Hines Global REIT, Inc. (Exact Name of Registrant As Specified in Governing Instruments)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Glazing for Protection: Blast-Resistant Windows

✦ Pozzi Custom Collection ✦ Norco Premium Collection ✦ ✦ Caradco Collection ✦ Summit Vinyl Collection ✦ America’s most trusted name in wood windows, JELD-WEN® Windows & Doors, has partnered with Texas’ most extensive supplier of exotic woods and specialty mouldings, Hogan Millwork Distribution. This assortment of products is ideal for commercial, residential, and historical applications. At JELD-WEN®, wood windows and patio doors are crafted with Auralast® pine for a 20-year protection against wood decay, water absorption and termite infestation. For more information, brochures or design tools, please call or visit one of our Hogan Millwork Distribution or Showroom locations. Hogan Millwork Distribution With over 15 years of experience in the wood window industry, Hogan Millwork is proud to welcome a new member to its team. Maribel Zimmerman Cell: 210-789-1002 AUSTIN SAN ANTONIO FORT WORTH Window & Door Showroom Window & Door Showroom Window & Door Showroom 600 Industrial Blvd. 16111 San Pedro, #102 5720 Locke Avenue 512-444-8464 210-499-4655 817-735-8875 www.hoganhardwoods.com Hogan Hardwoods.indd 2 6/16/05 2:05:31 PM Central Hardwoods Client Photo.qxp 4/5/2005 1:06 PM Page 1 THE FINEST HARDWOODS AND ARCHITECTURAL SPECIALTIES, FLOOR TO CEILING. Since 1946, Central Hardwoods has provided the finest selection of hardwoods and high-end architectural millwork. Today, we offer everything from floors to doors, carvings to columns. Along with custom mouldings, windows and more. All crafted from lumber meticulously selected and milled to exacting standards. We're your central resource for peerless architectural products. Be sure to visit our new showroom, opening soon in the Dallas Design District. -

WELCOME to the WORLD of ARCHITECTURE TSTU Publishing

WELCOME TO THE WORLD OF ARCHITECTURE TSTU Publishing House Учебное издание ДОБРО ПОЖАЛОВАТЬ В МИР АРХИТЕКТУРЫ Сборник текстов на английском языке Составители: ГВОЗДЕВА Анна Анатольевна НАЧЕРНАЯ Светлана Владимировна РЯБЦЕВА Елена Викторовна ЦИЛЕНКО Любовь Петровна Редактор З.Г. Чернова Компьютерное макетирование М. А. Филатовой Подписано в печать 20.05.04 Формат 60 × 84 / 16. Бумага офсетная. Печать офсетная. Гарнитура Тimes New Roman. Объем: 3,49 усл. печ. л.; 3,5 уч.-изд. л. Тираж 100 экз. С. 372М Издательско-полиграфический центр Тамбовского государственного технического университета, 392000, Тамбов, Советская, 106, к. 14 Министерство образования и науки Российской Федерации Тамбовский государственный технический университет ДОБРО ПОЖАЛОВАТЬ В МИР АРХИТЕКТУРЫ Сборник текстов на английском языке для студентов 1 курса архитектурно-строительных специальностей Тамбов Издательство ТГТУ 2004 УДК 802.0(076) ББК Ш13(Ан)я923 Д56 Рецензент: Кандидат педагогических наук Е.А. Воротнева Составители: А.А. Гвоздева, С.В. Начерная, Е.В. Рябцева, Л.П. Циленко Д56 Добро пожаловать в мир архитектуры: Сборник текстов на английском языке / Сост.: А.А. Гвоздева, С.В. Начерная, Е.В. Рябцева, Л.П. Циленко. Тамбов: Изд-во Тамб. гос. техн. ун-та, 2004. 60 с. Предлагаемые аутентичные тексты отвечают динамике современного научно- технического прогресса, специфике существующих в университете специально- стей, а также требованиям учебной программы по иностранному языку для сту- дентов очной и заочной форм обучения высших учебных заведений технического профиля. Сборник текстов предназначен для студентов первого курса архитектурно- строительных специальностей. УДК 802.0(076) ББК Ш13(Ан)я923 © Тамбовский государственный технический университет (ТГТУ), 2004 BOLSHOI THEATRE Widely considered as one of the most beautiful performance houses in the world, the Bolshoi Theatre stands as a testament to the enduring nature of the Russian character. -

