Harmonized Tariff Schedule of the United States (2020) Revision 15 Annotated for Statistical Reporting Purposes

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Precursors and Chemicals Frequently Used in the Illicit Manufacture of Narcotic Drugs and Psychotropic Substances 2017

INTERNATIONAL NARCOTICS CONTROL BOARD Precursors and chemicals frequently used in the illicit manufacture of narcotic drugs and psychotropic substances 2017 EMBARGO Observe release date: Not to be published or broadcast before Thursday, 1 March 2018, at 1100 hours (CET) UNITED NATIONS CAUTION Reports published by the International Narcotics Control Board in 2017 The Report of the International Narcotics Control Board for 2017 (E/INCB/2017/1) is supplemented by the following reports: Narcotic Drugs: Estimated World Requirements for 2018—Statistics for 2016 (E/INCB/2017/2) Psychotropic Substances: Statistics for 2016—Assessments of Annual Medical and Scientific Requirements for Substances in Schedules II, III and IV of the Convention on Psychotropic Substances of 1971 (E/INCB/2017/3) Precursors and Chemicals Frequently Used in the Illicit Manufacture of Narcotic Drugs and Psychotropic Substances: Report of the International Narcotics Control Board for 2017 on the Implementation of Article 12 of the United Nations Convention against Illicit Traffic in Narcotic Drugs and Psychotropic Substances of 1988 (E/INCB/2017/4) The updated lists of substances under international control, comprising narcotic drugs, psychotropic substances and substances frequently used in the illicit manufacture of narcotic drugs and psychotropic substances, are contained in the latest editions of the annexes to the statistical forms (“Yellow List”, “Green List” and “Red List”), which are also issued by the Board. Contacting the International Narcotics Control Board The secretariat of the Board may be reached at the following address: Vienna International Centre Room E-1339 P.O. Box 500 1400 Vienna Austria In addition, the following may be used to contact the secretariat: Telephone: (+43-1) 26060 Fax: (+43-1) 26060-5867 or 26060-5868 Email: [email protected] The text of the present report is also available on the website of the Board (www.incb.org). -

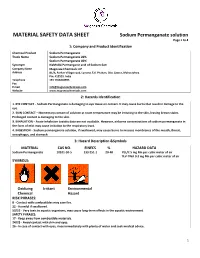

MATERIAL SAFETY DATA SHEET Sodium Permanganate Solution

MATERIAL SAFETY DATA SHEET Sodium Permanganate solution Page 1 to 4 1: Company and Product Identification Chemical Product Sodium Permanganate Trade Name Sodium Permanganate 20% Sodium Permanganate 40% Synonym NaMnO4 Permanganic acid of Sodium Salt Company Name Magnesia Chemicals LLP Address 81/A, Parhar Village road, Lonand, Tal. Phaltan, Dist. Satara, Maharashtra. Pin: 415523. India Telephone +91 7558428995 Fax E mail [email protected] Website www.magnesiachemicals.com 2: Hazards Identification 1. EYE CONTACT - Sodium Permanganate is damaging to eye tissue on contact. It may cause burns that result in damage to the eye. 2. SKIN CONTACT - Momentary contact of solution at room temperature may be irritating to the skin, leaving brown stains. Prolonged contact is damaging to the skin. 3. INHALATION - Acute inhalation toxicity data are not available. However, airborne concentrations of sodium permanganate in the form of mist may cause irritation to the respiratory tract. 4. INGESTION - Sodium permanganate solution, if swallowed, may cause burns to mucous membranes of the mouth, throat, oesophagus, and stomach. 3: Hazard Description &Symbols MATERIAL CAS NO. EINECS % HAZARD DATA Sodium Permanganate 10101-50-5 233-251-1 20-40 PEL/C 5 mg Mn per cubic meter of air TLV-TWA 0.2 mg Mn per cubic meter of air SYMBOLS: Oxidizing Irritant Environmental Chemical Hazard RISK PHRASES: 8 - Contact with combustibles may case fire. 22 - Harmful if swallowed. 50/53 - Very toxic to aquatic organisms, may cause long-term effects in the aquatic environment. SAFETY PHRASES: 17 - Keep away from combustible materials. 24/25 - Avoid contact with skin and eyes. 26 - In case of contact with eyes, rinse immediately with plenty of water and seek medical advice. -

