FAQ Bank of North Dakota

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A History of State Debt in North Dakota. Occasional Papers. INSTITUTION North Dakota Univ., Grand Forks

DOCUMENT RESUME ED 289 770 SO 018 400 AUTHOR Escarraz, Donald R. TITLE A History of State Debt in North Dakota. Occasional Papers. INSTITUTION North Dakota Univ., Grand Forks. Bureau of Business and Economic Research. PUB DATE Jun 87 NOTE 82p. PUB TYPE Reports Research/Technical (143) EDRS PRICE MF01/PC04 Plus Postage. DESCRIPTORS *Bond Issues; Credit (Finance); Data Analysis; Economic Factors; *Economic Research; *Expenditures; Fiscal Capacity; Loan Repayment; Regional Characteristics; *State Government; *State History; State Programs; Tables (Data); Taxes IDENTIFIERS *North Dakota ABSTRACT The history of state government debt in North Dakota can be divided into three 30-year periods which should be interpreted in terms of the political, social, and economic conditions of each period. The early statehood period of 1889-1918 began with the use of debt to construct facilities necessary to carry out the normal functions of state government. Although total expenditures increased because of tremendous population growth, per capita expenditures declined significantly. During the second period (1919-1949), population continued to grow but at a decreasing rate. Farmers' organizations were successful in having laws passed to regulate railroads, elevators, mills, and grain dealers. During the Depression years, debt grew, and North Dakota's bond rating was lowered. During World War II, state debt was reduced without undue strain on the taxpayer. The third period (1950-1978) saw prosperity and public construction. Data were analyzed and indicated:(1) regionalization of bond ratings and debt outstanding; (2) differences and similarities among economic variables within the North Central Region of the United States; (3) North Dakota in the North Central Region; and (4) determinants of the amount of state debt outstanding. -

90 Years of Evolution

2009 Annual Report 90 Years of Evolution Our Roots. Your Growth. Our Roots. Your Growth. ev·o·lu·tion (ev-uh-loo-shuhn) n. 1. A gradual process in which something changes into a different and usually more complex or better form. uring the early 1900’s, North Dakota’s economy was based on agriculture. Serious in-state problems prevented cohesiveD efforts in buying and selling crops and financing farm operations. Grain dealers outside the state suppressed grain prices; farm suppliers increased their prices; and interest rates on farm loans climbed. By 1919, popular consensus wanted state ownership and control -BND’s first President, FW Cathro, with bank staff in 1920 of marketing and credit agencies. Thus, the state legislature established Bank of North Dakota (BND) and the North Dakota Mill and Elevator Association. Instead, Bank of North Dakota was created to partner with other financial institutions and assist them in BND was charged with the mission of “promoting agriculture, meeting the needs of the citizens of North Dakota. commerce and industry” in North Dakota. It was never intended for BND to compete with or replace existing banks. Over the years, our fiscal responsibilities to the state have increased dramatically. Today, the Bank operates with more than $270 million in capital. The State of North Dakota began using bank profits in 1945 when money was first transferred into the General Fund. Since that time, capital transfers have become the norm to augment state revenues. Over the past 90 years, farm and secondary market real estate programs were established to benefit state residents and the local financial institutions who serve them. -

North Dakota's Golden Ju&Ilee

uifiGons wesr OFFICIAL! SOUVENTP « • • Q9H NORTH DAKOTA'S GOLDEN JU&ILEE 8 89 NORTH DAKOTA 939 • STATE LIBRARY • Bismarck, N. D. 58505 HI WS&aSm . -" PROCLAMATION OF ADMISSION (Issued by President Harrison, Nov. 2, 1889) WHEREAS, The congress of the United States hundred and eighty-nine, for ratification or rejec did, by an act approved on the twenty-second day tion by the qualified voters of said proposed state, of February, one thousand eight hundred and and that the returns of said election should be eighty-nine provide that the inhabitants of the made to the secretary of the territory of Dakota, territory of Dakota might, upon conditions pre who with the governor and chief justice thereof, scribed by said act, become the states of North or any two of them, should canvass the same, and Dakota and South Dakota, and if a majority of the legal votes cast should be for the constitution, the governor should certify the WHEREAS, It was provided by said act that result to the President of the United States, the area comprising the Territory of Dakota together with a statement of the votes cast should, for the purposes of this act, be divided on thereon, and upon separate articles of propositions the line of the seventh standard parallel produced and a copy of said constitution, articles, proposi due west to the western boundary of said Territory tions and ordinances; and and that the delegates elected as therein provided to the Constitutional Convention in districts WHEREAS, It has been certified to me by the north of said parallel should -

