Cold Lake Oil Sands Area, Comprehensive Regional

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Comparison of CSS and SAGD in Cold Lake

University of Calgary PRISM: University of Calgary's Digital Repository Graduate Studies The Vault: Electronic Theses and Dissertations 2015-05-04 Comparison of CSS and SAGD in Cold Lake Shayganpour, Farshid Shayganpour, F. (2015). Comparison of CSS and SAGD in Cold Lake (Unpublished master's thesis). University of Calgary, Calgary, AB. doi:10.11575/PRISM/25374 http://hdl.handle.net/11023/2240 master thesis University of Calgary graduate students retain copyright ownership and moral rights for their thesis. You may use this material in any way that is permitted by the Copyright Act or through licensing that has been assigned to the document. For uses that are not allowable under copyright legislation or licensing, you are required to seek permission. Downloaded from PRISM: https://prism.ucalgary.ca UNIVERSITY OF CALGARY Comparison of CSS and SAGD in Cold Lake By Farshid Shayganpour A THESIS SUBMITTED TO THE FACULTY OF GRADUATE STUDIES IN PARTIAL FULFILMENT OF THE REQUIREMENTS FOR THE DEGREE OF MASTERS OF ENGINEERING DEPARTMENT OF CHEMICAL & PETROLEUM ENGINEERING CALGARY, ALBERTA APRIL, 2015 © Farshid Shayganpour, 2015 ABSTRACT Several methods are being used to recover buried heavy oil or bitumen deposits within oil- sands reservoirs. Cyclic Steam Stimulation (CSS) has been a commercial recovery process since the mid 1980’s in the Cold Lake area in northeast Alberta. Also, Several Steam-Assisted Gravity Drainage (SAGD) projects are in operation in different types of reservoirs in the Cold Lake area. There is a debate over whether CSS is more efficient in the Cold Lake reservoirs or SAGD. It is very important for producers to know broadly about the performance and efficiency of the oil recovery process. -

Heavy Oil Vent Mitigation Options - 2015”

Environment Canada Environmental Stewardship Branch “Heavy Oil Vent Mitigation Options - 2015” Conducted by: New Paradigm Engineering Ltd. Prepared by: Bruce Peachey, FEIC, FCIC, P.Eng. New Paradigm Engineering Ltd Ph: (780) 448-9195 E-mail: [email protected] Second Edition (Draft) April 30, 2015 Acknowledgements and Disclaimer Acknowledgements The author would like to acknowledge funding provided by Environment Canada, Environmental Stewardship Branch, and the support of a wide range of equipment vendors, producers and other organizations whose staff have contributed to direction, content or comments. This second edition is an upgrade to the initial report for Environment Canada and reflects additional work and content developed by New Paradigm Engineering Ltd. Our intent is to continue to provide in-kind updates, as necessary to keep information current and to reflect any additional information we are made aware of. Disclaimers This document summarizes work done under this contract in support of Environment Canada’s efforts to understand the potential sources of methane venting from primary, or cold, heavy oil operations in Western Canada and the potential mitigation options and barriers to mitigation to reduce those emissions. Any specific technologies, or applications, discussed or referred to, are intended as examples of potential solutions or solution areas, and have not been assessed in detail, or endorsed as to their technical or economic viability. Suggestions made as recommendations for next steps, or follow-up actions are based on the authors’ learnings during the project, but are not intended as specific input to any government policy or actions, which might be considered in crafting future emissions policies. -

Canada's Oil Sands and Heavy Oil Deposits

14 APPENDED DOCUMENTS 14.1 Appendix 1: CANADA'S OIL SANDS AND HEAVY OIL DEPOSITS Vast deposits of viscous bitumen (~350 x 109m3 oil) exist in Alberta and Saskatchewan. These deposits contain enough oil that if only 30% of it were extracted, it could supply the entire needs of North America (United States and Canada) for over 100 years at current consumption levels. The deposits represent "plentiful" oil, but until recently it has not been "cheap" oil. It requires technologically intensive activity and the input of significant amounts of energy to exploit it. Recent developments in technology (horizontal drilling, gravity drainage, unheated simultaneous production of oil and sand, see attached note) have opened the possibility of highly efficient extraction of oil sands at moderate operating cost. For example, the average operating costs for a barrel of heavy oil was CAN$10- 12 in 1989; it was CAN$5-6 in 1996, without correcting for any inflation. This triggered a “mini-boom” in heavy oil development in Alberta and Saskatchewan until the price crash of 1997-1998. However, reasonable prices have triggered more interest in the period 2000-2001, and heavy oil and oil sands development is accelerating. At present, heavy oil production is limited by a restricted refining capacity (upgraders designed specially for the viscous, high sulfur, high heavy metal content crude oil), not by our ability to produce it in the field. Currently (2002), nearly 50% of Canada's oil production comes from the oil sands and the heavy oil producing, high porosity sandstone reservoirs which lie along the Alberta-Saskatchewan border. -

