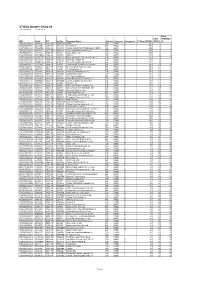

Stoxx® Emerging Markets Ex Pk Select 100 Eur Index

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

SUNAC CHINA HOLDINGS LIMITED 融創中國控股有限公司 (Incorporated in the Cayman Islands with Limited Liability) (Stock Code: 01918)

THIS CIRCULAR IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION If you are in any doubt about any aspect of this circular or as to the action to be taken, you should consult your licensed securities dealer or registered institution in securities, bank manager, solicitor, professional accountant or other professional advisers. If you have sold or transferred all your shares in Sunac China Holdings Limited, you should at once hand this circular together with the enclosed form of proxy to the purchaser(s) or transferee(s) or to the bank, licensed securities dealer or registered institution in securities or other agent through whom the sale or transfer was effected for transmission to the purchaser(s) or transferee(s). Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this circular, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this circular. This circular appears for information purposes only and does not constitute an invitation or offer to acquire, purchase or subscribe for any securities. SUNAC CHINA HOLDINGS LIMITED 融創中國控股有限公司 (incorporated in the Cayman Islands with limited liability) (Stock Code: 01918) (1) CONNECTED TRANSACTION — PROPOSED SHARE ISSUANCE UNDER SPECIFIC MANDATE AND (2) APPLICATION FOR WHITEWASH WAIVER Independent Financial Adviser to the Independent Board Committee and the Independent Shareholders Capitalised terms used on this cover shall have the same meanings as those defined in the section headed “Definition” in this circular, unless the context requires otherwise. -

BANK of COMMUNICATIONS (HONG KONG) LIMTED 交通銀行(香港) 有限公司 (Incorporated in Hong Kong with Limited Liability)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. This announcement is not for distribution, directly or indirectly, in or into the United States (including its territories and possessions, any state of the United States and the District of Columbia). This announcement is for informational purposes only and does not constitute or form a part of an offer to sell or the solicitation of an offer to buy any securities in the United States or any other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. The securities referred to herein have not been and will not be registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”), or the securities laws of any state of the United States or any other jurisdiction. If any offer proceeds, the securities will only be offered and sold outside the United States in reliance on Regulation S under the Securities Act (“Regulation S”) and may not be offered or sold within the United States absent registration under, or an applicable exemption from, or in a transaction not subject to, the registration requirements under the securities act and applicable state or local securities laws of the United States. -

Three Red Lines” Policy

Real Estate Developers with High Leverage to See Inventory Quality Tested Under Broader “Three Red Lines” Policy October 28, 2020 In our view, the widening of regulations aimed at controlling real estate developers’ interest- ANALYSTS bearing debt would further reduce the industry’s overall credit risk in the long term. However, the nearer term may see less headroom for highly leveraged developers to finance in the capital Xiaoliang Liu, CFA market, pushing them to sell off inventory to ease liquidity pressure. Beijing +86-10-6516-6040 The People’s Bank of China said in September that measures aimed at monitoring the funding [email protected] and financial management of key real estate developers will steadily be expanded. Media reports suggest that the new regulations would see a cap of 15% on annual growth of interest-bearing Jin Wang debt for all property developers. Developers will be assessed against three indicators, which are Beijing called “red lines”: whether asset liability ratios (excluding advance) exceeded 70%; whether net +86-10-6516-6034 gearing ratio exceeded 100%; whether cash to short-term debt ratios went below 1.0. Developers [email protected] which breached all three red lines won’t be allowed to increase their debt. If only one or two of the red lines are breached, such developers would have their interest-bearing debt growth capped at 5% and 10% respectively. The first half of the year saw debt grow rapidly among developers. In a sample of 87 real estate developers that we are monitoring, more than 40% saw their interest-bearing debt grow at a faster rate than 15% year over year as of the end of June (see the chart below). -

Announcement Report for the First Quarter of 2021 Of

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. ANNOUNCEMENT REPORT FOR THE FIRST QUARTER OF 2021 OF CHINA CITIC BANK CORPORATION LIMITED This announcement is made by CITIC Limited (the “Company”) pursuant to Rule 13.09(2)(a) of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited and the Inside Information Provisions under Part XIVA of the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong). The Company notes the announcement (the “CITIC Bank Announcement”) of today’s date made by China CITIC Bank Corporation Limited (“CITIC Bank”), a principal subsidiary of the Company, in relation to the unaudited consolidated results of CITIC Bank and its subsidiaries for the first quarter ended 31 March 2021. The CITIC Bank Announcement is available on the website of Hong Kong Exchanges and Clearing Limited at www.hkexnews.hk and is set out at the end of this announcement. By Order of the Board CITIC Limited Zhu Hexin Chairman Hong Kong, 29 April 2021 As at the date of this announcement, the executive directors of the Company are Mr Zhu Hexin (Chairman), Mr Xi Guohua and Ms Li Qingping; the non-executive directors of the Company are Mr Song Kangle, Mr Liu Zhuyu, Mr Peng Yanxiang, Ms Yu Yang, Mr Liu Zhongyuan and Mr Yang Xiaoping; and the independent non-executive directors of the Company are Mr Francis Siu Wai Keung, Dr Xu Jinwu, Mr Anthony Francis Neoh, Mr Shohei Harada and Mr Gregory Lynn Curl. -