Investing in Our Future: a Comparison Of

INVESTING IN OUR FUTURE: A COMPARISON OF STRATEGIES by EMILY ERICKSON A THESIS Presented to the Department of Political Science and the Robert D. Clark Honors College in partial fulfillment of the requirements for the degree of Bachelor of Arts June 2019 An Abstract of the Thesis of Emily Erickson for the degree of Bachelor of Arts in the Department of Political Science to be taken June 2019 Title: Investing in our Future: A Comparison of Strategies Approved: _______________________________________ Professor Gerald Berk This thesis explores public banking in the United States as an option to strengthen communities, implement investment strategies based on community needs and values, and increase community resilience from unexpected events. It begins with an overview of the various forms banking takes in the United States, their impacts and interrelationships, and a closer look at the single existing example of a public bank in America, the Bank of North Dakota. Following the overview, I will present some of the reasons the private banking industry is failing to meet the public need. Then, I will discuss greater nuances of the Bank of North Dakota and its state impact. From that foundation, I will present two statewide efforts to create public banking legislation, one in Oregon and one in California, and explore some of the difficulties involved with designing the legislation, particularly in light of using the Bank of North Dakota as a public banking model. The third reader of this thesis, PhD Candidate Alberto Lioy, said to me “There is nothing more American than preserving local communities.” Public banking options have significant potential for helping preserve and strengthen those communities. -

2020-Septoct-Community-Banker

INDEPENDENT COMMUNIT Y BANKS OF NORTH DAKOTA C OMMUNITY B ANKER NEWSLETTER Official Newsletter of Independent Community Banks of ND Sep/Oct 2020 Issue Emerging Leaders Development Program Fall Leadership Conference Oct 13-14, 2020 ICBND Office & Holiday Inn, Bismarck The Emerging Leaders Development Program (ELDP) is designed for career-aspiring community bankers who are committed to preserving and enhancing community banking and its philosophies. You do not need to be a member of the ELDP to attend and we encourage all bankers and business professionals to attend if they can. Sep/OctPO Box 2020 6128 Issue ~ Bismarck, ND 58506 ~ e-mail: [email protected] ~ Phone: 701.258.7121The ~Community icbnd.com Banker Together We Prosper Quick Look Inside This Issue: 3 Chairman & Presidents Remarks INDEPENDENT COMMUNITY 4 Flourish Column: Rebeca Romero Rainey, ICBA President and CEO 5 From the Top Column: Noah Wilcox, BANKS OF NORTH DAKOTA Chairman of ICBA 6 Portfolio Management, Jim Reber, PO BOX 6128 President and CEO of ICBA Securities 7 ICBA News: Multiple 8 Innovation Station: Charles Potts, BISMARCK ND 58506-6128 ICBA Sr Vice President, Chief Innovation Officer 9 Leadership at All Levels: Lindsay LaNore, Group Executive Vice 701.285.7121 President of Community Banker University INFO @ ICBND . COM 10 Our Associate Members 11 Main Street Matters: ‘How Community WWW ICBND COM Banks Can Lead in Weathering Natural . Disasters’ by Steven Estep 12-13 ICBA Newswatch: Multiple 14 Office of Attorney General: Judge Rejects Federal Government’s Efforts to -

