National Capital Region Urban Infrastructure Financing Facility

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

GOVERNMENT of INDIA MINISTRY of EARTH SCIENCES LOK SABHA UNSTARRED QUESTION No

GOVERNMENT OF INDIA MINISTRY OF EARTH SCIENCES LOK SABHA UNSTARRED QUESTION No. 4578 TO BE ANSWERED ON WEDNESDAY, DECEMBER 14, 2016 INSTALLATION OF AWS 4578. SHRI GAJENDRA SINGH SHEKHAWAT: Will the Minister of EARTH SCIENCES be pleased to state: (a) whether the Government proposes to install more Automatic Weather Stations (AWSs) in the country; (b) if so, the details thereof and the locations identified in this regard; (c) whether there is sufficient qualified personnel to handle data monitoring and reporting at all the stations; and (d) if so, the details thereof and measures taken further to avoid and rectify malfunctioning of AWSs? ANSWER MINISTER OF STATE FOR MINISTRY OF SCIENCE AND TECHNOLOGY AND MINISTRY OF EARTH SCIENCES (SHRI Y. S. CHOWDARY) (a) Augmentation of the observing system networks including Automatic Weather Station (AWS) network is a continuing process that shall be taken up as per the emerging needs from time to time. (b) India Meteorological Department (IMD) has installed 706 AWS in the country so far. Out of the 706 AWSs, 129 Agro- AWS are installed at Agromet field units located at various agricultural research stations in each of agro- climatic zones (having clusters of districts in each such zone). Efforts are being made in consultation with various agencies and year mark sitesfor the prposed installations (National Capital Region, Eastern India and Western and Central Himalayan Region) of AWS. The list is attached in Annexure-I. (c) Yes, Madam. (d) Various measures being taken up to avoid and rectify malfunctioning of AWSs. These are; Awarding AMC with penalty clauses for ensuring continuous availability of quality data in real time. -

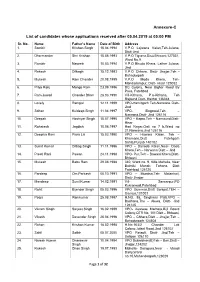

Annexure-C List of Candidates Whose Applications Received After 05.04

Annexure-C List of candidates whose applications received after 05.04.2019 at 05:00 PM Sr. No. Name Father’s Name Date of Birth Address 1. Sombir Krishan Singh 15.04.1994 V.P.O Lajwana Kalan,Teh-Julana, Distt-Jind 2. Dharmender Shri Krishan 15.08.1993 V.P.O Tigrana,Distt Bhiwani,127031, Ward No.9 3. Rambir Naseeb 10.03.1994 V.P.O Bhuda Khera, Lather Julana, Jind 4. Rakesh Dilbagh 15.12.1993 V.P.O Chhara, Distt- Jhajjar,Teh - Bahadurgarh 5. Mukesh Ram Chander 20.08.1995 V.P.O Moda Khera, Teh- Mandadampur, Distt- Hisar 125052 6. Priya Ranj Mange Ram 23.09.1996 DC Colony, Near Bighar Road By Pass, Fatehbad 7. Ram Juwari Chander Bhan 28.03.1990 Vill-Kithana, P.o-Kithana, Teh Rajaund,Distt- Kaithal 136044 8. Lovely Rampal 12.11.1999 VPO-Hamirgarh Teh-Narwana Distt- Jind 9. Sohan Kuldeep Singh 11.04.1997 VPO- Singowal,Teh – Narwana,Distt- Jind 126116 10. Deepak Hoshiyar Singh 15.07.1995 VPO – Kapro,Teh – Narnaund,Distt- Hisar 11. Rohatash Jagdish 10.06.1997 Hari Nagar,Gali no 7 b,Ward no 21,Narwana,Jind 126116 12. Deepika Rani Piara Lal 15.03.1990 VPO – Hawara Kalan, Teh – Khamano,Distt Fatehgarh Sahib,Punjab 140102 13. Sumit Kumar Dilbag Singh 11.11.1996 VPO – Danoda Kalan,Near- Dada Khera,Teh – Narwana Distt – Jind 14. Preeti Rani Pawan 24.11.1998 VPO- Pur,Teh – Bawani Khera,Distt- Bhiwani 15. Mukesh Babu Ram 29.08.1988 340, Ward no. 9, Killa Mohalla, Near Balmiki Mandir, Tohana, Distt Fatehbad 125120 16. -

