Form-990 I W 2006

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Young Scholars Program Renewed

News from the R&ACCenter for the Study of Religion and American Culture Spring 2007 Volume 14, Number 1 Young Scholars Program Renewed We are pleased to announce that Lilly Endowment has agreed to Mentors for the 2007-09 Young Scholars in American Religion renew funding for the Young Scholars in American Religion Program. Program will be Dr. Amanda Porterfi eld, the Robert A. Spivey The grant, totaling $852,589, will enable the program to continue Professor of Religion at Florida State University, and Dr. Paul Harvey, through 2012. Professor of History at University of Colorado, Colorado Springs. Begun in 1991, over one hundred new faculty members have Dr. Porterfi eld is author of such important books as Female Piety completed the series of seminars in Puritan New England, Mary Lyon dedicated to teaching and research. The and the Mount Holyoke Missionaries, program will continue to focus on those and The Transformation of American elements of the profession but also Religion, and more recently Healing include a weekend seminar on such “ in the History of Christianity and The other professional issues as constructing Protestant Experience in America. Dr. a tenure portfolio, publication, grant This program is unique Harvey is author of Redeeming the writing, and department politics. in its design and its long- South and Freedom’s Coming, as well “I believe this is one of the most as co-editor of Themes in Religion and time level of success. I’m successful training seminars for new American Culture and The Columbia faculty in any fi eld of study,” said Philip proud that it is associated Documentary History of Religion in Goff, director of the Center for the Study “with Lilly Endowment. -

List for 4-06

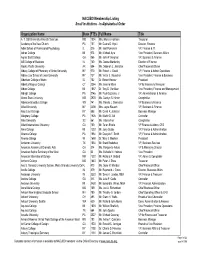

NACUBO Membership Listing Small Institutions - In Order by State Organization Name State FTEs Full Name Title University of Alaska Southeast AK 1760 Ms. Carol Griffin Vice Chancellor, Administrative Services Alaska Pacific University AK 554 Ms. Deborah L. Johnston Chief Financial Oficcer University of West Alabama AL 2131 Mr. Raiford T. Noland Vice President for Business Affairs Huntingdon College AL 690 Mr. Jay Dorman, CPA VP Business & Finance University of Mobile AL 1475 Mr. Steve Lee VP for Business Affairs Miles College AL 1638 Mrs. Diana Knighton Chief Fiscal Officer Spring Hill College AL 1202 Ms. Rhonda Shirazi, CPA VP for Finance University of Montevallo AL 2701 Ms. Cynthia Jarrett VP for Business Affairs & Treasurer Marion Military Institute AL 194 Mr. Gary R. Wallace Vice President, Finance Southern Christian University AL 545 Ms. Barbara P. Turner Business Manager Faulkner University AL 2092 Mrs. Wilma D. Phillips Vice President, Finance Birmingham-Southern College AL 1405 Dr. R. Wayne Echols VP, Bus & Finance Southern Arkansas University AR 2638 Mr. Roger W. Giles VP, Administration & Finance Williams Baptist College AR 556 Mr. Dan Watson VP, Business Affairs Ouachita Baptist University AR 1462 Mr. Richard M. Stipe Vice President for Administration Hendrix College AR 1034 Mr. Robert Young Vice President, Business & Finance University of Arkansas for Medical Sciences AR 1882 Ms. Melony Williams Goodhand Vice Chancellor, Finance & CFO Central Baptist College AR 336 Mr. Don J. Jones Vice President for Finance John Brown University AR 1769 Ms. Patricia R. Gustavson VP Finance & Administration University of Arkansas at Monticello AR 2561 Dr. Mark Davis VC for Finance & Admin Lyon College AR 495 Mr. -

City of Indianapolis, Indiana

Ratings: S&P: "A (stable)" Fitch: "A (stable)" Refunding Issue, Book-Entry Only See RATINGS In the opinion of Ice Miller LLP, Indianapolis, Indiana, bond counsel, under existing federal statutes, decisions, regulations and rulings, interest on the Series 2014A Bonds (as defined herein) is excludable from gross income for federal income tax purposes under Section 103 of the Code (as defined herein), is not an item of tax preference for purposes of the federal alternative minimum tax imposed on individuals and corporations, but is taken into account in determining adjusted current earnings for the purpose of computing the federal alternative minimum tax imposed on certain corporations. This opinion is conditioned on the continuing compliance of Citizens (as defined herein) with the Tax Covenants (as defined herein). In the opinion of Ice Miller LLP, Indianapolis, Indiana, bond counsel, under existing statutes, decisions, regulations and rulings, interest on the Series 2014A Bonds is exempt from income taxation in the State of Indiana. See "TAX MATTERS" herein and Appendix E hereto. $35,265,000 CITY OF INDIANAPOLIS, INDIANA Thermal Energy System First Lien Revenue Refunding Bonds, Series 2014A Dated: Date of Delivery The City of Indianapolis, Indiana, acting by and through its Board of Directors for Utilities of its Department of Public Utilities ("Citizens Energy Group" or "Citizens") is issuing its Thermal Energy System First Lien Revenue Refunding Bonds, Series 2014A ("Series 2014A Bonds") as described in this Official Statement, for the purpose of (i) currently refunding its Thermal Energy System First Lien Revenue Bonds, Series 2013B (the "Refunded Bonds"), and (ii) funding costs of the refunding and the issuance of the Series 2014 Bonds. -

