Vikas Ecotech Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

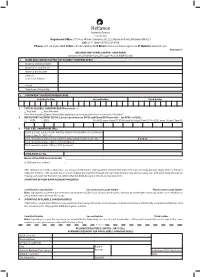

ASBA FORM (Only to Be Used While Paying Through Physical ASBA Facility) 1

Registered Office: 3rd Floor, Maker Chambers IV, 222, Nariman Point, Mumbai 400 021 CIN: L17110MH1973PLC019786 Phone: +91-22-3555 5000 l Fax: +91-22-2204 2268 l Email: [email protected] l Website: www.ril.com Annexure 1 RELIANCE INDUSTRIES LIMITED - ASBA FORM (Only to be Used While Paying Through Physical ASBA Facility) 1. NAME AND CONTACT DETAILS OF ELIGIBLE SHAREHOLDER(S) Name of sole/first holder Name of second holder Name of third holder Address (Sole / first holder) E-mail Telephone / Mobile No. 2. PERMANENT ACCOUNT NUMBER (PAN) Sole/first holder Second holder Third holder 3. TYPE OF ELIGIBLE SHAREHOLDER (Please tick P): Resident Non-Resident Note: Non-Resident Eligible Shareholder applying on non-repatriation basis should select “Resident”. 4. DEPOSITORY ACCOUNT DETAILS: please provide your DP ID and Client ID (Please tick P for NSDL or CDSL): NSDL CDSL (For NSDL enter 8 digit DP ID followed by 8 digit Client ID / For CDSL enter 16 digit Client ID) 5. FIRST CALL PAYMENT DETAILS Partly paid-up equity shares held by Eligible Shareholder on Call Record Date i.e. May 12, 2021 - (I) Total amount payable on First Call per partly paid-up equity share - (II) ₹ 314.25 Total amount payable – [(III) = (I x II)] (in figures) Total amount payable - [(III) = (I x II)] (in words) ASBA BANK A/c No. Name of the ASBA Account Holder : _____________________________________________________________________________________________ SCSB Name and address : _____________________________________________________________________________________________ _____________________________________________________________________________________________ I/We authorize the SCSB to block my / our account, hold funds / make payment towards First Call of ₹314.25 per partly paid-up equity share of Reliance Industries Limited. -

The Karnataka Bank Limited

Letter of Offer October 28, 2016 For Eligible Shareholders only The Karnataka Bank Limited Our Bank was incorporated on February 18, 1924 as The Karnataka Bank Limited under the Indian Companies Act, 1913. The certificate of commencement of business was obtained on May 23, 1924. Our Bank received a license to carry on the banking business in India under the Banking Regulation Act, 1949, from the Reserve Bank of India on April 4, 1966. Registered Office: P.B. No. 599, Mahaveera Circle, Kankanady Mangaluru 575 002, Karnataka Contact Person: Mr. Y.V. Balachandra, Company Secretary and Compliance Officer Telephone: +91 (824) 2228182-4; Facsimile: +91 (824) 2225588; Email: [email protected] Website: www.karnatakabank.com Corporate Identity Number: L85110KA1924PLC001128 FOR PRIVATE CIRCULATION TO THE ELIGIBLE SHAREHOLDERS OF THE KARNATAKA BANK LIMITED (OUR “BANK” OR THE “ISSUER”) ONLY ISSUE OF UP TO 9,42,35,441 EQUITY SHARES OF FACE VALUE ` 10 EACH (“RIGHTS EQUITY SHARES”) OF OUR BANK FOR CASH AT A PRICE OF ` 70 PER RIGHTS EQUITY SHARE (“ISSUE PRICE”) INCLUDING A PREMIUM OF ` 60 PER RIGHTS EQUITY SHARE AGGREGATING UP TO ` 659.65 CRORE ON A RIGHTS BASIS TO THE ELIGIBLE SHAREHOLDERS OF OUR BANK IN THE RATIO OF 1 (ONE) RIGHTS EQUITY SHARES FOR 2 (TWO) FULLY PAID-UP EQUITY SHARES HELD BY SUCH ELIGIBLE SHAREHOLDER ON THE RECORD DATE, THAT IS, OCTOBER 25, 2016 (“ISSUE”). THE ISSUE PRICE OF THE RIGHTS EQUITY SHARES IS SEVEN TIMES THE FACE VALUE OF THE EQUITY SHARES. FOR FURTHER DETAILS, PLEASE SEE “TERMS OF THE ISSUE” ON PAGE 92. THE ENTIRE ISSUE PRICE FOR THE RIGHTS EQUITY SHARES IS PAYABLE ON APPLICATION. -

