Sub Custodians

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

18 February 2019 Solvency and Diversification in Insurance Remain Key Strengths Despite Change in Structure

FINANCIAL INSTITUTIONS ISSUER IN-DEPTH Lloyds Banking Group plc 18 February 2019 Solvency and diversification in insurance remain key strengths despite change in structure Summary RATINGS In 2018, Lloyds Banking Group plc (LBG) altered its structure to comply with the UK's ring- Lloyds Banking Group plc Baseline Credit a3 fencing legislation, which requires large banks to separate their retail and SME operations, Assessment (BCA) and deposit taking in the European Economic Area (EEA) from their other activities, including Senior unsecured A3 Stable the riskier capital markets and trading business. As part of the change, LBG designated Lloyds Bank plc as the“ring-fenced” entity housing its retail, SME and corporate banking operations. Lloyds Bank plc It also assumed direct ownership of insurer Scottish Widows Limited, previously a subsidiary Baseline Credit A3 Assessment (BCA) of Lloyds Bank. The changes had little impact on the creditworthiness of LBG and Lloyds Adjusted BCA A3 Bank, leading us to affirm the deposit and senior unsecured ratings of both entities. Scottish Deposits Aa3 Stable/Prime-1 Widows' ratings were unaffected. Senior unsecured Aa3 Stable » LBG's reorganisation was less complex than that of most UK peers. The Lloyds Lloyds Bank Corporate Markets plc Banking Group is predominantly focused on retail and corporate banking, and the Baseline Credit baa3 required structural changes were therefore relatively minor. The group created a small Assessment (BCA) separate legal entity, Lloyds Bank Corporate Markets plc (LBCM), to manage its limited Adjusted BCA baa1 Deposits A1 Stable/Prime-1 capital markets and trading operations, and it transferred its offshore subsidiary, Lloyds Issuer rating A1 Stable Bank International Limited (LBIL), to LBCM from Lloyds Bank. -

Hsbc to Acquire Lloyds Banking Group Onshore Assets in the Uae

Ab c 29 March 2012 HSBC TO ACQUIRE LLOYDS BANKING GROUP ONSHORE ASSETS IN THE UAE HSBC Bank Middle East Ltd (‘HSBC’), an indirect wholly-owned subsidiary of HSBC Holdings plc, has entered into an agreement to acquire the onshore retail and commercial banking business of Lloyds Banking Group (‘Lloyds’) in the United Arab Emirates (‘UAE’). The value of the gross assets being acquired is US$769m as at 31 December 2011. The transaction, which is subject to regulatory approvals, is expected to complete in 2012. HSBC’s largest operations in the MENA region are based in the UAE where HSBC enjoys a market-leading trade and commercial banking presence, in addition to the largest international retail banking and wealth management business. The business being acquired from Lloyds has approximately 8,800 personal and commercial customers and a loan book of approximately US$573m as at 31 December 2011. Commenting on the acquisition, Simon Cooper, Deputy Chairman and Chief Executive Officer of HSBC in MENA, said: “HSBC is the leading international bank in the UAE and the addition of Lloyds’ strong presence in retail and commercial banking is highly complementary to our business. The acquisition underscores the strategic importance of the UAE, and of the MENA region as a whole, to HSBC.” Media enquiries to: Tim Harrison + 971 4 4235632 [email protected] Brendan McNamara +44 (0) 20 7991 0655 [email protected] ends/more Registered Office and Group Head Office: This news release is issued by 8 Canada Square, London E14 5HQ, United Kingdom Web: www.hsbc.com HSBC Holdings plc Incorporated in England with limited liability. -

