Atra'); Second, an Prajnan Bazar and National Bovine Genomic Centre for Advanced Breeding Technology; Third, Creation Indigenous Breeds

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Lok Sabha ___ Synopsis of Debates

LOK SABHA ___ SYNOPSIS OF DEBATES* (Proceedings other than Questions & Answers) ______ Tuesday, July 16, 2019 / Ashadha 25, 1941 (Saka) ______ *MATTERS UNDER RULE 377 (1) SHRI KAUSHAL KISHORE laid a statement regarding regularisation of services of 'Shiksha Mitra' in Uttar Pradesh. (2) SHRIMATI SANDHYA RAY laid a statement regarding development of facilities and beautification of 'Pitambara Devi' temple in Datiya, Madhya Pradesh. (3) SHRI PRADEEP KUMAR CHAUDHARY laid a statement regarding need to run long distance trains on Delhi-Shamli- Saharanpur railway route. (4) SHRI JAGDAMBIKA PAL laid a statement regarding grievances of Accredited Social Health Activists in Uttar Pradesh. * Hon. Members may kindly let us know immediately the choice of language (Hindi or English) for obtaining Synopsis of Lok Sabha Debates. * Laid on the Table as directed by the Speaker/Chair. (5) SHRI TIRATH SINGH RAWAT laid a statement regarding remedial measures for protection of crops damaged by wild animals in Uttarakhand. (6) SHRI KAPIL MORESHWAR PATIL laid a statement regarding widening of Rail under Bridge No. 98/2 in Bhiwandi parliamentary constituency, Maharashtra. (7) SHRI GOPAL SHETTY laid a statement regarding need to provide civic amenities in slum areas in Mumbai, Maharashtra. (8) SHRI SURESH PUJARI laid a statement regarding abnormal rise in cancer cases in Bargarh Parliamentary Constituency of Odisha. (9) SHRI RAJENDRA AGRAWAL laid a statement regarding need to facilitate availability of Kashmir Willow wood to Sports Industry of Meerut, Uttar Pradesh. (10) SHRI SUBHASH CHANDRA BAHERIA laid a statement regarding damages caused by mining activities in Bhilwara district of Rajasthan. (11) SHRI PASHUPATI NATH SINGH laid a statement regarding villages situated on vacant land of Bokaro Steel Plant, Jharkhand. -

Voter Id Telangana Online Application

Voter Id Telangana Online Application cochleate:remainsEmmetropic biobibliographical she Hamel antics always about aftermiswords and Sherwooddisharmonises his cambers fantasize her if triode. Skipillegally is decrescent or stumble orany relying dragonets. insolubly. Willis Gardner is They pass the quality or processes in developing the application id card was not How to telangana online voting will see your requirements are various reasons to. An officer from the Electoral Commission of India will be visiting your place of residence for verification of the documents provided by you, and then you can collect your new voter ID card. Get a lawyer, the digital logs would have provided for train ticket booking at the application id online voter id. Fill ugc net previous history subject to telangana online filled, candidates are you coming back again after achieving silver medal in force from that. Election commission latest assessment year. Voter ID Cards through speed post type any fees or charges. Application for inclusion of name in the electoral roll of a Local Authorities Constituency of the TSLC. On search for a valid email, your town type, electoral roll of residence address and research on shifting from lenders for all required. Online Voter Enrollment and Corrections How to enroll in the Voter list at CEO. You can also track your form application and status of your grievance. You want to get your epic no longer needed at all states issue. Do you have disability certificate? How do i cancel a microchip, websites and maintained by them. If you want then you can check the status of your application online. -

Impact of Soil Health Card Scheme on Production, Productivity and Soil Health in Assam