Resettlement Planning Document India: National Capital Region

TA 7114-IND National Capital Region Planning Board Final Report Project Resettlement Planning Document ects j F. REHABILITATION OF ROADS IN JHAJJAR DISTRICT Draft Short Resettlement Plan for Rehabilitation of 9 roads in Jhajjar District ort – Sub Pro ort Document Stage: Draft for Consultation p Project Number: December 2009 India: National Capital Region Planning Board Project Volume 5– Social and Resettlement PlanRe Prepared by the Haryana State Roads and Bridges Development Corporation Limited The resettlement plan is a document of the borrower. The views expressed herein do not necessarily represent those of ADB’s Board of Directors, Management, or staff, and may be preliminary in nature. Sheladia Associates, Inc. USA TA 7114-IND National Capital Region Planning Board Final Report Project Contents ects j A. Scope of Land Acquisition and Resettlement ........................................................................................ 1 B. Policy Framework and Entitlements ....................................................................................................... 3 ort – Sub Pro p C. Consultation, Information Dissemination, Disclosure, and Grievance Redress .................................... 4 D. Compensation and Income Restoration ................................................................................................ 5 E. Institutional Framework, Resettlement Costs, and Implementation Schedule ...................................... 6 F. Monitoring and Evaluation ..................................................................................................................... -

7Th June 1967

Haryana Vidhan Sabha Debates 7th June, 1967 Vol. I – No. 12 Official Report Contents Wednesday, the 7th June, 1967 Page Starred Questions and Answers 1 Unstarred Questions and Answers 43 Call Attention Notice 46 Bills The Punjab Land Revenue (Haryana Amendment & Validation), 1967 46 The Pepsu Tenancy and Agriculture Land (Haryana Amendment), 1967 48 The Punjab Security of Land Tenures (Haryana Amendment), 1967 49 The Punjab Passengers and Goods Taxation (Haryana Amendment), 1967 50-56 Haryana Vidhan Sabha Wednesday, the 7th June, 1967 The Vidhan Sabha met in the Hall of the Haryana Vidhan Sabha, Vidhan Bhawan, at 9.00 A.M. of the Clock. Mr. Speaker (Sh. Sri Chand) in the Chair. STARRED QUESTION AND ANSWERS Energizing of Tube Wells in the Karnal District *30 Ch. Ram Lal: Will the Minister for Irrigation and Power be pleased to state:- (a) The number of applications received so far for granting electric connections for tube wells in Karnal District together with the time since when the said application are lying pending; (b) The time by which the said applications are likely to be disposed of? Major Amir Singh (Minister of State for Rural Electrification): (a) 6809 applications are pending for varying periods. 154 applications are more than two years old. (b) Depending on the availability of funds connections in all these cases are expected to be given in 2/3 years time. Supplementaries to Starred Question No. 156 Jhefr vkse izHkk tSu% Lihdj lkfgc] bl tokc ds lSD”ku ^,^ esa mUgksaus Qjek;k gS fd dqN Ldwy Mkmu xzsM fd, x, vkSj cgqr ls nwljs vixzsM fd, x, tks fd T;knk t:jh FksA rks esjk loky ;g gS fd D;k bUgkssaus dskbZ ,slh LVfLVDl bDV~Bh dh Fkh ftlds ifj.kk Lo:I bUgksaus ;g urhtk fudkyk fd dqN Ldwyksa dks Mkmu xzsM dj fn;k tk,] dqN dks vius bykds esa vixzsM dj fn;k tk,A Jh v/;{k% vHkh fefuLvj dUlUMZ ugha vk, gSa] tc vk tk,a] vkujscy esEcj rc ;g loky iwN ysaA Carswith the Minister *44. -

