Building Societies at the Heart of Their Communities

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CHE 0902DRAFT.Indd

APPLICATION FORM FOR ADMISSION TO THE CONVEYANCING PANEL OF THE YORKSHIRE BUILDING SOCIETY GROUP - INCORPORATING YORKSHIRE BUILDING SOCIETY, ACCORD MORTGAGES LIMITED, CHELSEA BUILDING SOCIETY AND BARNSLEY BUILDING SOCIETY (“THE SOCIETY”) NOTES: • If your answer to any question exceeds the space allowed, continue on a separate sheet clearly marking the question number. • The whole of this application form is to be completed by the senior partner/director of your practice. • Please note that the Society reserves the right to terminate your membership of its Conveyancing Panel if you fail to provide any relevant information or provide incorrect information in this application form or in relation to any future requests for information. • Please also note that your membership of the Society’s Conveyancing Panel can be terminated at any time without notice by the Society in the event of a Disciplinary Tribunal decision or where your fi rm has not acted for the Society in the grant of a mortgage for a period in excess of one year. • The Society will verify the regulatory status of every practice applying for admission to its Conveyancing Panel. The Society will check whether practices located in England and Wales hold Conveyancing Quality Scheme (“CQS”) accreditation where appropriate. The society requires annual evidence that the practice has a renewed CQS certifi cate. • The completed application form must be returned to Conveyancers Panel Administration, Mortgage Service Department, Yorkshire Building Society, Yorkshire House, Yorkshire Drive, Bradford BD5 8LJ. Dx No. 11798 Bradford. • We reserve the right to terminate your membership at any time should the Society deem this to be appropriate. -

2010 Prospectus

Leeds Building Society (incorporated in England and Wales under the Building Societies Act 1986, as amended) €7 billion Global Covered Bond Programme unconditionally and irrevocably guaranteed as to payments of interest and principal by Leeds Building Society Covered Bonds Limited Liability Partnership (a limited liability partnership incorporated in England and Wales) Under this €7 billion covered bond programme (the Programme), Leeds Building Society (the Issuer) may from time to time issue bonds (the Covered Bonds) denominated in any currency agreed between the Issuer and the relevant Dealer(s) (as defined below). The price and amount of the Covered Bonds to be issued under the Programme will be determined by the Issuer and the relevant Dealer at the time of issue in accordance with prevailing market conditions. Leeds Building Society Covered Bonds LLP (the LLP) has guaranteed payments of interest and principal under the Covered Bonds pursuant to a guarantee which is secured over the Portfolio (as defined below) and its other assets. Recourse against the LLP under its guarantee is limited to the Portfolio and such assets. Covered Bonds may be issued in bearer or registered form. The maximum aggregate nominal amount of all Covered Bonds from time to time outstanding under the Programme will not exceed €7 billion (or its equivalent in other currencies calculated as described in the Programme Agreement described herein), subject to increase as described herein. The Covered Bonds may be issued on a continuing basis to one or more of the Dealers specified under "Overview of the Programme" and any additional Dealer appointed under the Programme from time to time by the Issuer (each, a Dealer and together, the Dealers), which appointment may be in relation to a specific issue or on an ongoing basis. -

