Tuniu Corporation (Exact Name of Registrant As Specified in Its Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report and Financial Statements

Annual Report and Financial Statements for the year ended 31 December 2018 Dimensional Funds ICVC Authorised by the Financial Conduct Authority No marketing notification has been submitted in Germany for the following Funds of Dimensional Funds ICVC: Global Short-Dated Bond Fund International Core Equity Fund International Value Fund United Kingdom Core Equity Fund United Kingdom Small Companies Fund United Kingdom Value Fund Accordingly, these Funds must not be publicly marketed in Germany. Table of Contents Dimensional Funds ICVC General Information* 2 Investment Objectives and Policies* 3 Authorised Corporate Directors’ Investment Report* 6 Incorporation and Share Capital* 10 The Funds 10 Fund Cross-Holdings 10 Authorised Status* 10 Regulatory Disclosure* 10 Potential Implications of Brexit* 10 Responsibilities of the Authorised Corporate Director 11 Responsibilities of the Depositary 11 Report of the Depositary to the Shareholders 11 Directors' Statement 11 Independent Auditors’ Report to the Shareholders of Dimensional Funds ICVC 12 The Annual Report and Financial Statements for each of the below sub-funds (the “Funds”); Emerging Markets Core Equity Fund Global Short-Dated Bond Fund International Core Equity Fund International Value Fund United Kingdom Core Equity Fund United Kingdom Small Companies Fund United Kingdom Value Fund are set out in the following order: Fund Information 14 Portfolio Statement* 31 Statement of Total Return 149 Statement of Change in Net Assets Attributable to Shareholders 149 Balance Sheet 150 Notes to the Financial Statements 151 Distribution Tables 168 Remuneration Disclosures (unaudited)* 177 Supplemental Information (unaudited) 178 * These collectively comprise the Authorised Corporate Directors’ (“ACD”) Report. Dimensional Fund Advisors Ltd. Annual Report and Financial Statements, 31 December 2018 1 Dimensional Funds ICVC General Information Authorised Corporate Director (the “ACD”): Dimensional Fund Advisors Ltd. -

4 China: Government Policy and Tourism Development

China: Government Policy 4 and Tourism Development Trevor H. B. Sofield Introduction In 2015, according to the China National Tourism Administration (CNTA), China welcomed 133.8 million inbound visitors; it witnessed 130 million outbound trips by its citizens; and more than 4 billion Chinese residents took domestic trips around the country. International arrivals generated almost US$60 billion, outbound tour- ists from China spent an estimated US$229 billion (GfK, 2016), and domestic tour- ism generated ¥(Yuan)3.3 trillion or US$491 billion (CNTA, 2016). By 2020, Beijing anticipates that domestic tourists will spend ¥5.5 trillion yuan a year, more than double the total in 2013, to account for 5 percent of the country’s GDP. In 2014, the combined contribution from all three components of the tourism industry to GDP, covering direct and indirect expenditure and investment, in China was ¥5.8 trillion (US$863 billion), comprising 9.4% of GDP. Government forecasts suggest this figure will rise to ¥11.4 trillion (US$1.7 trillion) by 2025, accounting for 10.3% of GDP (Wang et al., 2016). Few governments in the world have approached tourism development with the same degree of control and coordination as China, and certainly not with outcomes numbering visitation and visitor expenditure in the billions in such a short period of time. In 1949 when Mao Zedong and the Communist Party of China (CCP) achieved complete control over mainland China, his government effectively banned all domestic tourism by making internal movement around the country illegal (CPC officials excepted), tourism development was removed from the package of accept- able development streams as a bourgeoisie activity, and international visitation was a diplomatic tool to showcase the Communist Party’s achievements, that was restricted to a relative handful of ‘friends of China’. -

