The Value Added Tax (Northern Ireland) (EU Exit) Regulations 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Finance Act 1997

Changes to legislation: There are outstanding changes not yet made by the legislation.gov.uk editorial team to Finance Act 1997. Any changes that have already been made by the team appear in the content and are referenced with annotations. (See end of Document for details) View outstanding changes Finance Act 1997 1997 CHAPTER 16 An Act to grant certain duties, to alter other duties, and to amend the law relating to the National Debt and the Public Revenue, and to make further provision in connection with Finance. [19th March 1997] Most Gracious Sovereign, WE, Your Majesty’s most dutiful and loyal subjects, the Commons of the United Kingdom in Parliament assembled, towards raising the necessary supplies to defray Your Majesty’s public expenses, and making an addition to the public revenue, have freely and voluntarily resolved to give and grant unto Your Majesty the several duties hereinafter mentioned; and do therefore most humbly beseech Your Majesty that it may be enacted, and be it enacted by the Queen’s most Excellent Majesty, by and with the advice and consent of the Lords Spiritual and Temporal, and Commons, in this present Parliament assembled, and by the authority of the same, as follows:— PART I EXCISE DUTIES Alcoholic liquor duties 1 Rates of duty on spirits and wines of equivalent strength. (1) In section 5 of the M1Alcoholic Liquor Duties Act 1979 (spirits), for “£19.78” there shall be substituted “ £18.99 ”. (2) In Part II of the Table of rates of duty in Schedule 1 to that Act (wine or made-wine of a strength exceeding 22 per cent.), for “19.78” there shall be substituted “ 18.99 ”. -

IRC V. Willoughby

HOUSE OF LORDS Lord Nolan Lord Mustill Lord Hoffmann Lord Clyde Lord Hutton OPINIONS OF THE LORDS OF APPEAL FOR JUDGMENT IN THE CAUSE COMMISSIONERS OF INLAND REVENUE (APPELLANTS) v. WILLOUGHBY (RESPONDENT) (FIRST APPEAL) COMMISSIONERS OF INLAND REVENUE (APPELLANTS) v. WILLOUGHBY (RESPONDENT) (SECOND APPEAL) (CONSOLIDATED APPEALS) ON 10 JULY 1997 LORD NOLAN My Lords, In this appeal the Commissioners of Inland Revenue seek to uphold five assessments to income tax, four of which were made on the respondent Professor Willoughby for the years of assessment 1987/8 to 1990/1 inclusive and the fifth of which was made on his wife, the respondent Mrs. Willoughby, for the year of assessment 1990/1. The assessment upon Professor Willoughby for 1987/8 was made under section 478 of the Income and Corporation Taxes Act 1970. The remaining assessments were made under section 739 of the Income and Corporation Taxes Act 1988, which replaced and re-enacted section 478 of the Act of 1970 without material alteration. The origin of these sections is to be found in section 18 of the Finance Act 1936, a section whose provisions, either in their original or in their re-enacted form, have been considered by your Lordships' House on previous occasions. It will be convenient, and sufficient for all relevant purposes, if as a general rule I refer to these provisions in the form in which they appear in the Act of 1988. Section 739 is the first section in Chapter III of Part XVII of the Act, which is concerned with the transfer of assets abroad. -

Tax Credits Act 2002 (Commencement No 4, Transitional Provisions and Savings) Order 2003

2003/962 Tax Credits Act 2002 (Commencement No 4, Transitional Provisions and Savings) Order 2003 Made by the Treasury under TCA 2002 ss 61, 62(2) Made 31 March 2003 1 Citation and interpretation (1) This Order may be cited as the Tax Credits Act 2002 (Commencement No 4, Transitional Provisions and Savings) Order 2003. (2) In this Order— “the Act” means the Tax Credits Act 2002; “the 1999 Act” means the Tax Credits Act 1999; and “the superseded tax credits” means working families' tax credit and disabled person's tax credit. 2 Commencement of provisions of the Act (1) Subject to the provisions of articles 3 and 4 (savings and transitional provisions), the provisions of the Act specified in this article shall come into force in accordance with the following paragraphs of this article. (2) Section 47 (consequential amendments), so far as it relates to paragraphs 4 to 7 of Schedule 3, shall come into force on 1st April 2003. (3) The following provisions of the Act shall come into force on 6th April 2003— (a) section 1(3)(a) and (f) (abolition of children's tax credit under section 257AA of the Income and Corporation Taxes Act 1988 and employment credit); (b) section 47, so far as it relates to the provisions of Schedule 3 specified in sub-paragraph (d); (c) section 60 (repeals), so far as it relates to the provisions of Schedule 6 specified in sub-paragraph (e); (d) in Schedule 3 (consequential amendments)— (i) paragraphs 1 to 3, (ii) paragraphs 8 and 9, and (iii) paragraphs 13 to 59; and (e) in Schedule 6, the entries relating to the enactments specified in column 1 of Schedule 1 to this Order to the extent shown in column 2 of that Schedule. -