Utily08 UTILCODE UTILNAME ATTN 7 Tate & Lyle Ingredients Americas

UtilY08 UTILCODE UTILNAME ATTN 7 Tate & Lyle Ingredients Americas Inc 8 Tate & Lyle Ingredients Americas Inc 20 AES Cypress LLC 21 AES Shady Point LLC 23 A B Energy Inc 24 Nations Energy Holdings LLC 25 AES Greenidge 34 Abbeville City of Roger M Hall 35 AES WR Ltd Partnership 39 AES Hickling LLC 40 Hospira Inc 42 AES Thames LLC 46 AES Hoytdale LLC 52 ACE Cogeneration Co 54 Abitibi Consolidated 55 Aberdeen City of 56 Abitibi Consolidated Sale Corp 59 City of Abbeville Water & Light Plant 60 Acadia Bay Energy Co LLC 65 Abitibi Consolidated-Lufkin 82 Ada Cogeneration Ltd Partnership 84 A & N Electric Coop V N Brinkley 87 City of Ada 88 Granite Ridge Energy LLC 97 Adams Electric Coop 108 Adams-Columbia Electric Coop 109 Ag Processing Inc 113 Agway Energy Services, LLC 114 Addis Energy Center LLC 116 Agway Energy Services-PA Inc 118 Adams Rural Electric Coop, Inc 122 Village of Arcade 123 City of Adel 127 Aera Energy LLC 128 Adrian Energy Associates LLC 134 AES Eastern Energy LP 135 Agrilectric Power Partners Ltd 142 AES Beaver Valley 144 AEP Retail Energy LLC 146 AEI Resources 149 City of Afton 150 Adrian Public Utilities Comm Terry Miller 151 Adirondack Hydro-4 Branch LLC 154 AES Corp 155 Agralite Electric Coop Attn: R. Millett, Gen. Mgr. 156 AES Deepwater Inc 157 Town of Advance 162 Aiken Electric Coop Inc 163 AERA Energy LLC-Oxford 164 AERA Energy LLC 172 Ahlstrom Dexter LLC Page 1 UtilY08 174 Aitkin Public Utilities Comm Charles Tibbetts 176 Ajo Improvement Co 177 AES Hawaii Inc 178 AES Placerita Inc 179 Agrium US Inc 182 City of Akron 183 Village of Akron 189 PowerSouth Energy Cooperative Jeff Parish 191 Alamo Power District No 3 192 Akiachak Native Community Electric Co 194 Albuquerque City of 195 Alabama Power Co Mike Craddock 197 Akron Thermal LP 198 City of Alton 201 City of Alachua 202 Town of Black Creek 204 Alabama Pine Pulp Co Inc 207 City of Alameda 211 Aetna Life & Casualty 212 AHA Macav Power Service 213 Alaska Electric Light&Power Co Attn Scott Willis 219 Alaska Power Co Attn Sheryl Dennis 220 Alaska Power Administration Attn. -

