Exa Corporation 3DS Acquisition 3 Corp., Dassault Systemes Simulia

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ISIGHT Brochure

ISIGHT AUTOMATE DESIGN EXPLORATION AND OPTIMIZATION ISIGHT INDUSTRY CHALLENGES In today’s computer-aided product development and manufacturing environment, designers and engineers are using a wide range of KEY BENEFITS software tools to design and simulate their products. Often, the • Reduce time and costs parameters and results from one software package are required as • Improve product reliability inputs to another package, and the manual process of entering the required data can reduce efficiency, slow product development, and • Gain competitive advantage introduce errors in modeling and simulation assumptions. SIMULIA’s Isight Solution Isight provides designers, engineers, and researchers with an open system for integrating design and simulation models—created with various CAD, CAE, and other software applications—to automate the execution of hundreds or thousands of simulations. Isight allows users to save time and improve their products by optimizing them against performance or cost metrics through statistical methods, such as Design of Experiments (DOE) or Design for Six Sigma. Isight combines cross-disciplinary models and applications together in a simulation process flow, automates their execution, explores the resulting design space, and identifies the optimal design Isight parameters based on required constraints. Isight’s ability to manipulate and map parametric data between process steps and automate multiple simulations greatly improves efficiency, reduces manual errors, and accelerates the evaluation of product design alternatives. Open Component Framework Isight provides a standard library of components— including Excel™, Word™, CATIA V5™, Dymola™, MATLAB®, COM, Text I/O applications, Java and Python Scripting, and databases—for integrating and running a model or simulation. These components form the building blocks of simulation process flows. -

S.-H. Dan Shim – Curriculum Vitae

781E Terrace Rd Tempe, AZ 85287 S.-H. Dan Shim T 480-727-2876 B [email protected] Curriculum Vitae Í sites.google.com/site/shdshim Degrees 2001 Ph.D. Geosciences, Princeton University, Princeton, New Jersey, USA. Thesis Adviser: Dr. Thomas S. Duffy 1994 M.S. Geological Sciences, Seoul National University, Seoul, Korea. Thesis Adviser: Drs Soo Jin Kim and Jung Ho Ahn 1992 B.S. Geological Sciences, Seoul National University, Seoul, Korea. Academic Appointments 2012– Associate Professor, School of Earth and Space Exploration, Arizona State Uni- versity, USA. 2015– Honors Faculty, Barrett Honors College, USA. 2014 Visiting Researcher, Institut de Physique du Globe de Paris (IPGP), Paris, France. 2008–2011 Associate Professor of Experimental Geophysics, Massachusetts Institute of Technology, USA. 2003–2008 Assistant Professor of Experimental Geophysics, Massachusetts Institute of Technology, USA. 2001–2003 Miller Research Fellow, University of California at Berkeley, USA. Other Employments 1994–1996 Exploration Scientist, Army, Korea. 1993–1994 Research Intern, Korea Ocean Research and Development Institute, Korea. Honors 2010 Doornbos Memorial Prize, Studies of the Earth’s Deep Interior, International Union of Geodesy and Geophysics (IUGG) 2004 Jeptha H. and Emily V. Wade Award, Massachusetts Institute of Technology 2001–2003 Miller Research Fellowship, University of California, Berkeley 2001 Graduate Research Award, Mineral and Rock Physics Section, American Geophys- ical Union (AGU) 1/17 2000 Outstanding Student Paper Award, Tectonophysics -

PLM Industry Summary Jillian Hayes, Editor Vol

PLM Industry Summary Jillian Hayes, Editor Vol. 14 No 28 Friday 13 July 2012 Contents CIMdata News _____________________________________________________________________ 2 CIMdata Announces its 2012 Fall PLM Market & Industry Forum_________________________________2 Acquisitions _______________________________________________________________________ 3 Dassault Systèmes Announces Gemcom Software International Transaction Completed ________________3 Genpact Adds to Capabilities for Manufacturing Industry with Acquisition of Triumph Engineering Corp. _4 IHS Acquires Invention Machine and Releases Updated FY2012 Guidance __________________________5 Company News _____________________________________________________________________ 7 Advanced Solutions Earns Autodesk MEP Advanced Specialization _______________________________7 Applied Software Delivers Insights on BIM Lifecycle Management at RTC North America 2012 ________8 Bentley Helps Sustain Nuclear Engineering Professions by Granting Bentley Institute's Academic Subscription to KEPCO International Nuclear Graduate School ___________________________________9 CADsoft Consulting Earns Autodesk Product Support Specialization _____________________________10 Delcam’s success in Asia featured by UKTI _________________________________________________11 Dimensional Control Systems Leverages Technology from Spatial for New Analysis Solution __________12 Fujitsu Mission Critical Systems and Datameer Partner to Deliver Complete Data Analytics Solution ____14 MCAD Technologies, Inc. Merges with Shounco -

