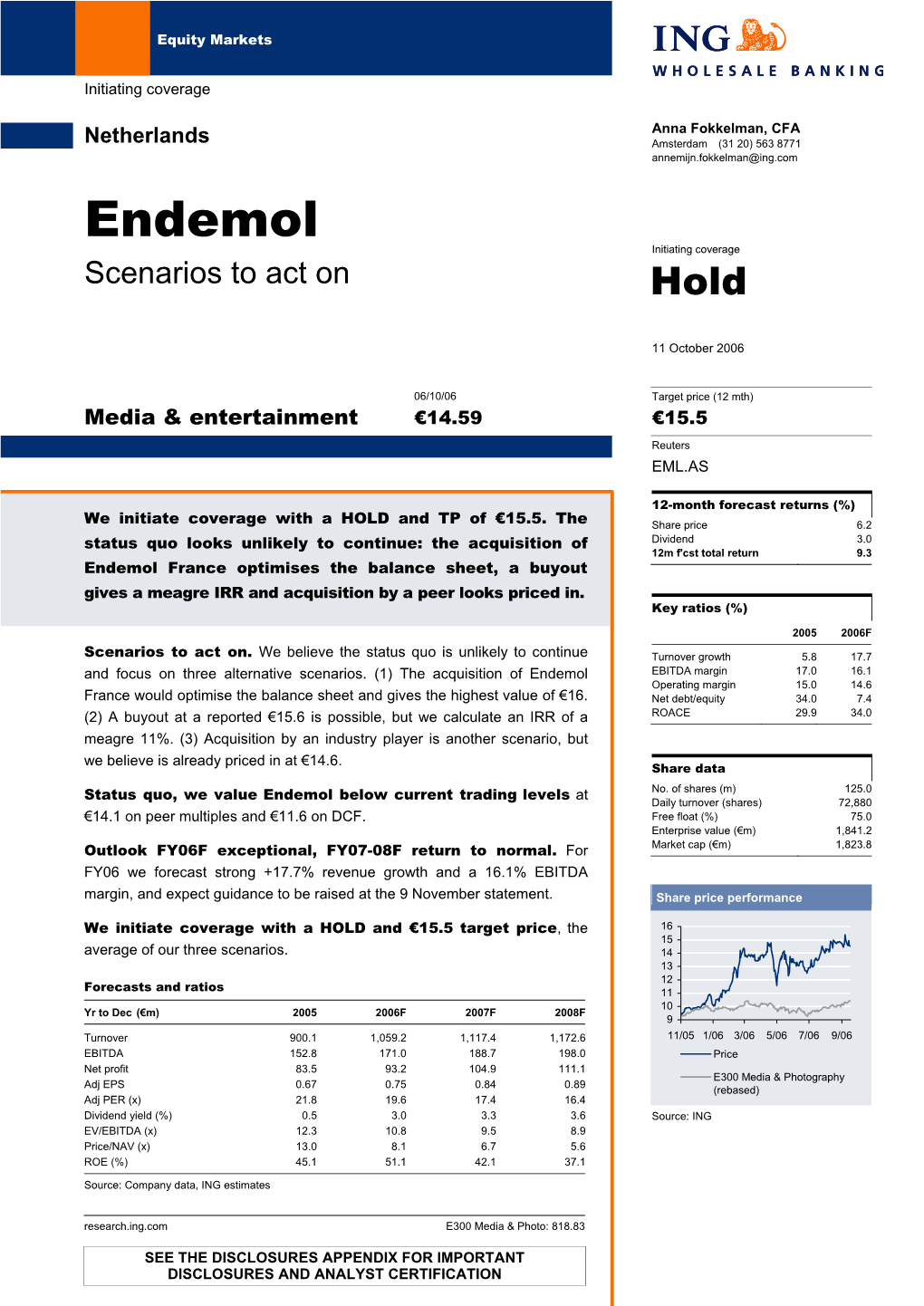

Endemol Initiating Coverage Scenarios to Act on Hold

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

L'argent De Poche

Manor Primary School Subject: Modern Foreign Language Year 4 Autumn Term: L’argent de Poche Overview of the Learning: In this unit of learning pupils will continue to gain confidence in manipulating numbers and learn further expressions for likes and dislikes. They begin to learn about the euro. They prepare and perform a radio or TV advert for a toy. Core Aims Children should be taught to: Children will: listen attentively to spoken language and show understanding by joining in and understand and respond to spoken and written language from a responding variety of authentic sources. explore the patterns and sounds of language through songs and rhymes and link the spelling, sound and meaning of words speak with increasing confidence, fluency and spontaneity, finding engage in conversations; ask and answer questions; express opinions and respond to ways of communicating what they want to say, including through those of others; seek clarification and help* discussion and asking questions, and continually improving the speak in sentences, using familiar vocabulary, phrases and basic language structures accuracy of their pronunciation and intonation. develop accurate pronunciation and intonation so that others understand when they can write at varying length, for different purposes and audiences, are reading aloud or using familiar words and phrases* using the variety of grammatical structures that they have learnt. present ideas and information orally to a range of audiences* discover and develop an appreciation of a range of writing -

France's Banijay Group Buys Endemol Shine to Create European Production Giant

Publication date: 28 Oct 2019 Author: Tim Westcott Director, Research and Analysis, Programming France's Banijay Group buys Endemol Shine to create European production giant Brought to you by Informa Tech France's Banijay Group buys Endemol Shine to 1 create European production giant France-based production company Banijay Group has reached agreement to acquire Endemol Shine Group from Walt Disney Company and US hedge fund Apollo Global Management. The price for the deal was not disclosed but is widely reported to be $2.2 billion. A statement from the group said the deal will be financed through a capital increase of Banijay Group and debt. On closure, subject to regulatory clearances and employee consultations. Post-closing, the combined group will be majority owned (67.1%) by LDH, the holding company controlled by Stephane Courbit's LOV Group, and Vivendi (32.9%), which invested in Banijay in 2014. The merged group said it will own almost 200 production companies in 23 territories and the rights for close to 100,000 hours of content, adding that total pro-forma revenue of the combined group is expected to be €3 billion ($3.3 billion) this year. Endemol Shine Group is jointly owned by Disney, which acquired its 50% stake as part of its acquisition of 21st Century Fox last year, and funds managed by affiliates of Apollo Global Management. Endemol Shine has 120 production labels and owns 66,000 hours of scripted and non- scripted programming and over 4,300 registered formats. Our analysis Endemol Shine Group has been up for sale since last year, and Banijay Group appears to be have been the only potential buyer to have made an offer, despite reported interest from All3Media, RTL Group-owned Fremantle and others. -

