Detroit Office Market

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Detroit's Future: Real Estate As a Key Driver

Detroit’s Future: Real Estate as a Key Driver Disclaimer: Although Todd Sachse, Sachse Construction, and Broder & Sachse Real Estate (“The Presenter”) has no reason to doubt the reliability of the sources from which it has obtained the information for this presentation, The Presenter does not intend for any person or entity to rely on any such information, opinions, or ideas, and cannot guarantee the accuracy or completeness of this presentation. Nothing in this presentation shall be taken and relied upon as if it is individual investment, legal, or tax advice. The Presenter does not assume any liability or responsibility for any loss to any person or entity that may result from any act or omission by such person or entity, or by any other person or entity, based upon any material from The Presenter and the information, opinions, or ideas expressed. The Presenter urges prospective investors to not place undue reliance on information contained in this document, and to independently verify the information contained in this report. THE WHAT ▪ Over 26 years of experience in Construction Management ▪ Headquartered in Detroit, Michigan ▪ Over 200 projects completed in Detroit in the last six years ▪ Contracts exceeding $500,000,000 in Detroit projects ▪ Completed more than 3,000,000 square feet of work in Detroit ▪ Over 25 years of real estate experience ▪ Developments exceeding $100,000,000 in Detroit ▪ Over $150,000,000 in our Detroit development pipeline WHAT WAS: OUR HISTORY “You have to know the past to understand the present.” - CARL SAGAN (ASTROPHYSICIST) DETROIT: POPULATION OVER THE YEARS DETROIT: OUR HISTORY 1900 Industrial Age in Detroit Detroit is the leading manufacturer of heating and cooking stoves, ship building, cigars and tobacco, beer, rail cars, and foundry and machine shop products. -

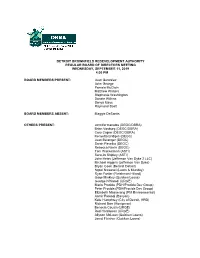

DDA Letterhead

DETROIT BROWNFIELD REDEVELOPMENT AUTHORITY REGULAR BOARD OF DIRECTORS MEETING WEDNESDAY, SEPTEMBER 11, 2019 4:00 PM BOARD MEMBERS PRESENT: Juan Gonzalez John George Pamela McClain Matthew Walters Stephanie Washington Donele Wilkins Sonya Mays Raymond Scott BOARD MEMBERS ABSENT: Maggie DeSantis OTHERS PRESENT: Jennifer Kanalos (DEGC/DBRA) Brian Vosburg (DEGC/DBRA) Cora Capler (DEGC/DBRA) Kenyetta Bridges (DEGC) Jean Belanger (DEGC) Sarah Pavelko (DEGC) Rebecca Navin (DEGC) Tom Wackerman (ASTI) Sara Jo Shipley (ASTI) John Heiss (Jefferson Van Dyke 2 LLC) Michael Higgins (Jefferson Van Dyke) Bryan Cook (Berardi Detroit) Ngozi Nwaesei (Lewis & Munday) Ryan Foster (Fleishman Hillard) Gage Minkley (Quicken Loans) George N’Namdi (URGE) Mario Procida (PDH/Procida Dev Group) Peter Procida (PDH/Procida Dev Group) Elizabeth Masserang (PM Environmental) Aamir Farooqi (Banyan) Kate Humphrey (City of Detroit, HRD) Richard Barr (Honigman) Benecia Cousin (URGE) Rod Hardamon (URGE) Allyson McLean (Quicken Loans) Jared Fleisher (Quicken Loans) MINUTES OF THE DETROIT BROWNFIELD REDEVELOPMENT AUTHORITY REGULAR MEETING WEDNESDAY, SEPTEMBER 11, 2019 DETROIT ECONOMIC GROWTH CORPORATION 500 GRISWOLD SUITE 2200 DETROIT, MI – 4:00 PM CALL TO ORDER Chair Matthew Walters called the meeting to order at 4:04 PM. GENERAL Approval of Minutes: Mr. Walters called for a motion approving the minutes of August 28, 2019 as presented. The Board took the following action: On a motion by Ms. Mays, seconded by Ms. Washington, DBRA Resolution Code 19-09-02-262 was unanimously -

