World Bank Document

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Overview of Coal Mining Industry in India

GOVT. OF INDIA OVERVIEW OF COAL MINING INDUSTRY IN INDIA FUTURE PROSPECTS AND POSSIBILITIES PARTHA S. BHATTACHARYYA CHAIRMAN, COAL INDIA LIMITED 05-07Th. JUNE 2007 CONTENT SN TOPIC SLIDE No. 1 Background 1-6 2 Nationalisation of Coal Industry 7-11 3 Turn around of CIL 12-15 4 X Plan performance 16-19 5 Demand and production projections 20-25 6 THRUST AREAS 26 A New Strategy 27-38 B Beneficiation of Non-coking coal 39-41 C Clean coal technologies 42-45 D Coal Videsh 46 % SHARE OF COMMERCIAL PRIMARY ENERGY RESOURCES - INDIA NUCLEAR 2% HYDRO 2% NATURAL GAS 9% COAL 51% OIL 36% 1 A.CIL :COAL PRODUCING SUBSIDIARIES 1 8 EASTERN COALFIELDS LTD. (1) 5 4 3 BHARAT COKING COAL LTD. (2) CENTRAL COALFIELDS LTD. (3) NORTHERN COALFIELDS LTD. (4) WESTERN COALFIELDS LTD. (5) SOUTH EASTERN COALFIELDS LTD.(6) MAHANADI COALFIELDS LTD. (7) NORTH EASTERN COALFIELDS. (8) ( A UNIT UNDER CIL(HQ) ) 2 PLANNING & DESIGN INSTITUTE COAL 7 LIGNITE CENTRAL MINE PLANNING & DESIGN INSTITUTE (CMPDIL) 6 B.SINGARENI COLLIERIES CO. LTD. (9) 9 10 C.NEYVELI LIGNITE CORPORATION (10) 2 INDIAN COAL RESOURCES – 2007 (Bill T) 33.2 222 Coking Non-Coking TOTAL RESOURCE – 255.2 3 COAL RESERVES IN INDIA (As on 1.1.2007) (Billion T) TYPE OF COAL PROVED INDICATED INFERRED TOTAL Prime Coking 4.6 0.7 0.0 5.3 Medium Coking 11.8 11.6 1.9 25.3 Semi Coking 0.5 1.0 0.2 1.7 Non coking 80.6 105.6 35.8 222.0 TOTAL 97.9 119.0 38.3 255.2 Lignite 4.3 12.7 20.1 37.1 4 Proved resource is around 10% of world’s proved reserves CHARACTERISTICS OF INDIAN COAL DEPOSITS 1. -

Brief Description of PAREJ EAST OCP

Brief Description of PAREJ EAST OCP (Proposed Coal Production Capacity 1.75 MTPA) 1.0 Background: The Project Report for Parej East OCP was sanctioned in March, 1993 at an estimated initial capital investment of Rs.116.19 crore for a rated capacity of 1.75 M.Te of ROM coal per annum. Parej East OCP contains ‘F’/WG-IV grade (Avg.) coal in seams from Seam-II (B) to Seam- V. A RPR for Parej East OCP has also been prepared in September, 1999. The project has obtained Environmental Clearance from MoEFCC for a rated capacity of 1.75 MTPA vide letter no: J-11015/36/89-IA-II(M) Dt. 23.11.1992. The details of previous production are as given below: Coal Produced Year (MTPA) 1992-93 0.00 1993-94 0.00 1994-95 0.35 1995-96 0.63 1996-97 0.80 1997-98 0.70 1998-99 0.54 1999-00 0.89 2000-01 1.38 2001-02 1.41 2002-03 1.66 2003-04 1.62 2004-05 1.66 2005-06 1.62 2006-07 1.30 2007-08 1.35 2008-09 1.36 2009-10 1.38 2010-11 1.10 2011-12 1.20 2012-13 0.93 2013-14 1.05 2014-15 1.06 2015-16 1.03 2016-17 0.92 2017-18 0.79 1.1 Purpose of the report 1 The project has obtained environmental clearance for 1.75 MTPA and 459.61 Ha project area including forest in Safety Zone. -