Fitch Places 31 EMEA Bank ST Issuer Ratings Under Criteria Observation

5/7/2019 [ Press Release ] Fitch Places 31 EMEA Bank ST Issuer Ratings Under Criteria Observation Fitch Places 31 EMEA Bank ST Issuer Ratings Under Criteria Observation Fitch Ratings-London-07 May 2019: Fitch Ratings has placed 31 Short-Term (ST) Issuer Default Ratings (IDR) and related ST debt level ratings of EMEA-based banks Under Criteria Observation (UCO) following the publication of its cross-sector criteria for Short-Term Ratings on 2 May 2019. A full list of rating actions is below. Fitch intends to conclude full implementation of the criteria, and resolution of all UCO designations within six months of the designation. KEY RATING DRIVERS The ST ratings of the affected banks are determined primarily by correspondence tables linking short-term to long-term ratings. The new ST rating criteria introduced changes to our correspondence table between long-term and ST ratings. Two new cusp points at 'A' and 'BBB+' have been added to the existing three cusp points ('A+', 'A-' and 'BBB'), where baseline or higher ST ratings can be assigned. For banks with Long-Term IDRs driven by their standalone profile, as reflected by their Viability Ratings (VR), Fitch uses the funding and liquidity factor score as the principal determinant of whether the 'baseline' or 'higher' ST IDR is assigned at each cusp point. The ST IDRs and, where relevant, associated ST debt/deposit ratings of the following issuers have been placed UCO because the ratings could be upgraded by one notch under the new criteria. This is because the latest funding and liquidity scores that feed into their VRs are at least in line with the minimum levels required for a higher ST rating under the new criteria: - Banco Cooperativo Espanol, S.A. -

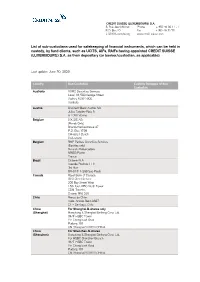

List of Sub-Custodians Used for Safekeeping of Financial Instruments

CREDIT SUISSE (LUXEMBOURG) S.A. 5, Rue Jean Monnet Phone + 352 46 00 11 - 1 P.O. Box 40 Fax + 352 46 32 70 L-2010 Luxembourg www.credit-suisse.com List of sub-custodians used for safekeeping of financial instruments, which can be held in custody, by fund clients, such as UCITS, AIFs, RAIFs having appointed CREDIT SUISSE (LUXEMBOURG) S.A. as their depositary (or banker/custodian, as applicable) Last update: June 30, 2020 Country Sub-Custodian Custody Delegate of Sub- Custodian Australia HSBC Securities Services Level 13, 580 George Street Sydney NSW 2000 Australia Austria UniCredit Bank Austria AG Julius Tandler-Platz 3 A-1090 Vienna Belgium SIX SIS AG (Bonds Only) Brandschenkestrasse 47 P.O. Box 1758 CH-8021 Zurich Switzerland Belgium BNP Paribas Securities Services (Equities only) 9 rue du Débarcadère 93500 Pantin France Brazil Citibank N.A. Avenida Paulista 1111 3rd floor BR-01311-290 Sao Paulo Canada Royal Bank of Canada GSS Client Service 200 Bay Street West 15th floor, RBC North Tower CDN-Toronto, Ontario M5J 2J5 Chile Banco de Chile Avda. Andrés Bello 2687 CL – Santiago, Chile China For Shanghai-B-shares only (Shanghai) Hongkong & Shanghai Banking Corp. Ltd. 34/F HSBC Tower Yin Cheng East Road Pudong 101 CN-Shanghai 200120 CHINA China For Shenzhen-B-shares (Shenzhen) Hongkong & Shanghai Banking Corp. Ltd. For HSBC Shenzhen Branch 34/F HSBC Tower Yin Cheng East Road Pudong 101 CN-Shanghai 200120 CHINA Colombia Cititrust Colombia S.A. Sociedad Fiduciaria Carrera 9A No. 99-02 First Floor Santa Fé de Bogotá D.C. -

Svenska Handelsbanken AB

OFFERING CIRCULAR Svenska Handelsbanken AB (publ) (Incorporated as a public limited liability banking company in The Kingdom of Sweden) U.S.$50,000,000,000 Euro Medium Term Note Programme for the issue of Notes with a minimum maturity of one month On 26th June, 1992 Svenska Handelsbanken AB (publ) (the “Issuer” or the “Bank”) entered into a U.S.$1,500,000,000 Euro Medium Term Note Programme (the “Programme”) and issued an offering circular on that date describing the Programme. This Offering Circular supersedes any previous offering circular and supplements therein prepared in connection with the Programme. Any Notes (as defined below) issued under the Programme on or after the date of this Offering Circular are issued subject to the provisions described herein. This does not affect any Notes already in issue. Under the Programme, the Bank may from time to time issue Notes (the “Notes”), which expression shall include Notes (i) issued on a senior preferred basis as described in Condition 3 (“Senior Preferred Notes”), (ii) issued on a senior non-preferred basis as described in Condition 4 (“Senior Non-Preferred Notes”), (iii) issued on a subordinated basis and which rank on any voluntary or involuntary liquidation (Sw. likvidation) or bankruptcy (Sw. konkurs) of the Bank as described in Condition 5 (“Subordinated Notes”) and (iv) issued on a subordinated basis with no fixed maturity and which rank on any voluntary or involuntary liquidation (Sw. likvidation) or bankruptcy (Sw. konkurs) of the Bank as described in Condition 6 (“Additional Tier 1 Notes”). The Outstanding Principal Amount (as defined in Condition 2) of each Series (as defined below) of Additional Tier 1 Notes will be subject to Write Down (as defined in Condition 2) if the Common Equity Tier 1 Capital Ratio (as defined in Condition 2) of the Bank and/or the Handelsbanken Group (as defined Condition 2) is less than the relevant Trigger Level (as defined in Condition 2). -

