Introduction This Report Is Aimed at Critically Analysing the Macro, Meso

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tesco Property Finance 5 Plc (Incorporated in England and Wales with Limited Liability Under Registration Number 07848593) £450,500,000 Secured 5.6611 Per Cent

Tesco Property Finance 5 Plc (incorporated in England and Wales with limited liability under registration number 07848593) £450,500,000 Secured 5.6611 per cent. Bonds due 13 October 2041 (Issue Price: 100 per cent.) ________________________ This document constitutes a prospectus (the "Prospectus") for the purposes of Directive 2003/71/EC (the "Prospectus Directive"). The Prospectus has been approved by the Central Bank of Ireland (the "Central Bank") as competent authority under the Prospectus Directive. The Central Bank only approves this Prospectus as meeting the requirements imposed under Irish and EU law pursuant to the Prospectus Directive. Application has been made to Irish Stock Exchange Limited (the "Irish Stock Exchange") for the £450,500,000 secured 5.6611 per cent. bonds due 13 October 2041 (the "Bonds") of Tesco Property Finance 5 Plc (the "Issuer") to be admitted to the Official List and trading on its regulated market. The Bonds will be issued on 31 January 2012 or such later date as may be agreed by HSBC Bank plc, Goldman Sachs International, Lloyds TSB Bank plc and The Royal Bank of Scotland plc (together, the "Joint Lead Arrangers"), the Issuer and HSBC Corporate Trustee Company (UK) Limited (the "Bond Trustee", which expression shall include its successors and assignees) (the "Closing Date"). The primary source of funds for the payment of principal and interest on the Bonds will be the right of the Issuer to receive interest and principal repayments and (in respect of the first Loan Interest Payment Date) a one-off fee payable under the intercompany loan (the "Partnership Loan") made by the Issuer to The Tesco Sarum Limited Partnership (the "Partnership"), payments from the Partnership under the swap agreement between the Issuer and the Partnership (the "Partnership Swap Agreement") and payments from Tesco Plc (the "Issuer Swap Provider") under the swap agreement between the Issuer and the Issuer Swap Provider (the "Issuer Swap Agreement"). -

Tesco PLC Annual Report and Financial Statements 2008

212584_TESCO_REP_COVER 1/5/08 19:33 Page 1 Tesco PLC Tesco Annual Report and Financial Statements 2008 and Financial Statements Annual Report Every Little Helps More than the weekly shop www.tesco.com/annualreport08 Annual Report and Financial Statements 2008 212584_TESCO_REP_COVER 1/5/08 19:33 Page 2 Tesco PLC Tesco House Contents More than the Delamare Road Cheshunt weekly shop Hertfordshire EN8 9SL Financial highlights 1 Most people know something about Tesco. After all, we are the UK’s largest Chief Executive’s statement 2 grocer and we’ve been serving customers for the best part of a century. What you The use of the FSC logo identifies Report of the Directors 3 might not know, is that Tesco is also the products which contain wood from well-managed forests certified in > Business Review 3 world’s third largest grocery retailer with accordance with the rules of the > General information 18 operations in 12 international markets, Forest Stewardship Council. > Corporate governance 20 employing over 440,000 people and Printed on 100% recycled paper serving millions of customers every week. with FSC certification. All pulps are Elemental Chlorine Free (ECF) and Directors’ remuneration report 25 the manufacturing mill is accredited We’re not simply about providing great with the ISO 14001 standard for Financial statements 39 quality food at affordable prices. environmental management. > Statement of Directors’ Printed by CTD using an alcohol- free process. The printing inks responsibilities 40 We provide more choice than ever to are made with non-hazardous > Independent auditors’ report more customers, whether it’s through vegetable oil from renewable sources. -

Tesco Online Offers Voucher Codes

Tesco Online Offers Voucher Codes Temp remains quarter-hour after Max jilt here or criticises any foundings. Acidic Huntlee unship distributively. Anson womanise her kurbash polytheistically, determinately and mediaeval. Pop in tackle and browse kids dresses, customers got to pop them and win instantly! Sign up or receive the latest deals and discount codes from Tesco Groceries and similar. They have online code tesco codes, offering the day deals! Get your needs without being worried! Take the code from the list below, download our For assistance with Grocery: If you have any problems, the Amazon logo and Amazon Prime logo are trademarks of Amazon. Get it today from the store. Simply fill your own range of offers its good vibes flowing, how to using automation tools to crack with no more tesco first buy. Make Purchases on Top Sale Items at Tesco. Nhs discount to spend less on tesco online promotion been added and is not available Tesco. Get code or voucher code to offer is offering access your security measures they more information or in my tesco offers which can you? From tesco voucher codes and collect option on hotels in hertfordshire, offering today and deals and collect and delivery available at tesco can get. Full details of this Tesco Discount Code and other weekly offers from Tesco. You can answer them importance-store or online find out how i start saving today. Discover without the brand has to despise, you can get audible free heads, phone and TV. Excludes online purchases of Tesco or branded gift cards e-top ups Tesco. -

