Pulling the Levers for Growth +44 (0)20 7851 0906 [email protected]

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Newspaper Licensing Agency - NLA

Newspaper Licensing Agency - NLA Publisher/RRO Title Title code Ad Sales Newquay Voice NV Ad Sales St Austell Voice SAV Ad Sales www.newquayvoice.co.uk WEBNV Ad Sales www.staustellvoice.co.uk WEBSAV Advanced Media Solutions WWW.OILPRICE.COM WEBADMSOILP AJ Bell Media Limited www.sharesmagazine.co.uk WEBAJBSHAR Alliance News Alliance News Corporate ALLNANC Alpha Newspapers Antrim Guardian AG Alpha Newspapers Ballycastle Chronicle BCH Alpha Newspapers Ballymoney Chronicle BLCH Alpha Newspapers Ballymena Guardian BLGU Alpha Newspapers Coleraine Chronicle CCH Alpha Newspapers Coleraine Northern Constitution CNC Alpha Newspapers Countydown Outlook CO Alpha Newspapers Limavady Chronicle LIC Alpha Newspapers Limavady Northern Constitution LNC Alpha Newspapers Magherafelt Northern Constitution MNC Alpha Newspapers Newry Democrat ND Alpha Newspapers Strabane Weekly News SWN Alpha Newspapers Tyrone Constitution TYC Alpha Newspapers Tyrone Courier TYCO Alpha Newspapers Ulster Gazette ULG Alpha Newspapers www.antrimguardian.co.uk WEBAG Alpha Newspapers ballycastle.thechronicle.uk.com WEBBCH Alpha Newspapers ballymoney.thechronicle.uk.com WEBBLCH Alpha Newspapers www.ballymenaguardian.co.uk WEBBLGU Alpha Newspapers coleraine.thechronicle.uk.com WEBCCHR Alpha Newspapers coleraine.northernconstitution.co.uk WEBCNC Alpha Newspapers limavady.thechronicle.uk.com WEBLIC Alpha Newspapers limavady.northernconstitution.co.uk WEBLNC Alpha Newspapers www.newrydemocrat.com WEBND Alpha Newspapers www.outlooknews.co.uk WEBON Alpha Newspapers www.strabaneweekly.co.uk -

RTS Scotland Announces Winners of the 2021 Student Television Awards

PRESS RELEASE THE ROYAL TELEVISION SOCIETY SCOTLAND ANNOUNCES WINNERS OF THE 2021 STUDENT TELEVISION AWARDS Glasgow, 1 June 2021 – The Royal Television Society’s (RTS) Scotland Centre last night celebrated the winners of its 2021 Student Television Awards, sponsored by STV. The awards ceremony was hosted by STV Entertainment Reporter Laura Boyd via STV Player last night, with all the outstanding winning entries also showcased in full on the platform. The RTS Scotland Student Television Awards celebrate the best audiovisual work created by students across the region in Animation, Scripted and Non-Scripted categories, with the judges looking for strong storytelling, creativity, innovation, outstanding visual and aural creativity with high-quality craft skills, and a strong emphasis on originality. For 2021, the nominees reflected the work from a range of talented students at Scottish institutions, with the winning teams of students from Glasgow Clyde College, City of Glasgow College and the Royal Conservatoire of Scotland. Simon Pitts, Chief Executive Officer of STV, said: “Supporting and celebrating the creative talent of the future is vital to us at STV, so we’re thrilled to once again be sponsoring the RTS Scotland Student Television Awards. The film-making prowess on display was hugely impressive, especially after the year our students have had, although I’ve come to expect nothing less from the fiercely talented bunch who enter these awards each year.” “I’m pleased that STV Player viewers will be given the opportunity to enjoy these unique short films, and I’m looking forward to continuing to work with RTS on supporting Scotland’s young creatives into the industry as part of our ongoing partnership.” All nominated and winning films are available on STV Player now, and the full ceremony is available to watch here. -