Global Offering

(Incorporated in the Cayman Islands with limited liability) Stock Code: Global Offering Joint Sponsors, Joint Global Coordinators, Joint Bookrunners and Joint Leadad ManagersManagers (in alphabetical order) Other Joint Global Coordinator, Joint Bookrunner and Joint Lead Manager Other Joint Bookrunners and Joint Lead Managers (in alphabetical order) Project A_PPTUS cover(Eng) Cover size: 210 x 280mm / Open size: 445.3 x 280mm / Spine width: 25.3mm IMPORTANT If you are in any doubt about any of the contents of this prospectus, you should obtain independent professional advice. (Incorporated in the Cayman Islands with limited liability) GLOBAL OFFERING Number of Offer Shares under : 550,000,000 Shares (subject to the Over- the Global Offering allotment Option) Number of Hong Kong Offer Shares : 27,500,000 Shares (subject to reallocation) Number of International Offer Shares : 522,500,000 Shares (including 55,000,000 Reserved Shares under the Preferential Offering) (subject to reallocation and the Over-allotment Option) Maximum Offer Price : HK$22.30 per Share plus brokerage of 1.0%, SFC transaction levy of 0.0027% and the Hong Kong Stock Exchange trading fee of 0.005% (payable in full on application, subject to refund) Nominal value : US$0.00001 per Share Stock code : 1209 Joint Sponsors, Joint Global Coordinators, Joint Bookrunners and Joint Lead Managers (in alphabetical order) Other Joint Global Coordinator, Joint Bookrunner and Joint Lead Manager Other Joint Bookrunners and Joint Lead Managers (in alphabetical order) Hong Kong Exchanges and Clearing Limited, The Stock Exchange of Hong Kong Limited and Hong Kong Securities Clearing Company Limited take no responsibility for the contents of this prospectus, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this prospectus. -

China CITIC Bank Corporation Limited 2020 Sustainability Report

2020 Sustainability Report of China CITIC Bank Corporation Limited China CITIC Bank Corporation Limited 2020 Sustainability Report March 25th, 2021 1 2020 Sustainability Report of China CITIC Bank Corporation Limited Preparation Explanation Reporting Scope The 2020 Sustainability Report of China CITIC Bank Corporation Limited is hereinafter referred to as “the Report”. Unless otherwise specified, for the purpose of the Report, “the Bank” refers to China CITIC Bank Corporation Limited, “the Group” refers to China CITIC Bank Corporation Limited and its subsidiaries. The subsidiaries of China CITIC Bank Corporation Limited include: Zhejiang Lin’an CITIC Rural Bank Co., Ltd., CITIC Financial Leasing Co., Ltd., CITIC International Financial Holdings Limited, and CNBC (Hong Kong) Investment Limited (formerly known as “China Investment and Finance Limited”), excluding CITIC aiBank Corporation Limited and JSC Altyn Bank. Preparation Basis The present report is prepared on the principle of responding to the United Nations’ Sustainable Development Goals. The basis for preparation of the Report includes the Opinions on Strengthening Social Responsibilities of Banking Financial Institutions promulgated by the China Banking Regulatory Commission (“CBRC” hereinafter), the SSE Guidelines on Environmental Information Disclosure of Listed Companies, the Guidelines on Preparation of Report on Company’s Fulfillment of Social Responsibilities and relevant notifications released by the SSE, as well as Appendix 27 Environmental, Social and Governance Reporting Guide1 (hereinafter referred to as the “ESG Guide”) to the Rules Governing the Listing of Securities on the Stock Exchange of Hong Kong Limited. The Report was prepared in accordance with the Core option of the Sustainability Reporting Standards (2016)2 issued by the Global Reporting Initiative (“GRI Standards” hereinafter). -