SGS-Safeguards 04910- Minimum Wages Increased in Jiangsu -EN-10

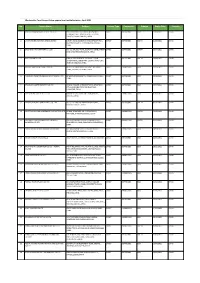

SAFEGUARDS SGS CONSUMER TESTING SERVICES CORPORATE SOCIAL RESPONSIILITY SOLUTIONS NO. 049/10 MARCH 2010 MINIMUM WAGES INCREASED IN JIANGSU Jiangsu becomes the first province to raise minimum wages in China in 2010, with an average increase of over 12% effective from 1 February 2010. Since 2008, many local governments have deferred the plan of adjusting minimum wages due to the financial crisis. As economic results are improving, the government of Jiangsu Province has decided to raise the minimum wages. On January 23, 2010, the Department of Human Resources and Social Security of Jiangsu Province declared that the minimum wages in Jiangsu Province would be increased from February 1, 2010 according to Interim Provisions on Minimum Wages of Enterprises in Jiangsu Province and Minimum Wages Standard issued by the central government. Adjustment of minimum wages in Jiangsu Province The minimum wages do not include: Adjusted minimum wages: • Overtime payment; • Monthly minimum wages: • Allowances given for the Areas under the first category (please refer to the table on next page): middle shift, night shift, and 960 yuan/month; work in particular environments Areas under the second category: 790 yuan/month; such as high or low Areas under the third category: 670 yuan/month temperature, underground • Hourly minimum wages: operations, toxicity and other Areas under the first category: 7.8 yuan/hour; potentially harmful Areas under the second category: 6.4 yuan/hour; environments; Areas under the third category: 5.4 yuan/hour. • The welfare prescribed in the laws and regulations. CORPORATE SOCIAL RESPONSIILITY SOLUTIONS NO. 049/10 MARCH 2010 P.2 Hourly minimum wages are calculated on the basis of the announced monthly minimum wages, taking into account: • The basic pension insurance premiums and the basic medical insurance premiums that shall be paid by the employers. -

ANNUAL REPORT 2018 Annual Report 2018 NEW CENTURY REAL ESTATE INVESTMENT TRUST

New Century Real Estate Investment Trust (a Hong Kong collective investment scheme authorised under section 104 of the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong)) (Stock code: 1275) ANNUAL REPORT 2018 Annual Report 2018 NEW CENTURY REAL ESTATE INVESTMENT TRUST The audited consolidated financial statements of New Century Real Estate Investment Trust (“New Century REIT”) and its subsidiaries (together, the “Group”) for the year ended 31 December 2018 (the “Reporting Period”), having been reviewed by the audit committee (the “Audit Committee”) and disclosures committee (the “Disclosures Committee”) of New Century Asset Management Limited (the “REIT Manager”) were approved by the board of directors of the REIT Manager (the “Board”) on 29 March 2019. LONG-TERM OBJECTIVES AND STRATEGY The REIT Manager continues its strategy of investing on a long-term basis in a diversified portfolio of income-producing real estate globally, with the aim of delivering regular and stable high distributions to the holders of the units of New Century REIT (the “Unit(s)”) (the “Unitholder(s)”) and achieving long-term growth in distributions and portfolio valuation while maintaining an appropriate capital structure. New Century REIT is sponsored by New Century Tourism Group Limited (“New Century Tourism”) and its subsidiaries (together the “New Century Tourism Group”), the largest domestic hotel group according to the number of upscale hotel rooms both in operation and under pipeline in the People’s Republic of China (“China” or the “PRC”). Ranked the 23rd globally in 2017, as published by Hotels Magazine in July/August 2018, New Century Tourism Group has about 319 star-rated hotels in operations or under development in China and Germany. -

