Fenimore Quarterly Investment Commentary Q2 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Company Location Additional Information

Company Location Additional Information Adecco Tuscaloosa addeccousa.com Advance Auto Parts Tuscaloosa jobs.net/jobs/advance-auto-parts Always Money Tuscaloosa careers-alwaysmoney.icims.com Ambassador Personnel Tuscaloosa teamambassador.com American Eagle Outfitters Tuscaloosa Sales Associate: indeed.com AMT Tuscaloosa amtstaffing.com Applebee's Grill + Bar Tuscaloosa Dishwasher Indeed.com Aramark Tuscaloosa aramark.com Ashley Furniture Tuscaloosa Sales Associate: indeed.com Multiple Avon www.startavon.com Ref: Anitasat Locations Help Wanted: Apply between 2-4 at 3380 Bama BBQ & Grill Northport McFarland Blvd Suite 14, Northport, Al 35476 No phone calls Bama Dinning Tuscaloosa bamadining.com/careers/applynow Barnes & Noble Tuscaloosa barnesandnobleinc.com/jobs/jobs.html Baymont Inn & Suites Tuscaloosa Housekeeping Attendant indeed Bed Bath and Beyond Tuscaloosa indeed.com Belflex Staffing Network Tuscaloosa belflex.com FT Sales Associate - Women's shoes Belk Tuscaloosa Indeed.com Best Buy Tuscaloosa bestbuy-jobs.com Correctional Officers, Stewards, Administrative Support Assistants, Plumber, Plant Maintenance Repair Supervisor, Security Guards, and Drug Bibb Correctional Facility Brent Treatment Counselors Correctional Officers. For a state application contact Bibb Correctional Payroll (205) 926-5252. Big Lots Northport Store Associate/Stocker $9.50/hr Indeed.com Blaze Pizza (New restaurant) Tuscaloosa Team member indeed.com Full Charge Bookkeeper needed Tuscaloosa Send resume to [email protected] Borden Dairy of Alabama Tuscaloosa www.bordendairy.com Bridgestone Americas Tuscaloosa Multiple positions indeed.com Buddy's Rib & Steak Northport HELP WANTED: Apply Inside Account Merchandiser - Rotating Account Merchandiser - CDL Driver/Retail Sales Support For more information about careers at Buffalo Buffalo Rock Tuscaloosa Rock, visit online at www.buffalorock.com/careers. You may also visit the career center. -

Fidelity National Information Services, Inc. (Exact Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 _______________________________________________ Form 10-Q _______________________________________________ x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended March 31, 2018 Or o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File No. 001-16427 _______________________________________________ Fidelity National Information Services, Inc. (Exact name of registrant as specified in its charter) Georgia 37-1490331 (State or other jurisdiction (I.R.S. Employer Identification No.) of incorporation or organization) 601 Riverside Avenue Jacksonville, Florida 32204 (Address of principal executive offices) (Zip Code) (904) 438-6000 (Registrant’s telephone number, including area code) Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO o Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO o Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. -

S&P 500 Say-On-Pay Failures Increase

pay & governance S&P 500 say-on-pay failures increase The number of S&P 500 companies whose executive pay plans failed to receive majority support from shareholders is up compared to last year. Nine S&P 500 companies have failed say on pay as of May No other surprises despite pandemic. Executive pay 29, which exceeds the total number of seven for all of 2019 decisions for 2019 predated the market gyrations brought and each of the prior years except 2012. In the past, S&P on by the COVID-19 pandemic and say-on-pay vote results 500 companies have enjoyed more say-on-pay support have been generally unaffected. Most indicators of than smaller companies, but this may be changing. shareholder support remain strong so far and consistent with prior years: Reasons for failures. Reasons some investors cited for voting against say on pay at the nine S&P 500 company • Out of 1,729 all-size companies reporting results, 43 (2.5%) failures, aggregated by Proxy Insight, were driven by pay- have received less than 50% support, a higher rate than for-performance disconnects, including: 47 out of about 2,100 (2.2%) as of June 12, 2019 • Modification of performance targets to make them easier • Votes continue to average about 91% in favor of to achieve companies’ executive pay programs • Lack of quantifiable (vs qualitative) performance metrics • Favorable votes of 90% or higher at individual companies are similar to last year (down slightly from 77% in 2019 to • Lack of transparency around performance goals, lack of 76% in 2020 for S&P 500 companies, and -