Finance Act, 2001 ———————— Arrangement Of

———————— Number 7 of 2001 ———————— FINANCE ACT, 2001 ———————— ARRANGEMENT OF SECTIONS PART 1 Income Tax, Corporation Tax and Capital Gains Tax Chapter 1 Interpretation Section 1. Interpretation (Part 1). Chapter 2 Income Tax 2. Tax credits. 3. Alteration of rates of income tax. 4. Age exemption. 5. Amendment of section 122 (preferential loan arrangements) of Principal Act. 6. Amendment of section 126 (tax treatment of certain benefits payable under Social Welfare Acts) of Principal Act. 7. Amendment of section 467 (employed person taking care of incapacitated individual) of Principal Act. 8. Amendment of section 469 (relief for health expenses) of Principal Act. 9. Amendment of section 473 (allowance for rent paid by cer- tain tenants) of Principal Act. 10. Amendment of section 477 (relief for service charges) of Principal Act. [No. 7.] Finance Act, 2001. [2001.] Section 11. Relief for trade union subscriptions. 12. Amendment of Part 16 (income tax relief for investment in corporate trades — business expansion scheme and seed capital scheme) of Principal Act. 13. Employee share ownership trusts — deceased beneficiaries. 14. Amendment of Schedule 13 (accountable persons for pur- poses of Chapter 1 of Part 18) to Principal Act. 15. Approved share option schemes. 16. Amendment of provisions relating to employee share schemes. 17. Provisions relating to certain approved profit sharing schemes and employee share ownership trusts. 18. Amendment of Part 30 (occupational pension schemes, retirement annuities, purchased life annuities and cer- tain pensions) of Principal Act. 19. Amendment of section 470 (relief for insurance against expenses of illness) of Principal Act. 20. Relief for premiums under qualifying long-term care policies, etc. -

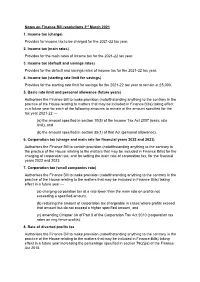

Notes on Finance Bill Resolutions 3Rd March 2021 1

Notes on Finance Bill resolutions 3rd March 2021 1. Income tax (charge) Provides for income tax to be charged for the 2021-22 tax year. 2. Income tax (main rates) Provides for the main rates of income tax for the 2021-22 tax year. 3. Income tax (default and savings rates) Provides for the default and savings rates of income tax for the 2021-22 tax year. 4. Income tax (starting rate limit for savings) Provides for the starting rate limit for savings for the 2021-22 tax year to remain at £5,000. 5. Basic rate limit and personal allowance (future years) Authorises the Finance Bill to make provision (notwithstanding anything to the contrary in the practice of the House relating to matters that may be included in Finance Bills) taking effect in a future year for each of the following amounts to remain at the amount specified for the tax year 2021-22 — (a) the amount specified in section 10(5) of the Income Tax Act 2007 (basic rate limit), and (b) the amount specified in section 35(1) of that Act (personal allowance). 6. Corporation tax (charge and main rate for financial years 2022 and 2023) Authorises the Finance Bill to contain provision (notwithstanding anything to the contrary in the practice of the House relating to the matters that may be included in Finance Bills) for the charging of corporation tax, and for setting the main rate of corporation tax, for the financial years 2022 and 2023. 7. Corporation tax (small companies rate) Authorises the Finance Bill to make provision (notwithstanding anything to the contrary in the practice of the House relating to the matters that may be included in Finance Bills) taking effect in a future year — (a) charging corporation tax at a rate lower than the main rate on profits not exceeding a specified amount, (b) reducing the amount of corporation tax chargeable in cases where profits exceed that amount but do not exceed a higher specified amount, and (c) amending Chapter 3A of Part 8 of the Corporation Tax Act 2010 (corporation tax rates on ring fence profits). -