Tourist Places in and Around Dhanbad

Tourist Places in and around Dhanbad Dhanbad the coal capital of India lies at the western part of Eastern Indian Shield, the Dhanbad district is ornamented by several tourist spots, namely Parasnath Hill, Parasnath Temple, Topchanchi, famous Jharia coalfields, to mention a few. Other important places are Bodh Gaya, Maithon Dam, and this town is only at 260 km distance by rail route from Kolkata. Bodh Gaya Lying at 220 km distance from Dhanbad. Bodh Gaya is the place where Gautam Buddha attained unsurpassed, supreme Enlightenment. It is a place which should be visited or seen by a person of devotion and which would cause awareness and apprehension of the nature of impermanence. About 250 years after the Enlightenment, the Buddhist Emperor, Ashoka visited the site of pilgrimage and established the Mahabodhi temple. Parasnath Temple The Parasnath Temple is considered to be one of the most important and sanctified holy places of the Jains. According to Jain tradition, no less than 23 out of 24 Tirthankaras (including Parsvanatha) are believed to have attained salvation here. Baidyanath Temple Baidyanath Jyotirlinga temple, also known as Baba dham and Baidyanath dham is one of the twelve Jyotirlingas, the most sacred abodes of Shiva. It is located in Deoghar at a distance of 134 km from Dhanbad. It is a temple complex consisting of the main temple of Baba Baidyanath, where the Jyotirlinga is installed, and 21 other temples. Maithon Dam Maithon is 52 km from Dhanbad. This is the biggest reservoir in the Damodar Valley. This dam, designed for flood control, has been built on Barakar river. -

3.8 Rajrappa Washery

A Mini Ratna Company PRE-FEASIBILTY REPORT OF RAJRAPPA OCP AND WASHERY Project Area Capacity OCP & Washery (Ha) (MTPA) 2263.83 Ha 3.0 (Rajrappa Area) Central Coalfields Limited (September, 2018) Prepared at Regional Institute – III Central Mine Planning & Design Institute Ltd. (A Subsidiary of Coal India Ltd.) Gondwana Place, Kanke Road Ranchi-834008, Jharkhand CONTENTS Contents ..................................................................................................................................... ii List of PLATES ........................................................................................................................ iv Chapter 1 Executive Summary ............................................................................................... 5 1.1 Summary ........................................................................................................... 5 Chapter 2 Project Background ............................................................................................... 7 2.1 Introduction ....................................................................................................... 7 2.2 Purpose of the report ......................................................................................... 8 2.3 Identification of project & project proponent.................................................... 9 2.4 Location & Communication .............................................................................. 9 2.5 Description of importance to the country and region ....................................... -

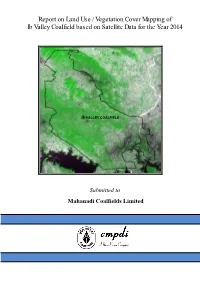

Report on Land Use / Vegetation Cover Mapping of Ib Valley Coalfield Based on Satellite Data for the Year 2014

