EEMEA Regional Overview

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tobacco Labelling -.:: GEOCITIES.Ws

Council Directive 89/622/EC concerning the labelling of tobacco products, as amended TAR AND NICOTINE CONTENTS OF THE CIGARETTES SOLD ON THE EUROPEAN MARKET AUSTRIA Brand Tar Yield Nicotine Yield Mg. Mg. List 1 A3 14.0 0.8 A3 Filter 11.0 0.6 Belvedere 11.0 0.8 Camel Filters 14.0 1.1 Camel Filters 100 13.0 1.1 Camel Lights 8.0 0.7 Casablanca 6.0 0.6 Casablanca Ultra 2.0 0.2 Corso 4.0 0.4 Da Capo 9.0 0.4 Dames 9.0 0.6 Dames Filter Box 9.0 0.6 Ernte 23 13.0 0.8 Falk 5.0 0.4 Flirt 14.0 0.9 Flirt Filter 11.0 0.6 Golden Smart 12.0 0.8 HB 13.0 0.9 HB 100 14.0 1.0 Hobby 11.0 0.8 Hobby Box 11.0 0.8 Hobby Extra 11.0 0.8 Johnny Filter 11.0 0.9 Jonny 14.0 1.0 Kent 10.0 0.8 Kim 8.0 0.6 Kim Superlights 4.0 0.4 Lord Extra 8.0 0.6 Lucky Strike 13.0 1.0 Lucky Strike Lights 9.0 0.7 Marlboro 13.0 0.9 Marlboro 100 14.0 1.0 Marlboro Lights 7.0 0.6 Malboro Medium 9.0 0.7 Maverick 11.0 0.8 Memphis Classic 11.0 0.8 Memphis Blue 12.0 0.8 Memphis International 13.0 1.0 Memphis International 100 14.0 1.0 Memphis Lights 7.0 0.6 Memphis Lights 100 9.0 0.7 Memphis Medium 9.0 0.6 Memphis Menthol 7.0 0.5 Men 11.0 0.9 Men Light 5.0 0.5 Milde Sorte 8.0 0.5 Milde Sorte 1 1.0 0.1 Milde Sorte 100 9.0 0.5 Milde Sorte Super 6.0 0.3 Milde Sorte Ultra 4.0 0.4 Parisienne Mild 8.0 0.7 Parisienne Super 11.0 0.9 Peter Stuyvesant 12.0 0.8 Philip Morris Super Lights 4.0 0.4 Ronson 13.0 1.1 Smart Export 10.0 0.8 Treff 14.0 0.9 Trend 5.0 0.2 Trussardi Light 100 6.0 0.5 United E 12.0 0.9 Winston 13.0 0.9 York 9.0 0.7 List 2 Auslese de luxe 1.0 0.1 Benson & Hedges 12.0 1.0 Camel 15.0 1.0 -

Supplementary Table 10.7

Factory-made cigarettes and roll-your-own tobacco products available for sale in January 2019 at major Australian retailers1 Market Pack Number of Year Tobacco Company segment2 Brand size3 variants Variant name(s) Cigarette type introduced4 British American Super-value Rothmans5 20 3 Blue, Gold, Red Regular 2015 Tobacco Australia FMCs 23 2 Blue, Gold Regular 2018 25 5 Blue, Gold, Red, Silver, Menthol Green Regular 2014 30 3 Blue, Gold, Red Regular 2016 40 6 Blue, Gold, Red, Silver, Menthol Green, Black6 Regular 2014 50 5 Blue, Gold, Red, Silver, Menthol Green Regular 2016 Rothmans Cool Crush 20 3 Blue, Gold, Red Flavour capsule 2017 Rothmans Superkings 20 3 Blue, Red, Menthol Green Extra-long sticks 2015 ShuangXi7 20 2 Original Red, Blue8 Regular Pre-2012 Value FMCs Holiday 20 3 Blue, Gold, Red Regular 20189 22 5 Blue, Gold, Red, Grey, Sea Green Regular Pre-2012 50 5 Blue, Gold, Red, Grey, Sea Green Regular Pre-2012 Pall Mall 20 4 Rich Blue, Ultimate Purple, Black10, Amber Regular Pre-2012 40 3 Rich Blue, Ultimate Purple, Black11 Regular Pre-2012 Pall Mall Slims 23 5 Blue, Amber, Silver, Purple, Menthol Short, slim sticks Pre-2012 Mainstream Winfield 20 6 Blue, Gold, Sky Blue, Red, Grey, White Regular Pre-2012 FMCs 25 6 Blue, Gold, Sky Blue, Red, Grey, White Regular Pre-2012 30 5 Blue, Gold, Sky Blue, Red, Grey Regular 2014 40 3 Blue, Gold, Menthol Fresh Regular 2017 Winfield Jets 23 2 Blue, Gold Slim sticks 2014 Winfield Optimum 23 1 Wild Mist Charcoal filter 2018 25 3 Gold, Night, Sky Charcoal filter Pre-2012 Winfield Optimum Crush 20 -

