ANNUAL REPORT 2018 for Personal Use Only Use Personal For

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The State of the Deal and Deloitte Queensland Index

The State of the Deal and Deloitte Queensland Index March 2021 – Queensland Index Exceeds $100 billion THE STATE OF THE DEAL | March 2021 – Queensland Index Exceeds $100 billion Contents Executive Summary 1 Then & Now – Investment Landscape 3 Then & Now – Deloitte Queensland Index 4 Queensland Economic Update 7 The Deloitte Queensland Index Q1 2021 8 Contacts 11 Sources 12 ii THE STATE OF THE DEAL | March 2021 – Queensland Index Exceeds $100 billion Executive Summary Following the significant rebound in the second half of 2020, companies in the Deloitte Queensland Index exceeded $100 billion at 31 March 2021, the highest month end market capitalisation on record for the State. Deloitte Queensland Index S&P/ASX All Ordinaries Companies in the Deloitte return in Q1 2021 return in Q1 2021 Queensland Index 3.5% 2.4% 169 at 31 March 2021 10.6% in Q4 2020 14.0% in Q4 2020 173 at 31 December 2020 90 companies increased Market capitalisation as at Mar-21 market capitalisation (53%) 66 companies decreased market $101.6b capitalisation (39%) 12 no movement (7%) $97.2b as at Dec-20 $18.5b as at Sep-02 5 delistings 1 listing (1%) Announced QLD M&A Disclosed value of announced transactions in Q1 2021 QLD M&A transactions in Q1 2021 64 $1.9b 92 in Q4 2020 $3.3b in Q4 2020 1 THE STATE OF THE DEAL | March 2021 – Queensland Index Exceeds $100 billion The Deloitte Queensland Index increased by 3.5% in Q1 2021 Queensland M&A more broadly remains strong with with total market capitalisation increasing to $101.6b at 64 transactions announced in Q1 2021 including: Mar-21, the highest month end value on record for the State. -

Socially Conscious Australian Equity Holdings

Socially Conscious Australian Equity Holdings As at 30 June 2021 Country of Company domicile Weight COMMONWEALTH BANK OF AUSTRALIA AUSTRALIA 10.56% CSL LTD AUSTRALIA 8.46% AUST AND NZ BANKING GROUP AUSTRALIA 5.68% NATIONAL AUSTRALIA BANK LTD AUSTRALIA 5.32% WESTPAC BANKING CORP AUSTRALIA 5.08% TELSTRA CORP LTD AUSTRALIA 3.31% WOOLWORTHS GROUP LTD AUSTRALIA 2.93% FORTESCUE METALS GROUP LTD AUSTRALIA 2.80% TRANSURBAN GROUP AUSTRALIA 2.55% GOODMAN GROUP AUSTRALIA 2.34% WESFARMERS LTD AUSTRALIA 2.29% BRAMBLES LTD AUSTRALIA 1.85% COLES GROUP LTD AUSTRALIA 1.80% SUNCORP GROUP LTD AUSTRALIA 1.62% MACQUARIE GROUP LTD AUSTRALIA 1.54% JAMES HARDIE INDUSTRIES IRELAND 1.51% NEWCREST MINING LTD AUSTRALIA 1.45% SONIC HEALTHCARE LTD AUSTRALIA 1.44% MIRVAC GROUP AUSTRALIA 1.43% MAGELLAN FINANCIAL GROUP LTD AUSTRALIA 1.13% STOCKLAND AUSTRALIA 1.11% DEXUS AUSTRALIA 1.11% COMPUTERSHARE LTD AUSTRALIA 1.09% AMCOR PLC AUSTRALIA 1.02% ILUKA RESOURCES LTD AUSTRALIA 1.01% XERO LTD NEW ZEALAND 0.97% WISETECH GLOBAL LTD AUSTRALIA 0.92% SEEK LTD AUSTRALIA 0.88% SYDNEY AIRPORT AUSTRALIA 0.83% NINE ENTERTAINMENT CO HOLDINGS LIMITED AUSTRALIA 0.82% EAGERS AUTOMOTIVE LTD AUSTRALIA 0.82% RELIANCE WORLDWIDE CORP LTD UNITED STATES 0.80% SANDFIRE RESOURCES LTD AUSTRALIA 0.79% AFTERPAY LTD AUSTRALIA 0.79% CHARTER HALL GROUP AUSTRALIA 0.79% SCENTRE GROUP AUSTRALIA 0.79% ORORA LTD AUSTRALIA 0.75% ANSELL LTD AUSTRALIA 0.75% OZ MINERALS LTD AUSTRALIA 0.74% IGO LTD AUSTRALIA 0.71% GPT GROUP AUSTRALIA 0.69% Issued by Aware Super Pty Ltd (ABN 11 118 202 672, AFSL 293340) the trustee of Aware Super (ABN 53 226 460 365). -