Report on Land Use / Vegetation Cover Mapping of Ib Valley Coalfield based on Satellite Data for the Year 2014 IB VALLEY COALFIELD Submitted to Mahanadi Coalfields Limited CMPDI Report on Land Use/ Vegetation Cover Mapping of Ib Valley Coalfield based on Satellite data for the year 2014 Submitted to Mahanadi Coalfields Limited Sambalpur March - 2015 Remote Sensing Cell Geomatics Division CMPDI (HQ), Ranchi Job No 561410027 Page i CMPDI Document Control Sheet (1) Job No. RSC-561410027 (2) Publication Date March 2015 (3) Number of Pages 28 (4) Number of Figures 07 (5) Number of Tables 06 (6) Number of Plates 02 (7) Number of Drawings 01 Land use/ Vegetation Cover mapping of Ib Valley (8) Title of the Report Coalfield using satellite data of the year 2014. Preparation of land use/vegetation cover map of Ib Valley (9) Aim of the Report Coalfield on 1:50,000 scale based on Landsat 8 (OLI) satellite data for creating the geo-environmental database. Remote Sensing Cell (10) Executing Unit Geomatics Division Central Mine Planning & Design Institute Ltd. Gondwana Place, Kanke Road, Ranchi (11) User Agency Mahanadi Coalfields Limited, Sambalpur Ms. A. Biswas, DyM(Geology) (12) Author Mr. N. P. Singh, GM(Geomatics) (13) Security Restriction Restricted Circulation (14) No. of Copies 6 (15) Distribution Statement Official Job No 561410027 Page ii CMPDI List of Figures 1. Map of India showing the location of Ib Valley Coalfield. 2. Remote Sensing Radiation System. 3. Electromagnetic Spectrum 4. Expanded Diagram of the visible and infrared regions. 5. Methodology of Land use/ Vegetation cover mapping. -

Correlation of Coal Seams in Chirimiri Coalfield, M.P., on the Basis of Sporae Dispersae*

CORRELATION OF COAL SEAMS IN CHIRIMIRI COALFIELD, M.P., ON THE BASIS OF SPORAE DISPERSAE* D. C. BHARADWA} & S. C. SRIVASTAVA Birbal Sahni Institute of Palaeobotany, Lucknow ABSTRACT MA TERIAL AND METHODS Fifteen samples of coal collected from different 15 samples of coal in 72 B.S. mesh size parts of Chirimiri Coalfield, M.P., have been sporo• from all over the area were studied (Table 1). logically investigated. The qualitative and quanti• These samples were subjected to similar tative composition of the samples at generic level indicates that the general dominance is consti• maceration procedure in each case. Five tuted by Lophotriletes, Microbaculispora, Indotri• gms. of material from each sample was radites and Sulcatisporites. In addition to these, treated with HNOa (comm.) for 3 days Horriditriletes, Retusotriletes, Potonieisporites, Fauni• followed by digestion with 10 per cent pollenites and Ginkgocycadophytus are characteristi• cally associated with the dominants. The asso• KOH after thorough washing with water ciation of these genera has enabled segregation of as detailed by Bharadwaj (1962) and Bhara• the samples into three assemblages. Assemblage A dwaj and Salujha (1964). The macerates is dominated by Microbaculispora. Assemblage B were mounted on slides in glycerine jelly. 500 is dominated by Microbaculispora in association with Indotriradites and Assemblage C has the miospores were counted from each sample dominance of Microbaculispora associated with at the generic level. Retusotriletes and Potonieisporites. It is suggested From Table 1 it is apparent that samples that the samples represent three coal seams corres• CACl - (129), (126), (143)E, (145)E and ponding to Assemblages A, B & C. -

SOUTH EASTERN COALFIELDS LIMITED (A Subsidiary of Coal India Limited)