2018 Conference Program

CONFERENCE PROGRAM THE FSU REAL ESTATE CENTER’S 24TH REAL ESTATE TRENDS CONFERENCE OCTOBER 25 & 26 , 2 0 18 TALLAHASSEE, FLORIDA LEGACY LEADERS GOLD SPONSORS PROGRAM PARTNERS The Real Estate TRENDS Conference is organized to inform participants of the The Program Partner designation is reserved for emerging trends and issues facing the real estate industry, to establish and strengthen those who have made major gifts to advance the professional contacts, and to present the broad range of career opportunities available Real Estate Program at Florida State University. to our students. It is organized by the FSU Real Estate Center, the Florida State University Donna Abood Real Estate Network and the students’ FSU Real Estate Society. This event would not be Beth Azor possible without the generous financial support of its sponsors. Kenneth Bacheller Mark C. Bane Bobby Byrd LEGACY LEADERS Harold and Barbara Chastain Centennial Management Corp. Marshall Cohn Peter and Jennifer Collins JLL John Crossman/Crossman & Company The Kislak Family Foundation, Inc. Scott and Marion Darling Florida State Real Estate Network, Inc. Mark and Nan Casper Hillis Evan Jennings GOLD SPONSORS The Kislak Family Foundation, Inc. • Berkadia • Cushman & Wakefield • Lennar Homes Brett and Cindy Lindquist • Carroll Organization • The Dunhill Companies • The Nine @ Tallahassee George Livingston William and Stephanie Lloyd • CBRE • Eastdil Secured • Osprey Capital Shawn McIntyre/North American Properties • CNL Financial Group, Inc. • Florida Trend • Ryan, LLC Greg Michaud • Colliers International • Gilbane Building Company • Stearns Weaver Miller Kyle Mowitz and Justin Mowitz • Commercial Capital LTD • GreenPointe Communities, LLC • STR, Inc. Francis Nardozza • Culpepper Construction • Hatfield Development/Pou • Walker & Dunlop Kyle D. -

Appendix 1. Categorization of Cigarette Brands As Either Premium Or Discount

Appendix 1. Categorization of Cigarette Brands as either Premium or Discount Category Name of Cigarette Brand Premium Accord, American Spirit, Barclay, Belair, Benson & Hedges, Camel, Capri, Carlton, Chesterfield, Davidoff, Du Maurier, Dunhill, Dunhill International, Eve, Kent, Kool, L&M, Lark, Lucky Strike, Marlboro, Max, Merit, Mild Seven, More, Nat Sherman, Newport, Now, Parliament, Players, Quest, Rothman’s, Salem, Sampoerna, Saratoga, Tareyton, True, Vantage, Virginia Slims, Winston, Raleigh, Business Club Full Flavor, Ronhill, Dreams Discount 24/7, 305, 1839, A1, Ace, Allstar, Allway Save, Alpine, American, American Diamond, American Hero, American Liberty, Arrow, Austin, Axis, Baileys, Bargain Buy, Baron, Basic, Beacon, Berkeley, Best Value, Black Hawk, Bonus Value, Boston, Bracar, Brand X, Brave, Brentwood, Bridgeport, Bronco, Bronson, Bucks, Buffalo, BV, Calon, Cambridge, Campton, Cannon, Cardinal, Carnival, Cavalier, Champion, Charter, Checkers, Cherokee, Cheyenne, Cimarron, Circle Z, Class A, Classic, Cobra, Complete, Corona, Courier, CT, Decade, Desert Gold, Desert Sun, Discount, Doral, Double Diamond, DTC, Durant, Eagle, Echo, Edgefield, Epic, Esquire, Euro, Exact, Exeter, First Choice, First Class, Focus, Fortuna, Galaxy Pro, Gauloises, Generals, Generic/Private Label, Geronimo, Gold Coast, Gold Crest, Golden Bay, Golden, Golden Beach, Golden Palace, GP, GPC, Grand, Grand Prix, G Smoke, GT Ones, Hava Club, HB, Heron, Highway, Hi-Val, Jacks, Jade, Kentucky Best, King Mountain, Kingsley, Kingston, Kingsport, Knife, Knights, -