Condominiums Historic Homes

Condominiums Chateaufort Place The Chateaufort Co-op was built in 1962. It is part of the Lafayette Park Historic District. This home has 1,450 square feet with three bedrooms, two baths and full basement. Additionally, the basement is finished with another half bath. The home also features a fenced yard that is 20’ by 45’. Out of the front picture windows, the view Click to enlarge includes Lafayette Park and in the distance, Ford Field. Nicolet Place The Lafayette Park neighborhood was designed by famed architect Mies van der Rohe. The ground breaking was in 1956 - this two- story, glass walled townhouse is about 1,400 square feet. It was once the home of Dr. Charles Wright, founder of Detroit’s African- American Museum. He lived here for 25 years before selling it to Click to enlarge the current owner. John R. (Brush Park) This condo features contemporary finishes with exotic hardwood floors, glass railings, muti-zone sound system, multiple outdoor spaces including a rooftop terrace with spectacular views of the downtown Detroit skyline. Brush Park Village North is located six blocks from Comerica Park, Ford Field and within walking distance of Click to enlarge the Detroit Medical Center, restaurants, entertainment and culture. Washington (Westin Book Cadillac) A condo in the Westin Book Cadillac. The hotel and condos opened at the end of 2008. This particular unit has been designed with a respect for the Italian design of the hotel but given a modern twist. Tom Verwest Interiors of Royal Oak decorated the unit. Tom Verwest Interiors specializes in converting Click to enlarge classic and vintage spaces in to Modern ones. -

Downtown Detroit Business Improvement Zone

BUSINESS IMPROVEMENT ZONE 2016-2017 ANNUAL REPORT DOWNTOWN DETROIT BUSINESS IMPROVEMENT ZONE LETTER FROM THE BOARD CHAIR LETTER FROM THE BIZ DIRECTOR As the Downtown Detroit Business Improvement Zone The Downtown Business Improvement Zone (BIZ) has celebrates its third anniversary, Downtown’s popularity created substantial improvements in the ever changing continues to rise and public perceptions about the quality environment of the Downtown, since the inception in of the services provided by the BIZ are positive. 2014. With the critical responsibility to create a vibrant Downtown, the BIZ oversees multiple supplemental Property owners contribute Enjoy new public spaces at Gratiot and about $4 million annually to Randolph and the Woodward Esplanade, services and resources for over 140 blocks and 550 augment city services and maintained by the BIZ. Know that the BIZ is establish a high level of quality in supporting public safety efforts by increasing properties, guided by the leadership of the volunteer BIZ priority service areas: safety and security in public spaces, including a new night board of directors that cover all corners and sectors of security, cleaning and hospitality, patrol vehicle equipped with a Lighthouse infrastructure planning, street and radio to communicate directly with the Detroit Downtown. parks landscape maintenance, Police Department. The work of the BIZ Downtown marketing and helps foster an increasingly clean, safe and The BIZ team consists of dedicated During the BIZ fiscal year business outreach. The BIZ has welcoming Downtown Detroit. individuals, who day in and day out, care beginning on July 1, 2016 and become an integral element of for our community. -

