanbadarn Fawr Aberystwyth SY23 3GX Thames Valley 934 ABINGDON DO 08456-113-218 PDO Abingdon Delivery Office Ock Street Abingdon OX14 5AD Scotland 8 ABOYNE SPDO 08457740740 SPDO Aboyne Delivery Office Charlestown Road Aboyne AB345EJ North West England 71 ACCRINGTON DO 08456-113-070 PDO Accrington Delivery Office Infant Street Accrington BB5 1ED Scotland 995 ACHARACLE SPDO 01967 431220 SPDO Acharacle -

The Old Mill, 23B Church End, Potterspury, Towcester, NN12 7PX

The Old Mill, Church End, Potterspury £799,950 Freehold The Old Mill, 23b Church End, Potterspury, Towcester, NN12 7PX The Old Mill is a substantial family home, standing in an Whittlewood Forest, an extensive area of ancient woodland to the west, that was idyllic location with views over the Church and Mill Leet part of the original estate of the Duke of Grafton. Much of the ancient woodland is designated an SSSI for protection from development. The parish church is to the front and wild flower meadows to the rear. One dedicated to St Nicholas, and there has been a church on the site since at least of three properties sympathetically converted from 1087, originally granted by Robert de Ferrers, 1st Earl of Derby to Bernard the Potterspury Mill in 1984 and listed Grade ll as a property Scribe. The Queen's Oak which stood nearby until 1997 was reputed to be the site of the first meeting between Edward IV and Elizabeth Woodville. Educational of architectural or historic interest, this unique home provision in the village includes John Hellins Primary School, which has about 115 retains many period features including oak ceiling and children, aged 4 –11. Potterspury Mill is mentioned in the Doomsday Book, the present conversion into three dwellings taking place in 1984. wall timbers and hand carved posts, exposed brick walls and a slate-hung gabled hoist on the third floor. Planning has been granted for a single storey garden room to replace the existing conservatory and an additional en- suite bedroom could be created on the third floor, with plumbing in situ. -

Potterspury, Northamptonshire

Potterspury, Northamptonshire A modern stone built four bedroom detached house with two en suite shower rooms and a double garage within walking distance of amenities in the village. Built by Francis Jackson Homes during 2013, the accommodation Modern stone built detached house 48 Mansion Gardens is over two floors and the ground floor includes an entrance hall Four bedrooms, two en suite Two reception rooms Potterspury, Northamptonshire, NN12 7FD with engineered oak flooring, a sitting room with a log burner and French doors to the rear, a snug/office, a cloakroom, an open plan Kitchen/dining/family room kitchen/dining/family room and a separate utility room with Utility room and cloakroom Guide Price £635,000 access to the garage. Enclosed rear garden Double garage and off street parking Balance of NHBC guarantee remaining 4 bedrooms On the first floor the landing gives access to all four bedrooms 2 reception rooms and the family bathroom. The master bedroom and bedroom Additional Information two both have en suite shower rooms and built-in wardrobes. Mains water, Gas, Electricity 3 bathrooms The Local Authority is West Northamptonshire Council The property is in council tax band F EPC Rating Band B The front garden is laid to lawn with a privet hedge, and the driveway at the side provides off street parking for two cars and leads to the double garage which has electric doors and eaves storage space. The enclosed rear garden is laid to lawn with a paved patio, shrubs and bushes. Kitchen/Dining/Family Room The kitchen area is fitted with a range of floor and wall units with granite worksurfaces and upstands. -