Bob Barker Has Made a Huge Impact on Television, and on Animal Rights, Too

2015 LEGEND AWARD A Host and a Legend BOB BARKER HAS MADE A HUGE IMPACT ON TELEVISION, AND ON ANIMAL RIGHTS, TOO BY PATT f there were a Mt. Rushmore for television this name; you’re going to hear a lot about him.” When he landed as host MORRISON game show hosts, there’s no doubt about it: Bob Barker, for his part, said modestly that, “I feel like Barker would be up there. I’m hitting afer Babe Ruth and Lou Gehrig.” on “The Price is Right” Even without being made of granite, his face Barker went on to become a one-man Murderers’ has endured, flling Americans’ eyeballs and Row of game show hosts, making a long-lasting mark in 1972, he found his television screens for a remarkable half-century. He on “Truth or Consequences” and hosting a number of Ihelped to defne the game-show genre, as a pioneer in others that came and went. television home, the myriad ways, right down to taking the radical step of But when he landed as host on “Te Price is Right” letting his hair go naturally white for TV. He has nearly in 1972, he found his television home, the place where place where he broke 20 Emmys to his credit. he broke Johnny Carson’s 29-year record as longest- Johnny Carson’s 29-year Now, he is the recipient of the Legend Award from serving host of a TV show. the Los Angeles Press Club, presented at the 2015 It’s easy to rattle of numbers—for example, the frst record as longest-serving National Arts & Entertainment Awards. -

The Price Is Right Template Guide

The Price is Right Template Guide SLB 3/09 Find this and other templates at: http://www.murray.k12.ga.us/teacher/kara%20leonard/Mini%20T%27s/Games/Games.htm (First result if you Google “Classroom game templates and more.” Don’t forget the “and more”) 1) Click on your desired template. In this case, we will be using The Price is Right. 2) Save the file to your computer. Consider creating a new folder for the slides and associated pictures and sound files. 3) Download the sound files that accompany the presentation by right clicking on each and selecting “Save Target As…” 4) Open The Price is Right PowerPoint template and check that the initial sound file works by starting the presentation. If you hear the theme from The Price is Right when the presentation starts, your sound clip is working as planned. Skip to step 5. To quickly start the presentation, click this third button from the left that looks like a projector screen. If your sound doesn’t work… don’t fret! You can try adding the track yourself. 4b) To add a track to any presentation, click Insert Movies and Sounds Sound from File… 4c) Select your desired track, in this case the theme song to The Price is Right (pricert.wav). Click OK. 4d) Select how you would like your sound to start: Automatically upon transition to that slide OR When you click on the gold loudspeaker Here is the sound icon to click in the presentation to play the embedded sound if you select “When Clicked.” . -

