GVC Holdings PLC (“GVC” Or the “Company” and Together with Its Subsidiary Undertakings, the “Group”)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Condominiums and Shared Sovereignty | 1

Condominiums and Shared Sovereignty | 1 Condominiums And Shared Sovereignty Abstract As the United Kingdom (UK) voted to leave the European Union (EU), the future of Gibraltar, appears to be in peril. Like Northern Ireland, Gibraltar borders with EU territory and strongly relies on its ties with Spain for its economic stability, transports and energy supplies. Although the Gibraltarian government is struggling to preserve both its autonomy with British sovereignty and accession to the European Union, the Spanish government states that only a form of joint- sovereignty would save Gibraltar from the same destiny as the rest of UK in case of complete withdrawal from the EU, without any accession to the European Economic Area (Hard Brexit). The purpose of this paper is to present the concept of Condominium as a federal political system based on joint-sovereignty and, by presenting the existing case of Condominiums (i.e. Andorra). The paper will assess if there are margins for applying a Condominium solution to Gibraltar. Condominiums and Shared Sovereignty | 2 Condominium in History and Political Theory The Latin word condominium comes from the union of the Latin prefix con (from cum, with) and the word dominium (rule). Watts (2008: 11) mentioned condominiums among one of the forms of federal political systems. As the word suggests, it is a form of shared sovereignty involving two or more external parts exercising a joint form of sovereignty over the same area, sometimes in the form of direct control, and sometimes while conceding or maintaining forms of self-government on the subject area, occasionally in a relationship of suzerainty (Shepheard, 1899). -

Hearing on the Report of the Chief Justice of Gibraltar

[2009] UKPC 43 Privy Council No 0016 of 2009 HEARING ON THE REPORT OF THE CHIEF JUSTICE OF GIBRALTAR REFERRAL UNDER SECTION 4 OF THE JUDICIAL COMMITTEE ACT 1833 before Lord Phillips Lord Hope Lord Rodger Lady Hale Lord Brown Lord Judge Lord Clarke ADVICE DELIVERED ON 12 November 2009 Heard on 15,16, 17, and 18 June 2009 Chief Justice of Gibraltar Governor of Gibraltar Michael Beloff QC Timothy Otty QC Paul Stanley (Instructed by Clifford (Instructed by Charles Chance LLP) Gomez & Co and Carter Ruck) Government of Gibraltar James Eadie QC (Instructed by R J M Garcia) LORD PHILLIPS : 1. The task of the Committee is to advise Her Majesty whether The Hon. Mr Justice Schofield, Chief Justice of Gibraltar, should be removed from office by reason of inability to discharge the functions of his office or for misbehaviour. The independence of the judiciary requires that a judge should never be removed without good cause and that the question of removal be determined by an appropriate independent and impartial tribunal. This principle applies with particular force where the judge in question is a Chief Justice. In this case the latter requirement has been abundantly satisfied both by the composition of the Tribunal that conducted the initial enquiry into the relevant facts and by the composition of this Committee. This is the advice of the majority of the Committee, namely, Lord Phillips, Lord Brown, Lord Judge and Lord Clarke. Security of tenure of judicial office under the Constitution 2. Gibraltar has two senior judges, the Chief Justice and a second Puisne Judge. -

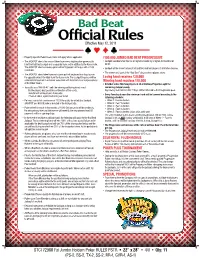

Official Rules Effective May 12, 2011

Bad Beat Official Rules Effective May 12, 2011 • Property Specific Poker Room Rules will apply where applicable. $100,000 JUMBO BAD BEAT PROGRESSIVE • The JACKPOT rake is the amount taken from every eligible poker game pot to • Jackpot awarded when four 6s or higher is beaten by a higher 4-Of-A-Kind or fund the Bad Beat Jackpot and is separate from and in addition to the House rake. better. $ The JACKPOT rake from every game will be 10 percent of the pot with a 1.00 • Jackpot will be shared amongst all qualified Hold’em players at all Station Casinos. maximum. • The winner and loser of the “Bad Beat” also receive a players share. • The JACKPOT rakes taken from each game pot will be placed in a drop box on the opposite side of the table from the house rake. The Jackpot Drop box will be Losing hand receives $30,000 collected and counted in a manner consistent with the internal control procedures Winning hand receives $20,000 of the Poker Room. • All other active Hold'em players at all of Stations Properties split the • To qualify as a “BAD BEAT” both the winning and losing hands must: remaining Jackpot evenly. Be the player’s best possible combination of five cards. Any money not claimed after 7 Days will be returned to the Progressive pool. Include both of the player’s hole cards: • Every Tuesday at noon the minimum hand will be lowered according to the If four of a kind, a pair must be in your hand. -