DEA Regulated Chemical Initiatives

Christine A. Sannerud, Chief Drug and Chemical Evaluation Section (ODE) U.S. Drug Enforcement Administration (202) 307-7183 Office of Diversion Control, ODE 1 Drug and Chemical Evaluation Section (ODE) Chemical Role includes: • Determination of chemicals used in the manufacture of controlled substances. • Use of existing regulatory mechanisms to control compounds used in this manufacture. Office of Diversion Control, ODE 2 Current Activities • Iodine Regulations (NPRM) • Sodium Permanganate • Elimination of Ephedrine/Pseudoephedrine Chemical Mixture Exemptions • Control of Precursors to Fentanyl • Positional Isomers Definition Office of Diversion Control, ODE 3 Methamphetamine Production Office of Diversion Control, ODE 4 Iodine Control • Iodine used as reagent in Methamphetamine production • Number one U.S. clandestinely produced drug Office of Diversion Control, ODE 5 U.S. Department of Justice Drug Enforcement Administration Office of Diversion Control Chemical Investigations Section Methamphetamine Clandestine Laboratory Seizures With DEA participation WASH MONTANA N DAKOTA WASH MONTANA N DAKOTA WASH MONTANA N DAKOTA MN 1993 -218 MN 1994 -263 MN 1995 -327 ME ME WI ME S DAKOTA WI S DAKOTA WI OREGON S DAKOTA OREGON VT OREGON VT 10 VT WYOMING IDAHO WYOMING WYOMING MI IDAHO MI MI IDAHO NH NH NH IOWA NY NY NY MA IOWA MA IOWA MA NEBRASKA ILL NEBRASKA ILL NEBRASKA ILL NEVADA NEVADA IN NEVADA IN PA RI OHIO PA RI OHIO PA RI IN OHIO CT CT CT UTAH UTAH COLORADO UTAH COLORADO NJ 14 NJ KANSAS NJ CA 10 COLORADO W CA W CA W KANSAS V DE 25 KANSAS -

Jnited States Patent Office Patented July 9, 1957

2,798,878 Jnited States Patent Office Patented July 9, 1957 2 weeks; and, finally, the method must be safe from the hazard of-explosion. One of the objects of the invention is to provide a 2,798,878 method of oxidizing graphite to graphitic oxide with the PREPARATION OF GRAPHITIC ACID production of a high quality product of low carbon-to Williaria S. Hummers, Jr., Detroit, Mich., assignor to Na oxygen ratio. tional Lead Company, New York, N. Y., a corporation Another object of the invention is to provide a method of New Jersey of preparing graphitic oxide in a hazard-free manner with a processing time of one or two hours, or less. No Drawing. Application July 19, 1954, 0. Another object of the invention is to provide a method Seria No. 444,400 of preparing graphitic oxide in high yield, with a favor ably low consumption of oxidizing agents. 16 Claims. (C. 260-348) Another object of the invention is to provide a method of preparing graphitic oxide with materials which are This invention relates to the preparation of graphitic 5 relatively cheap, available, and readily handled. oxide from graphite, and more particularly is concerned Other objects of the invention will appear as the de with an improved method of carrying out the oxidation scription thereof proceeds. In accordance with the invention, the starting material, step involved. which is a graphitic substance which may be graphite, Graphitic oxide, sometimes known as graphitic acid, 20 has been known for almost a century, and is an important and is preferably a high grade of synthetic or natural material for experimental studies in electrode processes graphite, such as Ceylon graphite, is treated with a water of colloidal properties of materials related to humic acids, free mixture of concentrated sulphuric acid and an an in inorganic structural chemistry, and the like. -

Interagency Committee on Chemical Management

DECEMBER 15, 2020 INTERAGENCY COMMITTEE ON CHEMICAL MANAGEMENT EXECUTIVE ORDER NO. 02-19 REPORT TO THE GOVERNOR WALKE, PETER Table of Contents Executive Summary ...................................................................................................................... 2 I. Introduction ............................................................................................................................. 4 II. Chemical Nomination Review Framework .......................................................................... 6 III. Summary of Chemical Use in the State Based on Reported Chemical Inventories.......... 8 IV. Summary of Identified Risks to Human Health and the Environment from Reported Chemical Inventories .............................................................................................................. 9 V. Summary of any change under Federal Statute or Rule affecting the Regulation of Chemicals in the State ............................................................................................................ 9 VI. Recommended Legislative or Regulatory Action to Reduce Risks to Human Health and the Environment from Regulated and Unregulated Chemicals of Emerging Concern . 25 VII. Final Thoughts ................................................................................................................. 26 Appendices ................................................................................................................................... 27 1 Executive Summary On August 7, 2017, Governor -

