ALBEMARLE CORPORATION (Exact Name of Registrant As Specified in Its Charter) ______

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Albemarle Corporation

A Progressive Digital Media business COMPANY PROFILE Albemarle Corporation REFERENCE CODE: B20093EF-4146-4B04-AFCE-A0B03CAFFDD6 PUBLICATION DATE: 10 Mar 2017 www.marketline.com COPYRIGHT MARKETLINE. THIS CONTENT IS A LICENSED PRODUCT AND IS NOT TO BE PHOTOCOPIED OR DISTRIBUTED Albemarle Corporation TABLE OF CONTENTS TABLE OF CONTENTS Company Overview ........................................................................................................3 Key Facts.........................................................................................................................3 SWOT Analysis ...............................................................................................................4 Albemarle Corporation Page 2 © MarketLine Albemarle Corporation Company Overview Company Overview COMPANY OVERVIEW Albemarle Corporation (Albemarle) is a global developer, manufacturer and marketer of highly- engineered specialty chemicals. The company serves a range of end markets including petroleum refining, consumer electronics, automotive, steel and aerospace, lubricants, pharmaceuticals, crop protection, household appliances, heating, ventilation, aluminum finishing, food safety and custom chemistry services. Albemarle operates in Americas, Europe, the Middle East, Africa, Australia and Asia. It is headquartered in Baton Rouge, Louisiana. The company reported revenues of (US Dollars) US$2,677.2 million for the fiscal year ended December 2016 (FY2016), a decrease of 26.7% over FY2015. In FY2016, the company’s operating margin -

Albemarle ACTION Catalyst Or Our Exceptional Portfolio of Products and Services, Call (281) 480-4747 Or Visit

114th American Fuel & Leader in Hydroprocessing Visit the ART and Grace Petrochemical Manufacturers AFPM Hospitality Suite at the Hilton San Francisco Union Square Sunday, March 13 – 8 PM to Midnight ANNUAL MEETING Monday, March 14 – 8 PM to Midnight afpm-hospitality-button.indd 1 3/2/2016 9:56:28 AM ® DAY ONE Sunday–Monday | March 13–14, 2016 | #AM16 Conference Daily Published by HYDROCARBON PROCESSING Creating a realistic and effective INSIDE THIS ISSUE 3 Schedule regulatory environment 4 Global trends in energy saving CHET THOMPSON, President, American Fuel & Petrochemical Manufacturers KBC Advanced Technologies highlights industry trends, EMS processes and technologies Thank you for joining us at look at the political world. The General Session prom- for energy management. the 114th Annual Meeting of the ises interesting commentary from Mark Halperin and American Fuel & Petrochemi- John Heilemann, co-authors of Game Change: Obama 6 A new furnace cal Manufacturers (AFPM). and the Clintons, McCain and Palin, and the Race of management playbook We are happy to welcome you a Lifetime, and Double Down: Game Change 2012, co- Furnace owner-operators make to San Francisco, home to the managing editors of Bloomberg Politics and co-hosts of real-time decisions with correct Golden Gate Bridge, the famous Bloomberg TV’s With All Due Respect. They will pro- data and Haldor Topsoe’s Fisherman’s Wharf, Alcatraz vide their professional views on this year’s rather un- image-based system. Island and, most importantly, usual presidential campaign. five refineries—all important You also will hear from Alex Epstein, author of the New 10 Optimizing catalyst facilities and structures benefit- York Times best-selling book The Moral Case for Fossil selection ing this wonderful city. -

NIPPON KETJEN, a Leader in the Field of Hydroprocessing Catalysts

5/2/2015 COMPANY OUTLINE | Nippon Ketjen Co.,Ltd. TOP > COMPANY OUTLINE Nippon Ketjen Co., Ltd. contributes advanced technologies that improve economic feasibility of oil refining through the development, production and sales of hydroprocessing catalysts, as well as, offsite catalyst regeneration/presulfiding, technology services and process licensing. The company is also dedicated to protecting the global environment through these activities. We are constantly improving our technologies with the aim to optimize our contributions to our customer and the environment. NIPPON KETJEN, a leader in the field of hydroprocessing catalysts Hydroprocessing catalysts play the most important role in the oil refining process. We have continued to provide the most advanced hydroprocessing catalysts to our customers since the company’s establishment in 1970. We have close business relationship with the Albemarle Corporation which has facilities in Texas, USA and Amsterdam, Netherlands. We are also receiving full supports from Sumitomo Metal Mining, Co. Ltd which has been developing their main business for more than 300 years in Niihama, Japan. The excellent R&D, technical services and production technology are not only our pride but also our lifeblood. We have developed and commercialized high activity desulfurization catalysts (STARS catalysts) and its rejuvenation technology (REACT). An alliance with UOP makes us possible to offer the best combination of process and catalysts in the hydroprocessing field. In the global scale the steady supply of energy and the environmental preservation are increasingly important. We are sincerely committed to responding speedily to a wide variety of customer needs and offering the innovative solution to them. Through these activities, we intend to contribute to the society in the fields of energy and environment. -