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Scottish Television

Scottish Television Are those who work in television libraries and archives to be classed as critical workers? This was the question facing management at Scottish Television (STV), a public service broadcaster based in Glasgow, as the UK went into lockdown when the Coronavirus crisis hit. STV’s Media Centre Manager, John McVie, has the challenging role of servicing broadcast, STV Player (an online hub for STV content), newsroom operations and production needs at this difficult time. In normal circumstances, the Media Centre team is based on site, managing a collection of physical and digital video assets and providing services to all parts of STV. As an office-based operation the team has quickly had to adapt their services, with transmission the main priority (keeping STV on-air), alongside ensuring that the daily news output continues to be captured to STV’s archive systems and catalogued to usual standards. However, one consequence of the current news cycle is that the demand for archive material to be used in news bulletins has reduced, as the journalistic focus is on one story only, which has little need for archive footage to illustrate it. The Media Centre has introduced a roster system (and, as a consequence, a reduced service for news), with only one member of the team based on site each day, while others in the team work from home. Working on site now presents new challenges, as the rostered person cannot mix with other teams and must maintain social distancing, remaining isolated as much as possible while in the building. In addition, archive workers in transmission and news environments handle multiple tapes and machines per day. -

Scotland's Digital Media Company

Annual Report and Accounts 2010 Annual Report and Accounts Scotland’s digital media company 2010 STV Group plc STV Group plc In producing this report we have chosen production Pacific Quay methods which aim to minimise the impact on our Glasgow G51 1PQ environment. The papers chosen – Revive 50:50 Gloss and Revive 100 Uncoated contain 50% and 100% recycled Tel: 0141 300 3000 fibre respectively and are certified in accordance with the www.stv.tv FSC (Forest stewardship Council). Both the paper mill and printer involved in this production are environmentally Company Registration Number SC203873 accredited with ISO 14001. Directors’ Report Business Review 02 Highlights of 2010 04 Chairman’s Statement 06 A conversation with Rob Woodward by journalist and media commentator Ray Snoddy 09 Chief Executive’s Review – Scotland’s Digital Media Company 10 – Broadcasting 14 – Content 18 – Ventures 22 KPIs 2010-2012 24 Performance Review 27 Principal Risks and Uncertainties 29 Corporate Social Responsibility Corporate Governance 34 Board of Directors 36 Corporate Governance Report 44 Remuneration Committee Report Accounts 56 STV Group plc Consolidated Financial Statements – Independent Auditors’ Report 58 Consolidated Income Statement 58 Consolidated Statement of Comprehensive Income 59 Consolidated Balance Sheet 60 Consolidated Statement of Changes in Equity 61 Consolidated Statement of Cash Flows 62 Notes to the Financial Statements 90 STV Group plc Company Financial Statements – Independent Auditors’ Report 92 Company Balance Sheet 93 Statement -

Scotland's Home of News and Entertainment

Scotland’s home of news and entertainment Strategy Update May 2018 STV in 2020 • A truly multi-platform media company with a balanced profit base across broadcast, production and digital o Expect around 1/3rd of profit from sources other than linear spot advertising (vs 17% today) • A magnet for the best creative talent from Scotland and beyond • A brand famous for a range of high quality programming and accessible by all Scots wherever they are in the world via the STV app • One of the UK’s leading producers, making world class returning series for a range of domestic and international players • Working in partnership with creative talent, advertisers, businesses and Government to drive the Scottish economy and showcase Scotland to the world Scotland’s home of news and entertainment 2 We have a number of strengths and areas of competitive advantage Strong, trusted brand Unrivalled Talented, connection with committed people Scottish viewers and advertisers Robust balance sheet and growing Scotland’s most returns to powerful marketing shareholders platform Settled A production relationship with business well ITV which placed for incentivises STV Profitable, growing “nations and to go digital digital business regions” growth holding valuable data 3 However, there is also significant potential for improvement •STV not famous for enough new programming beyond news •STV brand perceived as ageing and safe BROADCAST •STV2 not cutting through •News very broadcast-centric and does not embrace digital •STV Player user experience lags competition -

And Public Health

Medicine, the Market and the Mass Media It is sixty years since the end of the Second World War, but historians have only just begun to explore thoroughly the postwar history of health and its interwar antecedents. Most research and literature has focused on health services and the arrival of the NHS; where public health is concerned many historical surveys ignore the recent past and base their investigations on the nineteenth-century public health legacy. This collection opens up the postwar history of public health to sustained research- based, historical scrutiny. Medicine, the Market and the Mass Media examines the development of a new view of ‘the health of the public’ and the influences that shaped it in the postwar years. The book looks at the dual legacy of social medicine through health services and health promotion, and analyses the role of the mass media along with the connections between public health and industry. These essays take a broad perspective examining developments in Western Europe, and the relationships between Europe and the USA. Virginia Berridge is Professor of History and head of the Centre for History in Public Health at the London School of Hygiene and Tropical Medicine, University of London. She has published books and articles on health and society in the twentieth century. Kelly Loughlin is a lecturer in History at the London School of Hygiene and Tropical Medicine and the main focus of her research is the history of health and medical communications in the UK. Routledge Studies in the Social History of Medicine Edited by Joseph Melling, University of Exeter, and Anne Borsay, University of Wales at Swansea. -