High Resolution Monitoring and Modeling of Steam Injection in the Athabasca Oil Sands at UTF: a Case Study

High Resolution Monitoring and Modeling of Steam Injection in the Athabasca Oil Sands at UTF: A Case Study Evan Bianco* University of Alberta, Edmonton, AB [email protected] and Douglas Schmitt University of Alberta, Edmonton, AB, Canada Summary This case study explores rock physical properties of heavy oil reservoirs subject to the Steam Assisted Gravity Drainage (SAGD) thermal enhanced recovery process. Previously published measurements [e.g. Wang et. al, 1990, and Eastwood, 1993] of the temperature dependant properties of heavy oil saturated sands are extended by fluid substitutional modeling and wireline data in order to assess the effects of pore fluid composition, pressure and temperature changes on the seismic velocities of unconsolidated sands. Rock physics modeling is applied to the shallow McMurray reservoir (135-160m depth) encountered by the Underground Test Facility (UTF) within the bituminous Athabasca oil sands deposit in order to construct a petrophysical velocity model of the SAGD process. Although the injected steam pressure and temperature controls the fluid bulk moduli within the pore space, the stress dependant elastic frame modulus is the most poorly known yet most important factor governing the changes of seismic properties during this recovery operation. The results of the fluid substitution are used to construct a 2-D synthetic seismic section in order to establish seismic attributes for analysis and interpretation of the physical SAGD process. The findings of this modeling promote a more complete description of 11 high resolution time lapse 2-D seismic profiles collected at the UTF. This work presented is intended to provide an overview of the U of A’s geophysical involvement with the UTF project. -

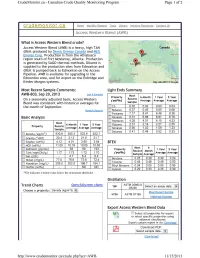

Crudemonitor.Ca - Canadian Crude Quality Monitoring Program Page 1 of 2

CrudeMonitor.ca - Canadian Crude Quality Monitoring Program Page 1 of 2 crudemonitor.ca Home Monthly Reports Tools Library Industry Resources Contact Us Access Western Blend (AWB) What is Access Western Blend crude? Access Western Blend (AWB) is a heavy, high TAN Canada dilbit produced by Devon Energy Canada and MEG Liberia Energy Corp. Production is from the Athabasca ManiTol region south of Fort McMurray, Alberta. Production sh (*) is generated by SAGD thermal methods. Diluent is ):;n Erfmynren Ssskalchewan supplied to the production sites from Edmonton and dilbit is pumped back to Edmonton on the Access Pipeline. AWB is available for upgrading in the Calgary Edmonton area, and for export on the Enbridge and Winnipf Kinder Morgan systems. Map data ©2013 Google Most Recent Sample Comments: Light Ends Summary Last 6 Samples AWB-803, Sep 20, 2013 Most Property 6 Month 1 Year 5 Year Recent On a seasonally adjusted basis, Access Western ( vol% ) Average Average Average Blend was consistent with historical averages for Sample the month of September. • C3- 0.02 0.02 0.03 0.03 Monthly Reports Butanes 0.37 0.45 0.55 0.68 Pentanes 7.17 8.47 8.48 8.38 Basic Analysis Hexanes 6.31 6.68 6.81 6.78 Heptanes 4.28 4.01 4.15 4.33 Most 6 Month 1 Year 5 Year Octanes 2.31 2.18 2.27 2.55 Property Recent Average Average Average No nanes 0.90 1.02 1.09 1.23 Sample canes 0.41 0.48 0.52 0.53 P Density (kg/m3) 930.8 925.3 923.6 922.7 Gravity (oAPI) 20.4 21.3 21.6 21.7 Sulphur ( wt%) 4.12 4.01 3.95 3.94 BTEX ITMCR (wt%) 11.00 10.79 10.65 10.65 Most 6 Sediment (ppmw) 94 89 193 Property 1 Year 5 Year Recent Month TAN (mgKOH/g) 1.77 1.73 1.72 1.70 (vol%) Average Average Sample Average Salt (ptb) 4.7 6.4 6.4 Benzene 0.25 0.28 0.30 0.29 Nickel (mg/L) 77.0 76.6 73.8 72.4 Toluene 0.44 0.46 0.49 0.50 Vanadium (mg/L) 206.0 202.0 196.7 194.1 Ethyl Benzene 0.04 0.05 0.05 0.06 Olefins (wt%) ND ND T=T Xylenes 0.29 0.33 0.35 0.39 *N1) indicates a tested value below the instrument threshold. -

