D Ix Ons R E Ta Il P Lc a N N U a L R E P O Rt a N D a C C O U N Ts 2 011/12

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Ben Terry Location Planning Manager -- More Than Just Shops

Ben Terry Location Planning Manager -- more than just shops Dixons Carphone plc is Europe’s leading specialist electrical and telecommunications retailer and services company, employing over 42,000 people in twelve countries Shop keepers? Have to be more than Shop Keepers Increasingly complexity and cost Retail supply chains Diversity of goods and how customers want them Store Reserve & Store Same day Online Installed setup collect ✓ ✓ ✓ ✓ ✗ ✓ ✓ ✓ ✓ ✓ ✗ ✓ ✓ Some ✓ ✓ Some ✓ ✓ Some ✓ ✗ ✓ ✓ How we currently do things - Newark o Centre of our UK&I Operations o Serves all UK&I Brands o Over 1.5m sq. ft. with max 4000 colleagues on site o Home Fulfillment Centre via CSC’s o Branch Fulfillment Centre o Small Products Warehouse o Customer Repair Centre Building 1 Overview Building 1 Building 1 o HFC (Home Fulfilment Centre); 440,000 sq. ft. in Chambers 2 and 3, a small portion of which is also utilised by Newark CSC. o Reverse Logistics (Returns) and Spares; 220,000 Chamber 1 Chamber 2 Chamber 3 sq. ft. on the ground floor of Chamber 1 o Customer Repair Centre; 184,000 sq. ft. on the mezzanine in Chamber 1. How we currently do things - CSCs o 22 Customer Service Centres o 5m+ home visits per year o 250 Specialist Engineers o +250,000 white goods repair in home o 7am to 9pm delivery slots o Enhanced Service Capability o Detailed Property Requirements Repair; Service; Install; Upgrade; Membership Ben Terry - Introduction Career History: 15 years experience in site location / retail analysis GeoBusiness Solutions – retail & leisure consultancy PinPoint -

Appointment of Group Finance Director

27 March 2018 Embargoed until 7.00am Appointment of Group Finance Director Dixons Carphone plc (the "Company") announces the appointment of Jonny Mason to its Board as Group Finance Director, with effect from a date to be confirmed. Jonny has been Chief Financial Officer of Halfords plc since 2015 and was Interim Chief Executive Officer between September 2017 and January 2018. Prior to that Jonny was CFO of Scandi Standard AB, a Scandinavian company which successfully listed in Stockholm in June 2014. Jonny’s early career included CFO at Odeon and UCI Cinemas, Finance Director of Sainsbury’s Supermarkets and finance roles at Shell and Hanson plc. Ian Livingston, Chairman of Dixons Carphone, said: “The Board and I are very pleased to welcome Jonny Mason to the Group. Together with Alex Baldock, we now have a great new team to lead Dixons Carphone.” Alex Baldock, incoming Chief Executive Officer of Dixons Carphone, said: “I am delighted to have Jonny by my side. He has an outstanding track record and brings the experience and qualities we need to take Dixons Carphone into the next phase of its transformation.” Jonny Mason said: “I am thrilled to be joining Dixons Carphone. The business has undergone a tremendous journey over recent years and is well placed to meet customers’ ever growing and complex needs for technology. I have experienced first-hand as a customer the quality of our shops, product and services, from my time living in both the UK and Norway, and I feel proud to join the Group to work with Alex, the Board and our great team of colleagues.” There is no information which is required to be disclosed pursuant to Listing Rule 9.6.13. -

BP Dropped 4.5% As It Revealed a 50% Fall in Profits

Market Roundup Chart 1: Inflation (CPI) projection Shares were on a losing streak this week ahead of next Tuesday’s US presidential election. The FTSE 100 index was off 0.6% on Monday, although with October coming to a close the blue-chip index still recorded its fifth monthly increase in a row. Tuesday saw the FTSE 100 lose another 0.5% amid rising concerns about a possible Trump victory in the US election. Royal Dutch Shell shares jumped 4% after announcing better than expected third-quarter profits, but BP dropped 4.5% as it revealed a 50% fall in profits. The market fell 1% on Wednesday as opinion polls continued to narrow in the US. Standard Chartered lost 4.3%, falling for the second day running after disappointing third-quarter results on Tuesday, while Barclays was off 2.5%. Source: Bank of England Inflation Report Data at 4/11/2016 However G4S leapt 10.3% on a positive trading update. EasyJet, among the FTSE 100’s worst performers this year, also rose 2.9% Chart 2: Markit/CIPS Manufacturing PMI after HSBC upgraded the airline’s shares to a “buy” and lifted its target price from 800p to 1,150p. 60 On Thursday the FTSE 100 was down another 0.8% - though mid-cap 58 shares rose - as the pound strengthened after the High Court ruled the 56 government would need parliamentary approval to trigger Article 50, 54 the treaty clause to leave the EU. 52 GlaxoSmithKline, a major beneficiary of sterling weakness, lost 3.3%, 50 while Pearson was down 2.1%. -