Chinese Visitors at Australia Wineries: Preferences, Motivations, and Barriers

School of Economics & Business Department of Organisation Management, Marketing and Tourism Emily (Jintao) Ma, Bob Duan, Lavender (Mengya) Shu & Charles Arcodia Full Paper — Published Version Chinese visitors at Australia wineries: Preferences, motivations, and barrier Journal of Tourism, Heritage & Services Marketing Suggested Citation: Ma, E.J., Duan, B., Shu, L.M. & Arcodia, C. (2017). Chinese visitors at Australia wineries: Preferences, motivations, and barrier. Journal of Tourism, Heritage & Services Marketing, ISSN 2529-1947, Vol. 3, Iss. 1, pp. 3-8. http://dx.doi.org/10.5281/zenodo.401062 Persistent identifier (URN): https://nbn-resolving.org/urn:nbn:de:0168-ssoar-67075-7 Όροι χρήσης: Terms of use: Το παρόν έγγραφο μπορεί να αποθηκευτεί και να αναπαραχθεί για This document may be saved and copied for your personal and προσωπική και ακαδημαϊκή χρήση. scholarly purposes. Το έργο αυτό προστατεύεται από άδεια πνευματικών δικαιωμάτων This work is protected by intellectual rights license Creative Creative Commons Αναφορά Δημιουργού – Μη Εμπορική Χρήση – Commons Attribution-NonCommercial-NoDerivatives 4.0 Όχι Παράγωγα Έργα 4.0 (CC BY-NC-ND). International (CC BY-NC-ND 4.0). Επιτρέπεται στο κοινό να έχει ελεύθερη πρόσβαση στο έργο και να Free public access to this work is allowed. Any interested party το διανέμει εφόσον γίνει αναφορά στο πρωτότυπο έργο και τον can freely copy and redistribute the material in any medium or δημιουργό του, ωστόσο, απαγορεύεται οποιαδήποτε τροποποίησή format, provided appropriate credit is given to the original work του ή τυχόν παράγωγα έργα, καθώς και η χρήση, αξιοποίηση ή and its creator. This material cannot be remixed, transformed, αναδιανομή του για εμπορικούς σκοπούς. -

The Regeneration of Millennium Ancient City by Beijing-Hangzhou

TANG LEI, QIU JIANJUN, ‘FLOWING’: The Regeneration of Millennium ancient city , 47 th ISOCARP Congress 2011 ‘FLOWING’: The Regeneration of Millennium ancient city by Beijing-Hangzhou Grand Canal ——Practice in Suqian, Jiangsu, China 1 The Millennium ancient city - Suqian Overview 1.1 City Impression Suqian, A millennium ancient city in China, Great Xichu Conqueror Xiangyu's hometown, Birthplace of Chuhan culture, Layers of ancient cities buried. Yellow River (the National Mother River 5,464km) and Beijing-Hangzhou Grand Canal (the National Wisdom River 1794km, declaring the World Cultural Heritage) run through it. With Luoma, Hongze Lake, it has "Two Rivers Two Lakes" unique spatial characteristics. Nowadays Suqian is meeting the challenge of leapfrog development and ‘Livable Cities’ transformation.The city area is 8555 square kilometers and the resident population is 4,725,100. In 2009 its GDP was RMB 82.685 billion, per capita GDP was RMB 1.75 million. It’s industrial structure is19.3:46.3:34.4, level of urbanization is 37.7% 1.2 Superiority Evaluation (1) industrial structure optimized continuously, overall strength increased significantly. (2) people's lives condition Improved. Urban residents per capita disposable income was 12000, increased 11.6% per year; Farmer’s per capita net income was 6,000, increased 8.9% per year. (3) City’s carrying capacity has improved significantly. infrastructure had remarkable results; the process of industrialization and urbanization process accelerated. (4) Good ecological environment. Good days for 331 days, good rate is 90.4%. (5) Profound historical accumulation. the ancient city, the birthplace of Chu and Han culture, the history of mankind living fossil 1.3 Development Opportunities (1) Expansion of the Yangtze River Delta. -

