Frucor Suntory 1 of 2

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SBF Overview

SECTION 02 Global Implementation of Mizu To Ikiru SBF Overview We are developing our five regional businesses by focusing on the needs of customers in each country and market. Number of employees Business overview Main products (as of December 31, 2018) Main company name (start year) Suntory Foods Limited (1972) We are strengthening the position of long-selling brands like Suntory Beverage Solution Limited (2016) Suntory Holdings Suntory Tennensui and BOSS, while offering a wide portfolio Suntory Beverage Service Limited (2013) that includes tea, juice drinks, and carbonated beverages. We JAPAN 9,682 Japan Beverage Holdings Inc. (2015) also develop integrated beverage services such as vending Suntory Foods Okinawa Limited (1997) machines, cup vending machines, and water dispensers. Suntory Products Limited (2009) Our business in Europe focuses on brands that have been Suntory Beverage & Food (SBF)* locally loved for many years. Alongside core brands like Orangina Schweppes Holding B.V. (2009) Orangina in France, and Lucozade and Ribena in the UK, EUROPE 3,798 Lucozade Ribena Suntory Limited (2014) we are also developing Schweppes carbonated beverages and a wide range of other products. Our business in Asia consists of soft drinks and health supplements. We have established joint venture companies Suntory Beverage & Food Asia Pte. Ltd. (2011) that manage the soft drink businesses in Vietnam, Thailand, BRAND’S SUNTORY INTERNATIONAL Co., Ltd. (2011) ASIA and Indonesia in a way that fits the specific needs of each 6,963 PT SUNTORY GARUDA BEVERAGE (2011) market. The health supplement business focuses on the Suntory PepsiCo Vietnam Beverage Co., Ltd. (2013) manufacture and sale of the nutritional drink, BRAND’S Suntory PepsiCo Beverage (Thailand) Co., Ltd. -

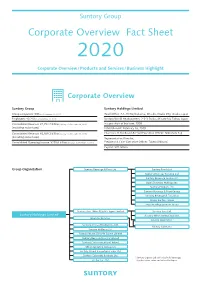

Corporate Overview Fact Sheet 2020

Suntory Group Corporate Overview Fact Sheet 2020 Corporate Overview/ Products and Services / Business Highlight Corporate Overview Suntory Group Suntory Holdings Limited Group companies: 300 (as of December 31, 2019) Head Office: 2-1-40 Dojimahama, Kita-ku, Osaka City, Osaka, Japan Employees: 40,210 (as of December 31, 2019) Suntory World Headquarters: 2-3-3 Daiba, Minato-ku, Tokyo, Japan Consolidated Revenue: ¥2,294.7 billion (January 1 to December 31, 2019) Inauguration of business: 1899 (excluding excise taxes) Establishment: February 16, 2009 Consolidated Revenue: ¥2,569.2 billion (January 1 to December 31, 2019) Chairman of the Board & Chief Executive Officer: Nobutada Saji (including excise taxes) Representative Director, Consolidated Operating Income: ¥259.6 billion (January 1 to December 31, 2019) President & Chief Executive Officer: Takeshi Niinami Capital: ¥70 billion Group Organization Suntory Beverage & Food Ltd. Suntory Foods Ltd. Suntory Beverage Solution Ltd. Suntory Beverage Service Ltd. Japan Beverage Holdings Inc. Suntory Products Ltd. Suntory Beverage & Food Europe Suntory Beverage & Food Asia Frucor Suntory Group Pepsi Bottling Ventures Group Suntory Beer, Wine & Spirits Japan Limited Suntory Beer Ltd. Suntory Holdings Limited Suntory Wine International Ltd. Beam Suntory Inc. Suntory Liquors Ltd.* Suntory (China) Holding Co., Ltd. Suntory Spirits Ltd. Suntory Wellness Ltd. Suntory MONOZUKURI Expert Limited Suntory Business Systems Limited Suntory Communications Limited Other operating companies Suntory Global Innovation Center Ltd. Suntory Corporate Business Ltd. * Suntory Liquors Ltd. sells alcoholic beverage Sunlive Co., Ltd. (spirits, beers, wine and others) in Japan. Suntory Group Corporate Overview Fact Sheet Products and Services Non-alcoholic Beverage and Food Business/Alcoholic Beverage Business Non-alcoholic Beverage and Food Business We deliver a wide range of products including mineral water, coffee, tea, carbonated drinks, sports drinks and health foods. -