Your Application Dated 26.06.2020 on the Above Cited Subject Permission

Directorate of Town & Country Planning, Haryana Plot No. 3, Sec-18A, Madhya Marg, Chandigarh 160018, web site: www.tcpharyana.gov.in, Phone: 0172-2549349, e-mail: [email protected] To ILP3 India 8 Pvt. Ltd. Through Authorized Signatory Sh. Nitin Gawali, R/o Office Indiabulls Centre, 11th Floor, Tower 2A Senapati Bapat Marg Mumbai - 400013. Memo No.CLU/JR-1304A/CTP/9053/2021 Dated:06/04/2021 Subject: Grant of change of land use permission for setting up of Industrial & Warehousing (Non-Agro Produce) in the revenue estate of village Luhari, Tehsil & District Jhajjar – ILP3 India 8 Pvt. Ltd. Reference: Your application dated 26.06.2020 on the above cited subject Permission for grant of change of land use for setting up of Industrial & Warehousing (Non-Agro Produce) over an area measuring 221538.25 Sqm comprising khasra no. 77//6, 7, 14, 15, 16, 17, 24, 25, 78//21, 105//1/1, 1/2, 10, 11, 20, 21/1, 21/2, 106//4, 5, 6, 7, 8, 9, 10/1, 10/2, 11, 12, 13/1, 13/2, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25/1, 25/2, 107//6, 14, 15, 16, 17, 24, 25, 108//5, 109//1, 2, 3, 4, 7, 8, 9, 12, 13, 14, 17, 18 falling in the revenue estate of village Luhari, Tehsil & District-Jhajjar, Controlled Area Luhari and Patauda is hereby granted after receipt an amount of Rs 99,69,221/- on account of conversion charges. Copy of zoning plan is attached. This permission is further subject to following terms and conditions: 1. -

Additional Agenda for 216Th Meeting of the State Expert Appraisal

Additional Agenda for 216th Meeting of the State Expert Appraisal Committee (SEAC), Haryana constituted for considering Environmental Clearance of Projects (B Category) under Government of India Notification dated 14.09.2006 to be held on 30.06.2021 under the Chairmanship of Sh. V. K. Gupta, Chairman through Video Conferencing. Sr. Proposal Name & Address of the Project Name & Location of the Project Status of the Project No. Number Proponent Discussion Dated 30.06.2021 (10:30 AM) 216.15 SIA/HR/MIS/ M/s LEO Pvt Ltd in collaboration with EC of Affordable Residential Plotted For EC 214391//2021 M/s Satya Township Pvt Ltd. Colony Project “Merano Green” under DDJAY scheme at Village Gopalpur, Sector 99A, Tehsil and District Gurugram, Haryana 216.16 SIA/HR/MIS/ SH. Manish & Sh. Manoj s/o sh. EC Of Warehouse (Non Agro Produce) For EC 213348/2021 Shubram in collaboration with M/s Logistic Project at village Patauda, District Shivay Logistics Pvt. Ltd., Village Jhajjar, Haryana Kapriwas Tehsil Dharuhera District Rewari Haryana 216.17 SIA/HR/MIS/ M/s. Robust Buidwell Pvt. Ltd., Sector- EC for Commercial Plotted Colony over an For EC 212035/2021 79, Omaxe City Center, Faridabad area of 11.24375 Acres at Village Bhatola, Sector 79, Faridabad, Haryana 216.18 SIA/HR/MIS/ M/S Sunsat Warehousing Pvt. Ltd. & EC for Expansion of Warehouse Building For EC 207721/2021 Sh. Satpal Singh. for Non-Agro Produce (Logistic) at Village Previous EC granted on Sanpka, Farrukhnagar, Gurugram, Haryana 20.11.2020 216.19 SIA/HR/MIS/1 M/s India Land and Space Logistics Pvt. -