Sustainability and Effectiveness of Chinese Outline for National

sustainability Article Sustainability and Effectiveness of Chinese Outline for National Tourism and Leisure Emanuele Giorgi 1,2,* , Tiziano Cattaneo 2,3, Minqing Ni 3 and Renata Enríquez Alatriste 4 1 Tecnologico de Monterrey, Escuela de Arquitectura, Arte y Diseño, Campus Chihuahua, Av. H. Colegio Militar 4700, Nombre de Dios, Chihuahua 31300, Mexico 2 China Lab. for Architecture and Urban Studies, Department of Civil Engineering and Architecture, University of Pavia, Via Ferrata 1, 27100 Pavia, Italy; [email protected] or [email protected] 3 Environmental Futures Lab., College of Design and Innovation, Tongji University, n. 281 Fuxin Road, Yangpu District, Shanghai 200092, China; [email protected] 4 Tecnologico de Monterrey, Escuela de Arquitectura, Arte y Diseño, Eugenio Garza Sada S/N, Predio Cerro Gordo, León 37190, Mexico; [email protected] * Correspondence: [email protected] Received: 8 November 2019; Accepted: 17 January 2020; Published: 6 February 2020 Abstract: This study is addressed to understand: (1) how the Chinese policies for tourism meet the international guidelines for sustainable development promoted by the United Nations, through the 17 Sustainable Development Goals (SDGs) and (2) how the Chinese policies for tourism are applied in reality by design practice. To answer these two research questions, the research considers mainly three groups of reference sources: the 2030 Agenda for Sustainable Development; the Outline for National Tourism and Leisure 2013–2020 (ONTL) of the Chinese Government and their analyses from independent sources; the descriptions of architectural interventions for hospitality. According with the two research questions, the research is based on two phases: (1) a comparison between the Chinese policies for tourism development and the international policies for sustainable development; (2) a search of sustainable policies in the design practice, through the analysis of 30 projects for hospitality, realized in China after 2013. -

Sustainable Development for Chinese Urban Heritage Tourism: Insights

University of Massachusetts Amherst ScholarWorks@UMass Amherst Travel and Tourism Research Association: 2012 ttra International Conference Advancing Tourism Research Globally Sustainable development for Chinese urban heritage tourism: Insights from travelers in Shanghai Lina Xiong Fox Business School, School of Tourism & Hospitality Management, Temple University Xinmei Zhang Department of Tourism, Fudan University Clark Hu School of Tourism & Hospitality Management, Temple University Follow this and additional works at: https://scholarworks.umass.edu/ttra Xiong, Lina; Zhang, Xinmei; and Hu, Clark, "Sustainable development for Chinese urban heritage tourism: Insights from travelers in Shanghai" (2016). Travel and Tourism Research Association: Advancing Tourism Research Globally. 32. https://scholarworks.umass.edu/ttra/2012/Oral/32 This is brought to you for free and open access by ScholarWorks@UMass Amherst. It has been accepted for inclusion in Travel and Tourism Research Association: Advancing Tourism Research Globally by an authorized administrator of ScholarWorks@UMass Amherst. For more information, please contact [email protected]. Sustainable development for Chinese urban heritage tourism: Insights from travelers in Shanghai Lina Xiong Fox Business School School of Tourism & Hospitality Management Temple University Xinmei Zhang Department of Tourism Fudan University And Clark Hu (Corresponding author) School of Tourism & Hospitality Management Temple University ABSTRACT As a widely-recognized destination for heritage tourism, China has attracted considerable amount of tourists from both domestically and internationally. Given the delicate nature of heritage in urban areas, this study paid special attention to the sustainable Chinese urban heritage tourism development from travelers’ perspectives based in Shanghai. Such perspectives are taken because their experiences perceived at popular urban heritage tourism attractions are the final tourism products. -

