Annual Report 2016 TODAY ANNUAL REPORT 2016

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Best Year

Carlsberg Brewery Malaysia Berhad (9210-K) Berhad Malaysia Brewery Carlsberg Annual Report 2018 Annual Report PROBABLY THE BEST Carlsberg Brewery Malaysia Berhad (9210-K) No. 55, Persiaran Selangor, Section 15 40200 Shah Alam, Selangor Darul Ehsan, Malaysia Tel : +603 5522 6688 Fax : +603 5519 1931 YEAR www.carlsbergmalaysia.com.my ANNUAL REPORT 2018 TABLE OF CONTENTS 2 Carlsberg Malaysia Group at a Glance 90 Audit & Risk Management Committee Report 4 Our Winning Portfolio of Brands 93 Responsibility Statement 6 Probably The Best Year by the Board of Directors 8 2018 Brand Highlights 94 Financial Statements 28 Chairman’s Address 183 Carlsberg Malaysia’s Sales Offices 30 Managing Director’s Message and 184 Particulars of Group Properties Management Discussion & Analysis 185 Analysis of Shareholdings 40 Sustainability Statement 187 Material Contracts 64 Management Team 188 List of Recurrent Related Party Transactions 66 Profile of Management eamT 190 Notice of Annual General Meeting 68 Profile of the Directors 195 Statement Accompanying Notice of Annual 72 Corporate Governance Overview Statement General Meeting 86 Statement on Risk Management Form of Proxy & Internal Control Corporate Information COVER RATIONALE This year’s theme of Probably the Best Year reflects the success we enjoyed on several fronts. We recorded strong top- and bottom-line growth as our mainstream, premium, craft and cider brands all grew. We delivered considerable value for shareholders with total declared and proposed dividends of 100.0 sen per ordinary share, driven by a 25.3% growth in net profit*. *Net profit refers to Group’s profit attributable to shareholders of the Company ANNUAL REPORT 2018 CARLSBERG +7.4% +25.3% +14.6%* FREE MALAYSIA GROUP NET PROFIT REVENUE CASH FLOW RM1.98 bil AT A GLANCE RM277.2 mil RM328.0 mil 100% Ownership 100% Ownership 51% Ownership MALAYSIA Carlsberg Marketing Sdn. -

Q 2 Shareholder M Agazine a Ugust 2013

Q2 Shareholder Magazine August 2013 WorldReginfo - a00da095-b474-43bf-a8db-f2f5b26cb8fd Q2 August 2013 3 Photo front page: GreenFest Russia The Tuborg brand is closely connected with music and sponsors music events across a large number of Carlsberg’s markets. The DEAR CARLSBERG Tuborg GreenFest is an annual series of rock music events which has Tuborg as its main sponsor. Read more on page 9. SHAREHOLDER Welcome to this edition of News! focused and by improving our ability to commercialise our ideas and knowledge. CONTENTS In the first half year, we grew our earnings In this edition of News, we have dedicated despite tough European markets. Asia con- four pages to shed more light on how we tinued its strong performance, supported work with innovation and provide exam- by strong growth from our international ples of recent innovations in our markets. premium brands. In Russia, we increased Please see pages 4-7. 03 CEO statement our market share in a declining beer 04 Innovation – the legacy and the future market, which continued to be impacted The Carlsberg Group has a long tradi- 06 A taste of Carlsberg Group innovations closure of non-permanent outlets and tion for sponsorships and they play an slower economic growth. In Western important part in our marketing efforts. 08 Sponsorship – it’s all about passion Europe, our market share remained flat, We consider sponsorships an efficient and 10 A glimpse of Carlsberg Group Jørgen a solid performance bearing in mind the engaging way of building brand awareness 13 Financial Statements as at 30 June 2013 Buhl Rasmussen difficult economic environment and tough and communicating with our consumers. -

