Capital Market Reforms for Recovery and Improved Business Dynamics in Croatia

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Press Release Changes to the List of Euro Foreign Exchange Reference

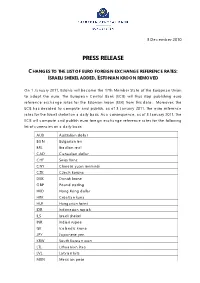

3 December 2010 PRESS RELEASE CHANGES TO THE LIST OF EURO FOREIGN EXCHANGE REFERENCE RATES: ISRAELI SHEKEL ADDED, ESTONIAN KROON REMOVED On 1 January 2011, Estonia will become the 17th Member State of the European Union to adopt the euro. The European Central Bank (ECB) will thus stop publishing euro reference exchange rates for the Estonian kroon (EEK) from this date. Moreover, the ECB has decided to compute and publish, as of 3 January 2011, the euro reference rates for the Israeli shekel on a daily basis. As a consequence, as of 3 January 2011, the ECB will compute and publish euro foreign exchange reference rates for the following list of currencies on a daily basis: AUD Australian dollar BGN Bulgarian lev BRL Brazilian real CAD Canadian dollar CHF Swiss franc CNY Chinese yuan renminbi CZK Czech koruna DKK Danish krone GBP Pound sterling HKD Hong Kong dollar HRK Croatian kuna HUF Hungarian forint IDR Indonesian rupiah ILS Israeli shekel INR Indian rupee ISK Icelandic krona JPY Japanese yen KRW South Korean won LTL Lithuanian litas LVL Latvian lats MXN Mexican peso 2 MYR Malaysian ringgit NOK Norwegian krone NZD New Zealand dollar PHP Philippine peso PLN Polish zloty RON New Romanian leu RUB Russian rouble SEK Swedish krona SGD Singapore dollar THB Thai baht TRY New Turkish lira USD US dollar ZAR South African rand The current procedure for the computation and publication of the foreign exchange reference rates will also apply to the currency that is to be added to the list: The reference rates are based on the daily concertation procedure between central banks within and outside the European System of Central Banks, which normally takes place at 2.15 p.m. -

Customer Satisfaction of the Co-Branded Food Products on Croatian Market

Journal of Economics, Business and Management, Vol. 7, No. 4, November 2019 Customer Satisfaction of the Co-branded Food Products on Croatian Market Berislav Andrlic, Anton Devcic, and Mario Hak Abstract—This scientific paper describes the marketing II. SELECTING THE APPROPRIATE PARTNERS AND FOOD impact of co-branding and customer satisfaction on the food CO-BRANDING FORMATION PROCESS market due to it's rapid changing and internal and external marketing environment. New ways of branding strategies and The purpose of co-branding on food market is the selection new model of consumer behavior give rise to new or existing appropriate partners and that represents the first step towards branded food products on the market. Term co-branding is most development of activity. By careful selection, co-branding commonly found in food market as these type of business often negative aspects and risks can be minimized. Compatibility face economic problems operating in certain times or seasons between food brands is extremely important and that must be hence they need the assistance of other services to make their the starting point in the elimination process among potential operating costs relevant. The typical co-branding agreement involves two or more companies acting in cooperation to candidates. Partner selection is made accordingly to associate any of various logos, color schemes, or brand predetermined criteria, depending on the specific aim that identifiers to a specific product that is contractually designated should be accomplished and by the strategy that is to be for this purpose.In order to examine this scientific problem the applied. Just as every individual has his own strengths and following methods were used: analysis, synthesis, induction, weaknesses, so the brands have. -

