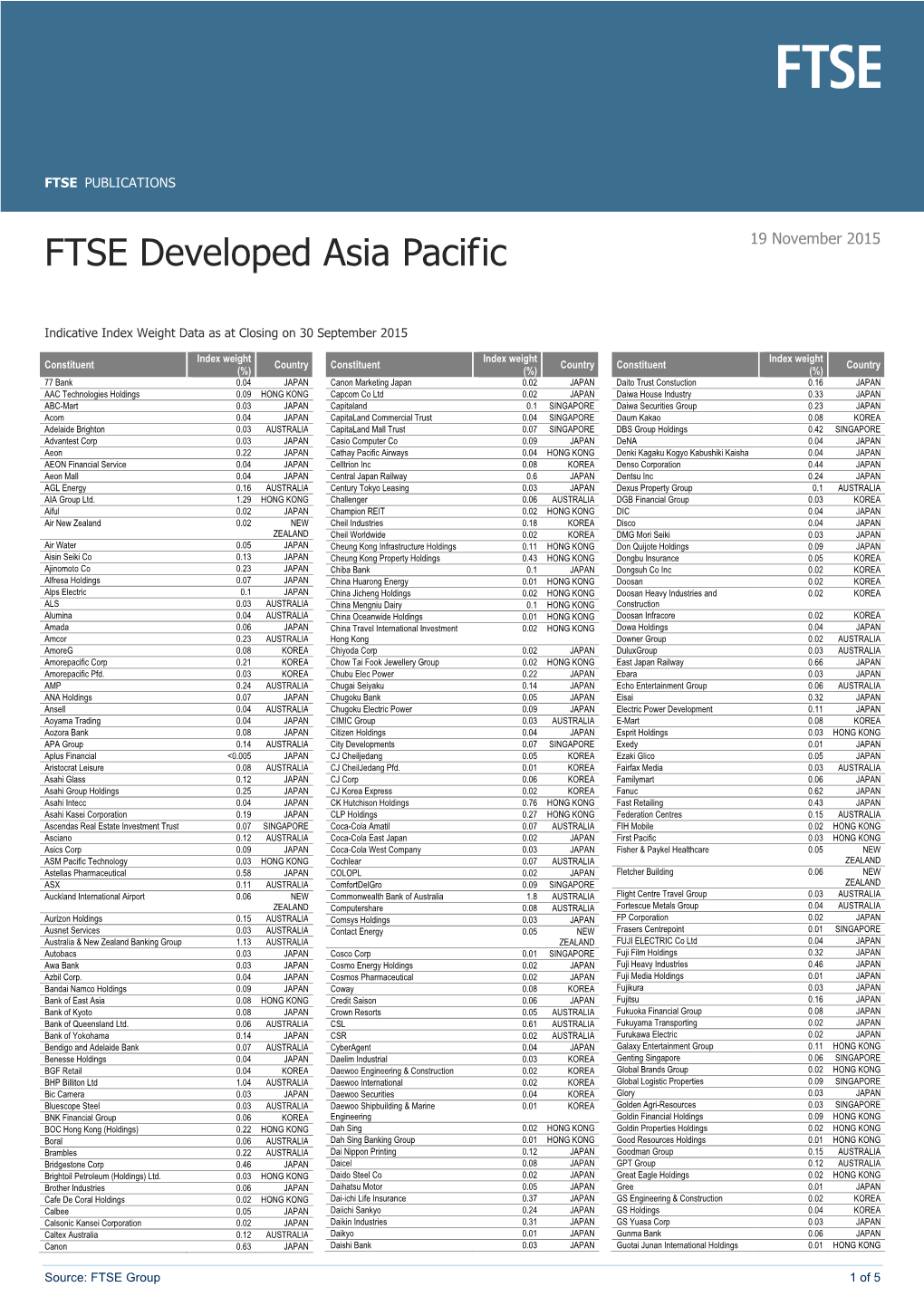

FTSE Developed Asia Pacific 19 November 2015

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report and Financial Statements

