Savills Studley Research New York City

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Appetite for Autumn 34Th Street Style Knicks & Nets

NOV 2014 NOV ® MUSEUMS | Knicks & Nets Knicks 34th Street Style Street 34th Restaurants offering the flavors of Fall NBA basketball tips-off in New York City York New in tips-off basketball NBA Appetite For Autumn For Appetite Styles from the world's brands beloved most BROADWAY | DINING | ULTIMATE MAGAZINE FOR NEW YORK CITY FOR NEW YORK MAGAZINE ULTIMATE SHOPPING NYC Monthly NOV2014 NYCMONTHLY.COM VOL. 4 NO.11 44159RL_NYC_MONTHLY_NOV.indd All Pages 10/7/14 5:18 PM SAMPLE SALE NOV 8 - NOV 16 FOR INFO VISIT: ANDREWMARC.COM/SAMPLESALE 1OOO EXCLUSIVES • 1OO DESIGNERS • 1 STORE Contents Cover Photo: Woolworth Building Lobby © Valerie DeBiase. Completed in 1913 and located at 233 Broadway in Manhattan’s financial district, The Woolworth building is an NYC landmark and was at the time the world’s tallest building. Its historic, ornate lobby is known for its majestic, vaulted ceiling, detailed sculptures, paintings, bronze fixtures and grand marble staircase. While generally not open to the public, this neo-Gothic architectural gem is now open for tours with limited availability. (woolworthtours.com) FEATURES Top 10 things to do in November Encore! Encore! 16 26 Feel the energy that only a live performance in the Big Apple can produce 34th Street Style 18 Make your way through this stretch of Midtown, where some of the biggest outposts from global NYC Concert Spotlight brands set up shop 28 Fitz and the Tantrums Appetite For Autumn 30 The Crowd Goes Wild 20 As the seasons change, so do these restaurant's NBA basketball tips off in NYC menus, -

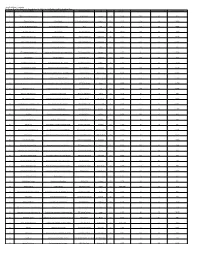

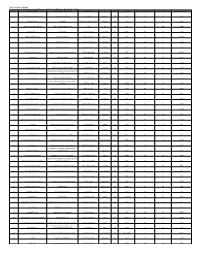

Sorted Alphabetically by Applicant Name Line

New York Power Authority ReCharge New York Applicants through June 25, 2020 - Sorted Alphabetically by Applicant Name Line Business Name Description of Applicant Street Address City State Zip Code NYS Assembly District(s) NY Senate District(s) Application Number 1 1886 Welcome Home Farm, Inc Community Food Pantry 6735 Route 9 Hudson NY 12534 103 41 8775 2 2 Twisted Farmers Farm (hops) 233 Clark Road Pulaski, NY 13142 Pulaski NY 13142 120 48 39930 3 24 Hour Tax & Accounting LLC Income tax preparation services N/A N/A NY N/A N/A N/A 18505 4 26 Cooper Ave., LLC Shop Painting 26 Cooper Avenue Tonawanda NY 14150 140 60 37389 5 2758 Trombley Road, LLC Bulk trucking services 2758 Trombley Road Weedsport NY 13166 130 50 96589 6 2758 Trombley Road, LLC Bulk trucking services 2758 Trombley Road Weedsport NY 13166 130 50 97098 7 346 Connecticut LLC Architect and developer 346 Connecticut Street Buffalo NY 14213 144 58 8794 8 365 Operating Company, LLC Data center & information technology services 500 Commack Road Commack NY 11725 8 2 87519 9 3M Company Cellulose sponges 305 Sawyer Ave. Tonawanda NY 14150 140 60 9379 10 425 Michigan Avenue LLC Medical/Educational office building 425 Michigan Avenue Buffalo NY 14203 141 63 23139 11 499 Syracuse City Centre Restoring and renovating buildings 499 S Warren St. Syracuse NY 13202 129 53 10117 12 5000 Group LLC Ownership/management of hotels, apartments & retail 5195 Main Street Williamsville NY 14221 148 61 11642 13 525 Wheat, LLC Start-up manufacturing facility 525 Wheatfield Street North Tonawanda NY 14120 140 62 11700 14 607 Phillips Street Acquisition, LLC (name to be determined for operating company) Frozen value added chicken products will be produced 607 Phillips Street Fulton NY 13069 120 48 14735 15 669 River Street LLC Incubator office space for new businesses 669 River Street Troy NY 12180 108 44 83448 16 850 East 138th Street, LLC Commercial laundry service 850 East 138th Street Bronx NY 10454 84 29 7773 17 A& Z Pharmaceutical Manufacturers pharmaceutical products 180 Oser Avenue Hauppauge NY 11788 8 2 40505 18 A. -