FTSE World Asia Pacific

2 FTSE Russell Publications 19 August 2021 FTSE World Asia Pacific Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) a2 Milk 0.04 NEW Asustek Computer Inc 0.1 TAIWAN Cheil Worldwide 0.02 KOREA ZEALAND ASX 0.12 AUSTRALIA Cheng Shin Rubber Industry 0.03 TAIWAN AAC Technologies Holdings 0.05 HONG KONG Atlas Arteria 0.05 AUSTRALIA Chiba Bank 0.04 JAPAN ABC-Mart 0.02 JAPAN AU Optronics 0.08 TAIWAN Chicony Electronics 0.02 TAIWAN Accton Technology 0.07 TAIWAN Auckland International Airport 0.06 NEW China Airlines 0.02 TAIWAN Acer 0.03 TAIWAN ZEALAND China Development Financial Holdings 0.07 TAIWAN Acom 0.02 JAPAN Aurizon Holdings 0.05 AUSTRALIA China Life Insurance 0.02 TAIWAN Activia Properties 0.03 JAPAN Ausnet Services 0.03 AUSTRALIA China Motor 0.01 TAIWAN ADBRI 0.01 AUSTRALIA Australia & New Zealand Banking Group 0.64 AUSTRALIA China Steel 0.19 TAIWAN Advance Residence Investment 0.05 JAPAN Axiata Group Bhd 0.04 MALAYSIA China Travel International Investment <0.005 HONG KONG ADVANCED INFO SERVICE 0.06 THAILAND Azbil Corp. 0.06 JAPAN Hong Kong Advantech 0.05 TAIWAN B.Grimm Power 0.01 THAILAND Chow Tai Fook Jewellery Group 0.04 HONG KONG Advantest Corp 0.19 JAPAN Bandai Namco Holdings 0.14 JAPAN Chubu Elec Power 0.09 JAPAN Aeon 0.2 JAPAN Bangkok Bank (F) 0.02 THAILAND Chugai Seiyaku 0.27 JAPAN AEON Financial Service 0.01 JAPAN Bangkok Bank PCL (NVDR) 0.01 THAILAND Chugoku Bank 0.01 JAPAN Aeon Mall 0.02 JAPAN Bangkok Dusit Medical Services PCL 0.07 THAILAND Chugoku Electric Power 0.03 JAPAN Afterpay Touch Group 0.21 AUSTRALIA Bangkok Expressway and Metro 0.02 THAILAND Chunghwa Telecom 0.17 TAIWAN AGC 0.08 JAPAN Bangkok Life Assurance PCL 0.01 THAILAND CIMB Group Holdings 0.08 MALAYSIA AGL Energy 0.04 AUSTRALIA Bank of East Asia 0.03 HONG KONG CIMIC Group 0.01 AUSTRALIA AIA Group Ltd. -