Bedrock Detroit Acquisitions Maps 2017 February

W. Grand River Ave. W. Elizabeth St. THETHE LITTLELITTLE CAESARSCAESARS COMERICACOMERICA FORDFORD DISTRICTDISTRICT ARENAARENA PARKPARK FIELDFIELD DETROIT Brush St. FEBRUARY 1,2017 N P E. Adams Ave. Beech St. a . r t BEDROCK DETROIT REAL ESTATE PORTFOLIO k S A BY ACQUISITION DATE l v GRANDGRAND CIRCUSCIRCUS l e e 1 Madison Building . r 2 Two Detroit Center Garage PARKPARK e th 3 Chase Tower MGMMGM GRANDGRAND i W 4 Chrysler House CASINOCASINO Plaza Dr. 5 Financial District Garage Beacon St. 8181 6 First National Building DTEDTE ENERGYENERGY HQHQ 7 Madison Surface Lot 3rd St. 8 1500 Woodward 9 1520 Woodward 11 Michigan Ave. 1st St. 10 1528 Woodward 11 1550 Woodward Bagley Ave. 1111 Clifford St. 77 12 Federal Reserve Building Madison St. 13 1521 Broadway 8383 1010 Centre St. 14-15 1000 Farmer & 815 Bates 1313 16 One Woodward Avenue 82 99 82 John R St. 17 1412 Woodward 28 18 The Z 28 88 Farmer St. 19 1301 Broadway PARADISEPARADISE Washington Blvd. E. Grand River Ave. 20 1201 Woodward 8787 4646 4949 VALLEYVALLEY 21 1217 Woodward 77-8077-80 GRATIOTGRATIOT 22 Vinton Building 59 23 1001 Woodward 59 66-6966-69 DEVELOPMENTDEVELOPMENT Cass Ave. 45 Times Square 45 24 1001 Woodward Garage 4444 SITESITE Griswold St. Gratiot Ave. 25 620 Woodward DETROITDETROIT PUBLICPUBLIC 6060 8484 26 630 Woodward AT&TAT&T 3838 1717 SAFETY HQ Broadway St. 27 1238 Randolph SAFETY HQ MICHIGANMICHIGAN HQHQ 3232 28 1505 Woodward 2929 5454 29 1265 Griswold 6161 Library St. 37375757 Clinton St. 30 1215 Griswold 1818 31 1401 Rosa Parks Not pictured on map 7676 62-65 St. -

Click on a Street

Apartments .......................................Neighborhood W. Lafayette A. .................................. Fort Shelby Towers W. Lafayette B. .................................. Fort Shelby Towers Woodward Ave. ........................ Studio One Apartments Washington Blvd A. ...................Detroit City Apartments Mies van der Rohe ................................Neighborhood Chateaufort Place ...............Lafayette Park/Chateaufort Nicolet Place .......................Lafayette Park/Chateaufort Click on Historic Homes ...................................Neighborhood Avery A ......................................................Woodbridge West Canfield A ............................................... Midtown a street Lincoln Street ...................................Woodbridge Farms E. Grand Blvd. .................................. Islandview Village for a sneak peek Woodward Ave. ...................... Charfoos & Christensens E. Ferry St. ...................................................... Midtown of homes Edison ..................................................Boston Edison Glastonbury Rd ...................................... Rosedale Park to choose from Lofts ..................................................Neighborhood West Hancock ................................................. Midtown Lafayette East A .....................................Lafayette Park Lafayette East B .....................................Lafayette Park Lafayette East C .....................................Lafayette Park West Canfield B ......................Midtown/Culture -

