The Mexico Fund, Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Mexican Supermarkets & Grocery Stores Industry Report

Mexican Supermarkets & Grocery Stores Industry Report July 2018 Food Retail Report Mexico 2018Washington, D.C. Mexico City Monterrey Overview of the Mexican Food Retail Industry • The Mexican food retail industry consists in the distribution and sale of products to third parties; it also generates income from developing and leasing the real estate where its stores are located • Stores are ranked according to size (e.g. megamarkets, hypermarkets, supermarkets, clubs, warehouses, and other) • According to ANTAD (National Association of Food Retail and Department Stores by its Spanish acronym), there are 34 supermarket chains with 5,567 stores and 15 million sq. mts. of sales floor in Mexico • Estimates industry size (as of 2017) of MXN$872 billion • Industry is expected to grow 8% during 2018 with an expected investment of US$3.1 billion • ANTAD members approximately invested US$2.6 billion and created 418,187 jobs in 2017 • 7 states account for 50% of supermarket stores: Estado de Mexico, Nuevo Leon, Mexico City, Jalisco, Baja California, Sonora and Sinaloa • Key players in the industry include, Wal-Mart de Mexico, Soriana, Chedraui and La Comer. Other regional competitors include, Casa Ley, Merza, Calimax, Alsuper, HEB and others • Wal-Mart de México has 5.8 million of m² of sales floor, Soriana 4.3 m², Chedraui 1.2 m² and La Cómer 0.2 m² • Wal-Mart de México has a sales CAGR (2013-2017) of 8.73%, Soriana 9.98% and Chedraui 9.26% • Wal-Mart de México has a stores growth CAGR (2013-2017) of 3.30%, Soriana 5.75% and Chedraui 5.82% Number -

Disclaimer July 15, 2021 │ Update

Disclaimer July 15, 2021 │ Update The content here in has only informative purposes. It does not constitute a recommendation, advice, or personalized suggestion of any product and/or service that suggest you make investment decisions as it is necessary to previously verify the congruence between the client's profile and the profile of the financial product. SALES TRADING COMMENT, NOT RESEARCH OR HOUSE VIEW. The information contained in this electronic communication and any attached document is confidential, and is intended only for the use of the addressee. The information and material presented are provided for information purposes only. Please be advised that it is forbidden to disseminate, disclose or copy the information contained herein. If you received this communication by mistake, we urge you to immediately notify the person who sent it. Actinver and/or any of its subsidiaries do not guarantee that the integrity of this email or attachments has been maintained nor that it is free from interception, interference or viruses, so their reading, reception or transmission will be the responsibility of who does it. It is accepted by the user on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Equity Research Guide for recommendations on investment in the companies under coverage included or not, in the Mexican Stock Exchange main Price Index (S&P/BMV IPC) Our recommendations are set based on an expected projected return which, as any estimate, cannot be guaranteed. Readers should be aware that a number of subjective elements have also been taken into consideration in order to determine each analyst’s final decision on the recommendation. -

Grupo Comercial Chedraui, S.A.B. De C.V

GRUPO COMERCIAL CHEDRAUI, S.A.B. DE C.V. Av. Constituyentes No. 1150, Lomas Altas Delegación Miguel Hidalgo C.P. 11950 México, D. F. www.chedraui.com.mx Características de las acciones representativas del capital social de GRUPO COMERCIAL CHEDRAUI, S.A.B. DE C.V. Nominativas Sin valor nominal Íntegramente suscritas y pagadas Serie B Clase I Capital mínimo fijo sin derecho a retiro. Clave de Cotización en la Bolsa Mexicana de Valores, S.A.B. de C.V.: CHDRAUI Los valores emitidos por Grupo Comercial Chedraui, S.A.B. de C.V. se encuentran inscritos en el Registro Nacional de Valores y se cotizan en la Bolsa Mexicana de Valores, S.A.B. de C.V. La inscripción en el Registro Nacional de Valores no implica certificación sobre la bondad de los valores, la solvencia de la emisora o la exactitud o veracidad de la información contenida en el reporte anual, ni convalida los actos que, en su caso, se hubieren realizado en contravención de las leyes. Reporte anual que se presenta de acuerdo con las disposiciones de carácter general aplicables a las Emisoras de valores y a otros participantes del mercado, por el año terminado el 31 de diciembre de 2015. México, D.F. a 30 de abril de 2016 ÍNDICE 1. INFORMACIÓN GENERAL ........................................................................................... 4 a) Glosario de Términos y Definiciones ......................................................................... 4 b) Resumen Ejecutivo ................................................................................................. 6 c) Factores -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

