Brewing” Into New Segments Recommendation: BUY Vs Previous Recommendation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Hanoi a Beer Drinker'

Hanoi a beer drinker's haven (11/10/2012) Hanoi has been named one of the cheapest and best places to drink fresh beer in Asia by travel guides and journalists, thanks to its lively drinking culture. Many tourists look forward to the chance to join local Hanoians and enjoy the city's famous Bia Hoi (fresh beer) - a light-bodied pilsner without preservatives that is brewed and delivered daily to drinking places throughout the capital. Hanoi has become a magnet for tourists who enjoy drinking beer, which is readily available at local pavement shops as well as in luxurious bars. There are thousands of corner bars with tiny plastic stools set out on the sidewalk and small low tables laden with glasses of beer. Visitors should taste Vietnamese beer and learn how local people drink. "Mot, hai, bazo!! (One, two, three go!!) and "Tram phan tram! ("100 percent" or "bottoms up") are common chants that accompany a drinking session in these local establishments. "Bia Hoi is one of things you should not miss when you come to Hanoi, says Thomas, a foreign tourist who chooses Hanois old quarter as his favourite place to imbibe a cool brew. He says he likes Hanoi beer because it is very cheap and delicious. Another thing that amazes visitors is that the beer bars are mostly on the sidewalk where drinkers sometimes have to raise their voices over the din of motorbike traffic or breathe in the clouds of diesel exhaust belched over the plastic tables by a passing bus. "Sitting on the pavement, listening to the mixed sounds, drinking beer and just looking at what's happening around me has become my habit during my time in Hanoi, Thomas elaborates. -

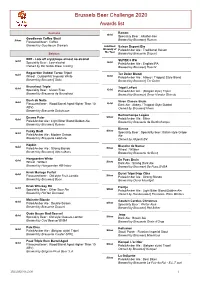

Brussels Beer Challenge 2020 Awards List

Brussels Beer Challenge 2020 Awards list Australia Ramon Gold Speciality Beer : Alcohol-free Goodieson Coffee Stout Silver Brewed by Brouwerij Roman Flavoured beer : Coffee Brewed by Goodieson Brewery Gold Best Saison Dupont Bio Brewery of Pale&Amber Ale : Traditional Saison the Year Belgium Brewed by Brasserie Dupont BIIR - Lots off cry(o)hops almost no alcohol SUPER 8 IPA Gold Gold Speciality Beer : Low-alcohol Pale&Amber Ale : English IPA Owned by Biir Noble Brew Trading Brewed by Brouwerij Haacht Bogaerden Dubbel Tarwe Tripel Ter Dolen Blond Gold Gold Wheat : DubbelWit/ Imperial White Pale&Amber Ale : Abbey / Trappist Style Blond Brewed by Brouwerij Sako Brewed by Brouwerij Ter Dolen Brunehaut Triple Tripel LeFort Gold Gold Speciality Beer : Gluten Free Pale&Amber Ale : (Belgian style) Tripel Brewed by Brasserie de Brunehaut Brewed by Brouwerij Omer Vander Ghinste Bush de Nuits Viven Classic Bruin Gold Gold Flavoured beer : Wood/Barrel Aged Higher Than 10 Dark Ale : Abbey / Trappist Style Dubbel ABV) Owned by Brouwerij Viven Brewed by Brasserie Dubuisson Bertinchamps Légère Ename Pater Silver Gold Pale&Amber Ale : Bitter Pale&Amber Ale : Light Bitter Blond/Golden Ale Brewed by Brasserie de Bertinchamps Brewed by Brouwerij Roman Bienne Funky Brett Silver Gold Speciality Beer : Speciality beer: Italian style Grape Pale&Amber Ale : Modern Saison Ale Brewed by Brasserie Lefebvre Owned by Aligenti BV Hapkin Blanche de Namur Gold Silver Pale&Amber Ale : Strong Blonde Wheat : Witbier Brewed by Brouwerij Alken-Maes Brewed by Brasserie du -