Group Income Statement

news release www.bat.com 06 May 2009 BRITISH AMERICAN TOBACCO p.l.c. INTERIM MANAGEMENT STATEMENT FOR THE THREE MONTHS ENDED 31 MARCH 2009 • Strong revenue growth at both constant and current exchange rates • Volumes from subsidiaries increased 7 per cent to 170 billion • All four Global Drive Brands grew volume, with overall growth of 7 per cent Trading update British American Tobacco had a good start to 2009 and is continuing to build on the success achieved in 2008. Group revenue for the three months grew strongly in constant currency terms, driven by the continued good pricing momentum and volume growth from the acquisitions made in the middle of last year (Skandinavisk Tobakskompagni (ST) and Tekel). All regions contributed to this good result. Revenue benefited further from the favourable impact of significant exchange rate movements which more than offset the adverse transactional impact of exchange rates on costs. Group volumes from subsidiaries were 170 billion, up 7 per cent, mainly as a result of the acquisitions of ST and Tekel. Excluding the benefits of these acquisitions, volumes were in line with last year with premium volumes slightly ahead. The four Global Drive Brands continued their strong performance and achieved overall volume growth of 7 per cent. Dunhill was up 8 per cent, Kent 3 per cent, Lucky Strike 4 per cent and Pall Mall grew by 11 per cent. Cigarette volumes The segmental analysis of the volumes of subsidiaries is as follows: 3 months to Year to 31.03.09 31.03.08 31.12.08 bns bns bns Asia-Pacific 43.3 42.9 179.5 Americas 37.9 39.2 161.0 Western Europe 29.7 25.1 122.6 Eastern Europe 27.1 29.1 137.3 Africa and Middle East 31.5 22.1 114.2 169.5 158.4 714.6 Trading environment This performance was achieved against general trading conditions which became tougher during the quarter with lower industry volumes in a number of key markets and a deceleration of growth in the premium segment. -

Tobacco Directory Deletions by Manufacturer

Cigarettes and Tobacco Products Removed From The California Tobacco Directory by Manufacturer Brand Manufacturer Date Comments Removed Catmandu Alternative Brands, Inc. 2/3/2006 Savannah Anderson Tobacco Company, LLC 11/18/2005 Desperado - RYO Bailey Tobacco Corporation 5/4/2007 Peace - RYO Bailey Tobacco Corporation 5/4/2007 Revenge - RYO Bailey Tobacco Corporation 5/4/2007 The Brave Bekenton, S.A. 6/2/2006 Barclay Brown & Williamson * Became RJR July 5/2/2008 2004 Belair Brown & Williamson * Became RJR July 5/2/2008 2004 Private Stock Brown & Williamson * Became RJR July 5/2/2008 2004 Raleigh Brown & Williamson * Became RJR July 5/6/2005 2004 Viceroy Brown & Williamson * Became RJR July 5/3/2010 2004 Coronas Canary Islands Cigar Co. 5/5/2006 Palace Canary Islands Cigar Co. 5/5/2006 Record Canary Islands Cigar Co. 5/5/2006 VL Canary Islands Cigar Co. 5/5/2006 Freemont Caribbean-American Tobacco Corp. 5/2/2008 Kingsboro Carolina Tobacco Company 5/3/2010 Roger Carolina Tobacco Company 5/3/2010 Aura Cheyenne International, LLC 1/5/2018 Cheyenne Cheyenne International, LLC 1/5/2018 Cheyenne - RYO Cheyenne International, LLC 1/5/2018 Decade Cheyenne International, LLC 1/5/2018 Bridgeton CLP, Inc. 5/4/2007 DT Tobacco - RYO CLP, Inc. 7/13/2007 Railroad - RYO CLP, Inc. 5/30/2008 Smokers Palace - RYO CLP, Inc. 7/13/2007 Smokers Select - RYO CLP, Inc. 5/30/2008 Southern Harvest - RYO CLP, Inc. 7/13/2007 Davidoff Commonwealth Brands, Inc. 7/19/2016 Malibu Commonwealth Brands, Inc. 5/31/2017 McClintock - RYO Commonwealth Brands, Inc. -