Annual Report and Financial Statements for the year ended 31 December 2018 Dimensional Funds ICVC Authorised by the Financial Conduct Authority No marketing notification has been submitted in Germany for the following Funds of Dimensional Funds ICVC: Global Short-Dated Bond Fund International Core Equity Fund International Value Fund United Kingdom Core Equity Fund United Kingdom Small Companies Fund United Kingdom Value Fund Accordingly, these Funds must not be publicly marketed in Germany. Table of Contents Dimensional Funds ICVC General Information* 2 Investment Objectives and Policies* 3 Authorised Corporate Directors’ Investment Report* 6 Incorporation and Share Capital* 10 The Funds 10 Fund Cross-Holdings 10 Authorised Status* 10 Regulatory Disclosure* 10 Potential Implications of Brexit* 10 Responsibilities of the Authorised Corporate Director 11 Responsibilities of the Depositary 11 Report of the Depositary to the Shareholders 11 Directors' Statement 11 Independent Auditors’ Report to the Shareholders of Dimensional Funds ICVC 12 The Annual Report and Financial Statements for each of the below sub-funds (the “Funds”); Emerging Markets Core Equity Fund Global Short-Dated Bond Fund International Core Equity Fund International Value Fund United Kingdom Core Equity Fund United Kingdom Small Companies Fund United Kingdom Value Fund are set out in the following order: Fund Information 14 Portfolio Statement* 31 Statement of Total Return 149 Statement of Change in Net Assets Attributable to Shareholders 149 Balance Sheet 150 Notes to the Financial Statements 151 Distribution Tables 168 Remuneration Disclosures (unaudited)* 177 Supplemental Information (unaudited) 178 * These collectively comprise the Authorised Corporate Directors’ (“ACD”) Report. Dimensional Fund Advisors Ltd. Annual Report and Financial Statements, 31 December 2018 1 Dimensional Funds ICVC General Information Authorised Corporate Director (the “ACD”): Dimensional Fund Advisors Ltd. -

News Release SRI International / Nomura Holdings Nomura-SRI Innovation Center Will Begin Operations in July to Accelerate Adopti

Nomura-SRI Innovation Center Will Begin Operations in July to Accelerate Adoption of Emerging Technologies Among Japanese Corporations SRI International and Nomura Will Support Japanese Businesses Through the Process of Evaluating and Bringing New Technology to Market MENLO PARK, Calif., PRNewswire, June 22, 2021: SRI International (SRI) and Nomura announced today that the Nomura-SRI Innovation Center (NSIC), located on SRI’s main campus in Menlo Park, Calif., will begin operations in July 2021. For industry leading businesses, keeping ahead of emerging technologies is vital to continued global success and growth. As NSIC members, Japanese enterprises will be connected with pioneering R&D labs, university research teams, as well as Silicon Valley incubators and startups that are relevant to their industries and specific investments. NSIC will help members acquire and cultivate best practices for identifying and evaluating emerging technologies. It will enhance their adoption of next-generation innovation, allowing members to optimize the value of their technology investments. SRI and Nomura welcome Harmonic Drive Systems Inc., Murata Manufacturing Co., Ltd., Nomura Research Institute, Ltd., Obayashi Corporation and Shizuoka Bank Ltd. as charter members scheduled to participate in July. “Here at NSIC, we’re excited to work with these market-leading companies to support their internal technology, research and innovation teams,” said Chris Cowart, managing director of NSIC. “Our charter members bring a spectrum of industry insights to NSIC’s Silicon Valley immersion program. We will be working closely with each member to share best practices, exclusive partner connections and tailored expertise relevant to their business goals for emerging technologies.” “At Nomura, we know that technology investments are vital to the future growth of our clients and partners in Japan,” commented Neeraj Hora, head of innovation and investment at Nomura Holding America Inc. -

STOXX Asia 100 Last Updated: 02.02.2015

STOXX Asia 100 Last Updated: 02.02.2015 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) JP3633400001 6900643 7203.T 690064 Toyota Motor Corp. JP JPY Y 170.2 1 1 KR7005930003 6771720 005930.KS KR002D Samsung Electronics Co Ltd KR KRW Y 150.6 2 2 TW0002330008 6889106 2330.TW TW001Q TSMC TW TWD Y 96.3 3 3 KYG875721634 BMMV2K8 0700.HK B01CT3 Tencent Holdings Ltd. CN HKD Y 78.9 4 5 JP3902900004 6335171 8306.T 659668 Mitsubishi UFJ Financial Group JP JPY Y 67.6 5 4 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 62.3 6 6 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 61.9 7 8 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 56.9 8 7 JP3436100006 6770620 9984.T 677062 Softbank Corp. JP JPY Y 50.9 9 9 JP3854600008 6435145 7267.T 643514 Honda Motor Co. Ltd. JP JPY Y 48.9 10 11 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 48.7 11 10 JP3890350006 6563024 8316.T 656302 Sumitomo Mitsui Financial Grou JP JPY Y 42.6 12 12 JP3496400007 6248990 9433.T 624899 KDDI Corp. JP JPY Y 39.2 13 16 INE002A01018 6099626 RELI.BO IN0027 Reliance Industries Ltd IN INR Y 38.9 14 14 JP3735400008 6641373 9432.T 664137 Nippon Telegraph & Telephone C JP JPY Y 38.7 15 17 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 37.8 16 13 JP3885780001 6591014 8411.T 625024 Mizuho Financial Group Inc. -