FIDELITY NATIONAL INFORMATION SERVICES, INC. (Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 14A (Rule 14a-101) Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ) Filed by the Registrant ☒ Filed by a party other than the Registrant ☐ Check the appropriate box: ☐ Preliminary Proxy Statement ☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) ☒ Definitive Proxy Statement ☐ Definitive Additional Materials ☐ Soliciting Material Pursuant to §240.14a-12 FIDELITY NATIONAL INFORMATION SERVICES, INC. (Name of Registrant as Specified In Its Charter) (Name of Person(s) Filing Proxy Statement, if other than the Registrant) Payment of Filing Fee (Check the appropriate box): ☒ No fee required. ☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. (1) Title of each class of securities to which transaction applies: (2) Aggregate number of securities to which transaction applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: ☐ Fee paid previously with preliminary materials. ☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. (1) Amount previously paid: (2) Form, Schedule or Registration Statement No.: (3) Filing party: (4) Date Filed: Table of Contents FIS Fidelity National Information Services, Inc. -

Participant List

Participant List 10/20/2019 8:45:44 AM Category First Name Last Name Position Organization Nationality CSO Jillian Abballe UN Advocacy Officer and Anglican Communion United States Head of Office Ramil Abbasov Chariman of the Managing Spektr Socio-Economic Azerbaijan Board Researches and Development Public Union Babak Abbaszadeh President and Chief Toronto Centre for Global Canada Executive Officer Leadership in Financial Supervision Amr Abdallah Director, Gulf Programs Educaiton for Employment - United States EFE HAGAR ABDELRAHM African affairs & SDGs Unit Maat for Peace, Development Egypt AN Manager and Human Rights Abukar Abdi CEO Juba Foundation Kenya Nabil Abdo MENA Senior Policy Oxfam International Lebanon Advisor Mala Abdulaziz Executive director Swift Relief Foundation Nigeria Maryati Abdullah Director/National Publish What You Pay Indonesia Coordinator Indonesia Yussuf Abdullahi Regional Team Lead Pact Kenya Abdulahi Abdulraheem Executive Director Initiative for Sound Education Nigeria Relationship & Health Muttaqa Abdulra'uf Research Fellow International Trade Union Nigeria Confederation (ITUC) Kehinde Abdulsalam Interfaith Minister Strength in Diversity Nigeria Development Centre, Nigeria Kassim Abdulsalam Zonal Coordinator/Field Strength in Diversity Nigeria Executive Development Centre, Nigeria and Farmers Advocacy and Support Initiative in Nig Shahlo Abdunabizoda Director Jahon Tajikistan Shontaye Abegaz Executive Director International Insitute for Human United States Security Subhashini Abeysinghe Research Director Verite -

BLM 2008-12.Pdf

DECEMBER 2008 2 BLUE LINE MAGAZINE December 2008 Volume 20 Number 10 “You should always look at the past with interest but never stare at it,” a journalist suggested recently. “With very little effort it will consume you and become your only future.” Wise words indeed, but it’s still worth paus- ing to look back on the occasion of our 20th anniversary. We hope setting aside one issue out of 200 will not be considered staring! Features 5 A story to tell 20 years later 30 The latest high retention holster technology 7 Jeers & cheers 34 Holster retention levels 8 Milestones in 20 years of This is what the numbers mean Canadian policing 62 Congratulations Departments Case Law 62 Advertisers Index 58 Court sets high standard for YCJA compliance 46 Deep Blue 37 Dispatches 48 Forensic Science 61 Market Place 45 Odditorials 56 Technology BLUE LINEINE MAGAZINEE 33 DECEMBER 2008 DECEMBER 2008 4 BLUE LINE MAGAZINE A story to tell... 20 years later by Morley Lymburner I pointed an authorita- tive finger at a Plymouth speeding in a school zone. The front end of the mis- creant’s car nose-dived, indicating his initial com- pliance, if not terror. Some- what more relaxed, I low- ered my arm and reflexively concentrated on the plate number. The front end immediately rose back up and there was the tell-tale sound of an accelerating motor as the car headed directly for me, a clear indication the driver did not want to speak to me. I quickly dove into my scout car, dropping it in gear at the same moment the Plymouth came along side. -