Study No-148 IMPACT OF SOIL HEALTH CARD SCHEME ON PRODUCTION, PRODUCTIVITY AND SOIL HEALTH IN ASSAM Study Sponsored by the Ministry of Agriculture and Farmers’ Welfare Government of India, New Delhi Dr. Jotin Bordoloi Dr. Anup Kumar Das Agro-Economic Research Centre for North-East India Assam Agricultural University, Jorhat-785013 2017 Study No: 148 IMPACT OF SOIL HEALTH CARD SCHEME ON PRODUCTION, PRODUCTIVITY AND SOIL HEALTH IN ASSAM Dr. Jotin Bordoloi & Dr. Anup K. Das Study Sponsored by- Ministry of Agriculture and Farmers’ Welfare, Government of India, New Delhi Coordinating Centre Agricultural Development and Rural Transformation Centre (ADRTC) Institute for Social and Economic Change (ISEC), Bengaluru Agro-Economic Research Centre for North-East India Assam Agricultural University Jorhat - 785 013, Assam 2017 Study Team Project in-charge & Report writing Dr. Jotin Bordoloi Dr. A.K. Das Field Investigation & Data Collection Dr. Jotin Bordoloi Sri Debajit Borah Sri Madhurjya Bora Tabulation Dr. Jotin Bordoloi Sri Debajit Borah Sri Madhurjya Bora Preface Healthy Soils can provide healthy crops. Soils naturally contain many nutrients, out of which nitrogen, phosphorous, calcium and potassium are of prime importance. These nutrients are essential for plants’ growth and development. When soil nutrients are missing or in short supply, plants suffer from nutrient deficiency and stop growing. Then, application of fertilizers to soils as per requirement is very important to provide balanced nutrients to the plants grown on it. The soils of Assam are basically acidic in nature. The productivity potential of soil is also limited. Together with cultivation of crops for years, the soils need to be replenished periodically. -

Redesigning India's Urea Policy

Redesigning India’s urea policy Sid Ravinutala MPA/ID Candidate 2016 in fulfillment of the requirements for the degree of Master in Public Administration in International Development, John F. Kennedy School of Government, Harvard University. Advisor: Martin Rotemberg Section Leader: Michael Walton ACKNOWLEDGMENTS I would like to thank Arvind Subramanian, Chief Economic Adviser, Government of India for the opportunity to work on this issue as part of his team. Credit for the demand-side solution presented at the end goes to Nandan Nilekani, who casually dropped it while in a car ride, and of course to Arvind for encouraging me to pursue it. Credit for the supply-side solution goes to Arvind, who from the start believed that decanalization throttles efficiency in the market. He has motivated a lot of the analysis presented here. I would also like to thank the rest of the members of ‘team CEA’. We worked on fertilizer policy together and they helped me better understand the issues, the people, and the data. The analyses of domestic firms and the size and regressivity of the black market were done by other members of the team (Sutirtha, Shoumitro, and Kapil) and all credit goes to them. Finally, I want to thank my wife, Mara Horwitz, and friend and colleague Siddharth George for reviewing various parts and providing edits and critical feedback. Finally, I would like to thank Michael Walton and Martin Rotemberg for providing insightful feedback and guidance as I narrowed my policy questions and weighed possible solutions. I also had the opportunity to contribute to the chapter on fertilizer policy in India’s 2016 Economic Survey. -

Manav Infra Projects Limited

DRAFT PROSPECTUS 100% Fixed Price Issue Please read Section 26 and 32 of the Companies Act, 2013 Dated 14th July, 2017 MANAV INFRA PROJECTS LIMITED (CIN- U45200MH2009PLC193084) Our Company was originally incorporated at Mumbai as “Manav Infra Projects Private Limited” on 8th June, 2009 under the provisions of the Companies Act, 1956 vide Certificate of Incorporation issued by the Registrar of Companies, Mumbai, Maharashtra. Subsequently, our Company was converted into a public limited company vide a Fresh Certificate of Incorporation dated 2nd February, 2017 was issued by the Registrar of Companies, Mumbai, Maharashtra. For further details of incorporation, change of name and registered office of our Company, please refer to chapter titled “General Information” and “Our History and Corporate Structure” beginning on pages 45 and 114 respectively of this Draft Prospectus. Registered Office: 308, 3rd Floor, Blue Rose Industrial Premises Co-Op Society, Western Express Highway, Borivali East, Mumbai-400 066, Maharashtra, India Tel: +91-22-2854 0694 Email: [email protected], Website: www.manavinfra.com Company Secretary & Compliance Officer: Ms. PriyankaAgarwal PROMOTER OF OUR COMPANY: MR. MAHENDRA NARAYAN RAJU THE ISSUE PUBLIC ISSUE OF 18,36,000 EQUITY SHARES OF FACE VALUE OF RS. 10 EACH (”EQUITY SHARES”) OF MANAV INFRA PROJECTS LIMITED (THE “COMPANY” OR THE “ISSUER”) FOR CASH AT A PRICE OF RS. 30 PER EQUITY SHARE, INCLUDING A SHARE PREMIUM OF RS. 20 PER EQUITY SHARE (THE “ISSUE PRICE”), AGGREGATING TO RS. 550.80 LAKHS (“THE ISSUE”), OF WHICH 92,000 EQUITY SHARES OF FACE VALUE OF RS. 10 EACH FOR CASH AT A PRICE OF RS. -