Annual Report 2013

29MAR201201524189 Annual Report 2013 Annual Financial Report This document is an English-language translation of Dassault Systemes’` Document de r´ef´erence (Annual Report), which was filed with the AMF (French Financial Markets Authority) on March 28, 2014, in accordance with Articles 212-13 of the AMF General Regulation. Only the French version of the Document de r´ef´erence is legally binding. DASSAULT SYSTEMES` Annual Report 2013 1 General This Annual Report also includes: – the annual financial report to be prepared and published by every listed company within four months of the end of its fiscal year, pursuant to Article L. 451-1-2 of the Monetary and Financial Code and Article 222-3 of the French Financial Markets Authority (‘‘AMF’’) General Regulation; and – the annual management report of Dassault Systemes` SA’s Board of Directors, which must be provided to the General Meeting of Shareholders approving the financial statements for each completed fiscal year, pursuant to Articles L. 225-100 et seq. of the French Commercial Code. The index set forth on page 182 provides cross-references to the relevant portions of these two reports. All references to ‘‘euro’’ or to the symbol ‘‘e’’ refer to the legal (Document de r´ef´erence) for the year 2012 filed with the AMF currency of the French Republic and certain countries of the on April 3, 2013, under no D.13-0272; European Union. All references to the ‘‘U.S. dollar’’ or to the • the financial information on pages 60 to 73 (inclusive) of the symbol ‘‘$’’ refer to the legal currency of the United States. -

Dassault Systèmes Annual Report 2018 1 General

NOUSWE 2018 SOMMESARE Financial report THERELÀ CONTENTS General 2 Person Responsible 3 15Presentation of the Group 5 Corporate governance 167 1.1 Profile of Dassault Systèmes 6 5.1 The Board’s Corporate Governance Report 168 1.2 Financial Summary: A Long History 5.2 Internal Control Procedures and Risk Management 203 of Sustainable Growth 7 5.3 Transactions in Dassault Systèmes shares 1.3 History 9 by the Management of the Company 207 1.4 Group Organization 14 5.4 Statutory Auditors 210 1.5 Business Activities 15 5.5 Declarations regarding the administrative Bodies 1.6 Research and development 29 and Senior Management 210 1.7 Risk factors 31 Information about Social, societal and environmental 6 Dassault Systèmes SE, the share capital 2 responsibility 39 and the ownership structure 211 6.1 Information about Dassault Systèmes SE 212 2.1 Social responsibility 41 6.2 Information about the Share Capital 216 2.2 Societal responsibility 48 6.3 Information about the Shareholders 219 2.3 Environmental Responsibility 53 6.4 Stock Market Information 224 2.4 Business Ethics and Vigilance Plan 58 2.5 Reporting methodology 61 2.6 Independent Verifier’s Report on Consolidated Non- General Meeting 225 financial Statement Presented in the Management 7 Report 64 7.1 Presentation of the resolutions proposed by the 2.7 Statutory Auditors’ Attestation on the information Board of Directors to the General Meeting on relating to the Dassault Systèmes SE’s total amount May 23, 2019 226 paid for sponsorship 67 7.2 Text of the draft resolutions proposed by the -