Bank of Queensland Submission to RBA: EFTPOS and Visa Debit

Bank of Queensland Submission to RBA EFTPOS and Visa Debit Consultation Document April 2005 Contents 1. Executive Summary 2. EFTPOS Interchange Fees 2.1 The Case for Zero EFTPOS Interchange Fees 2.2 RBA’s Draft EFTPOS Interchange Fee Standard 2.3 Potential Impact of the Reforms on Product Pricing 3. Visa Debit Reforms 3.1 The ‘Honour All Cards’ Rule 3.2 Visa Debit – Transparency 4. EFTPOS Access 5. Conclusion 1. Executive Summary It is a matter of history that the differing reform processes adopted for credit card interchange and for EFTPOS interchange has resulted in the implementation of these reforms becoming “out of step”. All the benefits from the disconnect between these reforms have fallen on the side of the retailers. In designating the EFTPOS system, we believed that the Reserve Bank would move to redress this situation and place the EFTPOS reforms back on track, as such we embraced designation as a positive development. Clearly, the self-regulatory industry EFTPOS reforms were aimed at achieving concurrent interchange fee reform between EFTPOS and Credit Cards but were required to follow an onerous and uncertain regulatory approval process. The uncertainty of the process was highlighted by the Australian Competition Tribunal (ACT) decision in 2004 to overturn the successful Authorisation Application determination made by the Australian Competition and Consumer Commission (ACCC) in relation to Zero EFTPOS Interchange Fees. For the record, Bank of Queensland supports the views expressed by the Reserve Bank1 in the Consultation Document in relation to the ACT findings. Throughout the whole Payments System reform process, the financial services industry has been characterised as being generally opposed to reform, when clearly this has not been the case. -

Monash University Caulfield Campus

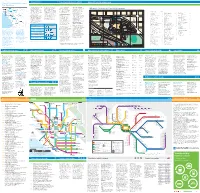

Monash University Caulfield campus Travel Smart Travelling to Monash Caulfield Monash Caulfield campus map Monash University Caulfield campus TravelSmart map Caulfield campus is located Monash has good reason Choosing sustainable Cycling to Caulfield in an urban area with to care about your travel transport has never Why not cycle to Monash Monash University Caulfield campus limited parking spaces, so choices! With limited been easier! A range of University’s Caulfield driving isn’t always going space available at Caulfield travel options is available campus? You can stay 1 2 3 4 to be the easiest option. campus, every new car park for getting to and from fit and healthy, and it can Building index Building On the plus side, Caulfield that Monash has to provide Caulfield campus. be quicker than other Access Monash B4 F Information Technology Office of the Vice-Provost By train and tram: The Caulfield Railway To St Kilda Computer Laboratories B3 B,K,T (Social Inclusion) B4 F Station is adjacent to the campus, and has great sustainable costs $20,000 and takes up Accounting A3 H transport options. and City Street Finch Bates Street Street Turner Epping Street Street Douglas Clarence Street Clarence four lines stop at the station: Cranbourne, Caulfield Train Station Road Burke Interior Architecture B3 E Overseas Student Services transport options, room that could be used for Architecture B4 F Dandenong, Frankston and Pakenham. (OSS) Lounge B2 S Languages, Literatures, The No. 3 tram from Swanston Street will particularly public transport. a new laboratory or lecture Why not jump on a train? Cycling routes are marked Waverley Road Waverley Road Art, Design and Architecture B3 G A A Cultures and Linguistics B3 C Parenting/Disability Room B2 S also take you directly to Caulfield campus. -

Portfolio Holdings Disclosure

NGS SUPER PORTFOLIO HOLDINGS DISCLOSURE SHARES PLUS - ACCUMULATION Effective date: 31 DEC 2020 AUSTRALIAN SHARES A2 MILK CO LTD ABACUS PROPERTY GROUP REIT ACCENT GROUP LTD ADAIRS LTD ADBRI LTD AFTERPAY LTD AGL ENERGY LTD AINSWORTH GAME TECHNOLOGY LTD ALACER GOLD CORP ALE PROPERTY GROUP REIT ALS LTD ALTIUM LTD ALUMINA LTD AMA GROUP LTD AMCOR PLC AMP LTD ANSELL LTD APA GROUP STAPLED SECURITY APPEN LTD ARB CORP LTD ARISTOCRAT LEISURE LTD ASALEO CARE LTD ASX LTD ATLAS ARTERIA STAPLED SECURITY AUB GROUP LTD AUCKLAND INTL AIRPORT LTD AURELIA METALS LTD AUSNET SERVICES Issued by NGS Super Pty Limited ABN 46 003 491 487 AFSL No 233 154 the trustee of NGS Super ABN 73 549 180 515 ngssuper.com.au 1300 133 177 NGS SUPER – PORTFOLIO HOLDINGS DISCLOSURE 1 SHARES PLUS - ACCUMULATION Effective date: 31 DEC 2020 AUSSIE BROADBAND AUST AND NZ BANKING GROUP AUSTAL LTD AUSTRALIAN FINANCE GROUP LTD AUSTRALIAN PHARMA INDUS LTD AUSTRALIAN VINTAGE LTD AVENTUS GROUP REIT AVITA MEDICAL INC BABY BUNTING GROUP LTD BANK OF QUEENSLAND LTD BAPCOR LTD BEACH ENERGY LTD BEACON LIGHTING GROUP LTD BEGA CHEESE LTD BENDIGO AND ADELAIDE BANK BHP GROUP LTD BINGO INDUSTRIES LTD BLACKMORES LTD BLUESCOPE STEEL LTD BORAL LTD BRAMBLES LTD BRAVURA SOLUTIONS LTD BREVILLE GROUP LTD BRICKWORKS LTD BWP TRUST REIT CALTEX AUSTRALIA LTD CAPITOL HEALTH LTD CAPRAL LTD CAPRICORN METALS LTD CARDNO LTD CARNARVON PETROLEUM LTD CARSALES.COM LTD CASH CEDAR WOODS PROPERTIES LTD CENTURIA INDUSTRIAL REIT CENTURIA METROPOLITAN REIT CHALLENGER LTD CHAMPION IRON LTD CHARTER HALL GROUP REIT CHARTER HALL -