Albemarle Corporation Benchmark Week 2020 - Lithium: the Keynotes

Albemarle Corporation Benchmark Week 2020 - Lithium: The Keynotes December 10, 2020 Forward-Looking Statements Some of the information presented in this presentation including, without limitation, statements with respect to product development, market trends, price, expected growth and earnings, demand for our products, capital projects, tax rates, stock repurchases, dividends, cash flow generation, economic trends, outlook, and all other information relating to matters that are not historical facts may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Actual results could differ materially from the views expressed. Factors that could cause actual results to differ materially from the outlook expressed or implied in any forward-looking statement include, without limitation: changes in economic and business conditions; changes in financial and operating performance of our major customers and industries and markets served by us; the timing of orders received from customers; the gain or loss of significant customers; competition from other manufacturers; changes in the demand for our products or the end-user markets in which our products are sold; limitations or prohibitions on the manufacture and sale of our products; availability of raw materials; increases in the cost of raw materials and energy, and our ability to pass through such increases to our customers; changes in our markets in general; fluctuations in foreign currencies; changes in laws and government regulation impacting -

Albemarle Corporation Annual Report 2020

Albemarle Corporation Annual Report 2020 Form 10-K (NYSE:ALB) Published: February 26th, 2020 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 ________________________________________ FORM 10-K ________________________________________ ☒ Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended December 31, 2019 or Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 ☐ For the transition period from to Commission file number 001-12658 ALBEMARLE CORPORATION (Exact name of registrant as specified in its charter) Virginia 54-1692118 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 4250 Congress Street, Suite 900 Charlotte, North Carolina 28209 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: ( 980) - 299-5700 Securities registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol Name of each exchange on which registered COMMON STOCK, $.01 Par Value ALB New York Stock Exchange Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for at least the past 90 days. -

Appointment of Lithium Industry Veteran As Vice President – Sales & Marketing

ASX RELEASE | June 2, 2020 | ASX:PLL; NASDAQ:PLL APPOINTMENT OF LITHIUM INDUSTRY VETERAN AS VICE PRESIDENT – SALES & MARKETING • Mr. Austin Devaney to join Piedmont as Vice President – Sales & Marketing • Mr. Devaney spent most of the past decade in senior marketing roles with Albemarle Corporation, most recently as Vice President, Strategic Marketing and Customer Excellence Piedmont Lithium Limited (“Piedmont” or “Company”) is pleased to announce that it has appointed Mr. Austin Devaney as Vice President – Sales & Marketing. Mr. Devaney will play a broad strategic role with Piedmont and will drive relationships with the global automotive, battery and cathode companies that are the prospective customers for the battery-grade lithium hydroxide we plan to produce in the United States. Mr. Devaney is a chemical engineer by training and has spent most of his career in senior commercial roles. From 2015 to 2019 he served in increasingly senior sales and marketing roles with Albemarle Corporation, the world’s #1 lithium producer, ultimately serving as Vice President Strategic Marketing and Customer Excellence. For Albemarle’s predecessor, Rockwood Lithium, Mr. Devaney served as Global Product Manager – Lithium Hydroxide, and National Sales Manager – Battery Products. In his time at Albemarle and Rockwood, Mr. Devaney developed broad and deep relationships with many of the most important participants in the global electric vehicle supply chain. His technical background was particularly useful in navigating the product qualification processes that are required by global auto makers. This experience will be directly relevant as Piedmont completes its initial lithium hydroxide testwork programs in coming weeks and will have product samples to share with prospective customers for the first time. -

Notes to Portfolio of Investments—March 31, 2021 (Unaudited)