Kirin Report 2016

KIRIN REPORT 2016 REPORT KIRIN Kirin Holdings Company, Limited Kirin Holdings Company, KIRIN REPORT 2016 READY FOR A LEAP Toward Sustainable Growth through KIRIN’s CSV Kirin Holdings Company, Limited CONTENTS COVER STORY OUR VISION & STRENGTH 2 What is Kirin? OUR LEADERSHIP 4 This section introduces the Kirin Group’s OUR NEW DEVELOPMENTS 6 strengths, the fruits of the Group’s value creation efforts, and the essence of the Group’s results OUR ACHIEVEMENTS and CHALLENGES to OVERCOME 8 and issues in an easy-to-understand manner. Our Value Creation Process 10 Financial and Non-Financial Highlights 12 P. 2 SECTION 1 To Our Stakeholders 14 Kirin’s Philosophy and TOPICS: Initiatives for Creating Value in the Future 24 Long-Term Management Vision and Strategies Medium-Term Business Plan 26 This section explains the Kirin Group’s operating environment and the Group’s visions and strate- CSV Commitment 28 gies for sustained growth in that environment. CFO’s Message 32 Overview of the Kirin Group’s Business 34 P. 14 SECTION 2 Advantages of the Foundation as Demonstrated by Examples of Value Creation Kirin’s Foundation Revitalizing the Beer Market 47 Todofuken no Ichiban Shibori 36 for Value Creation A Better Green Tea This section explains Kirin’s three foundations, Renewing Nama-cha to Restore Its Popularity 38 which represent Group assets, and provides Next Step to Capture Overseas Market Growth examples of those foundations. Myanmar Brewery Limited 40 Marketing 42 Research & Development 44 P. 36 Supply Chain 46 SECTION 3 Participation in the United Nations Global Compact 48 Kirin’s ESG ESG Initiatives 49 This section introduces ESG activities, Human Resources including the corporate governance that —Valuable Resource Supporting Sustained Growth 50 supports value creation. -

Travel in Vietnam

citypassguide.com BY LOCALS, FOR LOCALS - YOUR MONTHLY HCMC GAZETTE Volume 8 | June 2016 TRAVEL IN VIETNAM / “A journey is best meASURED IN FRIENDS, RATHER THAn miles.” – TIM CAHILL / MY THO PHONG NHA SAPA THE GATE TO THE MEKONG LARGEST CAVE IN THE WORLD THE TOWN IN THE CLOUDS 6 19 22 What’s Happening • Travel • Destinations Emmotional Baggage • Events PUBLISHED BY #iAMHCMC NEWS NEWS #iAMHCMC The following information Korea for the first time. Customs figures showed regions without clean water, and 1.1 million Foreign investment #iAMHCMC is provided by that 7,800 cars worth around US$140 million in need of food support. Officials from the By Locals, For Locals made in Thailand were sold to Vietnam in the agriculture ministry and United Nations have It has been a good few months for foreign investors first three months, up 64.5 percent from a year estimated that more than 60,000 women and in Vietnam. The government has decided to open What’s Happening ago. The market growth was thanks mostly to children in 18 hardest-hit provinces are facing up the fuel retail market for outsiders, with Japan’s a new free trade agreement that has cut import malnutrition. Around 1.75 million people from Idemitsu Kosan and Kuwait Petroleum on track by Le Trung Dung tariffs among the 10 ASEAN member states from farming families have suffered heavy losses to jointly launch the first fully foreign-owned oil CEO Patrick Gaveau 50 percent to 40 percent this year. The tax rate as drought damage to agriculture activities is business in the country. -

IWMI Working Paper Revitalizing Canal Irrigation: Towards Improving 160 Cost Recovery

IWMI Working Paper Revitalizing Canal Irrigation: Towards Improving 160 Cost Recovery Ravinder P. S. Malik, S. A. Prathapar and Madhavi Marwah Working Papers The publications in this series record the work and thinking of IWMI researchers, and knowledge that the Institute’s scientific management feels is worthy of documenting. This series will ensure that scientific data and other information gathered or prepared as a part of the research work of the Institute are recorded and referenced. Working Papers could include project reports, case studies, conference or workshop proceedings, discussion papers or reports on progress of research, country-specific research reports, monographs, etc. Working Papers may be copublished by IWMI and partner organizations. Although most of the reports are published by IWMI staff and their collaborators, we welcome contributions from others. Each report is reviewed internally by IWMI staff. The reports are published and distributed both in hard copy and electronically (www.iwmi.org) and where possible all data and analyses will be available as separate downloadable files. Reports may be copied freely and cited with due acknowledgment. About IWMI IWMI’s mission is to improve the management of land and water resources for food, livelihoods and the environment. In serving this mission, IWMI concentrates on the integration of policies, technologies and management systems to achieve workable solutions to real problems—practical, relevant results in the field of irrigation and land and water resources. IWMI Working Paper 160 Revitalizing Canal Irrigation: Towards Improving Cost Recovery Ravinder P. S. Malik S. A. Prathapar and Madhavi Marwah International Water Management Institute The authors: Ravinder P. -