Pope Beatifies Married Couple New President and 22 Committee Chairs VATICAN CITY (CNS)—For the First

Inside Archbishop Buechlein . 4, 5 Editorial. 4 Question Corner . 11 TheCCriterionriterion Sunday & Daily Readings. 11 Serving the Church in Central and Southern Indiana Since 1960 www.archindy.org October 26, 2001 Vol. XXXXI, No. 4 50¢ Parish Stewardship and United Catholic Appeal off to a fast start By Mary Ann Wyand thanked Peggy Magee, a member of Called to Serve advance commitment team. Home missions are parishes and arch- St. Pius X Parish in Indianapolis; Father Therber said people who attended the diocesan schools that need the financial Early commitments to the 2001 Called Paul D. Koetter, pastor of St. Monica deanery stewardship dinners, which support of all Catholics in the archdiocese. to Serve: Parish Stewardship and United Parish in Indianapolis, and included pastoral and lay lead- Shared ministries support people in every Catholic Appeal totaled $410,497 as of Jeffrey D. Stumpf, chief finan- ers, have contributed to date parish by paying for the cost of educating Oct. 23, said Joseph S. Therber, secretary cial officer of the archdiocese, 31 percent more than the pre- 24 seminarians, caring for 31 retired for Stewardship and Development for the for leading, respectively, the vious year. priests, supporting the work of eight Archdiocese of Indianapolis. advance commitment, pastoral The minimum goal for this Catholic Charities agencies, supporting the Pledges already received include and employee phases of the year’s Parish Stewardship and seven archdiocesan high schools, and fund- $340,790 in advance commitment gifts, campaign. United Catholic Appeal is ing evangelization and liturgical renewal $46,190 from the pastoral (clergy) phase of Advance commitment gifts $4.85 million. -

Held the Ordinance Constitutional

IP 00-1321-C H/G AAMA v Kendrick Judge David F. Hamilton Signed on 10/11/00 INTENDED FOR PUBLICATION AND PRINT UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF INDIANA INDIANAPOLIS DIVISION AMERICAN AMUSEMENT MACHINE ) CAUSE NO. IP00-1321-C-H/G ASSOCIATION, ) AMUSEMENT & MUSIC OPERATORS ) ASSOCIATION, ) INDIANA AMUSEMENT & MUSIC ) OPERATORS ASSOCIATION, ) SHAFFER DISTRIBUTING COMPANY, ) CLEVELAND COIN MACHINE EXCHANGE ) INC, ) NAMCO CYBERTAINMENT INC, ) B J NOVELTY INC. - FOR ) THEMSELVES AND AS ) REPRESENTATIVES OF A CLASS OF ) OWNERS, OPERATORS, DISTRIBUTORS ) AND MANUFACTURERS OF ) CURRENCY-OPERATED AMUSEMENT ) MACHINES, ) ) Plaintiffs, ) vs. ) ) COTTEY, JACK - FOR THEMSELVES ) IN THEIR OFFICIAL CAPACITIES AS ) MARION COUNTY PROSECUTOR AND ) SHERIFF FOR MARION COUNTY, ) RESPECTIVELY, AND AS ) REPRESENTATIVES OF THE CLASS OF ) PERSONS EMPOWERED TO ENFORCE ) GENERAL ORDINANCE NO. 72,2000, ) PETERSON, BART, ) BARKER, JERRY L - FOR ) THEMSELVES, IN THEIR OFFICIAL ) CAPACITIES AS MAYOR AND CHIEF ) OF POLICE FOR THE CITY OF ) INDIANAPOLIS, RESPECTIVELY, AND ) AS REPRESENTATIVES OF THE CLASS ) OF PERSONS EMPOWERED TO ENFORCE ) GENERAL ORDINANCE NO. 72,2000, ) KENDRICK, TERI, IN HER OFFICIAL ) B David L Kelleher Arent Fox Kintner Plotkin & Kahn 1050 Connecticut Avenue NW Washington, DC 20036-5339 B Wayne C Turner McTurnan & Turner 2400 Market Tower 10 West Market Street Indianapolis, IN 46204 A Scott Chinn Corp Counsel For the City of Indpls City-County Bldg Suite 1601 200 E Washington Street Indianapolis, IN 46204 Matthew R Gutwein Baker & Daniels 300 North Meridian Street Suite 2700 Indianapolis, IN 46204 CAPACITY AS THE DESIGNATED CITY ) PROSECUTOR OF THE CITY OF ) INDIANAPOLIS, ) ) Defendants. ) -2- UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF INDIANA INDIANAPOLIS DIVISION AMERICAN AMUSEMENT MACHINE, ) ASSOCIATION, et al., ) ) Plaintiffs, ) ) CAUSE NO. -