Peterborough Cathedral Prayer Calendar January 2021

Peterborough Cathedral Prayer Calendar January 2021 Canon: Rowan Williams, Precentor Friday Canon Emeritus: Hilary Davidson 1 Lay Canon: Maria Steele The various Cathedral congregations and the Community Forum Diocese: South Cleley Benefice (Potterspury, Furtho, Yardley Gobion, Cosgrove and Wicken) Rector: Vacant Readers: Mary McVay, Monty Lynds, Richard Yates, Graham Brack World Church: The Diocese of Aba –Nigeria Canon: Sarah Brown, Missioner Saturday Canon Emeritus: Peter Garlick 2 Lay Canon: Phil Rolfe Residents and tenants of the Precincts Diocese: Self supporting ministers Northampton Archdeaconry: Lulu Pelly Oakham Archdeaconry: Vacant World Church: The Diocese of Aba Ngwa North –Nigeria Canon: Tim Alban Jones, Vice Dean, Bishop’s Chaplain Sunday Canon Emeritus: Paul Rose 3 Lay Canon: Jackie Matthews The Garden House staff, volunteers and service users Diocese: DEANERY OF TOWCESTER Rural Dean: Paul McLeod Lay Chair: Sharron Bland World Church: The Episcopal / Anglican Province of Alexandria Monday Canon Residentiary: Ian Black 4 Canon Emeritus: David Wiseman Lay Canon: Mark Constant Cathedral Music Department staff and volunteers Diocese: The workplace: Senior managers and leaders in the private and public sectors World Church: The Diocese of Abakaliki –Nigeria Peterborough Cathedral Prayer Calendar January 2021 Tuesday College of Canons: Ven. Richard Ormston 5 Canon Emeritus: Jim Mynors Lay Canon: Mary Hanna The Cathedral Choir: lay clerks, choral scholars, choristers and their families The Cathedral Youth Choir Diocese: Salcey -

Applying for a Secondary School Place in Northamptonshire 2017

Applying for a Secondary School Place in Northamptonshire 2020-2021 Including UTC information Closing Date: Thursday 31st October 2019 at 5pm 1 Contents Section 1 – The Basics ........................................................................................... 4 Introduction ................................................................................................................................... 4 Timetable of secondary application process ................................................................................. 5 Who can apply for a secondary school place? ............................................................................. 6 How do I decide which schools to apply for? ................................................................................ 6 How do I apply? ............................................................................................................................ 8 Why should I state three preferences and what is ‘equal preferencing’? .................................... 10 Can I apply for the same school more than once? ..................................................................... 11 How do I include a school outside of Northamptonshire in my preferences? ............................. 11 Can I change my preferences once they have been submitted? ................................................ 11 What are my chances of getting one of my preferred schools? .................................................. 12 What is the position relating to twins/multiple births? ................................................................ -

How to Reach Deanshanger Primary School the Green Deanshanger Northamptonshire MK19 6HJ Tel: 01908 268920 by Car – Travelling

How to reach Deanshanger Primary School The Green Deanshanger Northamptonshire MK19 6HJ Tel: 01908 268920 By car – travelling from Northampton and M1 junction 15 – Take the A508 to Old Stratford (15.6 miles) and then the A422 (3rd exit at the Old Stratford roundabout) to Deanshanger. To enter the village on the A422, you will need to take the 3rd exit at the small roundabout. You will enter the village on the Stratford Road. Please note that there is a 30 miles an hour speed limit as you enter Deanshanger. Elizabeth Woodville Secondary School will be on your left. Turn right at the Beehive Pub (it will be on your left) and then take the next left to the front of the school building. By car - travelling from Buckingham – Take the A422 from Buckingham (6.2 miles). As you pass the MK Hotel, Spice Hut and petrol station, you will see a slip road on your left heading into Deanshanger village. Turn left at the Beehive pub (it will be on your right) and then take the next left to the front of the school building. By car - travelling from Towcester - Take the A5 (9 miles) through Paulerspury and Potterspury to Old Stratford and then the A422 (4th exit at the Old Stratford roundabout) to Deanshanger. To enter the village on the A422, you will need to take the 3rd exit at the small roundabout. You will enter the village on the Stratford Road. Please note that there is a 30 miles an hour speed limit. Elizabeth Woodville Secondary School will be on your left. -

