AEROSPACE CLUSTERS World’S Best Practice and Future Perspectives an Opportunity for South Australia

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Aviation Week & Space Technology

STARTS AFTER PAGE 34 Using AI To Boost How Emirates Is Extending ATM Efficiency Maintenance Intervals ™ $14.95 JANUARY 13-26, 2020 2020 THE YEAR OF SUSTAINABILITY RICH MEDIA EXCLUSIVE Digital Edition Copyright Notice The content contained in this digital edition (“Digital Material”), as well as its selection and arrangement, is owned by Informa. and its affiliated companies, licensors, and suppliers, and is protected by their respective copyright, trademark and other proprietary rights. Upon payment of the subscription price, if applicable, you are hereby authorized to view, download, copy, and print Digital Material solely for your own personal, non-commercial use, provided that by doing any of the foregoing, you acknowledge that (i) you do not and will not acquire any ownership rights of any kind in the Digital Material or any portion thereof, (ii) you must preserve all copyright and other proprietary notices included in any downloaded Digital Material, and (iii) you must comply in all respects with the use restrictions set forth below and in the Informa Privacy Policy and the Informa Terms of Use (the “Use Restrictions”), each of which is hereby incorporated by reference. Any use not in accordance with, and any failure to comply fully with, the Use Restrictions is expressly prohibited by law, and may result in severe civil and criminal penalties. Violators will be prosecuted to the maximum possible extent. You may not modify, publish, license, transmit (including by way of email, facsimile or other electronic means), transfer, sell, reproduce (including by copying or posting on any network computer), create derivative works from, display, store, or in any way exploit, broadcast, disseminate or distribute, in any format or media of any kind, any of the Digital Material, in whole or in part, without the express prior written consent of Informa. -

The Reason Given for the UK's Decision to Float Sterling Was the Weight of International Short-Term Capital

- Issue No. 181 No. 190, July 6, 1972 The Pound Afloat: The reason given for the U.K.'s decision to float sterling was the weight of international short-term capital movements which, despite concerted intervention from the Bank of England and European central banks, had necessitated massive sup port operations. The U.K. is anxious that the rate should quickly o.s move to a "realistic" level, at or around the old parity of %2. 40 - r,/, .• representing an effective 8% devaluation against the dollar. A w formal devaluation coupled with a wage freeze was urged by the :,I' Bank of England, but this would be politically embarrassing in the }t!IJ light of the U.K. Chancellor's repeated statements that the pound was "not at an unrealistic rate." The decision to float has been taken in spite of a danger that this may provoke an international or European monetary crisis. European markets tend to consider sterling as the dollar's first line of defense and, although the U.S. Treasury reaffirmed the Smithsonian Agreement, there are fears throughout Europe that pressure on the U.S. currency could disrupt the exchange rate re lationship established last December. On the Continent, the Dutch and Belgians have put forward a scheme for a joint float of Common Market currencies against the dollar. It will not easily be implemented, since speculation in the ex change markets has pushed the various EEC countries in different directions. The Germans have been under pressure to revalue, the Italians to devalue. Total opposition to a Community float is ex pected from France (this would sever the ties between the franc and gold), and the French also are adamant that Britain should re affirm its allegiance to the European monetary agreement and return to a fixed parity. -

