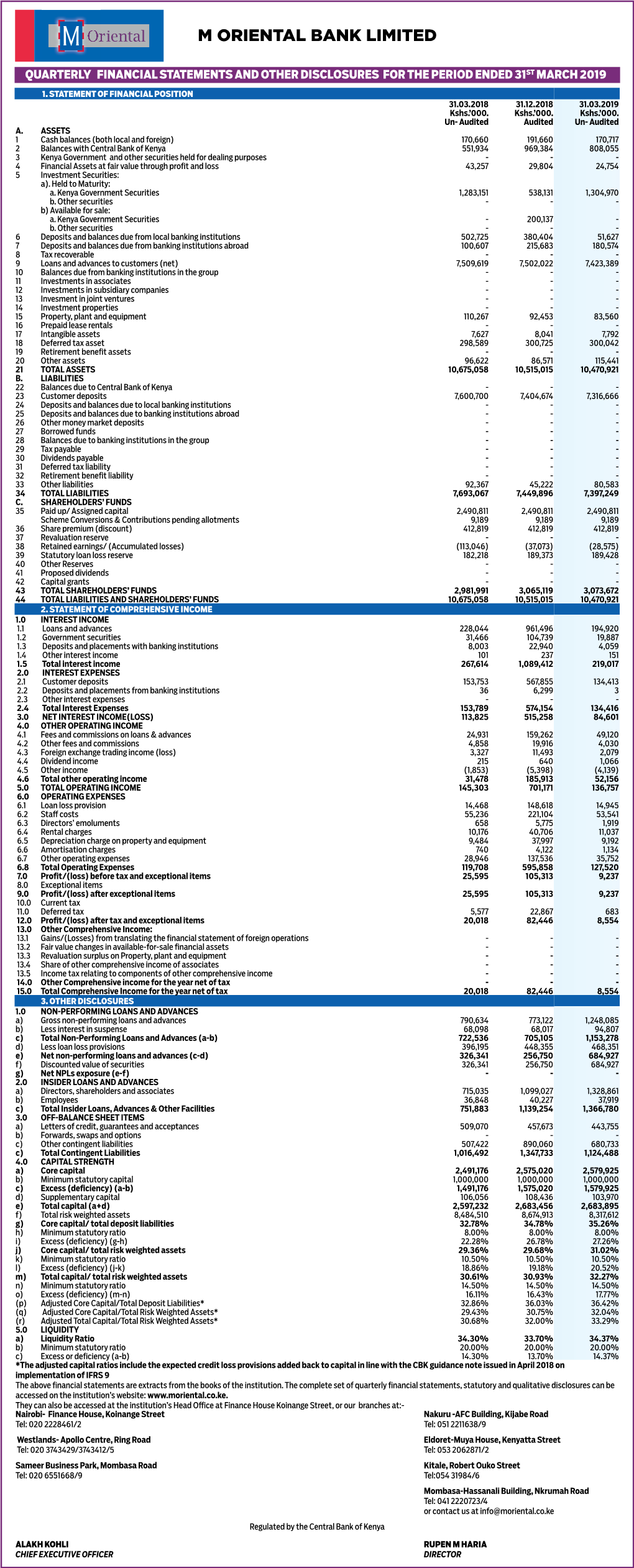

Financial Statement March 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

KDIC Annual Report 2018

ANNUAL REPORT 2017 - 2018 ANNUAL REPORT AND FINANCIAL STATEMENTS FOR THE FINANCIAL YEAR ENDED JUNE 30, 2018 Prepared in accordance with the Accrual Basis of Accounting Method under the International Financial Reporting Standards (IFRS) CONTENTS Key Entity Information..........................................................................................................1 Directors and statutory information......................................................................................3 Statement from the Board of Directors.................................................................................11 Report of the Chief Executive Officer...................................................................................12 Corporate Governance statement........................................................................................15 Management Discussion and Analysis..................................................................................19 Corporate Social Responsibility...........................................................................................27 Report of the Directors.......................................................................................................29 Statement of Directors' Responsibilities................................................................................30 Independent Auditors' Report.............................................................................................31 Financial Statements: Statement of Profit or Loss and other Comprehensive Income...................................35 -