Beverages in Asia

ISSUES FOR RESPONSIBLE INVESTORS BEVERAGES IN ASIA JUNE 2010 Rebecca Lewis Author Rumi M. Morales Editor COMMISSIONED BY Responsible Research is an independent provider of sectoral and thematic Asian environment, Responsible Research is the exclusive partner in Asia for RepRisk, a web-based tool which provides social and governance (ESG) research, targeted at global institutional investors. Many of these fund insights on environmental and social issues that present financial and reputational risks to companies managers and asset owners now find that traditional investment banking reports, financial models and and investment portfolios. The tool enables commercial and investment bankers, asset managers, public information sources can no longer be relied on to cover all risks to earnings and deliver superior and supply chain managers to manage the corresponding risks and to implement effective screening returns. Companies who do not monitor and report on this ‘non-financial’ performance not only risk procedures. financial penalties for non-compliance with stricter regulatory environments but are also denied access to substantial pools of global capital which are managed according to sustainable principles. About the RepRisk® tool Our approach is based on analysis of material ESG factors, which change according to sector and RepRisk® is a web-based tool that allows you to identify and assess the environmental and social market. We provide our clients with local market knowledge of important regulatory landscapes in issues which may present financial, reputational and ethical risks. It is used by investment pro- Asia, along with a fresh perspective on local operational and sectoral issues. We offer an annual fessionals, financial institutions, supply chain managers, multinational corporations and compliance subscription model for our monthly sectoral or thematic reports and give our clients access to the managers, and includes a variety of features enabling clients to monitor risk trends over time, create underlying data. -

Domestic Beer Price List

3 DOMESTIC BEER PRICE LIST Case 30- Case 24- Case 18- Pack 12- Case 24- Case 18- Pack 12- Pack 6-12oz Beer Name 12oz Cans 12oz Cans 12oz Cans 12oz Cans 12oz Bottles 12oz Bottles 12oz Bottles Bottles Bud Ice 15.98 7.99 Bud Light 19.49 16.49 13.99 9.49 16.49 13.99 9.49 5.29 Bud Light Golden Wheat 5.99 Bud Light Lime 21.98 16.99 10.99 21.98 16.99 10.99 5.99 Budweiser 19.49 16.49 13.99 9.49 16.49 13.99 9.49 5.29 Budweiser Select 19.49 18.98 9.49 18.98 13.99 9.49 5.29 Budweiser Select 55 19.49 18.98 13.99 9.49 16.49 9.49 5.29 Busch 16.99 15.98 7.99 Busch Light 16.99 Coors 18.98 18.98 9.49 5.29 Coors Light 19.49 18.98 13.99 9.49 16.49 13.99 9.49 5.29 Genesee Cream Ale 15.98 7.99 23.96 5.99 Genesee Ice 14.99 Genesee Light 14.99 Icehouse 17.99 15.98 7.99 15.98 7.99 Iron City Beer 27.96 6.99 Iron City Light 27.96 6.99 Keystone Light 16.99 Michelob 21.98 10.99 5.99 Michelob Amber Bock 21.98 10.99 5.99 Michelob Light 21.98 16.99 10.99 21.98 15.99 10.99 5.99 Michelob Ultra 16.99 21.98 16.99 10.99 5.99 Michelob Ultra Amber 21.98 10.99 5.99 Miller Genuine Draft 18.98 9.49 16.49 9.49 5.29 Miller High Life 17.99 12.49 14.98 7.49 4.29 Miller High Life Light 14.98 7.49 Miller Lite 19.49 16.49 13.99 9.49 16.49 13.99 9.49 5.29 Milwaukee's Best 15.99 Milwaukee's Best Ice 15.99 Milwaukee's Best Light 15.99 Natural Ice 16.99 15.98 7.99 15.96 3.99 Natural Light 16.99 15.98 11.99 7.99 15.96 3.99 Old Milwaukee 17.99 Pabst 17.99 15.99 8.99 17.98 8.99 Rolling Rock 18.98 9.49 5.99 Schlitz 19.98 9.99 23.96 5.99 Kegs Always In Stock We have cold kegs in stock, every day. -