Portfolio of investments—March 31, 2021 (unaudited) Shares Value Common stocks: 59.94% Communication services: 6.55% Diversified telecommunication services: 0.84% AT&T Incorporated 10,125 $ 306,484 Lumen Technologies Incorporated 1 , 4 0 0 1 8 , 6 9 0 Verizon Communications Incorporated 5,863 340,933 666,107 Entertainment: 1.27% Activision Blizzard Incorporated 1 , 1 0 2 1 0 2 , 4 8 6 Electronic Arts Incorporated 4 0 7 5 5 , 0 9 6 Live Nation Entertainment Incorporated † 204 17,269 Netflix Incorporated † 630 328,646 Take-Two Interactive Software Incorporated † 163 28,802 The Walt Disney Company † 2,573 474,770 1,007,069 Interactive media & services: 3.52% Alphabet Incorporated Class A † 425 876,571 Alphabet Incorporated Class C † 408 844,001 Facebook Incorporated Class A † 3,385 996,984 Twitter Incorporated † 1,128 71,775 2,789,331 Media: 0.79% Charter Communications Incorporated Class A † 200 123,404 Comcast Corporation Class A 4 7 4,6 3 5 0 , 3 0 8 Discovery Incorporated Class A † 225 9,779 Discovery Incorporated Class C † 408 15,051 DISH Network Corporation Class A † 351 12,706 Fox Corporation Class A 470 16,972 Fox Corporation Class B 216 7,545 Interpublic Group of Companies Incorporated 555 16,206 News Corporation Class A 553 14,063 News Corporation Class B 172 4,035 Omnicom Group Incorporated 304 22,542 ViacomCBS Incorporated Class B 827 37,298 629,909 Wireless telecommunication services: 0.13% T-Mobile US Incorporated † 827 103,615 Consumer discretionary: 7.50% Auto components: 0.09% Aptiv plc † 383 52,816 BorgWarner Incorporated -

Delivering Today to Create a Better Tomorrow

Delivering Today to Create a Better Tomorrow 2011 CEO Review 2011 CEO REVIEW There’s No Time Like the Present. In 2010, Albemarle developed a five-year plan to double its business through growth within core and adjacent markets. In 2011—year one of our Vision 2015 strategy—the company took an excellent first step toward meeting the challenge. Record sales and annual earnings. New markets and products. Multiple industry awards, 239 new patents and a constant eye on sustainable, conscientious growth. In the midst of a challenging economy and operating environment, we had both our best financial year ever and our safest year ever. All possible because in a culture built on innovation, collaboration and performance, creating a better tomorrow Globalization starts with delivering today. ($2,869 million net sales) 40% 38% About Albemarle Albemarle Corporation is a leading global developer, manufacturer and 22% marketer of highly engineered specialty chemicals for a wide range of markets, including petroleum refining, consumer electronics, plastics, crop North America protection, construction, automotive, pharmaceuticals, food safety and Western Europe Rest of World custom chemistry services. Our products and services create value for our customers by improving product performance, providing essential product attributes, lowering costs and simplifying processes. Segments ($2,869 million net sales) Headquartered in Baton Rouge, Louisiana, Albemarle employs more than 4,000 people worldwide and serves customers in approximately 100 countries through three business segments: Polymer Solutions, Catalysts and Fine Chemistry. Through its innovation-driven culture and 26% 35% growth-focused strategies, the company is committed to delivering exceptional performance that creates a better tomorrow for all of our stakeholders. -

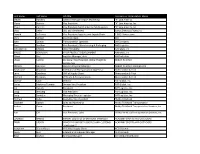

First Name Last Name Job Title Company Or Organization Name

First name Last name Job title Company or Organization Name Steven Hawkins General Manager Import Marketing "K" Line America Maria Bodnar Vice President "K" Line America, Inc. Shaun Gannon Vice President North America Field Logistics "K" Line America, Inc. Chas Deller CEO and CHAIRMAN 10XOCEANSOLUTIONS,INC Donald La France Vice President Logistics and Supply Chain 1-800-Flowers.com Chris McNeil Sourcing Agent 3M John Ladwig Transportation Specialist 3M Company Russ Boullion Vice President - Warehousing & Packaging A&R Logistics XIANGMING CHENG CEO/ PRESIDENT AAmetals, Inc BRUCE FERGUSON VP OF PRODUCT DEVELOPMENT AAmetals, Inc Eileen Wei Logistics Manager, Asia AB Electrolux Ulises Carrillo Divisional Vice President, Global Freight & Abbott Nutrition Distribution William Gaiennie Logistics Program Manager Abbott Nutrition International Sarah Jane Chapman International Transportation Supervisor Abercrombie & Fitch Larry Grischow GVP of Supply Chain Abercrombie & Fitch Michael Sherman VP Trade & Transportation Abercrombie & Fitch Gunnar Gose Director ABF Global, Inc. Carlos Martinez-Tomatis Division Vice President ABF Global, Inc. Jim Ingram President ABF Logistics, Inc. Doug Riesberg Vice President ABF Logistics, Inc. Craig Sandefur Managing Director Logistics ABF Logistics, Inc. Michael Kelso Executive Vice President Ability Tri-Modal Elizabeth Gaston Sales and Marketing Ability Tri-Modal Transportation Joshua Owen President Ability Tri-Modal Transportation Services, Inc. Ron Gill Vice President, Sales Ability/Tri-Modal Transportation Services, -