Annual Report 2013 Management Financial Review Statements

Annual Report 2013 Management Financial review statements 3 The Carlsberg Group at a glance 54 Consolidated financial statements 8 Letter from the Chairman 140 Parent Company 9 Statement from the CEO 160 Management statement 12 In the spotlight: Supply chain 161 Auditors’ report 13 Our regions 19 In the spotlight: China 20 Our business model and Strategy Wheel 21 KPIs 22 Strategy 28 CSR in the value chain 29 CSR targets 30 In the spotlight: Self-regulation 31 Risk management 35 In the spotlight: Sponsorships 36 Corporate governance 43 Remuneration report 49 Executive Committee 50 Shareholder information 52 Financial review 162 Supervisory Board DISCLAIMER This Annual Report contains forward-looking may contain the words “believe, anticipate, then current expectations or forecasts. Such actual results to differ materially from those distribution-related issues, information tech- not be possible for management to predict all statements, including statements about the expect, estimate, intend, plan, project, will be, information is subject to the risk that such expressed in its forward-looking statements nology failures, breach or unexpected termina- such risk factors, nor to assess the impact of Group’s sales, revenues, earnings, spending, will continue, will result, could, may, might”, expectations or forecasts, or the assumptions include, but are not limited to: economic and tion of contracts, price reductions resulting all such risk factors on the Group’s business or margins, cash flow, inventory, products, or any variations of such words or other words underlying such expectations or forecasts, may political uncertainty (including interest rates from market-driven price reductions, market the extent to which any individual risk factor, actions, plans, strategies, objectives and with similar meanings. -

The Journal of the International Association for Bon Research

THE JOURNAL OF THE INTERNATIONAL ASSOCIATION FOR BON RESEARCH ✴ LA REVUE DE L’ASSOCIATION INTERNATIONALE POUR LA RECHERCHE SUR LE BÖN New Horizons in Bon Studies 3 Inaugural Issue Volume 1 – Issue 1 The International Association for Bon Research L’association pour la recherche sur le Bön c/o Dr J.F. Marc des Jardins Department of Religion, Concordia University 1455 de Maisonneuve Ouest, R205 Montreal, Quebec H3G 1M8 Logo: “Gshen rab mi bo descending to Earth as a Coucou bird” by Agnieszka Helman-Wazny Copyright © 2013 The International Association for Bon Research ISSN: 2291-8663 THE JOURNAL OF THE INTERNATIONAL ASSOCIATION FOR BON RESEARCH – LA REVUE DE L’ASSOCIATION INTERNATIONALE POUR LA RECHERCHE SUR LE BÖN (JIABR-RAIRB) Inaugural Issue – Première parution December 2013 – Décembre 2013 Chief editor: J.F. Marc des Jardins Editor of this issue: Nathan W. Hill Editorial Board: Samten G. Karmay (CNRS); Nathan Hill (SOAS); Charles Ramble (EPHE, CNRS); Tsering Thar (Minzu University of China); J.F. Marc des Jardins (Concordia). Introduction: The JIABR – RAIBR is the yearly publication of the International Association for Bon Research. The IABR is a non-profit organisation registered under the Federal Canadian Registrar (DATE). IABR - AIRB is an association dedicated to the study and the promotion of research on the Tibetan Bön religion. It is an association of dedicated researchers who engage in the critical analysis and research on Bön according to commonly accepted scientific criteria in scientific institutes. The fields of studies represented by our members encompass the different academic disciplines found in Humanities, Social Sciences and other connected specialities. -

Sri Lanka a Handbook for US Fulbright Grantees

Welcome to Sri Lanka A Handbook for US Fulbright Grantees US – SL Fulbright Commission (US-SLFC) 55 Abdul Cafoor Mawatha Colombo 3 Sri Lanka Tel: + 94-11-256-4176 Fax: + 94-11-256-4153 Email: [email protected] Website: www.fulbrightsrilanka.com Contents Map of Sri Lanka Welcome Sri Lanka: General Information Facts Sri Lanka: An Overview Educational System Pre-departure Official Grantee Status Obtaining your Visa Travel Things to Bring Health & Medical Insurance Customs Clearance Use of the Diplomatic pouch Preparing for change Recommended Reading/Resources In Country Arrival Welcome-pack Orientation Jet Lag Coping with the Tropical Climate Map of Colombo What’s Where in Colombo Restaurants Transport Housing Money Matters Banks Communication Shipping goods home Health Senior Scholars with Families Things to Do Life and Work in Sri Lanka The US Scholar in Sri Lanka Midterm and Final Reports Shopping Useful Telephone Numbers Your Feedback Appendix: Domestic Notes for Sri Lanka (Compiled by U.S. Fulbrighters 2008-09) The cover depicts a Sandakadaphana; the intricately curved stone base built into the foot of the entrances to buildings of ancient kingdoms. The stone derives it’s Sinhala name from its resemblance to the shape of a half-moon and each motif symbolises a concept in Buddhism. The oldest and most intricately craved Sandakadaphana belongs to the Anuradhapura Kingdom. 2 “My preparation for this long trip unearthed an assortment of information about Sri Lanka that was hard to synthesize – history, religions, laws, nature and ethnic conflict on the one hand and names, advice, maps and travel tips on the other. -