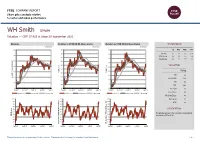

FTSE Factsheet

FTSE COMPANY REPORT Share price analysis relative to sector and index performance WH Smith SMWH Retailers — GBP 17.425 at close 29 September 2021 Absolute Relative to FTSE UK All-Share Sector Relative to FTSE UK All-Share Index PERFORMANCE 29-Sep-2021 29-Sep-2021 29-Sep-2021 22 180 180 1D WTD MTD YTD 170 170 Absolute 0.0 1.8 6.8 15.4 20 Rel.Sector -0.7 3.0 5.5 -1.4 160 160 Rel.Market -0.9 1.5 7.7 4.1 18 150 150 140 VALUATION 16 140 130 Trailing 14 130 Relative Price Relative Relative Price Relative 120 120 PE -ve 110 Absolute Price (local (local currency) AbsolutePrice 12 EV/EBITDA 30.8 110 100 10 PB 9.6 90 100 PCF 26.4 8 80 90 Div Yield 0.0 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Sep-2021 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Sep-2021 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Sep-2021 Price/Sales 2.1 Absolute Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Relative Price 4-wk mov.avg. 13-wk mov.avg. Net Debt/Equity 4.3 100 100 100 Div Payout 0.0 90 90 90 ROE -ve 80 80 80 70 70 Index) Share 70 Share Sector) Share - - 60 60 60 DESCRIPTION 50 50 50 The principal activity of the Company is retailing and 40 40 40 RSI RSI (Absolute) associated activities in UK. 30 30 30 20 20 20 10 10 10 RSI (Relative to FTSE UKFTSE All to RSI (Relative RSI (Relative to FTSE UKFTSE All to RSI (Relative 0 0 0 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Sep-2021 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Sep-2021 Sep-2020 Dec-2020 Mar-2021 Jun-2021 Sep-2021 Past performance is no guarantee of future results. -

Erasmus Student W0RK Placement

ERAsMus STuDENT W0RK PLAcEMENT IN THE CzEcH REPuBuc EMPLOYER INFORMATION Name of organization Pixmania s.r Address mcl. post cede Trnt 391/5. 60200 Brne, Czech Repuhiic Felephone 00420 543 123 100 mail [email protected] Wehsite \n uaa e; johs pixmania.corn Number cI emplevees 180 Dixons Reta plc s one of ELropes Ieadng electrLcal retaers, The Group trades through L200 stores and online stores, spanning 28 countnes and empIoyng 3650O people. Shert descrption of the Pixmania.com, as a part of Dixons Retail pc., is an European E-taer of company consurner e1ectronc goods. It app{ies innovative market strateges on an nterrational evei, leading te a pan-European presence n 26 countnes and 17 anguages. In order te support ts development in the flagshp markets and increase ts brard-awareness Pixrnanìa would ike to give an opportunty to studentsin vanousf!elds te join our tearn! Other CONTACT DETAILS (rntact persen for this ‘v arernka Modra placei ienl Departmer t and de’enata e i HR Support it Pi\mania [IR D partme ìt h ‘7 Diret tcleohene nun bLr (Ni42( 51 i i 593 E a Idrc \ ned’a i5 pi\ViI e om I)epartrnent I Funetion Transport aceount coordinator Description of activities The Transport Team Is responsible for ensure the quality of tra nsport services ordered by customers. The interna wN be responsibe for foflowing transport issues • Pick Ups (parcels on the way back to Pixmania frorn custorner) • !nvestigations hnquiry of darnaged, Iost parcels or delayed parceR) o Vahdation of Pick Ups with different carriers. -