Friends of Halesworth County Library Minutes of Meeting of the Trustees

Friends of Halesworth County Library Minutes of meeting of the Trustees held on 29th October 2019 Present: Alison Britton (Chair), David Borer, Natalie Evans, Sheila Freeman, Nigel Frostick, Julie Gulliver, Evelyn Lindqvist, Irene Thomas Actions 1. Welcome & Apologies: Yvonne Sandison. Apologies 2. Minutes • Minutes of meeting held 17th September were read and approved. 3. Matters arising • Transportation – A response from Emma Healey is still awaited. Alison AB and not elsewhere attended the Halesworth Volunteer Centre AGM on 17th October but did not on agenda have a chance to speak with Emma. But co-operation with the Library was mentioned in the HVC future plans! • Alison will ask David Hopkins to investigate a new screen and projector as he AB has knowledge of the previous one. • Christmas Raffle Prizes – it was agreed that Trustees would contribute to the AB purchase of two “One4all” gift cards – one for £100 and one for £50. 4. Updates David Borer reported: Treasurer’s report • Receipts: Donations £439.79 inc. a £100 from the Woolnoughs which Alison has acknowledged. £422.05 Antique Street Market; Income from donated items £144.10; £15.26 interest on savings account. Total receipts: £1,333.01 • Outgoing Payments: £1,828.64 shelving; EPS Banner £75; ReadySpex re-stock £139.92; petty cash £71.99. Total £2,115.95 • Balances: Petty cash £164.84 Current account £9,080.80 Savings account £30,275.31 Current Total: £39,520.95 5. Sorting Friends Bank account signatories for the • It was decided that the treasurer is to be the HSBC main account holder. bank accounts Alison Britton to remain a signatory and two new signatories to be added: Julie Gulliver and Evelyn Lindqvist. -

Lender Panel List December 2019

Threemo - Available Lender Panels (16/12/2019) Accord (YBS) Amber Homeloans (Skipton) Atom Bank of Ireland (Bristol & West) Bank of Scotland (Lloyds) Barclays Barnsley Building Society (YBS) Bath Building Society Beverley Building Society Birmingham Midshires (Lloyds Banking Group) Bristol & West (Bank of Ireland) Britannia (Co-op) Buckinghamshire Building Society Capital Home Loans Catholic Building Society (Chelsea) (YBS) Chelsea Building Society (YBS) Cheltenham and Gloucester Building Society (Lloyds) Chesham Building Society (Skipton) Cheshire Building Society (Nationwide) Clydesdale Bank part of Yorkshire Bank Co-operative Bank Derbyshire BS (Nationwide) Dunfermline Building Society (Nationwide) Earl Shilton Building Society Ecology Building Society First Direct (HSBC) First Trust Bank (Allied Irish Banks) Furness Building Society Giraffe (Bristol & West then Bank of Ireland UK ) Halifax (Lloyds) Handelsbanken Hanley Building Society Harpenden Building Society Holmesdale Building Society (Skipton) HSBC ING Direct (Barclays) Intelligent Finance (Lloyds) Ipswich Building Society Lambeth Building Society (Portman then Nationwide) Lloyds Bank Loughborough BS Manchester Building Society Mansfield Building Society Mars Capital Masthaven Bank Monmouthshire Building Society Mortgage Works (Nationwide BS) Nationwide Building Society NatWest Newbury Building Society Newcastle Building Society Norwich and Peterborough Building Society (YBS) Optimum Credit Ltd Penrith Building Society Platform (Co-op) Post Office (Bank of Ireland UK Ltd) Principality -

Banking in Cark-In Cartmel

An undated photograph produced by the firm of Woolfall & Eccles (later T M Alexander & Son), architects of the Midland Bank, 119, Station Rd. Cark in Cartmel1 Banking in Cark-in Cartmel In today's high street the bank is becoming a rarity and 2017 will see the closure of another branching the Cartmel Peninsula; the National Westminster Bank in Main Street, Grange over Sands.2The banks are leaving the small market town high street but in the late nineteenth and for the first half of the twentieth century they were part of the local landscape in not only market towns, but even villages and hamlets such as Cark in Cartmel. Until 1826, banks were essentially private merchant banks but the Bank Act of 1826 permitted joint stock banks of issue with unlimited liability to be established. The Lancaster Banking Co. was one such bank which was set up in 1826 and existed until 1907 when it was taken over. For over seventy years, the hamlet of Cark in Cartmel, Cumbria had three banks ; the Lancaster Banking Co. which according to the Bulmer's Directory of 19113 was located at Bank House, Station Rd. and opened initially on Fridays ; the York City and County Banking Co. which became 1 HSBC archives April 18th 2017 2 The Westmorland Gazette, Thursday, March 31st. 2017 3 Bulmer's Directory of 1911. the London and Joint Stock Bank Ltd. was also located at 119 Station Rd. ; and the Bank of Liverpool and Martin's Ltd. which was located opposite at 114 Station Rd. All three banks were characterised by the fact that the banking premises occupied only one room of the building that they occupied and in addition were staffed by one member of staff , which in the case of the Midland and Martin's banks was the bank manager from either the Ulverston or Grange branch. -