Gemdale Properties and Investment Corporation Limited 金地商置集團有限公司* (Incorporated in Bermuda with Limited Liability) (Stock Code: 535)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. Gemdale Properties and Investment Corporation Limited * 金地商置集團有限公司 (Incorporated in Bermuda with limited liability) (Stock Code: 535) DISCLOSEABLE TRANSACTION DISPOSAL OF 74% OF A SUBSIDIARY DISPOSAL OF 74% OF A SUBSIDIARY The Board announces that, on 12 July 2018, One Polaris, Shenzhen Weixin, Fainmark and Nanjing Jiqingfeng (all of which are indirect wholly-owned subsidiaries of the Company, as the Vendors) and Perfect Area, Shanghai Hongxing, Xuzhou Vanke and Charm Silver (collectively, as the Purchasers) entered into the Agreement in relation to the Disposal. Upon completion of the Disposal, the Group’s effective equity interest in the Target Company will be reduced from 100% to 26% and the Target Company will be under the joint control of the parties to the Agreement. Therefore, the Target Company will cease to be accounted for as a subsidiary of the Company and will be accounted for as a joint venture of the Group. The financial results of the Target Company will no longer be consolidated into the consolidated financial statements of the Group. LISTING RULES IMPLICATIONS As one the applicable percentage ratios (as defined under the Listing Rules) exceed 5% but are less than 25%, the entering into of the Agreement and the transactions contemplated thereunder (including the consideration) constitutes a discloseable transaction of the Company and is subject to the reporting and announcement requirements under Chapter 14 of the Listing Rules. -

China Reits Property Landlords to Shine 19

SECTOR BRIEFING number DBS Asian Insights DBS Group59 Research • May 2018 China REITs Property Landlords to Shine 19 DBS Asian Insights SECTOR BRIEFING 59 02 China REITs Property Landlords to Shine Ken HE Equity Analyst DBS (Hong Kong) [email protected] Carol WU Head of Greater China Research DBS (Hong Kong) [email protected] Danielle WANG CFA Equity Analyst DBS (Hong Kong) [email protected] Derek TAN Equity Analyst DBS Group Research [email protected] Jason LAM Equity Analyst DBS (Hong Kong) [email protected] Produced by: Asian Insights Office • DBS Group Research go.dbs.com/research @dbsinsights [email protected] Goh Chien Yen Editor-in-Chief Jean Chua Managing Editor Martin Tacchi Art Director 19 DBS Asian Insights SECTOR BRIEFING 59 03 04 Executive Summary 08 China REITs Are Lagging Edging Towards Onshore REITs Major Obstacles in Fostering 18 an Onshore REIT Regime CMBS/CMBNs Are Growing Faster C-REITs Are Imminent Which Asset Type Will Benefit 28 More? Modern Logistics Properties The Rise of Active Property Asset Management Which Developer Will Benefit From the Establishment of C-REITs? 49 Appendix DBS Asian Insights SECTOR BRIEFING 59 04 Executive Summary No REIT regime yet he real estate investment trust (REIT) has become an important investment vehicle as evidenced by its separation from the financial sector in the Global Industry Classification Standard as a sector on its own. Major Asian countries/regions have joined western countries to kickstart local versions of REITs, leaving China the last Tbig economy that has yet to have such an investment vehicle. Two major technical In our view, removing legislative obstacles (publicly traded funds are not allowed to obstacles hold commercial properties) is the first step that the government needs to take towards establishing a modern REIT regime. -

STOXX Greater China 80 Last Updated: 01.08.2017

STOXX Greater China 80 Last Updated: 01.08.2017 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) TW0002330008 6889106 2330.TW TW001Q TSMC TW TWD Y 113.9 1 1 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 80.6 2 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 60.5 3 3 TW0002317005 6438564 2317.TW TW002R Hon Hai Precision Industry Co TW TWD Y 51.5 4 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 50.8 5 5 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 41.3 6 6 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 32.0 7 9 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 31.8 8 7 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 31.1 9 8 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 28.0 10 10 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 20.6 11 12 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 20.0 12 11 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 20.0 13 13 TW0003008009 6451668 3008.TW TW05PJ LARGAN Precision TW TWD Y 19.7 14 15 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 18.3 15 14 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 16.4 16 16 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 15.4 17 19 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. -

Pacer CSOP FTSE China A50 ETF Schedule of Investments July 31, 2020 (Unaudited) Shares Value COMMON STOCKS - 98.0% Agriculture - 1.6% Muyuan Foodstuff Co Ltd