Northamptonshire

552 TOWCESTEB. .NORTHAMPTONSHIRE. [KELLTS LodeI' Sir Edmund Giles bart. M.A. Whittlebury lodge, To",- William Aroold, Blisworth; Pattishall &; Towcester dis ce.ster trict, Harold William Kingcombe Read L.C.R.P.Edin. Wake Sir Herewald bart. C-ourteenhall, Northampton Brackley road, Towcester; Silverstone district, Robert Blackwood Major Price Frederick R.A. The Lodge, Towcester Elphinstone L.R.c.p.Edin. Silverstone Eykyn Roger esq. Gayton house, Blisworlh R.S.O Superintendent Registrar, William Whitton, Town hall, Grant~Ives Wilfred Dryden esq. Bradden house, Towcester Towcester; deputy, vacant . Grant Edward esq. Litchborough house, Weedon Registrars of Births &: Deaths, Abthorpe sub-district, Fuller Craven Burrell esq. Park view, Towcester William Cook, Blakesley; deputy, Richard Whitlock, Vernon Bertie Wentworth esq. Stoke park, Towcester Woodend, Blakesley; Towcester sub-district, Samuel Watkins Robert Webb esq. High street, Towcester Sansom, Albert villa, Towcester; deputy, Henry Salmon, Watts Edward Hanslope esq. Hanslope park, Stony Stratford I Albert row, Towcester Clerk to the Magistrates, Thos. Mieres Percival, Town hall Registrar of Marriages for the Union, Samuel Sansom, Petty Sessions are held at the Police station every alternate Albert villa, Towcester; deputy,. Henry Salmon, Albert tuesday, at 12 noon row, Towcester The places within the division are :-A.lderton, Ashton, Ab. Workhouse, in Brackley road, is a plain building of stone, thorpe with Foscote, Adstone, Blakesley, Bradde~ Blis. , bolding 208 inmates; Rev. J. T. H. Delafons M.A. chap worth, Cosgrdve, Cold Higham, Caldecote, Deanshanger, lain; Harold William Kingcombfl Read L.R.C.P. Edin. Duncot & Burcot, Easton Neston, Eastcote &; Dalscot, medical officer; Henry H. Packer, mastel"; Mrs. Sarah Furtho, Foxley, Grafton Regis, Gayton, Green's Norton, Packer, matron Hartwell, Handley, Litchborough, Lois Weedo~ Maidford, RURAL SANITARY AUTHORITY. -

NORTHAMPTONSHIRE. [KELLY's Thoroughly Restored and Re-Seated in the Year 1857

18 LITTLE ADDING TON. NORTHAMPTONSHIRE. [KELLY'S thoroughly restored and re-seated in the year 1857. water; rateable value, £1,304; the population in 1901 The register dates from the year 1588. The living is a was 304. vicarage, net yearly value £130, with residence and 288 Sexton, Samuel Ager. acres of glebe, in the gift of Mrs. Benton-Keane, and Post Office.-Mrs. Hannah Farrar, sub-postmistress. held since 1904 by the Rev. Paul Roberts M.A. of Letters through Thrapston arrive about 7.40 a.m. & Queens' College, Cambridge. Here is a Wesleyan 1.45 p.m.; dispatched at u.5 a.m. & 5.30 p.m.; no chapel. There is no lord of the manor. The principal delivery or dispatch on sundays. lrthlingborough is landowners are Sidney Leveson Lane esq. B.A., D.L., the nearest money order & telegraph office J.P. of The Manor House, Great Addington, George Herbert Capron esq. B.A., J.P. of Southwick Grange, Public Elementary School (mixed), built in 1873 at a Oundle, Mrs. Thomas Waiters, and the vicar. The soil cost of £3oo, for 66 children; average attendance, is partly light and partly strong; subsoil, limestone and 6o; James Rose, master; Miss Parsons, infants' mist ironstone. The chief crops are wheat, barley, beans, Carriers.-George Hawes, Arthur Manning & Lot Week peas &c. The area is 1,134 acres of land and 9 of ley, pass through to Wellingborough, weds PRIVATE RESIDENTS. Farrar Hannah (Mrs.), shopkeeper, & Pashler John, farmer Roberts Rev. Paul M.A. (vicar), post office Perkins Edward, pig dealer Vicarage Garton Isabella (Mrs.), Bell inn Rose J ames, schoolmaster & clerk to Waiters Mrs. -