List for 4-06

NACUBO Membership Listing Small Institutions - In Alphabetical Order Organization Name State FTEs Full Name Title A. T. Still University of Health Sciences MO 1504 Mrs. Monica Harrison Treasurer Academy of the New Church PA 157 Mr. Duane D. Hyatt Director, Finance Adler School of Professional Psychology IL 316 Mr. Joel Pomerenk VP, Finance & IT Adrian College MI 973 Mr. Michael Ayre Vice President, Business Affairs Agnes Scott College GA 966 Mr. John P. Hegman VP, Business & Finance AIB College of Business IA 760 Ms. Donna Mackerley Director of Finance Alaska Pacific University AK 554 Ms. Deborah L. Johnston Chief Financial Oficcer Albany College of Pharmacy of Union University NY 970 Mr. Robert J. Gould VP, Finance & Admin Operations Albany Law School of Union University NY 727 Mr. Victor E. Rauscher Vice President, Finance & Business Albertson College of Idaho ID 782 Dr. Robert Hoover President Albertus Magnus College CT 2264 Ms. Jeanne Mann VP for Finance & Treasurer Albion College MI 1857 Dr. Troy D. VanAken Vice President, Finance and Management Albright College PA 2146 Mr. Paul Gazzerro, Jr. VP, Administration & Finance Alcorn State University MS 2928 Ms. Carolyn S. Hinton Comptroller Alderson-Broaddus College WV 741 Ms. Marsha L. Denniston VP Business & Finance Alfred University NY 2208 Mrs. Joyce Rausch VP, Business & Finance Alice Lloyd College KY 598 Mr. David R. Johnson Business Manager Allegheny College PA 1926 Mr. Martin D. Ahl Controller Allen University SC 561 Ms. Valeria Farr Comptroller Alliant International University CA 700 Mr. Tarun Bhatia VP Finance & Admin, CFO Alma College MI 1233 Mr. Jerry Scoby VP, Finance & Administration Alvernia College PA 1964 Mr. -

FYI Newsletter November 9, 2009

FYI Newsletter November 9, 2009 Quick Scan: Transition IEP Webinars ADA-Indiana Audio Conference The Ziggurat Model Workshop - Location Change Community Connections Wins “Your Day, Your Month” CWLab Experience! Resolutions Adopted by Indiana Commission on Developmental Disabilities When Did I Get Old? Library Corner UPCOMING TRANSITION IEP WEBINARS: The Indiana Institute’s Center on Community Living and Careers, in conjunction with the Indiana Department of Education, is sponsoring two opportunities to participle in a webinar focused on transition IEPs and the Indiana Transition Requirements checklist (indicator 13). Additional areas such as the summary of findings of the transition assessment and annual goals to support the measurable postsecondary goals will be highlighted and reviewed to enhance quality and compliance requirements. During the session, participants will have the opportunity to type in questions. Time will be allotted throughout the training to respond to questions. Additional questions and answers will be posted on the Center’s website at http://www.iidc.indiana.edu/cclc. Webinar dates and times are: Tuesday, November 17, 2009 – 3:15-4:45 p.m. Friday, November 20, 2009 – 11:00-12:30 p.m. To register, visit http://wwww.iidc.indiana.edu/index.php?pageId=1853. You will receive an e-mail confirmation and link to the webinar site. Note: All times are Eastern Daylight Savings Time. For more information or questions, contact Susan Harris at (812) 855-6508 or e-mail [email protected]. ADA-INDIANA AUDIO CONFERENCE: Are you interested in learning more about recent case law involving the Americans with Disabilities Act? If so, plan to attend the ADA-Indiana sponsored audio conference titled Legal Update: Review and Analysis of Key Concepts under the ADA, scheduled for Tuesday, November 17, from 2:00-3:30 p.m. -