Headquarters

Headquarters Northeast Florida Company Name Company Description Type of Headquarters Employees Florida Blue Health Insurance State Headquarters Regional 5,700 Southeastern Grocers Corporate HQ & Grocery Distribution Center Corporate 5,700 GATE Petroleum Company Petroleum Products Corporate Headquarters Corporate 3,000 CSX Corporation Railroad Corporate Headquarters Corporate 2,900 AT&T Telecommunications Regional Headquarters Regional 2,600 Brooks Rehabilitation Medical Rehabilitation Corporate 2,240 Black Knight Mortgage software development Corporate 2,120 Newfold Web Designers and Online Marketing Corporate 2,000 One Call Workers Compensation Services Corporate 1,970 Johnson & Johnson Vision Contact lens manufacturing Division 1,800 Fanatics E-Commerce Retailer Corporate 1,700 FIS Banking Services Software Provider Corporate 1,500 Wells Fargo Banking Regional 1,450 VyStar Credit Union Credit Union Corporate 1,410 TIAA Bank Banking and Mortgage Services Corporate 1,400 GuideWell Medicare administration Corporate 1,300 Miller Electric Company Electrical Contractors Corporate 1,300 Crowley Maritime Corporation Marine Transportation & Logistics Corporate 1,200 Fidelity National Financial Title Insurance Company Corporate 1,168 Citizens Property Insurance Corporation Insurance Corporate 1,040 Landstar System Inc. Transportation Logistics Corporate 1,000 McKesson Medical-Surgical Medical Supplies Provider to the Physician Market Division 1,000 Medtronic Inc. Surgical Products Manufacturer Division 900 06/2021 jaxusa.org BAKER CLAY DUVAL -

Terms and Conditions for Evercard Visa Platinum Accounts, Including Points Rewards Program and Cash Rewards Program

Terms and Conditions for EverCard Visa Platinum Accounts, including Points Rewards Program and Cash Rewards Program JUNE 2017 EverBank is a division of TIAA, FSB, member FDIC. EVERCARD VISA PLATINUM TERMS AND CONDITIONS BOOKLET 1.0. EverCard Visa Platinum Terms And Conditions .................................. 5 1.1. General................................................................ 5 1.2. Additional Services ...................................................... 5 1.3. Other Agreements....................................................... 5 1.4. Review And Keep Copies . 5 1.5. General Terms For EverCard Visa Platinum Account .......................... 5 1.6. Agreement To Terms . 6 1.7. Authorized Users........................................................ 6 1.8. Available Transactions–Credit Limit And Cash Advance Credit Limit ............. 6 1.9. Billing Statements....................................................... 7 1.10. Promise To Pay ......................................................... 8 1.11. When Periodic Interest Charges Begin...................................... 9 1.12. Average Daily Balance Of Purchases (Including New Purchases) ................ 9 1.13. Average Daily Balance Of Cash Advances (Including New Cash Advances) ........ 10 1.14. Average Daily Balance Of Balance Transfers (Including New Balance Transfers) .. 10 1.15. Calculation Of Interest Charges............................................ 10 1.16. Penalty Interest Charge .................................................. 10 1.17. Lost/Stolen Cards/Liability -