Bierliste Ausland Biername Brauerei Stadt Land Note Birell Non-Alcoholic (Gebr

Bierliste Ausland Biername Brauerei Stadt Land Note Birell Non-Alcoholic (gebr. in Ägypten) Al Ahram Beverages Co. Giza Ägypten 4,5 Heineken Lager Premium Al Ahram Beverages Co. Giza Ägypten 3,5 Meister Lager Al Ahram Manufacturing and Filling Co. Giza Ägypten 3,5 Sakara Gold Lager Al Ahram Beverages Co. Giza Ägypten 3,6 Stella Export Lager Al Ahram Beverages Co. Giza Ägypten 3,8 Stella Lager Al Ahram Beverages Co. Giza Ägypten 3,3 Stella Lager 115 Years Al Ahram Beverages Co. Giza Ägypten 3,0 Patagonia Estilo Amber Lager Cerveceria Quilmes SAICAY Buenos Aires Argentinien 2,7 Quilmes Cerveza Cerveceria Malteria Quilmes Buenos Aires Argentinien 4,0 Quilmes Cerveza Cristal Cerveceria Malteria Quilmes Buenos Aires Argentinien 3,8 Bati Beer Lager Kombolcha Brewery Kombolcha Äthiopien 3,7 Castlemaine XXXX Gold Lager Castlemaine Perkins Milton Brisbane Australien 3,7 Coopers Sparkling Ale Coopers Brewery LTD. Regency Park Australien 3,3 Foster´s Lager Carlton & United Melbourne Australien 4,0 James Boag's Premium Lager J. Boag & Son Brewing Launceston Australien 3,7 Reschs Pilsener Carlton & United Breweries Sydney Australien 4,3 Victoria Bitter Lager Carlton & United Breweries Southbank Australien 4,0 Banks Caribbean Lager Banks Breweries LTD. Christ Church Barbados 2,7 400 Jaar Brandaris Terschelling door Brouwerij Van Steenberge Ertvelde Belgien 3,8 Abbaye d´Aulne Amber Brasserie Val de Sambre Gozee Belgien 4,4 Abbaye du Val-Dieu Biere de Noel Brasserie de l´Abbaye du Val-Dieu Aubel Belgien 3,3 Adelardus Trudoabdijbier Tripel Brouwerij Kerkom Sint-Truiden Belgien 3,8 Archivist Hell Brouwerij De Brabandere Bavikhove Belgien 3,5 Arend blond Brouwerij De Ryck Herzele Belgien 4,3 Baltimore-Washington Beer Works Route US 66 Brewery Strubbe Ichtegem Belgien 3,0 Barista Chocolate Quad Br. -

Sustainability Report 2014 Brewing a Better World Introduction the Big Picture Our Focus Areas Values and Behaviours Appendices

Sustainability Report 2014 Brewing a Better World Introduction The big picture Our focus areas Values and behaviours Appendices Our Sustainability Report 2014 HEINEKEN is the world’s most international brewer with its brands available in 178 countries around the world. Sustainability is one of our core business priorities, and Brewing a Better World is our strategic focus. About this report The big picture This report summarises HEINEKEN’s progress on Brewing a Better World in 2014. CEO Foreword 3 We continue to focus on the topics that are most relevant for our stakeholders Brewing a Better World 4 and our business. For the first time, the report follows version 4.0 of the Global What we said and what we’ve done 6 Reporting Initiative Guidelines (G4). We believe the data and statements in this Our value chain 8 report should be externally assured. To confirm the information is reliable and Benchmarks and achievements 10 accurate, we have asked KPMG to provide us with independent, limited assurance Stakeholder dialogue 11 on the entire report. KPMG summarises its activities and conclusions in Appendix 1. Our focus areas This year, in response to stakeholder feedback, we have created a more focused Protecting water resources 15 and simplified report, while still maintaining the same level of transparency. To Reducing CO2 emissions 20 achieve this, we have made a clear separation between information about our Sourcing sustainably 28 actions and progress, and more in-depth contextual information. Advocating responsible consumption 33 Promoting health and safety 37 This PDF document summarises our main progress and activities in 2014. -