Dr. Teresa Hairston

ARCHIVES OF AFRICAN AMERICAN MUSIC AND CULTURE liner notesNO. 21 / 2016-2017 Dr. Teresa Hairston: Gospel Music Entrepreneur aaamc mission From the Desk of the Director The AAAMC is devoted to the collection, preservation, and dissemination of materials for With my official retirement from Cooper (African American and African the purpose of research and Indiana University, I mark the end of my Diaspora Studies) and Dr. Alisha Jones study of African American two and one-half year term as Director (Folklore and Ethnomusicology), music and culture. of the Archives of African American discuss how the construction of sound aaamc.indiana.edu Music and Culture (AAAMC). The in African American musical genres, as experience has been richly rewarding, as well as the physical bodies of African much for the opportunity to collect data American musicians, have often been Table of Contents which documents contemporary events assessed and analyzed in ways which and pivotal figures who have contributed run counter to deeply held values shared From the Desk to the development, dissemination among African Americans themselves. of the Director .....................2 and proliferation of African American Dr. Deborah Smith Pollard, gospel In the Vault: musics, as for the opportunities to devise music radio personality and University Recent Donations .................3 strategies for publicly sharing this data of Michigan-Dearborn faculty, served to the local IU community and the as keynote speaker, highlighting the One on One: Interview global public. extent to which decision-making in the with Dr. Teresa Hairston ........4 Established in 1991 with the support gospel music industry is influenced by Featured Collection: of a Ford Foundation grant issued to perceptions of musical and physical Teresa Hairston the Department of Afro-American beauty that often contradict rather than Gospel Music Collection ......10 Studies (where founding AAAMC embrace African American cultural director Portia K. -

Academy Celebrates 150 Years

Inside Archbishop Buechlein . 4, 5 Editorial . 4 Question Corner . 17 The Sunday and Daily Readings . 17 Serving the CChurchCriterion in Centralr andi Southert n Indianae Since 1960rion www.archindy.org September 6, 2002 Vol. XXXXI, No. 47 50¢ Catholic Charities focuses on Sept. 11 victims Pray for Peace A message from NEW YORK (CNS)—The Catholic for Catholic Charities of the Diocese of Charities organizations of New York, Brooklyn and the person in charge of its Archbishop which began programs of services to response to the Sept. 11 attack, said assis- Daniel M. Buechlein those affected by the destruction of the tance was being given within hours after CNS photo from Reuters World Trade Center immediately after the the towers were hit. Greetings and peace be with you. attack, are continuing these services a Signs quickly went up telling people The tragic events of last Sept. 11 year later and projecting extension of the fleeing Manhattan by foot across the have reinforced the importance of special effort for two more years. Manhattan Bridge into Brooklyn that a prayer in our lives. Asking for God’s Msgr. Kevin L. Sullivan, Catholic house was open there to help them, he healing grace through prayer can Charities director for the Archdiocese of said. They could wash the dust off their bring us hope in difficult times. New York, said in an interview on faces, use the telephones to contact family The best and least we can do is Aug. 27 that the experience of the members and rest while they tried to get pray for our president and his admin- Sept. -

NACUBO Membership Listing Small Institutions- in Order by State

NACUBO Membership Listing Small Institutions- in Order by State Institution FTEs State Full Name Title Alaska Pacific University 473 AK Ms. Deborah L. Johnston Chief Financial Officer University of Alaska Southeast 1651 AK Ms. Carol Griffin Director Administrative Services Birmingham-Southern College 1344 AL Dr. R. Wayne Echols VP, Bus & Finance Faulkner University 1993 AL Mrs. Wilma D. Phillips Vice President for Finance Huntingdon College 641 AL Mr. Jay Dorman, CPA VP Business & Finance Marion Military Institute 173 AL Mr. Gary R. Wallace Vice President, Finance Miles College 1587 AL Mrs. Diana Knighton Chief Fiscal Officer Southern Christian University 543 AL Ms. Barbara P. Turner Business Manager Spring Hill College 1203 AL Ms. Rhonda Shirazi, CPA VP for Finance University of Mobile 1469 AL Mr. Steve Lee VP for Business Affairs University of Montevallo 2738 AL Ms. Cynthia Jarrett VP for Business Affairs & Treasurer University of West Alabama 2023 AL Mr. Raiford T. Noland Vice President for Business Affairs Central Baptist College 372 AR Mr. Don J. Jones Vice President for Finance Hendrix College 1046 AR Mr. Robert Young Vice President, Business & Finance John Brown University 1670 AR Ms. Patricia R. Gustavson VP Finance & Administration Lyon College 464 AR Mr. Kenneth Rueter VP for Business & Finance Ouachita Baptist University 1501 AR Mr. Richard M. Stipe Vice President for Administration Southern Arkansas University 2649 AR Mr. Roger W. Giles VP, Administration & Finance University of Arkansas at Monticello 2506 AR Dr. Mark Davis VC for Finance & Admin University of Arkansas at Pine Bluff 2987 AR Mrs. Barbara A. Goswick Assoc VP, Finance & Admin University of Arkansas for Medical Sciences 1835 AR Ms. -