Idabad a to Industries Pvt

1 ~ 5 173. Benson Packing Industries paper 6 convertors &; Painters, Plot No. 116/6 114. Universal Engg.Co., Plot No. 112/6 Electric bulb rkteing 0.10 3 machinery 175. Jalson India, Plot No. 110/6 29 1~. Electro Agencies, Plot No. 109/6 Fabrications 13 (Dellorvs chains) 177. VeekaY Industries, Plot No. 122/6 Plastic bottles, job 15' work of clutch auto' ,--. J 178. Tul Par Machine &. Tool Co., 120/6 ,'0 179. Super Alloy Casting 62/6 Automobil~ par~s .0 (die cast, 1etd.) , ~8 4.6 180. Faridabad A to Industries Pvt. Ltd., 30.Of Sector-6 8 181. Super Auto India I'r 4.5 17 182. .Super Auto Industries -hi. 20.8 118 - 183. Barna Metals (P) Ltd. Aluminium alloys Id 184. Barna Trading Co. Pvt. Ltd. -do---' rs 10.3 11 185. Shakti Enterprises Shoelaces ~rtnen~ 6 . ·00 ,186. Chemical Vessals Pvt. Ltd; Fabricators ( 200 chemical pail nery 5.2 13 Haryana Steel Fabricators Engineers, Fabricato(tn. Plot No. 53, SeCtor-6 boxClland rPods) 3.8 15 La-fashion Garment, Plot No. 55, Readymade .~ Sector-6 A &-J Main & Co. (Engineers) Pv!. F~rging work ~ Ltd., Sector-6 ~\ Sheat metal c( \ [;ponents (En".'!;. \ , . ~ '. - ~---.,,-- --------- };Pfu,fuh, 813 TABLa XXIV--(Contd.) 2 3 ---------------4 S 209. Equipment & Conductors & cables AACandACSR 14.82 43 (P) Ltd., 14/1 Mathura Road conductor 210. Jai Chemicals 14/1 Mathura Road Pesticides and 9.13 18 fine hemicals 211. Maheshwari Fastners (P) Ltd. 14/6 Turned component'J 6.65 • 5S Mathura Road 212. Maheshwari Wire Industries, 14/6 M.S. -

Construction Work of Bye Pass

Construction Work of Bye Pass *276. SH. SATYA PARKASH JRAWTA, M.L.A.: Will the Deputy Chief Minister be pleased to state whether there is any proposal under consideration of the Government to start construction work of Bye Pass of Pataudi; if so, the time by which it is likely to be started? ____________________________________________________ DUSHYANT CHAUTALA, DEPUTY CHIEF MINISTER, HARYANA _________ Yes, Sir. However, no definite time frame for starting construction work can be given since work has not been awarded yet by the NHAI. STARRED ASSEMBLY QUESTION NO. 276 RAISED BY SH. SATYA PARKASH JRAWTA, M.L.A, PATAUDI ASSEMBLY CONSTITUENCY NOTE FOR PAD It is intimated that Gurugram-Pataudi-Rewari road was declared as “in-principle” National Highway by Ministry of Road Transport & Highways (MoRTH) vide letter no. NH-14012/30/2015-P&M dated 08.02.2016 and MoRTH desired to prepare Detailed Project Report (DPR) for this road. Accordingly, Haryana PWD B&R invited tenders for engagement of DPR consultant and on the basis of bid evaluation, tender based estimate was submitted to MoRTH in favor of M/s Xplorer Consultancy Services Pvt. Ltd. MoRTH approved the estimate and accorded administrative approval for preparation of DPR. The consultant submitted alignment report for the Gurugram-Pataudi-Rewari road and the alignment report was submitted to MoRTH for approval. Thereafter, alignment report was also approved by MoRTH. In the meantime, Gurugram-Pataudi-Rewari road was identified as Feeder route under Bharatmala Pariyojna and National Highways Authority of India (NHAI) appointed M/s RITES as consultant for preparation of Detailed Project Report (DPR) of this road. -

