Businesses Customers Communities Team Members

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Global Pharmaceutical and Medical Meetings Summit ™

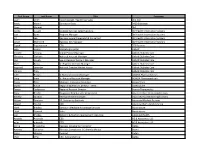

The 4th Annual Global Pharmaceutical and Medical Meetings Summit ™ February 10-12, 2016 - Philadelphia, PA Final Attendee List TRANSPARENCY STATEMENT: This is the final attendee list for this event. It is not a compiled list of alumni from previous years. TITLE COMPANY Natl Sales Mgr A Gift Inside Specailized Pharmacist Abbott Global Healthcare & Research Sr Specialist Procurement Abbott Laboratories Sr Partner AG Communications Sr Partner AG Communications Event Coordinator AHM Global Director Strategic Meeting Mgmt AHM Global VP Compliance & Strategic Solutions AHM Sr Event Manager AHM SVP Global Strategic Account Mgmt AHM Bus Mgr AIM Grp Intl Managing Dir AIM Grp Intl New York Office Account Dir AIMIA Account Dir Aimia Account Supv AIMIA Mgr Program Operations Aimia Purchasing Mgr / Channel & Employee Loyalty Aimia Strategy & Client Planning Dir Aimia VP Client Svcs Aimia Dir Exposition American College of Cardiology Mgr Bus Dev Strategic Meetings American Express Global Strategic Account Mgr American Express GBT Meeting Mgr American Express Global Business Travel Strategic Account Manager, Americas American Express Global Business Travel Strategic Account Mgr American Express Global Business Travel Project & Meetings Mgr R&D HCP American Express Meetings & Events Director Compliance Operations ARIAD PHARMACEUTICALS INC Account Dir Ashfield Meetings & Events Bus Dev Dir Ashfield Meetings & Events CEO Americas Ashfield Meetings & Events VP Commercial Ops Ashfield Meetings & Events Assoc Astrazeneca Global Category Mgr Meetings & Events -

Assetmark Names Natalie Wolfsen Chief Executive Officer Michael Kim

AssetMark Names Natalie Wolfsen Chief Executive Officer Michael Kim Appointed President CONCORD, Calif., February 23, 2021 – AssetMark Financial Holdings, Inc. (NYSE: AMK) today announced that its Board of Directors has named Natalie Wolfsen as the company’s new Chief Executive Officer and Michael Kim as its new President. Both appointments are effective as of March 3, 2021. Ms. Wolfsen and Mr. Kim are succeeding Charles Goldman, who will be leaving his role as President and Chief Executive Officer and as a member of the Board of Directors. Mr. Goldman will assist in the transition by serving as a consultant to the company for one year. Ms. Wolfsen will also join the AssetMark Board of Directors. Ms. Wolfsen, who most recently served as AssetMark’s Executive Vice President and Chief Solutions Officer, brings to her new position more than 25 years of experience in investment product management, investments, digital product development and marketing, as well as a proven track record of successfully achieving business results for AssetMark. She is an experienced strategist, consistently and successfully identifying and meeting the evolving needs of financial advisors and their clients through the development of new technology and services. “Natalie is a proven, high-performing leader who the Board of Directors unanimously believes is the right executive to lead AssetMark moving forward,” said Xiaoning Jiao, Chairperson of the AssetMark Board of Directors. “She brings to her new role a deep knowledge of AssetMark, a track record of successfully developing and leading teams and a forward-looking approach that promotes holistic advisor-client conversations, innovative technology and greater diversity and inclusion in the wealth management industry. -

Business Strategy Business Results Financial Section Journey So Far Journey Ahead Sustainability