List of Section 13F Securities

List of Section 13F Securities 1st Quarter FY 2004 Copyright (c) 2004 American Bankers Association. CUSIP Numbers and descriptions are used with permission by Standard & Poors CUSIP Service Bureau, a division of The McGraw-Hill Companies, Inc. All rights reserved. No redistribution without permission from Standard & Poors CUSIP Service Bureau. Standard & Poors CUSIP Service Bureau does not guarantee the accuracy or completeness of the CUSIP Numbers and standard descriptions included herein and neither the American Bankers Association nor Standard & Poor's CUSIP Service Bureau shall be responsible for any errors, omissions or damages arising out of the use of such information. U.S. Securities and Exchange Commission OFFICIAL LIST OF SECTION 13(f) SECURITIES USER INFORMATION SHEET General This list of “Section 13(f) securities” as defined by Rule 13f-1(c) [17 CFR 240.13f-1(c)] is made available to the public pursuant to Section13 (f) (3) of the Securities Exchange Act of 1934 [15 USC 78m(f) (3)]. It is made available for use in the preparation of reports filed with the Securities and Exhange Commission pursuant to Rule 13f-1 [17 CFR 240.13f-1] under Section 13(f) of the Securities Exchange Act of 1934. An updated list is published on a quarterly basis. This list is current as of March 15, 2004, and may be relied on by institutional investment managers filing Form 13F reports for the calendar quarter ending March 31, 2004. Institutional investment managers should report holdings--number of shares and fair market value--as of the last day of the calendar quarter as required by Section 13(f)(1) and Rule 13f-1 thereunder. -

Forename: Surname

Title: Forename: Surname: Representing: Self Organisation (if applicable): Email: What additional details do you want to keep confidential? : Keep name confidential If you want part of your response kept confidential, which parts? : Ofcom may publish a response summary: Yes I confirm that I have read the declaration: Yes Additional comments: My latest views on ITV's proposals...with a new idea that could potentially incorporating their idea. Question 1: Do you agree that the existing obligations on Channel 3 and Channel 5 licensees in respect of national and international news and current affairs, original productions, and Out of London productions should be maintained at their current levels? If not, what levels do you consider appropriate, and why? : My current feeling is that as part of the Regional News proposal (that incorporates ITV's) below, I feel the English Pan-regions (excluding the Border region) should receive 30 minutes Non-News Current Affairs programming for 40 weeks per year. This would mean a new 30 minute programme for the following Pan-Regions - ITV LONDON, ITV MERIDIAN, ITV WESTCOUNTRY, ITV CENTRAL, ITV ANGLIA, ITV GRANADA, ITV YORKSHIRE & ITV TYNE TEES. The other proposals that the Channel 3 franchises have come up with for the ITV BORDER, ITV WALES, ITV CHANNEL ISLANDS, STV AND UTV franchises seem realistic to me. Question 2: Do you agree with ITV’s proposals for changes to its regional news arrangements in England, including an increase in the number of news regions in order to provide a more localised service, coupled with a reduction in overall news minutage? : Yes if the Regions work something like this.. -

LMRC ‘Re-Tweeted’ the St

Campaign The Levenmouth Rail Campaign Update 37 Newsletter January “ More Than Just a Railway ! ” 2018 Happy New Year, Everyone - Enjoy 2018! “More Than Just a Railway!” ———————————–—————————————————————— New Slogan … and Plenty of New Campaign Strategies “A F I R S T - C L A S S P r e se n t a t i o n f r o m @Playfair15 tonight - lots of well—evidenced analysis and useful recommendations! ….. .... … .. ” — That was how the Above: The Playfair Consulting LMRC ‘re-tweeted’ the St. Group brief LMRC members at their meeting on Tuesday, 28th. November. Andrews-based Playfair Consulting Group for their impressive display at the TheDundee-Levenmouthfinal meeting of 2017 at Fife College, on Methil- Dundee, and its famous haven Road, Buckhaven. Tay railway bridge. The LMRC, and the Connection IImage:: Wiikiidata.. ‘News’ editor Alistair Ayn- scough, thank all of them LAST MONTH The LevenMouth Rail for all that sterling work! Campaign met up with their new He has already adopted the new LMRC campaign ‘mentors’, Playfair Consulting Group, and also Dundee Council ’s transport slogan ‘More Than Just a officials, for an important get together, to Railway’ for these news- discuss just how the Levenmouth rail link letters’ main title-banners. might benefit Dundee in future, and not connection could reduce Dundee’s likely The meeting, on Tues- day, 28th. November, was just Levenmouth. Gregor Hamilton, Head benefits but, by calling at a ‘minor’ plat- to set out new campaign of the Council ’s Planning and Economic form at one or other of the stations -