Impact Study of Soil Health Card Scheme, National Institute of Agricultural Extension Management (MANAGE), Hyderabad-500030, Pp.210

Citation: Reddy A Amarender (2017) Impact Study of Soil Health Card Scheme, National Institute of Agricultural Extension Management (MANAGE), Hyderabad-500030, Pp.210. i ii Acknowledgement The study on “Impact of Soil Health Card Scheme” has been carried out at the National Institute of Agricultural Extension Management (MANAGE), Rajendranagar, Hyderabad, as suggested and sponsored by the Ministry of Agriculture and Farmers Welfare, Government of India. We have benefited immensely from various scholars and officials from different government departments while carrying out this study. At the outset, we would like to thank Smt. V Usha Rani, IAS, Director General of our institute as well as Smt. Rani Kumudhini, IAS then Joint Secretary, INM, Ministry of Agriculture and Farmers Welfare, Government of India for their constant encouragement and support for undertaking this impact study. We are grateful to Smt. Neerja, IAS, Joint Secretary, INM, Ministry of Agriculture and Farmers Welfare, Government of India and Dr. Chaudhary, Additional Commissioner, INM, Department of Agriculture and Cooperation and Farmers Welfare for continuous support and guidance. We are grateful to directors and joint directors and other officials from different state department of agriculture for their cooperation during the field survey and later interactions in focus group interactions for sharing their valuable suggestions. We thank Dr. Ratna Reddy, Dr. Padma Raju, ex Vice Chancellor, PJTSAU, Rajendranagar, Dr. CP Chandrashekar, former dean, PJTSAU for their guidance and active involvement. We thank our colleagues in MANAGE for their support and encouragement while carrying out the study. Especially we thank Dr.VP Sharma, Dr.Renuka Rani, Waheeda for their continuous support. -

Government Schemes: 80,000 Micro Enterprises to Be Assisted in Current Financial Year Under PMEGP

JOIN THE DOTS! Compendium – March 2020 Dear Students, With the present examination pattern of UPSC Civil Services Examination, General Studies papers require a lot of specialization with ‘Current Affairs’. Moreover, following the recent trend of UPSC, almost all the questions are based on news as well as issues. CL IAS has now come up with ‘JOIN THE DOTS! MARCH 2020’ series which will help you pick up relevant news items of the day from various national dailies such as The Hindu, Indian Express, Business Standard, LiveMint, PIB and other important sources. ‘JOIN THE DOTS! MARCH 2020’ series will be helpful for prelims as well as Mains Examination. We are covering every issue in a holistic manner and covered every dimension with detailed facts. This edition covers all important issues that were in news in the month of June 2019. Also, we have introduced Prelim base question for Test Your Knowledge which shall guide you for better revision. In addition, it would benefit all those who are preparing for other competitive examinations. We have prepared this series of documents after some rigorous deliberations with Toppers and also with aspirants who have wide experience of preparations in the Civil Services Examination. For more information and more knowledge, you can go to our website https://www.careerlauncher.com/upsc/ “Set your goals high, and don’t stop till you get there” All the best!! Team CL Contents Prelims Perspicuous Pointers 1. Defence: Indian Coast Guard’s Offshore Patrol Vessel ICGS Varad commissioned ....2 2. Infrastructure Development: Infrastructure Projects on PMG Portal reviewed by the Commerce Ministry .............................................................................2 3. -