February 25, 2019 Toshiba Corporation for IMMEDIATE RELEASE

February 25, 2019 Toshiba Corporation FOR IMMEDIATE RELEASE Regarding Transfer of Toshiba Group’s Materials & Devices Businesses to a Wholly Owned Subsidiary by a Company Split, Implementing Business Reorganization Announced on January 10, 2019 TOKYO―Toshiba Corporation (TOKYO: 6502) today signed absorption-type company split agreements that transfer its materials and devices businesses to Toshiba Electronic Devices & Storage Corporation (hereinafter “TDSC”), its wholly owned subsidiary, with an effective date of April 1, 2019 This follows Toshiba’s January 10, 2019 announcement, “Toshiba Group to Reevaluate Organizational Structure,” announcing Toshiba’s decision to transfer the businesses, manufacturing operations and affiliated group companies operated by the Materials & Devices Division to related parts of the Group. Currently, the Materials & Devices Division is responsible for the photocatalyst business*1 and other materials-related business, and also oversees the management of two Toshiba Group companies, Toshiba Materials Co., Ltd. (hereinafter “T MAT”) and Toshiba Hokuto Electronics Corporation (hereinafter “THD”). These businesses will be transferred to TDSC, with an effective date of April 1, 2019 Some disclosure items and details are omitted since the company splits are between Toshiba and its wholly-owned subsidiary. 1. Purpose of the Company Splits Under the Toshiba Next Plan, introduced in November last year, Toshiba is implementing organizational changes to strengthen business operations and secure faster decision making across its business lines, and in its corporate operations. Measures to date include the January 1, 2019 establishment of the New Business Development Office, and consolidations that are concentrating business units in four key group companies. The reorganization of the materials and devices businesses is part of this process. -

FTSE Korea 30/18 Capped

2 FTSE Russell Publications 19 August 2021 FTSE Korea 30/18 Capped Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) Alteogen 0.19 KOREA Hyundai Engineering & Construction 0.35 KOREA NH Investment & Securities 0.14 KOREA AmoreG 0.15 KOREA Hyundai Glovis 0.32 KOREA NHN 0.07 KOREA Amorepacific Corp 0.65 KOREA Hyundai Heavy Industries 0.29 KOREA Nong Shim 0.08 KOREA Amorepacific Pfd. 0.08 KOREA Hyundai Marine & Fire Insurance 0.13 KOREA OCI 0.17 KOREA BGF Retail 0.09 KOREA Hyundai Merchant Marine 1.02 KOREA Orion 0.21 KOREA BNK Financial Group 0.18 KOREA Hyundai Mipo Dockyard 0.15 KOREA Ottogi 0.06 KOREA Celltrion Healthcare 0.68 KOREA Hyundai Mobis 1.53 KOREA Paradise 0.07 KOREA Celltrion Inc 2.29 KOREA Hyundai Motor 2.74 KOREA Posco 1.85 KOREA Celltrion Pharm 0.24 KOREA Hyundai Motor 2nd Pfd. 0.33 KOREA Posco Chemical 0.32 KOREA Cheil Worldwide 0.14 KOREA Hyundai Motor Pfd. 0.21 KOREA Posco International 0.09 KOREA CJ Cheiljedang 0.3 KOREA Hyundai Steel 0.33 KOREA S1 Corporation 0.13 KOREA CJ CheilJedang Pfd. 0.02 KOREA Hyundai Wia 0.13 KOREA Samsung Biologics 0.92 KOREA CJ Corp 0.11 KOREA Industrial Bank of Korea 0.22 KOREA Samsung C&T 0.94 KOREA CJ ENM 0.15 KOREA Kakao 3.65 KOREA Samsung Card 0.08 KOREA CJ Logistics 0.12 KOREA Kangwon Land 0.23 KOREA Samsung Electro-Mechanics 0.81 KOREA Coway 0.36 KOREA KB Financial Group 1.78 KOREA Samsung Electronics 25.36 KOREA Daewoo Engineering & Construction 0.12 KOREA KCC Corp 0.12 KOREA Samsung Electronics Pfd. -

Final Report –Institutional Framework for Financial Groups

Financial Service Agency The Working Group on Payments and Transaction Banking of the Financial System Council Financial Services Agency Institutional Framework for Financial Groups Final Report by the Financial System Council あ Final Report: Institutional Framework for Financial Groups Presented to the Minister for Financial Services by the chairman of the Financial System Council December 2015 This report is a provisional translation of original Japanese version. Contents Introduction 1 Chapter 1. Business Management of Financial Group 2 Section 1 Situation around business management of financial groups 2 (1) Megabank groups 2 (2) Regional bank groups 3 Section 2 Principle of desired business management style 3 Section 3 Ensuring the effectiveness of group-wide business management 4 (1) Functions required for group-wide business management 4 (2) Issues associated with the Companies Act 4 (3) Information sharing 5 Chapter 2 Consolidating Common and Duplicate Operations within a Group 6 Section 1 Principle 6 Section 2 Regulations on consolidation of common and duplicate operations 7 (1) Consolidating common and duplicate operations into a holding company 7 (2) Consolidating common and duplicate operations into a subsidiary 7 (3) Facilitating financing within a group 8 (4) Facilitating provision of banking services by an entire group 9 Chapter 3 IT and Payment-related Operations by Financial Group 11 Section 1 Principle of regulations on permissible activities of financial group 11 Section 2 IT and payment-related operations 12 (1) Facilitating -