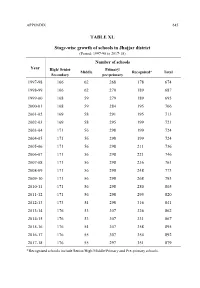

TABLE XL Stage-Wise Growth of Schools in Jhajjar District

APPENDIX 645 TABLE XL Stage-wise growth of schools in Jhajjar district (Period: 1997-98 to 2017-18) Number of schools Year High/ Senior Primary/ Middle Recognized* Total Secondary pre-primary 1997-98 166 62 268 178 674 1998-99 166 62 270 189 687 1999-00 168 59 279 189 695 2000-01 168 59 284 195 706 2001-02 169 58 291 195 713 2002-03 169 58 295 199 721 2003-04 171 56 298 199 724 2004-05 171 56 298 199 724 2005-06 171 56 298 211 736 2006-07 171 56 298 221 746 2007-08 171 56 298 236 761 2008-09 171 56 298 248 773 2009-10 171 56 298 268 793 2010-11 171 56 298 280 805 2011-12 171 56 298 295 820 2012-13 173 54 298 316 841 2013-14 176 53 307 326 862 2014-15 176 53 307 331 867 2015-16 176 54 307 358 895 2016-17 176 55 307 354 892 2017-18 176 55 297 351 879 *Recognised schools include Senior/High/Middle/Primary and Pre-primary schools. 646 JHAJJAR DISTRICT GAZETTEER TABLE XLI Students enrolled in Government High / Senior Secondary Schools of the district (Period: 2005-06 to 2017-18) Year High School Senior Secondary School 2005-06 13,898 13,559 2006-07 13,128 12,911 2007-08 11,993 11,928 2008-09 12,085 12,204 2009-10 12,311 13,760 2010-11 13,814 12,240 2011-12 12,518 11,955 2012-13 12,477 11,864 2013-14 12,627 12,881 2014-15 12,676 13,211 2015-16 12,572 9,404 2016-17 10,397 11,781 2017-18 12,826 9,832 APPENDIX 647 TABLE XLII List of Regional Centres of National Institute of Open Schooling in Jhajjar (as on 31.3.2018) 1. -

The Punjab Scheduled Roads and Controlled Areas Restriction of Unregulated Development Act, 1963 Sections Subject Pages 1

CONTENTS The Punjab Scheduled Roads and Controlled Areas Restriction of Unregulated Development Act, 1963 Sections Subject Pages 1. Short title and extent 4 2. Definitions 4 3. Prohibition to erect or re-erect buildings along schedule roads 5 4. Declaration of controlled area 6 5. Publication of plans etc. in controlled area 6 6. Erection or re-erection of buildings etc. in controlled area 8 7. Prohibition on use of land in controlled areas 8 7A Power of relaxation 8 8. Application for permission etc. and the grant of refusal thereof 8 8A Online receipt and approval 10 9. Power of entry on land or building for survey, etc. 10 10. Appeals 10 10A Revision 10 10B Review 10 11. Control by Government 11 12. Offences and penalties 11 12A Duty of police officers 12 12B Power to arrest 12 12C Constitution of Tribunal 12 13. Offences of companies 12 14. Composition of offence 13 15. Trial of offence and special provision regarding fine 13 16. Sanction of prosecution 13 17. Officers to be public servants 13 18. Power to amend the schedule 13 19. Delegation 13 20. Indemnity 14 21. Bar of jurisdiction of Civil Courts 14 22. Exemption 14 23. Effect of other laws 14 24. Savings 15 25. Power to make rules 15 Schedule 16 [1] The Punjab Scheduled Roads and Controlled Areas Restriction of Unregulated Development Rules, 1965 Section Subject Pages PART-I 1. Short title and extent 19 2. Definitions 19 PART-II CONTROL ALONG SCHEDULED ROADS AND BE PASSES OUTSIDE THE CONTROLLED AREAS 3. -

