The Company Plays a Pivotal Role in the Establishment of New Communities Centred on Rail Access and Implementing New Concepts Fo

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

And 4 December 2013

LEGISLATIVE COUNCIL ─ 4 December 2013 3579 OFFICIAL RECORD OF PROCEEDINGS Wednesday, 4 December 2013 The Council met at Eleven o'clock MEMBERS PRESENT: THE PRESIDENT THE HONOURABLE JASPER TSANG YOK-SING, G.B.S., J.P. THE HONOURABLE ALBERT HO CHUN-YAN THE HONOURABLE LEE CHEUK-YAN THE HONOURABLE JAMES TO KUN-SUN THE HONOURABLE CHAN KAM-LAM, S.B.S., J.P. THE HONOURABLE LEUNG YIU-CHUNG DR THE HONOURABLE LAU WONG-FAT, G.B.M., G.B.S., J.P. THE HONOURABLE EMILY LAU WAI-HING, J.P. THE HONOURABLE TAM YIU-CHUNG, G.B.S., J.P. THE HONOURABLE ABRAHAM SHEK LAI-HIM, G.B.S., J.P. THE HONOURABLE TOMMY CHEUNG YU-YAN, S.B.S., J.P. THE HONOURABLE FREDERICK FUNG KIN-KEE, S.B.S., J.P. THE HONOURABLE VINCENT FANG KANG, S.B.S., J.P. 3580 LEGISLATIVE COUNCIL ─ 4 December 2013 THE HONOURABLE WONG KWOK-HING, B.B.S., M.H. PROF THE HONOURABLE JOSEPH LEE KOK-LONG, S.B.S., J.P., Ph.D., R.N. THE HONOURABLE JEFFREY LAM KIN-FUNG, G.B.S., J.P. THE HONOURABLE ANDREW LEUNG KWAN-YUEN, G.B.S., J.P. THE HONOURABLE WONG TING-KWONG, S.B.S., J.P. THE HONOURABLE RONNY TONG KA-WAH, S.C. THE HONOURABLE CYD HO SAU-LAN THE HONOURABLE STARRY LEE WAI-KING, J.P. DR THE HONOURABLE LAM TAI-FAI, S.B.S., J.P. THE HONOURABLE CHAN HAK-KAN, J.P. THE HONOURABLE CHAN KIN-POR, B.B.S., J.P. DR THE HONOURABLE PRISCILLA LEUNG MEI-FUN, S.B.S., J.P. -

List of Buildings with Confirmed / Probable Cases of COVID-19

List of Buildings With Confirmed / Probable Cases of COVID-19 List of Residential Buildings in Which Confirmed / Probable Cases Have Resided (Note: The buildings will remain on the list for 14 days since the reported date.) Related Confirmed / District Building Name Probable Case(s) Islands Hong Kong Skycity Marriott Hotel 5482 Islands Hong Kong Skycity Marriott Hotel 5483 Yau Tsim Mong Block 2, The Long Beach 5484 Kwun Tong Dorsett Kwun Tong, Hong Kong 5486 Wan Chai Victoria Heights, 43A Stubbs Road 5487 Islands Tower 3, The Visionary 5488 Sha Tin Yue Chak House, Yue Tin Court 5492 Islands Hong Kong Skycity Marriott Hotel 5496 Tuen Mun King On House, Shan King Estate 5497 Tuen Mun King On House, Shan King Estate 5498 Kowloon City Sik Man House, Ho Man Tin Estate 5499 Wan Chai 168 Tung Lo Wan Road 5500 Sha Tin Block F, Garden Rivera 5501 Sai Kung Clear Water Bay Apartments 5502 Southern Red Hill Park 5503 Sai Kung Po Lam Estate, Po Tai House 5504 Sha Tin Block F, Garden Rivera 5505 Islands Ying Yat House, Yat Tung Estate 5506 Kwun Tong Block 17, Laguna City 5507 Crowne Plaza Hong Kong Kowloon East Sai Kung 5509 Hotel Eastern Tower 2, Pacific Palisades 5510 Kowloon City Billion Court 5511 Yau Tsim Mong Lee Man Building 5512 Central & Western Tai Fat Building 5513 Wan Chai Malibu Garden 5514 Sai Kung Alto Residences 5515 Wan Chai Chee On Building 5516 Sai Kung Block 2, Hillview Court 5517 Tsuen Wan Hoi Pa San Tsuen 5518 Central & Western Flourish Court 5520 1 Related Confirmed / District Building Name Probable Case(s) Wong Tai Sin Fu Tung House, Tung Tau Estate 5521 Yau Tsim Mong Tai Chuen Building, Cosmopolitan Estates 5523 Yau Tsim Mong Yan Hong Building 5524 Sha Tin Block 5, Royal Ascot 5525 Sha Tin Yiu Ping House, Yiu On Estate 5526 Sha Tin Block 5, Royal Ascot 5529 Wan Chai Block E, Beverly Hill 5530 Yau Tsim Mong Tower 1, The Harbourside 5531 Yuen Long Wah Choi House, Tin Wah Estate 5532 Yau Tsim Mong Lee Man Building 5533 Yau Tsim Mong Paradise Square 5534 Kowloon City Tower 3, K. -