Simulia Community News

SIMULIA COMMUNITY NEWS #08 October 2014 THE POWER OF THE PORTFOLIO COVER STORY SIMULATION HELPS UPGRADE LONDON TUNNELS in this Issue October 2014 3 Welcome Letter Scott Berkey, Chief Executive Officer, SIMULIA 4 Portfolio Update Latest SIMULIA Portfolio Releases Deliver Powerful, Advanced Simulation Functionality to Users 8 Strategy Overview DR. SAUER How to Stay at the Top of Your Game in the Fast-Evolving 10 World of Simulation 10 Cover Story Dr. Sauer and Partners Helps Upgrade London Underground Station 13 News SIMPACK Joins the Dassault Systèmes Family 14 Case Study Stadler Rail Simulates Train Safety with FEA 17 Alliances Topology and Shape Optimization Using the Tosca-Ansa Environment 18 Case Study Fine-tuning the Anatomy of Car-Seat Comfort STADLER 20 Academic Update 14 Oil & Gas Subsurface Innovation with Multiphysics Simulations 22 Tips & Tricks Optimization Module Within Abaqus/CAE Contributors: Dr. Alois Starlinger (Stadler Rail), Dr. Alexander Siefert (Wölfel Group), Jeremy Brown and Randi Jean Walters (Stanford University), Parker Group On the Cover: Ali Nasekhian, Dr. techn., M.Sc. Senior Tunnel Engineer, Dr. Sauer and Partners Cover photo by Roger Brown Photography WÖLFEL 18 SIMULIA Community News is published by Dassault Systèmes Simulia Corp., Rising Sun Mills, 166 Valley Street, Providence, RI 02909-2499, Tel. +1 401 276 4400, Fax. +1 401 276 4408, [email protected], www.3ds.com/simulia Editor: Tad Clarke Associate Editor: Kristina Hines Graphic Designer: Todd Sabelli ©2014 Dassault Systèmes. All rights reserved. 3DEXPERIENCE, the Compass icon and the 3DS logo, CATIA, SOLIDWORKS, ENOVIA, DELMIA, SIMULIA, GEOVIA, EXALEAD, 3D VIA, BIOVIA, NETVIBES, and 3DXCITE are commercial trademarks or registered trademarks of Dassault Systèmes or its subsidiaries in the U.S. -

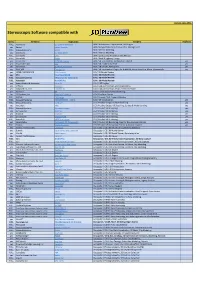

Stereo Software List

Version: June 2021 Stereoscopic Software compatible with Stereo Company Application Category Duplicate FULL Xeometric ELITECAD Architecture BIM / Architecture, Construction, CAD Engine yes Bexcel Bexcel Manager BIM / Design, Data, Project & Facilities Management FULL Dassault Systems 3DVIA BIM / Interior Modeling yes Xeometric ELITECAD Styler BIM / Interior Modeling FULL SierraSoft Land BIM / Land Survey Restitution and Analysis FULL SierraSoft Roads BIM / Road & Highway Design yes Xeometric ELITECAD Lumion BIM / VR Visualization, Architecture Models yes yes Fraunhofer IAO Vrfx BIM / VR enabled, for Revit yes yes Xeometric ELITECAD ViewerPRO BIM / VR Viewer, Free Option yes yes ENSCAPE Enscape 2.8 BIM / VR Visualization Plug-In for ArchiCAD, Revit, SketchUp, Rhino, Vectorworks yes yes OPEN CASCADE CAD CAD Assistant CAx / 3D Model Review yes PTC Creo View MCAD CAx / 3D Model Review FULL Dassault Systems eDrawings for Solidworks CAx / 3D Model Review FULL Autodesk NavisWorks CAx / 3D Model Review yes Robert McNeel & Associates. Rhino (5) CAx / CAD Engine yes Softvise Cadmium CAx / CAD, Architecture, BIM Visualization yes Gstarsoft Co., Ltd HaoChen 3D CAx / CAD, Architecture, HVAC, Electric & Power yes Siemens NX CAx / Construction & Manufacturing Yes 3D Systems, Inc. Geomagic Freeform CAx / Freeform Design FULL AVEVA E3D Design CAx / Process Plant, Power & Marine FULL Dassault Systems 3DEXPERIENCE - CATIA CAx / VR Visualization yes FULL Dassault Systems ICEM Surf CGI / Product Design, Surface Modeling yes yes Autodesk Alias CGI / Product -