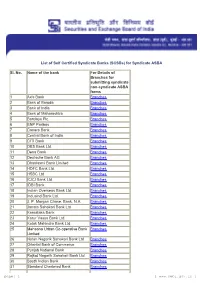

For Syndicate ASBA Sl. No. Name of the Bank for Details of Branches For

List of Self Certified Syndicate Banks (SCSBs) for Syndicate ASBA Sl. No. Name of the bank For Details of Branches for submitting syndicate non-syndicate ASBA forms 1 Axis Bank Branches 2 Bank of Baroda Branches 3 Bank of India Branches 4 Bank of Maharashtra Branches 5 Barclays Plc. Branches 6 BNP Paribas Branches 7 Canara Bank Branches 8 Central Bank of India Branches 9 CITI Bank Branches 10 DBS Bank Ltd. Branches 11 Dena Bank Branches 12 Deutsche Bank AG Branches 13 Dhanlaxmi Bank Limited Branches 14 HDFC Bank Ltd. Branches 15 HSBC Ltd. Branches 16 ICICI Bank Ltd. Branches 17 IDBI Bank Branches 18 Indian Overseas Bank Ltd. Branches 19 Indusind Bank Ltd. Branches 20 J. P. Morgan Chase, Bank, N.A. Branches 21 Janata Sahakari Bank Ltd Branches 22 Karnataka Bank Branches 23 Karur Vasya Bank Ltd. Branches 24 Kotak Mahindra Bank Ltd. Branches 25 Mehsana Urban Co-operative Bank Branches Limited 26 Nutan Nagarik Sahakari Bank Ltd Branches 27 Oriental Bank of Commerce Branches 28 Punjab National Bank Branches 29 Rajkot Nagarik Sahakari Bank Ltd Branches 30 South Indian Bank Branches 31 Standard Chartered Bank Branches page: 1 [ www.sebi.gov.in ] 32 State Bank of Bikaner & Jaipur Branches 33 State Bank of Hyderabad Branches 34 State Bank of India Branches 35 State Bank of Mysore Branches 36 State Bank of Patiala Branches 37 State Bank of Travancore Branches 38 Syndicate Bank Branches 39 Tamilnad Mercantile Bank Ltd. Branches 40 The Ahmedabad Mercantile Co-Op. Branches Bank Ltd 41 The Kalupur Commercial Co- Branches operative Bank Ltd. -

ASBA - a Mechanism to Subscribe Ipos Through Banks

COMPILED BY : - GAUTAM SINGH STUDY MATERIAL – BANKING AWARENESS 0 7830294949 ASBA - A Mechanism to Subscribe IPOs through Banks . Introduction Banks play a pivotal role in primary markets.ASBA is the service provided by banks. ASBA means “Application Supported by Blocked Amount (ASBA)". It refers to an application mechanism which helps investors to subscribe IPOs(Initial Public offerings) ASBA ensures that the applicant's money remains in his/her bank account till the shares are allotted, it was introduced by Sebi for retail investors in 2008. Now it has been extended to corporate investors and HNIs as well (from January 1, 2010, onwards). It is a mechanism in which the applicant has to give an authorisation to THANKS FOR READING – VISIT OUR WEBSITE www.educatererindia.com COMPILED BY : - GAUTAM SINGH STUDY MATERIAL – BANKING AWARENESS 0 7830294949 block his/her application money in the bank account for subscribing to the IPO. What is ASBA? ASBA is an application containing an authorization to block the application money in the bank account, for subscribing to an issue. If an investor is applying through ASBA, his/her application money shall be debited from the bank account only if his/her application is selected for allotment after the basis of allotment is finalised, or the issue is withdrawn / failed. It is a supplementary process of applying in Initial Public Offers (IPO), right issues and Follow on public offers (FPO) made through book building route and co-exists with the current process of using cheque as a mode of payment and submitting applications. List of banks offering ASBA facility ( as on 25 January 2016) 1. -

