Investor Briefings

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

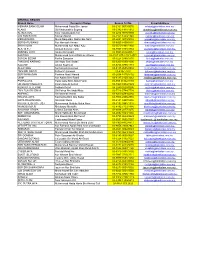

HP Resellers in Selangor

HP Resellers in Selangor Store Name City Address SNS Network (M) SDN BHD(Jusco Balakong Aras Mezzaqnize, Lebuh Tun Hussien Onn Cheras Selatan) Courts Mammoth Banting No 179 & 181 Jalan Sultan Abdul Samad Sinaro Origgrace Sdn Bhd Banting No.58, Jalan Burung Pekan 2, Banting Courts Mammoth K.Selangor No 16 & 18 Jalan Melaka 3/1, Bandar Melawati Courts Mammoth Kajang No 1 Kajang Plaza Jalan Dato Seri, P. Alegendra G&B Information Station Sdn Bhd Kajang 178A Taman Sri Langat, Jalan Reko G&B Information Station Sdn Bhd Kajang Jalan Reko, 181 Taman Sri Langat HARDNET TECHNOLOGY SDN BHD Kajang 184 185 Ground Floor, Taman Seri Langat Off Jalan Reko, off Jalan Reko Bess Computer Sdn Bhd Klang No. 11, Jalan Miri, Jalan Raja Bot Contech Computer (M) Sdn Bhd Klang No.61, Jalan Cokmar 1, Taman Mutiara Bukit Raja, Off Jalan Meru Courts Mammoth Berhad Klang No 22 & 24, Jalan Goh Hock Huat Elitetrax Marketing Sdn Bhd (Harvey Klang Aeon Bukit Tinggi SC, F42 1st Floor Bandar Bukit Norman) Tinggi My Gameland Enterprise Klang Lot A17, Giant Hypermarket Klang, Bandar Bukit Tinggi Novacomp Compuware Technology Klang (Sa0015038-T) 3-00-1 Jln Batu Nilam 1, Bdr Bukit Tinggi. SenQ Klang Unit F.08-09 First Floor, Klang Parade No2112, Km2 Jalan Meru Tech World Computer Sdn Bhd Klang No. 36 Jalan Jasmin 6 Bandar Botanic Thunder Match Sdn Bhd Klang JUSCO BUKIT TINGGI, LOT S39, 2ND FLOOR,AEON BUKIT TINGGI SHOPPING CENTRE , NO. 1, PERSIARAN BATU NILAM 1/KS6, , BANDAR BUKIT TINGGI 2 41200 Z Com It Store Sdn Bhd Klang Lot F20, PSN Jaya Jusco Bukit Raja Klang, Bukit Raja 2, Bandar Baru Klang Courts Mammoth Nilai No 7180 Jalan BBN 1/1A, Bandar Baru Nilai All IT Hypermarket Sdn Bhd Petaling Jaya Lot 3-01, 3rd Floor, Digital Mall, No. -