Annual Repor T & Accounts

C M Y K www.leedsbuildingsociety.co.uk LEEDS YELLOW 105 Albion Street, Leeds LS1 5AS Tel: 0113 225 7777 Annual Repor t PMS ??? PMS ??? JOB LOCATION: PRINERGY 3 DISCLAIMER Approver The accuracy and the & Accounts content of this file is the responsibility of the Approver. Please authorise approval only if you wish to proceed to print. Communisis PMS cannot accept liability for errors once the file has been printed. Printer This colour bar is produced manually all end user s must check final separations to verify 2012 colours before LDS00013 (03/13) LDS00043-R+A-COVER.indd 1 22/02/2013 13:24 Financial Highlights Where to find us For the year ended 31 December 2012 Aberdeen Harrogate Street Lane Norwich 68 Carden Place, Aberdeen AB10 1UL 12 Oxford Street, Harrogate HG1 1PU 69 Street Lane, Roundhay, Leeds LS8 1AP 6/7 Guildhall Hill, Norwich NR2 1JG Tel: 01224 642641 Tel: 01423 546510 Tel: 0113 225 8720 Tel: 01603 626978 Banbury Huddersfield Wetherby Nottingham 19 High Street, Banbury OX16 5EE 8 Cherry Tree Centre, Market Street, 2 Horsefair Centre, Wetherby LS22 6FL 23 Listergate, Nottingham NG1 7DE Tel: 01295 277912 Huddersfield HD1 2ET Tel: 01937 585768 Tel: 0115 947 2841 Barkingside Tel: 01484 530842 Yeadon Peterborough 84 High Street, Barkingside IG6 2DJ Hull 59 High Street, Yeadon LS19 7SP 2 Queen Street, Peterborough PE1 1PA £10.3 billion Tel: 020 8550 7678 78 Paragon Street, Hull HU1 3PW Tel: 0113 250 6313 Tel: 01733 896565 Barnsley Tel: 01482 224892 Reading total ASSETS 2 Peel Square, Barnsley S70 1YA Kendal 10 Cross Street, Reading -

Retail Monitoring Survey 2015

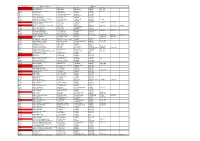

Retail Monitoring Survey 2015 1 Retail Monitoring Survey 2015 Retail Monitoring Survey 2015 As part of the Council’s ongoing monitoring work, a Retail Monitoring Survey is undertaken. The survey covers retailing within town centres (AP56) and district centres (AP59) identified as such within the 2001 Local Plan policy1. Town Centre reports – May 2015 Aldeburgh Felixstowe Framlingham Leiston Saxmundham Woodbridge District Centre reports – May 2015 Cavendish Park, Felixstowe 1 Grange Farm, Kesgrave The Square, Martlesham Heath Walton High Street Wickham Market This information helps monitor the viability and vitality of existing retail centres and has helped inform changes to town and district centre boundaries. Additional data concerning retailing in the district can be found in the annually updated Authority Monitoring Report (AMR). 1 Sycamore Drive, Rendlesham not monitored. Retail Monitoring Survey 2015 TOWN CENTRES FELIXSTOWE TOWN CENTRE SHOPPING USES - May 2015 ADDRESS NO. NAME AREA (sq USE FORMER USE IF CHANGED WITHIN YEAR or IS VACANT m) CLASS HAMILTON Rd,East 2 Vacant 95 A1 Coes Menswear 4 Taxi office no sign on door or anything 18 SG Coastal Taxis 6 The Card Centre 67 A1 8 San Moi Oriental – Noodle Bar & Restaurant 104 A3 China Garden – chinese restaurant 10 Tony`s Star Nails – nail bar 88 A1 Vacant 12 The Thrifty Thistle 44 A1 Vacant 14 Hair Artistry 84 A1 Vogue Hair Company 16 Café on the Corner 126 A3 Vacant 18-20 Barclays bank 480 A2 2 22 Trinity Methodist Church 555 D1 24 Vacant 72 A2 Ashton K C J - solicitors 26 Madison -