Carroll, B., Nelson, G., Rabanal-Ruiz, Y., Kucheryavenko, O., Dunhill- Turner, N. A., Chesterman, C. C., Zahari, Q., Zhang

Carroll, B. , Nelson, G., Rabanal-Ruiz, Y., Kucheryavenko, O., Dunhill- Turner, N. A., Chesterman, C. C., Zahari, Q., Zhang, T., Conduit, S. E., Mitchell, C. A., Maddocks, O. D. K., Lovat, P., von Zglinicki, T., & Korolchuk, V. I. (2017). Persistent mTORC1 signaling in cell senescence results from defects in amino acid and growth factor sensing. Journal of Cell Biology, 216(7), 1949-1957. https://doi.org/10.1083/jcb.201610113 Publisher's PDF, also known as Version of record License (if available): CC BY Link to published version (if available): 10.1083/jcb.201610113 Link to publication record in Explore Bristol Research PDF-document This is the final published version of the article (version of record). It first appeared online via The Rockefeller University Press at DOI:10.1083/jcb.201610113. Please refer to any applicable terms of use of the publisher. University of Bristol - Explore Bristol Research General rights This document is made available in accordance with publisher policies. Please cite only the published version using the reference above. Full terms of use are available: http://www.bristol.ac.uk/red/research-policy/pure/user-guides/ebr-terms/ Published Online: 31 May, 2017 | Supp Info: http://doi.org/10.1083/jcb.201610113 JCB: Report Downloaded from jcb.rupress.org on March 20, 2019 Persistent mTORC1 signaling in cell senescence results from defects in amino acid and growth factor sensing Bernadette Carroll,1 Glyn Nelson,1 Yoana Rabanal-Ruiz,1 Olena Kucheryavenko,1 Natasha A. Dunhill-Turner,1 Charlotte C. Chesterman,1 Qabil Zahari,1 Tong Zhang,3 Sarah E. -

Las Vegas Daily Gazette, 07-30-1881 J

University of New Mexico UNM Digital Repository Las Vegas Gazette, 1880-1886 New Mexico Historical Newspapers 7-30-1881 Las Vegas Daily Gazette, 07-30-1881 J. H. Koogler Follow this and additional works at: https://digitalrepository.unm.edu/lv_gazette_news Recommended Citation Koogler, J. H.. "Las Vegas Daily Gazette, 07-30-1881." (1881). https://digitalrepository.unm.edu/lv_gazette_news/21 This Newspaper is brought to you for free and open access by the New Mexico Historical Newspapers at UNM Digital Repository. It has been accepted for inclusion in Las Vegas Gazette, 1880-1886 by an authorized administrator of UNM Digital Repository. For more information, please contact [email protected]. ' á I LAS VEGAS DAILY GAZETTE O fc . , . VOL. 3. SATURDAY MORNING-;- ' JULY 30, 1881. NO. 21. ' SIMON A CLEMENTS. FELIX MARTINEZ. Keene's Jfw Company. The Oallawa In Leadville. Expert and Imperta. Chicago. July 29. A special from Lead ville. July 29. --Gilbert and Rosen- - Washington, 0 'uy 29. The excess of HEWS BV TELEGRAPH New York says Keene's new telegraph crants paid the penalty of their crimes exports of merck Li ndise over imports CLEMENTS MARTINEZ company was formally organized to- upon the scanold this morning. J. he during the year ciic'ing Juue 30, i x.vt I day. It is becoming quite fashionable streets were thronged with people from was 1259,720,25-i- , t igainst 1C7.083.912 DEALERS IN nowadays for millionaires and promi- daylight, and long before seven o'clock during the previ- - ous fiscal year. Excess nent Wall Street operators to control the gallows was surrounded by thou- of imports of gol d f or the past fiscal The Sews Front the White House Con- organizations of this character and fol-- sands of people. -