Contents • the Last Month in Brief, Shipping Companies

GURKHA INTERNATIONAL GROUP Apr 2017 Issue 236 Newsletter Contents • The Last Month in Brief, Shipping Companies ...........................................1 • GI (HK) Business, World Security: Economics, Nuclear, Europe ...........2 • The Arab World, Afghanistan & Pakistan, Palestine, Asia ...................3 • Thailand and Malaysia, The Malacca Straits, Somalia, Africa, The Americas, Myanmar, India ...............4 • Nepal News .....................................5 - 7 • Hong Kong News ........................8 - 9 • Conclusion .........................................10 We publish this month a photograph of Thomson Discovery of Columbia Cruise Services Ltd. If you have pictures or postcards of your ship, please send them in to us for future Newsletters. We Welcome Norwegian Cruise Lines I shall be in Myanmar at the start of next month re- Dev Bahadur Gurung Kusum Thapa cruiting for NCL. It is good to see that that Company Man Prasad Roka Magar Bishal Gurung has decided to resume recruiting after a gap of about Uda Ram Vishnoi a year. Carnival UK Bimala Gurung Raju Kalpit Gurung Raju Chhetri Culumbia Ship Management Bhuwan Moktan SHIPPING COMPANIES AND SHIPS LINKED TO US We are working with 21 shipping companies, and have 734 men and 170 women on ships, a total of 904 crew and staff under management. Gurkha International Group Newsletter 1 World Security World Security Economics The world’s economy seems to be on a slight upturn at the moment. There are no major worries this month. GI (HK) Business Nuclear Tension has risen markedly in and around Korea, as North Ko- We are providing security ser- vices for 28 Hong Kong Clients rea has continue to test missiles and threatened to conduct and have 104 security staff em- underground nuclear tests. -

Interim Report 2019 Corporate Information & Key Dates

20201919 QUICK FACTS 53 countries & territories 46,000+ employees worldwide 70M ft² land & facilities 10,000+ self-owned operating vehicles CONTENTS 02 Corporate Information & Key Dates 03 Financial Highlights 05 Management Discussion and Analysis Results Overview 05 Business Review 06 Financial Review 12 Staff and Remuneration Policies 12 GLOBAL NETWORK 13 Corporate Governance and Other Information 25 Independent Auditor’s Review Report 27 Interim Financial Statements 54 Definitions CHINA FOCUS ASIA SPECIALIST 1 INTERIM REPORT 2019 CORPORATE INFORMATION & KEY DATES KERRY LOGISTICS NETWORK LIMITED COMPANY SECRETARY (Incorporated in the British Virgin Islands and continued Ms LEE Pui Nee into Bermuda as an exempted company with limited liability) AUDITOR PricewaterhouseCoopers BOARD OF DIRECTORS Executive Directors LEGAL ADVISER Mr KUOK Khoon Hua (Chairman) Davis Polk & Wardwell Mr MA Wing Kai William (Group Managing Director) Mr NG Kin Hang REGISTERED OFFICE Victoria Place, 5th Floor, 31 Victoria Street Non-executive Director Hamilton HM 10, Bermuda Ms TONG Shao Ming CORPORATE HEADQUARTERS AND Independent Non-executive Directors PRINCIPAL PLACE OF BUSINESS IN HONG KONG Ms KHOO Shulamite N K 16/F, Kerry Cargo Centre, 55 Wing Kei Road Ms WONG Yu Pok Marina Kwai Chung, New Territories, Hong Kong Mr YEO Philip Liat Kok Mr ZHANG Yi Kevin PRINCIPAL SHARE REGISTRAR AND TRANSFER AGENT AUDIT AND COMPLIANCE COMMITTEE Estera Management (Bermuda) Limited Ms WONG Yu Pok Marina (Chairman) Victoria Place, 5th Floor, 31 Victoria Street Ms TONG Shao Ming -