PROPERTY DISPOSITION Health and Hospitals Corporation

SUPPLEMENT TO THE CITY RECORD THE CITY COUNCIL-STATED MEETING OF WEDNESDAY, JANUARY 7, 2009 28 PAGES THE CITY RECORD THE CITY RECORD Official Journal of The City of New York U.S.P.S.0114-660 Printed on paper containing 40% post-consumer material VOLUME CXXXVI NUMBER 55 MONDAY, MARCH 23, 2009 PRICE $4.00 PROPERTY DISPOSITION Health and Hospitals Corporation . .1023 Sanitation . .1024 TABLE OF CONTENTS Citywide Administrative Services . .1022 Materials Management . .1023 Agency Chief Contracting Officer . .1024 Homeless Services . .1023 PUBLIC HEARINGS & MEETINGS Division of Municipal Supply Services 1022 School Construction Authority . .1024 Office of Contracts and Procurement . .1023 Police . .1022 Contract Administration . .1025 Board Meetings . .1013 Housing Authority . .1023 Auction . .1022 Bureau of Contracts Services . .1025 Administration for Children’s Services .1013 Purchasing Division . .1024 PROCUREMENT Youth and Community Development . .1025 Housing Preservation and Development 1024 City University . .1013 Administration for Children’s Services .1022 AGENCY RULES Human Resources Administration . .1024 Citywide Administrative Services . .1025 City Planning Commission . .1013 Citywide Administrative Services . .1023 Labor Relations . .1024 SPECIAL MATERIALS Division of Municipal Supply Services 1023 Employees’ Retirement System . .1021 Office of the Mayor . .1024 Tax Commission . .1026 Vendor Lists . .1023 Landmarks Preservation Commission . .1021 Criminal Justice Coordinator’s Office .1024 Changes in Personnel . .1052 Design and Construction . .1023 Parks and Recreation . .1024 LATE NOTICES Transportation . .1022 Contract Section . .1023 Contract Administration . .1024 Criminal Justice Coordinator . .1052 Voter Assistance Commission . .1022 Environmental Protection . .1023 Revenue and Concessions . .1024 Economic Development Corporation . .1052 THE CITY RECORD MICHAEL R. BLOOMBERG, Mayor Contractor/Address 1. Brooklyn Perinatal Network, Inc. MARTHA K. -

Office Snapshot Q3 2015 Manhattan

MARKETBEAT Office Snapshot Q3 2015 Manhattan MANHATTAN OFFICE Economy The New York City economy slowed in the third quarter as Economic Indicators employment fell slightly following a very strong second 12-Month Q3 14 Q3 15 Forecast quarter increase. In August total employment declined by New York City Employment 4,127.10 4,201.40 12,900 jobs, the largest drop since mid-2010. However, the drop comes after a strong second quarter and total New York City Unemployment 6.70% 5.40% employment was still up a solid 66,000 jobs from a year ago. U.S. Unemployment 5.90% 5.10% Office-using employment also declined in August, but remains solidly above year-ago levels. The slowdown in New York City reflects the uncertainty that gripped financial Market Indicators markets during the quarter and created some hesitancy 12-Month among businesses about the future direction of the national Q3 14 Q3 15 Forecast economy. Expect the U.S. economy to grow at a solid pace Overall Vacancy 10.2% 8.9% for the balance of 2015 and that New York City will Net Absorption 5.3M 2.4M participate in that growth. Under Construction 7.9M 6.7M Average Asking Rent (FS) $66.62 $71.02 Market Overview A summer slowdown in activity caused the Manhattan vacancy rate to remain relatively flat during the third quarter Net Absorption/Asking Rent at 8.9%. With 21.9 million square feet (msf) leased year to 4Q TRAILING AVERAGE date, activity is down by 10.0% from the same time last year. -