M-Oriental Bank Limited V Commissioner of Domestic Taxes

REPUBLIC OF KENYA IN THE TAX APPEALS TRIBUNAL APPEAL NO.8 OF 2017 M-ORIENTAL BANK L1MITED APPELLANT VS THE COMMISSIONER OF DOMESTIC TAXES. RESPONDENT JUDGEMENT BACKGROUND: 1. The Appellant M-Qriental Bank Limited Oriental 'it-- Commercial Bank Ltd), is a li~ited [ability company incorporated in Kenya under Companie ct, Ca / ~ws of Kenya, licensed under The Banking Act Lawssof Kenya and registered by The Kenya ? Revenue Authority as a tax payer, PIN number P0006056 74D. 2. :rlje Resl?~ndent is the PrinciJl g'ent of the Government of Kenya in ''1 ~~ ,I'" Charge of'collection of revenue and ensuring compliance with the Tax Laws and is established by Section 3 of the Kenya Revenue Authority ~ >Nlf/ Act, Cap 469. ' , CAUSE OF ACTION: 3. The Respondent carried out an audit of the Appellant's records for the period 2014 to 2016 and issued an assessment for Capital Gains Tax (CGT) on 26th September 2016. The Appellant objected through a Notice of Objection dated 10th October 2016 and received by the Respondent on the following day. After an exchange of Judgement Appeal No.8 of 2017 eM-Oriental Bank Limited) Page 1 correspondence and further discussions, the Respondent issued an Objection Decision by way of a Confirmed Assessment dated 6th December 2016. 4. The Appellant being dissatisfied with the Objection Decision filed a Notice of Appeal dated 5th January 2017 with this Tribunal and served the same upon the Respondent on the same day. The Objection Decision was for CGT amounting together with penalties and interest am ,unted to Kshs.26,000,364.20. -

Automated Clearing House Participants Bank / Branches Report

Automated Clearing House Participants Bank / Branches Report 21/06/2017 Bank: 01 Kenya Commercial Bank Limited (Clearing centre: 01) Branch code Branch name 091 Eastleigh 092 KCB CPC 094 Head Office 095 Wote 096 Head Office Finance 100 Moi Avenue Nairobi 101 Kipande House 102 Treasury Sq Mombasa 103 Nakuru 104 Kicc 105 Kisumu 106 Kericho 107 Tom Mboya 108 Thika 109 Eldoret 110 Kakamega 111 Kilindini Mombasa 112 Nyeri 113 Industrial Area Nairobi 114 River Road 115 Muranga 116 Embu 117 Kangema 119 Kiambu 120 Karatina 121 Siaya 122 Nyahururu 123 Meru 124 Mumias 125 Nanyuki 127 Moyale 129 Kikuyu 130 Tala 131 Kajiado 133 KCB Custody services 134 Matuu 135 Kitui 136 Mvita 137 Jogoo Rd Nairobi 139 Card Centre Page 1 of 42 Bank / Branches Report 21/06/2017 140 Marsabit 141 Sarit Centre 142 Loitokitok 143 Nandi Hills 144 Lodwar 145 Un Gigiri 146 Hola 147 Ruiru 148 Mwingi 149 Kitale 150 Mandera 151 Kapenguria 152 Kabarnet 153 Wajir 154 Maralal 155 Limuru 157 Ukunda 158 Iten 159 Gilgil 161 Ongata Rongai 162 Kitengela 163 Eldama Ravine 164 Kibwezi 166 Kapsabet 167 University Way 168 KCB Eldoret West 169 Garissa 173 Lamu 174 Kilifi 175 Milimani 176 Nyamira 177 Mukuruweini 180 Village Market 181 Bomet 183 Mbale 184 Narok 185 Othaya 186 Voi 188 Webuye 189 Sotik 190 Naivasha 191 Kisii 192 Migori 193 Githunguri Page 2 of 42 Bank / Branches Report 21/06/2017 194 Machakos 195 Kerugoya 196 Chuka 197 Bungoma 198 Wundanyi 199 Malindi 201 Capital Hill 202 Karen 203 Lokichogio 204 Gateway Msa Road 205 Buruburu 206 Chogoria 207 Kangare 208 Kianyaga 209 Nkubu 210 -