STOXX AUSTRALIA 150 Selection List

STOXX AUSTRALIA 150 Last Updated: 20210701 ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) Rank (FINAL)Rank (PREVIOUS) AU000000CBA7 6215035 CBA.AX 621503 Commonwealth Bank of Australia AU AUD Y 112.2 1 1 AU000000BHP4 6144690 BHP.AX 614469 BHP GROUP LTD. AU AUD Y 90.6 2 2 AU000000CSL8 6185495 CSL.AX 618549 CSL Ltd. AU AUD Y 82.2 3 3 AU000000WBC1 6076146 WBC.AX 607614 Westpac Banking Corp. AU AUD Y 59.9 4 4 AU000000NAB4 6624608 NAB.AX 662460 National Australia Bank Ltd. AU AUD Y 54.8 5 5 AU000000ANZ3 6065586 ANZ.AX 606558 Australia & New Zealand Bankin AU AUD Y 50.7 6 6 AU000000WES1 6948836 WES.AX 694883 Wesfarmers Ltd. AU AUD Y 42.4 7 7 AU000000MQG1 B28YTC2 MQG.AX 655135 Macquarie Group Ltd. AU AUD Y 32.5 8 9 AU000000WOW2 6981239 WOW.AX 698123 WOOLWORTHS GROUP AU AUD Y 30.6 9 8 AU000000RIO1 6220103 RIO.AX 622010 Rio Tinto Ltd. AU AUD Y 29.8 10 10 AU000000TLS2 6087289 TLS.AX 608545 Telstra Corp. Ltd. AU AUD Y 28.3 11 11 AU000000FMG4 6086253 FMG.AX 608625 Fortescue Metals Group Ltd. AU AUD Y 25.5 12 12 AU000000TCL6 6200882 TCL.AX 689933 Transurban Group AU AUD Y 24.7 13 13 AU000000GMG2 B03FYZ4 GMG.AX 690433 Goodman Group AU AUD Y 22.5 14 14 AU000000APT1 BF5L8B9 APT.AX AU802E AFTERPAY AU AUD Y 18.7 15 17 AU000000ALL7 6253983 ALL.AX 605156 Aristocrat Leisure Ltd. AU AUD Y 17.4 16 15 AU0000030678 BYWR0T5 COL.AX AU80Q2 Coles Group AU AUD Y 14.4 17 18 AU000000WPL2 6979728 WPL.AX 697972 Woodside Petroleum Ltd. -