Finance Act 2009 (C.10) Which Received Royal Assent on 21 July 2009

These notes refer to the Finance Act 2009 (c.10) which received Royal Assent on 21 July 2009 FINANCE ACT 2009 —————————— EXPLANATORY NOTES INTRODUCTION 1. These notes relate to the Finance Act 2009 that received Royal Assent on 21st July 2009. They have been prepared by HM Revenue and Customs in partnership with HM Treasury in order to assist the reader in understanding the Act. They do not form part of the Act and have not been endorsed by Parliament. 2. The notes need to be read in conjunction with the Act. They are not, and are not meant to be, a comprehensive description of the Act. So, where a section or part of a section does not seem to require any explanation or comment, none is given. 3. The Act is divided into nine parts: (1) Charges, rates, allowances, etc (2) Income tax, corporation tax and capital gains tax (3) Pensions (4) Value Added Tax (5) Stamp taxes (6) Oil (7) Administration (8) Miscellaneous (9) Final Provisions The Schedules follow the sections on the Act. 4. Terms used in the Act are explained in these notes where they first appear. Hansard references are provided at the end of the notes. 1 These notes refer to the Finance Act 2009 (c.10) which received Royal Assent on 21 July 2009 SECTION 1: INCOME TAX: CHARGE AND MAIN RATES FOR 2009-10 SUMMARY 1. Section 1 imposes the income tax charge for 2009-10 and sets the basic rate of income tax at 20 per cent and the higher rate at 40 per cent. -

The Gaming Duty (Amendment) Regulations 2016

STATUTORY INSTRUMENTS 2016 No. 943 EXCISE The Gaming Duty (Amendment) Regulations 2016 Made - - - - 20th September 2016 Laid before the House of Commons 21st September 2016 Coming into force - - 31st October 2016 The Commissioners for Her Majesty’s Revenue and Customs make the following Regulations in exercise of the power conferred by section 12(4) of the Finance Act 1997( a). Citation, commencement and effect 1. —(1) These Regulations may be cited as the Gaming Duty (Amendment) Regulations 2016 and come into force on 31st October 2016. (2) Regulation 2 has effect in relation to payments on account of gaming duty payable on or after 31st October 2016. The amount of payments on account 2. In the Gaming Duty Regulations 1997(b), in regulation 5, for the Table substitute— “Part of the gross gaming yield Rate The first £1,185,250 15 per cent The next £817,000 20 per cent The next £1,430,750 30 per cent The next £3,020,000 40 per cent The remainder 50 per cent” Revocation 3. The Gaming Duty (Amendment) Regulations 2014( c) are revoked. (a) 1997 c. 16; section 10 defines “gaming duty” and is amended by paragraph 17 of Schedule 25 to the Finance Act 2007 (c. 11), section 114(1) to 114(9) of the Finance Act 2009 (c. 10) and paragraph 48 of Schedule 24 to the Finance Act 2012 (c. 14); section 15(2) provides for sections 10 to 14 and Schedule 1 to be construed as one with the Customs and Excise Management Act 1979 (c. 2), section 1(1) of which, as amended by section 50(6) of, and paragraph 22(b) of Schedule 4 to, the Commissioners for Revenue and Customs Act 2005 (c. -