A Report on Greater Downtown Detroit 2Nd Edition

7.2 A Report on Greater Downtown Detroit SQ MI 2nd Edition CONTRIBUTORS & CONTENTS Advisory Team Keegan Mahoney, Hudson-Webber Foundation Elise Fields, Midtown Detroit Inc. James Fidler, Downtown Detroit Partnership Spencer Olinek, Detroit Economic Growth Corporation Jeanette Pierce, Detroit Experience Factory Amber Gladney, Invest Detroit Contributors Regina Bell, Digerati Jela Ellefson, Eastern Market Corporation Phil Rivera, Detroit Riverfront Conservancy Data Consultant Jeff Bross, Data Driven Detroit Design Megan Deal, Tomorrow Today Photography Andy Kopietz, Good Done Daily Production Management James Fidler & Joseph Gruber, City Form Detroit 2 7.2 SQ MI | A Report on Greater Downtown Detroit | Second Edition 04 Introduction 06 Section One | Overview 08–09 Greater Downtown in Context 10–11 Greater Downtown by Neighborhood 12–25 Downtown, Midtown, Woodbridge, Eastern Market, Lafayette Park, Rivertown, Corktown 26 Section Two | People Demographics 28 Population & Household Size 29–30 Density 31 Age 32–33 Income 34 Race & Ethnicity 35 Foreign-Born Education 36 Young & College-Educated 37 Residence of Young Professionals 39 Families 40 Programs for Young Professionals 41 Anchor Academic Institutions Visitors 42–43 Visitors & Venues 45 Hotels & Occupancy 46 Section Three | Place Vibrancy 48–63 Amenities & Necessities 64–65 Pedestrians & Bicycles Housing 66–69 Units & Occupancy 70–71 Rents 72 Incentives 74 Section Four | Economy & Investment Employment 76 Employment, Employment Sectors & Growth 77 Wages 78–80 Commercial Space 82–91 Real Estate Development 92 Note on Data 94 Sources, Notes & Definitions Contributors & Contents 3 INTRODUCTION 7.2 square miles. That is Greater Downtown Detroit. A slice of Detroit’s 139-square mile geography. A 7.2 square mile collection of neighborhoods: Downtown, Midtown, Woodbridge, Eastern Market, Lafayette Park, Rivertown, and Corktown—and so much more. -

National Register of Historic Places Registration Form

NPS Form 10-900 OMB No. 1024-0018 United States Department of the Interior National Park Service National Register of Historic Places Registration Form This form is for use in nominating or requesting determinations for individual properties and districts. See instructions in National Register Bulletin, How to Complete the National Register of Historic Places Registration Form. If any item does not apply to the property being documented, enter "N/A" for "not applicable." For functions, architectural classification, materials, and areas of significance, enter only categories and subcategories from the instructions. 1. Name of Property Historic name: _Grosfield Building_____________________________ Other names/site number: _____________________________________ Name of related multiple property listing: _N/A______________________________________________________ (Enter "N/A" if property is not part of a multiple property listing ____________________________________________________________________________ 2. Location Street & number: _3365 Michigan Avenue_________________________ City or town: _Detroit_____ State: _Michigan____ County: _Wayne__ Not For Publication: Vicinity: ____________________________________________________________________________ 3. State/Federal Agency Certification As the designated authority under the National Historic Preservation Act, as amended, I hereby certify that this nomination ___ request for determination of eligibility meets the documentation standards for registering properties in the National Register of -

City of Detroit Historic District Map.Pdf

y Q w D K U E H U Eight Mile E E EIGHT MILE W EIGHT MILE E M R CARLISLE E N k V O E ght Mile W B E I T i H A N c R O R N D A C R U e VE E MEDA S ALA E I I COLLINGHAM L D A M A D R T C R T b G R R R D H I T B O LE R HAM P s C RT N R EDMORE E OLK COU A C COLTON SAVAGE ORF R R E N N L E e W R ST M EL G S L F HE D HESS A Y C O D NORFOLK IN o D I A A H W R R M H F NORFOLK COU E M r I O RT S K E Y DR C T BRINGARD M F I O L E V N A E I F N E F N O G AD A T E AMR N P O BURN EN F F D EAST S R T C E I I OJAN I A R TR E E T E H B R U L O G L L MILBANK D A U E E R S D D GTON EMINGTON FAIRMOUNT DR BLOOMFIELD MIN R L E K R D L H I I CORDOVA E C C S L ROSSINI DR I Y N H S A O H E C FARGO G E L B R P R A H F X E I I R O C E d O P A Outer Drive E E K L R I E OUTER DR VE R N P TACOMA R LE WI S E G E E D STATE FAIR W STATE FAIR E MBROK E PE E E E R SIRRON E y W N c A l N l F ADELINE MANNING h F ST MARTINS N A T L A ROLYAT T R N e R E N S OAKLEY C O o I E L C I L S R S T FERNH L LIBERAL K H C K S E B ARTIN O O T e M W S ST R A O E NO ARA E S R V O O C Z W T T STURGIS n E L E S N LA T N Y TZ W K L R O ST MARTINS S Y O YOLANDA D N Y E PINEWOOD h E N A A D G E R T A L A L R ANNIN BLISS A CORAM A C C e A E X B T T L L PFEN RT LD N N VERDUN IEW COU IE N INV F T PLA A R U W VASSAR L E E E N T O ES r H D B C S I V L M CARME M L T R N A Y r V A L R U I R C B E L A T G R B M O S A A B N R I LAPPI R EMERY R O R R L A S Y C E R N F P O T CAMBRIDGE U E H AN Y SUZ N R H V G N U U U C R B T T C O E H R N G MADDELEI C PENROSE N y E A K E L E D E U O I L B F D B S L A H -