4 the Country's Largest Infrastructure Project, the Klang Valley Mass

4 Gamuda Berhad (29579-T) • Annual Report 2011 The country’s largest infrastructure project, the Klang Valley Mass Rapid Transit will significantly improve public transport connectivity between the populated suburbs and key employment areas in the Klang Valley Gamuda Berhad (29579-T) • Annual Report 2011 5 Performance Review Five-Year Financial Highlights 6 - 7 Chairman’s Perspective 8 - 10 Prospects for Financial Year 2012 11 6 Gamuda Berhad (29579-T) • Annual Report 2011 Five-Year Financial Highlights RM’000 2007 2008 2009 2010 2011 Revenue 1,516,359 2,403,660 2,727,302 2,455,143 2,673,208 Profit Before Tax 276,561 470,814 282,157 412,260 544,524 Profit Attributed to Shareholders 185,428 325,078 193,689 322,918 425,411 Total Assets 5,038,482 5,774,301 5,878,459 6,733,561 7,551,298 Shareholders’ Equity 2,945,950 3,051,582 3,161,011 3,440,176 3,686,565 Total Number of Shares 981,528 2,005,016 2,009,257 2,025,888 2,064,824 Sen per Share 2007 2008 2009 2010 2011 Group Earnings Per Share (sen) 11* 16 10 16 21 Net Tangible Assets Per Share (sen) 150* 152 157 170 179 * Comparatives have been restated to take into effect the bonus issue exercise on the basis of one (1) new ordinary share for every one (1) existing share held which was completed on 25 October 2007. Gamuda Berhad (29579-T) • Annual Report 2011 7 Revenue (RM’000) Profit Before Tax (RM’000) 2,673,208 412,260 544,524 2,403,660 2,727,302 2,455,143 276,561 470,814 282,157 1,516,359 07 08 09 10 11 07 08 09 10 11 Group Earnings Per Share (sen) Shareholders’ Equity (RM’000) 21 16 11* 16 10 2,945,950 3,051,582 3,161,011 3,440,176 3,686,565 07 08 09 10 11 07 08 09 10 11 8 Gamuda Berhad (29579-T) • Annual Report 2011 Chairman’s Perspective Y M Raja Dato’ Seri Abdul Aziz bin Raja Salim Chairman, Gamuda Berhad To our shareholders, customers, employees, partners, suppliers and friends, On behalf of the Board of Directors, it gives me great pleasure to present the 21st Annual Report and Audited Financial Statements of Gamuda Berhad for the financial year ended 31 July 2011 (financial year 2011). -

12 Azhar Hj. Ahmad

Perceptions of Small Retailers and Entreprenuer on the Departmental Store Development: Case Study in Bandar Bukit Tinggi Klang,Malaysia Azhar Hj. Ahmad, Ishak Hj. Abd Rahman, Sallehuddin Mohd Nor, Jumaat Abd Moen, Che Aniza Che Wel, Ahmad Raflis Che Omar, Lecturer, School of Business Management, Faculty of Business and Economics, National University of Malaysia ABSTRACT The presence of bigger retail outlets have brought new business opportunities and moved the retailing industry and Malaysian economy to greater heights. Since these bigger outlets affects the existing retailers, a study was undertaken to assess the potential impact of the proposed development of departmental stores on existing small business retailers in Bandar Bukit Tinggi, Selangor .The assessment was based primarily on the perceptions and expressed opinions of the sampled retailers in the catchments area of the proposed development of the departmental stores. The objectives of the study were to: 1) elaborate on the characteristics of the retailers in the catchments area and 2) assess the perceptions of the small retailers regarding their performance, future outlook, and actions needed amid the development of the departmental store. From the analysis, there would be short-term adverse impact on most retail outlets and the degree of the impact is determined by the type of retail business. The study also raised several recommendations for the existing small retailers to employ in order to stay competitive. INTRODUCTION The Malaysian economy is projected to grow by an average of 6% annually. This growth will be supported by domestic demand with strong private investment and consumption with the services sector is expected to sustain its growth momentum at 6.5% per year on average during the Ninth Malaysia Plan (9MP) period. -