List of Scsbs Displayed on SEBI Website

List of Self Certified Syndicate Banks under the ASBA process 1. As on date, there are 57 banks registered with SEBI as Bankers to an Issue under the SEBI (Bankers to an Issue) Regulations, 1994. In terms of the SEBI Circular no. SEBI/CFD/DIL/DIP/31/2008/30/7 dated July 30, 2008 on Applications Supported by Blocked Amount (ASBA), all these banks are eligible to act as Self Certified Syndicate Bank for the purpose of ASBA subject to their submitting a self certification to SEBI ,inter-alia certifying that they have undertaken the mock trial run of their systems with the Stock Exchange(s) and Registrar(s) and have satisfied themselves that they have adequate systems/ infrastructure in place at their Controlling Branch/ Designated Branches to fulfill their responsibilities/ obligations as envisaged in the ASBA process within the timelines specified therein. 2. Once the banks submit this self certification, their names shall be included in SEBI’s list of Self Certified Syndicate Banks (SCSBs) whereafter these SCSBs shall be eligible to accept ASBAs. 3. Investors desirous of appling through ASBA process may submit their ASBAs to the SCSBs mentioned herein below. List of SCSBs is as under: Sl. Name of the Date of Eligible to Details of designated No. bank receipt of act as SCSB branches and self w.e.f. Controlling branch certification available at 1. Corporation August 21, September 1, Details of branches of Bank 2008 2008 Corporation Bank 2. Union Bank August 25, September 1, Details of branches of of India 2008 2008 Union Bank of India 3. -

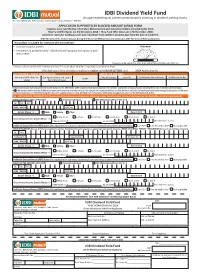

IDBI Dividend Yield Fund ASBA Form

IDBI Dividend Yield Fund An open ended equity scheme predominantly investing in dividend yielding stocks. 4th Floor, IDBI Tower, WTC Complex, Cuffe Parade, Colaba, Mumbai - 400 005. APPLICATION SUPPORTED BY BLOCKED AMOUNT (ASBA) FORM Investors must read the Key Information Memorandum and Instructions before completing this Form. New Fund Offer Opens on: 3rd December, 2018 • New Fund Offer Closes on: 17th December, 2018 Scheme re-opens for continuous sale and repurchase from: Within 5 business days from the date of allotment Offer for Units of Rs. 10 each (at par) during the New Fund Offer period and continuous offer for Units of NAV based prices. This product is suitable for investors who are seeking*: • Long term capital growth Riskometer • Investment in predominantly in dividend yielding equity and equity related instruments Investors understand that their principal will be at Moderately High risk *Investors should consult their financial advisors if in doubt about whether the product is suitable for them. (The Application Form should be completed in English and in BLOCK LETTERS only.) ASBA Application No. KEY PARTNER / AGENT INFORMATION FOR OFFICE USE ONLY Name and AMFI Reg. No. Date of Receipt Folio No. SCSB Branch Stamp & Code SCSB Branch Sr. No. Sub Agent’s Name and Code / EUIN@ (ARN) Bank Branch Code Upfront commission shall be paid directly by the investor to the ARN Holder (AMFI registered Distributor) based on the investors’ assessment of various factors including the service rendered by the distributor. @ I/We hereby confirm that the EUIN box has been intentionally left blank by me/us as this transaction is executed without any interaction or advice by the employee/relationship manager/sales person of the above distributor/sub broker or notwithstanding the advice of in-appropriateness, if any, provided by the employee/relationship manager/sales person of the distributor/sub broker. -