Green Tourism in China in Search of Harmony Between Nature and Mankind

GTTP CASE STUDY WRITING COMPETITION INTERNATIONAL CONFERENCE 2010 Green Tourism in China In Search of Harmony between Nature and Mankind Team members: Manli Chen Yanping Feng Instructor: Lianping Ren Ningbo Polytechnic Zhejiang, China Content Page Acknowledgement⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯ 1 Preface ⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯ 3 Section One Background information⋯⋯⋯⋯⋯⋯⋯⋯ 6 Section Two Research Method⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯ 9 Section Three Field Trips ⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯ 10 3.1 Green Tourism I Eco-tourism–Xixi Wetland Park ⋯⋯⋯⋯ 10 3.2 Green Tourism II Going back to nature⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯ 18 —— Tiangong Fazenda Agricultural Park and Tengtou Village 3.3 Green Tourism III Good example of environmental protection 28 —— Word Expo 2010 and 2008 Olympics 3.4 Green Tourism IV Turning an Industrial wreck into an educational site ⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯ 42 — Haizhou National Geological Park in Liaoning Open-air Coal Mine 3.5 Green Tourism V Restructuring natural park - 2 - —— the West Lake Project⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯ 46 Section Four Discussion Topics ⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯ 51 Subtopic I: What does the government do to promote Green Tourism in China? ⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯ 51 Subtopic II What do hotels do to protect the environment?⋯⋯⋯⋯55 Subtopic III What are the measures taken by tourist attractions? ⋯ 58 Subtopic IV What are the travel agencies doing to promote Green Tourism?⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯ 60 Subtopic V What do tourists and ordinary people think about Green Tourism? ⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯ 62 Question samples ⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯ 62 Survey Finding⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯ 64 Section Five Existing problems and Suggestions⋯⋯⋯ 70 Section Six Conclusion⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯ - 3 - 76 Reference⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯ 77 Appendix ⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯⋯ 78 - 4 - Acknowledgement: It is a distinct privilege for us to introduce our Green Tourism research project and share our investigation findings in China. With the rapid development of tourism in recent years, tourists in China can own have a variety of modern facilities and quality services when travelling at home and abroad. -

China-Italy Destination Wedding New Opportunities for the Luxury Tourism Market

Master’s Degree Programme in Language and Management to China (D.M. 270/2004) Final Thesis China-Italy Destination Wedding New opportunities for the luxury tourism market Supervisor Ch. Prof. Renzo Riccardo Cavalieri Assistant supervisor Ch. Prof. Veronica Tasciotti Graduand Tiziana La Ragione Matriculation Number 840907 Academic Year 2017 / 2018 Contents Abstract…………………………………………………………………………..i 前言…………………………………………………………………………………..ii Chapter 1: Introductive analysis on the Chinese wedding 1.1 Historical background……………………………………………………………10 1.2 Today’s wedding customs and traditions……………………………………..….13 1.3 Traditional wedding dress………………………………………………………..16 1.3.1 Wedding accessories and jewelry……………………………………....19 Chapter 2: Tourism and Wedding-Induced Tourism in China 2.1 Introductive analysis on Chinese outbound tourism …………………………….21 2.1.1 Chinese luxury tourism market………………………………………....25 2.2 Wedding market and wedding-induced tourism from China to other countries….27 2.3 Interview with Yumi Nishiwaki owner of I Wish Wedding and Toria Lee of Timeless Event Design: a comparison between the destination wedding market in Mainland China and Hong Kong……………………………………………………..31 Chapter 3: Tourism and Wedding-Induced Tourism in Italy 3.1 Introductive analysis on Chinese tourism in Italy………………………………...39 3.1.1 Luxury Chinese tourism in Italy………..………………………………42 3.2 Introductive analysis on destination wedding in Italy…………………………....46 3.2.1 Wedding-induced tourism from China………………………………...49 Chapter 4: Analysis of the final-offer 4.1 Sector’s professional -