1 Facial First Bandar Botanic 03-3326 3880 016-723 5330 23G, Jalan

Outlet Tel Outlet Mobile Address 23G, Jalan Remia 3, Bandar Ambang 1 Facial First Bandar Botanic 03-3326 3880 016-723 5330 Botanik, 41200 Klang. Unit A6G-A7G, Jalan Selaman 1/1, 2 Facial First Ampang 03-4270 1530 016-213 3369 Dataran Palma 68000 Ampang. Selangor. Lot F1.20 & 21 Sunway Pyramid Shopping 3 Facial First Sunway Pyramid 03-5636 0203 016-213 3375 Mall, Bandar Sunway, 46150 Petaling Jaya, Selangor Facial First Damansara No 71, Jalan SS21/60, Damansara Utama, 4 03-7725 8330 016-201 2271 Utama 47400 Petaling Jaya, Selangor Wisma Laxton, No 7, Jalan Desa, Taman 5 Facial First Klang Lama 03-7983 8330 016-702 5330 Desa, Off Jalan Klang Lama, 58100 Kuala Lumpur Unit #170-03-33A-35-36, Plaza Gurney, 6 Facial First Gurney Plaza 04-228 8330 016-713 6330 Persiaran Gurney, 10250 Penang. L1-11 & 12, Level 1, Brem Mall, Jalan 7 Facial First Brem Mall 03-6257 6880 016-920 3392 Kepong, 52000 Kuala Lumpur. Unit No. L4-07B(P), Level 4 The Mines, Jalan Dulang 8 Facial First The Mines 03-8948 3880 016-201 3320 Mines Resort City, 43300 Seri Kembangan, Lot 07-19,07-20 & 07-21, 7th Floor, Facial First Berjaya Times 9 03-2142 8330 016-201 2330 Berjaya Times Square, No.1 Jalan Imbi, Square 55100 Kuala Lumpur. Lot 06-64,65 Sixth Floor,Berjaya Times Facial First Berjaya Times 10 03-2143 1330 016-227 5330 Square,No 1 Jalan Imbi, 55100 Kuala Square Lumpur. LOT L2-59, IOI CITY MALL, LEBUH IRC, 11 Facial First IOI City Mall 03-8938 9007 016-229 7930 IOI RESORT CITY, 62502 PUTRAJAYA, SEPANG, SELANGOR. -

E-REWARDS SPREE - ECOTANK Region Coverage Area Company Name Address Tel

E-REWARDS SPREE - ECOTANK Region Coverage Area Company Name Address Tel Central AEON Ampang Utara Pineapple Computer Systems Sdn Bhd (AEON) AEON AU2, 1st Floor, (AEON Digital Mall), No. 6, Jalan Taman Setiawangsa (37/56), AU2, Taman Keramat, 54200 Kuala Lumpur Central AEON Bandar Baru Klang SNS Network Sdn Bhd 1st Floor, AEON Bandar Baru Klang, 41150 Klang, Selangor Central AEON Big Mid Valley SNS Network Sdn Bhd Lower Ground Floor, AEON BIG Mid Valley, 59200 Kuala Lumpur Central AEON Big Putrajaya SNS Network Sdn Bhd 1st Floor, AEON BIG Putrajaya, 62000 Putrajaya Central AEON Big Subang SNS Network Sdn Bhd 2nd Floor, AEON Big Subang, 47500 Subang Jaya Central AEON Bukit Tinggi Pineapple Computer Systems Sdn Bhd (AEON) No. 1, Persiaran Batu Nilam 1/KS 6, Bandar Bukit Tinggi 2, 41200 Klang, Selangor Central AEON Cheras Selatan SNS Network Sdn Bhd 1st Floor, AEON Cheras Selatan, 43200 Balakong, Selangor, Malaysia Central AEON IOI Mall Pineapple Computer Systems Sdn Bhd (AEON) Ground Floor, Lot G-40, Batu 9, IOI Mall, Jusco Bandar Puchong, Bandar Puchong Jaya, 47200, Puchong Selangor Central AEON Kepong Pineapple Computer Systems Sdn Bhd (AEON) Jusco Metra Prima Store, Lot. No. 4086, Fasa 3B (ii), Jalan Metro Prima/Jalan Kepong, Mukim Batu, 52100, Kuala Lumpur Central AEON Mid Valley Pineapple Computer Systems Sdn Bhd (AEON) 2nd Floor Mid Valley, AT3, Mid Valley Mega Mall, Mid Valley City, 58300, Kuala Lumpur Central AEON One Utama Pineapple Computer Systems Sdn Bhd (AEON) 2nd Floor, Jusco Bandar Utama, No. 1, Leboh Bandar Utama, Bandar Utama Damansara, 47800, Petaling Jaya Selangor Central AEON Rawang Pineapple Computer Systems Sdn Bhd (AEON) No. -