IBS Annual Review 2018.Pdf

Established 1849 Includes summary financial statement for year ended 30 November 2018 growing closer One of the most significant events of the year was the introduction of the General Data Protection Regulation, a complex project which we worked efficiently and diligently to comply with. Membership and branches Chairman’s summary 4 As a mutual we place great importance on the 170 Years of “The Old Freehold” 5 satisfaction and support of our members and work All In 6 to meet their needs. Community matters 8 The demand for our face-to-face services saw us Savings & Mortgages 10 open new premises at a time when other financial Introducing our Board 12 service providers have closed branches. We are Summary Financial Statement 14 facing increasing demand for complementary Directors’ Remuneration Report 18 online services and are making good progress with this project which will remain a focus in the coming year. Supporting home ownership Looking back By employing an expert, manual approach to underwriting we understand the personal at 2018 circumstances behind each mortgage A welcome from Richard Norrington, application enabling us to be innovative with Chief Executive our mortgage lending. We introduced new products specifically designed With a backdrop of continuing economic for borrowers aged 50 plus, offering no maximum uncertainty, we began our financial year positively age restriction at the end of the mortgage deal. with a commitment to our face-to-face services, Borrowing in later life brings with it a set of unique opening two new premises in the existing branch needs as well as changing sources of income towns of Ipswich and Woodbridge. -

Lender Action Required What Do I Need to Do? Express Payments?

express lender action required what do i need to do? payments? how will i be paid? You can request to be paid within Phone Accord Mortgaegs’ Business Support Team 24 hours of the lender confirming Accord Mortgages Telephone Registration on 03451200866 and ask them to add ‘TMA’as a Yes completion by requesting a payment payment route. through ‘TMA My Portal’. Affirmative Finance will release Registration is required for Affirmative Finance, the payment to TMA on the day of Affirmative No Registration however please state ‘TMA’ when putting a case No completion. TMA will then release Finance through. the payment to the you once it is received. Aldermore products are only available via carefully selected distribution partners. To register to do business with Aldermore go to https;//adlermore- brokerportal.co.uk/MoISiteVisa/Logon/Logon.aspx. You can request to be paid within If you are already registered with Aldermore the on 24 hours of the lender confirming Aldermore Online Registration Yes each case submission you will be asked if you are completion by requesting a submitting business though a Mortgage Club, tick payment through ‘TMA My Portal’. yes and then select ‘TMA’. If TMA is not already in your drop down box then got to ‘Edit Profile’ on the ‘Portal’ and add in ‘TMA’ Please visit us at https://www. Payment will be made every postoffice4intermediaries.co.uk/ and Monday to TMA via BACs. Bank of Ireland Online registration https://www.bankofireland4intermediaries. No Payment is calculated on the first co.uk/ and click register, you will need a Monday 2 weeks after completion profile for each brand. -