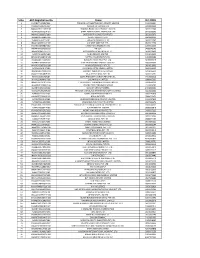

S.No. AEO Registration No Name IEC CODE

S.No. AEO Registration No Name IEC CODE 1 INAABCT3125D1F181 TENNECO AUTOMOTIVE INDIA PRIVATE LIMITED 0410021504 2 INAAECK5045N1F187 KURLON ENTERPRISE LTD 0314001204 3 INAAACM5317M1F183 MADRAS HARDTOOLS PRIVATE LIMITED 0492021040 4 INAATCS0933Q1F184 SHREE ASHTAVINAYAK PAPERS PVT.LTD 0313035059 5 INAAACB3691F1F180 OYSTER BATH CONCEPTS PVT.LTD. 0503036072 6 INAAACD5762B1F186 DEEPS TOOLS PVT.LTD. 3091001032 7 INAAACJ5553C1F181 JANATICS INDIA PVT. LTD 0489021042 8 INAAFCM8351G1F182 M V SHOE CARE PVT.LTD., 0509017240 9 INAANCS4209B1F182 S AND T ENGINEERS (P) LTD, 3209016330 10 INAAAFA4124D1F183 ANTLER 0488040043 11 INAABCM8697F1F181 AVO CARBON INDIA PRIVATE LTD., 0498028488 12 INAAFCA9114P1F180 ALINA PRIVATE LIMITED, 0491012349 13 INAABCM1418N1F186 MITTAL PIGMENTS PVT.LTD, 1394000189 14 INAAACB8571E1F186 BEKAERT INDUSTRIES PVT. LTD. 3198000378 15 INAABCF9836H1F184 FINE PAPERSOURCE PRIVATE LIMITED 3803000092 16 INAAACV9365Q1F188 VIJAY ENTERPRISES PVT.LTD. 0894013602 17 INAAACJ2661H1F186 SUNGWOO HITECH INDIA LIMITED, 0406010005 18 INAABCF8078M1F182 FLIPKART INDIA PRIVATE LIMITED 0711023611 19 INAACCK9634R1F180 KB AUTOSYS INDIA PVT LTD 0410014991 20 INAAKCS9901P1F184 SUSPA PNEUMATICS INDIA PRIVATE LTD., 0493003312 21 INAAACS6498M1F186 SAJJAN INDIA LIMITED 0388005131 22 INAADCC4791N1F185 C J S SPECIALTY CHEMICALS PRIVATE LIMITED 0309000122 23 INAAFFM4128G1F186 MYSORE DEEP PERFUMERY HOUSE 1103006282 24 INAABFD4690C1F186 MASCOT METAL TRADERS 2493000081 25 INAACCP5395A1F189 PRAKASH CHEMICALS INTERNATIONAL PVT. LIMITED 3402001152 26 INAAACK2172J1F182 -

Piaggio Aerospace Viale Generale Disegna, 1 17038 Villanova D’Albenga (Savona, Italy) Ph

Piaggio Aerospace Viale Generale Disegna, 1 17038 Villanova d’Albenga (Savona, Italy) Ph. 0039 0182 267911 [email protected] www.piaggioaerospace.it Piaggio America 1515 Perimeter Rd. West Palm Beach, FL 33406 THE PIAGGIO The Piaggio Aerospace MPA – Multirole Patrol Aircraft – is a technologically advanced, Piaggio Aerospace MPA with a Maximum Mach Operative (MMO) of 0.65 is the fastest not protrude into the pressure vessel and is provided with highly reliable 28VDC energy MPA – MULTIROLE PATROL AIRCRAFT efficient and competitive Special Mission, Multi-Role, Enforcement light twin turboprop aircraft Special Mission turboprop on the market. The platform has been designed to integrate supply for maximum mission performance. AEROSPACE designed to meet the requirement for security and enforcement missions in peacekeeping the most sophisticated mission sensors in the category and provide best in class vehicle The MPA’s open architecture Mission System offers inherent mission flexibility, while DIMENSIONS operations to real combat scenarios with the advanced performance and best in class performance at the same time, e.g.: the extensive use of COTS components guarantee a state-of-the-art human/machine Span 21.382 m [65.16 ft] MPA operational characteristics, comparable to those required by the most demanding operators • Climb quickly up to 41.000 feet. interface, graphics capability and computer throughput performance. The Aquila MMS Length 14.400 m [43.89 ft] MULTIROLE in this category. • Loiter quietly at low speed (125KTAS). integrates tactical sensors and data links providing the Operators with total situational Heigh 3.964 m [12.08 ft] Piaggio Aerospace is developing the Multirole Patrol Aircraft - MPA in partnership with • Dash at high speed (up to 350 KTAS, MMO=0.65) to distant operative theaters. -