“Inelastic Proxy for Consumption Growth”

“Inelastic Proxy for Consumption Growth” Liquor Sector in Sri Lanka March 2016 Analyst- Hiruni Perera [email protected] 011 5889809 LOLC Securities Limited (An LOLC Group Company) Contents Investment Case Industry Dynamics Liquor industry to reap benefits from expected increase in GDP Inelastic demand for Arrack consumption Arrack Consumption to maintain a modest growth of 1.7% Inelastic demand for malt liquor (Beer) consumption Beer consumption growth to slow with recent excise duty hike Excise duty for 1% of alc. strength of Beer > Excise duty paid for 1% of alc. strength of Arrack However demand growth for Beer to outpace growth for Arrack in mid-long term We estimate 4% growth in total recorded liquor consumption for 2016 Growth in tourism can be a key catalyst for the growth in the liquor sector LOLC Securities Limited | Sector Research 2 Contents contd. Industry Dynamics contd. A gradual reduction in the illicit and illegal liquor consumption Budget 2016 is trending positive for big players Excise duty on liquor to play an important role in the Gvt. Fiscal revenue Less likelihood of a complete ban of liquor in Sri Lanka However certain countries exists in the world with prohibition of liquor Tight regulations to govern the liquor industry in Sri Lanka Cultural and demographic factors to influence liquor consumption We estimate liquor consumers to represent 25% of population Key Players in the industry Appendices LOLC Securities Limited | Sector Research 3 Investment Case LOLC Securities Limited | Sector Research 4 Investment Case Inelastic proxy for consumption growth……. Liquor consumption in Sri Lanka is expected to be supported from the increase in GDP per capita income due to its strong positive correlation between total liquor consumption and GDP. -

Puttalam Lagoon System an Environmental and Fisheries Profile

REGIONAL FISHERIES LIVELIHOODS PROGRAMME FOR SOUTH AND SOUTHEAST ASIA (RFLP) --------------------------------------------------------- An Environmental and Fisheries Profile of the Puttalam Lagoon System (Activity 1.4.1 : Consolidate and finalize reports on physio-chemical, geo-morphological, socio-economic, fisheries, environmental and land use associated with the Puttalam lagoon ecosystem) For the Regional Fisheries Livelihoods Programme for South and Southeast Asia Prepared by Sriyanie Miththapala (compiler) IUCN, International Union for Conservation of Nature, Sri Lanka Country Office October 2011 REGIONAL FISHERIES LIVELIHOODS PROGRAMME FOR SOUTH AND SOUTHEAST ASIA (RFLP) – SRI LANKA An Environmental and Fisheries Profile of the Puttalam Lagoon System (Activity 1.4.1- Consolidate and finalize reports on physio-chemical, geo-morphological, socio-economic, fisheries, environment and land use associated with Puttalam lagoon ecosystem) For the Regional Fisheries Livelihoods Programme for South and Southeast Asia Prepared by Sriyanie Miththapala (compiler) IUCN, International Union for Conservation of Nature, Sri Lanka Country Office October 2011 i Disclaimer and copyright text This publication has been made with the financial support of the Spanish Agency of International Cooperation for Development (AECID) through an FAO trust-fund project, the Regional Fisheries Livelihoods Programme (RFLP) for South and Southeast Asia. The content of this publication does not necessarily reflect the opinion of FAO, AECID, or RFLP. All rights reserved. Reproduction and dissemination of material in this information product for educational and other non-commercial purposes are authorized without any prior written permission from the copyright holders provided the source is fully acknowledged. Reproduction of material in this information product for resale or other commercial purposes is prohibited without written permission of the copyright holders. -