Konica Minolta’s Konica Minolta’s Platform Supporting Business Strategy Business Results Financial Section Journey So Far Journey Ahead Sustainability Business Strategy Boosting the earning potential of core businesses while further expanding growth businesses and new businesses Business Toshimitsu Taiko Strategy Senior Executive Officer 1 Lead officer responsible for Business Technologies Business Roman Tihelka We will boost the earning potential Managing Director, Cluster East, Boosting Business Technologies of core businesses, with a focus on Konica Minolta developing stronger long-term Business Solutions Europe GmbH relationships with customers. Business Profitability Ramping up our IT services for a greater presence Core Growth in Eastern Europe. Business Hitoshi Kamezawa Douglas Kreysar Strategy 2 Executive Officer Chief Solutions Officer, General Manager, Radiant Vision Systems Sensing Business unit, Industrial Optical System Leveraging the assets of the Business Headquarters Growth Strategies for the Konica Minolta Group, Utilizing technologies for measuring we will continue to provide light and color, Konica Minolta high quality, innovative pursues genre-top strategies for the solutions. Measuring Instruments Business ICT and automotive industries. Core Growth Business Kiyotaka Fujii Strategy Senior Managing Executive Officer 3 General Manager, Healthcare Business Headquarters Jack Hoppin We will build a global business Growth Strategies for the management system and CEO, Invicro LLC accelerate business strategies for the precision -

First Name Last Name Job Title Company Type Company Name Hank Beaver VP, Group Account Director Ad Tech

First Name Last Name Job Title Company_Type Company Name Hank Beaver VP, Group Account Director Ad Tech - Platform 360i Kristen Baker VP Ad Tech - Platform 360i Heather Chancey Account Director Ad Tech - Platform 360i Blake Ivie Director, Integrated Media Ad Tech - Platform 360i Michaela Haswell Associate Media Manager Ad Tech - Platform 360i Marla Kaplowitz CEO Trade Body 4A's R Lee Barstow VP Revenue Operations Publisher A+E Networks Joe Catanzaro VP, Revenue Operations & Yield Ad Tech - Platform a4 media pty Dan Riccio VP, Advertising Insights & Ad Operations Publisher Al Jazeera Cooper Greene Agency Partnerships Ad Tech - Platform Ampersand Megan Kasler Associate Director of Marketing & Communications Media Agency Amplifi USA/ dentsu Timothy Chung Technical Account Manager Media Agency Annalect Anny Buakaew Director Media Agency Annalect Nicole Lewis Associate Director Media Agency Annalect Kristopher Schmelzer Senior Account Manager Media Agency Annalect Ashley Lai Senior Account Manager Media Agency Annalect Genie Gilder Assistant Vice President Marketing Advertiser Aon Corporation Delia O'Donnell Buyer Ad Tech - Platform APEX EXCHANGE, LLC Jason Wulfsohn COO & Co-Founder Ad Tech - Platform AUDIENCEX Steve Bligh-WIlliams Director, Paid Media Media Agency Aurum Producciones SA Tara Craze VP, Digital Media Agency Aurum Producciones SA Nora Okonski Senior Director, Revenue Operations Publisher Axios Kathleen Pratt Director, Ad Operations Publisher Axios Media Terri Schriver SVP Enterprise Customer Engagement & Investment Advertiser Bank of America paul D'Urso Head of Digital Taxonomy and Projects Publisher Bauer Media Paul Gelb Head of Social and Programmatic Advertiser Bayer Courtney Greenspan Head of AdOps, North America Publisher BBC Melissa Chapman Collaborator Consultancy Beeler Tech LLC Rob Beeler Founder & CEO Consultancy Beeler.Tech Ariel Anderson Media Director Media Agency Best Buy Co., Inc. -

Networking List

Networking List 2017 Business Forecasting and Analytics Forum First Name Last Name Title Organization Sondra Lennon Director of Financial Planning & Analysis Acushnet Company Brandon Pike Enterprise Strategy Research Analyst American Family Insurance Sandra DeMas VP Analytics & Integration Aramark Kohlman Verheyen Financial Analyst AstroPak Robert Zwerling Managing Director and Founder Aurora Predictions Eric Judd Market Research Manager BioFire Diagnostics Kurt Moore Market Analyst BioFire Diagnostics Christi Pierce Chief Financial Officer Brokers International, Ltd. Christian Helmetag Controller Calamos Investments Mark Hansen Manager, Financial Analytics Calamos Investments Kapil Kardam GM - Financial Analysis and Strategy Cambridge University Press India Wanda Carlson Sr. Director of Reporting and Analytics Choctaw Nation Div. of Commerce Mark Fegley Senior Vice President Supply Chain Clarks Americas Eric Garland Managing Director Competitive Futures Kimberly Rosenberg Marketing Manager Continental Structural Plastics Victoria Arnold Inside Sales Specialist Continental Structural Plastics Naveen Bandla Assistant Vice President, Research & Analysis Dallas Fort Worth Int. Airport Andrew McCann Director, Commercial Insights Diageo Li Ng Manager, Strategy Diageo Avi Levine VP, Finance Driven Brands, Inc. Brad Holt Sr. Director of Financial Planning & Analysis Ecova Theresa Nguyen Senior Strategy & Insights Manager Electronic Arts Molly Rammel-Puckett Vice President Demand Management & Operations Ellery Homestyles Paul Legutko Senior Manager, -