Piaggio Aerospace Viale Generale Disegna, 1 17038 Villanova D

PIAGGIO AEROSPACE AVANTI EVO SPECIFICATIONS EXTERNAL DIMENSIONS Span 14.345 m 47.06 ft Length 14.408 m 47.27 ft Height 3.980 m 13.06 ft CABIN DIMENSIONS Height 1.75 m 5.74 ft Width 1.85 m 6.07 ft Length 4.55 m 14.92 ft Max Seating Capacity 8+2 crew Typical Executive Payload 6+1 crew BAGGAGE COMPARTMENT Volume 1.00 m3 35 ft3 Length 1.70 m 5.58 ft Maximum Weight 159 kg 350 lb PRESSURIZATION Differential 0.62 bar 9.0 psi Sea Level cabin up to 7,315 m 24,000 ft WEIGHTS Max Take-off Weight 5,489 kg 12,100 lb Max Landing Weight 5,216 kg 11,500 lb Max Zero Fuel Weight 4,445 kg 9,800 lb Standard Empty (Shuttle Configuration) 3,561 kg 7,850 lb Max Fuel Capacity 1,271 kg 2,802 lb Fuel with Max Net Payload 1,066 kg 2,350 lb Max Net Payload 794 kg 1,750 lb Net Payload with Max Fuel 589 kg 1,298 lb Max Fuel Capacity (Increased Range Config.) 1,451 kg 3,200 lb POWERPLANT 2 x Pratt & Whitney Canada PT6A–66B Engines 850shp/634kW each (ISA, sea level), flat-rated from 1,630hp 2 x Hartzell five-scimitar blades low noise Propellers PERFORMANCE Maximum Speed @ 9000 lb (at 31,000ft ISA) 745 km/h 402 KTAS MMO 0.70 Mach Piaggio Aerospace Max Range (NBAA IFR, .Ferry Conf. LRC) 2,813 km 1,519 NM Viale Generale Disegna, 1 Max Range (NBAA IFR, Increased Ferry Conf. -

AEROSPACE CLUSTERS World’S Best Practice and Future Perspectives an Opportunity for South Australia

0 AEROSPACE CLUSTERS World’s Best Practice and Future Perspectives An Opportunity for South Australia Matteo Paone Intern – Universita’ Commerciale Luigi Bocconi Supervisor: Nicola Sasanelli AM Director – Space Industry and R&D Collaboration Defence SA Government of South Australia September 2016 Matteo Paone, Nicola Sasanelli AEROSPACE CLUSTERS - World’s Best Practice and Future Perspectives 1 “Quod Invenias Explorans Spatium Progressus Est Humanitatis” - Human Progress is in Space Exploration Hon Jay Weatherill - Premier of South Australia Matteo Paone, Nicola Sasanelli AEROSPACE CLUSTERS - World’s Best Practice and Future Perspectives 2 Disclaimer While every effort has been made to ensure the accuracy of the information contained in this report, the conclusions and the recommendations included in it constitute the opinions of the authors and should not be taken as representative of the views of Defence SA and the South Australian Government. No warranty, express or implied is made regarding the accuracy, adequacy, completeness, reliability or usefulness of the whole or any part of the information contained in this document. You should seek your own independent expert advice and make your own enquiries and satisfy yourself of all aspects of the information contained in this document. Any use or reliance on any of information contained in this document is at your own risk in all things. The Government of South Australia and its servants and its agents disclaim all liability and responsibility (including for negligence) for any direct or indirect loss or damage which may be suffered by any person through using or relying on any of the information contained in this document. -

