PNB Overseas Branches

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Frequently Asked Questions on What Is Pesonet?

Frequently Asked Questions on What is PESONet? PESONet is a new electronic fund transfer service that enables customers of participating banks, e- money issuers or mobile money operators to transfer funds in Philippine Peso currency to another customer of other participating banks, e-money issuers or mobile money operators in the Philippines. It is more inclusive platform for Electronic Fund Transfers which will make G2B(Government-to- Business) and G2C(Government-to-Consumer) payments more practical, convenient, fast, and secure. What is the purpose of PESONet? Through PESONet, businesses, government, and individuals will be able to conveniently pay or transfer funds from their account to one or multiple recipient accounts in other financial institutions. PESONet is the perfect alternative to the still widely used paper-based check system. What are the features of PESONet? What are the uses of PESONet? How does PESONet work? Customers instruct their financial institution to send credit instructions to other financial institutions via online banking, mobile banking or over-the-counter transaction. They need to provide the payees’ financial institution, account number, and amount. The credit instruction is transmitted by the financial institution to the clearing switch operator, which currently is the Philippine Clearing House Corporation (PCHC). The funds are settled in the respective financial institutions demand deposit accounts held in Bangko Sentral ng Pilipinas (BSP) through BSP’s Philippine Payments and Settlement System (PhilPaSS). Upon settlement, the beneficiary’s or payee’s financial institution will credit the payee's account. How long does it take to transfer funds via PESONet? The availability of funds to the receiving account shall depend on the facility used to carry out your transaction. -

The 50 Years

The 50 years. Foreword 5 Peter Seah, Piyush Gupta A bank is born 7 S Dhanabalan The courage of youth 12 S Dhanabalan Best of all leaders 18 J Y Pillay From negative to positive 22 Ang Kong Hua Of fishmongers and stallholders 26 Shirley Loo-Lim A first against all odds 32 N Ganesan Buses, planes and the stock exchange 36 Tan Soo Nan Daring to do 40 Hong Tuck Kun The condo project that almost wasn’t 44 S Dhanabalan, Ng Kee Choe Ruffling feathers 48 Ng Kee Choe, Elsie Foh City within a city 52 Lau Chan Sin Grand old dame gets a facelift 56 Loh Soo Eng A game-changing first 60 Elsie Foh Putting Singapore on the map 64 Eng-Kwok Seat Moey Turning crisis into opportunity 69 Jeanette Wong A dino-mite story 73 Digor (The last dinosaur alive) A Smart Buddy for a Smart Nation 79 P’ing Lim, Jeremy Soo The journey together continues 85 Chester Teo (A reel-life character) Beyond dollars and cents 89 Eric Ang 50 Enterprises of Change 94 50 Memorable Highlights 146 Once upon a time... 4 Foreword This year, DBS turns 50. With our coming of age, it’s inevitable that we’ve been a little introspective, remembering our roots and celebrating our rich heritage as the former Development Bank of Singapore. In many ways, the DBS story mirrors that of Singapore’s. After all, the bank was founded in 1968, just three years after the independence of Singapore – for the express purpose of financing the nation’s development and industrialisation. -

Managing in the New Normal

MANAGING IN THE NEW NORMAL 2020 ANNUAL REPORT Vision: ABOUT THE THEME CONTENTS To be the country’s consumer and retail bank of choice. Managing in the New Normal 01 About PSBank Mission: The coronavirus (COVID-19) pandemic has dramatically and irreversibly changed, not just 02 Message from the Chairman • As an INSTITUTION: To conform to the highest standards of integrity, professionalism and teamwork. the way we live, but also the way we bank. This unprecedented crisis is ushering in a “new 06 President’s Report • For our CLIENTS: To provide superior products and reliable, normal,” with digital technology playing a pivotal top-quality services responsive to their banking needs. role. Those previously reluctant to embrace 10 Financial Highlights • For our EMPLOYEES: To place a premium on their growth, technology now find themselves thrust into a and nurture an environment of teamwork where outstanding relationship with their laptops or mobile phones 12 Digital Ready performance is recognized. for work, education, health care, commercial transactions, and social interactions. 16 Safety First • For our SHAREHOLDERS: To enhance the value of their investments. At PSBank, putting the customer first has always 20 Employee & Customer Engagement been at the heart of our business strategy. Even before the pandemic, we have already been 22 Sustainability Commitment embarking on digital initiatives that would make ABOUT PSBANK every customer journey simple and maaasahan 26 Risk Management (reliable). This pandemic only deepened our Philippine Savings Bank (PSBank) is the thrift banking arm of the commitment to keep up with the new breed of 31 Audit Committee Report Metrobank Group, one of the largest financial onglc omerates in the “always-connected” customers and to deliver an Philippines. -