CORPORATE GOVERNANCE Statement of Compliance with the UK Corporate Governance Code

CORPORATE GOVERNANCE Statement of Compliance with the UK Corporate Governance Code Chairman’s Introduction The Board of EMIS Group understands the importance of ensuring that there is a strong governance framework in place which underpins the Company’s ability to achieve its strategic goals. Governance arrangements are reviewed on an ongoing basis to ensure that they remain fit for purposes. As the Company operates within the healthcare sector, it is important the focus remains on the safety and security of the Company’s products as well as balancing the interests of all our stakeholders. EMIS Group adopted the UK Corporate Governance Code 2016 (the Code) for the year ending 31 December 2018 and this report sets out how the Company fully complied with the Code. From 1 January 2019, the Company will adopt the UK Corporate Governance Code 2018 and we will report on compliance with the 2018 Code in the Annual Report and Accounts for the year ending 31 December 2019. The Code is published by the Financial Reporting Council and is available at www.frc.org.uk. Compliance with the UK Corporate Governance Code 2016 We have addressed each Code principle in the table below. Section Main Principle How EMIS Group complies A. Leadership A.1 Role of the Every company should be The Board’s principal role is to provide effective leadership Board headed by an effective of the Group. It is responsible to shareholders for delivering board which is shareholder value by developing the overall strategy and collectively responsible supporting the development of the direction of the Group. -

CUNA Finance Council Conference

CUNA Finance Council Conference 05/19 ‐ 05/22 New York, NY Demographics Report Asset Size: Attendees: Total Attendees CFONY19539 Total CUs 281 CFONY19 Assets: N/A = 217 CFONY19 Avg Assets $785,686,906 Assets: 0 ‐ 5,000,000 = 0 Median Asset Size $497,511,191 Assets: 5,000,000 ‐ 10,000,000 = 1 Assets: 10,000,000 ‐ 20,000,000 = 0 Assets: 20,000,000 ‐ 35,000,000 = 4 CFONY19 Attendees by Gender Assets: 35,000,000 ‐ 50,000,000 = 5 Gender not Reported 215 Assets: 50,000,000 ‐ 75,000,000 = 9 Female 119 Assets: 75,000,000 ‐ 100,000,000 = 8 Male 203 Assets: 100,000,000 ‐ 200,000,000 = 40 Unknown 2 Assets: 200,000,000 ‐ 350,000,000 = 49 Assets: 350,000,000 ‐ 500,000,000 = 46 Assets: 500,000,000 ‐ 750,000,000 = 30 Assets: 750,000,000 ‐ and above = 130 CFONY19 Attendees By State Attendees by TitleCFONY19 Alabama 5 No Entry 4 Arizona 13 Account Exec 1 Arkansas 3 Account Executive 6 California 50 Account Manager 1 Colorado 17 Accountant 4 Connecticut 5 Delaware 3 Accounting Analyst 1 District of Columbia 5 Accounting Manager 3 Florida 38 Accounting Representative 1 Georgia 13 Accounting Supervisor 1 Idaho 2 Advisor 2 Illinois 23 Advisor, Teacher, and Speaker 1 Indiana 10 Advisory Services Group 1 Iowa 9 AIM Mgr & Sr Financial Analyst 2 Kansas 11 Assistant Controller 1 Kentucky 4 Assistant Vice President, Accounting 1 Louisiana 9 Attorney/Counselor 1 Maryland 11 Audit Manager 1 Massachusetts 14 AVP Account Manager 1 Michigan 24 AVP Accounting 1 Minnesota 13 AVP Analytics & Business Development 1 Mississippi 2 AVP Finance 1 Missouri 5 AVP Institutional Funding 1 Montana 2 Nebraska 6 AVP of Accounting & Finance 1 Nevada 1 AVP/Controller 1 New Hampshire 5 Behavioral Economist 1 New Jersey 4 Benefits Consultant 1 New York 21 Board Director 1 Monday, May 13, 2019 03:31 PM PSFY Mtg05 and 05b Demographics w Class.bq Page 1 of 6 Meeting Code: CFONY19 CFONY19 CFONY19 Attendees By State Attendees by Title North Carolina 13 Business Intelligence Analyst 1 Ohio 14 Business Solutions Manager 1 Oklahoma 11 Business Solutions Sr. -