Endless Catalog Final

® 19991999 Endless Games™ would like to thank the toy trade for all the support they have given us in 1998. We feel privileged to be a part of this exciting and colorful industry, and look forward to bringing to market products that change the way that people feel about the board game business. We are very proud to bring our new line out this year, mixing classic games and new games for a distinctive and profitable collection for retailers and consumers. We position our product to provide solid margin and offer the retailer games that the consumer knows and seek out. We are are in a changing business and we are committed to our philosophy of great games, old and new. We are always on the hunt for new games that have the potential to go “all the way.” We are in a “what’s new?” industry and we strive to bring out products that capture the magic of great game play and offer consumers an experience. Sincerely, Kevin McNulty Vice President of Sales ® 1 NO.009 THE BEATLES GAME™ “A Document Of The Band That Changed The World!” A chronicle of the life and times of the greatest band the music industry has ever seen... It is a game like no other, based on a rock group like no other! Challenge your opponents with your knowledge of the Beatles™, their music, their lyrics, and their lives, as you take a trip down the Long and Winding Road from Liverpool to The End. For 2 or more players Ages: 10 to Adult 3 3 1 Item Size: 10 ⁄4 x 10 ⁄4 x 3⁄2 3 1 1 Case Size: 21 ⁄8 x 11⁄8 x 11⁄2 Pack: 6/Case Cube: 1.58 UPC: 6-32468-00009-6 ISBN: 1-890665-15-0 The “Beatles”® is a registered trademark of Apple Corp Limited All Rights Reserved. -

Trends in TV Production Ofcom, December 2015 Contents

Trends in TV Production Ofcom, December 2015 Contents 1. Summary 2. What were the original aims of intervention? 3. The UK production market 4. How many companies are active in the market? 5. How easy is it to enter? 6. Production sector revenue and flow of funds 7. Production sector consolidation 8. Quotas 9. Regionality 10. Historical context of the US market Summary – the questions asked This pack aims to confirm (or dispel) many of the widely held beliefs about the UK television production sector. Among the questions it seeks to answer are: • What is the intervention (regulation of the sector) meant to do? • How has commissioning developed over time? • How has the number of producers changed over time? • Is it harder to get into the market? • How do terms of trade work? • How has the sector grown? • What has consolidation looked like? • How do quotas work? • How does the sector operate regionally? 3 Summary – caveats This report was produced for Ofcom by Oliver & Ohlbaum Associates Ltd (“O&O”). The views expressed in this report are those of O&O and do not necessarily represent the views of Ofcom. While care has been taken to represent numbers in this report as accurately as possible based on available sources there may be inaccuracies and they may not correspond with Ofcom’s view of the market and cannot be taken as officially representative of Ofcom data. 4 Summary - data sources used • Oliver & Ohlbaum Producer Database, 2006-2015 ₋ BARB data supplied by Attentional and further coded by O&O to include production companies and their status as qualifying or no-qualifying producers, plus their respective turnover bands. -

The Price Is Right Recapitulation for September 23Rd, 2015 Season 44, Episode 3 (#7213K)

The Price Is Right Recapitulation for September 23rd, 2015 Season 44, Episode 3 (#7213K) Season 44 of The Price Is Right kicks off with “Decades Week”; each of the first five shows this season pays tribute to one of the decades during which The Price Is Right aired. Today’s show pays tribute to the 1990s. The cast and contestants appear in costume, and tributes occur throughout the hour. I won’t spoil most of them, as half the fun of this week for us long-time fans will come from watching the show. Needless to say, the crew went all-out this week and paid attention to details in ways we thought impossible in this day and age. Models: Manuela Arbelaez, James O’Halloran, Rachel Reynolds Mic Handoff: Rachel Reynolds First Four: Adam Hertz, Jelecia Smith, Elliot Mangoubi, Raven Anderson IUFB1: 16GB iPhone 6(4.7” retina HD display, fingerprint identification sensor) (For all of you viewers with 4.7” retinas, this phone suits you perfectly! Have fun waiting in line for a few days.) Stagey Bids: $760 $880 $1103 $1104 ARP1: $1196 Raven plays Benghazi Game Cover Up for a Kia Rio LX (1.6L, 6-spd AT, front wheel drive, carpeted floor mats, power package, cargo net)! No word exists on if Raven dances on the sand. Game Board: A = the logo for $UPER $AVER B = the logo for BUMP C = the logo for D = the logo for SPLIT DECISION E = the logo for Raven’s first guess: Raven’s second guess: Raven’s third guess: Nicely done, Raven! Have fun picking up Robin and Starfire. -