2019 Property Portfolio Simon Malls®

The Shops at Clearfork Denver Premium Outlets® The Colonnade Outlets at Sawgrass Mills® 2019 PROPERTY PORTFOLIO SIMON MALLS® LOCATION GLA IN SQ. FT. MAJOR RETAILERS CONTACTS PROPERTY NAME 2 THE SIMON EXPERIENCE WHERE BRANDS & COMMUNITIES COME TOGETHER SIMON MALLS® LOCATION GLA IN SQ. FT. MAJOR RETAILERS CONTACTS PROPERTY NAME 2 ABOUT SIMON Simon® is a global leader in retail real estate ownership, management, and development and an S&P 100 company (Simon Property Group, NYSE:SPG). Our industry-leading retail properties and investments across North America, Europe, and Asia provide shopping experiences for millions of consumers every day and generate billions in annual sales. For more information, visit simon.com. · Information as of 12/16/2019 3 SIMON MALLS® LOCATION GLA IN SQ. FT. MAJOR RETAILERS CONTACTS PROPERTY NAME More than real estate, we are a company of experiences. For our guests, we provide distinctive shopping, dining, and entertainment. For our retailers, we offer the unique opportunity to thrive in the best retail real estate in the best markets. From new projects and redevelopments to acquisitions and mergers, we are continuously evaluating our portfolio to enhance the Simon experience—places where people choose to shop and retailers want to be. 4 LOCATION GLA IN SQ. FT. MAJOR RETAILERS CONTACTS PROPERTY NAME WE DELIVER: SCALE A global leader in the ownership of premier shopping, dining, entertainment, and mixed-use destinations, including Simon Malls®, Simon Premium Outlets®, and The Mills® QUALITY Iconic, irreplaceable properties in great locations INVESTMENT Active portfolio management increases productivity and returns GROWTH Core business and strategic acquisitions drive performance EXPERIENCE Decades of expertise in development, ownership, and management That’s the advantage of leasing with Simon. -

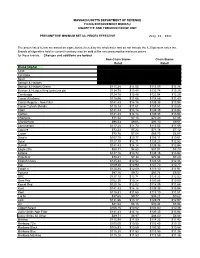

Cigarette Minimum Retail Price List

MASSACHUSETTS DEPARTMENT OF REVENUE FILING ENFORCEMENT BUREAU CIGARETTE AND TOBACCO EXCISE UNIT PRESUMPTIVE MINIMUM RETAIL PRICES EFFECTIVE July 26, 2021 The prices listed below are based on cigarettes delivered by the wholesaler and do not include the 6.25 percent sales tax. Brands of cigarettes held in current inventory may be sold at the new presumptive minimum prices for those brands. Changes and additions are bolded. Non-Chain Stores Chain Stores Retail Retail Brand (Alpha) Carton Pack Carton Pack 1839 $86.64 $8.66 $85.38 $8.54 1st Class $71.49 $7.15 $70.44 $7.04 Basic $122.21 $12.22 $120.41 $12.04 Benson & Hedges $136.55 $13.66 $134.54 $13.45 Benson & Hedges Green $115.28 $11.53 $113.59 $11.36 Benson & Hedges King (princess pk) $134.75 $13.48 $132.78 $13.28 Cambridge $124.78 $12.48 $122.94 $12.29 Camel All others $116.56 $11.66 $114.85 $11.49 Camel Regular - Non Filter $141.43 $14.14 $139.35 $13.94 Camel Turkish Blends $110.14 $11.01 $108.51 $10.85 Capri $141.43 $14.14 $139.35 $13.94 Carlton $141.43 $14.14 $139.35 $13.94 Checkers $71.54 $7.15 $70.49 $7.05 Chesterfield $96.53 $9.65 $95.10 $9.51 Commander $117.28 $11.73 $115.55 $11.56 Couture $72.23 $7.22 $71.16 $7.12 Crown $70.76 $7.08 $69.73 $6.97 Dave's $107.70 $10.77 $106.11 $10.61 Doral $127.10 $12.71 $125.23 $12.52 Dunhill $141.43 $14.14 $139.35 $13.94 Eagle 20's $88.31 $8.83 $87.01 $8.70 Eclipse $137.16 $13.72 $135.15 $13.52 Edgefield $73.41 $7.34 $72.34 $7.23 English Ovals $125.44 $12.54 $123.59 $12.36 Eve $109.30 $10.93 $107.70 $10.77 Export A $120.88 $12.09 $119.10 $11.91 -