Exchange Market Pressure on the Croatian Kuna

EXCHANGE MARKET PRESSURE ON THE CROATIAN KUNA Srđan Tatomir* Professional article** Institute of Public Finance, Zagreb and UDC 336.748(497.5) University of Amsterdam JEL F31 Abstract Currency crises exert strong pressure on currencies often causing costly economic adjustment. A measure of exchange market pressure (EMP) gauges the severity of such tensions. Measuring EMP is important for monetary authorities that manage exchange rates. It is also relevant in academic research that studies currency crises. A precise EMP measure is therefore important and this paper re-examines the measurement of EMP on the Croatian kuna. It improves it by considering intervention data and thresholds that ac- count for the EMP distribution. It also tests the robustness of weights. A discussion of the results demonstrates a modest improvement over the previous measure and concludes that the new EMP on the Croatian kuna should be used in future research. Key words: exchange market pressure, currency crisis, Croatia 1 Introduction In an era of increasing globalization and economic interdependence, fixed and pegged exchange rate regimes are ever more exposed to the danger of currency crises. Integrated financial markets have enabled speculators to execute attacks more swiftly and deliver devastating blows to individual economies. They occur when there is an abnormally large international excess supply of a currency which forces monetary authorities to take strong counter-measures (Weymark, 1998). The EMS crisis of 1992/93 and the Asian crisis of 1997/98 are prominent historical examples. Recently, though, the financial crisis has led to severe pressure on the Hungarian forint and the Icelandic kronor, demonstrating how pressure in the foreign exchange market may cause costly economic adjustment. -

Trading Summary First Quarter of 2017

Trading Summary First quarter of 2017 Zagreb, April 2017. This publication was prepared and published by the Zagreb Stock Exchange Inc., Ivana Lučića 2a/22, Zagreb (hereinafter: Exchange). The publication is intended to provide information to the public and shall not be deemed to constitute an offer or invitation to buy or advice on trade or investment in financial instruments or opinion on the terms of the purchase or sale of any financial instrument mentioned therein whether favourable or not, nor should it be relied on as a substitute for own judgement or assessment by any user of this publication. The Exchange waives responsibility and liability for any damage which might arise out of the use of information contained therein. Further use of information available in this publication is permitted by the Exchange provided that the source is cited. Copyright © 2017. Zagreb Stock Exchange Zagreb Ivana Lučića 2a/22 All rights reserved. Content: 1 TRADING .................................................................................................................................. 1 1.1 COMPARISION WITH PREVIOUS QUARTER .............................................................................................................. 1 1.2 COMPARISON WITH PREVIOUS YEAR ..................................................................................................................... 2 1.3 MONTHLY TRADING OVERVIEW ........................................................................................................................... 4 -

Merchants and the Origins of Capitalism

Merchants and the Origins of Capitalism Sophus A. Reinert Robert Fredona Working Paper 18-021 Merchants and the Origins of Capitalism Sophus A. Reinert Harvard Business School Robert Fredona Harvard Business School Working Paper 18-021 Copyright © 2017 by Sophus A. Reinert and Robert Fredona Working papers are in draft form. This working paper is distributed for purposes of comment and discussion only. It may not be reproduced without permission of the copyright holder. Copies of working papers are available from the author. Merchants and the Origins of Capitalism Sophus A. Reinert and Robert Fredona ABSTRACT: N.S.B. Gras, the father of Business History in the United States, argued that the era of mercantile capitalism was defined by the figure of the “sedentary merchant,” who managed his business from home, using correspondence and intermediaries, in contrast to the earlier “traveling merchant,” who accompanied his own goods to trade fairs. Taking this concept as its point of departure, this essay focuses on the predominantly Italian merchants who controlled the long‐distance East‐West trade of the Mediterranean during the Middle Ages and Renaissance. Until the opening of the Atlantic trade, the Mediterranean was Europe’s most important commercial zone and its trade enriched European civilization and its merchants developed the most important premodern mercantile innovations, from maritime insurance contracts and partnership agreements to the bill of exchange and double‐entry bookkeeping. Emerging from literate and numerate cultures, these merchants left behind an abundance of records that allows us to understand how their companies, especially the largest of them, were organized and managed. -

Economic Growth in Croatia: What Have We Learned?