Interagency Committee on Chemical Management

DECEMBER 14, 2018 INTERAGENCY COMMITTEE ON CHEMICAL MANAGEMENT EXECUTIVE ORDER NO. 13-17 REPORT TO THE GOVERNOR WALKE, PETER Table of Contents Executive Summary ...................................................................................................................... 2 I. Introduction .......................................................................................................................... 3 II. Recommended Statutory Amendments or Regulatory Changes to Existing Recordkeeping and Reporting Requirements that are Required to Facilitate Assessment of Risks to Human Health and the Environment Posed by Chemical Use in the State ............................................................................................................................ 5 III. Summary of Chemical Use in the State Based on Reported Chemical Inventories....... 8 IV. Summary of Identified Risks to Human Health and the Environment from Reported Chemical Inventories ........................................................................................................... 9 V. Summary of any change under Federal Statute or Rule affecting the Regulation of Chemicals in the State ....................................................................................................... 12 VI. Recommended Legislative or Regulatory Action to Reduce Risks to Human Health and the Environment from Regulated and Unregulated Chemicals of Emerging Concern .............................................................................................................................. -

Chemical Compatibility Storage Group

CHEMICAL SEGREGATION Chemicals are to be segregated into 11 different categories depending on the compatibility of that chemical with other chemicals The Storage Groups are as follows: Group A – Compatible Organic Acids Group B – Compatible Pyrophoric & Water Reactive Materials Group C – Compatible Inorganic Bases Group D – Compatible Organic Acids Group E – Compatible Oxidizers including Peroxides Group F– Compatible Inorganic Acids not including Oxidizers or Combustible Group G – Not Intrinsically Reactive or Flammable or Combustible Group J* – Poison Compressed Gases Group K* – Compatible Explosive or other highly Unstable Material Group L – Non-Reactive Flammable and Combustible, including solvents Group X* – Incompatible with ALL other storage groups The following is a list of chemicals and their compatibility storage codes. This is not a complete list of chemicals, but is provided to give examples of each storage group: Storage Group A 94‐75‐7 2,4‐D (2,4‐Dichlorophenoxyacetic acid) 94‐82‐6 2,4‐DB 609-99-4 3,5-Dinitrosalicylic acid 64‐19‐7 Acetic acid (Flammable liquid @ 102°F avoid alcohols, Amines, ox agents see SDS) 631-61-8 Acetic acid, Ammonium salt (Ammonium acetate) 108-24-7 Acetic anhydride (Flammable liquid @102°F avoid alcohols see SDS) 79‐10‐7 Acrylic acid Peroxide Former 65‐85‐0 Benzoic acid 98‐07‐7 Benzotrichloride 98‐88‐4 Benzoyl chloride 107-92-6 Butyric Acid 115‐28‐6 Chlorendic acid 79‐11‐8 Chloroacetic acid 627‐11‐2 Chloroethyl chloroformate 77‐92‐9 Citric acid 5949-29-1 Citric acid monohydrate 57-00-1 Creatine 20624-25-3 -

Process Development for Permanganate Addition During Oxidative Leaching of Hanford Tank Sludge Simulants