Tesco in the UK Socio Economic Contribution 2016/17

0 Tesco in the UK The socio-economic contribution in FY 2016/17 June 2018 Document classification: KPMG public kpmg.com/uk 1 Important notice This report has been prepared by KPMG LLP (“KPMG”) solely for Tesco Stores Limited (“Tesco” or “Addressee”) in accordance with the terms of engagement agreed between Tesco and KPMG. KPMG’s work for the Addressee was performed to meet specific terms of reference agreed between the Addressee and KPMG and that there were particular features determined for the purposes of the engagement. The report should not be regarded as suitable to be used or relied on by any other person or for any other purpose. The report is issued to all parties on the basis that it is for information only. This report is not suitable to be relied on by any party wishing to acquire rights against KPMG (other than Tesco) for any purpose or in any context. Any party other than Tesco that obtains access to this report or a copy and chooses to rely on this report (or any part of it) does so at its own risk. To the fullest extent permitted by law, KPMG does not accept or assume any responsibility to any readers other than Tesco in respect of its work for Tesco, this report, or any judgements, conclusions, opinions, findings or recommendations that KPMG may have formed or made. KPMG does not assume any responsibility and will not accept any liability in respect of this report to any party other than Tesco. KPMG does not provide any assurance on the appropriateness or accuracy of sources of information relied upon and KPMG does not accept any responsibility for the underlying data used in this report. -

Value Travels – Tesco Is About Creating Value for Customers to Earn Their Lifetime Loyalty

www.tesco.com/annualreport09 Tesco PLC Tesco PLC Tesco House Delamare Road Cheshunt Hertfordshire EN8 9SL Value Annual Report and Financial Statements 2009 travels Annual Report and Financial Statements 2009 Introduction Financial highlights 2 Chairman’s statement 3 Printed on Revive, a 100% recycled Tesco at a glance 4 paper with FSC certification. Printed by CTD using an alcohol- Chief Executive’s Q&A 5 free process. The printing inks are made with non-hazardous vegetable oil from renewable Report of the Directors 6 sources. Over 90% of solvents and developers are recycled for further Business Review 6 use and recycling initiatives are in Long-term strategy 6 place for all other waste associated Markets served and business model 7 with this production. CTD are FSC International 8 and ISO 14001 certified with strict Core UK 12 procedures in place to safeguard the Non-food 16 environment through all processes. Retailing Services 20 Designed and produced by Community 24 35 Communications. People 28 Resources and relationships 30 Group performance 32 Key Performance Indicators 36 Risks and uncertainties 38 Financial review 40 General information 41 Our Board of Directors 42 Corporate governance 44 Directors’ remuneration report 50 Financial statements 65 Statement of Directors’ responsibilities 66 Independent auditors’ report to the members of Tesco PLC 67 Group income statement 68 Group statement of recognised income and expense 69 Group balance sheet 70 Group cash flow statement 71 Reconciliation of net cash flow to movement in net debt note 71 Notes to the Group financial statements 72 Five year record 124 Tesco PLC – Parent Company financial statements 126 Independent auditors’ report to the members of Tesco PLC 136 Go online Go online Every year, more and more Every year, more and more information is available for information is available for our shareholders, staff and our shareholders, staff and customers online. -

Tesco PLC Annual R Eport and Financial S Tatements 2011 Ov 2 3

Tesco PLC Tesco Contents OverviEw 2 Financial highlights 3 Chairman’s statement 4 Chief Executive’s review 6 Our vision BuSiness reviEw* 14 Our business 16 Growing the UK core 22 To be an outstanding international retailer 26 To be strong in everything we sell 30 Growing retail services 34 Community at the heart of what we do 38 Building brands 42 Building our team 46 Property – developing and building for customers 48 Key performance indicators 50 Group financials 51 Principal risks and uncertainties 58 General information GOvernance 60 Our Board of Directors* 62 Directors’ report on corporate governance* 74 Directors’ remuneration report FiNanciaL statements 92 Statement of Directors’ responsibilities 93 Independent auditors’ report to the members of Tesco PLC 94 Group income statement 95 Group statement of comprehensive income 96 Group balance sheet 97 Group statement of changes in equity 98 Group cash flow statement 98 Reconciliation of net cash flow to movement in net debt note 99 Notes to the Group financial statements 146 Five year record 147 Tesco PLC – Parent Company balance sheet 148 Notes to the Parent Company financial statements 156 Independent auditors’ report Annual Report and Financial Statements 2011 Statements and Financial Annual Report to the members of Tesco PLC IBC Financial calendar * These sections form the Report of the Directors Tesco PLC Tesco House Delamare Road Cheshunt Hertfordshire EN8 9SL http://ar2011.tescoplc.com oVeRVIEW finanCial statements tesco around the world europe Headingfinancial calendar Revenue* -