Business Forecasting and Analytics 2019

Business Forecasting and Analytics 2019 - Networking List First Name Last Name Company Title Michael Webb Abbott Vascular Manager Demand Planning Andre Carvalho Alcon Head FP&A for Manufacturing Amanda Lewis Alcon Finance Head Global Supply Chain Kenny Chernauskas Apex Clean Energy Assistant Controller Alexandra Theriault Apex Clean Energy Financial Planning Manager Juan Porter Archetype Consulting Chief Solutions Officer Prajakta Pathak Associated Black Charities Senior Accountant Raimunda Salamanca Associated Black Charities Controller Mike Hodge Audio Technica Marketing Analyst Robert Zwerling Aurora Predictions Managing Director Arik Johnson Aurora WDC Founder & Chairman Robert Bottome Biomarin Executive Director, Global Supply Chain Darren Johnson Biomarin Senior Director, Global Commercial Analytics Roy Barnes Blue Space Consulting Blue Space Consulting - President Michael Devinoff Bristol-Myers Squibb Vice President - Head of Enterprise Forecasting & Strategy Analytics Kimberly Levadoux Central Garden and Pet Senior Finance Manager Miyako Omori Central Garden and Pet Financial Analyst Janice Innocenti Central Garden and Pet Director and Finance Process Lead, Reporting & Analytics Andrew Rosendahl Children's MN Sr Dir Fin Planning/Analysis Andrew Bartz CHS Inc Senior Financial Analyst, FP&A Lindsie Herzog CHS Inc Manager, Financial Planning & Analysis Prashant Gupta Cisco Principal Data Scientist @ Customer Excellence Tina Burke Citrix Systems Inc S&OP Manager Keith Davidson CliftonLarsonAllen (CLA) BizOps Chief Financial Officer -

2019-Conf-Attendee-L

First Name Last Name Title Company Jason Smith Vice President, Health Plan Sales 2nd.MD Brady Heiner Director of Sales 340B Exchange Dawn Weimar 3M Carole Cusack Strategic Services Sales Executive 3M Health Information Systems Jack Ijams Program Manager 3M Health Information Systems Kit Lee Decision Support Specialist & Consultant 3M Health Information Systems David Wetherelt Business Dev Manager 3M Health Information Systems Taguhi Sogomonyan CEO 3TS Partners Jean Huang Marketing Director Abbott Jennifer Cheung Senior Product Manager Abbott Diabetes Care Christine Garforth National Account Manager Abbott Diabetes Care Dao Huynh Senior Regional Account Manager Abbott Diabetes Care Alan Kaska Sr. Regional Account Manager Abbott Diabetes Care Reginald Lavender National Director Market Access Abbott Diabetes Care Melody Tran Abbott Diabetes Care Julie Brown Sr National Account Manager ACADIA Pharmaceuticals Craig Irwin Sr. National Account Manager ACADIA Pharmaceuticals Pastor Perez Manager, Innovative Solutions Access2Care Crystal Rouse Regional Operations Director - West Access2Care Teresa Cadenasso Regional Account Director Acorda Therapeutics Stacy Brecht Diagnostic Reimbursement Specialist Advanced Accelerator Applications Beverly Salcedo Reimbursement Manager Advanced Accelerator Applications Nelson Dunham VP, Enterprise Accounts Advanced Medical Reviews Abigail Aboitiz CEO Advanced Remote Monitoring Mark Bradley Director - Medicare Advantage Services Advantasure Heidi Howard Sales Advantasure Dan Rhodes Network & Market Development -