Voting Report 31 December 2016

Voting report for the period 1 July 2016 to 31 December 2016 Meeting Date Ticker Company Name Summary CareSuper Vote 08/11/16 NCM Newcrest Mining Ltd. Elect Peter Hay as Director For 08/11/16 NCM Newcrest Mining Ltd. Elect Philip Aiken as Director For 08/11/16 NCM Newcrest Mining Ltd. Elect Rick Lee as Director For 08/11/16 NCM Newcrest Mining Ltd. Elect John Spark as Director For 08/11/16 NCM Newcrest Mining Ltd. Elect Vickki McFadden as Director For 08/11/16 NCM Newcrest Mining Ltd. Approve the Grant of Performance Rights to Sandeep Biswas For 08/11/16 NCM Newcrest Mining Ltd. Approve the Grant of Performance Rights to Gerard Bond For 08/11/16 NCM Newcrest Mining Ltd. Approve the Remuneration Report For 04/07/16 BAP Bapcor Limited Approve the Change of Company Name to BAPCOR Limited For 12/07/16 SEA Sundance Energy Australia Ltd. Ratify the Past Issuance of Shares to Certain Sophisticated, Professional or Institutional Investors Abstain^ 12/07/16 SEA Sundance Energy Australia Ltd. Approve the Issuance of Shares to Certain Sophisticated, Professional and Institutional Investors Abstain^ 12/07/16 SEA Sundance Energy Australia Ltd. Approve the Issuance of SPP Shares to Shareholders Abstain^ 14/07/16 AAC Australian Agricultural Company Ltd. Approve the Remuneration Report For 14/07/16 AAC Australian Agricultural Company Ltd. Elect David Crombie as Director For 14/07/16 AAC Australian Agricultural Company Ltd. Elect Tom Keene as Director For 14/07/16 AAC Australian Agricultural Company Ltd. Elect Neil Reisman as Director For 14/07/16 AAC Australian Agricultural Company Ltd. -

(ASX100) Women on Boards Analysis

Australia/NZ | Australia Thematic Investing (Citi) Equities 18 August 2011 │ 32 pages ESG: ASX100 Women on Board Analysis Increasing Focus on Board Diversity Women on Boards of ASX100 Companies — The ASX Corporate Governance Council’s new principles and recommendations on diversity commenced on 1 January Elaine Prior 2011. This is likely to lead to increasing focus on companies’ approaches to diversity +61-2-8225-4891 issues, including female representation on company boards. This report looks at data [email protected] on women directors on ASX100 company boards. The number of women directors has Felipe Faria increased, particularly in recent months (Figure 5 to Figure 8). Board diversity may [email protected] enhance effectiveness, by providing a wider range of perspectives and knowledge. Women on Boards Data — We collected and analysed data on female board directors of S&P/ASX100 companies from FY08 to 8 August 2011 (Figure 5 to Figure 9). At 8 August 2011 there were 134 women on ASX100 boards, a 46% increase from FY08. ASX100 companies with no female board directors were AQP, CQO, EGP, FMG, IPL, JHX, LEI, LYC, OSH, PDN, PRY, RHC, RMD, SGM and SWM. Companies with three female directors (the highest number identified) are AMP, BEN, CBA, MQG, QAN, QBE and WBC. Seven female directors each currently hold three ASX100 directorships. Business Case for Gender Diversity — Reibey Institute research found that those ASX500 companies with women directors on 30 June 2010 had a 3-year return on equity (ROE) 10.7% higher than those without any women directors. The 5-year ROE was 11.1% higher. -