Developing Downhole Oil and Gas Drilling Products Faster with Simuliaworks

DEVELOPING DOWNHOLE OIL AND GAS DRILLING PRODUCTS FASTER WITH SIMULIAWORKS By adding SIMULIAworks to its SOLIDWORKS product development implementation, InFocus Energy Services has acquired the simulation power and efficiency that it needs to consistently develop innovative, effective downhole products for the oil and gas industry more quickly and affordably. Challenge: launching a new 3DEXPERIENCE® simulation solution that Leverage high-end, nonlinear structural incorporated the SIMULIA® Abaqus solver, we signed up for simulation technology to reduce reliance on the Lighthouse Program so we could start using the new costly, time-consuming physical testing and SIMULIAworks immediately. As soon as we got our hands on develop innovative downhole drilling products it, we started testing it and benchmarking it against known test results.” more quickly and cost-effectively. SIMULATING TRICKY, COMPLEX CONTACT ACCURATELY Solution: Add SIMULIAworks to its SOLIDWORKS InFocus first utilized SIMULIAworks on the bearing section implementation to conduct nonlinear structural of the company’s RE|FLEX Premium HP/HT Drilling Motor. The motor’s bearing section is a proprietary design that was and complex contact analyses in the cloud developed to convert extreme loading parameters, including to advance and accelerate new product torque of over 30,000 foot-pounds, into efficient drilling action. development. The company’s initial concept design of the drive system, which utilized traditional ball bearings, resulted in failure during Results: testing when the load crushed the bearings and the faces that • Saved tens of thousands of dollars in testing costs load the bearings. SIMULIAworks predicted the failure—with • Cut months of time and extra labor from accurate correlation to actual test results—and helped the development process company develop a better, more innovative design. -

Simulation Lifecycle Management Manage & Secure Simulation Intellectual Property 3DS.COM/SIMULIA SIMULIA SLM

Simulation Lifecycle Management Manage & Secure Simulation Intellectual Property 3DS.COM/SIMULIA SIMULIA SLM Industry Challenges In the manufacturing industry, design analysis technology and related methods are being used to create innovative and reliable products while reducing time and costs. However, even those companies gaining significant benefits from simulation will admit that they often fail to capture their simulation processes or Capture best practices manage the results in a manner that allows effective knowledge reuse or decision-making traceability. Reuse intellectual property SIMULIA Solutions Improve process quality SIMULIA Simulation Lifecycle Management (SLM) solutions simplify the capture and deployment of approved simulation methods and best practices, providing guidance and improved confidence in the use of simulation results for collaborative decision making. Users can improve product quality with fully traceable simulation history and associated data. SLM also accelerates product development by providing timely access to the right information through secure storage, search and retrieval with distinct functionality dedicated specifically to simulation scenarios and data. rt po up P S ro n c io e s s i s c e M D a n a g e m Collaboration e n t D a ta M an agement Improve your simulation data and process quality The SIMULIA SLM solution portfolio, includes Scenario Definition, Live Simulation Review, Isight, and the SIMULIA Execution Engine. Scenario Definition enables methods developers to create workflow-specific simulation templates incorporating their company’s best practices while using the simulation tools of their choosing. These templates can then be deployed to a wide range of users ensuring adherence to standard practices in order to improve repeatability, reliability and confidence in simulations. -

Annual Report 2015 Annual Financial Report

2015 3DEXPERIENCE® GROUP PRESENTATION FINANCIAL REVIEW & STATEMENTS ANNUAL REPORT CORPORATE GOVERNANCE DASSAULT SYSTÈMES FINANCIAL REPORT GENERAL MEETING OF SHAREHOLDERS CONTENTS PERSON RESPONSIBLE 3 PRESENTATION OF THE GROUP 5 CORPORATE GOVERNANCE 151 1 1.1 Key Figures 6 5 5.1 Report of the Chairman on Corporate Governance 1.2 History 8 and Internal Control 152 1.3 Group Organization 12 5.2 Report of the Statutory Auditors on Corporate Governance and Internal Control 171 1.4 Business Activities 14 5.3 Summary of the Compensation and Benefi ts Due 1.5 Research and Development 27 to Corporate Offi cers (mandataires sociaux) 172 1.6 Risk factors 28 5.4 Transactions in the Company’s Shares by the Management of the Company 181 5.5 Statutory Auditors 184 SOCIAL, SOCIETAL AND 2 ENVIRONMENTAL RESPONSIBILITY 37 2.1 Social and Societal Responsibility 38 INFORMATION ABOUT DASSAULT SYSTÈMES SE, THE SHARE 2.2 Environmental Responsibility 58 6 CAPITAL AND THE OWNERSHIP 2.3 Independent Verifi er’s Attestation STRUCTURE 185 and Assurance Report on Social, Societal and Environmental Information 68 6.1 Information about Dassault Systèmes SE 186 6.2 Information about the Share Capital 189 FINANCIAL REVIEW AND PROSPECTS 71 6.3 Information about the Shareholders 194 3 6.4 Stock Market Information 199 3.1 Operating and Financial Review 72 3.2 2016 Financial Objectives and Multi-Year Growth Plan 83 3.3 Interim and Other Financial Information 84 7 GENERAL MEETING 201 7.1 Presentation of the Resolutions Proposed by the Board of Directors to the General Meeting FINANCIAL -