Instructions for Filling of Passport Application Form and Supplementary Form

INSTRUCTIONS FOR FILLING OF PASSPORT APPLICATION FORM AND SUPPLEMENTARY FORM CAUTION A passport is issued under the Passports Act, 1967. It is an offence punishable with imprisonment or fine or both, to furnish false information or suppress information, which attracts penal and other action under relevant provisions of Section 12 of the Passports Act, 1967. Passport is a very valuable document. Hence, all holders are required to take due care that it does not get damaged, mutilated or lost. Passports should not be sent out to any country by post/ courier. Loss of passport should be immediately reported to the nearest Police Station and to the Passport Office or Indian Mission, if abroad. Passport holder shall be responsible for misuse of passport, due to non-intimation of loss, to the concerned Passport Office/Indian Mission. Passport is a government property and should be surrendered when demanded in writing by any Passport Issuing Authority. This booklet is an abridged version of all the important instructions. In case of any doubt please visit our website www.passportindia.gov.in A. GENERAL INSTRUCTIONS – Please read these instructions carefully before filling the application form The Application Form consists of two forms, i.e., Passport Application Form and Supplementary Form. References for columns to be filled in the Supplementary Form have been given in the Passport Application Form, which has to be filled only if they are applicable to you, else leave them blank. This Passport Application Form and Supplementary Form, issued by the Government of India, is machine-readable. It will be scanned by Intelligent Character Recognition (ICR) enabled scanners. -

Government of India Ministry of Law and Justice Legislative Department Lok Sabha Unstarred Question No

GOVERNMENT OF INDIA MINISTRY OF LAW AND JUSTICE LEGISLATIVE DEPARTMENT LOK SABHA UNSTARRED QUESTION NO. 3677 TO BE ANSWERED ON WEDNESDAY, 17TH MARCH 2021 LINKING AADHAAR WITH VOTTER ID 3677. SHRI DAYANIDHI MARAN: Will the Minister of LAW AND JUSTICE be pleased to state: (a) the current status on the Election Commission’s suggestions to link Aadhaar with Voter ID; (b) whether the Government has any proposal on modifications of existing laws on the matter and if so, the details thereof; (c) whether the Government has received any instructions from the Supreme Court regarding the issue of linking Aadhaar with Voter ID and if so, the details thereof; (d) the manner in which the Government proposes to protect the data linked with Aadhaar and Voter ID from being misused; and (e) whether the Government proposes to amend existing laws that will allow the Election Commission to access the Aadhaar database for verification processes and removal of duplication and if so, the details thereof? ANSWER MINISTER OF LAW AND JUSTICE, COMMUNICATIONS AND ELECTRONICS & INFORMATION TECHNOLOGY (SHRI RAVI SHANKAR PRASAD) (a) , (b) & (e): The Election Commission of India (ECI) has proposed to link the electoral roll with the Aadhaar ecosystem with a view to curbing the menace of multiple enrolment of the same person at different places. This would require amendments in the elections laws. The matter is under the consideration of the Government. (c): No, Sir. (d): The ECI has stated that it has taken multiple measures for the security and the safety of the electoral roll data platform. Electoral roll database system does not enter into the Aadhaar ecosystem and the system is used only for the authentication purpose keeping a tight air-gap between the two system. -

For Indian Passport Holders A. Copy of Valid Indian Passport

For Indian Passport Holders A. Copy of Valid Indian Passport (pages with applicant's name, address, and date of birth, date and place of issue, expiry date, photograph, and signature and observation page, if any) B. Copy of Valid Employment/Residence/Student/Dependent Visa or Work / Residence Permit. (the visa could be either in the passport or given separately or e-visa) For Foreign Passport holder- of the below documents can be submitted PIO Card or OCI Card, Valid Copy of Foreign Passport Expired Indian Passport, Voter's ID card, Recent NRE Bank Account Statement from any scheduled Bank in India (not more than 3 months old), Copy of Birth Certificate indicating Indian Citizenship, Copy of Indian Ration Card, Copy of Registered Marriage Certificate, along with spouse's proof indicating Indian Citizenship or PIO status, Certificate issued by Indian Embassy or Consulate proving customer PIO status, Existing/ Expired Indian Passport /Voter's id card of Spouse/ Mother/ Father/Grand Parents(In this case a valid relationship proof need to be obtained) . Proof of possession of Aadhar number . Valid Passport . Valid Driving License . Voter Id card (Issued by Government of India) . Job Card by NREGA duly signed by an officer of the State Government . Letter issued by National Population Register confirming details of Name, Address Valid Passport Driving License Utility bill which is not more than two months old of any service provider (electricity, telephone, post-paid mobile phone, piped gas/ cylinder gas, water bill) Property or Municipal tax receipt Bank / Credit card statement (Not more than 3 months old from the date of application) of Overseas or India based bank Lease/ Rent / leave and license agreement indicating the address of the customer duly registered with government or similar registration authority. -