Annual Securities Report / Yukashoken Hokokusho (Excerpt)

Annual Securities Report “Yukashoken Hokokusho” (Excerpt) for the fiscal year ended March 31, 2020 MUFG Bank, Ltd. Table of Contents Page Cover ............................................................................................................................................................ 1 I. Overview of the Company .................................................................................................................. 2 1. Key Financial Data and Trends ....................................................................................................... 2 2. History ............................................................................................................................................. 5 3. Business Outline .............................................................................................................................. 6 4. Information on Subsidiaries and Affiliates ...................................................................................... 8 5. Employees ..................................................................................................................................... 10 II. Business Overview ............................................................................................................................ 11 1. Management Policy, Business Environment and Issues to be Addressed, etc. .............................. 11 2. Risks Related to Business ............................................................................................................. -

Banks and Corporates Realign Relationships in Asia 2018 Greenwich Leaders: Asian Large Corporate Banking and Cash Management

Banks and Corporates Realign Relationships in Asia 2018 Greenwich Leaders: Asian Large Corporate Banking and Cash Management Q1 2018 Although the names at the top of Asia’s corporate banking market are unchanged from 2017 to 2018, the industry as a whole is actually in the midst of an accelerated evolution, as large companies and a growing list of global, regional and domestic banks work to sort out who is—and who wants to be—relevant to whom. HSBC, Standard Chartered Bank and Citi have been the top three banks in Asia since Greenwich Associates started tracking the large corporate banking market over 15 years ago. In recent years, ANZ Bank and DBS Bank have consistently rounded out the top five, while a few European global franchises have stepped back to varying degrees in the landscape. Amid the stability at the top of the market, a longer term evolution has progressed among the majority of leading banks in Asia. An Increasing Focus on “Target Market” When Greenwich Associates started covering Asia’s corporate banking landscape in the early 2000s, almost all of our bank clients asked to see their results based on our “total sample” research universe—meaning the full sample of interviews conducted with hundreds of large companies from across the entire region. (This year, Greenwich Associates interviewed 708 companies across 11 markets, representing a known universe of some 2,200 companies with annual sales of more than U.S.$500 million.) This approach reflected their broad strategies, with ambitions to serve much of the Asian large corporate banking market. -

Fintech and Digital Banking 2025 Asia Pacific

FINTECH AND DIGITAL BANKING 2025 ASIA PACIFIC Co-published in association with AN IDC INFOBRIEF 2020 Fintech & Digital Banking 2025 Readiness Challenges Five years ago, IDC Financial Insights predicted that 100% of the top 250 banks across Asia Pacific would be executing a digital strategy. The reality? We are far from that number. Digital-first banking is even more important now as the COVID-19 situation has intensified customers’ need for availability, access, and control of digital channel interactions. Poor Customer Adoption Legacy Views of Value Chain This is due to extreme focus on channels, Banks have not been able to take advantage of potential ecosystem disregarding necessary integration with partners as they still hold traditional views of the value chain. business processes. 80% of the top 250 banks still prefer to own the entire value chain 70% of Asia Pacific banking customers view of banking, with third party-contributed business at a mere 2%. banking processes as tedious. Only 30% of the banking customer base is active on digital banking channels. Slow to Innovate Fintech Innovation momentum is easier built from the ground up, while & Digital traditional banks are held back by traditional products, processes, Banking and people. Core Systems Lagging 63% of banking customers in Asia Pacific are willing to switch to neo Banks still find it too difficult and expensive Readiness banks or new digital challengers. to transform legacy core systems. Challenges More than 35 neo banks or new digital challengers across Asia Average age of core banking systems in Pacific are built on agile innovative best practices — way ahead of the top 100 banks in Asia Pacific remains incumbents in terms of flexibility, self-service capabilities, customer at 17.5 years — hardly responsive and needs, and personalization. -