Part 05.Indd

PART MISCELLANEOUS 5 TOPICS Awards and Honours Y NATIONAL AWARDS NATIONAL COMMUNAL Mohd. Hanif Khan Shastri and the HARMONY AWARDS 2009 Center for Human Rights and Social (announced in January 2010) Welfare, Rajasthan MOORTI DEVI AWARD Union law Minister Verrappa Moily KOYA NATIONAL JOURNALISM A G Noorani and NDTV Group AWARD 2009 Editor Barkha Dutt. LAL BAHADUR SHASTRI Sunil Mittal AWARD 2009 KALINGA PRIZE (UNESCO’S) Renowned scientist Yash Pal jointly with Prof Trinh Xuan Thuan of Vietnam RAJIV GANDHI NATIONAL GAIL (India) for the large scale QUALITY AWARD manufacturing industries category OLOF PLAME PRIZE 2009 Carsten Jensen NAYUDAMMA AWARD 2009 V. K. Saraswat MALCOLM ADISESHIAH Dr C.P. Chandrasekhar of Centre AWARD 2009 for Economic Studies and Planning, School of Social Sciences, Jawaharlal Nehru University, New Delhi. INDU SHARMA KATHA SAMMAN Mr Mohan Rana and Mr Bhagwan AWARD 2009 Dass Morwal PHALKE RATAN AWARD 2009 Actor Manoj Kumar SHANTI SWARUP BHATNAGAR Charusita Chakravarti – IIT Delhi, AWARDS 2008-2009 Santosh G. Honavar – L.V. Prasad Eye Institute; S.K. Satheesh –Indian Institute of Science; Amitabh Joshi and Bhaskar Shah – Biological Science; Giridhar Madras and Jayant Ramaswamy Harsita – Eengineering Science; R. Gopakumar and A. Dhar- Physical Science; Narayanswamy Jayraman – Chemical Science, and Verapally Suresh – Mathematical Science. NATIONAL MINORITY RIGHTS MM Tirmizi, advocate – Gujarat AWARD 2009 High Court 55th Filmfare Awards Best Actor (Male) Amitabh Bachchan–Paa; (Female) Vidya Balan–Paa Best Film 3 Idiots; Best Director Rajkumar Hirani–3 Idiots; Best Story Abhijat Joshi, Rajkumar Hirani–3 Idiots Best Actor in a Supporting Role (Male) Boman Irani–3 Idiots; (Female) Kalki Koechlin–Dev D Best Screenplay Rajkumar Hirani, Vidhu Vinod Chopra, Abhijat Joshi–3 Idiots; Best Choreography Bosco-Caesar–Chor Bazaari Love Aaj Kal Best Dialogue Rajkumar Hirani, Vidhu Vinod Chopra–3 idiots Best Cinematography Rajeev Rai–Dev D Life- time Achievement Award Shashi Kapoor–Khayyam R D Burman Music Award Amit Tivedi. -