The Global Grocery and General Merchandising Market Marketing Essay

The Global Grocery And General Merchandising Market Marketing Essay Jack Cohen founded Tesco in 1919 when he began to sell surplus groceries from a stall at Well Street Market, Hackney, in the East End of London (ironically, the market is now much smaller than in those days; a large Tesco Metro store now sits on the site.)[11] The Tesco brand first appeared in 1924. The name came about after Jack Cohen bought a shipment of tea from T.E. Stockwell. He made new labels using the first three letters of the supplier’s name (TES), and the first two letters of his surname (CO), forming the word TESCO.[12] The first Tesco store was opened in 1929 in Burnt Oak, Edgware, Middlesex. Tesco was floated on the London Stock Exchange in 1947 as Tesco Stores (Holdings) Limited.[11] The first self-service store opened in St Albans in 1956 (which remained operational until 2010, with a period as a Tesco Metro),[13] and the first supermarket in Maldon in 1956.[11] During the 1950s and the 1960s Tesco grew organically, and also through acquisitions, until it owned more than 800 stores. The company purchased 70 Williamsons stores (1957), 200 Harrow Stores outlets (1959), 212 Irwins stores (1960, beating Express Dairies Premier Supermarkets to the deal), 97 Charles Phillips stores (1964) and the Victor Value chain (1968) (sold to Bejam in 1986).[14] Originally specialising in food and drink, it has diversified into areas such as clothing, electronics, financial services, telecoms, home, health, car, dental and pet insurance, retailing and renting DVDs,[10] CDs, music downloads, Internet services and software. -

Retail Change: a Consideration of the UK Food Retail Industry, 1950-2010. Phd Thesis, Middlesex University

Middlesex University Research Repository An open access repository of Middlesex University research http://eprints.mdx.ac.uk Clough, Roger (2002) Retail change: a consideration of the UK food retail industry, 1950-2010. PhD thesis, Middlesex University. [Thesis] This version is available at: https://eprints.mdx.ac.uk/8105/ Copyright: Middlesex University Research Repository makes the University’s research available electronically. Copyright and moral rights to this work are retained by the author and/or other copyright owners unless otherwise stated. The work is supplied on the understanding that any use for commercial gain is strictly forbidden. A copy may be downloaded for personal, non-commercial, research or study without prior permission and without charge. Works, including theses and research projects, may not be reproduced in any format or medium, or extensive quotations taken from them, or their content changed in any way, without first obtaining permission in writing from the copyright holder(s). They may not be sold or exploited commercially in any format or medium without the prior written permission of the copyright holder(s). Full bibliographic details must be given when referring to, or quoting from full items including the author’s name, the title of the work, publication details where relevant (place, publisher, date), pag- ination, and for theses or dissertations the awarding institution, the degree type awarded, and the date of the award. If you believe that any material held in the repository infringes copyright law, please contact the Repository Team at Middlesex University via the following email address: [email protected] The item will be removed from the repository while any claim is being investigated. -

ICO Issues Monetary Penalty Notice Under DPR 1998

ICO Issues Monetary Penalty Notice under DPR 1998 Released : 09 Jan 2020 RNS Number : 2698Z Dixons Carphone PLC 09 January 2020 Information Commissioner's Office issues Monetary Penalty Notice under Data Protection Act 1998 DSG Retail Limited, a subsidiary of Dixons Carphone plc, has today received a Monetary Penalty Notice from the UK Information Commissioner's Office (ICO) in relation to the historic unauthorised access of customer data previously announced on 13 June 2018 and 31 July 2018. The ICO has imposed a fine of £500,000 under the Data Protection Act 1998. Dixons Carphone Chief Executive, Alex Baldock, said: "We are very sorry for any inconvenience this historic incident caused to our customers. When we found the unauthorised access to data, we promptly launched an investigation, added extra security measures and contained the incident. We duly notified regulators and the police and communicated with all our customers. We have no confirmed evidence of any customers suffering fraud or financial loss as a result. We have upgraded our detection and response capabilities and, as the ICO acknowledges, we have made significant investment in our Information Security systems and processes. We are disappointed in some of the ICO's key findings which we have previously challenged and continue to dispute. We're studying their conclusions in detail and considering our grounds for appeal." Next announcement The Group will publish its Peak Trading Statement on Tuesday 21 January 2020. For further informa on Assad Malic Group Strategy & Corporate Affairs Director +44 (0)7414 191044 Dan Homan Head of Investor Relations +44 (0)7400 401442 Amy Shields Head of External Communications +44 (0)7588 201442 Tim Danaher Brunswick Group +44 (0)207 404 5959 Information on Dixons Carphone plc is available at www.dixonscarphone.com Follow us on Twi er: @dixonscarphone About Dixons Carphone Dixons Carphone plc is a leading mul channel retailer of technology products and services, opera ng 1,500 stores and 16 websites in eight countries. -