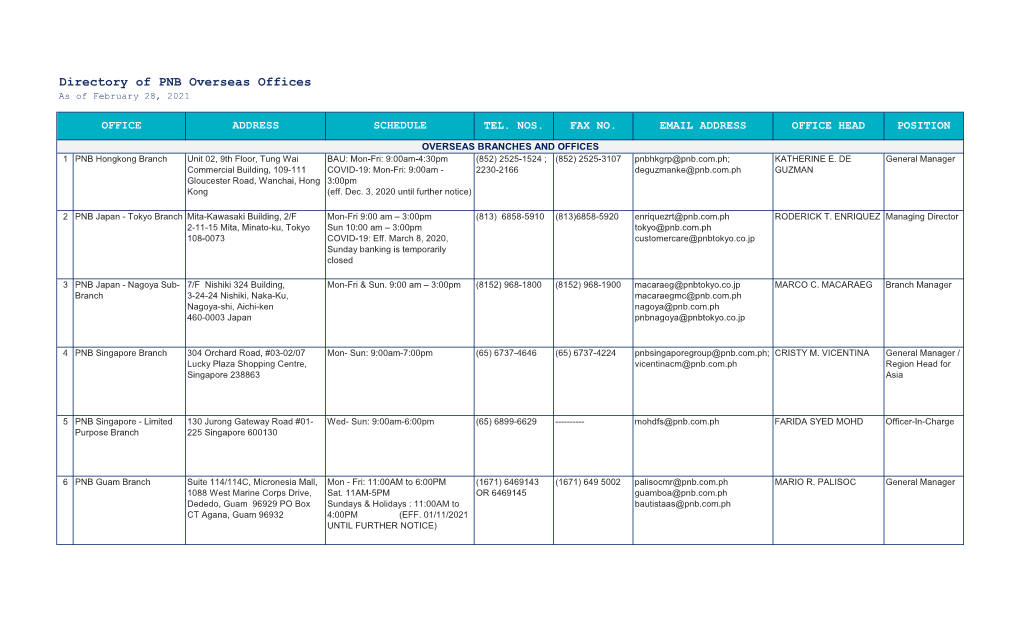

2020 PNB Annual Report

Panahon Ng Bayanihan 2020 Annual Report CONTENTS Financial Summary / Financial Highlights 1 Corporate Governance 58 Corporate Objective Sustainability Report 84 Vision-Mission 2 GRI Content Index 120 About the PNB Brand Board of Directors and Board Advisors 126 PNB Values Board of Directors 128 Business Model & Scope of Business 4 Board Advisors 136 Message from the Chairperson’s to Shareholders 6 Management Committee 138 Message from the President and CEO to Shareholders 8 The Bank’s Subsidiaries and Affiliate 145 Operational Highlights 10 Market Price of and Dividends on 147 Awards and Recognitions 26 PNB Common Equity Plans for 2020 27 Statement of Management’s Responsibility Message from the Board Audit and Compliance 28 for Financial Statements 149 Committee Chairman Independent Auditor’s Report 150 Message from the Board IT Governance 30 Statements of Financial Position 157 Committee Chairman Statements of Income 158 Message from the Board Oversight 32 Statements of Comprehensive Income 159 RPT Committee Chairman Statements of Changes In Equity 160 Message from the Board Strategy and Statements of Cash Flows 162 Policy Committee Chairman 29 Products and Services 164 Capital Structure and Adequacy 36 Management Directory 166 Message from the Risk Oversight Overseas Offices 166 Committee Chairman 39 Region and Area Heads 178 Risk Management Disclosure 40 Area Retail Lending Centers 179 Message from the Corporate Governance and PNB Domestic Subsidiaries and Affiliate 180 Sustainability Committee Chairperson 56 ABOUT THE COVER Annual Report 2020 Paper used: MOHAWK Navajo Smooth 216 gsm Bright White Philippine National Bank FSC-Certified reinforces its commitment as Paper meets the mark of responsible forestry a Partner Ng Bayan. -