Site Review: Innovation

Site Review: Website: www.americascardroom.eu Americas Cardroom has brought the excitement of online poker back to the USA! Americas Cardroom has grown rapidly over the past several years, bringing players back to the glory days of online poker in the US through unique incentives and promotions. They are the only US facing site to offer The Million Dollar Sunday $1,000,000 GTD poker tournaments while hosting a weekly progressive rake race for both cash game and Sit & Go players. Americas Cardroom is truly living up to its name as being the online poker site that US players can trust. As the flagship skin of the Winning Poker Network, Americas Cardroom has already grown into one of the top communities for US poker players thanks to its no-nonsense deposits, quick payouts and high tournament guarantees. Reasons to join America’s Cardroom - Rated fastest Payouts in the industry - US players Accepted - WSOP Qualifiers - Million Dollar Sundays $1,000,000 GTD Tournaments - The only site with weekly progressive rake races for sit & go’s and cash games - Now accepts Bitcoin for Deposits and Withdrawals Poker Network: THE WINNING POKER NETWORK (WPN) Innovation $1,000,000 GTD Million Dollar Sundays -Americas Cardroom brought back the glory days of poker to the US market in 2015 with $1,000,000 GTD Million Dollar Sunday tournaments. More are on tap for 2016 with the next one scheduled for April 24th at 4pm ET. They are the only US facing network to offer tournaments close to this magnitude. Tournament Series-Americas Cardroom runs numerous online poker tournament series throughout each year. -

The Sovereignty of the Crown Dependencies and the British Overseas Territories in the Brexit Era

Island Studies Journal, 15(1), 2020, 151-168 The sovereignty of the Crown Dependencies and the British Overseas Territories in the Brexit era Maria Mut Bosque School of Law, Universitat Internacional de Catalunya, Spain MINECO DER 2017-86138, Ministry of Economic Affairs & Digital Transformation, Spain Institute of Commonwealth Studies, University of London, UK [email protected] (corresponding author) Abstract: This paper focuses on an analysis of the sovereignty of two territorial entities that have unique relations with the United Kingdom: the Crown Dependencies and the British Overseas Territories (BOTs). Each of these entities includes very different territories, with different legal statuses and varying forms of self-administration and constitutional linkages with the UK. However, they also share similarities and challenges that enable an analysis of these territories as a complete set. The incomplete sovereignty of the Crown Dependencies and BOTs has entailed that all these territories (except Gibraltar) have not been allowed to participate in the 2016 Brexit referendum or in the withdrawal negotiations with the EU. Moreover, it is reasonable to assume that Brexit is not an exceptional situation. In the future there will be more and more relevant international issues for these territories which will remain outside of their direct control, but will have a direct impact on them. Thus, if no adjustments are made to their statuses, these territories will have to keep trusting that the UK will be able to represent their interests at the same level as its own interests. Keywords: Brexit, British Overseas Territories (BOTs), constitutional status, Crown Dependencies, sovereignty https://doi.org/10.24043/isj.114 • Received June 2019, accepted March 2020 © 2020—Institute of Island Studies, University of Prince Edward Island, Canada. -

Commentary on the Bangalore Principles of Judicial Conduct

COMMENTARY ON THE BANGALORE PRINCIPLES OF JUDICIAL CONDUCT THE JUDICIAL INTEGRITY GROUP March 2007 2 CONTENTS PREFACE … 5 ACKNOWLEDGMENTS … 7 DRAFTING HISTORY … 9 PREAMBLE … 19 Value 1: INDEPENDENCE … 35 Value 2: IMPARTIALITY … 53 Value 3: INTEGRITY … 73 Value 4: PROPRIETY … 79 Value 5: EQUALITY … 111 Value 6: COMPETENCE AND DILIGENCE … 119 IMPLEMENTATION … 131 DEFINITIONS … 133 Appendix: CULTURAL AND RELIGIOUS TRADITIONS … 135 SELECT BIBLIOGRAPHY … 147 INDEX … 151 3 4 PREFACE A judiciary of undisputed integrity is the bedrock institution essential for ensuring compliance with democracy and the rule of law. Even when all other protections fail, it provides a bulwark to the public against any encroachments on its rights and freedoms under the law. These observations apply both domestically within the context of each nation State and globally, viewing the global judiciary as one great bastion of the rule of law throughout the world. Ensuring the integrity of the global judiciary is thus a task to which much energy, skill and experience must be devoted. This is precisely what the Judicial Group on Strengthening Judicial Integrity (The Judicial Integrity Group) has sought to do since it set out on this task in 2000. It commenced as an informal group of Chief Justices and Superior Court Judges from around the world who combined their experience and skill with a sense of dedication to this noble task. Since then, its work and achievements have grown to a point where they have made a significant impact on the global judicial scene. The principles tentatively worked out originally have received increasing acceptance over the past few years from the different sectors of the global judiciary and from international agencies interested in the integrity of the judicial process. -