Open Alexander Grosek Thesis V Final.Pdf

THE PENNSYLVANIA STATE UNIVERSITY SCHREYER HONORS COLLEGE DEPARTMENT OF FINANCE PSYCHIC VALUE AND URBAN REGENERATION: HOW AND WHY SIGNATURE ARCHITECTURE AFFECTS REGIONAL ECONOMIES ALEXANDER GROSEK SUMMER 2020 A thesis submitted in partial fulfillment of the requirements for a baccalaureate degree in Finance with honors in Finance Reviewed and approved* by the following: Christoph Hinkelmann Clinical Associate Professor of Finance Thesis Supervisor Brian Davis Clinical Associate Professor of Finance Honors Adviser * Electronic approvals are on file. i ABSTRACT Focusing on buildings designed by winners of the Pritzker Prize for Architecture, I create a sample of 509 buildings-designed-by-signature-architects (BDSA) in the United States. This yields 170 metropolitan statistical areas (MSAs) that contain 509 BDSA. Drawing on U.S. Census data from 2010 – 2019, 13 economic data points are collected for each MSA in the sample, yielding 2,210 initial data points. The same 13 data points are collected for each of the 37 states where at least one BDSA currently resides, yielding an additional 481 unique data points Finally, the same 13 data points are collected for the U.S. economy as a whole. This data is sorted using basic weighted-average calculations to measure the relationship between the number of BDSA and the regional economic performance of the group of MSAs containing those BDSA, weighted by the number of BDSA in each city. The BDSA-weighted average of these economic statistics is then compared to the state and national averages for the same economic indicators. The results of this study show that the 170 regions under analysis have BDSA-weighted economic indicators that, when viewed together, demonstrate significantly more robust regional economic environments than the population-weighted average statistics for the 37 state economies in which they reside and the national average for the U.S. -

Manhattan Office Market

Manhattan Offi ce Market 2 ND QUARTER 2015 REPORT A NEWS RECAP AND MARKET SNAPSHOT Pictured: 1001 Avenue of the Americas Looking Ahead Partnership for New York City: New York’s Future as the World Financial Capital The report released in June concluded that while New York City remains the preferred location of global fi nancial companies to establish their headquarters, there is a growing trend to relocate jobs and business operations to lower cost, more business-friendly locations that are beyond the city’s border. A comprehensive survey was conducted in collaboration with Gerson Lehrman Group (GRG), intending to better understand how the fi nancial industry is evolving; and what measures are required to solidify New York’s competitive advantage as a global fi nancial center. Collected data represents an overview of the responses from 50-fi rm respondents that included large banks, insurance companies and asset managers, private equity fi rms, hedge funds, and fi nancial technology (FinTech) startups; and represent about 1/3rd of the total industry employment in the city. Additionally, observations were included from 8-real estate fi rms that were surveyed; along with interviews from other related experts in the fi eld. Financial Industry – an economic snapshot • Contributes 20% of the city’s economic output, representing twice that of the next top-grossing industry. • Accounts for nearly 1/3rd of the city’s private sector payroll, despite accounting for only 8%, or about 310,000 of the city’s private sector jobs in 2013; of which 23,000 jobs are high-technology in the areas of software, data processing and network management. -