Taxation and Good Governance: the Case of Value-Added Tax in Bangladesh

TAXATION AND GOOD GOVERNANCE: THE CASE OF VALUE-ADDED TAX IN BANGLADESH AHMED MUNIRUS SALEHEEN MA in English (Jahangirnagar University, Bangladesh) 1989, Bachelor of Arts (Honours) in English, (Jahangirnagar University, Bangladesh) 1988 Thesis submitted in fulfilment of the requirements for the Degree of Doctor of Philosophy Department of Politics and Public Policy, School of Social and Policy Studies, Flinders University, Australia, June 2013 i Dedicated to My Father—(Late) A.B. Muslehuddin Ahmed whom I lost when I was two years old and yet whose ethereal presence has always been a source of guidance and My Mother—(Late) Hazera Khatoon whose indomitable spirits shaped me to become what I am. ii PAPERS DRAWN FROM THE THESIS The following papers have been drawn from the thesis: Saleheen, A.M. (2012), “Presumptive Taxation under Bangladesh VAT,” International VAT Monitor 23(5):316-321 Saleheen, A.M. and Siddiquee, N.A (2013), “Tax Innovation or Excise Duty in Disguise? Deviations and Distortions in Value-Added Tax in Bangladesh,” International Journal of Public Administration 36(6): 381-396 Saleheen, A.M. (2013), “Reigning Tax Discretion: A Case Study of VAT in Bangladesh,” Asia-Pacific Journal of Taxation 16(2):77-91 iii TABLE OF CONTENTS DEDICATION…………………………………………………………….……....…ii PAPERS DRAWN FROM THE THESIS…………………………………….....….iii TABLE OF CONTENTS ................ …………………………………………….….iv LIST OF APPENDICES…………………………………………………….….…vii LIST OF TABLES, FIGURES AND BOXES ........................................................ viii ABSTRACT -

REPORTABLE in the SUPREME COURT of INDIA CIVIL APPELLATE JURISDICTION CIVIL APPEAL NO.8750 of 2014 (Arising out of SLP (C) No. 5

REPORTABLE IN THE SUPREME COURT OF INDIA CIVIL APPELLATE JURISDICTION CIVIL APPEAL NO.8750 OF 2014 (arising out of SLP (C) No. 540 of 2009) COMMISSIONER OF INCOME TAX (CENTRAL)-I, NEW DELHI …..APPELLANT(S) VERSUS VATIKA TOWNSHIP PRIVATE LIMITED …..RESPONDENT(S) W I T H CIVIL APPEAL NO.8764 OF 2014 (arising out of SLP (C) No. 1362 of 2009) CIVIL APPEAL NO.8762 OF 2014 (arising out of SLP (C) No. 1339 of 2009) CIVIL APPEAL NO.8773 OF 2014 (arising out of SLP (C) No. 19319 of 2008) CIVIL APPEAL NO.8763 OF 2014 (arising out of SLP (C) No. 1342 of 2009) CIVIL APPEAL NO.8755 OF 2014 (arising out of SLP (C) No. 31528 of 2008) CIVIL APPEAL NO.8775 OF 2014 (arising out of SLP (C) No. 22444 of 2008) Civil Appeal No.________ of 2014 & connected matters Page 1 of 57 (arising out of S.L.P. (C) Nos. 540 of 2009) Page 1 CIVIL APPEAL NO.8779 OF 2014 (arising out of SLP (C) No. 27162 of 2008) CIVIL APPEAL NO.8780 OF 2014 (arising out of SLP (C) No. 27413 of 2008) CIVIL APPEAL NO.8774 OF 2014 (arising out of SLP (C) No. 20855 of 2008) CIVIL APPEAL NO.8765 OF 2014 (arising out of SLP (C) No. 4769 of 2009) CIVIL APPEAL NO.8760 OF 2014 (arising out of SLP (C) No. 1257 of 2009) CIVIL APPEAL NO.8756 OF 2014 (arising out of SLP (C) No. 31537 of 2008) CIVIL APPEAL NO.8759 OF 2014 (arising out of SLP (C) No. -

MISCELLANEOUS PROVISIONS) ACT 1979 REVISED Updated to 29 May 2020

Number 27 of 1979 HOUSING (MISCELLANEOUS PROVISIONS) ACT 1979 REVISED Updated to 29 May 2020 This Revised Act is an administrative consolidation of the Housing (Miscellaneous Provi- sions) Act 1979. It is prepared by the Law Reform Commission in accordance with its function under the Law Reform Commission Act 1975 (3/1975) to keep the law under review and to undertake revision and consolidation of statute law. All Acts up to and including the Emergency Measures in the Public Interest (Covid-19) Act 2020 (2/2020), enacted 27 March 2020, and all statutory instruments up to and including the Housing (Private Water Supply Financial Assistance) Regulations 2020 (S.I. No. 192 of 2020), made 29 May 2020, were considered in the preparation of this Revised Act. Disclaimer: While every care has been taken in the preparation of this Revised Act, the Law Reform Commission can assume no responsibility for and give no guarantees, undertakings or warranties concerning the accuracy, completeness or up to date nature of the information provided and does not accept any liability whatsoever arising from any errors or omissions. Please notify any errors, omissions and comments by email to [email protected]. Number 27 of 1979 HOUSING (MISCELLANEOUS PROVISIONS) ACT 1979 REVISED Updated to 29 May 2020 Introduction This Revised Act presents the text of the Act as it has been amended since enactment, and preserves the format in which it was passed. Related legislation Housing Acts 1966 to 2019: this Act is one of a group of Acts included in this collective citation, to be construed together as one (Housing (Regulation of Approved Housing Bodies) Act 2019 (47/2019), s. -