Detroit Insider's Map + Guide

DETROIT INSIDER’S MAP + GUIDE EAT, SHOP, STAY + PLAY SEE THE OVERVIEW USING MAP AT THE END OF THIS THE GUIDE GUIDE Detroit Insider's Map + Guide is a THIS IS GREATER resource to help you connect with DOWNTOWN AND KEY NEIGHBORHOOD downtown Detroit and surrounding DESTINATIONS BEYOND THE CENTER neighborhoods. It highlights key DOWNTOWN destinations for business, retail, GREEKTOWN Though only a small part of MEXICANTOWN Detroit’s 139-square-mile geography, this is a collection food and fun. CORKTOWN of neighborhoods in the city RIVERTOWN center and beyond. Like many THIS GUIDE IS Detroit Metro Convention EASTERN MARKET city centers globally, greater BROUGHT TO YOU & Visitors Bureau (DMCVB) MIDTOWN downtown Detroit is a nexus BY DDP & DMCVB is an independent, nonprofit AVENUE OF FASHION of activity — welcoming Downtown Detroit Partnership economic development residents, employees and (DDP) plans, manages and organization. Its mission visitors. Downtown contains supports downtown Detroit is to market and sell the Detroit high-rise and low-rise living, through diverse, resilient metropolitan region to business some of the city’s most storied and economically urban and leisure visitors in order to CONTENTS neighborhoods and many of initiatives. It is a member- maximize economic impact. DDP PROGRAMS + southeast Michigan’s leading based nonprofit working in In collaboration with our RESOURCES 2 educational and medical partnership with corporate, partners, stakeholders and DETROIT EXPERIENCE institutions. Greater downtown philanthropic and government customers, our purpose is to FACTORY TOURS 4 Detroit is the center of the entities to create a vibrant champion the continuous DOWNTOWN 5 city’s business world, home to and world-class urban core improvement of the region our richest cultural, sports and in downtown Detroit. -

Class Members for Settlement of Abbott, Et Al V. City of Detroit, Water and Sewerage Department, United States District Court Case No