SOUTH EASTERN COALFIELDS LIMITED (A Subsidiary of Coal India Limited) Notification No.CAD/01/2021 Date : 05.02.2021 South Eastern Coalfields Limited(SECL), a Miniratna CPSE, is a wholly owned subsidiary of Coal India Limited, A Maharatna CPSE,SECL is single largest Coal producing Company of India, Coal reserves of SECL are spread over the States of Chhattisgarh & Madhya Pradesh and the Company is operating 70 mines, besides a Coal Carbonization Plant namely Dankuni Coal Complex(DCC) at Dankuni in West Bengal on lease basis from Coal India Limited. SECL is having two(02) Subsidiary Companies viz. Chhattisgarh East Railway Limited (CERL) and Chhattisgarh East-West Railway Limited(CEWRL) at Raipur, Chhattisgarh in the form of Joint Venture with IRCON International Limited (IRCON) and Chhattisgarh State Industrial Development Corporation (CSIDC, representing Govt. of Chhattisgarh) formed in terms of the Memorandum of Understanding(MoU) signed between SECL, IRCON International Limited and Government of Chhattisgarh, for establishment of the two Railway Corridors viz., East Corridor and East-West Corridor, projects declared as national importance. SECL, having registered office at SECL Bhawan, Seepat Road, Bilaspur – 495006 Chhattisgarh is planning to impart practical training in two (02) Executive and one (01) Professional qualified students of the Institute of Company Secretaries of India (ICSI) as per CIL’s Scheme for imparting practical training to the students who have passed Executive/Professional Programme of ICSI, with the following terms & conditions: 1. Scope of work of the stipend trainees: The Students after passing Executive / Professional Programme of ICSI will be under practical training for the following period on whole time basis: For Students who have passed Executive Programme 2 Years For Students who have passed Professional Programme 1 Year They shall undergo practical training in various fields viz. -

Annual Report 2018-2019

ANNUAL REPORT 2018-2019 STATE POLLUTION CONTROL BOARD, ODISHA A/118, Nilakantha Nagar, Unit-Viii Bhubaneswar SPCB, Odisha (350 Copies) Published By: State Pollution Control Board, Odisha Bhubaneswar – 751012 Printed By: Semaphore Technologies Private Limited 3, Gokul Baral Street, 1st Floor Kolkata-700012, Ph. No.- +91 9836873211 Highlights of Activities Chapter-I 01 Introduction Chapter-II 05 Constitution of the State Board Chapter-III 07 Constitution of Committees Chapter-IV 12 Board Meeting Chapter-V 13 Activities Chapter-VI 136 Legal Matters Chapter-VII 137 Finance and Accounts Chapter-VIII 139 Other Important Activities Annexures - 170 (I) Organisational Chart (II) Rate Chart for Sampling & Analysis of 171 Env. Samples 181 (III) Staff Strength CONTENTS Annual Report 2018-19 Highlights of Activities of the State Pollution Control Board, Odisha he State Pollution Control Board (SPCB), Odisha was constituted in July, 1983 and was entrusted with the responsibility of implementing the Environmental Acts, particularly the TWater (Prevention and Control of Pollution) Act, 1974, the Water (Prevention and Control of Pollution) Cess Act, 1977, the Air (Prevention and Control of Pollution) Act, 1981 and the Environment (Protection) Act, 1986. Several Rules addressing specific environmental problems like Hazardous Waste Management, Bio-Medical Waste Management, Solid Waste Management, E-Waste Management, Plastic Waste Management, Construction & Demolition Waste Management, Environmental Impact Assessment etc. have been brought out under the Environment (Protection) Act. The SPCB also executes and ensures proper implementation of the environmental policies of the Union and the State Government. The activities of the SPCB broadly cover the following: Planning comprehensive programs towards prevention, control or abatement of pollution and enforcing the environmental laws. -

Jogeshwar & Khas Jogeshwar Coal Block Summary

JOGESHWAR & KHAS JOGESHWAR COAL BLOCK SUMMARY PART A Sr. Features Details No. 1. Location Coal Block Jogeshwar & Khas Jogeshwar (However, name of block as per available GR is Jogeshwar) Latitude 23045’31” N to 23046’45” N (Provisional) Longitude 85035’29” E to 85037’58” E (Provisional) Topo Sheet No. 73 E/9 on RF 1:50000 Coalfield South Eastern part of West Bokaro Coalfield Villages Jogeshwar Tehsil/ Taluka Not available District Ramgarh State Jharkhand 2. Connectivity with Block Nearest Rail Head Nearest Rly Stn: Jogeshwar Bihar (on Gomoh-Barkakana loop line of South Eastern Rly) at a distance of about 2.5km south-west of the block Road Connected to National Highway 33 between Ranchi and Hazaribagh by Coal Trunk Road which is connected to block by an all weathered metalled road Airport Ghato Air Strip of TISCO Mines is located at a distance of about 7km from the block 3. Area Geological Block Area 2.66 sq km (As per shape file; Refer Note No. 3) Mining Lease Area 275.64 Ha (As per Draft Mining Plan) Forest Area 115.20 Ha Non-Forest Area 53.90 Ha 4. Climate and Topography Average Annual Rainfall 1200mm Temperature (Min. – 100C – 450C Max.) Local Surface Drainage Bokaro River flows from west to east along the northern limit of the block. Channels Besides this , four perennial nalas namely Lachman Hir, Bisramihir, Sankattwa and Hathwa Jharna are located in the eastern, central and western parts of the block respectively Rivers Bokaro River flows from west to east along the northern limit of the block 5. -