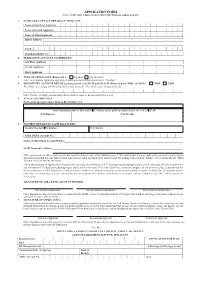

Physical-ASBA-Application.Pdf

APPLICATION FORM [ONLY TO BE USED WHILE PAYING THROUGH PHYSICAL ASBA FACILITY] 1. NAME AND CONTACT DETAILS OFAPPLICANT Name of Sole/First Applicant Name of Second Applicant Name of Third Applicant Indian Address: Email: Telephone/Mobile No. 2. PERMANENT ACCOUNT NUMBER(PAN) Sole/First Applicant Second Applicant Third Applicant 3. TYPE OF APPLICANTS (Please tick ): Resident Non-Resident Note: Non-resident Applicants applying on non-repatriation basis should select “Resident”. 4. DEPOSITORY ACCOUNT DETAILS :please provide your DP ID and Client ID (Please tick for NSDL or CDSL): NSDL CDSL For NSDL enter 8 digit DP ID followed by 8 digit Client ID / For CDSL enter 16 digit Client ID. Note: Transfer of partly paid-up equity shares shall be made in dematerialized form only. 5. APPLICATIONDETAILS Partly-paid-up equity shares held on Record Date [ I ] Total amount payable on first call at ₹ 27.50 per partly paid-up equity share[ II] = [ I ] x ₹ 27.50 ( in Figures) ( in Words) 6. PAYMENT DETAILS [IN CAPITALLETTERS] Amount blocked (₹ in figures) : ( in words) ASBA BANK Account No. Name of ASBA Bank Account Holder: SCSB Name and Address: I/We authorise the SCSB to block the amount specified above as part of the ASBA process. I/ We confirm that I/ we are making the payment towards my/our Application through my/ our bank account only and not using any third-party bank account for making such payment. Further, I/we confirm that the ASBA Account is held in my/our own name. I/We understand that on Application, Investors will have to pay the call money of ₹ 27.50 per partly paid-up equity share, which constitutes 25% of the Issue Price and the balance ₹ 27.50 per partly paid-up equity share, which constitutes 25% of the Issue Price, will have to be paid, on one or more Call(s), as determined the Board of Directors of the Company at its sole discretion. -

The Karnataka Bank Limited

Letter of Offer [ • ] For Eligible Shareholders only The Karnataka Bank Limited Our Bank was incorporated on February 18, 1924 as The Karnataka Bank Limited under the Indian Companies Act, 1913. The certificate of commencement of business was obtained on May 23, 1924. Our Bank received a license to carry on the banking business in India under the Banking Regulation Act, 1949, from the Reserve Bank of India on April 4, 1966. Registered Office: P.B. No. 599, Mahaveera Circle, Kankanady Mangaluru 575 002, Karnataka Contact Person: Mr. Y.V. Balachandra, Company Secretary and Compliance Officer Telephone: +91 (824) 2228182-4; Facsimile: +91 (824) 2225588; Email: [email protected] Website: www.karnatakabank.com Corporate Identity Number: L85110KA1924PLC001128 FOR PRIVATE CIRCULATION TO THE ELIGIBLE SHAREHOLDERS OF THE KARNATAKA BANK LIMITED (OUR “BANK” OR THE “ISSUER”) ONLY ISSUE OF UP TO 9,42,35,441 EQUITY SHARES OF FACE VALUE ` 10 EACH (“RIGHTS EQUITY SHARES”) OF OUR BANK FOR CASH AT A PRICE OF ` 70 PER RIGHTS EQUITY SHARE (“ISSUE PRICE”) INCLUDING A PREMIUM OF ` 60 PER RIGHTS EQUITY SHARE AGGREGATING UP TO ` 659.65 CRORE ON A RIGHTS BASIS TO THE ELIGIBLE SHAREHOLDERS OF OUR BANK IN THE RATIO OF 1 (ONE) RIGHTS EQUITY SHARES FOR 2 (TWO) FULLY PAID-UP EQUITY SHARES HELD BY SUCH ELIGIBLE SHAREHOLDER ON THE RECORD DATE, THAT IS, [●] (“ISSUE”). THE ISSUE PRICE OF THE RIGHTS EQUITY SHARES IS SEVEN TIMES THE FACE VALUE OF THE EQUITY SHARES. FOR FURTHER DETAILS, PLEASE SEE “TERMS OF THE ISSUE” ON PAGE 93. THE ENTIRE ISSUE PRICE FOR THE RIGHTS EQUITY SHARES IS PAYABLE ON APPLICATION. -