PNNL-16794 WTP-RPT-164, Rev 0 Process Development for Permanganate Addition During Oxidative Leaching of Hanford Tank Sludge Simulants B. M. Rapko G. J. Lumetta J. R. Deschane R. A. Peterson October 2007 Prepared for the U.S. Department of Energy under Contract DE-AC05-76RL01830 DISCLAIMER This report was prepared as an account of work sponsored by an agency of the United States Government. Neither the United States Government nor any agency thereof, nor Battelle Memorial Institute, nor any of their employees, makes any warranty, express or implied, or assumes any legal liability or responsibility for the accuracy, completeness, or usefulness of any information, apparatus, product, or process disclosed, or represents that its use would not infringe privately owned rights. Reference herein to any specific commercial product, process, or service by trade name, trademark, manufacturer, or otherwise does not necessarily constitute or imply its endorsement, recommendation, or favoring by the United States Government or any agency thereof, or Battelle Memorial Institute. The views and opinions of authors expressed herein do not necessarily state or reflect those of the United States Government or any agency thereof. PACIFIC NORTHWEST NATIONAL LABORATORY operated by BATTELLE for the UNITED STATES DEPARTMENT OF ENERGY under Contract DE-ACO5-76RL01830 PNNL-16794 WTP-RPT-164, Rev 0 Process Development for Permanganate Addition During Oxidative Leaching of Hanford Tank Sludge Simulants B. M. Rapko G. J. Lumetta J. R. Deschane R. A. Peterson October 2007 Test specification: 24590-PTF-TSP-RT-06-002, Rev. 0 Test Plan: TP-RPP-WTP-453, Rev. 0, and ICN-TP-RPP-WTP-453.1 Test exceptions: 24590-WTP-TEF-RT-07-00002 R&T focus area: Pretreatment Test scoping statement(s): None Pacific Northwest National Laboratory Richland, Washington 99352 Contents Acronyms.................................................................................................................................................... -

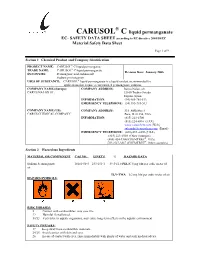

CARUSOL C Liquid Permanganate EC- SAFETY DATA SHEET According to EC Directive 2001/58/EC Material Safety Data Sheet

® CARUSOL C liquid permanganate EC- SAFETY DATA SHEET according to EC directive 2001/58/EC Material Safety Data Sheet Page 1 of 9 Section 1 Chemical Product and Company Identification PRODUCT NAME: CARUSOL® C liquid permanganate TRADE NAME: CARUSOL® C liquid permanganate Revision Date: January 2006 SYNONYMS: Permanganic acid sodium salt Sodium permanganate USES OF SUBSTANCE: CARUSOL® liquid permanganate is a liquid oxidant recommended for applications that require a concentrated permanganate solution. COMPANY NAME (Europe): COMPANY ADDRESS: Barrio Nalon, s/n CARUS NALON S.L. 33100 Trubia-Oviedo Espana, Spain INFORMATION: (34) 985-785-513 EMERGENCY TELEPHONE: (34) 985-785-513 COMPANY NAME (US): COMPANY ADDRESS: 315 Fifth Street CARUS CHEMICAL COMPANY Peru, IL 61354, USA INFORMATION: (815) 223-1500 (815) 224-6816 (FAX) www.caruschem.com (Web) [email protected] (Email) EMERGENCY TELEPHONE: (800) 435 –6856 (USA) (815) 223-1500 (Other countries) (800) 424-9300(CHEMTREC®, USA) (703) 527-3887 (CHEMTREC®, Other countries) Section 2 Hazardous Ingredients MATERIAL OR COMPONENT CAS NO. EINECS % HAZARD DATA Sodium Permanganate 10101-50-5 233-251-1 39.5-41.0 PEL/C 5 mg Mn per cubic meter of air TLV-TWA 0.2 mg Mn per cubic meter of air HAZARD SYMBOLS: RISK PHRASES: 8 Contact with combustibles may case fire. 22 Harmful if swallowed. 50/53 Very toxic to aquatic organisms, may cause long-term effects in the aquatic environment. SAFETY PHRASES: 17 Keep away from combustible materials. 24/25 Avoid contact with skin and eyes. 26 In case of contact with eyes, rinse immediately with plenty of water and seek medical advice. -

THB SOLUBILITY OP 30MS SALTS of CIS- AMD TRANS- DIN ITROTETRAMMINE COBALT III IM MIXED SOLVENTS DISSERTATION Presented in Partia