INSIDE Structure

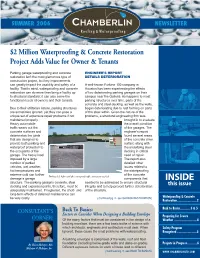

SUMMER 2006 NEWSLETTER $2 Million Waterproofing & Concrete Restoration Project Adds Value for Owner & Tenants Parking garage waterproofing and concrete ENGINEER’S REPORT restoration isn’t the most glamorous type of DETAILS DETERIORATION construction project, but key improvements can greatly impact the usability and safety of a A well-known Fortune 100 company in facility. That in mind, waterproofing and concrete Houston has been experiencing the effects restoration can do more than bring a facility up of two deteriorating parking garages on their to structural standard; it can also serve the campus near the Galleria. As happens to most functional needs of owners and their tenants. parking structures over time, parts of the concrete and steel decking, as well as the walls, Due to their utilitarian nature, parking structures began deteriorating due to rust forming on parts are sometimes ignored, yet they can pose a of the steel within. Given the nature of the unique set of expensive repair problems if not problems, a structural engineering firm was maintained properly. brought in to evaluate Heavy automobile the overall condition traffic wears out the After of the garages. The concrete surfaces and engineer’s report deteriorates the joints found several areas that are designed to of the concrete drive provide both parking and surface along with waterproof protection to the underlying steel the occupants of the decking in critical garage. The heavy load need of repair. imposed by a large The report also number of parked detailed other vehicles, wet weather, Before issues related to hot temperatures and the waterproofing extreme cold can further of the concrete Parking deck before and after waterproof traffic coating was applied. -

Attachments Convention Center Hotel Financings

Attachments Convention Center Hotel Financings March 26, 2008 Objective Summary of Convention Center Hotel Financings given certain financial statements for the following: Austin Convention Center Enterprises, Inc. Houston Convention Center Hotel Corporation Metropolitan Pier and Exposition Authority (Chicago, IL) 2 Convention Center Hotel Financings Austin Convention Center Hotel 3 Austin Convention Center Hotel Project Description 800-room Hotel managed by Hilton Hotels Corporation Full service, first class, convention oriented upscale hotel including: 800 Guest Rooms Two full-service restaurants and lobby bar 60,000 gross square feet of meeting space 600-space underground parking garage Opening Date January 2004 Key Participants Municipal Sponsor: City of Austin Issuer: Austin Convention Enterprises, Inc. Sole-Managing Underwriter: Piper Jaffray Hotel Manager: Hilton Hotels Corporation 4 Case Study: Austin Convention Center Hotel – Financing Overview The financing structure included: $109.665 million in senior lien current interest bonds $134.95 million in subordinate lien bonds insured by ZC Specialty Insurance $20.50 million in third-tier subordinate manager and developer bonds City of Austin’s financial contribution was limited to $15.0 million No ongoing obligation Low reserve fund requirements as a result of non-conventional multi-line guarantor (ZC Specialty) $6.0 million Senior Debt Service Reserve Fund $2.0 million Subordinate Senior Debt Service Reserve Fund $1.25 million Operating Reserve Fund and Working -

Downtown Development

DOWNTOWN DEVELOPMENT This list provides details on all public and private sector construction projects in downtown since 1995. Costs are estimated or otherwise not available. Interior renovations are not included unless the entire building, including its exterior, is part of the project scope. Under Construction POST Houston (formerly, the Barbara Jordan Post Office) Renovation of the former post office into a 550,000-square-foot multiuse development for cultural experiences, food and a coworking space. The plan calls for three atriums between the building’s second floor and roof. The building’s roof will feature a nearly six-acre park with Downtown skyline views along with space for restaurants and retail. Address 401 Franklin St. Developer Lovett Commercial Estimated cost $42.5 millionV Est. completion Summer 2020 Website POST Houston Total Plaza Renovation of the office lobbies and retail space on the Downtown Tunnel System, street and second-floor levels. Recent complete renovations and added amenities include a new fitness center and new secured bike room. Address 1201 Louisiana St. Developer Brookfield Properties Estimated cost TBD Est. completion 1Q 2020 Website Total Plaza Hyatt Place Hotel Redevelopment of the former Southwestern Bell Telephone Company building into a 16 story, 150-key hotel. Address 1114 Texas Ave. Developer Pride Management Inc. Estimated cost $22.8 million Est. completion 3Q 2019 Website TDB C. Baldwin Hotel Redevelopment and rebranding of the former DoubleTree by Hilton Houston Downtown anchored by Allen Center into an independent 354-unit luxury hotel named, C. Baldwin. Address 400 Dallas St. Developer Brookfield Properties Estimated cost $19.2 millionP Est. -