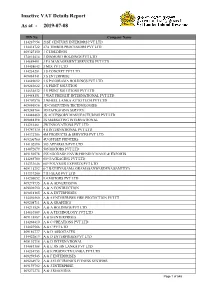

Inactive VAT Details Report As at - 2019-07-08

Inactive VAT Details Report As at - 2019-07-08 TIN No Company Name 114287954 21ST CENTURY INTERIORS PVT LTD 114418722 27A TIMBER PROCESSORS PVT LTD 409327150 3 C HOLDINGS 174814414 3 DIAMOND HOLDINGS PVT LTD 114689491 3 FA MANAGEMENT SERVICES PVT LTD 114458643 3 MIX PVT LTD 114234281 3 S CONCEPT PVT LTD 409084141 3 S ENTERPRISE 114689092 3 S PANORAMA HOLDINGS PVT LTD 409243622 3 S PRINT SOLUTION 114634832 3 S PRINT SOLUTIONS PVT LTD 114488151 3 WAY FREIGHT INTERNATIONAL PVT LTD 114707570 3 WHEEL LANKA AUTO TECH PVT LTD 409086896 3D COMPUTING TECHNOLOGIES 409248764 3D PACKAGING SERVICE 114448460 3S ACCESSORY MANUFACTURING PVT LTD 409088198 3S MARKETING INTERNATIONAL 114251461 3W INNOVATIONS PVT LTD 114747130 4 S INTERNATIONAL PVT LTD 114372706 4M PRODUCTS & SERVICES PVT LTD 409206760 4U OFFSET PRINTERS 114102890 505 APPAREL'S PVT LTD 114072079 505 MOTORS PVT LTD 409150578 555 EGODAGE ENVIR;FRENDLY MANU;& EXPORTS 114265780 609 PACKAGING PVT LTD 114333646 609 POLYMER EXPORTS PVT LTD 409115292 6-7 BATHIYAGAMA GRAMASANWARDENA SAMITIYA 114337200 7TH GEAR PVT LTD 114205052 9.4.MOTORS PVT LTD 409274935 A & A ADVERTISING 409096590 A & A CONTRUCTION 409018165 A & A ENTERPRISES 114456560 A & A ENTERPRISES FIRE PROTECTION PVT LT 409208711 A & A GRAPHICS 114211524 A & A HOLDINGS PVT LTD 114610569 A & A TECHNOLOGY PVT LTD 409118887 A & B ENTERPRISES 114268410 A & C CREATIONS PVT LTD 114023566 A & C PVT LTD 409186777 A & D ASSOCIATES 114422819 A & D ENTERPRISES PVT LTD 409192718 A & D INTERNATIONAL 114081388 A & E JIN JIN LANKA PVT LTD 114234753 A & -

Cargills (Ceylon) PLC (CARG.N0000)

Sri Lanka | Beverage, Food & Tobacco EQUITY RESEARCH Initiation of coverage 19 December 2013 Cargills (Ceylon) PLC (CARG.N0000) A consumption play Cargills (Ceylon) PLC (CARG) is the largest organized food retailer by market Key statistics capitalization listed on the Colombo Stock Exchange (CSE), and also CSE/Bloomberg tickers CARG.N0000/CARG SL manufactures a range of fast-moving consumer goods (FMCG) and operates a Share price (18 Dec 2013) LKR149 fast-food chain. The company is majority owned by its parent company CT No. of issued shares (m) 224 Holdings PLC (CTHR), itself one of the largest traded conglomerates on the Market cap (USDm) 258 CSE. We expect the typical signs of consumption growth, such as rising GDP Enterprise value (USDm) 363 and private consumption expenditure, to support CARG’s revenue growth, at Free float (%) 20.5% an 11.3% CAGR over FY14E-FY16E. We also forecast CARG’s EBIT margin to 52-week range (H/L) LKR184/143 expand to 4.3% in FY16E from 4.1% in FY13. Margin development across all Avg. daily vol. (shares,1yr) 43,098 segments is likely to be tempered by persisting high operating costs, Avg. daily turnover (USD 55 particularly electricity and fuel expenses, as well as currently underwhelming ‘000) results from the brewery and biscuits businesses. CARG’s debt and gearing Source: CSE, Bloomberg levels in the past three years have risen due to a string of acquisitions and Note: USD/LKR=129.1 (average for the one year ended 18 investments to expand capacity of several product lines. Our SOTP and P/E December 2013) analyses yield a valuation range of LKR110-149, compared with the share price of LKR149 as of 18 December 2013. -