NETSUITE ELECTRONIC BANK PAYMENTS Securely Automate EFT Payments and Collections with a Single Global Solution

NETSUITE ELECTRONIC BANK PAYMENTS Securely Automate EFT Payments and Collections with a Single Global Solution Electronic Bank Payments brings to NetSuite complementary electronic banking functionality Key Features that includes Electronic Funds Transfer (EFT) • Automated payment batch allows multiple payments, customer refunds and customer payment batch creation stemmed from payments (direct debits), as well as check fraud different batch criteria, controls and payment deadlines. prevention through the Positive Pay service offered by leading banks. It helps ensure that • Approval routing and email alert notification enables additional payment employees and vendors are paid on time authorization prior to payment processing. and customer bills are settled automatically. With support for a wide range of global and • Enhanced EFT capabilities with filtering options support bill display, partial payments, local bank formats, Electronic Bank Payments bill management and other controls. provides a single payment management • Automated direct debit customer solution worldwide. collections to settle outstanding invoices. Electronic Bank Payments creates files of • Payment management options include payments or direct debit information in bank’s payment batch queuing, rollbacks, reversals predefined file format ready for import into with notations and automated notifications. banking software or submission to the bank • Positive Pay anti-fraud capabilities with online, thus lowering payment processing proactive notification to banks processing expenses by eliminating checks, postage and the checks. envelopes, and saving time as well. In addition, • Support for more than 50 international it supports management of large payment bank formats with Advanced Electronic runs (typically up to 5,000 payments per file) Bank Payment License customers having with the ability to process reversals and partial the flexibility to add more. -

DTC Participant Alphabetical Listing June 2019.Xlsx

DTC PARTICPANT REPORT (Alphabetical Sort ) Month Ending - June 30, 2019 PARTICIPANT ACCOUNT NAME NUMBER ABN AMRO CLEARING CHICAGO LLC 0695 ABN AMRO SECURITIES (USA) LLC 0349 ABN AMRO SECURITIES (USA) LLC/A/C#2 7571 ABN AMRO SECURITIES (USA) LLC/REPO 7590 ABN AMRO SECURITIES (USA) LLC/ABN AMRO BANK NV REPO 7591 ALPINE SECURITIES CORPORATION 8072 AMALGAMATED BANK 2352 AMALGAMATED BANK OF CHICAGO 2567 AMHERST PIERPONT SECURITIES LLC 0413 AMERICAN ENTERPRISE INVESTMENT SERVICES INC. 0756 AMERICAN ENTERPRISE INVESTMENT SERVICES INC./CONDUIT 7260 APEX CLEARING CORPORATION 0158 APEX CLEARING CORPORATION/APEX CLEARING STOCK LOAN 8308 ARCHIPELAGO SECURITIES, L.L.C. 0436 ARCOLA SECURITIES, INC. 0166 ASCENSUS TRUST COMPANY 2563 ASSOCIATED BANK, N.A. 2257 ASSOCIATED BANK, N.A./ASSOCIATED TRUST COMPANY/IPA 1620 B. RILEY FBR, INC 9186 BANCA IMI SECURITIES CORP. 0136 BANK OF AMERICA, NATIONAL ASSOCIATION 2236 BANK OF AMERICA, NA/GWIM TRUST OPERATIONS 0955 BANK OF AMERICA/LASALLE BANK NA/IPA, DTC #1581 1581 BANK OF AMERICA NA/CLIENT ASSETS 2251 BANK OF CHINA, NEW YORK BRANCH 2555 BANK OF CHINA NEW YORK BRANCH/CLIENT CUSTODY 2656 BANK OF MONTREAL, CHICAGO BRANCH 2309 BANKERS' BANK 2557 BARCLAYS BANK PLC NEW YORK BRANCH 7263 BARCLAYS BANK PLC NEW YORK BRANCH/BARCLAYS BANK PLC-LNBR 8455 BARCLAYS CAPITAL INC. 5101 BARCLAYS CAPITAL INC./LE 0229 BB&T SECURITIES, LLC 0702 BBVA SECURITIES INC. 2786 BETHESDA SECURITIES, LLC 8860 # DTCC Confidential (Yellow) DTC PARTICPANT REPORT (Alphabetical Sort ) Month Ending - June 30, 2019 PARTICIPANT ACCOUNT NAME NUMBER BGC FINANCIAL, L.P. 0537 BGC FINANCIAL L.P./BGC BROKERS L.P. 5271 BLOOMBERG TRADEBOOK LLC 7001 BMO CAPITAL MARKETS CORP. -