Patel Integrated Logistics Limited

APPLICATION FORM FOR ELIGIBLE NOT INTENDED FOR ELIGIBLE EQUITY EQUITY SHAREHOLDERS OF THE SHAREHOLDERS IN THE UNITED STATES COMPANY AND RENOUNCEES ONLY ISSUE OPENS ON Friday, February 26, 2021 USING ASBA FACILITY LAST DATE FOR ON Monday, March 08, 2021 The Investors may also apply in the Issue using MARKET RENUNCIATION# B-WAP facility at www.bigshareonline.com. PATEL INTEGRATED LOGISTICS LIMITED Corporate Identification Number: L71110MH1962PLC012396 ISSUE CLOSES ON* Friday, March 12, 2021 Further, the Eligible Equity Shareholders who have not provided details of their respective Registered Office: Patel House, 5th floor, Plot No. 48, # Eligible Equity Shareholders are requested to ensure that demat account to the Company or the Registrar Gazdarbandh, North Avenue Road, Santacruz (West), renunciation through off-market transfer is completed in such at least two Working Days prior to the Issue Mumbai- 400 054, Maharashtra, India, a manner that the Rights Entitlements are credited to the Closing Date may apply in the Issue using Tel: +91 022 2605 8476 demat account of the Renouncees on or prior to the Issue only the B-WAP facility. However, the Eligible Closing Date. Equity Shareholders, who hold Equity Shares Corporate Office (Address where books of account and in physical form as on Record Date and who papers are maintained): 52, Natasha, Hill Road, Bandra (West), * Our Board or a duly authorized committee thereof will have have not furnished the details of their demat Mumbai – 400 052, Maharashtra, India, Tel: +91 022 2642 1242 the right to extend the Issue Period as it may determine account to the Registrar or our Company shall Contact Person: Sweta Pankaj Parekh, Company Secretary from time to time but not exceeding 30 days from the Issue not be eligible to apply in this Issue. -

Mahindra & Mahindra Financial Services Limited

FOR THE ELIGIBLE EQUITY SHAREHOLDERS OF THE COMPANY ONLY This is an Abridged Letter of Offer containing salient features of the Letter of Offer dated July 21, 2020 (“Letter of Offer”) which is available on the websites of the Registrar, our Company, the Lead Managers and the Stock Exchanges. You are encouraged to read greater details available in the Letter of Offer. Capitalized terms not specifically defined herein shall have the meaning ascribed to them in the Letter of Offer. THIS ABRIDGED LETTER OF OFFER CONTAINS 12 PAGES. PLEASE ENSURE THAT YOU HAVE RECEIVED ALL THE PAGES Our Company has made available on the Registrar’s website at https://rights.kfintech.com/mahindra and the Company’s website at https://www.mahindrafinance.com, this Abridged Letter of Offer, the Rights Entitlement Letter and the Application Form for the Eligible Equity Shareholders who have provided an Indian address to our Company or who are located in jurisdictions where the offer and sale of the Equity Shares may be permitted under the laws of such jurisdictions. You may also download the Letter of Offer from the websites of the Securities and Exchange Board of India (“SEBI”), the stock exchanges where the Equity Shares of our Company are listed, i.e., BSE Limited (“BSE”) and National Stock Exchange of India Limited (“NSE”, and together with BSE, the “Stock Exchanges”) and the Lead Managers, i.e., at www.sebi.gov.in, www.bseindia.com, www.nseindia.com, www.investmentbank.kotak.com, www.axiscapital.co.in, www.bnpparibas.co.in, www.online.citibank.co.in/rhtm/citigroupglobalscreen1.htm, www.hdfcbank.com, www.hsbc.co.in/1/2/corporate/equities-global-investment- banking, www.icicisecurities.com, www.nomuraholdings.com/company/group/asia/india/index.html and www.sbicaps.com, respectively. -