Trio E Pamphlet

FREEHOLD TRANSIT . TREND . TRANSFORM Artist’s impression only IT’S NOT WHERE YOU LIVE, IT’S HOW YOU LIVE Bringing the best of THE WALKING DISTANCE 24 HOURS LOCATED AT cosmopolitan living in Bukit Tinggi TALLEST TOWER TO LRT 3 TESCO MULTI-TIER THE HEART OF IN BUKIT TINGGI BUKIT TINGGI SECURITY AN ESTABLISHED Never before in Klang is there a mixed development that achieves such STATION SYSTEM TOWNSHIP sophistication in contemporary quality, design and sustainability. Paving the way for a perfect new experience in lavish living amidst modern amenities and all the conveniences of an urban lifestyle. PORT BANDAR PULAU BANDAR MANIPAL LRT 3 TESCO HOSPITAL KLANG BUKIT TINGGI 2 KETAM PANDAMARAN BUKIT TINGGI HOSPITAL BUKIT TINGGI STATION BESAR KLANG *Artist’s Impression Only Artist’s impression only Immerse Yourself In A New Exclusive Comfort Benchmark A pulsating lifestyle in the splendid sky gym where you can unwind and reinvigorate In Urban your body, mind and soul. Rest your mind in these tranquil surroundings and enrich Lifestyle your soul with refreshing social activity all within the comforts of your doorsteps. Artist’s impression only Gymnasium Playground An active area to flex and stay fit. Sweat it out A fun zone for the little ones to run free and make full use of the indoor equipment. and explore their imagination. REFRESH REJUVENATE RELAX 1 4 10 2 5 11 3 6 12 7 13 8 14 9 15 16 Artist’s impression only Artist’s impression only 8 LIFT LOBBY 1 LIFT LOBBY 9 16 DROP OFF 12 4 6 5 2 LINK 11 BRIDGE 7 14 LIFT LOBBY 3 10 13 15 Swimming Pool Enjoy a rejuvenating dip at the shimmering pool on facility deck. -

Gross Pollutants Study in Urban Areas Under Tropical Climates

Jan. 2014, Volume 8, No. 1 (Serial No. 74), pp. 107-114 Journal of Civil Engineering and Architecture, ISSN 1934-7359, USA D DAVID PUBLISHING Gross Pollutants Study in Urban Areas under Tropical Climates Lariyah Mohd Sidek1, Hidayah Basri1, Mohamed Roseli Zainal Abidin2, Lim Chow Hock3, Md Nasir Md Nor3 4 and Nor Azazi Zakaria 1. Centre for Sustainable Technology and Environment (CSTEN), College of Engineering, Universiti Tenaga Nasional, Kajang 43000, Malaysia 2. Drainage and Irrigation Department, Humid Tropics Centre Kuala Lumpur, Kuala Lumpur 50480, Malaysia 3. Drainage and Irrigation Department, River Basin & Coastal Zone Management, Kuala Lumpur 50626, Malaysia 4. River Engineering and Urban Drainage Centre (REDAC), Universiti Sains Malaysia, Nibong Tebal 14300, Malaysia Abstract: Gross pollutants are the primary targeted pollutants in urban catchment management for urban water quality improvement as well as mitigation of flood. Apart from aesthetically unattractive because of its visibility, gross pollutants also contributes to degradation of river water quality and loss of aquatic habitat as it carries harmful pollutants such as oxygen demanding material, hydrocarbons and heavy metals. This study analyzed trend of gross pollutant generated from two urban residential areas located in Selangor, Malaysia. The median value of gross pollutant load obtained from the Amanah Apartment and Bandar Botanic are 347.41 kg/ha/year and 32.46 kg/ha/year, respectively. Relationship between gross pollutant wet load with rainfall depths was derived using regression equation. A significant trend of increasing gross pollutant wet load into drainage system with increasing rainfall depth was observed. The behavior of pollutant load is related to the one observed in Australia. -