Jax Regional Headquarters

JAX REGIONAL HEADQUARTERS COMPANY NAME DESCRIPTION TYPE ADDRESS CITY EMPLOYEES Florida Blue Health Insurance State Headquarters Regional 4800 Deerwood Campus Parkway Jacksonville 6700 Southeastern Grocers Corporate HQ & Grocery Distribution Center Corporate 8928 Prominence Parkway, #200 Jacksonville 5700 CSX Corporation Railroad Corporate Headquarters Corporate 500 Water Street Jacksonville 3600 GATE Petroleum Company Petroleum Products Corporate Headquarters Corporate 9540 San Jose Blvd Jacksonville 3125 Black Knight Financial Services Mortgage IT Provider Corporate 601 Riverside Ave. Jacksonville 2400 Johnson & Johnson Vision Care Contact lens manufacturing Division 7500 Centurion Parkway Jacksonville 2000 Brooks Rehabilitation Medical Rehabilitation Corporate 3599 University Boulevard South Jacksonville 1600 VyStar Credit Union Credit Union Corporate 4949 Blanding Blvd. Jacksonville 1300 GuideWell Source Medicare administration Corporate 532 Riverside Avenue Jacksonville 1300 FIS Banking Services Software Provider Corporate 601 Riverside Avenue Jacksonville 1100 Stein Mart Inc. Retail Corporate Headquarters Corporate 1200 Riverplace Blvd. Jacksonville 1000 Web.com Web Designers and Online Marketing Corporate 12808 Gran Bay Parkway West Jacksonville 1000 McKesson Medical-Surgical Medical Supplies Provider to the Physician Market Division 4345 Southpoint Blvd Jacksonville 1000 Fanatics E-Commerce Retailer Corporate 8100 Nations Way Jacksonville 1000 CrowleyBeaver StreetMaritime Fisheries Corporation Inc. MarineWholesale Transportation -

Sentenza Tal-Qorti Ġenerali Tat-12 Ta' April 2011 — Fuller &Amp

28.5.2011 MT Il-Ġurnal Uffiċjali tal-Unjoni Ewropea C 160/19 Sentenza tal-Qorti Ġenerali tat-13 ta’ April 2011 — Unites Konvenut: L-Uffiċċju għall-Armonizzazzjoni fis-Suq Intern (Trade States Polo Association vs UASI — Textiles CMG marks u Disinni) (rappreżentant: D. Botis, aġent) (U.S. POLO ASSN.) (Kawża T-228/09) ( 1 ) Partijiet oħra fil-proċedimenti quddiem il-Bord tal-Appell tal-UASI, intervenjenti quddiem il-Qorti Ġenerali: DEF-TEC Defense Techno (“Trade mark Komunitarja — Proċedimenti ta’ oppożizzjoni logy GmbH (Francfort-sur-le-Main, il-Ġermanja) (rappreżentanti: — Applikazzjoni għat-trade mark Komunitarja verbali U.S. inizjalment minn H. Daniel u O. Haleen, sussegwentement minn POLO ASSN. — Trade mark Komunitarja u nazzjonali O. Haleen, avukati) verbali preċedenti POLO-POLO — Raġuni relattiva għal rifjut — Probabbiltà ta’ konfużjoni — Xebh tas-sinjali — Artikolu 8(1)(b) tar-Regolament (KE) Nru 40/94 (li sar Suġġett l-Artikolu 8(1)(b) tar-Regolament (KE) Nru 207/2009)”) Rikors kontra d-deċiżjoni tar-raba’ Bord tal-Appell tal-UASI tal- 4 ta’ Mejju 2009 [Każ R 493/2002-4 (II)], dwar proċedimenti (2011/C 160/26) ta’ oppożizzjoni bejn Defence Technology Corporation of Lingwa tal-kawża: l-Ingliż America u DEF-TEC Defense Technology GmbH. Partijiet Dispożittiv Rikorrenti: Unites States Polo Association (Lexington, Kentucky, l-Istati Uniti) (rappreżentanti: P. Goldenbaum, I. Rohr u T. Melc (1) Ir-rikors huwa miċħud. hert, avukati) Konvenut: L-Uffiċċju għall-Armonizzazzjoni fis-Suq Intern (Trade (2) Safariland LLC għandha tbati l-ispejjeż tagħha stess kif ukoll marks u Disinni) (rappreżentant: D. Botis, aġent) dawk tal-Uffiċċju għall-Armonizzazzjoni fis-Suq Intern (Trade marks u Disinni) (UASI) u tad-DEF-TEC Defense Technology Parti oħra fil-proċedimenti quddiem il-Bord tal-Appell tal-UASI: GmbH. -