Bank Supervision Annual Report 2019 1 Table of Contents

CENTRAL BANK OF KENYA BANK SUPERVISION ANNUAL REPORT 2019 1 TABLE OF CONTENTS VISION STATEMENT VII THE BANK’S MISSION VII MISSION OF BANK SUPERVISION DEPARTMENT VII THE BANK’S CORE VALUES VII GOVERNOR’S MESSAGE IX FOREWORD BY DIRECTOR, BANK SUPERVISION X EXECUTIVE SUMMARY XII CHAPTER ONE STRUCTURE OF THE BANKING SECTOR 1.1 The Banking Sector 2 1.2 Ownership and Asset Base of Commercial Banks 4 1.3 Distribution of Commercial Banks Branches 5 1.4 Commercial Banks Market Share Analysis 5 1.5 Automated Teller Machines (ATMs) 7 1.6 Asset Base of Microfinance Banks 7 1.7 Microfinance Banks Market Share Analysis 9 1.8 Distribution of Foreign Exchange Bureaus 11 CHAPTER TWO DEVELOPMENTS IN THE BANKING SECTOR 2.1 Introduction 13 2.2 Banking Sector Charter 13 2.3 Demonetization 13 2.4 Legal and Regulatory Framework 13 2.5 Consolidations, Mergers and Acquisitions, New Entrants 13 2.6 Medium, Small and Micro-Enterprises (MSME) Support 14 2.7 Developments in Information and Communication Technology 14 2.8 Mobile Phone Financial Services 22 2.9 New Products 23 2.10 Operations of Representative Offices of Authorized Foreign Financial Institutions 23 2.11 Surveys 2019 24 2.12 Innovative MSME Products by Banks 27 2.13 Employment Trend in the Banking Sector 27 2.14 Future Outlook 28 CENTRAL BANK OF KENYA 2 BANK SUPERVISION ANNUAL REPORT 2019 TABLE OF CONTENTS CHAPTER THREE MACROECONOMIC CONDITIONS AND BANKING SECTOR PERFORMANCE 3.1 Global Economic Conditions 30 3.2 Regional Economy 31 3.3 Domestic Economy 31 3.4 Inflation 33 3.5 Exchange Rates 33 3.6 Interest -

Effect of Mobile Banking on Cost Efficiency Of

EFFECT OF MOBILE BANKING ON COST EFFICIENCY OF COMMERCIAL BANKS IN KENYA WILLY WACHIRA MUTHII A RESEARCH PROJECT SUBMITTED IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE AWARD OF THE DEGREE OF MASTER OF SCIENCE IN FINANCE, SCHOOL OF BUSINESS, UNIVERSITY OF NAIROBI OCTOBER, 2019 DECLARATION I, the undersigned, declare that this is my original work and has not been presented to any institution or university other than the University of Nairobi for examination. Signed: _____________________Date: __________________________ WILLY WACHIRA MUTHII D63/64566/2013 This research project has been submitted for examination with my approval as the University Supervisor. Signed: _____________________Date: __________________________ DR. CYRUS IRAYA Department of Finance and Accounting School of Business, University of Nairobi ii ACKNOWLEDGEMENTS Quoting the words of Shannon L Adler, "When you invite people to share in your miracle, you create future allies during rough weather". This quote is a true reflection of my journey writing this research project because without the individuals involved, this journey would have been impossible. A sincere thank you goes to my supervisor Dr. Cyrus Iraya for his patience, support and guidance. For believing in my project and offering his insight and expertise in this field. For not hesitating to share his thoughts and views enabling me to be where I am today. A special thank you to Mr. Murage for his guidance and support throughout this process. Finally I would like to thank my colleagues and friends who were there to offer me support and listen to me and my views while writing this research project. They encouraged me to never give up and for that I will forever be grateful. -

The Effect of Credit Information Sharing on Profitability of Commercial Banks in Kenya and a Descriptive Research Design Was Used