An Overlooked Colonial English of Europe: the Case of Gibraltar

.............................................................................................................................................................................................................WORK IN PROGESS WORK IN PROGRESS TOMASZ PACIORKOWSKI DOI: 10.15290/CR.2018.23.4.05 Adam Mickiewicz University in Poznań An Overlooked Colonial English of Europe: the Case of Gibraltar Abstract. Gibraltar, popularly known as “The Rock”, has been a British overseas territory since the Treaty of Utrecht was signed in 1713. The demographics of this unique colony reflect its turbulent past, with most of the population being of Spanish, Portuguese or Italian origin (Garcia 1994). Additionally, there are prominent minorities of Indians, Maltese, Moroccans and Jews, who have also continued to influence both the culture and the languages spoken in Gibraltar (Kellermann 2001). Despite its status as the only English overseas territory in continental Europe, Gibraltar has so far remained relatively neglected by scholars of sociolinguistics, new dialect formation, and World Englishes. The paper provides a summary of the current state of sociolinguistic research in Gibraltar, focusing on such aspects as identity formation, code-switching, language awareness, language attitudes, and norms. It also delineates a plan for further research on code-switching and national identity following the 2016 Brexit referendum. Keywords: Gibraltar, code-switching, sociolinguistics, New Englishes, dialect formation, Brexit. 1. Introduction Gibraltar is located on the southern tip of the Iberian Peninsula and measures just about 6 square kilometres. This small size, however, belies an extraordinarily complex political history and social fabric. In the Brexit referendum of 23rd of June 2016, the inhabitants of Gibraltar overwhelmingly expressed their willingness to continue belonging to the European Union, yet at the moment it appears that they will be forced to follow the decision of the British govern- ment and leave the EU (Garcia 2016). -

MISS WORLD 2009 - KAIANE ALDORINO (Miss Gibraltar)”

GOVERNMENT OF GIBRALTAR “MISS WORLD 2009 - KAIANE ALDORINO (Miss Gibraltar)” WELCOME HOME CELEBRATION Thursday 17 th December 2009. Programme of Events EVENTS SUMMARY 1. Arrival at Gibraltar Airport. 2. Parade through Main Street. 3. Appearance on City Hall Balcony, John Mackintosh Square. 4. Press Conference at Rock Hotel. 5. Chief Minister’s evening reception at Rock Hotel. 6. Fireworks Display. PROGRAMME DETAILS 1. Airport Arrival . 1.1 KA arrives at Gibraltar Airport on Thursday at 4 pm on a private jet laid on for her by the Government of Gibraltar. 1.2 KA will be greeted at foot of aircraft steps by CM and Mrs Caruana, Minister & Mrs Reyes, and KA’s parents and close family members. CM will hand KA a bouquet of red and white roses (Gibraltar colours). RGR buglers will play a fanfare as she disembarks the plane. 1.3 Facilities will be available for members of the public to welcome her at airport, from a special enclosure on the tarmac next to the aircraft parking stand. Any member of the public wishing to greet KA at the airport must go to the air terminal early, no later than 3.30 pm, as they will have to be taken by bus to the aircraft parking stand. 1.4 Gibraltar flags will be issued to those members of the public attending at the airport, who wish to have them. Members of the public who attend at the airport will have time to reach Main Street to take part in the KA parade. 1.5 After spending a few minutes greeting dignitaries, family and friends, and members of the public present at the airport, KA will retire into Air Terminal to prepare for parade. -