Summary of Consolidated Financial Results for the Fiscal Year Ended

English Translation February 14, 2019 Summary of Consolidated Financial Results for the Fiscal Year Ended December 31, 2018 <IFRS> (UNAUDITED) Company name: Suntory Beverage & Food Limited Shares listed: First Section, Tokyo Stock Exchange Securities code: 2587 URL: https://www.suntory.com/sbf/ Representative: Saburo Kogo, President and Chief Executive Officer Inquiries: Yuji Yamazaki, Director, Senior Managing Executive Officer, Division COO, Corporate Strategy Division TEL: +81-3-3275-7022 (from overseas) Scheduled date of ordinary general meeting of shareholders: March 28, 2019 Scheduled date to file securities report: March 29, 2019 Scheduled date to commence dividend payments: March 29, 2019 Preparation of supplementary material on financial results: Yes Holding of financial results presentation meeting (for institutional investors and analysts): Yes (Millions of yen with fractional amounts discarded, unless otherwise noted) 1. Consolidated financial results for the fiscal year ended December 31, 2018 (from January 1, 2018 to December 31, 2018) (1) Consolidated operating results (Percentages indicate year-on-year changes) Revenue Operating income Profit before tax Profit for the year Fiscal year ended (Millions of yen) (%) (Millions of yen) (%) (Millions of yen) (%) (Millions of yen) (%) December 31, 2018 1,294,256 4.9 113,557 (3.7) 111,813 (2.3) 88,833 3.1 December 31, 2017 1,234,008 2.1 117,955 5.4 114,442 6.2 86,175 9.7 Profit for the year Comprehensive income attributable to owners of for the year the Company Fiscal year ended -

To Read Our Inaugural Sustainability Report

Growing for Good Our sustainability progress 2020 CONTENTS INTRODUCTION Introduction 3 We are Our 2030 goals 7 Frucor Suntory How we’re doing 8 Since our beginnings in the early Sugar 10 1960s as part of the New Zealand Apple & Pear Board, Frucor Suntory has Packaging 13 evolved from a small local juice business to a significant trans-Tasman beverages company. Waste 18 Frucor Suntory manufactures, markets We employ 1,000 people across Australia Emissions 20 and distributes a range of fruit juices, and New Zealand and since 2009, we’ve fruit drinks, energy drinks, waters and soft been wholly owned by leading Japanese Water 22 drinks. We’re the company behind iconic beverage and food company, Suntory Group. brands V, h2go, Just Juice, Maximus, We’re passionate about satisfying Fresh Up and Simply Squeezed – and tomorrow’s thirst and offering more choice we produce more than 25 million cases when it comes to choosing a beverage of drinks a year at our South Auckland to suit people’s lifestyle. Alongside our manufacturing plant. parent company Suntory, we believe it is our social responsibility to have a positive impact on the world around us. We produce 200 million litres of product annually We sell 25 million cases of product per year We have offices across New Zealand Over 550,000 deliveries and Australia and two per year across Australia manufacturing sites – and New Zealand in Auckland and Napier 2 Growing For Good 2020 Frucor Suntory Growing For Good 2020 Frucor Suntory 3 INTRODUCTION INTRODUCTION From the Chief From the Head Executive Officer of Sustainability At Frucor Suntory, we’re Hungry to Make Drinks Better – and Welcome to Frucor Suntory’s inaugural annual sustainability part of this hunger is our commitment to help lead positive report. -

Suntory Group Corporate Profile Our Passion

2018 Suntory Group Corporate Profile Our Passion Suntory Group’s Philosophy Creating New Values Suntory Group’s Promise by Taking Challenges That Others Will Not. “Mizu To Ikiru”, literally “living with water”, is the promise we make to our customers, and the voice of our philosophy. From here flow all our other brand attributes, and every facet of our business. We value the blessings of water, and deliver them as goodness that touches every part of our world. We protect water in all its forms. Like water, we change and adapt. Every day, we turn into something new. Takeshi Niinami President & Chief Executive Officer Member of the Board, Representative Director Suntory Holdings Limited Toward Making Suntory a “Growing for Good” Global Corporate Group Suntory Group’s Initiatives based on our Promise “Mizu To Ikiru” The Suntory Group is continually growing as a spirit “Giving back to society.” Under this spirit, corporate group that is globally expanding its we will especially address the issues of “water,” wide range of businesses having alcoholic and since water is the core of our business, and also non-alcoholic beverage business at its core. The a valuable resource supporting people's lives. driving force of our growth is the “Yatte Last year, we have formulated the group-wide Minahare” spirit, which has been passed down “Sustainable Water Philosophy”; based on this since our founding. This spirit represents our will philosophy, we are strongly committing to to actively challenge what others will not take, contribute solving water relevant -