09. Directors' Profiles

BOARD OF DIRECTORS FLORENCIA G. TARRIELA FELIX ENRICO R. ALFILER REYNALDO A. MACLANG FLORIDO P. CASUELA Age 69 Age 67 Age 78 Age 75 Nationality Filipino Nationality Filipino Nationality Filipino Nationality Filipino Education • Bachelor of Science in Business Administration Education • Bachelor of Science and Masters in Statistics, Education • Bachelor of Laws, Ateneo de Manila University Education • Bachelor of Science in Business Administration, Major in degree, Major in Economics, University of the University of the Philippines Accounting, University of the Philippines Philippines Current Position • President of the Bank • Masters in Business Administration, University of • Masters in Economics degree, University of Current Position • Vice Chairman/Independent Director in the Bank the Philippines in the Bank • Advanced Management Program for Overseas Bankers, California, Los Angeles, where she topped the Masters Date of First • February 9, 2013 (as Director) Comprehensive Examination Philadelphia National Bank in conjunction with Date of First • January 1, 2012 Appointment • May 27, 2014 (as President) Wharton School of the University of Pennsylvania Current Position • Chairman of the Board/Independent Director Appointment Directorship in • None Government Civil Service Eligibilities in the Bank Directorship in • None Other Listed Ř &HUWLƓHG3XEOLF$FFRXQWDQW(FRQRPLVW&RPPHUFLDO Companies Attaché Date of First • May 29, 2001 (as Director) Other Listed Appointment • May 24, 2005 (as Chairman of the Board) Companies Other Current • Chairman of PNB (Europe) Plc. Current Position • Director • May 30, 2006 (as Independent Director) Other Current • Chairman/Independent Director of PNB General Insurers Positions • Director of Allied Leasing & Finance Corporation, PNB in the Bank Positions Co., Inc. and PNB RCI Holdings Co., Ltd. Directorship in • Independent Director of LT Group, Inc. -

Philippine National Bank

Philippine National Bank Company Brief June 2019 Page 1 Company Introduction 3 2 Financial Highlights 9 3 Board of Directors & Senior Management 13 4 Awards & Citations 16 Page 2 About PNB . Philippine National Bank is one of the country’s largest private universal banks in terms of assets, loans and deposits. It provides a full range of banking and other financial services to its highly diverse clientele comprised of individual depositors, small and medium enterprises, domestic and international corporations, government institutions, and overseas Filipinos. PNB has 712 branches and 1,552 ATMs strategically located nationwide. The Bank maintains its position as the Philippine bank with the most extensive international reach with 71 overseas branches, representative offices, remittance centers and subsidiaries across Asia, Europe, the Middle East, and North America. Backed by over a century of stability and excellence, PNB looks forward to more years of serving its customers first. Page 3 Products & Services . PNB provides a full range of quality products and services to a wide customer base: Branch Retail Institutional Trust & Treasury Remittance Banking Lending Banking Wealth Mgmt Services Services • Fixed .Sending/ • Deposit • Home Loans • Corporate & • UITFs Income Receiving Accounts • Auto Loans Middle • Personal Investments .Global • e-Banking • Salary Market Trust • Foreign Filipino Card Services Loans • Trade • Corporate Exchange .Overseas • Cash • SMEs Finance Trust Services Bills Management • OPHL • Financial • PNB Wealth • Interest -