Coalmine Methane Under Indian Mining Scenario

Coalmine Methane Under Indian Mining Scenario CMM under Indian Mining Scenario • In India coal is a reliable energy resource due to limited availability of petroleum and natural gas. • Coal based non-conventional energy is poised to play a major role in India as : 9 It would bridge the gap between demand and availability of conventional energy source 9 International trading scenario in energy sector has been stormy 9 Environmental concerns has given impetus to clean coal technologies. • Under the scenario, Coalbed Methane (CBM) and its subsets like Coal Mine Methane (CMM) and Abandoned Mine Methane (AMM) may find important place in Indian Energy scenario in coming years. CMM under Indian Mining Scenario Development of CBM in India • Out of different sub-sets of Coalbed Methane (CBM), CBM from the deep lying coal deposits (VCBM) has been pursued. • So far 16 Coalbed Methane (VCBM) blocks have been allotted under CBM policy of GoI covering an area of 7807 sq. km and prognosticated CBM resource of 825 BCM. • 10 more blocks have been opened for global bidding. • Several core wells/pilot wells have been drilled in the allotted blocks and are giving encouraging results. • Few operators are planning commercial production from 2007- 08. • The total production potentiality in the allotted blocks is 23 MMSCMD, which is about 10% of the existing Natural Gas demand. CMM under Indian Mining Scenario Coal Mine Methane and Abandoned Mine Methane • Coal Mine Methane (CMM)/ Abandoned Mine Methane (AMM) also subset of CBM is related to mining activities and as per MOU between MoC and MoP&NG, coal producing companies have right of CBM exploitation in their working mines including pre and post mining operations. -

River Action Plan Damodar

ACTION PLAN FOR REJUVENATION OF DAMODAR RIVER IN JHARKHAND JHARKHAND STATE POLLUTION CONTROL BOARD, DHURWA, RANCHI, JHARKHAND-834004 CONTENT CHAPTER I ❖ BACKGROUND ❖ INTRODUCTION ❖ PHYSIOGRAPHY ❖ WATER RESOURCES & RAINFALL ❖ ANNUAL RAINFALL ❖ DEVIATION OF RAINFALL ❖ SEASONAL RAINFALL ❖ RAINFALL TREND IN RABI SEASON ❖ AVERAGE MOTHLY RAINFALL ❖ MOVING AVERAGE OF THE RAINFALL ❖ EXTREME EVENT ANALYSIS ❖ SURFACE WATER RESOURCES ❖ GROUND WATER RESOURCES ❖ DRAINAGE SYSTEM AND MAPS CHAPTER II DAMODAR RIVER BASIN RIVER COURSE AND MAJOR TRIBUTARIES CHAPTER III- SOCIO-ECONOMIC IMPORTANCE ❖ WATER RESOURCES AND ITS USES ❖ MINING AND INDUSTRIAL ACTIVITIES ❖ NATURAL AND ANTHROPOGENIC HAZARDS ❖ IDENTIFIED STRETCHES FOR REDUCING POLLUTION CHAPTER IV- ACTION PLAN ❖ ACTION PLAN- SHORT TERM AND LONG TERM ACTION AND THE IDENTIFIED AUTHORITIES FOR INITIATING ACTIONS AND THE TIME LIMITS FOR ENSURING COMPLIANCE ❖ SHORT TERM AND LONG TERM ACTION PLANS FOR REJUVENATION OF RIVERS AND THE IMPLEMENTING AGENCIES RESPONSIBLE FOR EXECUTION OF THE ACTION PLANS AND THE TIME LIMITS ARE GIVEN IN TABLE AS BELOW ❖ PROPOSED ACTION PLAN BY VARIOUS DEPARTMENT OF GOVT. OF JHARKHAND ❖ PROPOSED ACTION PLAN FOR RESTORATION OF JHARKHAND RIVERS ❖ ACTION PLAN AT VILLAGE LEVEL ❖ TIMELINES FOR IMPLEMENTATION OF MODEL RESTORATION PLAN in 2019- 2020 and 2020-2021 Chapter-1 JHARKHAND & ITS WATER RESOURCES 1.1 BACKGROUND:-Hon’ble National Green Tribunal passed the following orders in OA No. 673/2018 & M.A. No. 1777/2018 titled News item published in “The Hindu “authored by Shri Jacob Koshy titled “More river stretches are now critically polluted: CPCB on 20.09.2018 as per excerpts below. “The issue taken up for consideration in this matter is abatement of pollution in 351 river stretches in the country, identified as such by the Central Pollution Control Board (CPCB). -