Page 1 of 4 Pacer CSOP FTSE China A50 ETF Schedule of Investments July 31, 2020 (Unaudited) Shares Value COMMON STOCKS - 98.0% Agriculture - 1.6% Muyuan Foodstuff Co Ltd. - Class A 9,230 $ 120,977 Wens Foodstuffs Group Co Ltd. - Class A 4,660 15,857 136,834 Auto Manufacturers - 0.7% SAIC Motor Corp Ltd. - Class A 24,600 64,077 Banks - 23.7% Agricultural Bank of China Ltd. - Class H 352,300 163,039 Bank of China Ltd. - Class H 193,900 92,512 Bank of Communications Co Ltd. - Class A 184,100 125,556 China CITIC Bank Corp Ltd. - Class H 24,700 18,261 China Construction Bank Corp. - Class H 81,500 71,464 China Everbright Bank Co Ltd. - Class H 126,400 68,456 China Merchants Bank Co Ltd. - Class A 108,200 539,489 China Minsheng Banking Corp Ltd. - Class A 254,300 201,851 Industrial & Commercial Bank of China Ltd. - Class A 198,400 140,993 Industrial Bank Co Ltd. - Class A 127,400 285,849 Ping An Bank Co Ltd. - Class A 75,000 143,348 Shanghai Pudong Development Bank Co Ltd. - Class A 132,300 196,379 2,047,197 Beverages - 17.9% Jiangsu Yanghe Brewery Joint-Stock Co Ltd. - Class A 4,000 77,398 Kweichow Moutai Co Ltd. - Class A 4,000 961,777 Wuliangye Yibin Co Ltd. - Class A 16,200 504,835 1,544,010 Building Materials - 1.6% Anhui Conch Cement Co Ltd. - Class H 15,900 139,921 Coal - 0.5% China Shenhua Energy Co Ltd. -

China CITIC Bank Corporation Limited App 1A 1 (A Joint Stock Limited Company Incorporated in the People's Republic of China with Limited Liability) GLOBAL OFFERING

CITIC IPO-final o_p.fh11 4/10/07 8:08 PM 頁 1 C M Y CM MY CY CMY K 合成的 IMPORTANT: If you are in any doubt about any of the contents of this prospectus, you should obtain CO S342(2A) independent professional advice. China CITIC Bank Corporation Limited App 1A 1 (a joint stock limited company incorporated in the People's Republic of China with limited liability) GLOBAL OFFERING Number of OÅer Shares in the Global OÅering : 4,885,479,000 H Shares (subject to the Over-allotment Option) Number of Hong Kong OÅer Shares : 244,274,000 H Shares (subject to adjustment) App 1A 15(2)(a) Number of International OÅer Shares : 4,641,205,000 H Shares (subject to adjustment and the Over- CO 3rd Sch(1)2 allotment Option) CO 3rd Sch(1)9 Maximum oÅer price : HK$5.86 per H Share (payable in full on application, plus brokerage of 1%, SFC transaction levy of 0.004%, and Hong Kong App 1A 15(2)(c) Stock Exchange trading fee of 0.005% and subject to refund) Nominal value : RMB 1.00 each Stock code : 998 App 1A 15(2)(c) CO 3rd Sch(1)2 Joint Global Coordinators and Joint Bookrunners China International Capital Corporation Limited CITIC Securities Co., Ltd. Citigroup Global Markets Asia Limited The Hongkong and Shanghai Banking Corporation Limited Lehman Brothers Asia Limited (in alphabetical order) Joint Sponsors and Joint Lead Managers China International Capital Corporation (Hong Kong) Limited CITIC Securities Corporate Finance (HK) Limited Citigroup Global Markets Asia Limited The Hongkong and Shanghai Banking Corporation Limited Lehman Brothers Asia Limited (in alphabetical order) The Stock Exchange of Hong Kong Limited and Hong Kong Securities Clearing Company Limited, take no responsibility for the contents of this LR 11.20 prospectus, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this prospectus. -

U.S. Investors Are Funding Malign PRC Companies on Major Indices

U.S. DEPARTMENT OF STATE Office of the Spokesperson For Immediate Release FACT SHEET December 8, 2020 U.S. Investors Are Funding Malign PRC Companies on Major Indices “Under Xi Jinping, the CCP has prioritized something called ‘military-civil fusion.’ … Chinese companies and researchers must… under penalty of law – share technology with the Chinese military. The goal is to ensure that the People’s Liberation Army has military dominance. And the PLA’s core mission is to sustain the Chinese Communist Party’s grip on power.” – Secretary of State Michael R. Pompeo, January 13, 2020 The Chinese Communist Party’s (CCP) threat to American national security extends into our financial markets and impacts American investors. Many major stock and bond indices developed by index providers like MSCI and FTSE include malign People’s Republic of China (PRC) companies that are listed on the Department of Commerce’s Entity List and/or the Department of Defense’s List of “Communist Chinese military companies” (CCMCs). The money flowing into these index funds – often passively, from U.S. retail investors – supports Chinese companies involved in both civilian and military production. Some of these companies produce technologies for the surveillance of civilians and repression of human rights, as is the case with Uyghurs and other Muslim minority groups in Xinjiang, China, as well as in other repressive regimes, such as Iran and Venezuela. As of December 2020, at least 24 of the 35 parent-level CCMCs had affiliates’ securities included on a major securities index. This includes at least 71 distinct affiliate-level securities issuers.