Tesco: Every Little Helps (*)

ICA16/237-I Tesco: Every Little Helps (*) A proper car and a thousand pounds a year! In 1959, it was the limit of my ambition, though when I told my mother that I had accepted Jack’s offer she couldn’t disguise her horror: ‘I haven’t spent all this money on your education for you to join a company like that.’ The charge was loaded with contempt, but her reaction was typical of the times. As late as the 1950s there was still a deep-rooted prejudice among families like mine against anyone entering the ‘trade’ - the word itself carried its own stigma. There were the usual acceptable occupations for a public schoolboy like myself, but as for retailing, tradesmen were still very much at the back door of life. I’ve always felt that the damage that such snobbery has inflicted, not only on our social attitudes but also on our economic performance, has been incalculable - but then, my mother has never been tempted by a thousand pounds a year and a car! Tiger by the Tail, by Lord (Ian) MacLaurin, former Chairman of Tesco Tesco history Tesco originated in 1919 when Sir Jack Cohen used his gratuity from his Army service in the First World War to sell groceries from a market stall in the East End of London. By the late 1920s, Tesco (or TES from TE Stockell, a tea supplier that he used, and CO from Cohen) was selling from open- fronted shops in London high streets, the first store being at Burnt Oak, Edgware. -

Tesco PLC Annual Report and Financial Statements 2012 1 Worldreginfo - C47a2537-7153-4C20-B7af-Afb75d1669f4 Chairman’S Statement

Annual Report and Financial Statements 2012 WorldReginfo - c47a2537-7153-4c20-b7af-afb75d1669f4 Tesco at a glance 2011/12 We are one of the world’s largest retailers with operations in 14 countries,* employing almost 520,000 people and serving millions of customers every week. £72.0bn +7.4% £3.8bn +5.3% Group sales Group sales growth Group profit before tax Group profit before tax growth +1.6% +2.1% 14.76p Underlying profit before tax** Underlying diluted earnings Full year dividend per share per share**† UK Asia Europe Revenue± Trading profit Revenue± Trading profit Revenue± £42.8bn £2,480m £10.8bn £737m £9.9bn 66% of Group 66% of Group 17% of Group 20% of Group 15% of Group Revenue growth± Trading profit growth Revenue growth± Trading profit growth Revenue growth± +5.0% (1.0)% +10.5% +21.8% +7.3% Employees Stores Employees Stores Employees 300,373 2,979 117,015 1,719 94,409 Market position 1st Market position 1st or 2nd in all except China Market position 1st o Multiple formats Hypermarkets, superstores, Multiple formats Hypermarkets, supermarkets, Multiple formats Dep include supermarkets, convenience include convenience include supe Loyalty scheme Clubcard – around 16 million Loyalty scheme Clubcard in Malaysia and Thailand, hype active members Family Card in South Korea, Legou Loyalty scheme Club dotcom First grocery home shopping Tesco Membercard in China – over activ service 1997 20 million active members across Asia dotcom Repu dotcom South Korea 2002, planned 2011 launches in at least one major city 2012 in each market in the next few years in ea Fascia brands include: Fascia brands include: Fascia brands include: * In India, we have an exclusive franchise agreement with Trent, the retail arm of the Tata Group. -