Projects Under Development

EXPERIENCE RECORD AS OF 6.30.18 EXPERIENCE RECORD AS OF 06-30-18 (updated semi-annually) 109 PROJECTS IN DESIGN OR UNDER CONSTRUCTION SQUARE FEET Office 15,446,176 Living/Housing 15,530,932 Industrial/Logistics 1,983,800 Retail 1,452,692 Other 2,216,271 Total SF 36,629,871 856 COMPLETED DEVELOPMENT PROJECTS Office 149,538,456 Industrial/Logistics 40,113,324 Living/Housing 27,618,910 Retail 11,982,998 Hospitality 7,764,918 Sports Facilities 3,790,107 Medical/Biotechnological 3,472,366 Arts & Cultural 2,041,130 Educational 946,952 Other 2,982,864 Total SF 250,252,025 463 ACQUISITIONS Office 134,938,632 Industrial/Logistics 30,537,805 Retail 11,601,407 Living/Housing 2,313,876 Other 2,077,721 Total SF 181,469,441 527 PROPERTY/ASSET MANAGEMENT ASSIGNMENTS Hines Investment Management, 289 projects 107,800,000 Property-Level Services, 238 projects 117,100,000 Total SF 224,900,000 207 CURRENT HINES LOCATIONS (exclusive of facility management locations) U.S. Cities 96 Cities Outside of the United States 111 Cities with Facilities Mgmt. Assignments Only 468 Global Presence (Number of Cities) 675 Projects In Design and Under Construction Office 10000 AVALON 17850 VON KARMAN ATLANTIC YARDS Alpharetta, GA Irvine, CA Atlanta, GA 249,855 sq. ft. office development 242,000 sq. ft. office development 500,000 sq. ft. two-building office development 10 stories 9 stories that will include 20,000 sq. ft. of retail space AXA GENERALITAT BLOCK 58 BRUNESEAU DUO 1 Barcelona, Spain Houston, TX Paris, France A development management project 1,140,000 sq. -

Sorted Alphabetically by Applicant Name Line Bu

New York Power Authority ReCharge New York Applicants through February 5, 2021 - Sorted Alphabetically by Applicant Name Line Business Name Description of Applicant Street Address City State Zip Code NYS Assembly District(s) NY Senate District(s) Application Number 1 1886 Welcome Home Farm, Inc Community Food Pantry 6735 Route 9 Hudson NY 12534 103 41 8775 2 2 Twisted Farmers Farm (hops) 233 Clark Road Pulaski, NY 13142 Pulaski NY 13142 120 48 39930 3 24 Hour Tax & Accounting LLC Income tax preparation services N/A N/A NY N/A N/A N/A 18505 4 26 Cooper Ave., LLC Shop Painting 26 Cooper Avenue Tonawanda NY 14150 140 60 37389 5 2758 Trombley Road, LLC Bulk trucking services 2758 Trombley Road Weedsport NY 13166 130 50 96589 6 2758 Trombley Road, LLC Bulk trucking services 2758 Trombley Road Weedsport NY 13166 130 50 97098 7 346 Connecticut LLC Architect and developer 346 Connecticut Street Buffalo NY 14213 144 58 8794 8 365 Operating Company, LLC Data center & information technology services 500 Commack Road Commack NY 11725 8 2 87519 9 3M Company Cellulose sponges 305 Sawyer Ave. Tonawanda NY 14150 140 60 9379 10 425 Michigan Avenue LLC Medical/Educational office building 425 Michigan Avenue Buffalo NY 14203 141 63 23139 11 499 Syracuse City Centre Restoring and renovating buildings 499 S Warren St. Syracuse NY 13202 129 53 10117 Ownership/management of hotels, apartments & 12 5000 Group LLC retail 5195 Main Street Williamsville NY 14221 148 61 11642 13 525 Wheat, LLC Start-up manufacturing facility 525 Wheatfield Street North Tonawanda NY 14120 140 62 11700 Frozen value added chicken products will be 14 607 Phillips Street Acquisition, LLC (name to be determined for operating company) produced 607 Phillips Street Fulton NY 13069 120 48 14735 15 669 River Street LLC Incubator office space for new businesses 669 River Street Troy NY 12180 108 44 83448 16 850 East 138th Street, LLC Commercial laundry service 850 East 138th Street Bronx NY 10454 84 29 7773 17 A& Z Pharmaceutical Manufacturers pharmaceutical products 180 Oser Avenue Hauppauge NY 11788 8 2 40505 18 A. -