Chapter-I Introduction

CHAPTER-I INTRODUCTION 1 INTRODUCTION Tata Group Type Private Industry Conglomerate Founded 1868 Founder(s) Jamsetji Tata Bombay,house Headquarters Mumbai, India Area served Worldwide RatanTata Key people (Chairman) Steel Automobiles Telecommunications Products Software Hotels Consumer goods 2 Revenue 319,534 crore (US$69.34 billion) Profit 8,240 crore (US$1.79 billion) Total assets US$ 52.8 billion (2009-10) Employees 396,517 (2009-10) TataSteel TataSteelEurope TataMotors TataConsultancyServices TataTechnologies TataTea Subsidiaries TitanIndustries TataPower TataCommunications TataTeleservices TataAutoCompSystemsLimited Taj Hotels Website Tata.com Tata Group Companies CMC · Tata BP Solar · Tata Coffee · Tata Chemicals · Tata Consultancy Services · Tata Elxsi · Tata Interactive Systems · Tata Motors · Tata Steel · Tata Power · Tata India-basedTea · Tata Communications · Tata Technologies Limited · Tata Teleservices · Titan Industries · Tata Voltas · The Indian Hotels Company · Trent (Westside) · Cromā 3 Brunner Mond · Jaguar Land Rover (Jaguar Cars · Land Other Rover) · Tata Daewoo Commercial Vehicle · Tata Steel Europe · Tetley · VSNL International Canada Ginger · Good Earth Teas · Tanishq · Taj Hotels · I-shakti · Tata Salt · Brands Tata Sky · Tata Indicom · Tata DoCoMo · Titan · Westside · Voltas · Virgin Mobile India Notable Jamsetji Tata · Ratanji Dadabhoy · Dorabji Tata · Nowroji People Saklatwala · J. R. D. Tata · Ratan Tata · Pallonji Mistry Bombay House is the head office of Tata Group The Tata Group is an Indian multinational conglomerate company headquartered in the Bombay House in Mumbai, India. In terms of market capitalization and revenues, Tata Group is the largest private corporate group in India. It has interests in chemicals, steel, automobiles, information technology, communication, power, beverages, and hospitality. The Tata Group has operations in more than 80 countries across six continents and its companies export products and services to 80 nations. -

Piaggio Aero Industries S.P.A. in Extraordinary Administration

Piaggio Aero Industries S.p.A. in Extraordinary Administration INVESTMENT OPPORTUNITY The Company at a Glance Villanova d’Albenga, 24 April 2020 The Businesses Design, development, production and maintenance activities on business and special mission aircraft Design, development, production and maintenance activities on Unmanned Aerial Systems (UAS) and on Multirole (manned) Patrol Aircraft (MPA) Production, assembly and maintenance on aero engines 2 Timeline • Delivery of the first P.1HH in Abu Dhabi (July 2018) First flight of Inauguration of the Villanova • Admission to the maritime patrol D'Albenga plant with Premier Extraordinary Receivership M. Renzi (Nov. 2014) aircraft MPA Beginning Motorcycle (Vespa) Enters the Procedure (EA) and of aircraft and aircraft shareholding by appointment of production production are split Mubadala and Commissioner V. Nicastro activities TATA (Dec. 2018) • Signing of new contracts for Engine and Customer Service P180 for €45M (Dec. 2018) 2006 - 1917 1957 1964 1986 2014 2015 2016 2017 2018 2019 2008 Signing of the • Delivery of 3 new P180 and P.166 for the P.180 Certification of Financial ongoing operations both in the Italian Air Avanti P.1HH first the P.180 Restructuring Engine and Aircraft Customer Force first flight flight Avanti EVO Plan between service sectors Mubadala, • Signing of new contracts for banks and approximately €400M. Leonardo (Dec. 2017) 3 Why Piaggio is a unique investment opportunity 3 years revenue stream secured by The Envisaged Transaction Wide range of products approx. 900 €M backlog • Constant growth in revenues stream • Sale of assets only: tangible, • Development, production, sale and for the next 3 years, secured by a intangible and inventory. -