2021 Suntory Corp Comm Book 07062021 Small

CORPORATE COMMUNICATIONS BOOK 2021 Suntory Corporate Communications Book CEO MESSAGE Inspiring the Brilliance of Life The Suntory Group aspires to inspire the take the bold step ahead towards a society brilliance of life. With our mission "To that "creates harmony with people and create harmony with people and nature," nature," where social and economic Suntory has been enriching people's growth coexist with the sustainability of lifestyles and culture by delivering highest natural environment. quality products and services. At the same time, we have been always seeking to Our products are intended not only to realize a sustainable society by coexisting serve the function of quenching people's with diverse society and beautiful natural thirst, but to help create the bond environment. between people, as well as to offer joy and happiness, and touch people's hearts. As At the root of everything we do, we our business globalizes, Suntorians around embrace the spirit of "Yatte Minahare" and the world who share the "Monozukuri" "Giving back to society," which is what spirit are collaborating beyond borders. We Suntory has cherished since its founding. are continuously coming up with During the challenging times of pandemic, innovative and value-adding products and Suntory fulfilled its responsibility as a global services, and developing products that are food and beverages company by continuing not only tasty but also healthy, and production and delivering our products and proposing new ways to enjoy drinks. services to consumers. Moreover, our group Suntory will bring together and share the companies around the world provided technologies and culture across the region medical workers with neutral-alcohol for to create innovations and new markets, sterilization and protective equipment to and continue its challenge to spreading prevent infections, as well as offering smiles and brilliance among consumers various supports to help people in need in throughout the world. -

Frucor Suntory New Zealand

IN THE HIGH COURT OF NEW ZEALAND AUCKLAND REGISTRY I TE KŌTI MATUA O AOTEAROA TĀMAKI MAKAURAU ROHE CIV-2012-404-0219 [2018] NZHC 2860 BETWEEN FRUCOR SUNTORY NEW ZEALAND LIMITED Plaintiff AND COMMISSIONER OF INLAND REVENUE Defendant Hearing: 2, 3, 4, 5, 9, 10 and 11 July 2018 Appearances: L McKay, M McKay and J Q Wilson for the Plaintiff JBM Smith QC, J Norris, L K Worthing for the Defendant Judgment: 5 November 2018 JUDGMENT OF MUIR J This judgment was delivered by me on Monday 5 November 2018 at 2.30 pm Pursuant to Rule 11.5 of the High Court Rules. Registrar/Deputy Registrar Date:………………………… Solicitors: Bell Gully, Auckland Crown Law, Wellington FRUCOR SUNTORY NEW ZEALAND LIMITED v COMMISSIONER OF INLAND REVENUE [2018] NZHC 2860 [5 November 2018] Table of Contents Introduction [1] The issues [5] The key parties [7] Diagram of the key steps [12] The Note and the Forward Purchase — Outline [13] The Note [13] The Forward Purchase [16] Subsidiary documents [18] The Convertible Note guarantee [19] Mutual acknowledgment as to the lowest price of shares [20] The Forward Purchase guarantee [22] The cashflows, share issues and transfers [23] The commercial context of the Arrangement [27] The basis of the Commissioner’s assessments [37] Approach in statement of position dated 25 January 2011 [42] Approach of Adjudication Unit, 22 November 2011 [45] The Commissioner’s expert evidence [49] Comparison of experts’ approach with accounting treatment [76] The tax avoidance framework [80] Section DB 7 and the financial arrangements rules [96] The wider -