Gravity Co., Ltd. Securities Litigation 05-CV-04804-Stipulation Of

UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK x Civil Action No. 1:05-CV-04804-LAP IN RE GRAVITY CO., LTD. SECURITIES (Consolidated) LITIGATION CLASS ACTION This Document Relates to: - STIPULATION OF SETTLEMENT ALL ACTIONS x This Stipulation of Settlement dated as of July _, 2007 (the "Stipulation") is made and entered into pursuant to Rule 23 of the Federal Rules of Civil Procedure and contains the terms of a proposed settlement of the claims arising out of the allegations made in the above-captioned action (the "Action") by and among the following Settling Parties, as defined in ¶1.23 below: (i) Lead Plaintiff Pipefitters Locals 522 and 633 Pension Trust Fund (the "Pipefitters") (the "Lead Plaintiff') (on behalf of itself and each of the Class Members, as defined below), and (ii) Defendants Gravity Co., Ltd. ("Gravity" or the "Company"), Jung Ryool Kim ("J. Kim"), and Credit Suisse First Boston', Daewoo Securities Co., Ltd., CIBC World Markets Corp. and CLSA Limited (the "Underwriter Defendants"), by and through their respective undersigned counsel of record in the Action. This Stipulation is intended by the Settling Parties to fully, finally and forever resolve, discharge. and settle the Released Claims, as defined in ¶1.19 below, against the Released Parties, as defined in ¶1.21 below, upon and subject to the terms and conditions hereof and subject to the approval of this Court, as defined below. 1. THE LITIGATION On and after May 2005, three purported securities class actions were filed against the Defendants in the United States District Court for the Southern District of New York (the "Court") on behalf of purchasers of American Depository Shares ("ADSs") of Gravity, alleging The Action purports to name as a defendant an entity identified as "Credit Suisse First Boston." No such entity currently exists. -

Experience Record As of 06.30.20

EXPERIENCE RECORD AS OF 06.30.20 EXPERIENCE RECORD AS OF 06-30-20 (updated semi-annually) 165 PROJECTS IN DESIGN OR UNDER CONSTRUCTION SQUARE FEET Office 27,337,600 Living/Housing 23,650,145 Industrial/Logistics 8,582,028 Retail 2,408,363 Other 1,276,806 Total SF 63,254,942 907 COMPLETED DEVELOPMENT PROJECTS Office 152,612,708 Industrial/Logistics 45,403,143 Living/Housing 31,956,204 Retail 13,076,644 Hospitality 9,069,842 Sports Facilities 3,790,107 Medical/Biotechnological 3,472,366 Arts & Cultural 2,041,130 Educational 946,952 Other 3,292,088 Total SF 265,661,184 519 ACQUISITIONS Office 148,387,664 Industrial/Logistics 38,161,731 Retail 12,879,783 Living/Housing 4,243,631 Other 3,379,233 Total SF 207,052,042 576 PROPERTY/ASSET MANAGEMENT ASSIGNMENTS Hines Investment Management, 232 projects 102,788,044 Property-Level Services, 344 projects 143,798,904 Total SF 246,586,948 225 CURRENT HINES LOCATIONS (exclusive of facility management locations) U.S. Cities 118 Cities Outside of the United States 107 Cities with Facilities Mgmt. Assignments Only 450 Global Presence (Number of Cities) 675 Projects In Design and Under Construction Office 9 STEWART STREET 36-52 WELLINGTON 92 AVENUE OF THE AMERICAS Melbourne, Victoria, Australia Melbourne, Victoria, Australia New York, NY 55,208 sq. ft. office building 195,655 sq. ft. heavy timber creative office A development management project 10 stories building 24,181 sq. ft. office building 14 stories 100 MILL 415 20TH STREET 561 GREENWICH Tempe, AZ Oakland, CA New York, NY 279,531 sq. -