Senarai Pakar/Pegawai Perubatan Yang Mempunyai

SENARAI PAKAR/PEGAWAI PERUBATAN YANG MEMPUNYAI NOMBOR PENDAFTARAN PEMERIKSAAN KESIHATAN BAKAL HAJI BAGI MUSIM HAJI 1440H / 2019M HOSPITAL & KLINIK KERAJAAN NEGERI SELANGOR TEMPAT BERTUGAS BIL NAMA DOKTOR (ALAMAT LENGKAP DAERAH HOSPITAL & KLINIK) 1. Dr. Izan Hairani Bt Ishak 2. Dr. Rizawati Bt Ramli 3. Dr. Zamzurina Bt Asmuee 4. Dr. Menaga A/P Munusamy Dr. Kalaashini A/P KLINIK KESIHATAN 5. Ramachandran BUKIT KUDA 6. Dr. Siti Noor Akmar Bt Ahmad 76, Jalan Batu Tiga Lama 41300 Klang 7. Dr. Nelli Yohana Bt Mohd Said 8. Dr. Nurulhuda Bt Haironi 9. Dr. Noorasyikin Bt Jamar 10. Dr. Solehah Bt Abdul Rahim 11. Dr. Nur Shairah Bt Mohd Yahaya 12. Dr. Syariza Bt. Shahir KLINIK KESIHATAN RANTAU PANJANG 13. Dr. Mardina Bt Fardi Jalan Rantau Panjang 14. Dr. Sandramathi Arul 42100 Klang 15. Dr. Ho Bee Kiau KLINIK KESIHATAN BANDAR BOTANIC KLANG 16. Dr. Salbiah Bt Mohamed Isa Blok B, Jalan Langat Dr. Farhatul 'Aliaa Bt Mohammed Bandar Botanic 17. Toha 41200 Klang Dr. Salzuliyanti binti Zulkifli 18. KLINIK KESIHATAN 19. Dr. Azura Bt Nadzimuddin BANDAR BOTANIC Blok B, Jalan Langat Dr. Vithyasri A/P Nithiyanandan 20. Bandar Botanic 21. Dr. Nur Zaiha Bt Zainal Abidin 41200 Klang 22. Dr. Nor Asnita Nordin 23. Dr. Ahmad Fairul B Mahat Dr. Fathiah Syahirah Bt Mohd 24. Ghazali KLINIK KESIHATAN KAPAR 25. Dr. Nur Fadzilah Zainal Abidin PT. 3763 Seksyen 1 Batu 10 42200 Kapar Dr. Nazahah Rohanip Klang 26. SENARAI PAKAR/PEGAWAI PERUBATAN YANG MEMPUNYAI NOMBOR PENDAFTARAN PEMERIKSAAN KESIHATAN BAKAL HAJI BAGI MUSIM HAJI 1440H / 2019M HOSPITAL & KLINIK KERAJAAN NEGERI SELANGOR TEMPAT BERTUGAS BIL NAMA DOKTOR (ALAMAT LENGKAP DAERAH HOSPITAL & KLINIK) KLINIK KESIHATAN KAPAR Dr. -