Complete Issue

World Customs Journal World World Customs Journal Volume 12, Number 2 Volume September 2018 Volume 12, Number 2 ISSN: 1834-6707 (Print) 1834-6715 (Online) World Customs Journal September 2018 Volume 12, Number 2 update page no International Network of Customs Universities World Customs Journal Published by the Centre for Customs and Excise Studies (CCES), Charles Sturt University, Australia and the University of Münster, Germany in association with the International Network of Customs Universities (INCU) and the World Customs Organization (WCO). The World Customs Journal is a peer-reviewed journal which provides a forum for customs professionals, academics, industry researchers, and research students to contribute items of interest and share research and experiences to enhance its readers’ understanding of all aspects of the roles and responsibilities of Customs. The Journal is published twice a year. The website is at: www.worldcustomsjournal.org. Guidelines for Contributors are included at the end of each issue. More detailed guidance about style is available on the Journal’s website. Correspondence and all items submitted for publication should be sent in Microsoft Word or RTF, as email attachments, to the Editor-in-Chief: [email protected]. ISSN: 1834-6707 (Print) 1834-6715 (Online) Volume 12, Number 2 Published September 2018 © 2018 CCES, Charles Sturt University, Australia and University of Münster, Germany INCU (www.incu.org) is an association that provides the WCO and other organisations with a single point of contact with universities and research institutes that are active in the field of customs research, education and training. Copyright. All rights reserved. Permission to use the content of the World Customs Journal must be obtained from the copyright owner. -

Valuation of Carlsberg

Copenhagen Business School MSc Accounting, Strategy and Control Master Thesis Valuation of Carlsberg A/S A strategic and financial analysis of Carlsberg considering the effect of the operational restructuring program SAIL’22 on the company’s operating performance and share price Supervisor: Svend Peter Malmkjær by Theresa Haffer - 106062 Annika Kunz - 107931 Pages: 118 Characters: 269.435 Date of Submission: May 15th, 2018 Abstract The thesis answers the research question: What is the estimated value per share of Carlsberg as of 31st December 2017 considering the restructuring initiative SAIL’22? To answer the question, first a strategic analysis of the macro- and micro environment is conducted followed by a profitability analysis based on Carlsberg’s historical performance. The analysis help to identify value drivers which are then taken into account when forecasting Carlsberg’s future performance. Finally, this input is used to calculate the enterprise value applying the Discounted Cash Flow model as well as the Economic Value Added approach. During the course of the thesis a special focus is put on the company-wide operational restructuring program SAIL’22 that Carlsberg currently conducts. On the one hand, we consider the potential effects of SAIL’22 when assessing the business environment and when forecasting future performance. Measures within SAIL’22 aim to make the company more successful by driving sustainable growth and more efficient through streamlining processes throughout the value chain. By taking a closer look at the specific activities we derive the expectation that SAIL’22 will enhance an increase in revenue and a reduction in costs. On the other hand, we calculate the effect of the restructuring initiative on the shareholder value. -

Imperial Hops: How Beer Traveled the World, Especially to Asia Jeffrey M

Imperial Hops: How Beer Traveled the World, Especially to Asia Jeffrey M. Pilcher This is a very preliminary discussion of a book I hope to write on the globalization of beer. The first section outlines the literature and my research plan as sort of a first draft of a grant proposal intended to convince some funding agency to pay for me to travel the world drinking beer. The rest of the paper illustrates some of these ideas with three Asian case studies. I started with Asia in response to an invitation to participate in a recent SSRC Interasia Workshop in Istanbul and because the languages and meager secondary literature make it the hardest part of the project to research. There are mostly questions where the conclusions should be, and I welcome all suggestions. In June of 2013, Turkish crowds gathered in Istanbul’s Taksim Square to protest the growing authoritarianism of Prime Minister Recep Tayyip Erdogan. Refusing to surrender their democratic freedoms, they opened bottles of Efes Pilsner and raised mock toasts to the tee-totaling Islamist politician: “Cheers, Tayyip!”1 The preference for European-style beer, rather than the indigenous, anise-flavored liquor arak, illustrates the complex historical movements that have shaped global consumer culture, and at times, political protests. Turkish entrepreneurs founded the Efes brewery in 1969, less than a decade after guest workers first began traveling to Germany and returning home with a taste for lager beer.2 This brief episode illustrates both the networks of migration, trade, and colonialism that carried European beer around the world in the nineteenth and twentieth centuries, and the new drinking cultures that emerged as a result.