List of Buildings with Confirmed / Probable Cases of COVID-19

List of buildings with confirmed / probable cases of COVID-19 List of residential buildings in which confirmed / probable cases have resided (Note: The buildings will remain on the list for 14 days since the reported date) District Building name Related confirmed / probable case number Sai Kung Yee Ching House Yee Ming Estate 58,128 Wan Chai Envoy Garden 114, 213 Case notified by the health Southern Block 28, Baguio Villa authority of Canada and Case 117, 118 Tai Po Heng Tai House, Fu Heng Estate 119, 124, 140 Tuen Mun On Hei House, Siu Hei Court 120, 121 Sha Tin Mau Lam House, Kwong Lam Court 122 Tsuen Wan Tower 7, Bellagio 123, 129 Kwun Tong Block T, Telford Gardens 125 Kwun Tong Block 26, Phase 2, Laguna City 126, 127 130, 131,133, Kwai Tsing iPlace 138 Central & Western Serene Court, 35 Sai Ning Street 132 Tai Po Ng Tung Chai, Lam Tsuen 134 Central & Western View Villa 135 Southern 18 Stanley Main Street 136 Wan Chai Block A, Tai Hang Terrace 137 Eastern Cornell Centre 139 Sai Kung 684 Clear Water Bay Road 141 Kwai Tsing Tivoli Garden 142 North Lai Ming House, Wah Ming Estate 143 Sai Kung The Palisades 145 Eastern Fort Mansion 146 Central & Western Kellett View Town Houses, 65 Mount 147, 148 District Building name Related confirmed / probable case number Kellett Road Southern Wah Cheong House, Wah Fu 2 Estate 149 Yau Tsim Mong Hotel ICON 150 Yau Tsim Mong Block A, Chungking Mansions 151 Tuen Mun Tower 1, Oceania Heights 152 Shatin Block 10, Pristine Villa 153 Kowloon City 8 Hok Ling Street 154 Wong Tai Sin Lung Chu House, Lung Poon -