COME on Mo Knows Television, Guiding Light Gives Back D 22

TAKEStelevision’s behind-the-scenes notebook Daytime fixture and pop 20 culture icon Bob Barker COME ON Mo Knows Television, Guiding Light Gives Back D 22 Villain’s Manifesto O W N! 24 12 questions for television’s favorite game show host t age 83, Bob Barker is the oldest more time making the world a better Remembering man ever to host a weekday place for animals. After one of his Peter Boyle game show—and to beat up last show tapings, Watch! caught up A Adam Sandler. From flying with Barker backstage for an exclusive fighter planes in World War II to master- one-on-one interview. ing karate midlife to advocating animal rights, this beloved, white-haired, day- Watch! : What will you miss the 26 time TV dynamo has shown no signs of most about Th e Price Is Right? slowing down … until now. Bob Barker: The paycheck. For 35 years, Barker has hosted The Price Is Right, and it’s at this juncture W: Did you ever think the words In the Stars that the television icon is ready to hang “come on down” would become Bob: Tony Esparza/CBS; Peter: Monty Brinton/ CBS Brinton/ Monty Peter: Esparza/CBS; Tony Bob: By Mona Buehler up his mic, skip the studio and spend part of pop culture history? Watch! June 2007 17 FdCW0607_17-19_QT_Barker7.indd 17 3/15/07 1:43:59 PM TAKES “I enjoy the younger generations very much,” Bob Barker says. “Not only do they make splendid contestants, but they bring energy to the audience.” W: Do you do the buying in your household? BB: My housekeeper shops, and sometimes when I do an interview, the interviewer will show up with a brown paper bag and start pull- ing things out and play the games with me. -

The Price Is Right /The Real Estate Corner

The Price is Right / The Real Estate Corner By Kitty Barran There is an ever-popular TV a job offer in Sheboygan and needs sits idle when she’s ready to go. game show that has transcended to move in 90 days. She decides Her best bet is to have a heart-to- generations of contestants – The that although she hasn’t made any heart with her realtor, set a price Price is Right . From old-school improvements to it since she that will sell quickly and allows Bob Barker fans to newly hooked bought it, the market must have her to start fresh without worrying Drew Carey junkies, we all love to appreciated in five years. She about a property left behind. guess the price of the myriad items heard a news story a year or so ago Mrs. Seller C? Ding-ding-ding! on the show. that said 6% was the average Her home might not have the most Real estate is a little like playing annual increase in home values so amenities or be the most updated The Price is Right . Whether you’re she prices her home 30% above of our three properties, but she is a buyer, seller or curious observer, what she paid five years ago. the most realistic about its market you probably have a price in mind And our final contestant, Mrs. value. Her house will likely be the for any property you see on the Seller C, come on down! You are first of the three to sell and she’ll market. -

Limitations on Copyright Protection for Format Ideas in Reality Television Programming

For exclusive use of MLRC members and other parties specifically authorized by MLRC. © Media Law Resource Center, Inc. LIMITATIONS ON COPYRIGHT PROTECTION FOR FORMAT IDEAS IN REALITY TELEVISION PROGRAMMING By Kent R. Raygor and Edwin Komen* * Kent R. Raygor and Edwin Komen are partners in the Entertainment, Media, and Technology Group in the Century City, California and Washington, D.C. offices, respectively, of Sheppard Mullin Richter & Hampton LLP. The authors thank Ben Aigboboh, an associate in the Century City office, for his assistance with this article. 97 For exclusive use of MLRC members and other parties specifically authorized by MLRC. © Media Law Resource Center, Inc. LIMITATIONS ON COPYRIGHT PROTECTION FOR FORMAT IDEAS IN REALITY TELEVISION PROGRAMMING I. INTRODUCTION Television networks constantly compete to find and produce the next big hit. The shifting economic landscape forged by increasing competition between and among ever-proliferating media platforms, however, places extreme pressure on network profit margins. Fully scripted hour-long dramas and half-hour comedies have become increasingly costly, while delivering diminishing ratings in the key demographics most valued by advertisers. It therefore is not surprising that the reality television genre has become a staple of network schedules. New reality shows are churned out each season.1 The main appeal, of course, is that they are cheap to make and addictive to watch. Networks are able to take ordinary people and create a show without having to pay “A-list” actor salaries and hire teams of writers.2 Many of the most popular programs are unscripted, meaning lower cost for higher ratings. Even where the ratings are flat, such shows are capable of generating higher profit margins through advertising directed to large groups of more readily targeted viewers. -

The Nation Speaks Back!