General History the Diocese of Vincennes—Now the Archdiocese of Indianapolis—Was Established by Pope Gregory XVI on May 6, 1834

General History The Diocese of Vincennes—now the Archdiocese of Indianapolis—was established by Pope Gregory XVI on May 6, 1834. The territory then comprised the entire state of Indiana and the eastern third of Illinois. The latter was separated from the Diocese of Vincennes upon the establishment of the Diocese of Chicago, November 28, 1843. By decree of Pope Pius IX, January 8, 1857, the northern half of the state became the Diocese of Fort Wayne, the boundaries being that part of the state north of the south boundaries of Fountain, Montgomery, Boone, Hamilton, Madison, Delaware, Randolph, and Warren counties. The remaining southern half of the state made up the Diocese of Vincennes, embracing 50 counties. It covered an area of 18,479 square miles extending from the north boundaries of Marion and contiguous counties to the Ohio River and from Illinois on the west to Ohio on the east. The second bishop of Vincennes was permitted by apostolic brief to establish his resi- dence at Vincennes, Madison, Lafayette, or Indianapolis; Vincennes was, however, to remain the see city. This permission, with the subtraction of Lafayette, was renewed to the fourth bishop. Upon his appointment in 1878, Bishop Francis Chatard, the fifth bishop of Vincennes, was directed to fix his residence at Indianapolis. Although the site of the cathedral and the title of the see were continued at Vincennes, Bishop Chatard used St. John the Evangelist Parish in Indianapolis as an unofficial cathedral until the Cathedral of SS. Peter and Paul was completed in 1907. St. John the Evangelist Parish, established in 1837, was the first parish in Indianapolis and Marion County. -

Largest Indianapolis-Area Commercial Property Management

Largest Indianapolis-Area Commercial Property Management Firms (Ranked by gross leasable area managed locally (1)) LOCAL FTE: BROKERS / PERCENT: LOCAL PROPERTIES AGENTS PROPERTY RANK FIRM GLA MANAGED:(1) OFFICE MANAGED HEAD(S) OF LOCAL EMPLOYEES: OWNERSHIP: ESTAB. 2013 ADDRESS LOCALLY RETAIL LARGEST INDIANAPOLIS-AREA % OF SPACE OPERATIONS, TITLE(S) PROPERTY MGT. % INDIANA LOCALLY rank TELEPHONE / FAX / WEBSITE NATIONALLY INDUSTRIAL PROPERTIES MANAGED OWNED BY FIRM LOCAL DIRECTOR(S) TOTAL % OTHER HQ CITY Cassidy Turley 32.9 million 30 Keystone at the Crossing, 308 Jeffrey L. Henry, 29 24 1918 One American Square, Suite 1300, 46282 400.0 million 4 The Precedent Office Park, 0 regional managing principal 145 76 Washington, 1 (317) 634-6363 / fax (317) 639-0504 / cassidyturley.com 66 OneAmerica Tower Timothy J. Michel 209 D.C. 1 Duke Realty Corp. 27.5 million 22 AllPoints Midwest Bldg. 1, 164 Keith Konkoli, Charlie Podell, 9 94 1972 600 E. 96th St., Suite 100, 46240 15.3 million 0 AllPoints Midwest Bldg. 3, 91 SVPs; Jeff Stone, VP 18 6 Indianapolis 2 (317) 808-6000 / fax (317) 808-6650 / dukerealty.com 78 AllPoints at Anson Bldg. 1 Chris Yeakey, Ryan Rothacker 360 2 Cushman & Wakefield/Summit Realty Group (2) 10.2 million 20 BMO PLaza, 58 Matt Langfeldt, Brian Zurawski, DND DND 1993 241 N. Pennsylvania St, Suite 300, 46204 DND 1 ISTA Center, DND managing partners 23 DND Indianapolis 3 (317) 713-2100 / fax (317) 713-2103 / summitrealtygroup.com 79 One and Two Penn Mark Kenneth M. Petruska DND 3 Simon Property Group Inc. 7.0 million 1 Castleton Square, 13 David E.