2020 Universal Registration Document

2020 2018/2019/2020 Universal Registration Document CONTENTS General 2 Person Responsible 3 1 Presentation of the Company 5 4 Financial statements 105 2020 Performance and Strategy 6 4.1 Consolidated Financial Statements 106 1.1 Key data 8 4.2 Parent company financial statements 153 1.2 Profile of Dassault Systèmes & Our Purpose 10 4.3 Legal and Arbitration Proceedings 184 1.3 History and Development of the Company 13 1.4 Business Activities 18 Corporate governance 185 1.5 Research and development 31 5 1.6 Company Organization 34 5.1 The Board’s Corporate Governance Report 186 1.7 Financial Summary: five-year historical information 36 5.2 Internal Control Procedures and Risk Management 229 1.8 Extra-financial performance 38 5.3 Transactions in Dassault Systèmes shares by the 1.9 Risk Factors 39 Management of Dassault Systèmes 233 5.4 Information on the Statutory Auditors 237 5.5 Declarations regarding the administrative Social, societal and environmental and management bodies 237 2 responsibility 47 2.1 Sustainability Governance 49 Information about 2.2 Social, societal and environmental risks 49 6 Dassault Systèmes SE, the share capital 2.3 Social responsibility 50 and the ownership structure 239 2.4 Societal responsibility 56 6.1 Information about Dassault Systèmes SE 240 2.5 Environmental responsibility 61 6.2 Information about the Share Capital 244 2.6 Business Ethics and Vigilance Plan 67 6.3 Information about the Shareholders 247 2.7 Environmental, Social and Governance metrics 74 6.4 Stock Market Information 253 2.8 Reporting Methodology -

Forming Technologies Releases CATSTAMP

Julia White 905-827-2997 ext. 215 [email protected] For Release 9 a.m. EST October 4, 2004 Forming Technologies Releases CATSTAMP Associative and Generative Forming Feasibility for CATIA V5 Product Designers and Die Designers Oakville, ON, CANADA — October 4, 2004 —Forming Technologies Inc., (FTI) a global innovator of sheet metal formability analysis software and technology, today announced the worldwide release and immediate availability of CATSTAMP which delivers complete stamping evaluation for product and process development. CATSTAMP is CAA V5- based and provides CATIA V5 users with detailed formability analysis for evaluation and validation of stamped components and draw die developments. “The demand for CATSTAMP was generated by the global automotive OEM community and their Tier 1 suppliers,” said Dan Marinac, Director of Business Development at FTI. “They were seeking a fully associative and regenerative draw die feasibility tool to evaluate part configurations and stamping processes conditions. Automotive product designers and draw die development engineers will benefit most from the single-window interface that lets them quickly determine their formability risks prior to committing to hard tooling.” Formability analysis considers conditions for material properties, friction, blank holder force, pressure pad, drawbeads, curved binder, and pilot holes. CATSTAMP quickly identifies splitting, wrinkling and thinning within the familiar CATIA workbenches utilizing analysis results such as safety zone, forming zone, FLD, splitting, thinning, wrinkling, and thickening. CATSTAMP can also generate NASTRAN and LS-DYNA files containing thickness and strain results for input to downstream CAE applications such a vehicle impact simulation. Results are stored in the CATAnalysis file which is fully integrated into Dassault Systèmes’ PLM environment.