Classified List of Acts in Force in Ireland Updated to 17 September 2021

Classified List of Acts in Force in Ireland Updated to 17 September 2021 35. Taxation1 2 35.1. Air Travel Tax Finance Finance (No. 2) Act 2008 25/2008 • Finance (No. 2) Act 2008 (Commencement of Section 37) Order 2009, S.I. No. 91 of 20093 • Finance (No. 2) Act 2008 (Commencement of Section 28(1)) Order 2009, S.I. No. 97 of 20094 • Air Travel Tax Regulations 2009, S.I. No. 134 of 20095 • Finance (No. 2) Act 2008 (Commencement of Section 35) Order 2009, S.I. No. 392 of 20096 • Finance (No. 2) Act 2008 (Section 18) (Commencement) Order 2009, S.I. No. 448 of 20097 • Finance (No. 2) Act 2008 (Schedule 5) (Commencement of Certain Provisions) Order 2009, S.I. No. 483 of 20098 • Finance (No. 2) Act 2008 (Commencement of Section 79(1)) Order 2009, S.I. No. 484 of 20099 • Finance (No. 2) Act 2008 (Commencement of Section 31) Order 2009, S.I. No. 516 of 200910 • Finance (No. 2) Act 2008 (Commencement of Section 57(1)) Order 2012, S.I. No. 227 of 201211 • Air Travel Tax (Abolition) Order 2014, S.I. No. 130 of 2014 35.2. Alcohol Products Tax12 Finance Finance Act 2003 3/2003 • Wine Duty (Amendment) Regulations 1969, S.I. No. 180 of 196913 1 This Title in the Classified List contains the main headings of tax, and the relevant Act under which the tax in question is imposed. The role of Departments other than the Department of Finance is not noted in the Classified List. For examples, see the role of the Department of Arts, Heritage and the Gaeltacht under ss. -

Number 37 of 2014 Finance Act 2014

Number 37 of 2014 Finance Act 2014 Number 37 of 2014 FINANCE ACT 2014 CONTENTS PART 1 UNIVERSAL SOCIAL CHARGE, INCOME TAX, CORPORATION TAX AND CAPITAL GAINS TAX CHAPTER 1 Interpretation Section 1. Interpretation (Part 1) CHAPTER 2 Universal Social Charge 2. Amendment of Part 18D of Principal Act (universal social charge) CHAPTER 3 Income Tax 3. Amendment of section 15 of Principal Act (rate of charge) 4. Amendment of section 128 of Principal Act (treatment of directors of companies and employees granted rights to acquire shares or other assets) 5. Amendment of section 195 of Principal Act (exemption of certain earnings of writers, composers and artists) 6. Exemption in respect of compensation for certain living donors 7. Amendment of section 244 of Principal Act (relief for interest paid on certain home loans) 8. Amendment of Schedule 13 to Principal Act (accountable persons for purposes of Chapter 1 of Part 18) 9. Amendment of section 216A of Principal Act (rent-a-room relief) 10. Amendment of section 189A of Principal Act (special trusts for permanently incapacitated individuals) 11. Amendment of Chapter 1 of Part 12 of Principal Act (loss relief) 12. Amendment of section 467 of Principal Act (employed person taking care of incapacitated individual) 13. Amendment of section 477B of Principal Act (home renovation incentive) 1 [No. 37.] Finance Act 2014. [2014.] 14. Amendment of section 836 of Principal Act (allowances for expenses of members of the Oireachtas) 15. Amendment of section 825C of Principal Act (special assignee relief programme) 16. Amendment of section 823A of Principal Act (deduction for income earned in certain foreign states) 17.