HSBC Bank USA, N.A. Global Opportunity Certificates of Deposit TM with Minimum Return

HSBC Bank USA, N.A. Global Opportunity Certificates of Deposit TM With Minimum Return FINAL TERMS CD Description The Global Opportunity CDs provide exposure to Issuer HSBC Bank USA, N.A. potential price appreciation in a basket of global equity Issue 6 Year Global Opportunity CD with indices and if held to maturity, 100% principal protection. Minimum Return These CDs can help reduce and diversify portfolio risk by providing broad exposure to equity markets in the Issuer Rating AA (S&P), Aa3 (Moody’s) U.S., Europe and Hong Kong/China. The principal protection applies only if held to maturity. Denomination US Dollars (USD) Trade Date April 21, 2010 Highlights Index Set Date April 22, 2010 Growth Potential: Depositors receive uncapped Settlement Date April 27, 2010 upside participation in the quarterly average performance of a basket of three global equity Maturity Date April 27, 2016 indices. Issue Price 100.00% Guaranteed Minimum Return: Regardless of the index performance, depositors will receive at least a Index Basket The Hang Seng Index (1/3) 3.00% total aggregate return if held to maturity. and Weightings S&P 500® Index (1/3) DJ EURO STOXX 50® Index (1/3) FDIC Insurance: This deposit qualifies for FDIC coverage generally up to $250,000 in aggregate for Redemption Principal Amount x (100% + the individual depositors through December 31, 2013 and Proceeds At greater of the Minimum Return and thereafter $100,000, and up to $250,000 in aggregate for Maturity the Final Basket Return) certain retirement plans and accounts, including IRAs Final Basket The average of the three Index IRA-eligible. -

Global Finance Names the World's Best Investment Banks 2020

Global Finance Names The World’s Best Investment Banks 2020 NEW YORK, February 10, 2020 – Global Finance magazine has named the 21st annual World’s Best Investment Banks in an exclusive survey to be published in the April 2020 issue. Winning organizations will be honored at an awards ceremony on the evening of March 26 at Sea Containers London. J.P. Morgan was honored as the Best Investment Bank in the world for 2020. About Global Finance “Investment banking is a critical factor driving global growth. Global Finance’s Best Global Finance, founded in Investment Bank awards identify the financial institutions that deliver innovative and 1987, has a circulation of practical solutions for their clients in all kinds of markets,” said Joseph D. Giarraputo, 50,000 and readers in 188 publisher and editorial director of Global Finance. countries. Global Finance’s audience includes senior Global Finance editors, with input from industry experts, used a series of criteria— corporate and financial including entries from banks, market share, number and size of deals, service and officers responsible for making investment and strategic advice, structuring capabilities, distribution network, efforts to address market decisions at multinational conditions, innovation, pricing, after-market performance of underwritings and companies and financial market reputation—to score and select winners, based on a proprietary algorithm. institutions. Its website — Deals announced or completed in 2019 were considered. GFMag.com — offers analysis and articles that are the legacy For editorial information please contact Andrea Fiano, editor: [email protected] of 33 years of experience in international financial markets. Global Finance is headquartered in New York, with offices around the world. -

Close Brothers Group Plc (Incorporated with Limited Liability in England and Wales with Registered Number 00520241)