NORTH DAKOTA HISTORY JOURNAL of the NORTHERN PLAINS Cumulative Index, 1945-1998

NORTH DAKOTA HISTORY JOURNAL OF THE NORTHERN PLAINS Cumulative Index, 1945-1998 Indexed and compiled by Janet Daley and Ann M. Rathke Edited by Janet Daley State Historical Society of North Dakota Bismarck, North Dakota 2000 Back issues of many issues of North Dakota History: Journal of the Northern Plains are available for purchase. Please check our web site: www.state.nd.us/hist or, for current price list, write to: State Historical Society of North Dakota 612 East Boulevard Avenue Bismarck, North Dakota 58505 Daley, Janet (Janet F.) North Dakota history, journal of the Northern Plains : cumulative index, 1945-1998 / indexed and compiled by Janet Daley and Ann M. Rathke ; edited by Janet Daley. - Bismarck, N.D. : State Historical Society of North Dakota, 2000. vii, 105 p. ; 28 cm. ISBN 1-891419-19-6 1. North Dakota-History-Periodicals-Indexes. 2. North Dakota history-Indexes. I. Rathke, Ann M. II. State Historical Society of North Dakota. III. North Dakota history. North Dakota History: Journal of the Northern Plains Cumulative Index, 1945-1998 © 2000 by State Historical Society of North Dakota, Bismarck, North Dakota 58505 All rights reserved. Printed in the United States of America ISBN 1-891419-19-6 Cover design: Brian R. Austin Cover photograph: Francine Fiske (1921-1983) is pictured setting type for the Sioux County Pioneer Arrow. She was the daughter of the well-known photographer and journalist Frank B. Fiske, who ran the paper from 1929 to 1939. From the photo collections of the State Historical Society of North Dakota, Frank Fiske Collection #64. ii Preface The publication of this index, covering the first fifty-four years of the State Historical Society of North Dakota’s quarterly journal, North Dakota History, has been long-awaited by historians, researchers, and interested readers. -

Political Culture on the Northern Plains : North Dakota and the Nonpartisan Experience Thomas P

University of North Dakota UND Scholarly Commons Theses and Dissertations Theses, Dissertations, and Senior Projects 8-1997 Political culture on the northern plains : North Dakota and the Nonpartisan experience Thomas P. Shilts Follow this and additional works at: https://commons.und.edu/theses Part of the Political History Commons, and the United States History Commons Recommended Citation Shilts, Thomas P., "Political culture on the northern plains : North Dakota and the Nonpartisan experience" (1997). Theses and Dissertations. 2533. https://commons.und.edu/theses/2533 This Thesis is brought to you for free and open access by the Theses, Dissertations, and Senior Projects at UND Scholarly Commons. It has been accepted for inclusion in Theses and Dissertations by an authorized administrator of UND Scholarly Commons. For more information, please contact [email protected]. POLITICJ.h., CULTURf. ON THC NORTHERN PLAINS: NORTH DAi\OTA AND THE NONPARTI.SM~ EXPERIENCE by Thomas P. Shilts Bachelor of Art2, ~ak? Superior State College, 1S86 ~aster nf .cieDce in Library ~cicncef Clar:i.on Jniv2r~ity 0f Peri.11sylvania, 1990 A Thesis Submitted to the Grsdua~e ~aculty of L.- Uni vend.ty of Nor.th Dakota in partial fulfillmen~ of the requirements for the degree of ~12stPr of A.r. ts Grand Forks, North Dakota August 1997 This ~hesis, submitted oy Thomas P. Shilts in partial fulfillment of the requirments for the Degr9e of .~"z:s ter of Art;, from t~,.e Uni V8rsi ty of North· Dakot2, has beer. :r-e2..ci by the Faculty Adviso.cy Committee under w.hom the work has bei::.:r. -

The Political Effect of the Ku Klux Klan in North Dakota

University of Nebraska - Lincoln DigitalCommons@University of Nebraska - Lincoln Dissertations, Theses, & Student Research, Department of History History, Department of Winter 12-2-2011 The Political Effect of the Ku Klux Klan in North Dakota Trevor M. Magel University of Nebraska-Lincoln Follow this and additional works at: https://digitalcommons.unl.edu/historydiss Part of the United States History Commons Magel, Trevor M., "The Political Effect of the Ku Klux Klan in North Dakota" (2011). Dissertations, Theses, & Student Research, Department of History. 46. https://digitalcommons.unl.edu/historydiss/46 This Article is brought to you for free and open access by the History, Department of at DigitalCommons@University of Nebraska - Lincoln. It has been accepted for inclusion in Dissertations, Theses, & Student Research, Department of History by an authorized administrator of DigitalCommons@University of Nebraska - Lincoln. The Political Effect of the Ku Klux Klan in North Dakota By Trevor M. Magel A THESIS Presented to the Faculty of The Graduate College at the University of Nebraska In Partial Fulfillment of Requirements For the Degree of Master of Arts Major: History Under the Supervision of Professor Timothy Mahoney Lincoln, Nebraska December, 2011 The Political Effect of the Ku Klux Klan in North Dakota Trevor Matthew Magel, M.A. University of Nebraska, 2011 Advisor: Timothy Mahoney The 1920s was a transitional decade in the political history of the United States. Progressivism did not have the influence it had had in the first couple of decades of the 20th Century but its ideas were still part of the debate. But many other elements became more prominent such as: Americanism, Urbanization, and Nativism. -