THE EFFECT OF CREDIT INFORMATION SHARING ON PROFITABILITY OF COMMERCIAL BANKS IN KENYA BY KARIUKI JOSPHINE WANGARI D61/81289/2015 A RESEARCH PROJECT SUBMITTED IN PARTIAL FUFILMENT OF THE REQUIREMENTS FOR THE AWARD OF THE DEGREE OF MASTER OF BUSINESS ADMINSTRATION SCHOOL OF BUSINESS, UNIVERSITY OF NAIROBI NOVEMBER 2017 DECLARATION I hereby declare that this research project is my original work and has not been presented in any other university or institution of higher learning before. Signed…………………………………………… Date……………………………… Kariuki Josphine Wangari D61/81289/2015 This research project has been submitted for examination with my approval as the University of Nairobi Supervisor. Signed…………………………………………… Date……………………………… Dr. Kennedy Okiro Lecturer, Department of Finance and Accounting School of Business, University of Nairobi ii ACKNOWLEDGMENT First, I wish thank the almighty God for life and knowledge which enabled me to undertake this research project. I would also wish to express my sincere gratitude to my supervisor Dr. Kennedy Okiro for the guidance and encouragement during this project. Finally, I wish to thank my family, friends and colleagues for their support during execution of this project. Special gratitude to my parents for the financial support and being there for me during the entire time. iii DEDICATION I dedicate this research project to my loving parents and siblings for the support, encouragement and prayers during the entire period of my study. God bless you. iv TABLE OF CONTENT DECLARATION ......................................................................................................... -

THE KENYA GAZETTE Published by Authority of the Republic of Kenya (Registered As a Newspaper at the G.P.O.)

THE KENYA GAZETTE Published by Authority of the Republic of Kenya (Registered as a Newspaper at the G.P.O.) Vol. CXXIII—No. 22 NAIROBI, 29th January, 2021 Price Sh. 60 CONTENTS GAZETTE NOTICES GAZETTE NOTICES —(Contd.) PAGE The Prisons Act—Declaration of Prison, etc ......................... 286 The Sacco Societies Act—List of Sacco Societies Licensed to Undertake Deposit-Taking Sacco Business in Kenya The Accountants Act—Appointment .................................... 286 for the Finacial Year Ending December, 2021 ................... 308–310 The Kenya Civil Aviation Act—Appointment ..................... 286 The Building Surveyors Act—Appointment ......................... 286 The Kenya Deposit Insurance Act—List of Member The Kenya Agricultural and Livestock Research Institutions ............................................................................. 310 Organization (KALRO) Act—Corrigendum ..................... 286 The Companies Act—Dissolutions, etc ................................. 310–312 The Taskforce to Review the Survey Sector Legal, Policy and Institutional Framework—Appointment ..................... 287 In the Matter of DAC Aviation (EA) Limited—Petition for The Community Land Act—Appointment ............................ 287–288 Liquidation ............................................................................ 312 The Human Resource Management Professionals Act— The Physical and Land Use Planning Act—Completion of Appointment ......................................................................... 288 Part Development -

ABIS 2019 Post Event Report

NAIROBI, KENYA | 19-20 FEBRUARY 2019 | WWW.AFRICABFSI.COM POST EVENT REPORT DIRECTOR’S NOTE Dear Participant, On behalf of Tradepass, I take immense pleasure in welcoming you to the inaugural edition of Africa BFSI Innovation Summit 2019. Being the inaugural edition, ABIS 2019 has attracted 350+ participants from the BFSI and technology industries, making it the largest Banking, Financial Services and Insurance summit in East Africa. The participation of leading local and international speakers representing some of the top banks, insurance and ȴQDQFLDOVHUYLFHFRPSDQLHVZLOOEULQJWRWKHIRUHQHZLQIRUPDWLRQDQGEXVLQHVVGHYHORSPHQWRSSRUWXQLWLHV 2YHUWKHFRXUVHRIWKHVHWZRGD\VWKHVXPPLWZLOOFRYHUFXWWLQJHGJHWRSLFVVXFKDV'LJLWDO%DQNLQJ&XVWRPHU([SHULHQFH0LFURȴQDQFH5LVNDQG &\EHUVHFXULW\'LJLWDO.<&&RUH%DQNLQJ3D\PHQWVDQG5HWDLO%DQNLQJDPRQJVWPDQ\RWKHUV$VSDUWRIWKHFXUUHQWHGLWLRQRIWKHFRQIHUHQFHDJHQGDD VHOHFWLRQRIRYHUSUHVHQWDWLRQVZLOOEHIHDWXUHGDORQJZLWKSDQHOGLVFXVVLRQVDQGȴUHVLGHFKDWVWKDWZLOOWKURZOLJKWRQVRPHRIWKHODWHVW technologies and innovations which play a key role in the evolving BFSI landscape.A series of interactive panel discussions and an array of networking sessions represent an exclusive opportunity to exchange ideas on trends in the BFSI sector & global best practices. The summit itself remains as an excellent platform to meet the industry thought leaders and key decision makers. I take this opportunity to specially thank our line-up of distinguished speakers for sparing their time to be here with us today. I would also like to extend a warm welcome to all -