The Mexican Business Class and the Processes Of

/?s % THE MEXICAN BUSINESS CLASS AND THE PROCESSES OF GLOBALIZATION TRENDS AND COUNTER-TRENDS Alejandra Salas-Porras London School of Economics Thesis submitted in fulfilment of the requirements for the degree of Doctor in Philosphy in November of 1996 UMI Number: U615514 All rights reserved INFORMATION TO ALL USERS The quality of this reproduction is dependent upon the quality of the copy submitted. In the unlikely event that the author did not send a complete manuscript and there are missing pages, these will be noted. Also, if material had to be removed, a note will indicate the deletion. Dissertation Publishing UMI U615514 Published by ProQuest LLC 2014. Copyright in the Dissertation held by the Author. Microform Edition © ProQuest LLC. All rights reserved. This work is protected against unauthorized copying under Title 17, United States Code. ProQuest LLC 789 East Eisenhower Parkway P.O. Box 1346 Ann Arbor, Ml 48106-1346 T h £ S £ S F 95 e British 1 ™£c°mmicsa.Z 121 ABSTRACT This thesis discusses the globalising processes undergone by a segment of the Mexican business class, notably: the spaces of the world economy they control; their links to social and political networks of global scope, as well as to global movements and currents of thought; and the interests, strategies, projects and perceptions which they share with their counterparts around the world. It argues that they have become one of the main and most powerful forces for the integration of the country in the global capitalist system. Globalising processes lived and promoted by the Mexican business class are contradictory in several respects: on one hand, modernisation, institutionalisation and depersonalisation of corporate structures and of the system of business representation; is hindered by business clientelism and corruption in party funding. -

US-Mexico Trade Relationship

1 U.S. – Mexico Trade Relationship 2 Mexico is a growing economy Mexico has built a solid framework for macroeconomic stability in the past two decades Total Exports $374 billion $1.2 trillion economy $776 billion in total trade $457 billion in FDI attracted since 1999 125 million consumer market/ 60% middle class GDP 1.4% 2.3% 2.6% 2.3% 2013 2014 2015 2016 The 15th largest world economy 10th largest world exporter and 1st in Latin America 9th largest world importer 5th leading recipient of FDI Total Imports among emerging economies $387 billion Source: INEGI, SE-DGIE (Sep. 2016), WTO, UNCTAD, Brookings Institution, SHCP. 3 Recognizing the importance of NAFTA Trilateral trade has more than tripled, reaching nearly $1 trillion in 2016. Trilateral Trade between the NAFTA Partners 1,122 1200 1,075 1,059 1,033 1,010 997 942 1000 893 846 880 NAFTA 772 800 699 661 699 615 626 568 602 600 476 506 419 376 338 400 289 200 0 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Mexico-Canada Trade U.S.-Canada Trade Mexico-U.S. Trade Source: SE with import data from Statistics Canada, Banxico, and USDOC, and World Bank. 4 Since NAFTA, U.S.-Mexico trade has multiplied by six a million dollar a minute business Mexico is the U.S.’ third-largest trading partner $1.5 billion dollars in products are bilaterally traded each day U.S.-Mexico Trade 506 534 531 494 525 500 461 392 400 NAFTA 367 348 332 278 280 294 296 294 290 305 263 300 267 247 235 230 233 231 216 197 198 211 173 177 Billion 200 157 170 131 136 156 $ 131 134 138 108 82 101 110 226 86 95 240 236 231 100 198 217 74 163 50 62 134 137 152 129 40 111 102 111 120 71 79 87 97 97 42 51 46 57 0 199319941995199619971998199920002001200220032004200520062007200820092010201120122013201420152016 US Exports to Mexico US Imports from Mexico Source: USDOC. -