Dixons Carphone

Dixons Carphone 14 years of delivering an outstanding maintenance solution, built on a foundation of collaboration and flexibility. A long-standing partnership VINCI Facilities’ regional management team are VINCI Facilities provides planned and reactive FM works strategically located across England, Wales and Scotland, to circa 450 Currys, Dixons and Carphone Warehouse sites enabling them to respond rapidly to site-specific issues. across the UK and the Republic of Ireland. This encompasses Each manager has also received training in specialist areas, the client’s entire network of sites, including: such as gas, electrics, roofing and scaffolding, in order to » Currys PC World and Carphone Warehouse stores. better support the contract’s wider team of nationwide » 29 Dixons tax-free airport stores. engineers. » 23 distribution centres, the largest of which covers an area of 2,000,000sq.m and is operational 24/7/365. Collaboration Self-delivery In order to maximise the pool of knowledge within the VINCI Facilities self-delivers the majority of the works, partnership, joint training activities are rolled out for both including 24/7/365 planned and reactive maintenance to VINCI Facilities and Dixons Carphone. Recent sessions have building fabric and M&E assets. covered topics such as CDM 2015 regulations, asbestos This approach ensures control of the service delivery, regulations, Tyco sprinklers, Daikin air conditioning and while also strengthening communication, reliability and IOSH Managing Safely. accountability. Health, safety, environment and quality The self-delivered model is underpinned by VINCI Facilities’ To ensure exemplary HSEQ standards, VINCI Facilities external accreditations covering the UK and Ireland. provides comprehensive training for managers from both Exceptional management organisations, including IOSH Managing Safely and a range The contract benefits from a management team that acts of specialist compliance courses on topics such as asbestos as an extension of Dixons Carphone’s own team. -

A Historical Look at the Shops – Past and Present in the Colchester Town Centre Area

A HISTORICAL LOOK AT THE SHOPS – PAST AND PRESENT IN THE COLCHESTER TOWN CENTRE AREA 1 INTRODUCTION Having written about walking around our town and others over Christmas and the month of January, looking at churches in Essex, Suffolk and Norfolk, the weekend of 1st and 2nd February 2014, saw me writing and photographing the main shops in our town of Colchester and trying to find out the National History of the businesses. So here is my story again …… 99p STORE (84-86 Culver Street East) 99p Stores Ltd. is a family run business founded in January 2001 by entrepreneur Nadir Lalani, who opened the first store in the chain in Holloway, London, with a further three stores opening later that year. In 2002, Lalani decided to expand the business throughout the UK and has rapidly developed 99p Stores, operating a total of 129 stores as of March 2010 and serving around 1.5 million customers each week, undercutting their main rival Poundland by a penny. As of mid-2009 the company offered more than 3,500 different product lines throughout its stores. Most of their stores are based in the south of the UK, although there are stores as far north as Liverpool and Hartlepool. The chain saw accelerated store expansion upon the collapse of Woolworths Group, where they took the opportunity to acquire 15 of these former stores, increasing their estate to 79 at that time. Landlords are now regarding 99p Stores as an anchor tenant due to the significant number of customers one of their stores can bring to a location. -

Chief Executive's Review Group Turnover for the 52 Weeks Ended 27

Chief Executive’s review Group turnover for the 52 weeks ended 27 April 2002 increased by 5 per cent to £4,888 million (2000/01 £4,643 million excluding Freeserve). Like for like sales were unchanged across the Group in challenging markets. Group profit before tax and exceptional The Group continued to grow market telecoms solutions provider for the items increased by 7 per cent to £297.2 share, showing particularly strong gains business to business market. million (2000/01 £277.8 million before in widescreen televisions, large domestic taxation, exceptional items and Freeserve). appliances, games, personal computers International and PC related products. The International Retail division achieved UK Retail an operating profit of £15.2 million UK Retail division operating profit before The product cycle is a major determinant (£22.3 million) on sales ahead 14 per cent exceptional items was £253.6 million of sales growth. New products have at £688 million (£602 million). (£244.8 million), an increase of 4 per cent. driven sales even during the recessions Total UK Retail sales were £4,122 million of the early 1980s and 1990s. Looking Our expansion into Continental (£3,979 million), a 4 per cent increase ahead, the product outlook appears Europe continued, with investments year on year and unchanged like for like. positive with new technologies coming in eight markets. The Group now has onto the market, from large flat screen retail operations in 11 countries. Although Currys and PC World made televisions to wireless home networks, As anticipated, start-up losses were strong contributions to the divisional and the potential for a recovery in the incurred in new businesses in France, performance, these were largely personal computer market.