Sri Lankan Spring Supper

SRI LANKAN SPRING SUPPER Butternut squash, green kale & raw green mango patty empanadas, tamarind mayo Black pepper pulled pork shoulder, kithul and elderflower caramel Aubergine and jaggery moju Northern turmeric dahl, tempered onion & black mustard seeds Burnt pork crackling coconut pol sambol Smoked coconut yoghurt Green tea and jasmine cucumber, chilli capsicum, Spanish black & daikon radish pickles Roast paan bread, seeni sambol butter Muthu Samba rice – Arrack, cinnamon & coconut kiri-bath rice pudding, candied pistachios Fresh Sri Lankan ginger beer Sri Lankan Spring Supper by Hōtal Paradise 4. When you are ready for your main course, empty the pork into a saucepan and place over a medium heat. Add 20ml of water 35 minutes A fiery, modern riff on the traditional to loosen the meat. Cook for 10-15 minutes, stirring occasionally. Dutch-Burgher Lamprais. Serves 2 5. Empty the dahl into a small saucepan, add a splash of water and warm over a medium heat for 5-7 minutes. Halfway through, add the onion and black mustard seed temper and stir to combine. In the Box Give the instructions a read through to familiarise yourself with the process before you start. Moju 6. Place the paan bread under the grill and lightly toast on both sides. Cut into slices and plate with the seeni sambol butter . Muthu samba rice Remove aubergine moju and seeni sambol butter Empanadas from the fridge to allow to come to room temperature. 7. The aubergine moju can either be enjoyed at room temperature or heated in the microwave for 90 seconds according to preference. -

Glassmaking Trends in Malaysia

Focus ASEAN Glassmaking trends in Malaysia Malaysia has emerged as an important player for flat glass manufacture in recent times, the arrival of leading Chinese producers contributing to the nation becoming one of the region’s leading players. In comparison, glass container production/demand has failed to grow in parallel, as Sunder Singh explains. With a population of nearly 32 million Three producers in each of in 2018, Malaysia is the smallest the two major segments cater for among four major South East Asian Malaysian flat and container glass countries. It has the highest per capita demand. In recent years, Chinese income of the four, however. The glass producers have invested heavily country’s flat and hollow glass industry in the country’s flat and downstream has benefited from steady economic glass processing activities. growth, averaging above 5% for the Addressing the Malaysian media past five years, leading to higher per recently, Ms Woo Wan Zheng, capita income and reducing already President of the Malaysia Glass low poverty levels. Association said: “The glass industry Malaysia also has some of the needs to push for new technology to best ingredients for the development improve glass (product mix) quality. of flat and container glass production The industry is doing well, with a lot in the future. The country has a young of players in the market providing population with 17% in the 15-24 year healthy competition. It keeps all age group and 41% in the 25-54 age players on their toes and may help band. About half of the population them to innovate their products.The is in the middle to high income second thing we would have to note Flat glass industry group, with growing purchasing (to improve the industry) would be to The Malaysian flat glass industry has witnessed one of the power. -

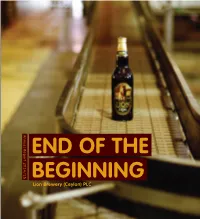

Annual Report 2014/15

Annual Report 2014/15 | ReportAnnual 2014/15 Lion Brewery (Ceylon) PLC Lion Brewery Annual ReportAnnual 2014/15 END OF THE BEGINNING Lion Brewery (Ceylon) PLC Read the Lion Brewery (Ceylon) PLC Annual Report 2014/15 online 1 Annual Report 2014/15 END OF THE BEGINNING Lion Brewery was incorporated in 1996 as a joint venture between Ceylon Brewery (now known as Ceylon Beverage Holdings PLC) and the global brewing giant Carlsberg. Today its portfolio includes a trio of Lion brands, widely acclaimed as Sri Lanka’s finest beers and Carlsberg & Carlsberg Special Brew, which are brewed and marketed under license. Both the Lion and Carlsberg claim to heritage of over a century in brewing excellence and market leadership. Recently Lion Brewery acquired the Three Coins and Sando portfolio and with it a range of brands that have served Sri Lankan consumers for well over 5 decades. In its formative years, Lion has built a strong foundation to grasp the opportunities that lie ahead. It has remained true to its rich heritage of brewing excellence but has nevertheless modernised to remain relevant to the 21st century. Lion has an aggressive and creative corporate culture that is driven by consumer needs and supported by a truly state of the art manufacturing facility and supply chain excellence. It may operate in the most regulated industry in the Country, but this is a challenge its talented team thrives on as they strive to exceed stakeholder expectations. At Lion the journey is never ending. Perfection is said to be unattainable but it doesn’t stop us from seeking it.