Stoxx® Pacific Total Market Index

STOXX® PACIFIC TOTAL MARKET INDEX Components1 Company Supersector Country Weight (%) CSL Ltd. Health Care AU 7.79 Commonwealth Bank of Australia Banks AU 7.24 BHP GROUP LTD. Basic Resources AU 6.14 Westpac Banking Corp. Banks AU 3.91 National Australia Bank Ltd. Banks AU 3.28 Australia & New Zealand Bankin Banks AU 3.17 Wesfarmers Ltd. Retail AU 2.91 WOOLWORTHS GROUP Retail AU 2.75 Macquarie Group Ltd. Financial Services AU 2.57 Transurban Group Industrial Goods & Services AU 2.47 Telstra Corp. Ltd. Telecommunications AU 2.26 Rio Tinto Ltd. Basic Resources AU 2.13 Goodman Group Real Estate AU 1.51 Fortescue Metals Group Ltd. Basic Resources AU 1.39 Newcrest Mining Ltd. Basic Resources AU 1.37 Woodside Petroleum Ltd. Oil & Gas AU 1.23 Coles Group Retail AU 1.19 Aristocrat Leisure Ltd. Travel & Leisure AU 1.02 Brambles Ltd. Industrial Goods & Services AU 1.01 ASX Ltd. Financial Services AU 0.99 FISHER & PAYKEL HLTHCR. Health Care NZ 0.92 AMCOR Industrial Goods & Services AU 0.91 A2 MILK Food & Beverage NZ 0.84 Insurance Australia Group Ltd. Insurance AU 0.82 Sonic Healthcare Ltd. Health Care AU 0.82 SYDNEY AIRPORT Industrial Goods & Services AU 0.81 AFTERPAY Financial Services AU 0.78 SUNCORP GROUP LTD. Insurance AU 0.71 QBE Insurance Group Ltd. Insurance AU 0.70 SCENTRE GROUP Real Estate AU 0.69 AUSTRALIAN PIPELINE Oil & Gas AU 0.68 Cochlear Ltd. Health Care AU 0.67 AGL Energy Ltd. Utilities AU 0.66 DEXUS Real Estate AU 0.66 Origin Energy Ltd. -

ESG Reporting by the ASX200

Australian Council of Superannuation Investors ESG Reporting by the ASX200 August 2019 ABOUT ACSI Established in 2001, the Australian Council of Superannuation Investors (ACSI) provides a strong, collective voice on environmental, social and governance (ESG) issues on behalf of our members. Our members include 38 Australian and international We undertake a year-round program of research, asset owners and institutional investors. Collectively, they engagement, advocacy and voting advice. These activities manage over $2.2 trillion in assets and own on average 10 provide a solid basis for our members to exercise their per cent of every ASX200 company. ownership rights. Our members believe that ESG risks and opportunities have We also offer additional consulting services a material impact on investment outcomes. As fiduciary including: ESG and related policy development; analysis investors, they have a responsibility to act to enhance the of service providers, fund managers and ESG data; and long-term value of the savings entrusted to them. disclosure advice. Through ACSI, our members collaborate to achieve genuine, measurable and permanent improvements in the ESG practices and performance of the companies they invest in. 6 INTERNATIONAL MEMBERS 32 AUSTRALIAN MEMBERS MANAGING $2.2 TRILLION IN ASSETS 2 ESG REPORTING BY THE ASX200: AUGUST 2019 FOREWORD We are currently operating in a low-trust environment Yet, safety data is material to our members. In 2018, 22 – for organisations generally but especially businesses. people from 13 ASX200 companies died in their workplaces. Transparency and accountability are crucial to rebuilding A majority of these involved contractors, suggesting that this trust deficit. workplace health and safety standards are not uniformly applied. -

Annual Report 2014/15 Report | Annual

Screen Australia | Annual Report 2014/15 Screen Australia Annual Report 2014/15 www.screenaustralia.gov.au Published by Screen Australia October 2015 ISSN 1837-2740 © Screen Australia 2015 The text in this Annual Report is released subject to a Creative Commons BY licence (Licence). This means, in summary, that you may reproduce, transmit and distribute the text, provided that you do not do so for commercial purposes, and provided that you attribute the text as extracted from Screen Australia’s Annual Report 2014/15. You must not alter, transform or build upon the text in this Annual Report. Your rights under the Licence are in addition to any fair dealing rights which you have under the Copyright Act 1968 (Cwlth). For further terms of the Licence, please see http://creativecommons.org/licenses/ by-nc-nd/3.0/au/. You are not licensed to reproduce, transmit or distribute any still photographs contained in this Annual Report without the prior written permission of Screen Australia. TV ratings data Metropolitan and National market data is copyright to OzTAM. The data may not be reproduced, published or communicated (electronically or in hard copy) in whole or part without the prior consent of OzTAM. All Annual Report enquiries should be addressed to: Regional market data is copyright to RegionalTAM. The data may not be reproduced, published or communicated Communications Unit (electronically or in hard copy) in whole Screen Australia or part without the prior consent of Level 7, 45 Jones Street RegionalTAM. Ultimo NSW 2007 This Annual Report is available to download Toll free: 1800 213 099 as a PDF from www.screenaustralia.gov.au Phone: 02 8113 5800 Front cover image from Mad Max: Fury Road.