Reference Banks / Finance Address

Reference Banks / Finance Address B/F2 Abbey National Plc Abbey House Baker Street LONDON NW1 6XL B/F262 Abbey National Plc Abbey House Baker Street LONDON NW1 6XL B/F57 Abbey National Treasury Services Abbey House Baker Street LONDON NW1 6XL B/F168 ABN Amro Bank 199 Bishopsgate LONDON EC2M 3TY B/F331 ABSA Bank Ltd 52/54 Gracechurch Street LONDON EC3V 0EH B/F175 Adam & Company Plc 22 Charlotte Square EDINBURGH EH2 4DF B/F313 Adam & Company Plc 42 Pall Mall LONDON SW1Y 5JG B/F263 Afghan National Credit & Finance Ltd New Roman House 10 East Road LONDON N1 6AD B/F180 African Continental Bank Plc 24/28 Moorgate LONDON EC2R 6DJ B/F289 Agricultural Mortgage Corporation (AMC) AMC House Chantry Street ANDOVER Hampshire SP10 1DE B/F147 AIB Capital Markets Plc 12 Old Jewry LONDON EC2 B/F290 Alliance & Leicester Commercial Lending Girobank Bootle Centre Bridal Road BOOTLE Merseyside GIR 0AA B/F67 Alliance & Leicester Plc Carlton Park NARBOROUGH LE9 5XX B/F264 Alliance & Leicester plc 49 Park Lane LONDON W1Y 4EQ B/F110 Alliance Trust Savings Ltd PO Box 164 Meadow House 64 Reform Street DUNDEE DD1 9YP B/F32 Allied Bank of Pakistan Ltd 62-63 Mark Lane LONDON EC3R 7NE B/F134 Allied Bank Philippines (UK) plc 114 Rochester Row LONDON SW1P B/F291 Allied Irish Bank Plc Commercial Banking Bankcentre Belmont Road UXBRIDGE Middlesex UB8 1SA B/F8 Amber Homeloans Ltd 1 Providence Place SKIPTON North Yorks BD23 2HL B/F59 AMC Bank Ltd AMC House Chantry Street ANDOVER SP10 1DD B/F345 American Express Bank Ltd 60 Buckingham Palace Road LONDON SW1 W B/F84 Anglo Irish -

Chief Executive's Report 2010

Chief Executive’s report The highlights of the Society’s performance include: “excess” was managed down in line with the • return to profitability; statutory operating profit reduced requirements of the enlarged Group; £115m (2009: £12m loss) and core operating • maintained asset quality; the percentage of loans profit (see table below) of £128m (2009: over three months in arrears by volume was Iain Cornish £8m), representing a continuation of the trend stable at 1.84% (31 December 2009: 1.84%); reported at 30 June 2010; Our vision and strategy • wholesale funding; the issuance of a €600m five year covered bond in September supporting Our vision is “to be the best organisation that our For many decades the Yorkshire has been run with Core operating profit our balanced funding strategy; customers do business with”. the interests of current and future members very In addition to statutory profit before tax, the Board uses core clearly at its heart. The vast majority of the Society’s operating profit to monitor the Group’s performance. This is • performance of the Chelsea brand ahead We aim to achieve our vision by providing our because the statutory figure includes a number of items that activities have been centred on lending to people the Board believes do not reflect the longer-term, sustainable of expectations; delivery of planned merger members and customers with financial security to allow them to own their own homes, funded business performance either because they are pure accounting synergies and integration well advanced; and long-term value across a comprehensive range measures (e.g. -

2018 Annual Results March 2019 ► Leeds Building Society

Leeds Building Society 2018 Annual Results March 2019 ► Leeds Building Society 2018 Financial Highlights 2018 New Lending & the Mortgage Portfolio Funding, Liquidity and Capital Outlook for 2019 1 Executive Summary Leeds Building Society has continued to build on its strengths and delivered annual growth of 5% and a strong post tax profit performance of £89 million in 2018 Gross mortgage lending was £3.8 billion and was above the Society’s natural market share, net lending was £1.0 billion Issued £200 million of Tier 2 capital, increasing capital resources ahead of the expected future MREL requirement In June, the Prudential Regulation Authority (PRA) granted the Society an Internal Ratings Based (IRB) permission Improved financial stability through further reducing legacy portfolios, via the sale of the Irish mortgage portfolio Colleague engagement improved this year, and the Society’s leadership score was maintained. It continues to be in the top quartile for the financial services industry. The Society gained a two-star award in the Best Companies survey and is the 77th Best Mid Sized Company to work for 2 Our Future Strategy and 2019 Deliverables Vision To be Britain’s most successful building society Our purpose is to help people save and have the home they want. Mission We will continually adapt to anticipate our members’ changing needs and by doing the things we do well, we will help our members get on with life. Strategic Secure Customer Centred Simple Future Facing Pillars & Generate strong, sustainable Deliver an outstanding Drive efficiency by Invest in our capabilities and Corporate profit levels by meeting the member and broker experience removing complexity technology to meet the evolving needs of key segments needs of members Priorities 1.