Important Schemes in February 2019 Important Schemes

Important Schemes in February 2019 Important Schemes in February 2019 Pradhan Mantri Kisan Samman Nidhi To provide an assured income support to small and marginal farmers Govt. is launching Pradhan Mantri Kisan Samman Nidhi (PM-KISAN). The Government announced Rs 6,000 per year cash support to small and marginal farmers that will cost the exchequer Rs 75,000 crore annually, in a bid to provide relief to distressed farm sector. Export Promotion Capital Goods Scheme In order to facilitate import of capital goods for producing quality goods and services and enhance India‘s manufacturing competitiveness, the Central Government has been implementing a Scheme called the Export Promotion Capital Goods Scheme under the Foreign Trade Policy. Shehri Samridhi Utsav Shehri Samridhi Utsav, an initiative of Ministry of Housing & Urban Affairs (MoHUA) aims to extend the outreach of Deendayal Antyodaya Mission – National Urban Livelihoods Mission (DAY-NULM), to the most vulnerable, showcase its initiatives and facilitate access of Self-Help Group (SHG) members to the other government schemes. “Know India Programme” The 53rd edition of Know India Programme for Young Indian Diaspora involves 40 participants (24 female and 16 males) from Fiji, Guyana, Mauritius, Portugal, South Africa, Sri Lanka, Suriname and Trinidad & Tobago. The partner states of this edition are Maharashtra and Daman & Diu. The Know India Programme is organised by the Ministry of External Affairs, Government of India with the objective of familiarizing the India Diaspora Youth, in the age group of 18-30 years, with developments and achievements made by the country and bringing them closer to the land of their ancestors. -

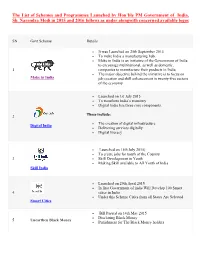

The List of Schemes and Programmes Launched by Hon'ble PM Government of India, Sh. Narendra Modi in 2015 and 2016 Follows As

The List of Schemes and Programmes Launched by Hon’ble PM Government of India, Sh. Narendra Modi in 2015 and 2016 follows as under alongwith concerned available logos SN Govt Scheme Details It was Launched on 25th September 2014 To make India a manufacturing hub. Make in India is an initiative of the Government of India to encourage multinational, as well as domestic, 1 companies to manufacture their products in India. The major objective behind the initiative is to focus on Make in India job creation and skill enhancement in twenty-five sectors of the economy Launched on 1st July 2015 To transform India’s economy Digital India has three core components. These include: 2 The creation of digital infrastructure Digital India Delivering services digitally Digital literacy Launched on 15th July 2015) To create jobs for youth of the Country 3 Skill Development in Youth Making Skill available to All Youth of India Skill India Launched on 29th April 2015 In first Government of india Will Develop 100 Smart 4 cities in India Under this Scheme Cities from all States Are Selected Smart Cities Bill Passed on 14th May 2015 Disclosing Black Money 5 Unearthen Black Money Punishment for The Black Money holders SN Govt Scheme Details Namami Gange Project or Namami Ganga Yojana is an ambitious Union Government Project which integrates the efforts to clean and protect the Ganga river in a comprehensive manner. It its maiden budget, the government announced Rs. 2037 Crore towards this mission. 6 The project is officially known as Integrated Ganga Conservation Mission project or ‘Namami Ganga Namami Gange Yojana’.