Suntory Group's Global

Suntory Group Kicks-Off Its Inaugural Program to Reflect on the Importance of Respecting Humanity— “Suntory Group’s Global Action for Humanity” TOKYO (October 27, 2020)—Suntory Group will be dedicating the months of November and December to the first “Suntory Group’s Global Action for Humanity” program, where all of its 40,000 global employees are encouraged to take part in various activities to reflect on the importance of respecting humanity. Such activities include participation in volunteer work that allows employees to recognize the importance of respecting and valuing other’s happiness in their daily work. “We respect humanity” is one of the five principles of The Suntory Group Way, which defines how each employee should think and act during their daily work to ensure that Suntory Group is supported by its customers and continues to grow. Respecting humanity is an integral part of what makes Suntory Group what it is today. Since our founding, we have been providing products and services that enrich the minds, bodies, and lifestyles of our consumers. Not only through our business, but with the founding spirit of “giving back to society,” Suntory Group is determined to make social contributions to the communities in which it operates, promoting spiritually richer and more fulfilling lives through art, music and culture to emergency relief in the wake of a disaster. “As a company that aims to enrich people’s lives through our products and services, passion for people and respect for all humankind are essential for the company to continue growing for good,” says Tomomi Fukumoto, COO of Corporate Sustainability at Suntory Holdings. -

Modern Slavery Statement

MODERN SLAVERY STATEMENT This statement is made pursuant to Modern Slavery Act 2018 (Cth) (the Act) and relates to the first reporting period for Frucor Suntory under the Act, 1 January 2020 to 31 December 2020. This statement sets out the steps that Frucor Suntory has taken and is continuing to take to seek to ensure that modern slavery is not taking place within our operations or our supply chains. Criteria 1 and 2: Our business, structure, operations and supply chains Suntory Holdings is the parent company in our corporate structure, which is a non-listed holdings company. It owns 59.48% of Suntory Beverage and Food Limited (SBF), which is a company incorporated in Japan and listed in the first section of the Tokyo Stock Exchange. Suntory Holdings and SBF together with their subsidiaries produce and distribute various popular brands of beverages. SBF has 100% ownership of both Frucor Suntory New Zealand Limited (Frucor NZ) and Frucor Suntory Australia Pty Limited ABN 73 060 091 536 (Frucor AU) (together, the Frucor Group). Frucor NZ manufactures products which are acquired by Frucor AU. Frucor AU carries on the entirety of the business in Australia, including contracting, property management and all other operations. Frucor AU and Frucor NZ share management and employees but otherwise Frucor NZ does not carry on business in Australia. Frucor AU is the reporting entity for the purpose of this statement under section 13 of the Act. Frucor AU does not own or control any other entities. Frucor AU does not have any investment holdings. Frucor AU’s operations take place in Australia, New Zealand, Japan and the USA. -

2019 Suntory Group Sustainability Site

PDF 2019 Suntory Group Sustainability Site 001 CONTENTS Top Commitment ………………………………… 002 To Create Harmony with Society Cultural and Social Contribution …………………… 147 Suntory Group ' Founder 's Spirit and Sustainability ……………………………… 004 ● Basic Policy on Social Activities FY 2019 Stakeholder Dialogue ……………… 008 ● Arts, Culture and Academic Activities ● Sports Activities Suntory Group's Philosophy on Sustainability … 016 ● Social Welfare ● Developing the Next Generation ● Enhancing CSR Activities using ISO26000 ● Disaster Recovery Support ● Editorial Policy on Sustainability Information ● Suntory "Land of Water "Kumamoto Support To Create Harmony with Customers and Partners Project Products and Services …………………………………… 028 ● The Suntory Tohoku Sun-Sun Project ● Contributions to Local Communities ● Voluntary Declaration toward Consumer Orientation ● Supporting Challenged Sports ● Voluntary Declaration of Consumer-orientation ● Employee Volunteer Activity Report (FY2018) ● Promotion of Group Quality Management To Create Harmony with Employee ● Quality Assurance from a Customer Perspective in Diversity Management ……………………………… 189 All Processes ● Basic Policy on Human Resource ● Appropriate Information Disclosure ● Employment Status ● Communicating with Customers ● Development of Human Resources ● Nurturing Employees that are Consumer Oriented ● Promoting Diversity ● Sustainable Procurement ● Promoting Work-Life Balance ● Just and Fair Transactions ● Labor/Management Relations ● Promoting Distribution Considering Safety ● Occupational Health -