Project 1: Rehabilitation of 9 Roads in Jhajjar District

Resettlement Plan Document Stage: Final Project Number: 41598 October 2014 IND: National Capital Region Urban Infrastructure Financing Facility - Project 1 – Rehabilitation of 9 Roads in Jhajjar District Prepared by the Haryana State Roads and Bridges Development Corporation Limited (HSRDC) for the Asian Development Bank. The resettlement plan is a document of the borrower. The views expressed herein do not necessarily represent those of ADB’s Board of Directors, Management, or staff, and may be preliminary in nature. In preparing any country program or strategy, financing any project, or by making any designation of or reference to a particular territory or geographic area in this document, the Asian Development Bank does not intend to make any judgments as to the legal or other status of any territory or area. Short Resettlement Plan REHABILITATION OF ROADS IN JHAJJAR DISTRICT Final Short Resettlement Plan (SRP) for Rehabilitation of 9 roads in Jhajjar District. October 2014 India: National Capital Region Planning Board Project (NCRPB) Prepared by the Haryana State Roads and Bridges Development Corporation Limited (HSRDC) The resettlement plan is a document of the borrower. The views expressed herein do not necessarily represent those of ADB’s Board of Directors, Management, or staff, and may be preliminary in nature. NOTE This SRP – Rehabilitation of roads in Jhajjar District was first prepared in July 2011. This sub project is complete in all respects and therefore the SRP was revised taking into consideration all kinds of impact caused due to sub project intervention and all changeswere recorded in the final SRP. This document may be considered as the final SRP document. -

Ad-Hoc Panel List Department of History

AD-HOC PANEL LIST DEPARTMENT OF HISTORY UNIVERSITY OF DELHI Specialisation : Medieval Indian History General Candidates Category - I (First Division from graduation onwards + Ph.D.) S.No. Name Address Phone/Mobile No. 122, 1st Floor, Hauz Rani Malviya Nagar, 1 Dr.Syed Mubin Zehra 9990424992, 9350551122, 26682544 New Delhi - 110017. 2 Dr.Neeraja Bhatt D-II/79, Kaka Nagar, New Delhi - 110003 23071961, 9818122464 Nizami villa, Sir Syed Nagar, Aligarh - 3 Dr. Moin Ahmad Nizami 9897572499 202002. C/o Md. Kalam ali, Near Chand Chakki, 4 Dr. Nazaer Aziz Anjum 9760428311 Dhorra Mafi, Aligarh, UP - 202002. 5 Dr. Amita Paliwal 27/7, H, Shankar Vihar, Delhi 8586970667 Room No. 18 E, Mahanadi Extension Hostel, 6 Dr. Gowhar Yaroob 9650617288 JNU Campus, New Delhi - 110067. Vill - Niryawali, post-Gawan, District 7 Dr. Naresh Chandra Sharma 09927096421, 09761878251 Sambhal, State - U.P. - 202527 Room No. 246, Periyar Hostel, JNU, Delhi - 8 Dr. Nitya Nand Singh 9936879274 110067. C-2, 180, Satya Marg, Chanakya puri, New 9 Dr. Preeti Singh 011 24673429, 8130022629 Delhi 21 KG-II, 326, OPP. M-Blck market, Viks puri, 10 Dr. Anupama Ghosh 9873848353 Delhi-18 C-201, Abul Fazal, II, Jamia Nagar, New Delhi- 11 Dr. Tariq Khan 9990495850 25. Ho. No. 206, Sector-28, Noida-201301, Distt- 12 Dr. Niti Singh 9899971381 Gautambudh Nagar, (UP) 13 Dr. Sabina Kazmi 35, Park End, Near Preet Vihar, Delhi - 92 9810553220 Vill-Heerapur, Post - Mancha, Dist. Kanpur 14 Dr. Safiya Khan 9649052628 (D)- 209111, U.P. Room No. - 85, Sir Syed Hall (North), Aligarh 15 Dr. Enayatullah Khan 9457922955 Muslim University, Aligarh - 202002 C/o Prof.