Albemarle Corporation Annual Report 2018

Albemarle Corporation Annual Report 2018 Form 10-K (NYSE:ALB) Published: February 28th, 2018 PDF generated by stocklight.com UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 ________________________________________ FORM 10-K ________________________________________ x Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 For the fiscal year ended December 31, 2017 or Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of ¨ 1934 For the transition period from to Commission file number 001-12658 ALBEMARLE CORPORATION (Exact name of registrant as specified in its charter) VIRGINIA 54-1692118 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 4350 Congress Street, Suite 700 Charlotte, North Carolina 28209 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (980) 299-5700 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered COMMON STOCK, $.01 Par Value NEW YORK STOCK EXCHANGE Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for at least the past 90 days. -

Q4 2017 Earnings Release

Exhibit 99.1 Contact: Eric Norris 980.299.5518 Albemarle finishes strong - guiding to continued growth in 2018 CHARLOTTE, NC - February 27, 2018 – Fourth quarter 2017 highlights: • Fourth quarter net sales were $857.8 million, an increase of 23% over the prior year • Fourth quarter loss of $218.4 million, or $1.95 per diluted share, included $366.9 million of income tax expense related to the new U.S. tax reform laws • Fourth quarter adjusted EBITDA was $245.8 million, an increase of 31% over the prior year; adjusted diluted earnings per share from continuing operations of $1.34, an increase of 72% over the prior year • Signed definitive agreement to sell the polyolefin catalysts and components portion of its PCS business • Expect adjusted diluted earnings per share in 2018 between $5.00 and $5.40, an increase of 9% to 18% over 2017 Three Months Ended Twelve Months Ended December 31, December 31, In thousands, except per share amounts 2017 2016 2017 2016 Net sales $ 857,789 $ 696,655 $ 3,071,976 $ 2,677,203 Net (loss) income from continuing operations $ (207,071) $ 50,304 $ 99,468 $ 478,638 Net (loss) income attributable to Albemarle Corporation $ (218,366) $ 602,090 $ 54,850 $ 643,675 Adjusted EBITDA $ 245,780 $ 187,384 $ 885,480 $ 758,217 Diluted (loss) earnings per share attributable to Albemarle Corporation $ (1.95) $ 5.30 $ 0.49 $ 5.68 (a) Non-operating pension and OPEB items (0.08) 0.16 (0.09) 0.16 (a) Non-recurring and other unusual items 3.36 0.25 4.20 (0.49) (b) Discontinued operations — (4.93) — (1.78) Adjusted diluted(c) earnings per share from continuing operations $ 1.34 $ 0.78 $ 4.59 $ 3.57 See accompanying notes (a) through (c) to the condensed consolidated financial information and non-GAAP reconciliations. -

Companies That Offer Charitable Gift Matching As of February 2020

Companies that Offer Charitable Gift Matching as of February 2020 A - C D - I K - P Q - Z Kansas City Southern Abbott Laboratories D & B Corporation, The Quaker Chemical Corporation Industries Kansas City Terminal Railway ACE USA Inc./ACE Group DataSource, Inc. Qualcomm Inc. Company David and Lucile Packard Quest Diagnostics Addison Wesley Longman Kaplan Educational Centers Foundation, The Incorporated Keefe, Bruyette & Woods, Adobe Systems, Inc. Demont & Associates, Inc. R Inc. Advanced Micro Devices Deutsche Bank America KeyCorp Radian Kimberly-Clark Company Advanta, DFS Group Limited RadioShack Corporation Foundation AES Corporation Diageo North America, Inc. Koch Foundation Inc. Ralston Purina Company Aetna, Inc. Dictaphone Corporation K/P Corporation RBC Dain Rauscher AK Steel Corporation DIMON Incorporated KPRC-TV Reader's Digest Foundation Albemarle Corporation Dominion Resources L Real Networks Alliance Capital Management DST Systems Inc. LabCorp Reuters America Inc. L.P. Alliant Energy Corp. Duke Energy Ladd Furniture Rexnord Foundation, Inc. Alliant Techsystems E Lam Research Corporation RLI Insurance Company Lamson & Sessions Company, Robert Wood Johnson Altria Eastern Bank The Foundation Alyeska Pipeline Service Roche Diagnostics Eastern Enterprises Lehman Brothers Company Corporation Rockefeller Brothers Fund, American Express Company Eastern Mountain Sports Leo Burnett Company, Inc. Inc., The American International eBay Foundation Levi Strauss & Co. Rockefeller Family Fund Group, Inc. American Ref-Fuel Company Eckerd Corporation Lexmark International, Inc. Rockefeller Financial Services American Re-Insurance EducationQuest Foundation, Liz Claiborne RPM International Company Inc. Amgen, Inc. Electronis Arts Loews Corporation RuffaloCODY AMSTED Industries Eli Lilly and Company Lojack Corporation R.U.S.A. Incorporated Loomis, Sayles & Company Anchor Capital Advisors, Inc. Energen S L.P.