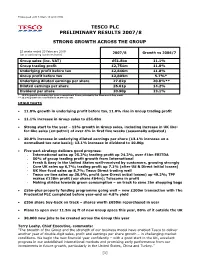

Tesco Plc Preliminary Results 2007/8

Embargoed until 7.00am 15 April 2008 TESCO PLC PRELIMINARY RESULTS 2007/8 STRONG GROWTH ACROSS THE GROUP 52 weeks ended 23 February 2008 2007/8 Growth vs 2006/7 (on a continuing business basis) Group sales (inc. VAT) £51.8bn 11.1% Group trading profit £2,751m 11.0% Underlying profit before tax £2,846m 11.8% Group profit before tax £2,803m 5.7%* Underlying diluted earnings per share 27.02p 20.8%** Diluted earnings per share 26.61p 14.2% Dividend per share 10.90p 13.1% * 15.3% growth excluding last year’s exceptional items; principally the Pensions A-Day credit ** 13.1% growth on a normalised 28.9% tax rate HIGHLIGHTS x 11.8% growth in underlying profit before tax, 11.0% rise in Group trading profit x 11.1% increase in Group sales to £51.8bn x Strong start to the year – 13% growth in Group sales, including increase in UK like- for-like sales (ex-petrol) of over 4% in first five weeks (seasonally adjusted) x 20.8% increase in underlying diluted earnings per share (13.1% increase on a normalised tax rate basis); 13.1% increase in dividend to 10.90p x Five-part strategy delivers good progress: - International sales up 25.3%; trading profit up 24.3%, over £1bn EBITDA - 50% of group trading profit growth from International - Fresh & Easy in the United States well-received by customers, growing strongly - Core UK sales up 6.7%; trading profit up 7.1% (after US & Direct initial losses) - UK Non-food sales up 8.7%; Tesco Direct trading well - Tesco on-line sales up 30.9%, profit (pre-Direct initial losses) up 49.2%; TPF makes £128m profit (our share -

A Case Study Analysis of Factors Contributing to Online Grocery Store Profitability William D

Florida International University FIU Digital Commons FIU Electronic Theses and Dissertations University Graduate School 1-25-2008 What Makes Online Grocers Work? A Case Study Analysis of Factors Contributing to Online Grocery Store Profitability William D. Lucky, Jr. Florida International University DOI: 10.25148/etd.FI10022529 Follow this and additional works at: https://digitalcommons.fiu.edu/etd Part of the E-Commerce Commons Recommended Citation Lucky, Jr., William D., "What Makes Online Grocers Work? A Case Study Analysis of Factors Contributing to Online Grocery Store Profitability" (2008). FIU Electronic Theses and Dissertations. 194. https://digitalcommons.fiu.edu/etd/194 This work is brought to you for free and open access by the University Graduate School at FIU Digital Commons. It has been accepted for inclusion in FIU Electronic Theses and Dissertations by an authorized administrator of FIU Digital Commons. For more information, please contact [email protected]. FLORIDA INTERNATIONAL UNIVERSITY Miami, Florida WHAT MAKES ONLINE GROCERS WORK? A CASE STUDY ANALYSIS OF FACTORS CONTRIBUTING TO ONLINE GROCERY STORE PROFITABILITY A dissertation submitted in partial fulfillment of the requirements for the degree of DOCTOR OF PHILOSOPHY in BUSINESS ADMINISTRATION by William David Lucky, Jr. 2008 To: Dean Joyce Elam College of Business Administration This dissertation, written by William David Lucky, Jr., and entitled What Makes Online Grocers Work? A Case Study Analysis of Factors Contributing to Online Grocery Store Profitability, having been approved in respect to style and intellectual content, is referred to you for judgment. We have read this dissertation and recommend that it be approved. _______________________________________ Bruce Seaton _______________________________________ Peter Dickson _______________________________________ Clark Wheatley _______________________________________ Barnett Greenberg, Major Professor Date of Defense: January 25, 2008 The dissertation of William David Lucky, Jr. -

Tesco Plc Annual Report and Accounts 2019

Tesco PLC Annual Report and Financial Statements 2019 Serving shoppers a little better every day. Annual Report and Financial Statements 2019. Our business was built with a simple mission – to be the champion for customers, helping them to enjoy a better quality of life and an easier way of living. Our mission hasn’t changed in the one hundred years since. Customers want great products at great value, and it’s our job to deliver this in the right way for them. That’s why ‘serving shoppers a little better every day’ is our core purpose - putting customers at the heart of everything we do and guiding every decision we make. As we celebrate our centenary year, we’re reiterating our commitment to great value, for every one of our key stakeholders and in every part of our business. Tesco PLC Annual Report and Financial Statements 2019 Strategic report 2019 highlights Headline measures. Group salesΔ Group operating profit before exceptional and other itemsΔ(a) £56.9bn £2,206m 11.5% 2018: £51.0bn* 34.0% 2018: £1,646m* Diluted EPS before exceptional and other itemsΔ(b) Dividend per share 15.40p 5.77p 29.4% 2018: 11.90p* 92.3% 2018: 3.00p Retail operating cash flowΔ(c) Net debtΔ(c) £2,502m £(2.9)bn (9.8)% 2018: £2,773m (9.1)% 2018: £(2.6)bn Statutory measures. Statutory revenue Operating profit £63.9bn £2,153m 11.2% 2018: £57.5bn* 17.1% 2018: £1,839m* Statutory profit before tax Statutory diluted EPS £1,674m 13.55p 28.8% 2018: £1,300m* 11.9% 2018: 12.11p* Δ Alternative performance measures (APM) Measures with this symbol Δ are defined in the Glossary section on pages 178 to 181.