Now Destination India

A350 XWB: INTERVIEW: MIKE SHOW REPORT: QUIET & ARCAMONE, PARIS AIR SHOW IMPRESSIVE BOMBARDIER 2013 P 14 P 21 P 24 JUNE - JULY 2013 `100.00 (INDIA-BASED BUYER ONLY) VOLUME 6 • iSSUE 3 WWW.SPSAIRBUZ.NET ANAIRBUZ EXCLUSIVE MAGAZINE ON CIVIL AVIATION FROM INDIA NOW DESTINATION AN SP GUIDE PUBLICATION INDIA RNI NUMBER: DELENG/2008/24198 Sweet Have you heard the buzz? Our industrious engineers have cross-pollinated the fuel efficiency of wide-body engines with more than 630 million hours of high-cycle experience to produce the LEAP engine family. CFM’s legendary reliability and low maintenance costs. Longer time on wing. The result is simply irresistible. Go to cfmaeroengines.com CFM International is a 50/50 joint company between Snecma (Safran) and GE. Superior performance | Lower cost of ownership | Greater reliability MORE TO BELIEVE IN C32386.011_CFM_BEE_SPsAviation_267x210_v1.indd 1 15/07/2013 10:58 taBLE OF CONTENTS A350 XWB: INTERVIEW: MIKE SHOW REPORT: QUIET & ARCAMONE, PARIS AIR SHOW IMPRESSIVE BOMBARDIER 2013 Cover: P 14 P 21 P 24 JUNE - JULY 2013 `100.00 (INDIA-BASED BUYER ONLY) VOLUME 6 • ISSUE 3 Tony Fernandes, AirAsia WWW.SPSAIRBUZ.NET ANAIRBUZ EXCLUSIVE M A G A ZINE ON C IVIL AVIA TION FROM I NDI A Chief, is buoyant about his airlines’ foray into the Indian market. He hopes to live up to his company’s motto: NOW “Now everyone can fly.” DESTINATION AN SP GUIDE PUBLICATION INDIA RNI NUMBER: DELENG/2008/24198 Cover Image: SP Guide Pubns SP's Airbuz Cover 03-2013.indd 1 30/08/13 11:31 AM AIR TRANSPORT / AIRLINES P12 AIRASIA’S FORAY INTO INDIA AirAsia Chief Tony Fernandes says that the market in India is now favourable and it’s the perfect time to enter as silly capital has gone out. -

Design Challenges of High Endurance MALE UAV –

Design Challenges of High Endurance MALE UAV – A. Cozzolino Head Of R&TD and Preliminary Design Futuro Remoto 17 October2015 Piaggio Historical background Aircraft Company merges The P166 and P166M First flight of the The Company is Subsidiary Tata Limited manufacturing with “Pegna- aircraft are created for P180 Avanti reorganized in its Piaggio America becomes new is started Bonmartini” in the Italian Air Force prototype aircraft present form as is established shareholder of Rome “Piaggio Aero the Company Industries SpA” exit in the 2010 1884 1915 1922 1924 1925 1957 1964 1986 1998 2000 2005 2008 2014 2015 “Rinaldo Piaggio” Piaggio acquires A strategic Mubadala Aircraft engines The company splits: Mubadala becomes is founded in “Società Anonima manufacturing is one branch is alliance with becomes 100 % the major holder of owner Genoa as a Navigazione Aerea” Ferrari is started started dedicated to the the Company and the “Piaggio rolling-stock in Genoa and motorbikes brand name becomes Aerospace manufacturer “Costruzioni manufacturing, the Mubadala “Piaggio Aerospace” Meccaniche other to the becomes Nazionali” in aeronautical markets. shareholder of Pontedera “Industrie the company Aeronautiche e Meccaniche Rinaldo Piaggio SpA” is 2 founded Villanova d’Albenga plant New state-of-the art facility Designed to implement the latest lean manufacturing technologies Total Area: 129.000 sqm Current Workforce: 600 Currently transferred activities: • Headquarter • Aircraft Design • Engine Parts Manufacturing • PW200 Engine Assembly & Test • -