Solid Profitable Growth

SOLID PROFITABLE GROWTH 2015 Annual report For more than 20 years, we have been supporting our clients with top quality financial services. We are a company with a reputation for building solid, lasting alliances with our clients. We want to become the leading company in our market by helping companies to grow thus making Mexico stronger. 2 SOLID PROFITABLE GROWTH With a multi-product offering focused on three core business lines —leasing, factoring and auto loans— UNIFIN’s financial solidity comes from its origination process and its skillful, well-timed portfolio management. Total portfolio Ps. 18.9 billion 3 SOLID • The compiled information is submitted to a The loan origination process is handled by a special- credit committee: i) Minor Risk Committee for ized team in each business line, using cutting-edge transactions below Ps. 7.5 million, with a dig- technology and various selection criteria: ital response within 72 hours; ii) Major Risk Loan origination process Committee, which meets in person to decide • Strict and formal analysis of national and ION on larger transactions, providing a response VAT CL ENO IEN global economies and trends in various R T P ND R within two weeks. A OS LE P industries. A EC S TI ET N S G S • We also have highly rigorous systems involv- A 6 • 16 dynamic credit scorings, analysis for ma- 1 ing month to month tracking and monitoring, jor and minor risk and analytic parameters that in compliance with anti-money laundering are part of our in-house model. and data privacy laws. 5 E E T A T P I P M L I M C O A C 2 T I T O I N D E R Collection process C 4 -5 0 2-7 8-30 31-60 61-90 +90 C R E D I S T E B C U N E 3 R R E E A F U E R A N D Administrative L E E-mail G A In-person L Payment Call center Workout Court collection reminder collection date 2nd reminder collection TEAM 1 TEAM 2 TEAM 3 TEAM 4 Collection is simpler because UNIFIN maintains ownership of the assets. -

T E P N L R E V I E W

T e p n L R e v i e w , NUMBER 65 AUGUST 1998 SANTIAGO, CHILE OSCAR ALTIMIR Director o f the Review EUGENIO LAHERA Technical Secretary Notes and explanation of symbols The following symbols are used in tables in the Review: (...) Three dots indicate that data are not available or are not separately reported. (-) A dash indicates that the amount is nil or negligible. A blank space in a table means that the item in question is not applicable. (-) A minus sign indicates a deficit or decrease, unless otherwise specified. (■) A point is used to indicate decimals. (/) A slash indicates a crop year or fiscal year, e.g., 1970/1971. (-) Use of a hyphen between years, e.g., 1971-1973, indicates reference to the complete number of calendar years involved, including the beginning and end years. References to “tons” mean metric tons, and to “dollars”, United States dollars, unless otherwise stated. Unless otherwise stated, references to annual rates of growth or variation signify compound annual rates. Individual figures and percentages in tables do not necessarily add up to the corresponding totals, because of rounding. Guidelines for contributors to CEPAL Review The editorial board of the Review are always interested in encouraging the publication of articles which analyse the economic and social development of Latin America and the Caribbean. With this in mind, and in order to facilitate the presentation, consideration and publication of papers, they have prepared the following information and suggestions to serve as a guide to future contributors. —The submission of an article assumes an undertaking by the author not to submit it simultaneously to other periodical publications. -

Comunicado De Prensa 78-2016.Pdf

– – – – Evaluación Calificación Estatus Final De 80% a 100% Calidad Buena De 51% a 79% Calidad Regular Menor o igual a 50% Calidad Deficiente Instrumento No. de emisoras Verde Amarillo Rojo Acciones 137 124 5 8 Deuda a largo plazo 66 66 - - FIBRAs* 11 11 - - CKDs 55 55 - - Total 269 256 5 8 * Incluye un fideicomiso hipotecario. Nota: La calificación que obtuvo cada una de las emisoras evaluadas se detalla en el Anexo 1 de este comunicado. , Clave de Razón Social de la emisora (ACCIONES) Calificación Pizarra Accel, S.A.B. de C.V. ACCELSA 100 Alfa, S.A.B. de C.V. ALFA 100 Alpek, S.A.B. de C.V. ALPEK 100 América Móvil, S.A.B. de C.V. AMX 100 Arca Continental, S.A.B. de C.V. AC 100 Axtel, S.A.B. de C.V. AXTEL 100 Banregio Grupo Financiero, S.A.B. de C.V. GFREGIO 100 Bio Pappel, S.A.B. de CV PAPPEL 100 Bolsa Mexicana de Valores, S.A.B. de C.V. BOLSA 100 Casa de Bolsa Finamex, S.A.B. de C.V. (3) FINAMEX 100 Cemex, S.A.B. de C.V. CEMEX 100 CMR, S.A.B. de C.V. CMR 100 Coca-Cola FEMSA, S.A.B. de C.V. KOF 100 Compañia Minera Autlan, S.A.B. de C.V. AUTLAN 100 Consorcio Ara, S.A.B. de C.V. ARA 100 Consorcio Aristos, S.A.B. de C.V. ARISTOS 100 Controladora Vuela Compañía de Aviación, S.A.B. de C.V. VOLAR 100 Convertidora Industrial, S.A.B. -