Banking on America

BANKING ON AMERICA: HOW MAIN STREET PARTNERSHIP BANKS CAN IMPROVE LOCAL ECONOMIES JASON JUDD HEATHER MCGHEE ABOUT DE¯MOS Dēmos is a non-partisan public policy research and advocacy organization. Headquartered in New York City, Dēmos works with advocates and policymakers around the country in pursuit of four overarching goals: a more equitable economy; a vi- brant and inclusive democracy; an empowered public sector that works for the common good; and responsible U.S. engage- ment in an interdependent world. Dēmos was founded in 2000. In 2010, Dēmos entered into a publishing partnership with "e American Prospect, one of the nation’s premier magazines focusing on policy analysis, investigative journalism, and forward-looking solutions for the nation’s greatest challenges. ACKNOWLEDGEMENTS Jason Judd is President of Cashbox Partners, a Maryland-based small business, former director of SEIU’s banking campaign, and a consultant to Dēmos. Heather McGhee is Washington o"ce Director of Dēmos and co-author of “Six Principles for True Systemic Risk Reform.” Research Assistance by Sarah Babbage, Dēmos. TABLE OF CONTENTS EXECUTIVE SUMMARY 1 INTRODUCTION: LOCAL ECONOMIES NEED LOCAL FUNDING SOLUTIONS 2 A Solution from the Heartland: the Bank of North Dakota Bank of North Dakota Keeps Lending Strong BACKGROUND: HOW HIGH FINANCE HAS FAILED LOCAL ECONOMIES 5 Washington Bets on Big Banks Big Banks Stop Betting on Main Street RESULT: STATES DEMAND MORE LOCAL ECONOMIC CONTROL 6 Partnership Banks Help Small Businesses by Helping Small Banks Partnership Banks Help States Raise Revenue without Raising Taxes Partnership Banks O#er a Potentially Bi-Partisan Solution CONCLUSION 9 ENDNOTES KEY QUESTIONS AND ANSWERS ABOUT PARTNERSHIP BANKS 13 EXECUTIVE SUMMARY Across the country, states are considering proposals to move general revenue deposits out of the Wall Street banks that dominate the banking business today, and use them to capitalize a new local public structure with a mission to grow the lo- cal economy. -

Education, Research, Writing, and Medicine, 1920-1960 in a BROAD PERSPECTIVE the Cultural Development of the United States Was an Extension of That of Europe

Education, Research, Writing, and Medicine 475 CHAPTER 21 Cultural Growth and Adaptation: Education, Research, Writing, and Medicine, 1920-1960 IN A BROAD PERSPECTIVE the cultural development of the United States was an extension of that of Europe. American culture expanded European beginnings in a new setting. In turn, the new setting—the wilderness, free political institutions, relative isolation from Europe, the wealth produced by resources and human energies—influenced American cultural development by shaping the entire complement of social and cultural institutions: churches, schools, colleges, libraries, the search for new knowledge, the production of books and newspapers, and the provision of medical care. Just as the cultural development of America sprang from that of Europe, so, too, did the cultural development of North Dakota derive from that of the United States. North Dakota was influenced by all of the national cultural currents of the 1920’s, the Great Depression, and the postwar years. In the nation, schools improved, high school and college enrollments and 476 History of North Dakota expenditures grew, research and the dissemination of new knowledge expanded, and medicine and the fields of hospital care and public health were revolutionized. North Dakota shared in all of these trends; it looked to the nation for standards, and the national standards stimulated the state’s own achievements. And just as the development of European cultural beginnings in America was shaped by the new setting, so also was the development of American cultural institutions in North Dakota influenced by the North Dakota environment. The sparsely settled country, the rural agricultural economy, the remoteness of the state, the ethnic make-up of the population—these influenced the establishment of schools and colleges, the support for research and the subjects which concerned it, the provision of medical care, and all other cultural activities. -