PIAGGIO Aerospace Seminario 24 10 15.Pdf

Sistemi di controllo degli Aeromobili a Pilotaggio Remoto (APR), dalle applicazioni militari a quelle civili. A. Cozzolino Head Of R&TD and Preliminary Design Seminario di Cultura Aeronautica Innovazione e ricerca aerospaziale: Aeromobili a Pilotaggio Remoto 24 October2015 • Piaggio Historical background Aircraft Company merges The P166 and P166M First flight of the The Company is Subsidiary Tata Limited manufacturing with “Pegna- aircraft are created for P180 Avanti reorganized in its Piaggio America becomes new is started Bonmartini” in the Italian Air Force prototype aircraft present form as is established shareholder of Rome “Piaggio Aero the Company Industries SpA” exit in the 2010 1884 1915 1922 1924 1925 1957 1964 1986 1998 2000 2005 2008 2014 2015 “Rinaldo Piaggio” Piaggio acquires A strategic Mubadala Aircraft engines The company splits: Mubadala becomes is founded in “Società Anonima manufacturing is one branch is alliance with becomes 100 % the major holder of owner Genoa as a Navigazione Aerea” Ferrari is started started dedicated to the the Company and the “Piaggio rolling-stock in Genoa and motorbikes brand name becomes Aerospace manufacturer “Costruzioni manufacturing, the Mubadala “Piaggio Aerospace” Meccaniche other to the becomes Nazionali” in aeronautical markets. shareholder of Pontedera “Industrie the company Aeronautiche e Meccaniche Rinaldo Piaggio SpA” is 2 founded • Villanova d’Albenga plant New state-of-the art facility Designed to implement the latest lean manufacturing technologies Total Area: 129.000 sqm -

August 2017 Front Cover the FINAL.Indd

AEROSPACE 2017 August 44 Number 8 Volume Society Royal Aeronautical August 2017 AFRICAN AIRLINES BETTER BRIEFINGS FOR PILOTS ISRAEL’S MISSILE DEFENCE SYSTEM www.aerosociety.com MAGNETIC ATTRACTION? DAVID LEARMOUNT ASKS, WHY ARE WE NOT USING TRUE NORTH? On demand, cost effective dedicated payload delivery to any orbit Skyrocketing innovation. We’re in the midst of a new space race. Around the world, demand for innovative satellite applications is surging, creating an enormous appetite for small payload launch capabilities. Even the most modern small vertical launch systems still demand dedicated, remote and costly fixed infrastructure. Only horizontal launch systems and spaceports can offer the global small payload launch capacity necessary to meet current demand and fuel future growth. follow us Volume 44 Number 8 August 2017 North by North Why does Taxi to LEO please aviation continue Six years after the last 14 to navigate by Space Shuttle mission, Magnetic North 38 the US counts down rather than True to regaining its human North? spacefl ight access. Contents Boeing Defense Correspondence on all aerospace matters is welcome at: The Editor, AEROSPACE, No.4 Hamilton Place, London W1J 7BQ, UK [email protected] Comment Regulars 4 Radome 12 Transmission The latest aviation and Your letters, emails, tweets aeronautical intelligence, and feedback. analysis and comment. 58 The Last Word Smothering the infant king 10 Antenna Keith Hayward looks at Howard Wheeldon the increasing competition considers Boeing’s claims between private and Some 40 years ago, the then civil airliner giants of Boeing, McDonnell of unfair competition from government space Douglas and Lockheed laughed at the idea of a European ‘Airbus’ widebody Bombardier’s CSeries.