Report No. 48879- HR Public Disclosure Authorized CROATIA Croatia’s EU Convergence Report: Reaching and Sustaining Higher Rates of Economic Growth Public Disclosure Authorized (In two volumes) Vol. II: Full Report June 2009 Public Disclosure Authorized Europe and Central Asia Region Document of the World Bank Public Disclosure Authorized CURRENCY AND EQUIVALENT UNITS Currency Unit=Croatian kuna US$1 =HRK 5.6102 (As of April 30, 2009) FISCAL YEAR January 1 – December 31` WEIGHTS AND MEASURES Metric System ACRONYMS AND ABBREVIATIONS AAE Agency for Adult Education IEC International Electrotechnical Commission ADR Alternative Dispute Resolution ILAC International Laboratory Accreditation Cooperation AVET Agency for Vocational Education and ILO International Labor Organization Training CA Company Act IP Intellectual Property CARDS Community Assistance for Reconstruction, ISO International Organization for Standardization Development and Stabilization CEE Central and Eastern Europe OECD Organization for Economic Cooperation and Development CENLE European Committee for Electrotechnical LLL Life Long Learning C Standardization CES ??? MoSES Ministry of Science, Education and Sports CGPM General conference on Weights and MoELE Ministry of Economy, Labor & Measures Entrepreneurship ECA Europe and Central Asia MS&T Mathematics, Science & Technology FDI Foreign Direct Investment FE Fixed Effects NIS National Innovation System FINA Financial Agency PMR Product Market Regulation GDP Gross Domestic Product PPS Purchasing Power Standards GFCF Gross Fixed -

Podravka Group Business Results for January – December 2020 Unaudited Content

koprivnica, 26th february 2021 Podravka Group business results for January – December 2020 unaudited Content 3 Key financial indicators in 1 – 12 2020 5 Operations of the Podravka Group in conditions of COVID-19 disease 8 Significant events in 1 – 12 2020 and after the balance sheet date 12 Overview of sales revenues in 1 – 12 2020 19 Profitability in 1 – 12 2020 24 Key highlights of the income statement in 1 – 12 2020 27 Key highlights of the balance sheet as at 31 December 2020 30 Key highlights of the cash flow statement in 1 – 12 2020 32 Share in 1 – 12 2020 36 Additional tables for 1 – 12 2020 40 Consolidated financial statements in 1 – 12 2020 48 Statement of liability 49 Contact podravka group business results for 1 – 12 2020 2 Key financial indicators in 1 – 12 2020 podravka group business results for 1 – 12 2020 3 Key financial indicators in 1 – 12 2020 (in HRK millions) 2019 2020 Δ % Sales revenue 4,409.4 4,503.2 93.8 2.1% EBITDA1 509.0 546.7 37.7 7.4% Net profit after MI 221.6 248.9 27.3 12.3% Net cash flow from operating activities 272.9 384.5 111.5 40.9% Cash capital expenditures 153.9 192.4 38.5 25.0% Normalized EBITDA2 515.5 543.1 27.5 5.3% Normalized net profit after MI 223.6 244.4 20.8 9.3% (in HRK; market capitalization in HRKm) 31. 12. 2019 31. 12. 2020 Δ % Net debt / normalized EBITDA 1.6 1.4 (0.2) (15.3%) Normalized Earnings per share 32.0 35.0 2.9 9.2% Last price at the end of period 484.0 485.0 1.0 0.2% Market capitalization 3,380.6 3,391.2 10.5 0.3% Return on average equity3 7.3% 7.6% +26 bp Return on average assets4 4.7% 5.1% +41 bp note: decimal differences in the document are possible due to rounding. -