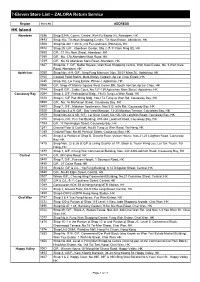

7-Eleven Store List – ZALORA Return Service HK Island

7-Eleven Store List – ZALORA Return Service Region Store No. ADDRESS HK Island Aberdeen 0286 Shop S24A, Comm. Centre, Wah Fu Estate (II), Aberdeen, HK 0493 Shop 102, Tin Wan Shopping Centre, Tin Wan Estate, Aberdeen, HK 0568 Shop No.401 + 401A, Chi Fu Landmark, Pokfulam, HK 0572 Shop 25, G/F., Aberdeen Center, Site 2 (7-11 Nam Ning St), HK 0688 G/F., 11 Wu Nam Street, Aberdeen, HK 1089 G/F., No. 178 Aberdeen Main Road, HK 1239 G/F., No.38 Aberdeen Main Road, Aberdeen, HK 1607 Shop No. 1, G/F, Noble Square, Wah Kwai Shopping Centre, Wah Kwai Estate, No. 3 Wah Kwai Road, Aberdeen, HK Apleichau 0030 Shop Nos. 6-9, G/F., Ning Fung Mansion, Nos. 25-31 Main St., Apleichau, HK 0165 Cooked Food Stall 6, Multi-Storey Carpark, Ap Lei Chau Estate, HK 0235 Shop 102, Lei Tung Estate, Phase I, Apleichau, HK 0366 G/F, Shop 47 Marina Square West Comm Blk, South Horizon,Ap Lei Chau, HK 0744 Shop B G/F., Coble Court, No.127-139 Apleichau Main Street, Apleichau, HK Causeway Bay 0094 Shop 3, G/F, Professional Bldg., 19-23 Tung Lo Wan Road, HK 0325 Shop C, G/F Pak Shing Bldg, 168-174 Tung Lo Wan Rd, Causeway Bay, HK 0468 G/F., No. 16 Matheson Street, Causeway Bay, HK 0608 Shop 7, G/F., Malahon Apartments, Nos.513 Jaffe Rd., Causeway Bay, HK 0920 Shop Nos.8 & 9, G/F., Bay View Mansion, 13-33 Moreton Terrace, Causeway Bay, HK 0929 Shop Nos.6A & 6B, G/F., Lei Shun Court, No.106-126 Leighton Road, Causeway Bay, HK 1075 Shop G, G/F, Pun Tak Building, 478-484 Lockhart Road, Causeway Bay, HK 1153 G/F, 17 Pennington Street, Causeway Bay, HK 1241 Ground Floor & Cockloft, No.68 Tung Lo Wan Road, Tai Hang, HK 1289 Ground Floor, No.60 Percival Street, Causeway Bay, HK 1295 Shop A & Portion of Shop B, Ground Floor, Vulcan House, Nos.21-23 Leighton Road, Causeway Bay, HK 1475 Shop Nos. -

Final Report

Transport and Housing Bureau The Government of the Hong Kong SAR FINAL REPORT Consultancy Services for Providing Expert Advice on Rationalising the Utilization of Road Harbour Crossings In Association with September 2010 CONSULTANCY SERVICES FOR PROVIDING EXPERT ADVICE ON RATIONALISING THE UTILISATION OF ROAD HARBOUR CROSSINGS FINAL REPORT September 2010 WILBUR SMITH ASSOCIATES LIMITED CONSULTANCY SERVICES FOR PROVIDING EXPERT ADVICE ON RATIONALISING THE UTILISATION OF ROAD HARBOUR CROSSINGS FINAL REPORT TABLE OF CONTENTS Chapter Title Page 1 BACKGROUND AND INTRODUCTION .......................................................................... 1-1 1.1 Background .................................................................................................................... 1-1 1.2 Introduction .................................................................................................................... 1-1 1.3 Report Structure ............................................................................................................. 1-3 2 STUDY METHODOLOGY .................................................................................................. 2-1 2.1 Overview of methodology ............................................................................................. 2-1 2.2 7-stage Study Methodology ........................................................................................... 2-2 3 IDENTIFICATION OF EXISTING PROBLEMS ............................................................. 3-1 3.1 Existing Problems -

Branch List English

Telephone Name of Branch Address Fax No. No. Central District Branch 2A Des Voeux Road Central, Hong Kong 2160 8888 2545 0950 Des Voeux Road West Branch 111-119 Des Voeux Road West, Hong Kong 2546 1134 2549 5068 Shek Tong Tsui Branch 534 Queen's Road West, Shek Tong Tsui, Hong Kong 2819 7277 2855 0240 Happy Valley Branch 11 King Kwong Street, Happy Valley, Hong Kong 2838 6668 2573 3662 Connaught Road Central Branch 13-14 Connaught Road Central, Hong Kong 2841 0410 2525 8756 409 Hennessy Road Branch 409-415 Hennessy Road, Wan Chai, Hong Kong 2835 6118 2591 6168 Sheung Wan Branch 252 Des Voeux Road Central, Hong Kong 2541 1601 2545 4896 Wan Chai (China Overseas Building) Branch 139 Hennessy Road, Wan Chai, Hong Kong 2529 0866 2866 1550 Johnston Road Branch 152-158 Johnston Road, Wan Chai, Hong Kong 2574 8257 2838 4039 Gilman Street Branch 136 Des Voeux Road Central, Hong Kong 2135 1123 2544 8013 Wyndham Street Branch 1-3 Wyndham Street, Central, Hong Kong 2843 2888 2521 1339 Queen’s Road Central Branch 81-83 Queen’s Road Central, Hong Kong 2588 1288 2598 1081 First Street Branch 55A First Street, Sai Ying Pun, Hong Kong 2517 3399 2517 3366 United Centre Branch Shop 1021, United Centre, 95 Queensway, Hong Kong 2861 1889 2861 0828 Shun Tak Centre Branch Shop 225, 2/F, Shun Tak Centre, 200 Connaught Road Central, Hong Kong 2291 6081 2291 6306 Causeway Bay Branch 18 Percival Street, Causeway Bay, Hong Kong 2572 4273 2573 1233 Bank of China Tower Branch 1 Garden Road, Hong Kong 2826 6888 2804 6370 Harbour Road Branch Shop 4, G/F, Causeway Centre, -