Global Equity Fund Description Plan 3S DCP & JRA MICROSOFT CORP

Global Equity Fund June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA MICROSOFT CORP 2.5289% 2.5289% APPLE INC 2.4756% 2.4756% AMAZON COM INC 1.9411% 1.9411% FACEBOOK CLASS A INC 0.9048% 0.9048% ALPHABET INC CLASS A 0.7033% 0.7033% ALPHABET INC CLASS C 0.6978% 0.6978% ALIBABA GROUP HOLDING ADR REPRESEN 0.6724% 0.6724% JOHNSON & JOHNSON 0.6151% 0.6151% TENCENT HOLDINGS LTD 0.6124% 0.6124% BERKSHIRE HATHAWAY INC CLASS B 0.5765% 0.5765% NESTLE SA 0.5428% 0.5428% VISA INC CLASS A 0.5408% 0.5408% PROCTER & GAMBLE 0.4838% 0.4838% JPMORGAN CHASE & CO 0.4730% 0.4730% UNITEDHEALTH GROUP INC 0.4619% 0.4619% ISHARES RUSSELL 3000 ETF 0.4525% 0.4525% HOME DEPOT INC 0.4463% 0.4463% TAIWAN SEMICONDUCTOR MANUFACTURING 0.4337% 0.4337% MASTERCARD INC CLASS A 0.4325% 0.4325% INTEL CORPORATION CORP 0.4207% 0.4207% SHORT-TERM INVESTMENT FUND 0.4158% 0.4158% ROCHE HOLDING PAR AG 0.4017% 0.4017% VERIZON COMMUNICATIONS INC 0.3792% 0.3792% NVIDIA CORP 0.3721% 0.3721% AT&T INC 0.3583% 0.3583% SAMSUNG ELECTRONICS LTD 0.3483% 0.3483% ADOBE INC 0.3473% 0.3473% PAYPAL HOLDINGS INC 0.3395% 0.3395% WALT DISNEY 0.3342% 0.3342% CISCO SYSTEMS INC 0.3283% 0.3283% MERCK & CO INC 0.3242% 0.3242% NETFLIX INC 0.3213% 0.3213% EXXON MOBIL CORP 0.3138% 0.3138% NOVARTIS AG 0.3084% 0.3084% BANK OF AMERICA CORP 0.3046% 0.3046% PEPSICO INC 0.3036% 0.3036% PFIZER INC 0.3020% 0.3020% COMCAST CORP CLASS A 0.2929% 0.2929% COCA-COLA 0.2872% 0.2872% ABBVIE INC 0.2870% 0.2870% CHEVRON CORP 0.2767% 0.2767% WALMART INC 0.2767% -