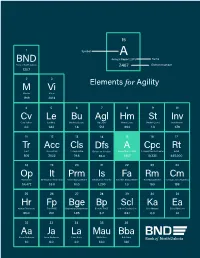

BND M Vi Cv Hm St Inv Tr Acc Cls Dfs Cpc Rt Op It Prm Fa Rm Cm Hr Fp

15 1 Symbol A BND Annual Report 2015 Name Bank of North Dakota 7.407 Element number 130.7 2 3 Elements for Agility M Vi Mission Vision 1919 2014 4 5 6 7 8 9 10 Cv Le Bu Agl Hm St Inv Core Values Lending Business Loans Ag Loans Home Loans Student Loans Investments 4.0 1.84 1.8 514 694 1.3 679 11 12 13 14 15 16 17 Tr Acc Cls Dfs A Cpc Rt Trust Accounting College SAVE Dollars for Scholars Annual Report 2015 College Planning Center Retail 506 7,02 2 19.6 93.0 7.407 10,330 445,000 18 19 20 21 22 23 24 Op It Prm Is Fa Rm Cm Operations Information Technology Project Management Information Security Facilities Management Risk Management Communications/Marketing 54,472 53.0 10.0 1,200 1.3 160 198 25 26 27 28 29 30 31 Hr Fp Bge Bp Scl Ka Ea Human Resources Flex PACE Beginning Entrepreneur Biofuels PACE School Construction Kris Ahmann Erika Albertson 95.0 20.1 1.95 3.2 64.1 6.0 1.0 32 33 34 35 36 Aa Ja La Mau Bba Alison Anderson Jason Anderson Liane Auch Mitch Auer Bob Baier 1.0 6.0 4.0 14.0 14.0 37 38 39 40 41 42 43 Jba Mab Sbe Rb De Jb Trb James Barnhardt Marla Belohlavek Steve Berger Rhiannon Betz Deana Binstock Jane Bjugstad Tracy Boehm 13.0 25.0 3.0 6.0 6.0 12.0 27.0 44 45 46 47 48 49 50 Kb Jbs Sy Bb Cb Mb Jc Kelly Boespflug Janell Bosch Sylvia Brockman Benjamin Brouillette Cynthia Buchanan Melanie Burgard Jonas Carlisle 12.0 17.0 19.0 3.0 10.0 5.0 5.0 51 52 53 54 55 56 57 Lc Mc Mco Sa Dc Anc Crd Lisa Carlson Mercedes Clark Mike Collins Sarah Crutchfield Devin Cunningham Annette Curl Crystal Deringer 2.0 10.0 8.0 5.0 5.0 29.0 25.0 58 59 60 61 -

2018 BND Annual Report

Mission To deliver quality, sound financial services that promote agriculture, commerce and industry in North Dakota. Vision BND is an agile partner that creates financial solutions for current and emerging economic needs. Core Values Our core values of service, teamwork, ethics and people-centered allow us to excel and deliver while accomplishing more together by doing the right thing and setting ourselves apart. Culture Initiative By creating a coaching culture, we will inspire curiosity, empower individuals and identify opportunities to collaborate. President’s Message In 1919, the 16th Assembly of the North Dakota Legislature started Bank of North Dakota (BND) with a $2 million bond sale. As we close out 2018 and enter our 100th year, we are being asked how we’ve gotten to this point. How have we survived, and ultimately thrived, as the only state-owned bank in the country? A bank needs to provide a return on investment for its stakeholders. BND’s investors are the citizens of North Dakota. Each of them has a stake in this unique and progressive institution that affects their lives daily. Taxes are lower because the Bank’s profits are returned to the general fund under the direction of the Legislature. Profits support infrastructure needs and disaster relief. Businesses begin and expand. Residents save for college with College SAVE, then attend college and refinance afterward with our student loan program. Farmers and ranchers start value-added businesses and sell their farms to the next generation. To ensure our programs are agile and meet the needs of North Dakota residents, meetings are held across the state with legislators, economic developers, bankers, business owners, higher education officials and other stakeholders.