The Kenya Gazette

coun.CLL ATONEspORTINS PS yyoRA® THE KENYA GAZETTE Published by Authority of the Republic of Kenya (Registered as a Newspaperat the G.P.O.) Vol. CXIX—No. 167 NAIROBI, 10th November, 2017 Price Sh. 60 CONTENTS GAZETTE NOTICES pace GazeTTE NoTices—(Contd.) Taskforce on the National Climate Change Action Plan— The Energy Act— Application for Licence for Generation, 5786 Distribution and Supply of Electricity .......cssssssssseee §823 Appointment Taskforce on the Implemantation of the Decision of the The Physical Planning Act—Completion of African Court on Human and People’s Rights Issued Development Plans......sscessssssssssecssccserseececenseneessssneeness 5823 Against the Government’ of Kenya in Respect of the The Environmental Management and Co-ordination Act— Rights of the Ogiek Community of Mau— Appointment 5786-5787 Environmental Impact Assessment Study Repott........... 5823-5824 The Wildlife Conservation and Management Act— Public Business Transfer 5824 Participation on Development of the National Wildlife 5787 Court Summon 5824-5825 Conservation and ManagementStrategy .........-.s-ssssees 5787 Loss ofPolicies 5825-5830 The Valuers Act—Appointment.......sssssssssssnsesssssssseessnnnnaes The Prisons Act—Reclassification of Langata Women Change of Name: 5830-5831 Prison 5787-5788 The Land Registration Act—JIssue of Provisional Certificates,etc..... sessansnessencnsnseserssuucseccssssssscenanveecesnsnenes 5788-5798 SUPPLEMENTNe.162 The Land Act— Inquiry, tc. .......sssssssssscssssssnssesersnesssuecnennrsnnses 5799 Acts , 2017 5799-5804 -

EAC Financial Inclusion Stakeholder Mapping

EAC Financial Inclusion Stakeholder Mapping REPORT JANUARY - 2020 Supported by the: 1 Acknowledgements This report was produced by FinTechStage and Canela Consulting (our research partners). Contributors included Dr. Erin Taylor, Dr. Whitney Easton and Luis Carlos Serna Prati. Ariadne Plaitakis contributed material on regulation. Data analysis was carried out by Mariela Atannasova and Gawain Lynch. Infographics were produced by Ana Subtil, Mariela Atanassova and Whitney Easton. We would like to thank the Bill and Melinda Gates Foundation for their active support of the programme and the broad access to research material on Financial Inclusion. Lazaro Campos Co-Founder, FinTechStage January 2020 2 EAC FINANCIAL INCLUSION STAKEHOLDER MAPPING - REPORT EXECUTIVE SUMMARY The East African Community (EAC), a regional economic community, is often presented as a model of financial inclusion in Africa. Over the past few years, we have seen tremendous improvement across the region, but much remains to be done. The purpose of this body of work is to understand the state of financial inclusion across the EAC and identify how to advance. The first step is to map the financial inclusion landscape to identify stakeholders, gaps, and areas for intervention. We carried out data collection and network mapping for all six EAC Member States. In this report we identify: • All stakeholders who are working on financial inclusion issues in the EAC, including the financial sector, mobile network operators (MNOs), mobile money operators (MMOs), microfinance institutions -