Lista De Entidades Autorizadas Para Captar Emisoras

Lista de Entidades Autorizadas para Captar Emisoras Clave Clave No. Razón Social Captación No. Razón Social Captación PES PES ACCIONES Y VALORES BANAMEX, S.A. Investa Bank, S.A., Institución de Banca 25 126 Si 1 2 DE C.V., CASA DE BOLSA, INTEGRANTE Si Múltiple DEL GRUPO FINANCIERO BANAMEX. BANCO NACIONAL DE COMERCIO GRUPO FINANCIERO INBURSA, S.A.B. EXTERIOR, SOCIEDAD NACIONAL DE 38 Si 128 Si 2 DE C.V. 26 CRÉDITO, INSTITUCIÓN DE BANCA DE DESARROLLO GRUPO FINANCIERO BANORTE, S.A.B. 40 Si 3 DE C.V. Banco Nacional de Obras y Servicios 129 Públicos, Sociedad Nacional de Crédito, Si GRUPO FINANCIERO BANCRECER, S.A. 27 41 Si Institución de Banca de Desarrollo 4 DE C.V. Nacional Financiera, Sociedad Nacional CASA DE BOLSA FINAMEX, S.A.B. DE 42 Si 130 de Crédito, Institución de Banca de Si 5 C.V. 28 Desarrollo 6 62 BANCO NACIONAL DE MEXICO, S.A. Si Banco Nacional del Ejército, Fuerza Aérea y Armada, Sociedad Nacional BANCO SANTANDER (MEXICO), S.A., 29 133 Si INSTITUCION DE BANCA MULTIPLE, de Crédito, Institución de Banca de 67 Si 7 GRUPO FINANCIERO SANTANDER Desarrollo MEXICO ALMACENADORA AFIRME, S.A. DE 8 70 HSBC MEXICO, S.A. Si 30 173 C.V., ORGANIZACION AUXILIAR DEL Si CREDITO, AFIRME GRUPO FINANCIERO Scotiabank Inverlat, S.A., Institución 9 72 de Banca Múltiple, Grupo Financiero Si AF Banregio, S.A. de C.V., Sociedad Scotiabank Inverlat 31 204 Financiera de Objeto Múltiple, Entidad Si Regulada 75 BBVA BANCOMER, S.A. Si 10 ARRENDADORA AFIRME, S.A. -

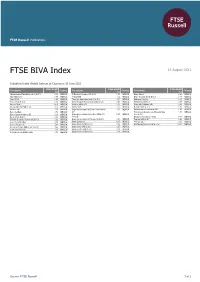

FTSE BIVA Index

2 FTSE Russell Publications 19 August 2021 FTSE BIVA Index Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) Administradora Fibra Danhos S.A. de C.V. 0.15 MEXICO El Puerto de Liverpool SA de CV 0.53 MEXICO Grupo Mexico 8.89 MEXICO Alfa SAB de CV 0.89 MEXICO Femsa UBD 9.2 MEXICO Grupo Rotoplas S.A.B. de C.V. 0.17 MEXICO Alpek S.A.B. 0.28 MEXICO Fibra Uno Administracion S.A. de C.V. 1.91 MEXICO Industrias Penoles 1.02 MEXICO Alsea S.A.B. de C.V. 0.56 MEXICO Genomma Lab Internacional S.A.B. de C.V. 0.46 MEXICO Kimberly Clark Mex A 0.88 MEXICO America Movil L 13.59 MEXICO Gentera SAB de CV 0.35 MEXICO Megacable Holdings SAB 0.64 MEXICO Arca Continental SAB de CV 1.53 MEXICO Gruma SA B 1.37 MEXICO Nemak S.A.B. de C.V. 0.16 MEXICO Bachoco Ubl 0.36 MEXICO Grupo Aeroportuario del Centro Norte Sab de 1.31 MEXICO Orbia Advance Corporation SAB 1.59 MEXICO Banco del Bajio 0.76 MEXICO CV Promotora y Operadora de Infraestructura 1.05 MEXICO Banco Santander Mexico (B) 0.43 MEXICO Grupo Aeroportuario del Pacifico SAB de CV 2.27 MEXICO S.A. de C.V. Becle S.A.B. de C.V. 0.86 MEXICO Series B Qualitas Controladora y Vesta 0.48 MEXICO Bolsa Mexicana de Valores SAB de CV 0.62 MEXICO Grupo Aeroportuario del Sureste SA de CV 2.21 MEXICO Regional SAB de CV 0.83 MEXICO Cementos Chihuahua 0.79 MEXICO Grupo Banorte O 11.15 MEXICO Televisa 'Cpo' 4.38 MEXICO Cemex Sa Cpo Line 7.43 MEXICO Grupo Bimbo S.A.B.