We Re Proud of Our Part in Building This Great

The grand Gaylord Texan Resort of the Lone Star State, references the natural materials rooted in the architecture of Texas. The Hnedak BoBo Group, Inc. chose the Tite-Loc Metal Roofing Panel in Galvalume Plus to mirror the metal roofs used throughout the region. The roofing contractor, Supreme Systems, installed 163,261 square feet of Tite-Loc Panels over this expansive roof. Our newest roofing profiles, Tite-Loc and Tite-Loc Plus, have been designed for structural and architectur- al metal roofing applications and are available in a variety of materials including 22 and 24 gauge steel, and aluminum. Both profiles feature factory-applied hot Gaylord Texan Resort and Convention Center melt sealant to insure weather tight performance. Grapevine, TX Owner: Gaylord Properties Panels are corrective-leveled during fabrication to pro- Architect: Hnedak Bobo Group, Inc. - Memphis vide superior panel flatness. Both profiles feature our Roofing Contractor: Supreme Systems Panel Profile: Tite-Loc ® ® PAC-CLAD Kynar 500 finish, now available in 42 Color: Galvalume Plus standard colors on steel and 37 standard colors on aluminum. For more information regarding our complete line of metal roofing products, please call us at 1-800-PAC- CLAD or visit our website @ www.pac-clad.com. Central Hardwoods Client Photo.qxp 10/17/2005 1:22 PM Page 2 THE FINEST HARDWOODS AND ARCHITECTURAL SPECIALTIES, FLOOR TO CEILING. Central Hardwoods offers you a single source for outstanding architectural millwork. This includes custom mouldings, windows, doors and elegant wood flooring for residential and commercial projects. In fact, we manufacture and install plank, distressed and strip wood flooring. -

2018 Media Kit

2018 Media Kit For more info: [email protected] | Bellaire: 713.661.6300 | Outside Houston: 800.836.2191 MEDIA KIT ABOUT US MARCH 2016 YOUR COMMERCIAL REAL ESTATE MARKETING SOURCE REDNews: The established, dominant force Top Trends in in Commercial Real Estate marketing for Texas Retail over 25 years. Bridging the gap between traditional print advertising and digital media REDNews ensures that its clients receive maximum exposure Legal Exactions or“Platmail”? across many different platforms. Whether our client’s objective is a focus on direct marketing, branding or web traffic development, our Interview with array of marketing mediums are customizable and affordable. Kristen McDade Van Alstyne We Are Planning for You FEBRUARY 2016 BRANDING/MARKETING SERVICES CUSTOM & ONLINE MARKETING YOUR COMMERCIAL REAL ESTATE MARKETING SOURCE Nothing Plain About Plano Why Houston? WE KNOW OUR READERS! 82% Male Everything's 18% Female Biggerin Texas Interview with Doug Simpkins 42.4% Average Age From Left: Hap Peyton, Chuck Townsend, Alicia Hicks, and Vic Condrey JANUARY 2016 YOUR COMMERCIAL REAL ESTATE MARKETING SOURCE . to own investment real estate GALLERIA more likely Texas Property TaxAFTON Code HIGHLAND HowOAKS Fair Is It? VILLAGE North Texas WESTHEIMERJust KeepsST. on Interview with . to drive prestigious luxury vehicle WEST ALABAMA ST. John Fenoglio Growing The Interest Rate Hike . to own their own business and What it Means SITE GREENWAY PLAZA for Texas 3x EDLOE ST. to attend networking and social events 3000 ±34,562 SF ALABAMA SWC OF W. ALABAMA AND EDLOE COURT HOUSTON, TX William A. McDade Kristen McDade Peter Mainguy Nolan Mainguy 713.577.1876 713.577.1808 713.577.1782 713.577.1841 5909 W. -