Northamptonshire Militia Lists 1777: Cleyley Hundred

CLEYLEY HUNDRED Ashton 26 Potterspury 50 Cosgrove 40 Roade 28 Furtho 2 Shutlanger 23 Grafton Regis 11 Stoke Bruerne 34 Hartwell 40 Wicken 35 Hulcote 10 Yardley Gobion 36 Passenham & Denshanger 41 458 Paulerspury 82 Ale-seller's son 2 Maltster 1 Baker 9 Mason 8 Baker's son 1 Mason's son 1 Blacksmith 9 Miller 3 Brickmaker 1 No trade given 15 Butcher 6 Sawyer 2 Butler 1 Schoolmaster 1 Carpenter 16 Servant 105 Coachman 1 Shepherd 6 Collar-maker 1 Shoemaker 15 Cooper 1 Shopkeeper 1 Dealer & chapman 1 Snead-maker 1 Dealer in hogs 2 Stableboy 1 Farmer 44 Stay-maker 1 Farmer's son 19 Stone-cutter 1 Framework-knitter 1 Tailor 9 Gardener 2 Victualler 6 Grazier 2 Weaver 8 Grocer 1 Wheeler 2 Hemp-dresser 1 Wheelwright 4 Horse-dealer 2 Wool-comber 2 Keeper 1 Labourer 136 458 Lace-maker 5 ASHTON Decbr. ye 13th 1777. A true list of all the men now dwelling in the parish of Ashton in the county of Northampton between the ages of eighteen and forty five years by me, John Hodgkens, constable. Robert Cook, farmer Robert Waite, farmer William Webb, servant man John Welch, labourer William Linnel, farmer John Penn, labourer Jasper Blunt, servant man William Morris, labourer Thomas Wickens, dealer & James Sturdidge, labourer chapman Robert Smith, lace maker William Wickens, lace maker Henry Linnel, farmer Edward Clark, labourer James Chrouch, servant man 8 NORTHAMPTONSHIRE MILITIA LISTS, 1777 William Ferne, lace maker Henry Ferne, labourer William Goodridge, senr., Robert Raws, servant man blacksmith William Dunsby, farmer William Goodridge, junr., <Thomas Marris, servant man) blacksmith Thomas Bull, labourer John Marriott, farmer Edward Blunt, famers sun Daniel Dencher, servant man If any person in this list shall think himself agrieved you may appeal on Wednesday next at the White Horse Inn in Towcester being the 17 day of this instant December. -

Eligible If Taken A-Levels at This School (Y/N)

Eligible if taken GCSEs Eligible if taken A-levels School Postcode at this School (Y/N) at this School (Y/N) 16-19 Abingdon 9314127 N/A Yes 3 Dimensions TA20 3AJ No N/A Abacus College OX3 9AX No No Abbey College Cambridge CB1 2JB No No Abbey College in Malvern WR14 4JF No No Abbey College Manchester M2 4WG No No Abbey College, Ramsey PE26 1DG No Yes Abbey Court Foundation Special School ME2 3SP No N/A Abbey Gate College CH3 6EN No No Abbey Grange Church of England Academy LS16 5EA No No Abbey Hill Academy TS19 8BU Yes N/A Abbey Hill School and Performing Arts College ST3 5PR Yes N/A Abbey Park School SN25 2ND Yes N/A Abbey School S61 2RA Yes N/A Abbeyfield School SN15 3XB No Yes Abbeyfield School NN4 8BU Yes Yes Abbeywood Community School BS34 8SF Yes Yes Abbot Beyne School DE15 0JL Yes Yes Abbots Bromley School WS15 3BW No No Abbot's Hill School HP3 8RP No N/A Abbot's Lea School L25 6EE Yes N/A Abbotsfield School UB10 0EX Yes Yes Abbotsholme School ST14 5BS No No Abbs Cross Academy and Arts College RM12 4YB No N/A Abingdon and Witney College OX14 1GG N/A Yes Abingdon School OX14 1DE No No Abraham Darby Academy TF7 5HX Yes Yes Abraham Guest Academy WN5 0DQ Yes N/A Abraham Moss Community School M8 5UF Yes N/A Abrar Academy PR1 1NA No No Abu Bakr Boys School WS2 7AN No N/A Abu Bakr Girls School WS1 4JJ No N/A Academy 360 SR4 9BA Yes N/A Academy@Worden PR25 1QX Yes N/A Access School SY4 3EW No N/A Accrington Academy BB5 4FF Yes Yes Accrington and Rossendale College BB5 2AW N/A Yes Accrington St Christopher's Church of England High School