23/F, 8-Commercial Tower, 8 Sun Yip Street, Chai Wan, Hong Kong Tel 25799398 26930136 Fax (+852) 26027153 Email [email protected]

To Whom it may concern ISO Test methods for cigarette tar and nicotine content are outdated and unrepresentative of the actual yield and toxins intake due to smoker compensation - Countries should adopt the Health Canada Intense test method, like RIVM Holland The old and outdated ISO test criteria for cigarette tar and nicotine content used by the HK Government Lab is way out of date. The industry deliberately perforates the filter and paper of the tobacco rods with tiny holes to ‘cheat’ the current ISO machine test methods. What actually happens is the smokers wrap their fingers and of course mouth around the filter to compensate for the additional dilution air being sucked in through the perforations. The ISO smoking test machine is not real world, does not compensate by blocking the holes and hence reveals test results that are far, far lower than the smokers actually inhale. RIVM, the Dutch Ministry of Health, has adopted the Health Canada Intense smoking test criteria which better reveals the actual tar and nicotine in each cigarette rod since they tape over the perforated holes in the same way that the smoker compensates with fingers and mouth, to seal the holes - and then test the actual values. Attached herewith you can see the vast disparities as revealed in the RIVM test data which show the level of toxics which the smokers actually inhale versus the mythical ISO data preferred and provided by the manufacturers. Countries Kong need to switch to the Health Canada Intense method of cigarette testing asap and inform the public accordingly of the actual level of toxins they inhale when they smoke cigarettes. -

NVWA Nr. Merk/Type Nicotine (Mg/Sig) NFDPM (Teer)

NVWA nr. Merk/type Nicotine (mg/sig) NFDPM (teer) (mg/sig) CO (mg/sig) 89537347 Lexington 1,06 12,1 7,6 89398436 Camel Original 0,92 11,7 8,9 89398339 Lucky Strike Original Red 0,88 11,4 11,6 89398223 JPS Red 0,87 11,1 10,9 89399459 Bastos Filter 1,04 10,9 10,1 89399483 Belinda Super Kings 0,86 10,8 11,8 89398347 Mantano 0,83 10,8 7,3 89398274 Gauloises Brunes 0,74 10,7 10,1 89398967 Winston Classic 0,94 10,6 11,4 89399394 Titaan Red 0,75 10,5 11,1 89399572 Gauloises 0,88 10,5 10,6 89399408 Elixyr Groen 0,85 10,4 10,9 89398266 Gauloises Blondes Blue 0,77 10,4 9,8 89398886 Lucky Strike Red Additive Free 0,85 10,3 10,4 89537266 Dunhill International 0,94 10,3 9,9 89398932 Superkings Original Black 0,92 10,1 10,1 89537231 Mark 1 New Red 0,78 10 11,2 89399467 Benson & Hedges Gold 0,9 10 10,9 89398118 Peter Stuyvesant Red 0,82 10 10,9 89398428 L & M Red Label 0,78 10 10,5 89398959 Lambert & Butler Original Silver 0,91 10 10,3 89399645 Gladstone Classic 0,77 10 10,3 89398851 Lucky Strike Ice Gold 0,75 9,9 11,5 89537223 Mark 1 Green 0,68 9,8 11,2 89393671 Pall Mall Red 0,84 9,8 10,8 89399653 Chesterfield Red 0,75 9,8 10 89398371 Lucky strike Gold 0,76 9,7 11,1 89399599 Marlboro Gold 0,78 9,6 10,3 89398193 Davidoff Classic 0,88 9,6 10,1 89399637 Marlboro Red 100 0,79 9,6 9 89398878 Lucky Strike Ice 0,71 9,5 10,9 89398045 Pall Mall Red 0,81 9,5 10,5 89398355 Dunhill Master Blend Red 0,82 9,5 9,8 89399475 JPS Red 0,81 9,5 9,6 89398029 Marlboro Red 0,79 9,5 9 89537355 Elixyr Red 0,79 9,4 9,8 89398037 Marlboro Menthol 0,72 9,3 10,3 89399505 Marlboro