Jun 30, 2021 Assaggio Trattoria Italiana 6/F Hong Kong A

Promotion Period Participating Merchant Name Address Telephone 6/F Hong Kong Arts Centre, 2 Harbour Road Wanchai, HK +852 2877 3999 Assaggio Trattoria Italiana 22/F, Lee Theatre, 99 Percival Street, Causeway Bay, Hong Kong +852 2409 4822 2/F, New World Tower,16-18 Queen’s Road Central, Hong Kong +852 2524 2012 Tsui Hang Village Shop 507, L5, Mira Place 1, 132 Nathan Road, Tsim Sha Tsui, Hong Kong +852 2376 2882 3101, Podium Level 3, IFC Mall,8 Finance Street, Central, Hong Kong +852 2393 3812 May 7 - Jun 30, The French Window 2021 3101, Podium Level 3, IFC mall, Central, HK +852 2393 3933 CUISINE CUISINE IFC 3/F, The Mira Hong Kong, Mira Place, 118 – 130 Nathan Road, Tsim Sha Tsui +852 2315 5222 CUISINE CUISINE at The Mira 5/F, The Mira Hong Kong, Mira Place, 118 – 130 Nathan Road, Tsim Sha Tsui +852 2315 5999 WHISK 5/F, The Mira Hong Kong, Mira Place, 118 – 130 Nathan Road, Tsim Sha Tsui +852 2351 5999 Vibes G/F Lobby, The Mira Hong Kong, Mira Place, 118 – 130 Nathan Road, Tsim Sha Tsui +852 2315 5120 YAMM Mira Place, 118-130 Nathan Road, Tsim Sha Tsui, Kowloon, Hong Kong +852 2368 1111 The Mira Hong Kong KOLOUR Tsuen Wan II, TWTL 301, Tsuen Wan, New Territories, Hong Kong +852 2413 8686 2/F – 4/F, KOLOUR Yuen Long, 1 Kau Yuk Road, YLTL 464, Yuen Long, New Territories, +852 2476 8666 Hong Kong 2/F - 3/F, MOSTown, 18 On Luk Street, Ma On Shan, New Territories, Hong Kong +852 2643 8338 May 10 - Jun 30, Citistore * L2, MCP Central, Tseung Kwan O, Kowloon, Hong Kong +852 2706 8068 2021 1/F, Metro Harbour Plaza, 8 Fuk Lee Street, Tai Kok Tsui, Kowloon, Hong Kong +852 2170 9988 L3 North Wing, Trend Plaza, Tuen Mun, New Territories, Hong Kong +852 2459 3777 Shop 47, Level 3, 21-27 Sha Tin Centre Street, Sha Tin Plaza, Sha Tin, New Territories +852 2698 1863 Citilife 18 Fu Kin Street, Tai Wai, Shatin, N.T. -

Property Management Revenue from Property Management for 2003 Increased by 11.0% Over 2002 to HK$94 Million