Comparison of the Corrosivity of Dilbit and Conventional Crude

Alberta Alberta Innovates Innovates Idf Technology ~ Energyand \Ill Futures tm Environment Solutions ' Comparison of the Corrosivity of Dilbit and Conventional Crude Prepared for: Dr. John Zhou Alberta Innovates Energy and Environment Solutions Prepared by: Jenny Been, PEng, Ph.D., PMP Corrosion Engineering, Advanced Materials, AITF Reviewed by: John Wolodko, PEng, Ph.D. Advanced Materials, AITF Copyright© 2011 September 2011 Alberta Innovates - Technology Futures 2480002 EXHIBIT I I NOTICE 1. This Report was prepared as an account of work conducted at the Albe1ta Innovates Technology Futures ("AITF") on behalf of Alberta Innovates Energy and Environment Solutions ("AIEES"). All reasonable effo1ts were made to ensure that the work conforms to accepted scientific, engineering and environmental practices, but AITF makes no other representation and gives no other warranty with respect to the reliability, accuracy, validity or fitness of the information, analysis and conclusions contained in this Report. Any and all implied or statutory warranties of merchantability or fitness for any purpose are expressly excluded. AIEES acknowledges that any use or interpretation of the information, analysis or conclusions contained in this Report is at its own risk. Reference herein to any specified commercial product, process or service by trade-name, trademark, manufacturer or otherwise does not constitute or imply an endorsement or recommendation by AITF. 2. Any authorized copy of this Repo1i distributed to a third party shall include an aclrnowledgement that the Repo1t was prepared by AITF and shall give appropriate credit to AITF and the authors of the Report. 3. Copyright AITF 2011. All rights reserved. Comparison of the Corrosivity of Dilbit and Conventional Crude ii CONFIDENTIAL EXECUTIVE SUMMARY Pipeline expansions for the transportation of Canadian crude to refining markets in the United States are currently under regulatory review. -

0162002113593 Alberta Oil Sands Corridor Study

0162002113593 Alberta Oil Sands Corridor Study McMurray Volume 1 Report-Part 2 Corridor Development Plan oed for by Alberta Oil Sands rAta Corridor Study Group IRONMENT ~74 edmonton, alberta ALBERTA OIL SANDS CORRIDOR STUDY VOLUME 1 REPORT, PART 2 CORRIDOR DEVELOPMENT PLAN Prepared for: By: Alberta Alberta Oil Sands Environment Corridor Study Group June, 1974 Edmonton, Alberta SUMMARY ALBERTA OIL SANDS CORRIDOR STUDY CORRIDOR DEVELOPMENT PLAN In this plan a transportation corridor connects the oil sands resources of the Athabasca area to a new major provin cial terminal which serves as a central hub for additional corridors radiating out to existing and future industrial facilities and extra-provincial terminals. The placement of these corridors and industrial facilities meets the loca tion parameters agreed upon by the study group. The new corridor components are pipelines, power trans mission lines and a relatively short railway spur line in the vicinity of the terminal. Where possible the corridors are integrated with existing pipelines, highways and rail ways. The Corridor Concept is applicable. "Alberta Skaro Terminal" is the provisional name used in this report for the major provincial terminal. The pur pose of this terminal is to receive, measure, pass-through, transfer, or direct liquid hydrocarbons by pipe~ine, railway or truck between petrochemical complexes, refineries, extra provincial terminals and the mineral source. An additional possible future terminal is indicated in the Hardisty area which will probably be interconnected with the system some time in the future. The plan envisions several major petrochemical complexes and refinery sites to be developed easterly along the south side of the North Saskatchewan River. -

Technologies, Markets and Challenges for Development of the Canadian Oil Sands Industry