Apparel & Textile Factory List

Woolworths Food Group-Active apparel and textile factories- April 2021 No. Factory Name Address Factory Type Commodity Scheme Expiry Date Country 1 JIANGSU HONGMOFANG TEXTILE CO., LTD EAST CIFU ROAD, EAST RUISHENG AVENUE,, DIRECT SOFTGOODS BSCI 23/04/2021 CHINA ECONOMIC DEVELOPMENT ZONE, SHUYANG COUNTY,,SUQIAN,JIANGSU,,CHINA 2 LIANYUNGANG ZHAOWEN SHOES LIMITED 2 BEIHAI ROAD,ECONOMIC DEVELOPMENT AREA, DIRECT SOFTGOODS SMETA 11/05/2021 CHINA GUANNAN COUNTY,,LIANYUNGANG,JIANGSU,, CHINA 3 ZHUCHENG YIXIN GARMENT CO., LTD NO. 321 SHUNDU ROAD,,ECONOMIC DEVELOPMENT DIRECT SOFTGOODS SMETA 13/07/2021 CHINA ZONE,,ZHUCHENG,SHANDONG,,CHINA 4 HRX FASHION CO LTD 1000 METERS SOUTH OF GUOCANG TOWN DIRECT SOFTGOODS SMETA 25/08/2021 CHINA GOVERNMENT,,WENSHANG COUNTY, JINING CITY, JINING,SHANDONG,,CHINA 5 PUJIANG KINGSHOW CARPET CO LTD NO.75-1 ZHEN PU ROAD, PU JIANG, ZHE JIANG, DIRECT HARDGOODS BSCI 24/12/2021 CHINA CHINA,,PUJIANG,ZHEJIANG,,CHINA 6 YANGZHOU TENGYI SHOES MANUFACTURE CO., LTD. 13 WEST HONGCHENG RD,,,FANGXIANG,JIANGSU,, DIRECT SOFTGOODS BSCI 22/10/2021 CHINA CHINA 7 ZHAOYUAN CASTTE GARMENT CO LTD PANJIAJI VILLAGE, LINGLONG TOWN,,ZHAOYUAN DIRECT SOFTGOODS BSCI 06/07/2021 CHINA CITY, SHANDONG PROVINCE,ZHAOYUAN, SHANDONG,,CHINA 8 RUGAO HONGTAI TEXTILE CO LTD XINJIAN VILLAGE, JIANGAN TOWN,,RUGAO, DIRECT HARDGOODS BSCI 07/12/2021 CHINA JIANGSU,,CHINA 9 NANJING BIAOMEI HOMETEXTILES CO.,LTD NO.13 ERST WUCHU ROAD,HENGXI TOWN,,, DIRECT SOFTGOODS SMETA 04/11/2021 CHINA NANJING,JIANGSU,,CHINA 10 NANTONG YAOXING HOUSEWARE PRODUCTS CO.,LTD NO.999, TONGFUBEI RD., CHONGCHUAN, DIRECT HARDGOODS SMETA 24/09/2021 CHINA NANTONG,,NANTONG,JIANGSU,,CHINA 11 CHAOZHOU CHAOAN ZHENGYUN CERAMICS QIAO HU VILLAGE, CHAOAN, CHAOZHOU CITY, DIRECT HARDGOODS SMETA 19/05/2021 CHINA INDUSTRIAL CO LTD GUANGDONG, CHINA,,CHAOZHOU,GUANGDONG,, CHINA 12 YANTAI PACIFIC HOME FASHION FUSHAN MILL NO. -

China's E-Commerce Market Leapfrogged

05 August 2015 Asia Pacific/India Equity Research India Internet Primer #2 Connections Series Ten lessons from China Figure 1: E-commerce in India is 4-10 years behind China on several parameters Organised retail Online shopping penetration penetration Online Internet shoppers penetration China (1999): ~10% China (2007): 0.6% India (2014): 9-10% India (2014): 0.7% China (2006): 43 mn China (2008): 23% India (2014): 38 mn India (2014): 20% Urbanisation GDP per-capita (US$) Spend per online Smartphone The Credit Suisse Connections Series buyer (US$) penetration China (1997): ~33% China (2004): 1,498 India (2014): 32% India (2014): 1,487 leverages our exceptional breadth of China (2007): 135 China (2010): 13% macro and micro research to deliver India (2014): 104 India (2014): 14% 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 incisive cross-sector and cross-border (-17) (-16) (-15) (-14) (-13) (-12) (-11) (-10) (-9) (-8) (-7) (-6) (-5) (-4) thematic insights for our clients. Year (years from 2014) Source: Credit Suisse research Research Analysts Anantha Narayan ■ India at the 'tipping point', based on the China experience. While there 91 22 6777 3730 are differences, the two internet markets are similar in many ways—a large [email protected] population, growing middle class, and an underdeveloped organised market. Nitin Jain 91 22 6777 3851 From 0.2% of GDP in 2007, the Chinese e-tailing market rose to about 5% in [email protected] 2014, an 80% CAGR from US$7.4 bn to US$458 bn.