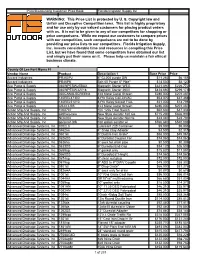

WARNING: This Price List Is Protected by U. S. Copyright Law and Unfair and Deceptive Competition Laws

Price/Discounting Customer Price Book Florida Irrigation Supply Inc WARNING: This Price List is protected by U. S. Copyright law and Unfair and Deceptive Competition laws. This list is highly proprietary and for use only by our valued customers for placing product orders with us. It is not to be given to any of our competitors for shopping or price comparisons. While we expect our customers to compare prices with our competition, such comparisons are not to be done by providing our price lists to our competitors. Florida Irrigation Supply, Inc. invests considerable time and resources in compiling this Price List, but we have found that some competitors have obtained our list and simply put their name on it. Please help us maintain a fair ethical business climate. County Of Lee Fort Myers Fl Vendor Name Product Description 1 Base Price Price Accord Industries PR200PJ 6" CL200 purple SW $11.282 $6.155 Accord Industries PR40PK Sch 40 Purple 8" Pipe" $14.530 $8.120 Ace Pump & Supply 030WPESW25BAX Magnetic Starter WEG $321.890 $226.772 Ace Pump & Supply 030WPESW32V18 Magnetic Starter 460V $424.660 $299.173 Ace Pump & Supply 060CANALSCREEN4 4x4 Metal Canal Screen $286.000 $201.487 Ace Pump & Supply 140REL47300 8 Pin Relay Coil 24VAC $53.070 $37.388 Ace Pump & Supply 140REL51210 8 Pin Relay Socket F/UL $21.000 $14.795 Ace Pump & Supply CS4X3-SS 4x3 Metal Canal Screen $286.000 $201.487 Action Mfg And Supply, Inc 1002707 10ft 120v Float Switch $62.630 $47.336 Action Mfg And Supply, Inc a20hws-new New Style Aerator 160 Ga $715.200 $666.996 Action -

Texas Department of Public Safety Non-Compete Report Pursuant to Texas Government Code 2261.253

Texas Department of Public Safety Non-Compete Report Pursuant to Texas Government Code 2261.253 Purchase Order Total Amount Award Date Vendor Description Competitively Bid Procurement Method Justification 20P0025222 $ 121.07 6/2/2020 BROWNELLS INC AUS-FTM-Trigger Weight System NO Delegated Purchase Competitive bidding is not required for delegated purchases under $5000.00 pursuant to Texas Administrative Code §20.82 and §20.211 20P0025695 $ 107.66 6/11/2020 SAFARILAND LLC DBA FORENSICS SOURCE TYL NIK Spot Wells* NO Delegated Purchase Competitive bidding is not required for delegated purchases under $5000.00 pursuant to Texas Administrative Code §20.82 and §20.211 20P0025887 $ 3,536.01 6/16/2020 BEEPSMART COMMUNICATIONS INC Mooney HP Toner NO SPD Smart Buy Office of the Comptroller, SPD Procurement 20P0024609 $ 3,305.00 6/17/2020 GTS TECHNOLOGY SOLUTIONS INC UPS install and removal HQ B NO Delegated Purchase Competitive bidding is not required for delegated purchases under $5000.00 pursuant to Texas Administrative Code §20.82 and §20.211 20P0026318 $ 87.00 6/26/2020 THE TOWNSEND GROUP INC 06.26.20_Felt Hats NO SPD Smart Buy Office of the Comptroller, SPD Procurement 20P0025176 $ 12,092.08 6/29/2020 GOVERNMENT SCIENTIFIC SOURCE INC WES LAB EVAPORATION DISHES NO SPD Contract Office of the Comptroller, SPD Procurement 20P0025259 $ 328.56 6/29/2020 GRAINGER WES LAB GRAINGER NO SPD Contract Office of the Comptroller, SPD Procurement 20P9000946 $ 43,420.72 6/29/2020 GALLS LLC CID UNISEX POLO M REG NO SPD Smart Buy Office of the Comptroller,