Downtown Development

DOWNTOWN DEVELOPMENT This list provides details on all public and private sector construction projects in Downtown Houston since 1995. Costs are estimated or otherwise not available. Under Construction 1001 Fannin Renovation of the main lobby in the 49‐story, 1.3 million SF‐square‐foot building to the tunnel level with updates to an 8,000‐square‐foot fitness center and adjacent tenant lounge with areas for entertainment, seating and gaming. The renovations are slated for completion in mid‐2020, with a building conference center to follow in 2021. Address 1001 Fannin Developer FC Tower Property Partners LP Estimated cost $20 million Est. completion 2022 Website 1001 Fannin 1810 Main – Fairfield Residential Development of a new 10‐story, 286‐‐unit Class A residential building. Address 1810 Main Developer Fairfield Residential Estimated cost TBD Est. completion 2022 Website Fairfield Residential Heritage Plaza Redevelopment of 53‐story, 1.1 million‐SF office tower to include the addition of a new glass curtain wall at the corner of Dallas and Brazos street, refinishing main lobby and 13th floor sky lobby. Address 1111 Bagby St. Developer Brookfield Properties Estimated cost $10‐$15 million Est. completion December 2021 Website Heritage Plaza Wyatt Square (Jones Plaza) Renamed Lynn Wyatt Square For The Performing Arts. 1.5‐acre renovation to include a 4,000 SF restaurant. Address 600 Louisiana St. Developer Downtown Redevelopment Authority, Houston First Corporation Estimated cost $29 million Est. completion Mid‐2021 Website Wyatt Square (Jones Plaza) TC Energy Center Renaming and renovation of 56‐story, 1.26 million‐SF former Bank of America Center. -

Copy of Copy of Copy of Central Business District Rate Survey 2009

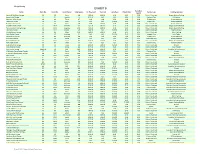

Garage Parking EXHIBIT B Early Bird Name Block No. Street No. Street Name Total Spaces Un-Reserved Reserved Daily Rate Hourly Rate Facility Type Parking Operator Special Lomas & Nettleton Garage 13 119 Fannin 206 $81.00 $130.00 $9.00 $4.00 N/A Visitor / Contract Ampco System Parking Bayou Lofts Garage 15 915 Franklin 75 $135.00 N/A N/A N/A N/A Contract Only LAZ Parking Hermann Lofts Garage 19 204 Travis 47 N/A N/A N/A N/A N/A Tenants Only Private Operator Hotel Icon Garage 20 220 Main 150 N/A N/A $10.00 N/A N/A Guests Only Private Operator Franklin Lofts Garage 21 201 Main 206 N/A $160.00 $5.00 N/A N/A Visitor / Contract Private Operator Congress Plaza Garage 21 1019 Congress 614 $75.78 $97.43 $5.50 $1.90 N/A Visitor / Contract Ampco System Parking Harris County Parking Garage 25 1401 Congress 2400 $92.02 $135.00 $8.00 $4.00 $4.00 Visitor / Contract Ampco System Parking Flamingo Garage 29 1311 Preston 583 $60.00 N/A $10.00 $8.00 $4.00 Visitor / Contract Central Parking Market Square Garage 35 300 Milam 1200 $81.19 $129.90 $5.00 $0.75 $4.00 Visitor / Contract Merit Parking Lyric Centre Garage 41 440 Louisiana 115 N/A N/A $14.00 $5.00 N/A Tenants Only Lyric Centre Hogg Palace Garage 42 401 Louisiana 105 N/A N/A N/A N/A N/A Tenants Only Private Operator Chronicle Garage 42 719 Prairie 581 N/A N/A N/A N/A N/A Employees Only Private Operator Binz Building Garage 56 1001 Texas 432 $119.08 $139.00 $8.00 $7.00 N/A Visitor / Contract Ampco System Parking Rice Hotel Garage 57 909 Texas 417 N/A N/A N/A N/A N/A Contract Only Post Properties Calpine -