The World's Most Active Food & Beverages Professionals

The World's Most Active Food & Beverages Professionals on Social - July 2021 Industry at a glance: Why should you care? So, where does your company rank? Position Company Name LinkedIn URL Location Employees on LinkedIn No. Employees Shared (Last 30 Days) % Shared (Last 30 Days) 1 Too Good To Go https://www.linkedin.com/company/too-good-to-go/Denmark 1,079 384 35.59% 2 Restalliance https://www.linkedin.com/company/restalliance/France 748 108 14.44% 3 Royal Unibrew https://www.linkedin.com/company/royalunibrew/Denmark 829 116 13.99% 4 Eckes-Granini https://www.linkedin.com/company/eckes-granini/Germany 510 69 13.53% 5 Compass Group France https://www.linkedin.com/company/compass-group-france-holdings-sas/France 951 126 13.25% 6 Beyond Meat https://www.linkedin.com/company/beyond-meat/United States 628 82 13.06% 7 Asahi Europe & International https://www.linkedin.com/company/asahieurope&international/Czech Republic 711 92 12.94% 8 DöhlerGroup https://www.linkedin.com/company/doehler/Germany 2,216 282 12.73% 9 Nestlé Professional https://www.linkedin.com/company/nestle-professional/Switzerland 2,962 370 12.49% 10 ZX Ventures https://www.linkedin.com/company/zx-ventures/United States 611 70 11.46% 11 BrewDog https://www.linkedin.com/company/brewdog/United Kingdom 736 84 11.41% 12 Nespresso UK https://www.linkedin.com/company/nespressouk/United Kingdom 573 62 10.82% 13 Mahou San Miguel https://www.linkedin.com/company/mahou-san-miguel/Spain 1,574 168 10.67% 14 Ansamble https://www.linkedin.com/company/ansamble/France 518 54 10.42% 15 Goodfood -

Corporate Overview Fact Sheet 2021

Suntory Group Corporate Overview Fact Sheet 2021 Corporate Overview/ Products and Services / Business Highlight Corporate Overview Suntory Group Suntory Holdings Limited Group companies: 303 (as of December 31, 2020) Head Office: 2-1-40 Dojimahama, Kita-ku, Osaka City, Osaka, Japan Employees: 40,044 (as of December 31, 2020) Suntory World Headquarters: 2-3-3 Daiba, Minato-ku, Tokyo, Japan Consolidated Revenue: ¥2,108.3 billion (January 1 to December 31, 2020) Inauguration of business: 1899 (excluding excise taxes) Establishment: February 16, 2009 Consolidated Revenue: ¥2,367.6 billion (January 1 to December 31, 2020) Representative Director, (including excise taxes) Chairman of the Board & Chief Executive Officer: Nobutada Saji Consolidated Operating Income: ¥217.0 billion (January 1 to December 31, 2020) Representative Director, President & Chief Executive Officer: Takeshi Niinami Capital: ¥70 billion Group Organization Suntory Beverage & Food Ltd. Suntory Foods Ltd. Suntory Beverage Solution Ltd. Suntory Beverage Service Ltd. Japan Beverage Holdings Inc. Suntory Products Ltd. Suntory Beverage & Food Europe Suntory Beverage & Food Asia Pacific Pepsi Bottling Ventures Group Suntory Beer, Wine & Spirits Japan Limited Suntory Beer Ltd. Suntory Holdings Limited Suntory Wine International Ltd. Beam Suntory Inc. Suntory Liquors Ltd.* Suntory Wellness Ltd. Suntory Spirits Ltd. Suntory (China) Holding Co., Ltd. Suntory MONOZUKURI Expert Limited Suntory Business Systems Limited Suntory Communications Limited Suntory Global Innovation Center Ltd. Suntory System Technology Limited Suntory Corporate Business Ltd. Sunlive Co., Ltd. * Suntory Liquors Ltd. sells alcoholic beverage Other operating companies (spirits, beers, wine and others) in Japan. Suntory Group Corporate Overview Fact Sheet Products and Services Non-alcoholic Beverage and Food Business/Alcoholic Beverage Business Non-alcoholic Beverage and Food Business We deliver a wide range of products including mineral water, coffee, tea, carbonated drinks, sports drinks and healthy drinks.