032 Executive management’s report Property review This caused revenue from investment properties for the year of our properties further and establishing them as a to decline slightly by 1% over 2002 to HK$888 million. benchmark for the industry in Hong Kong. Our staff performed outstandingly during the period of SARS For Two IFC, the quality of the office building and its to ensure shoppers’safety and mitigate the effects of the management enabled MTR to attract tenants despite the outbreak on public confidence. We also supported tenants lingering cautious sentiment resulting from SARS, the war in through aggressive promotion campaigns, including an Iraq and the weak economy. Considerable effort was taken attractive rebate promotion. Within this context, we took full to explain to potential tenants, agents and the business advantage of the relaxation of travel restrictions on tourists community the merits of the building, which is ideally suited from Mainland China through proactive, tailor-made to the sophisticated needs of multi-national corporations. programmes, such as organising shopping tours, designed The decision by Swiss banking giant UBS to lease seven floors to bring high spending Mainland visitors to our shopping represented one of the largest and highest profile relocations centres. These programmes proved successful in boosting of an office tenant in Hong Kong in 2003. UBS joined a growing the business turnover of our tenants. list of leading institutions in the building, including the Hong The Total Quality Service Regime, our pioneering customer Kong Monetary Authority, reinforcing Two IFC’s position as the service enhancement programme, and our computerised building of choice for top-tier corporations. -

Sai Kung and Tseung Kwan O Route Bus-Bus Interchange Scheme

Sai Kung and Tseung Kwan O route Bus-Bus Interchange Scheme This BBI Scheme is provided by NWFB, including Route 694, 792M, 796C, 796E, 796S, 796X, 797M, 798 and 798A. It is designed for passengers traveling between Hong Kong Island, Kowloon and Tseung Kwan O / New Territories East. Passengers should use the same Octopus card to make interchange within prescribed time limit at the following bus stop to enjoy the fare discount. From New Territories / Tseung Kwan O to Kowloon First Journey on Alighting Point Second Journey on Interchange Point Fare Time (Direction) (Direction) Discount Limit 792M from Sai Kung Tiu Keng Leng 796C to So Uk Tiu Keng Leng Adult 90 Station 796E to So Uk Station Less $1.00 minutes 796S to Ngau Tau Kok Station Child / Senior Less $0.50 792M from Sai Kung Tseung Kwan O 796X to Tsim Sha Tsui (E) Tseung Kwan O Adult 90 Station Station Less $1.00 minutes Child / Senior Less $0.50 796C from Oscar by the Sea* Tiu Keng Leng 796X to Tsim Sha Tsui (E) Tseung Kwan O Adult 90 Station PTI PTI Less $4.80 minutes Child / Senior Less $2.40 Tseung Kwan O 796S to Ngau Tau Kok Station Tseung Kwan O Free PTI PTI 797M from Tseung Kwan O Tseung Kwan O 796C to So Uk Tseung Kwan O Adult 90 Industrial Estate* PTI 796X to Tsim Sha Tsui (E) PTI Less $1.00 minutes Child / Senior Less $0.50 796X from Tseung Kwan O Tiu Keng Leng 796C to So Uk Tiu Keng Leng Adult 60 Industrial Estate* Station PTI 796E to So Uk Station PTI Less $5.70 minutes Child / Senior Less $2.80 * BBI discounts are available for first journey passengers boarding before Tiu Keng Leng and Tseung Kwan O. -

Property Review (Part 2)

30 MTR CORPORATION LIMITED EXECUTIVE MANAGEMENT’S REPORT Property Review 31 She feels glad to have use of the extensive Club House facilities at Tierra Verde. After a hard week at work, there’s nothing better than a game of tennis before relaxing with a juice. was achieved through managers’ remuneration income from newly In Singapore, we won our first property development consultancy completed Airport Railway properties and from other property contract. The Company was selected by the Land Transport management services such as Octopus Access business and MTR Authority of Singapore to provide consultancy services for the Property Agency Company Limited, a wholly-owned subsidiary of packaging and marketing of a 24,980 square metre site situated the Company that provides agency services for the sale, purchase above a proposed Singapore Mass Rail Transit station at Serangoon and leasing of properties in Hong Kong. Central, a residential area located north of the city centre. During the year, our property management-related business Outlook continued to expand and diversify. At Olympic Station, the Central 1998 1999 2000 2001 2002 We maintain a cautious outlook for the property market in 2003. Park development of 1,312 residential flats was completed and units Investment properties Distribution of property management income Any sustained improvements in demand for Grade A office space handed over to individual owners, in the process coming under MTR With shopping centres maintained at 100% occupancy levels, strong growth in More properties came under MTR management in 2002 with more to follow will await an upturn in the global economy.