“Political Views of Tech People” Methodology

“Political views of tech people” Niels Selling, Institute for Futures Studies [email protected] Methodology Last updated: 2019-09-23 1. Sample selection 1.1. Selection of firms The population consists of the 842 American corporations that appeared at least once between 2007 and 2014 on the Forbes Global 2000 list, an annual ranking of the 2000 largest public enterprises in the world. 2. Data & Operationalization 2.1. Corporations An “AI firm” is defined as a company that primarily operates in the technology sector and, at the same time, is a big player in AI research and development. The stipulation of these two criteria is consistent with the aim of the analysis, which is to study corporations whose AI development is a core activity. For this reason, the definition excludes non-tech corporations that invest heavily in AI R&D, such as General Motors, and tech-firms that are relatively minor players in the AI domain. First, the NAICS classification system was used to determine whether a corporation is a tech firm or not. NAICS codes are constructed to denote varying levels of specificity. The two first digits designate the broadest business sector, the first three the subsector, the first four the industry group, the first five the industry. The full six-digit sequence is the national industry. Table 1 contains a list of the tech relevant NAICS codes. The NAICS codes of firms were collected from Compustat. A company whose primary NAICS code corresponds to any of those listed in Table 1 was classified as a “tech firm.” Table 1: NAICS codes associated with tech firms. -

This Year's HRO Today Superstars Are Leading the Charge in HR

#HRSuperstars Shining Bright This year’s HRO Today Superstars are leading the charge in HR transformation and innovation at their organizations. By The Editors We are living in an age of immense disruption. Digital transformation is a top concern in boardrooms across the world, with companies developing and adopting new technologies to reinvent themselves, deliver more value to their customers, and remain relevant in today’s high-paced business climate. Low unemployment and a candidate-driven job market are forcing organizations to reevaluate their approach to talent acquisition and people management. Globalization and an increasingly diverse and connected workforce are transforming the way businesses are run—and HR is at the forefront. This year’s HRO Today Superstars have a proven track record of innovating, challenging the status quo, and redefi ning the new normal for HR. All the leaders featured on these pages have worked to deliver technologies, solutions, and strategies to uplift each employee while supporting organizational goals. Our roundup recognizes three categories of leadership because each has a significant impact on the successful management of human capital: Providers, Practitioners, and Consultants/Advisors/Analysts/Academics/Investors/ Thought Leaders. Superstars were nominated externally and by the HRO Today staff. [16] HRO TODAY MAGAZINE | DECEMBER 2018 #HRSuperstars 2018 Superstars PROVIDERS TALENT ACQUISITION Patrick Beharelle Chief Executive Offi cer TrueBlue Patrick Beharelle has served as TrueBlue’s Chief Executive Offi cer (CEO) and member of its board since September. Previously, he was president and chief operating offi cer (COO), leading global operations, business development, technology and human resource functions across TrueBlue’s PeopleReady, PeopleScout, and PeopleManagement businesses. -

The National Association for Children's Behavioral

THE NATIONAL ASSOCIATION FOR CHILDREN’S BEHAVIORAL HEALTH ATTENDEES ALASKA Cook Inlet Tribal Council Dana Burgan, QA Manager, [email protected] Rebecca Ling, Senior Director, [email protected] Family Centered Services of Alaska Kimberly Houston, Director of Quality Assurance, [email protected] Justin Borgen, Human Resource Director, [email protected] John Regitano, Executive Director, [email protected] Presbyterian Hospitality House Naomi Tigner, Director of Community Programs, [email protected] Ty Tigner, Executive Director, [email protected] Gabe Duran, Clinical Director, [email protected] Residential Youth Care Dustin Larna, Chief Operating Office, [email protected] ARKANSAS Youth Home, Inc. David Napier, Executive Director, [email protected] Peggy Kelly, Chief Clinical Officer, [email protected] 1 ARIZONA Devereux Advanced Behavioral Health Arizona Yvette Jackson, Acting Executive Director, [email protected] CONNECTICUT Adelbrook, Behavioral & Developmental Health Services Sabrina Cameron, Executive Vice President, [email protected] Child Health and Development Institute Jeffrey Vanderploeg, President & CEO, [email protected] Community Health Resources Kathy Schiessl, Senior Vice President, [email protected] Connecticut Junior Republic Christine Jaffer, Director of Residential Services, [email protected] Dan Rezende, COR, President, [email protected] Klingberg Family Centers, Inc. Steven Girelli, President and Chief Executive Officer, [email protected]