List of Self Certified Syndicate Banks Under the ASBA Facility

List of Self Certified Syndicate Banks under the ASBA facility Details of Sr. No. Name of the bank Branches 1 Allahabad Bank Branches 2 Andhra Bank Branches 3 Axis Bank Ltd Branches 4 Bank of Baroda Branches 5 Bank of India Branches 6 Bank of Maharashtra Branches 7 Barclays Bank PLC Branches 8 BNP Paribas Branches 9 Canara Bank Branches 10 Central Bank of India Branches 11 CITI Bank Branches 12 City Union Bank Ltd. Branches 13 Corporation Bank Branches 14 DBS Bank Ltd. Branches 15 Dena Bank Branches 16 Deutsche Bank Branches 17 Dhanlaxmi Bank Limited Branches 18 HDFC Bank Ltd. Branches 19 HSBC Ltd. Branches 20 ICICI Bank Ltd Branches 21 IDBI Bank Ltd. Branches 22 Indian Bank Branches 23 Indian Overseas Bank Branches 24 IndusInd Bank Branches 25 ING Vysya Bank Branches 26 J P Morgan Chase Bank, N.A. Branches 27 Janata Sahakari Bank Ltd. Branches 28 Karnataka Bank Ltd. Branches 29 Karur Vysya Bank Ltd. Branches 30 Kotak Mahindra Bank Ltd. Branches 31 Mehsana Urban Co-operative Bank Limited Branches 32 Nutan Nagarik Sahakari Bank Ltd. Branches 33 Oriental Bank of Commerce Branches 34 Punjab National Bank Branches 35 Punjab & Sind Bank Branches page: 1 [ www.sebi.gov.in ] 36 Rajkot Nagarik Sahakari Bank Ltd Branches 37 South Indian Bank Branches 38 Standard Chartered Bank Branches 39 State Bank of Bikaner and Jaipur Branches 40 State Bank of Hyderabad Branches 41 State Bank of India Branches 42 State Bank of Mysore Branches 43 State Bank of Patiala Branches 44 State Bank of Travencore Branches 45 Syndicate Bank Branches 46 Tamilnad Mercantile Bank Ltd. -

List of Self Certified Syndicate Banks Under the ASBA Facility Sl. No

List of Self Certified Syndicate Banks under the ASBA facility 1. As on date, there are 62 banks registered with SEBI as Bankers to an Issue under the SEBI (Bankers to an Issue) Regulations, 1994. All these banks are eligible to act as Self Certified Syndicate Bank (SCSB) for the purpose of ASBA Phase II subject to their submitting a self certification to SEBI, inter-alia certifying that they have undertaken the mock trial run of their systems with the Stock Exchange(s) and Registrar(s) and have satisfied themselves that they have adequate systems/ infrastructure in place at their Controlling Branch/ Designated Branches to fulfill their responsibilities/ obligations as envisaged in the ASBA process within the timelines specified therein. 2. Once the bank submits this self certification, its names shall be included in SEBI’s list of SCSBs whereafter these SCSBs shall be eligible to accept ASBAs. 3. Investors applying through ASBA process may submit their ASBAs to the SCSBs mentioned herein below. List of SCSBs is as under: List of SCSBs as on January 08, 2016 Sl. Name of the bank Date ofDate ofEligible to act No. receipt of self inclusion as as SCSB for certification SCSB issues opening on or after * 1. Axis Bank Ltd December 23, January 1, January 1, 2009 2010 2010 2. State Bank of Hyderabad December 24, January 1, January 1, 2009 2010 2010 3. Corporation Bank December 24, January 1, January 1, 2009 2010 2010 4. State Bank of Travencore December 24, January 1, January 1, 2009 2010 2010 5. IDBI Bank Ltd.