Branch Name Person in Charge Branch Tel.No E-Mail Address

CENTRAL REGION Branch Name Person in Charge Branch Tel.No E-mail Address MENARA BANK ISLAM Mohammad Faizal Bin Jamari 03-2161 0073/0076 [email protected] KLANG Siti Khairunabila Sugang 03-3342 1911/1912 [email protected] KL SENTRAL Noor Aszalinawati Asri 03-2274 9878/9899 [email protected] JLN TUN RAZAK Nazuan Nazali 03-2161 1333/1340 [email protected] MEDAN MARA Mohd Naqiuddin Nadhir Bin Nazri 03-2691 9079/9082 [email protected] BDR BARU BANGI Nur Hamizah Amran 03-8925 8490/8491 [email protected] SHAH ALAM Muhammad Azri Abdul Aziz 03-5510 1481/1492 [email protected] SEK.14 P.J Ahmad Suhaimi Tahir 03-7957 3131/3834 [email protected] SUBANG JAYA Aman Kamarudin 03-8023 2072/2087 [email protected] BANTING Muhammad Amirul Ridzuan Azman 03-3187 3772/3181 4772 [email protected] SUNGAI BESAR Fariha Sangidan 03-3224 2886/3478 [email protected] TANJUNG KARANG Siti Hajar Binti Sadali 03-3269 1090/1690 [email protected] KAJANG Amirul Syafiq Ali 03-8736 0798/1773 [email protected] SELAYANG Nurhidayah Rasiman 03-6135 2655/2934 [email protected] TMN MELAWATI Fathorazi Samsuri 03-4107 7800 [email protected] BDR WAWASAN Farhana Abdul Hamid 03-2694 8175/8192 [email protected] UIAM Nor Azlina Binti Ramli 03-6185 3150/3262 [email protected] PUTRAJAYA Haniz Azila Binti Abdul Halim 03-888 31932/3193 [email protected] UNIVERSITI MALAYA Farah Ilani Ali Ashraf 03-7960 8934/7429 [email protected] MENARA TELEKOM Najihah -

Corporate Brochure Eng 2017

DRIVEN BY INNOVATION Engineering Construction Property Development Infrastructure GAMUDA BERHAD (29579-T) Menara Gamuda, Block D, PJ Trade Centre Concessions No. 8, Jalan PJU 8/8A, Bandar Damansara Perdana 47820 Petaling Jaya, Selangor Darul Ehsan, Malaysia 603-7491 8288 603-7728 6571 / 9811 gamuda.com.my Copyright © 2017 by Gamuda Berhad All rights reserved. No part of this publication may be reproduced, distributed, or transmitted in any form without the prior written permission printed 2017 Starting o as a small construction outt in 1976, we have steadily built our expertise in three core businesses; Engineering & Construction, Property Development and Infrastructure Concessions, achieving a market capitalisation of RM13 billion in 2017. Today, we are proud to be identied as an innovative builder behind some of the world’s rsts, namely the dual purpose Bridges Stormwater Management and Road Tunnel (SMART) and Railway Malaysia’s rst MRT. Systems and Trains IBS Highways and Airport Ports Expressways Hospital Water Tunnelling Treatment Plants 1 Dams Townships Buildings Power Plants 2 9.7km dual-purpose EMBRACING INNOVATION SMART, the world’s rst EXPERT TUNNELLERS With proven expertise and extensive Stormwater management know-how in advanced tunnelling technology and techniques, we have and motorway demonstrated that tunnels need not be single-function structures. This is evident in our track record of constructing tunnels for river and stormwater diversion as well as highways and railways in dicult geological conditions. Listed by CNN as one of the world’s Top 10 greatest tunnels 3 4 Malaysia’s only TBM Refurbishment Plant Using the Tunnel Boring Machine (TBM) under Kuala Lumpur city centre for the SMART project has led to another innovative invention Highly-complex that was successfully used in TBMs used for Malaysia’s rst MRT. -