Media Kit Beaute' in Tech

20212021 Media Kit Beaute in tech Magazine www.beauteintechnologymagazine.com Beaute in tech Magazine Compiling the latest trend news with featured case studies on the industry's leading organizations and ) ashion professionals, Beaute' in Tech is a comprehensive F source of industry information. Covering all aspects of Technology, app designs, artificial intelligence and founder stories, the magazine highlights everything related to I )n coporate responsibility across a vast number of fashion in technology sectors, including, but not limited ) echnology to: Internet of things, mobile commerce to AI algorithms, T virtual and augmented reality, block chain, novel fabrics, beauty tech trends and artificial intelligence in business. Beaute' in Tech Magazine endeavours to bring you the latest need to know content and up dates from across the global Technolgy and artificial intelligence industry. Keeping pace with a vast array of ever- changing sectors thanks to regular contributions from some of the worlds foremost technology and artificial intelli- gence experts and firms, Beaute' in Tech is home to some of the best news, features and comments from people and institutions in the know. Taking in everything from the latest innovations, products and app designs, trends and industry molding regula- tions, Beaute' in Tech should be your source of Tech- nology and Artificial Intelligence for women in business and professionals. Beaute' in Tech should be the first port of call for any woman in business and professional looking to remain on the cutting edge of technology and artificial intelligence news, features and com- ments when it comes to their or related industries. 1 Beaute in tech Magazine reading Beaute in tech Beaute' in Tech is the go-to resource for Tech- nology and Artificial Intelligence Industry CEO's, business owners, tech ecosystem professionals and includes a dedicated female founder focused section. -

2020 Media Kit

2020 Media Kit For more info contact: [email protected] | Houston: 713.661.6300 MEDIA KIT ABOUT US RE journals MARCH 2016 YOUR COMMERCIAL REAL ESTATE MARKETING SOURCE REDNews: The established, dominant force Top Trends in in Commercial Real Estate marketing for Texas Retail over 25 years. Bridging the gap between traditional print advertising and digital media REDNews ensures that its clients receive maximum exposure Legal Exactions or“Platmail”? across many different platforms. Whether our client’s objective is a focus on direct marketing, branding or web traffic development, our Interview with array of marketing mediums are customizable and affordable. Kristen McDade Van Alstyne We Are Planning for You FEBRUARY 2016 BRANDING/MARKETING SERVICES CUSTOM & ONLINE MARKETING YOUR COMMERCIAL REAL ESTATE MARKETING SOURCE Nothing Plain About Plano Why Houston? WE KNOW OUR READERS! 82% Male Everything's 18% Female Biggerin Texas Interview with Doug Simpkins 42.4% Average Age From Left: Hap Peyton, Chuck Townsend, Alicia Hicks, and Vic Condrey JANUARY 2016 YOUR COMMERCIAL REAL ESTATE MARKETING SOURCE . to own investment real estate GALLERIA more likely Texas Property TaxAFTON Code HIGHLAND HowOAKS Fair Is It? VILLAGE North Texas WESTHEIMERJust KeepsST. on Interview with . to drive prestigious luxury vehicle WEST ALABAMA ST. John Fenoglio Growing The Interest Rate Hike . to own their own business and What it Means SITE GREENWAY PLAZA for Texas 3x EDLOE ST. to attend networking and social events 3000 ±34,562 SF ALABAMA SWC OF W. ALABAMA AND EDLOE COURT HOUSTON, TX William A. McDade Kristen McDade Peter Mainguy Nolan Mainguy 713.577.1876 713.577.1808 713.577.1782 713.577.1841 2537 S.