THB SOLUBILITY OP 30MS SALTS OF CIS- AMD TRANS- DIN ITROTETRAMMINE COBALT III IM MIXED SOLVENTS DISSERTATION presented In Partial Fulfillment of the Requirements for the Degree Dootor of Philosophy In the Graduate School of The Ohio State University By HENRY LAWRENCE CLEVER. B.So#. M*SO The Ohio State University 1931 Approved byi AGKHOffLEDGUIBT I wish to express appr •olatloa to Dr* Frank Yerhoek for suggesting thla problem and for guidanoe and oounaal throughout tho work. I wish to express appreciation for the financial assistance of a fellowship g r suited t y the University Ooasdttee for the Allooatlon of Rose aroh Foundation Grants. TABLE OF CONTENTS Pag* INTRODUCTION ..................................... 1 EXPERIMENTAL ..................................... 6 Calibration of Glassware*................... 6 * Standardisations............................ 7 Cobalt Analysis............................. 11 Ansnonla Analysis......... 13 Solvents ............................. 21 Effsot of Tims and Light.................... 24 Tims and Saturation* ...... 20 Preparation of Compounds.................... 33 Solubility Determination Procedure.......... 47 Literature Densities of Mixed Solvents...... 50 Literature Dleleotrlo Constant of Mixed Solvinte........................... 51 CALCULATIONS AND DISCUSSION ..................... 129 Crooeo and Flavo Plcrate.................... 129 Solubility and Solvent Composition.......... 135 Solubility and Dleleotrlo Constant.......... 136 Comparison of Solubilities In Water......... 137 Heats of Solution* -

Advanced Water Treatment Concepts

Advanced Water Treatment Concepts Lesson 2 Appendix of Common Chemicals Used in PWS Treatment This listing of chemicals used in the treatment of drinking water classifies them according to their purpose in water treatment. We have also listed any special properties of the chemicals and safe handling procedures of the hazardous chemicals. D. Appendix - Common Chemicals used in Public Water System Treatment: i. pH/Alkalinity Adjustments: A discussion of the chemicals used in pH and alkalinity adjustments exists not just because there is a desired level of pH and alkalinity in finished water, but because the pH levels and alkalinity levels of water throughout the treatment process affects the dosing and effectiveness of other chemicals involved in the water treatment process. For example, in the coagulation/flocculation basins the alkalinity in the water will be consumed by the formation of flocs. This means that an adequate amount of bicarbonate must be present to offset the loss of alkalinity to floc formation. There are several chemicals that can be added to offset the loss of alkalinity or to make adjustments to the pH during the water treatment process. Six chemicals that are commonly used in West Virginia plants include: 1. Sodium carbonate (Na2CO3): Sodium carbonate or soda ash is a very common chemical used to raise the pH levels of the water from a more acidic level into the neutral range. It is also known as a water softener. Mildly alkaline, it is produced from inexpensive and plentiful raw materials. Soda ash is a white, odorless powder with a slightly alkaline taste. -

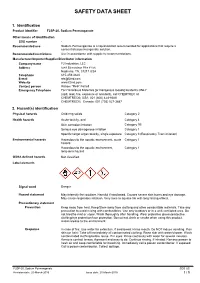

Safety Data Sheet

SAFETY DATA SHEET 1. Identification Product identifier F2SP-20, Sodium Permanganate Other means of identification SDS number - Recommended use Sodium Permanganate is a liquid oxidant recommended for applications that require a concentrated permanganate solution. Recommended restrictions Use in accordance with supplier's recommendations. Manufacturer/Importer/Supplier/Distributor information Company name F2 Industries, LLC Address 5543 Edmondson Pike # 156 Nashville, TN, 37211 USA Telephone 615-459-4620 E-mail [email protected] Website www.f2ind.com Contact person William “Reb” Ferrell Emergency Telephone For Hazardous Materials [or Dangerous Goods] Incidents ONLY (spill, leak, fire, exposure or accident), call CHEMTREC at CHEMTREC®, USA: 001 (800) 424-9300 CHEMTREC®, Canada: 001 (703) 527-3887 2. Hazard(s) identification Physical hazards Oxidizing solids Category 2 Health hazards Acute toxicity, oral Category 4 Skin corrosion/irritation Category 1B Serious eye damage/eye irritation Category 1 Specific target organ toxicity, single exposure Category 3 (Respiratory Tract irritation) Environmental hazards Hazardous to the aquatic environment, acute Category 1 hazard Hazardous to the aquatic environment, Category 1 long-term hazard OSHA defined hazards Not classified. Label elements Signal word Danger Hazard statement May intensify fire; oxidizer. Harmful if swallowed. Causes severe skin burns and eye damage. May cause respiratory irritation. Very toxic to aquatic life with long lasting effects. Precautionary statement Prevention Keep away from heat. Keep/Store away from clothing and other combustible materials. Take any precaution to avoid mixing with combustibles. Use only outdoors or in a well-ventilated area. Do not breathe mist or vapor. Wash thoroughly after handling. Wear protective gloves/protective clothing/eye protection/face protection.