PROSPECTUS DATED 8 JUNE 2021 Close Brothers Group plc (incorporated with limited liability in England and Wales with registered number 00520241) £200,000,000 2.00% Subordinated Tier 2 Notes Issue price: 99.531 per cent. The £200,000,000 2.00% Subordinated Tier 2 Notes (the “Notes”) will be issued by Close Brothers Group plc (the “Issuer”) on or about 11 June 2021 (the “Issue Date”). The terms and conditions of the Notes are set out herein in “Terms and Conditions of the Notes” below (the “Conditions”, and references to a numbered “Condition” shall be construed accordingly). The Notes will bear interest on their outstanding principal amount from (and including) the Issue Date to (but excluding) 11 September 2026 (the “Reset Date”), at a rate of 2.00 per cent. per annum and thereafter at the Reset Interest Rate as provided in Condition 5. Interest will be payable on the Notes semi-annually in arrear on each Interest Payment Date, commencing on 11 September 2021 (with a short first Interest Period from (and including) the Issue Date to (but excluding) 11 September 2021). Unless previously redeemed or purchased and cancelled, or (pursuant to Condition 7(f)) substituted, the Notes will mature on 11 September 2031 and shall be redeemed at their principal amount, together with any accrued and unpaid interest on such date. The Noteholders will have no right to require the Issuer to redeem or purchase the Notes at any time. The Issuer may, in its discretion but subject to Regulatory Approval, elect to (a) redeem all (but not some only) of the -

Annual Review Show Major International Network Comprises Some 6,500 Offices in Developments in the HSBC Group Last Year

The HSBC Group Headquartered in London, HSBC Holdings plc is one Illustrative Theme of the largest banking and financial services Managing for Value organisations in the world. The HSBC Group’s The photographs in this Annual Review show major international network comprises some 6,500 offices in developments in the HSBC Group last year. They illustrate 79 countries and territories in Europe, the Asia- the progress we have made in implementing our five-year strategic plan, ‘Managing for Value’, launched in 1998. Pacific region, the Americas, the Middle East and Africa. The picture spreads are grouped around these initiatives. They reflect the breadth and scope of our operations, and With listings on the London, Hong Kong, New our international character. York and Paris stock exchanges, shares in HSBC Building our ‘wealth management’ (personal financial Holdings plc are held by around 190,000 shareholders services) business is a cornerstone of our plan. It was seen in in some 100 countries and territories. The shares are our acquisitions during 2000, notably CCF, and in the launch traded on the New York Stock Exchange in the form of our first truly global service for personal customers, HSBC Premier. To provide essential back office support, we of American Depositary Receipts. invested more resources in the global processing of banking operations. We focused on e-business to bring customers a Through a global network linked by advanced range of new services via new delivery channels, such as technology, including a rapidly growing e-commerce internet and mobile phone banking. We joined forces with capability, HSBC provides a comprehensive range of Merrill Lynch in a joint venture offering online investment and banking services. -

Competition Commission Addresses Exclusionary Conveyancing Practices in the Banking Industry

Media Statement For Immediate Release 17 July 2020 COMPETITION COMMISSION ADDRESSES EXCLUSIONARY CONVEYANCING PRACTICES IN THE BANKING INDUSTRY The Competition Commission (Commission) is pleased to announce commitments made by Standard Bank, Investec, FNB and Nedbank, to reform their conveyancing practices, following advocacy engagements over the past two years. The banks’ renewed commitment is in response to concerns raised by the Commission on the relationship between banks and conveyancers, which is governed through Service Level Agreements (SLAs) and structured in an exclusionary and anti-competitive manner. In February 2018, the Commission conducted the advocacy engagements following a complaint that was filed by Mr Michael Monthe (Mr Monthe) against Standard Bank. In the complaint, Mr Monthe alleged that he had approached about several law firms in the area where he resides for assistance to institute legal action against Standard Bank. Mr Monthe alleged all the law firms that he had approached refused to take on his matter on the basis that they are part of the SBSA’s panel of attorneys and that they are conflicted in terms of their Service Level Agreements (“SLA’s”) with Standard Bank. Further, the Commission established that the practice of restrictive SLAs for conveyancing services extended to other major banks, namely, Investec, FNB and Nedbank. Following the engagements between the Commission, Standard Bank, Investec, FNB and Nedbank, it was agreed that contractual clauses that prevented law firms appointed to provide conveyancing services from acting against the banks on any matter should be removed. These exclusionary clauses created barriers for small and particularly firms owned by historically disadvantaged persons to expand in the market.