The Impact of Capital Market on the Economic Growth in Oman

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Alam, Md. Shabbir; Hussein, Muawya Ahmed Article The impact of capital market on the economic growth in Oman Financial Studies Provided in Cooperation with: "Victor Slăvescu" Centre for Financial and Monetary Research, National Institute of Economic Research (INCE), Romanian Academy Suggested Citation: Alam, Md. Shabbir; Hussein, Muawya Ahmed (2019) : The impact of capital market on the economic growth in Oman, Financial Studies, ISSN 2066-6071, Romanian Academy, National Institute of Economic Research (INCE), "Victor Slăvescu" Centre for Financial and Monetary Research, Bucharest, Vol. 23, Iss. 2 (84), pp. 117-129 This Version is available at: http://hdl.handle.net/10419/231680 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. -

FIMA Daily Insight

FIMA Daily Insight IN FOCUS - ZAGREB STOCK EXCHANGE January 8, 2013 Stocks on ZSE traded higher today. CROBEX increased 0.24% to ZSE STOCK MARKET 1,808.40 pts while blue chip CROBEX10 gained 0.21% to 1,010.86 pts. CROBEX Last 1.808,4 Regular stock turnover amounted to HRK 14.4 million. % daily 0,24% Integrated telecom HT (HTRA CZ) topped the liquidity board collecting % YTD 3,91% HRK 4.3 million in turnover. The price increased 0.9% to HRK 210.70. CROBEX10 last 1010,9 Fertilizers producer Petrokemija (PTKMRA CZ) also came to focus again % daily 0,21% with HRK 1.5 million in turnover while price gained 5.5% to HRK 240.0. % YTD 4,05% Petrokemija was in investors’ focus few months ago, after speculations on Government selling its share of 1.7 million shares (50.6% of capital). Stock Turnov er (HRK m) 14,37 A few days ago Mladen Pejnović, head of the State Office for State Total MCAP (HRK bn) 194,39 Property Management confirmed government’s plans to privatize Source: w w w .zse.hr Petrokemija. Auto-parts producer AD Plastik (ADPLRA CZ) came to focus trading in -4,0% -2,0% 0,0% 2,0% 4,0% 6,0% blocks. The price advanced 1% to HRK 115.99 on HRK 1.3 million in PTKM-R-A ATPL-R-A turnover. AD Plastik currently trades at P/E=7.7, P/S=0.7 and DDJH-R-A P/Bv=0.7. VPIK-R-A LKPC-R-A Tobacco and tourism Adris group preferred share (ADRSPA CZ) was VIRO-R-A KORF-R-A also in investors’ focus with HRK 0.7 million in turnover while price KNZM-R-A slipped 1.3% to HRK 262.20. -

Expat Capital – the Etf Provider for Cee Countries

Market data as of 21 May 2020 EXPAT CAPITAL – THE ETF PROVIDER FOR CEE COUNTRIES Expat Asset Management has created a family of exchange traded funds (ETFs) covering the equity markets in 11 countries in Central and Eastern Europe (CEE). Expat’s ETF products are unique market propositions providing country-specific exposure in the CEE region to international investors. Chart 1. Expat’s 11 ETFs on the Map of Europe Source: Expat Asset Management Table 1. The List of All ETFs Managed by Expat Asset Management CURRENCY No. COUNTRY FUND NAME INDEX EXPOSURE 1 Poland Expat Poland WIG20 UCITS ETF WIG20 PLN 2 Czech Republic Expat Czech PX UCITS ETF PX CZK 3 Slovakia Expat Slovakia SAX UCITS ETF SAX EUR 4 Hungary Expat Hungary BUX UCITS ETF BUX HUF 5 Slovenia Expat Slovenia SBI TOP UCITS ETF SBI TOP EUR 6 Croatia Expat Croatia CROBEX UCITS ETF CROBEX HRK 7 Serbia Expat Serbia BELEX15 UCITS ETF BELEX15 RSD 8 North Macedonia Expat Macedonia MBI10 UCITS ETF MBI10 MKD 9 Romania Expat Romania BET UCITS ETF BET RON 10 Bulgaria Expat Bulgaria SOFIX UCITS ETF SOFIX BGN 11 Greece Expat Greece ASE UCITS ETF ATHEX Composite EUR Source: Expat Asset Management Expat Capital Bulgaria, Sofia 1000, 96A G. S. Rakovski Str.; +359 2 980 1881; [email protected]; www.expat.bg 1 Market data as of 21 May 2020 Expat’s ETF products are designed to be major highways for capital flows to and from the equity markets of the CEE countries. They link the stock exchanges of those countries with the financial centres of London and Frankfurt, making it easy and cost-effective for international investors to take and liquidate an exposure to the specific countries in the region. -