Formats TBIvision.com October/November 2016 It’s time to listen to the people... The nation speaks back! FormatspOFC OctNov16.indd 1 04/10/2016 19:58 THE iconic new game show Coming to screens in the UK and the Netherlands FormatspIFC-01 Talpa dps OctNov16.indd 2 03/10/2016 20:21 THE iconic new game show Coming to screens in the UK and the Netherlands FormatspIFC-01 Talpa dps OctNov16.indd 3 03/10/2016 20:21 Logic will get you from A to B. Imagination will take you everywhere. Pop-Science format now in its fifth season. Over 50 episodes of smart entertainment. One of the highest-rated series of all time on National Geographic. MIPCOM stand C16.C fngcontentdistribution.com 03041Formatsp02-03 - FOX MipCom Fox OctNov16.indd Ad BRAIN GAMES 2 V1.indd 1 28/09/2016 10:27 26/09/2016 21:08 Logic will get you from A to B. Imagination will take you everywhere. Pop-Science format now in its fifth season. Over 50 episodes of smart entertainment. One of the highest-rated series of all time on National Geographic. MIPCOM stand C16.C fngcontentdistribution.com 03041 - FOX MipCom Ad BRAIN GAMES V1.indd 1 Formatsp02-03 Fox OctNov16.indd 3 28/09/201626/09/2016 21:0810:27 8 x 60’ SERIES + FORMAT CHALLENGING FASHION CHANGING LIVES MASSIVE SOCIAL MEDIA PRESENCE: 4 MILLION An engaging and entertaining UNIQUE VISITORS TO Hosted by new competitive series, creating a new thefashionhero.com BROOKE HOGAN reality in the world of fashion. VISIT US AT MIPCOM, BOOTH P-1.B85 Created by or contact Nha-Uyen Chau, Looking Glass International: [email protected] CAROLINE BERNIER or Nathalie Bourdon Beauty World Search: [email protected] Beauty World Search Formatsp04 Beauty World OctNov16.indd 1 26/09/2016 18:03 J9758_FASHION_HERO_TBI_FP_MIPCOM_ISSUE_FORMATS_ADVERT_AW.indd 1 26/09/2016 17:47 CONTENTS INSIDE THIS ISSUE 6 This issue 12 6 TBI Interview: Ben Silverman and Howard T. -

The Price Is Right Contestant Search 2016 - 2017 Eligibility Requirements

THE PRICE IS RIGHT CONTESTANT SEARCH 2016 - 2017 ELIGIBILITY REQUIREMENTS NO PURCHASE OR PAYMENT OF ANY KIND IS NECESSARY TO ENTER OR WIN. VOID WHERE PROHIBITED BY LAW. Please note: the following eligibility requirements and terms must be met in order to proceed with the application process for THE PRICE IS RIGHT CONTESTANT SEARCH (the "Contestant Search"). Promotion Description There will be open casting calls (“Casting Call”) in selected markets June 1, 2016 through October 31, 2016 (“Casting Calls”). Each applicant will be interviewed on camera for approximately thirty (30) seconds answering questions such as "Why do you want to be a contestant on THE PRICE IS RIGHT?" (See “Winner Selection” for judging criteria). These questions may change from time to time at the sole discretion of the producers of THE PRICE IS RIGHT (“Producers”). Sponsored by THE PRICE IS RIGHT PRODUCTIONS, INC. and CBS TELEVISION STATIONS (“Sponsors”). Only one application per person. Eligibility You must be 18 years of age or older at the time of application. You must be a legal resident of the United States and live in the United States as of the date you submit your application and continuing through the dates of travel to Los Angeles, CA, if you are selected as a semi-finalist. You may not be a candidate for public office at the time of entry, and if selected to be a contestant, you must agree not to become a candidate for public office until after the initial broadcast of the program in which you appear. You are not eligible, if: You have been a contestant