The Association of Banks in Malaysia List of Branches with Extended

The Association of Banks in Malaysia List of branches with extended operation hours for debit card replacement to PIN- enabled MyDebit Card Bank: Hong Leong Bank / Hong Leong Islamic Bank List of participating branches (in alphabetical order by state) State Branch / Centre Branch address 120 AND 122, JALAN MERSING, JOHOR 1 Kluang KLU 86000 KLUANG, JOHOR DARUL TAKZIM 9, JLN KUNDANG, TMN BUKIT 2 Batu Pahat BPH PASIR, 83000 BATU PAHAT, JOHOR NO 3 PUSAT DAGANGAN BAKRI, 3 Muar MUR JALAN BAKRI, 84000 MUAR JOHOR. NO 43A & 45, JLN GENUANG KAMPUNG, KAMPUNG 4 Segamat SEG ABDULLAH, 85000 SEGAMAT, JOHOR 49, JALAN JENANG, 83000 BATU 5 Batu Pahat BTP PAHAT, JOHOR DARUL TAKZIM No 345A, JALAN ISMAIL, 86800 6 Mersing, Johor MSG MERSING, JOHOR DARUL TAKZIM NO. LC531, JALAN PAYAMAS 7 Tangkak TGK 84900 TANGKAK, JOHOR 109 MAIN ROAD, 83700 YONG 8 Yong Peng YPG PENG, JOHOR NO. 70, JALAN SEGAMAT, 85300 9 Labis LBS LABIS, JOHOR DARUL TAKZIM NO. 2 JALAN JATI SATU, TAMAN 10 Nusa Bestari Jaya NBJ NUSA BESTARI JAYA, 81300 SKUDAI, JOHOR BAHRU Page 1 of 25 6 AND 8, JALAN NAKHODA 12, JOHOR 11 Skudai SKD TAMAN UNGKU TUN AMINAH, 81300 SKUDAI, JOHOR NO 39 AND 41, JALAN KEBUDAYAAN 1, TAMAN 12 Taman Universiti TMU UNIVERSITI, 81300 SKUDAI, JOHOR NO 6 AND 7, JALAN ANGGERIK 1, 13 Kulai Utama, Johor KUI TAMAN KULAI UTAMA, 81000 KULAI, JOHOR NO 21 & 23, JLN INDAH 15/1, 14 Bukit Indah BIN BUKIT INDAH,81200 JOHOR BAHRU, JOHOR NO. 115, JALAN SUTERA UTAMA, Taman Sutera 15 UDA 81300 SKUDAI, JOHOR DARUL Utama TAKZIM Ground Floor, No. -

Mitraland Fills a Market Gap in Klang South Published on the Edge Markets (

City & Country: Mitraland fills a market gap in Klang South Published on The Edge Markets (http://www.theedgemarkets.com) Jul 20, 2015 | Written by Rachel Chew | 0 MITRALAND GROUP SDN BHD will be building a new landmark in the fast-growing southern Klang corridor in Selangor. A number of townships, such as Bandar Bukit Tinggi, Bandar Botanic, Bayuemas and Bandar Parklands, have come up in this area, making Klang a rising housing and property investment hot spot. Banking on the potential of Klang South, Mitraland is embarking on a RM1.3 billion mixed-use development there called Gravit8. “We looked at the opportunity and potential in Klang South. The place lacks a lifestyle development, Page 1 of 4 City & Country: Mitraland fills a market gap in Klang South Published on The Edge Markets (http://www.theedgemarkets.com) a place where friends and families can gather and enjoy some time together. We want our project to be that place,” CEO Chuah Theong Yee tells City & Country. The name “Gravit8” is a play on the word “gravitate”, he adds. The development is located on a 15-acre freehold site in Jalan Klang Banting, opposite the proposed Johan Setia LRT station. It is also next to the Shah Alam Expressway (Kesas) headed towards Port Klang — about a 10 to 15-minute drive from Kota Kemuning. Consisting of serviced apartments, speciality retail outlets, a mall, corporate offices, small offices/versatile offices (SoVos) and a boutique hotel, it has a marine theme, which is what comes to mind when Klang is mentioned. Mitraland chairman Datuk Johan Ariffin says the developer plans to have an eight-acre lake on the site.