An Evolution in Gambling

Gaming plc Realms Annual ReportAnnual 2014 & Accounts An Evolution in Gambling Gaming Realms plc Annual Report & Accounts 2014 Strategic Report The Group hopes to 01 Highlights 02 Gaming Realms at a Glance 04 Chairman’s Statement become a market leader 06 Market Positioning 08 Our Strategy in the mobile-led casual 10 Chief Executive’s Review 12 Principal Risks and Uncertainties gambling market forecast Corporate Governance 14 Board and Executive to be worth $100bn Management 16 Directors’ Report 17 Statement of Directors’ worldwide in 2 years. Responsibilities 18 Corporate Governance Financial Statements 19 Independent Auditors’ Report 20 Consolidated Statement of Profit and Loss and Other Comprehensive Income 21 Consolidated Statement of Financial Position 22 Consolidated Statement of Cash Flows 23 Consolidated Statement of Changes in Equity 24 Notes to the Consolidated Financial Statements 47 Parent Company Balance Sheet 48 Notes to Parent Company Financial Statements 52 Company Information www.gamingrealms.com Highlights Strategic Report Strategic Operational highlights › Increase of 635% in new real money › Completion of new in-house scalable gambling depositors compared to the platform which includes a feature set previous financial period. to enhance conversion, retention and › Increase of 338% in average daily players monetisation of real money gambling compared to previous financial period. players. › Acquisition of QuickThink Media Limited › Obtained licences from the Alderney and Blueburra Holdings Limited. Gambling Control Commission -

Brexit Referendum in Gibraltar. Result and Effect Northern Ireland7 with the Average Turnout of 70,9%

Białostockie Studia Prawnicze 2019 vol. 24 nr 1 DOI: 10.15290/bsp.2019.24.01.07 Bartłomiej H. Toszek University of Szczecin [email protected] ORCID ID: http://orcid.org/ 0000-0003-2989-7168 Brexit Referendum in Gibraltar. Result and Eff ect Abstract: Almost complete unanimity of the small Gibraltar community during 2016 referendum on Brexit remained nearly unnoticed because of including this British Overseas Territory into “combined electoral region” with South West England where most of people were in favour of the United Kingdom withdrawing from the European Union. No political diff erences with the UK (i.e. England and Wales) but concern about future possibilities of economic development outside the Single Market stimulated an intense discussion among the Gibraltarians. Th e vision of being non-subject of the EU’s four freedoms (i.e. damage or lost present prosperity basis) would force Gibraltar to re-orientate its economic relations especially by creating and developing new trade links which could gradually replace the existing ones. Despite that Gibraltarians have consequently rejected Spanish proposals of remaining inside the Single Market for the price of sharing sovereignty between the UK and Spain. It is therefore beyond doubt that the people of Gibraltar can be characterised as more British than European. Keywords: Brexit, European Union, Gibraltar, United Kingdom Th e specifi city of Gibraltar’s referendum on Brexit expressed itself not only because it was the fi rst time for any British Overseas Territory (BOT) to participate in the United Kingdom-wide referendum but also because the Gibraltarians were straight included in the decision-making process related to one of the most important question in the UK’s modern history. -

Panel Listing

Panel Listing Abdus A Financial Services & Investment Banking professional, majoring in Rujubali Business & Finance as well as Economics, with more than 22 years of industry experience, having worked for a number of top financial institutions in various locations globally, namely Lehman Brothers, Standard Chartered Bank & Barclays Capital in London, New York, Tokyo and Singapore. Strong technical expertise in various traditional investment banking products as well as front to back operations knowledge, a keen supporter and advocator of new technologies and innovations (like Blockchain) that can be used in the financial markets which will enable financial inclusion and create more financial equality. Addy Crezee Bitcoin/Blockchain Enthusiast since 2013. 2014 has become the year of changes when I entered the doors of CoinTelegraph. I was working as the CMO and tried to show my best in developing growth, sales and marketing. In August 2015 I founded my own project Investors' Angel - Blockchain Investments Consultancy agency. Investors' Angel has helped to raise $800k for Blockchain-oriented startups up to this moment. Since August 2016 I have become the CEO at Blockshow by Cointelegraph focused on creating an international platform for founders to showcase their Blockchain solutions. Adrian Yeow Dr. Adrian Yeow is currently a Senior Lecturer at School of Business, Singapore University of Social Sciences (SUSS) where he teaches Accounting Information Systems and Accounting Analytics courses for the full-time Accounting programme. He earned his Ph.D. from R.H. Smith School of Business, University of Maryland, College Park in 2008. Adrian's research and consulting work focuses on the implementation and use of business systems in accounting, healthcare, and financial settings.