U L T I M a T E G U I D E T O N E W Y O R K C I

ULTIMATE GUIDE TO NEW YORK CITY SUMMER SPECIAL HAMPTONS COVERAGE A U G 2 0 1 3 S H O P P I N G | DINING | BROADWAY | MUSEUMS NYC Monthly NYC June, 2013 June, 12.75 x 8.9375 12.75 13.125 x 9.3125 13.125 Laird & Partners Laird 12.875 x 9.0625 x 9.0625 12.875 ARTWORKS.com client: publication: date: issue bleed: trim: safety: DKNY ARTWORKS ARTWORKS DKNY # NYC MONTHLY - DPS (COVER 2, PAGE 1) - JUNE - DPS (COVER 2, PAGE NYC MONTHLY by Amy Gartrell 15936_LP-DKNYM-13-0XX_NYC_MTHLY_JUNE.indd ryo yamamoto ryo 15559-DKNY_Amy_Gartrell_SWOP.tif ‘Testing 1’ ‘Testing 15936 05.20.13 05.20.13 9 am time: job#: date: image name: by: prepared document name: DATE MODIFIED: PREPARED BY LISA May 20, 2013 3:38 PM DPS (COVER 2, PaGE CLIENT/SEASON: DKNy UNIT: BLEED: 13.125" W X 9.3125" H 1) - 4C DESIGN JOB#: DKNyM-DOM-13-0XX CREATIVE: DKNySP13_LOGO TRIM: 12.875" W X 9.0625" H MEDIA ISSUE DATE/ SAFETY: POSTING DATE: JUNE 12.75" W X 8.9375" H PRODUCTION PUBLICATION: NyC MONTHLy CLOSING DATE: 5/20 CLIENT SERVICES Jimmy Page and Gary Clark Jr. Photographed by Danny Clinch, London 2013 SOHO BOWERY EAST HAMPTON SHOP THE NEW JOHNVARVATOS.COM metropolis collection 18K Brushed Yellow Gold and Diamond Earrings Available for Pre-Order IVANKA TRUMP 109 Mercer St. | 725 5th Ave. | NYC 1.888.756.9912 www.ivankatrumpcollection.com Contents p.20 FEATURES 18 Top 10 things to do in August 30 Welcome to NYC! Summer at its best, in NYC. -

→ the Value of Design in Real Estate Development ↓

The Value of Royal Gold Gold Gold AWARDED ARCHITECTS Study Medal Medal Medal Architects who won the lifetime achievement awards ↓ and/or innovation awards Results Design in Organization Organization Organization RIBA AIA UIA Aldo Rossi 557 Broadway How often How often How often '90 When controlling for location and transaction 555 Broadway Real Estate Annual Annual Triennial time, building features and transaction First awarded First awarded First awarded features, the result of the hedonic analysis 1848 1907 1984 Alvar Alto 809 UN Plaza Award Criteria '63 suggests that buildings designed by awarded Development → From 1950 From 1950 From 1950 69 awarded 59 awarded 26 awarded architects/firms are transacted with a Jean Nouvel '01 '08 45-47 W 53rd St This study investigates the financial performance A total of 18 awarded architects/firms have 23.1% premium than buildings that are de- Golden Innovator National of awarded architectural design for commercial designed 56 buildings in Manhatta, and 89 César Pelli 3 World Financial Center signed by non-awarded architects. Lion Awards Desgin Award '95 office buildings in Manhattan, New York. transactions were observed. Within the 18 4 World Financial Center 900 3rd Avenue 35 firms, 4 firms have received more than 2 Organization Organization Organization NY Mercantile Exchange Venice WSJ Cooper Hewitt 32.1% *** awards from 3 award categories Biennale How often How often How often Annual Annual Norman Foster '83 '94 '99 610 Lexington Avenue Biennial First awarded First awarded 425 Park Avenue 30