The International Journal of Business & Management

THE INTERNATIONAL JOURNAL OF BUSINESS & MANAGEMENT ISSN 2321–8916 www.theijbm.com THE INTERNATIONAL JOURNAL OF BUSINESS & MANAGEMENT The Effect of Operational Risk Management on Financial Performance of Commercial Banks: A Case of Tier Two and Three Commercial Banks in Kenya Rose Waithira Kamau Operations Officer, Department of Branch Operations, SBM Bank Kenya Limited, Nairobi, Kenya Dr. James Gatauwa Lecturer, Department of Accounting and Finance, Kenya Methodist University, Kenya Dr. Felix Mwambia Lecturer, Department of Accounting and Finance, Kenya Methodist University, Kenya Abstract: Kenyan banking sector is exposed to risks that initiate from external and internal environments. Operational risk threatens the viability and long-term sustainability of banks. Despite growth in the Kenyan banking sector, operational risk possesses a major challenge. The main objective of this paper was to examine the impact of operational risk on the financial health of tier two and three commercial banks in Kenya. The findings indicate that operational risk has a significant negative effect on the financial performance of tier two and three banks. Bank size has a significant positive effect on the financial performance of tier two and three banks. The study also concluded that tier three banks are not able to mitigate operational risks as well as tier two banks through the dummy variable measure. Banks are therefore encouraged to develop effective risk management and measurements techniques to avoid huge operational losses that negatively affect the financial health of the institutions. Keywords: Operational risk, financial performance, Bank size, dummy variable 1. Introduction Commercial banks are established to maximize their shareholder value which is a function of risk and return. -

Digital Revolution: a Case from Kenyan Banks

Digital Revolution: A Case from Kenyan Banks Presentation by George Bodo Head of Banking Research, Ecobank Capital. 8th September, 2016. Villa Rosa Kempinsky, Nairobi Kenyan Banks: Retail Franchise Strength UBA M Oriental Bank Guardian Bank ABC Bank Bank of Baroda Fidelity Commercial Bank Spire Bank Credit Bank Limited Gulf African Bank Ltd GTBank Trans-National Bank Prime Bank Limited First Community Bank Consolidated Bank Jamii Bora Bank CfC Stanbic NIC CBA Ecobank I&M Bank Bank of Africa Sidian Standard Chartered Diamond Trust Bank Limited National Bank of Kenya Family Bank Barclays Co-operative Bank Equity KCB 0% 2% 4% 6% 8% 10% 12% 14% 16% 2 Source: Ecobank Research Kenyan Banks: Loan book concentration by key segments Ecobank Corporate Citi SME Consumer National Bank Bank of Africa Family Bank I&M DTB NIC* CfC Stanbic CBA Barclays Standard Chartered Co-operative Equity KCB 0% 20% 40% 60% 80% 100% 120% 3 Source: Ecobank Research The ‘New Normal’ now requires certain key adjustments Chart below shows old normal as at FY2015 W.A.R on Deposits Spreads W.A.R on Loans Ecobank 8.0% Prime Bank 3.7% Bank of Africa 7.1% Family Bank 8.6% Citi 7.1% NBK 11.6% NIC 8.1% I&M 6.9% CfC Stanbic 7.8% CBA 9.5% DTB 7.0% Barclays 11.9% Standard Chartered 6.8% Co-op Bank 11.1% Equity 15.0% KCB 13.5% 0.0% 5.0% 10.0% 15.0% 20.0% 25.0% 30.0% 35.0% 40.0% Source: Ecobank Research 4 New Normal: Key adjustment points Cost of Deposits* Efficiency(CIR) 80% 70% 70% 60% 51% 50% 47% 46% 43% 41% 40% 34% 29% 30% 20% 10% 0% Tier 1 Banks Tier 2 Banks Tier 3 Banks Industry Now that caps on lending rates as well as floors on deposit rates are part of our national laws, banks will have to make adjustments to their business models-especially around costs (both funding and non-funding).