489.108 Name. 1. the Name of a Limited Liability Company Must Contain the Words “Limited Liability Company” Or “Limited Company” Or the Abbreviation “L

1 REVISED UNIFORM LIMITED LIABILITY COMPANY ACT, §489.108 489.108 Name. 1. The name of a limited liability company must contain the words “limited liability company” or “limited company” or the abbreviation “L. L. C.”, “LLC”, “L. C.”, or “LC”. “Limited” may be abbreviated as “Ltd.”, and “company” may be abbreviated as “Co.”. 2. Unless authorized by subsection 3, the name of a limited liability company must be distinguishable in the records of the secretary of state from all of the following: a. The name of each person that is not an individual and that is incorporated, organized, or authorized to transact business in this state. b. Each name reserved under section 489.109. 3. A limited liability company may apply to the secretary of state for authorization to use a name that does not comply with subsection 2. The secretary of state shall authorize use of the name applied for if either of the following applies: a. The present user, registrant, or owner of the noncomplying name consents in a signed record to the use and submits an undertaking in a form satisfactory to the secretary of state to change the noncomplying name to a name that complies with subsection 2 and is distinguishable in the records of the secretary of state from the name applied for. b. The applicant delivers to the secretary of state a certified copy of the final judgment of a court establishing the applicant’s right to use in this state the name applied for. 4. A limited liability company may use the name, including the fictitious name, of another entity that is used in this state if the other entity is formed under the law of this state or is authorized to transact business in this state and the proposed user limited liability company meets any of the following conditions: a. -

FIMA Daily Insight

FIMA Daily Insight IN FOCUS - ZAGREB STOCK EXCHANGE March 16, 2012 Croatian equities recorded an upward movement today; CROBEX ZSE STOCK MARKET gained 0.74% to 1,844.03 pts while blue chip CROBEX10 accelerated CROBEX Last 1.844,0 0.41% to 1,008.60 pts. Total turnover of the day reached HRK 30.4 % daily 0,74% million. % YTD 5,97% Integrated telecom operator HT (HTRA CZ) topped the liquidity board CROBEX10 last 1008,6 as usual with HRK 5.6 million in turnover and increasing 0.49% to HRK % daily 0,41% 216.05. % YTD 3,32% Construction engineering company Ingra (INGRRA CZ) followed Stock Turnov er (HRK m) 30,44 collecting HRK 2.3 million in turnover and advancing 2.9% to HRK 8.40. Total MCAP (HRK bn) 187,00 Frozen foods producer Ledo (LEDORA CZ) came to focus with HRK 2.1 Source: w w w .zse.hr million in turnover while price accelerated 2.33% to HRK 6,049.97. Other companies from Agrokor concern were among better performers today. Agricultural producer Vupik (VPIKRA CZ) and kiosk chain Tisak -10,0% -5,0% 0,0% 5,0% 10,0% 15,0% 20,0% (TISKRA CZ) increased 4.59% and 4.53%, respectively, largest RIVP-R-A domestic retail chain Konzum (KNZMRA CZ) accelerated 5.76% to HRK DLKV-R-A KNZM-R-A 165.99 while food producer Belje (BLJERA CZ) declined 1.98% to HRK LKRI-R-A 89.20. ATPL-R-A INGR-R-A Heavy constructor Viadukt (VDKTRA CZ) rocketed 30.32% to HRK 245 THNK-R-A DDJH-R-A after company informed investors about new contract signed in total PTKM-R-A worth HRK 516 million, related to construction of Zagreb airport.