Class members for settlement of Abbott, et al v. City of Detroit, Water and Sewerage Department, United States District Court Case No. 17-10761, Eastern District of Michigan, Southern Division OCCUPANT_NAME ACCOUNT MAILING_ADDRESS MAILING_CITY MAILING_ZIP CREDIT A.R.T. MANAGEMENT 1102116300 16950 NORMANDY ST DETROIT MI 48221-3347 $ 120.60 AARON BRYANT 7602382300 4081 PASADENA ST DETROIT MI 48238-2631 $ 471.10 ACADEMY OF DETROIT WEST 2404159300 20820 GREENFIELD RD OAK PARK MI 48237-3051 $ 214.15 ACADEMY OF DETROIT WEST 2404160300 20820 GREENFIELD RD OAK PARK MI 48237-3051 $ 208.64 ACADEMY OF DETROIT WEST 2404161300 20820 GREENFIELD RD OAK PARK MI 48237 $ 214.15 ALBERTA W KING APTS 1301545300 2140 MARTIN LUTHER KING JR BLVD DETROIT MI 48208-2699 $ 685.20 ALBERTA W KING APTS 4004010300 2140 MARTIN LUTHER KING JR BLVD DETROIT MI 48208-2699 $ 657.16 ALBERTA W KING APTS 4004012300 2140 MARTIN LUTHER KING JR BLVD DETROIT MI 48208-2699 $ 685.20 ALEXANDRINE SQUARE APARTMENTS 1300211300 16250 NORTHLAND DRIVE SOUTHFIELD MI 48075 $ 685.20 ALTER ROAD APARTMENTS, LLC 6503203300 19785 W 12 MILE RD SOUTHFIELD MI 48076 $ 214.15 ANA E CIPRES-VARELA 3600295301 8790 FALCON STREET DETROIT MI 48209-1768 $ 214.15 ASHLEY OWNER LLC 100061300 2550 S TELEGRAPH RD BLOOMFIELD HILLS MI 48302-2119 $ 598.83 BABCOCK MORANG CO OP 8203937300 6450 LOZON ROAD COTTRELLVILLE MI 48039-3109 $ 657.16 BELCREST APARTMENTS 100752300 5440 CASS AVE DETROIT MI 48202-3680 $ 536.97 BLANCHE KELSO BRUCE ACADEMY 100797300 8045 2ND AVE DETROIT MI 48202-2403 $ 1,211.03 BOBBY JOE SHERMAN 600825300 215 E EDSEL FORD HWY DETROIT MI 48202-3730 $ 434.88 BRIDGEVIEW I 6200426300 231 E GRAND BLVD DETROIT MI 48207-3739 $ 702.27 BRIDGEVIEW II 6202638300 231 E GRAND BLVD DETROIT MI 48207-3739 $ 371.89 BRIDGEVIEW II 6202638300 231 E GRAND BLVD DETROIT MI 48207-3739 $ 330.38 BRISTOL PROPERTIES U.S. -

Detroit City Council Formal Session July 2, 2019 10:00 A.M

DETROIT CITY COUNCIL FORMAL SESSION JULY 2, 2019 10:00 A.M. NEW BUSINESS UNFINISHED BUSINESS 1. Benson, an Ordinance to amend Chapter 22 of the 1984 Detroit City Code, Handling of Solid Waste and Prevention of Illegal Dumping, Article I, In General, Division 2, Civil Fines for Violations, by amending Section 22-1-14, Civil fines for violation of Sections 22-2-83(b), (c) and (d), 22-2-84(a) and (b)(1), (2) and (4), 22- 2-87, 22-2-88 (b) and (c), 22-2-96 and 22-2-97 of this Code regarding solid waste except for medical waste and hazardous waste; cost of removal incurred by City of Detroit; factors to be considered by hearings officer when determining fine; burden of proof for factors upon the violator, adding Section 22-1-17, Civil fines for violations of Section 22-2-83(d) of this Code regarding solid waste from a motor vehicle except for medical waste and hazardous waste; cost of removal incurred by City of Detroit; factors to be considered by hearings officer when determining fine; burden of proof for factors upon the violator, and amending Article II, Storage, Preparation, Collectiion, Transport, Disposal, and Placement, Division 5, Illegal Dumping, by amending Section 22-2-83, Dumping, storing or depositing solid waste, medical waste, hazardous waste of bulk solid material on any publicly owned property, or private property or water, without permit, to provide: uniform measurements for determining blight violations related to illegal dumping of solid waste from a motor vehicle; uniform measurements for determining fines related to illegal dumping of solid waste from a motor vehicle; and an additional classification and higher fines related to illegally dumping larger quantities of solid waste from a motor vehicle, laid on the table, June 18, 2019.