Inner Front.Pmd

BUREAU’S HIGHER SECONDARY (+2) GEOLOGY (PART-II) (Approved by The Council of Higher Secondary Education, Odisha, Bhubaneswar) BOARD OF WRITERS (SECOND EDITION) Dr. Ghanashyam Lenka Dr. Shreerup Goswami Prof. of Geology (Retd.) Professor of Geology Khallikote Autonomous College, Berhampur Sambalpur University, Jyoti Vihar, Burla Dr. Hrushikesh Sahoo Dr. Sudhir Kumar Dash Emeritus Professor of Geology Reader in Geology Utkal University, Vani Vihar, Bhubaneswar Sundargarh Autonomous College, Sundargarh Dr. Rabindra Nath Hota Dr. Nabakishore Sahoo Professor of Geology Reader in Geology Utkal University, Vani Vihar, Bhubaneswar Khallikote Autonomous College, Berhampur Dr. Manoj Kumar Pattanaik Lecturer in Geology Khallikote Autonomous College, Berhampur BOARD OF WRITERS (FIRST EDITION) Dr. Satyananda Acharya Mr. Premananda Ray Prof. of Geology (Retd.) Reader in Geology (Retd.) Utkal University, Vani Vihar, Bhubaneswar Utkal University, Vani Vihar, Bhubaneswar Mr. Anil Kumar Paul Dr. Hrushikesh Sahoo Reader in Geology (Retd.) Professor of Geology Utkal University, Vani Vihar, Bhubaneswar Utkal University, Vani Vihar, Bhubaneswar Dr. Rabindra Nath Hota Reader in Geology, Utkal University, Vani Vihar, Bhubaneswar REVIEWER Dr. Satyananda Acharya Professor of Geology (Retd) Former Vice Chancellor of Utkal University, Vani Vihar, Bhubaneswar Published by THE ODISHA STATE BUREAU OF TEXTBOOK PREPARATION AND PRODUCTION Pustak Bhawan, Bhubaneswar Published by: The Odisha State Bureau of Textbook Preparation and Production, Pustak Bhavan, Bhubaneswar, Odisha, India First Edition - 2011 / 1000 Copies Second Edition - 2017 / 2000 Copies Publication No. - 194 ISBN - 978-81-8005-382-5 @ All rights reserved by the Odisha State Bureau of Textbook Preparation and Production, Pustak Bhavan, Bhubaneswar, Odisha. No part of this publication may be reproduced in any form or by any means without the written permission from the Publisher.