FTSE Factsheet

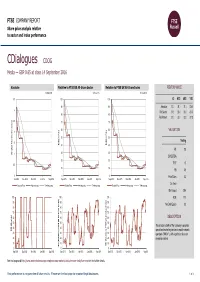

FTSE COMPANY REPORT Share price analysis relative to sector and index performance Data as at: 14 September 2016 CDialogues CDOG Media — GBP 0.65 at close 14 September 2016 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 14-Sep-2016 14-Sep-2016 14-Sep-2016 3.5 100 100 1D WTD MTD YTD 90 90 Absolute 31.3 31.3 31.3 -23.5 3 Rel.Sector 31.5 33.0 33.2 -24.0 80 80 Rel.Market 31.2 33.3 33.2 -27.8 2.5 70 70 60 60 VALUATION 2 (local currency) (local 50 50 Trailing 1.5 Relative Price 40 Relative Price 40 PE 2.8 30 30 Absolute Price Price Absolute 1 EV/EBITDA - 20 20 0.5 PCF 1.0 10 10 PB 0.5 0 0 0 Price/Sales 0.3 Sep-2015 Dec-2015 Mar-2016 Jun-2016 Sep-2016 Sep-2015 Dec-2015 Mar-2016 Jun-2016 Sep-2016 Sep-2015 Dec-2015 Mar-2016 Jun-2016 Sep-2016 Div Yield - Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Div Payout 29.4 100 100 100 ROE 17.7 90 90 90 Net Debt/Equity 0.0 80 80 80 70 70 70 60 60 60 DESCRIPTION 50 50 50 The principal activity of the Company is provides 40 40 40 RSI (Absolute) RSI specialised marketing services to mobile network 30 30 30 operators ("MNOs" ), with a particular focus on 20 20 20 emerging markets. -

Registrations of Cultivars

Published July, 2004 REGISTRATIONS OF CULTIVARS Registration of ‘Ok102’ Wheat determined in replicated variety trials in Oklahoma in 2001 and 2002. Across seven environments, fall forage production ‘Ok102’ (Reg. no. CV-941, PI 632635) is a hard red winter (measured by hand clipping at the soil surface in December, wheat (Triticum aestivum L.) developed cooperatively by the Feekes stages 2–4) averaged 2610 kg haϪ1 for Ok102, com- Oklahoma Agric. Exp. Stn. and the USDA-ARS. Ok102 was pared with 2710 kg haϪ1 for Ok101, 2790 kg haϪ1 for 2174, released in March 2002, primarily on the basis of its resistance and 2770 kg haϪ1 for Jagger. Across 40 site-years representing to several foliar diseases, excellent milling quality, and desir- mostly grain-only trials, grain yield of these four cultivars were able dough strength for leavened bread products. 3000 kg haϪ1 (Ok102), 2990 kg haϪ1 (Ok101), 2920 kg haϪ1 Ok102 was derived from the cross ‘2174’/‘Cimarron’ (PI (2174), and 3020 kg haϪ1 (Jagger). From the same trials, grain 536993), performed in 1991. 2174 has the pedigree IL71-5662/ volume weight averaged 763 kg mϪ3 (Ok102), 746 kg mϪ3 ‘PL145’ (PI 600840)//‘2165’ and was released by the Oklahoma (Ok101), 768 kg mϪ3 (2174), and 748 kg mϪ3 (Jagger). Agric. Exp. Stn. in 1997. Cimarron has the pedigree ‘Payne’ In greenhouse tests, juvenile plants of Ok102 exhibited a (CItr 17717)*2/CO725052 and was released by the Oklahoma susceptible reaction to leaf rust comprised of bulk samples of Agric. Exp. Stn. in 1990. Ok102 traces to the bulk progeny of urediniospores collected from wheat fields in Oklahoma in a single F3:4 head row harvested in 1995.