Technologies, Markets and Challenges for Development of the Canadian Oil Sands Industry by Romain H. Lacombe and John E. Parsons 07-006 June 2007 Technologies, Markets and Challenges for Development of the Canadian Oil Sands Industry Romain H. Lacombe* and John E. Parsons** June 2007 This paper provides an overview of the current status of development of the Canadian oil sands industry, and considers possible paths of further development. We outline the key technology alternatives, critical resource inputs and environmental challenges and strategic options both at the company and government level. We develop a model to calculate the supply cost of bitumen and synthetic crude oil using the key technologies. Using the model we evaluate the sensitivity of the supply costs to the critical model inputs. * Technology and Policy Program, MIT, E40-442, 77 Massachusetts Ave., Cambridge, MA 02139 USA, E-mail: [email protected] ** Center for Energy and Environmental Policy Research, MIT, E40-435, 77 Massachusetts Ave., Cambridge, MA 02139 USA, E-mail: [email protected] This research was supported by a grant from BP Technologies Ventures Inc. for research on “Conversion of High-C/Low Value Feedstock into Fuels and Electricity: Exploring Technological Opportunities and How These Could Impact the Market.” 1. INTRODUCTION The Canadian oil sands resource has been under development since 1967 when the mining and upgrading operations of the Great Canadian Oil Sands project (now Suncor Energy Inc.) started in the Fort McMurray region of Alberta. For many decades the resource remained promising but inconsequential. Spurred by the recent increase in the world price of oil, the industry has begun to expand rapidly. -

Canada Oil Sands Opportunities and Challenges to 2015: an Update

OppCanada'sOrtunities and Challenges Oil tO 2015:Sands an update An EnErgy MArkEt AssEssMEnt JUnE 2006 Permission to Reproduce Materials may be reproduced for personal, educational and/or non-profit activities, in part or in whole and by any means, without charge or further permission from the National Energy Board, provided that due diligence is exercised in ensuring the accuracy of the information reproduced; that the National Energy Board is identified as the source institution; and that the reproduction is not represented as an official version of the information reproduced, nor as having been made in affiliation with, or with the endorsement of the National Energy Board. For permission to reproduce the information in this publication for commercial redistribution, please e-mail: [email protected] Autorisation de reproduction Le contenu de cette publication peut être reproduit à des fins personnelles, éducatives et(ou) sans but lucratif, en tout ou en partie et par quelque moyen que ce soit, sans frais et sans autre permission de l’Office national de l’énergie, pourvu qu’une diligence raisonnable soit exercée afin d’assurer l’exactitude de l’information reproduite, que l’Office national de l’énergie soit mentionné comme organisme source et que la reproduction ne soit présentée ni comme une version officielle ni comme une copie ayant été faite en collaboration avec l’Office national de l’énergie ou avec son consentement. Pour obtenir l’autorisation de reproduire l’information contenue dans cette publication à des fins commerciales, faire parvenir un courriel à : [email protected] © Her Majesty the Queen in Right of Canada as © Sa Majesté la Reine du chef du Canada représentée par represented by the National Energy Board 2006 l’Office national de l’énergie 2006 Cat. -

Imperial Oil Resources Limited (“IOR”) Cold Lake Midzaghe Project (The “Project”) Located Within Cold Lake First Nations Traditional Territory, Treaty No

C O L D L A K E F I R S T N ATIONS C ONSULTATION DEPARTME NT P.O. BOX 389 COLD LAKE, ALBERTA T9M 1P1 PHONE: (780) 594-7183 EXT. 229 [email protected] October 16, 2015 RTS 595 Sent via e-mail: [email protected] Manager, Environmental Assessment Authorizations Branch, Alberta Energy Regulator Suite 1000, 250 – 5th Street SW Calgary, Alberta T2P 0R4 Dear Sirs: Re: Written Comments on Proposed Terms of Reference (“PTOR”) for Imperial Oil Resources Limited (“IOR”) Cold Lake Midzaghe Project (the “Project”) Located within Cold Lake First Nations Traditional Territory, Treaty No. 6 We write on behalf of Cold Lake First Nations, Treaty No. 6 (“CLFN”) in response to the Public Notice regarding IOR’s PTOR for the above noted Project. We acknowledge the extension granted to CLFN to provide these comments by October 16, 2015 The Project is planned for construction within CLFN’s Traditional Territory, Denne Ni Nenne (“Our Land”) and within close proximity our English Bay Reserve Lands (Reserve 149B). The Project area is rich with history and our members have been exercising their Treaty and Aboriginal Rights in this area since time immemorial. Local archaeological digs proximate to the Project have demonstrated an unbroken pattern of use and occupancy in the area for over thousands of years.1 Our members continue to use the Project area for the exercise of their Treaty and Aboriginal rights, including the rights to hunt, fish, trap and gather plants and resources. In addition, the Project is located close to our Reserve Lands where many of our members live. -