Dbs-Annual-Report-2018.Pdf

BANK OF THE YEAR – GLOBAL The Banker Best Bank in the World TO BE THE BEST BANK IN THE WORLD Global Finance The WORLD’S BEST DIGITAL BANK World’s Euromoney Best WORLD’S BEST BANK BEST BANK FOR SMEs Bank Euromoney SME BANK OF THE YEAR – GLOBAL (PLATINUM WINNER) Global SME Finance (International Finance FOR OUR Corporation) CASH MANAGEMENT GLOBAL BEST SERVICE – OVERALL: #1 Euromoney #1 BEHIND THE CUSTOMERS LOGIN EXPERIENCE MyPrivateBanking BEST PRIVATE BANK FOR INNOVATION PWM/ The Banker BEST PRIVATE BANK FOR ENTREPRENEURS – GLOBAL DBS Group Holdings Ltd Annual Report 2018 Global Finance Perhaps that’s why we were named 12 Marina Boulevard Best Bank in the World Marina Bay Financial Centre Tower 3 Singapore 018982 (65) 6878 8888 | www.dbs.com Co. Reg. No. 199901152M DBS GROUP HOLDINGS LTD facebook.com/dbs ANNUAL REPORT 2018 twitter.com/dbsbank #RecyclemoreWasteless DBS_AR18_Inside Spreads_001-041_Front.indd 1-3 7/3/19 8:03 PM About us DBS is a leading fi nancial services group in Asia with a presence in 18 markets. Headquartered and listed in Singapore, we have a growing presence in the three key Asian axes of growth: Greater China, Southeast Asia and South Asia. Our “AA-” and “Aa1” credit ratings are among the highest in the world. We have been recognised for our leadership globally, having been named “Bank of the Year – Global” by The Banker and “Best Bank in the World” by Global Finance. We are also at the forefront of leveraging technology to shape the future of banking and have been named “World’s Best Digital Bank” by Euromoney. -

Overview of Apis and Bank-As- A-Service in FINTECH Baas for Banks As Amazone Web Services for E-Commerce

Overview of APIs and Bank-as- a-Service in FINTECH BaaS for banks as Amazone Web Services for e-commerce Traditional bank 2015 customers 67% product Amazon’s profit New fintech comes from AWS! players marketing support ? human resources To fight with - complience IT-guys to support - processing center and manage servers or to earn with - card issuing 2006 - money storage Creation of AWS for new players License Servers You may write off infrastructure investments or use them as new revenue streams While banks have always been looking to con- ratization.¹ Fintech-startups nowadays can serve trol the financial services industry, with the rise of almost any financial need for the eligible popu- fintech, the situation has changed drastically. One lation. Now banks are looking to collaborate with of the core differences in approach to financial fintech so as to not to lose the links in the value services between banks and fintech lies in democ- chains that make them so powerful. Chris Skinner one of the TOP5 fintech-influencers and predictors, author of bestsellers «DIGITAL BANK and «VALUE WEB», managing partner of the BB Fund in London You’re probably all familiar with SaaS – it’s basically paying for applications as you use them, rather than buying them. These services used to cost you a fortune, but are now free or near enough. That’s where banking is going. Banking becomes plug and play apps you stitch together to suit your business or lifestyle. There’s no logical reason why Banking shouldn’t be delivered as SaaS. This is the future bank, and old banks will need to reconsider their services to com- pete with this zero margin model. -

Digital Wealth Management in Asia Pacific

Digital Wealth Management in Asia Pacific A comparative analysis across eight key markets 2021 kpmg.com/cn Foreword Asia Pacific has been witnessing strong economic As a result, a growing number of financial institutions prosperity as a result of its open business have widened their target customer groups and environment, relaxed regulatory landscape and a increased focus on developing efficient digital well-developed infrastructure. This has led to a rise in capabilities to cater to mass markets. In relation to the population of High-Net-Worth Individuals mobile access to financial services, the race is on to (HNWIs), particularly the younger generation who provide customers with the best “bank-in-a-pocket” demand technologically advanced and highly service. This race has been joined not just by customised banking and wealth management traditional and neobanks, but also by megatech and solutions, designed specifically to cater to their telecommunications companies with ambitions to growing investment needs. widen their market presence throughout Asia Pacific. The region is home to ~15 million HNWIs, the This move toward digitalisation has further picked up second-largest concentration in the world after North pace post the COVID-19 pandemic. According to America, with an expected growth of 39 percent by KPMG’s 2020 CEO Outlook Survey, 81 percent of 2024, the highest growth forecast globally.1 About CEOs in the Financial Services (FS) sector feel that half of these people are located in mainland China COVID-19 has accelerated digitisation of operations alone. They are looking for highly-personalised and creation of next-generation operating models, advisory solutions from technologically sound while 76 percent feel that it has accelerated the advisors to help plan their family wealth and creation of new digital business models.2 succession.