Bp and Shell: Rising Risks in Tar Sands Investments Contents

BP AND SHELL: RISING RISKS IN TAR SANDS INVESTMENTS CONTENTS Summary and recommendations to investors 3 Will the tar sands bubble burst? 4 Heroic prospects or desperate measures? 6 A transcontinental infrastructure project 9 A transnational finance project 15 Risk 1 – Regulation: tightening constraints 17 Risk 2 – Operational: mounting technological and cost pressures 21 Risk 3 – Reputational: weakening public acceptance 24 Conclusion 27 Appendices 28 ACKNOWLEDGEMENTS This report was written and researched by James Marriott of PLATFORM, Lorne Stockman and Charlie Kronick of Greenpeace UK. The authors would like to thank the following for their comments and contributions to the report: Colin Baines of The Cooperative Group, Niall O’Shea of The Co-operative Asset Management, Mark Hoskins and Peter Holden of Holden & Partners, Kirsty Hamilton, Andrew Dlugolecki, Nick Robins, Paul Dickinson of Carbon Disclosure Project, Marc Brammer of Innovest, Ben Watson of Fairs Pensions, Matt Crossman of Rathbone Greenbank Investments, Miles Litvinoff of Ecumenical Council for Corporate Responsibility, Hyewon Kong and Seb Beloe of Henderson Global Investors, Stephanie Maier of EIRIS, James Leaton of WWF UK, Kenny Bruno and Steve Kretzman of Oil Change International, Mika Minio, Greg Muttitt, Kevin Smith of PLATFORM and John Sauven, Mike Hudema and Anna Rognaldsen of Greenpeace. SUMMARY AND RECOMMENDATIONS TO INVESTORS THIS REPORT DETAILS THE RANGE OF EXISTING AND EMERGING RISKS THAT BP AND SHELL FACE FROM THEIR EXPANSION OF PRODUCTION IN THE CANADIAN TAR SANDS. WE BELIEVE THESE RISKS ARE SIGNIFICANT FOR BP AND SHELL SHAREHOLDERS AND THAT INVESTORS SHOULD QUESTION THE COMPANIES MORE DEEPLY ON THEIR TAR SANDS STRATEGIES AND CALL FOR GREATER TRANSPARENCY REGARDING THE ASSESSMENT OF THE MID TO LONG TERM VIABILITY OF THESE PROJECTS. -

Biodegradation and Origin of Oil Sands in the Western Canada Sedimentary Basin

Pet.Sci.(2008)5:87-94 87 DOI 10.1007/s12182-008-0015-3 Biodegradation and origin of oil sands in the Western Canada Sedimentary Basin Zhou Shuqing1, Huang Haiping1,2 * and Liu Yuming1 1 School of Energy Resource, China University of Geosciences, Beijing 100083, China 2 Department of Geology and Geophysics, University of Calgary, T2N 1N4, Calgary, Canada Abstract: The oil sands deposits in the Western Canada Sedimentary Basin (WCSB) comprise of at least 85% of the total immobile bitumen in place in the world and are so concentrated as to be virtually the only such deposits that are economically recoverable for conversion to oil. The major deposits are in three geographic and geologic regions of Alberta: Athabasca, Cold Lake and Peace River. The bitumen reserves have oil gravities ranging from 8 to 12° API, and are hosted in the reservoirs of varying age, ranging from Devonian (Grosmont Formation) to Early Cretaceous (Mannville Group). They were derived from light oils in the southern Alberta and migrated to the north and east for over 100 km during the Laramide Orogeny, which was responsible for the uplift of the Rocky Mountains. Biodegradation is the only process that transforms light oil into bitumen in such a dramatic way that overshadowed other alterations with minor contributions. The levels of biodegradation in the basin increasing from west (non-biodegraded) to east (extremely biodegraded) can be attributed to decreasing reservoir temperature, which played the primary role in controlling the biodegradation regime. Once the reservoir was heated to approximately 80 °C, it was pasteurized and no biodegradation would further occur.