Annual Results for 3QFY2016

Matsui Securities Co., Ltd. (First Section of TSE: 8628) Annual Results for 3QFY2016 January 2017 Table of Contents Section 1 Financial Summary 6 Section 2 Results of Operation 16 Section 3 Recent Developments 23 1 Results of Operation ◆ Equity trading value / Market share ◆ Equity commission rate Excluding “Margin Trading Service for (JPY tn) Margin Trading Service for Day-trades (bp) Day-trades” 15 15% 12 13.5% 13.8% 12.4% 12.7% 12.2% 10.0 10.0 9.6 9.9 9.8 12 12% 10 8 9 9.6 9% 9.2 8.9 8.6 8.4 6 6% 6 4.8 4.7 4.4 4.3 5.4 5.3 5.3 3.9 3 4.6 4.5 3% 4 0 0% 2 3Q 4Q 1Q 2Q 3Q 3Q 4Q 1Q 2Q 3Q FY15 FY16 FY15 FY16 ◆ Margin balance / Market share ◆ Net financial income ratio (JPY bn) 5.0% 400 9.2% 9.1% 10% 9.0% 8.9% 4.2% 8.3% 3.8% 3.9% 8% 4.0% 3.6% 3.7% 300 308 6% 3.0% 200 258 241 224 231 4% 2.0% 100 2% 1.0% 0 0% 0.0% 3Q 4Q 1Q 2Q 3Q 3Q 4Q 1Q 2Q 3Q FY15 FY16 FY15 FY16 2 Financial Results ◆ Operating revenue ◆ Ordinary income (JPY mn) (JPY mn) 10,000 10,000 8,071 7,823 8,000 7,463 8,000 6,981 6,284 6,000 6,000 5,057 4,569 4,084 3,860 4,000 4,000 3,296 2,000 2,000 0 0 3Q 4Q 1Q 2Q 3Q 3Q 4Q 1Q 2Q 3Q FY15 FY16 FY15 FY16 1 ◆ Net income / ROE ◆ Ordinary income ratio (JPY mn) 10,000 20% 80% 63% 58% 8,000 14.3% 55% 15% 60% 55% 52% 12.5% 12.4% 11.6% 6,000 10.0% 10% 40% 4,000 3,273 2,865 2,828 2,673 2,277 5% 20% 2,000 0 0% 0% 3Q 4Q 1Q 2Q 3Q 3Q 4Q 1Q 2Q 3Q FY15 FY16 FY15 FY16 Note 1: Annualized on each quarter 3 Financial Highlights ◆ Operating revenues up JPY 700 million QoQ • Commissions were up JPY 590 million due to increase of equity trading value excluding -

Cheil Industries Stronger Is the Unconventional Challenges

year in review in year unconventional challenges and our responses What makes Cheil Industries stronger is the unconventional challenges. We continued to move forward when competitors were at a standstill, and worked on making the company better while others were solely focused on external growth. Cheil Industries looks to push boundaries and seeks challenges and innovation even in times of great uncertainty. This Corporate Report is a record of what Cheil Industries has done in the past, and how we have responded to crisis by taking full advantage of opportunities and boldly adopting changes. It is also a commitment to growth in the future, so that Cheil Industries can join with all of our stakeholders in becoming a stronger, better company. 03 Cheil Industries Corporate Report 2011 year in review in year we are original strong no future creative without a past Cheil Industries’ 57 year history has built a company of immense experience. The company has always upheld a strong set of values, resulting in today’s growth and success. This is an introduction to the history of Cheil Industries – a history which also serves as the basis for the core values that will shape our future. 04 05 Cheil Industries Corporate Report 2011 1954 Cheil Woolen Fabrics Industries founded ns I 1956 Commenced plant operations and manufactured Korea’s first combed yarn Beg year in review in year 1961 Launched Korea’s first textile exports (1954~1968) 1965 Became the first Korean business to secure a license to use the WOOL trademark A Journey 1969 Became the -

FTSE Japan ESG Low Carbon Select

2 FTSE Russell Publications 19 August 2021 FTSE Japan ESG Low Carbon Select Indicative Index Weight Data as at Closing on 30 June 2021 Constituent Index weight (%) Country Constituent Index weight (%) Country Constituent Index weight (%) Country ABC-Mart 0.01 JAPAN Ebara 0.17 JAPAN JFE Holdings 0.04 JAPAN Acom 0.02 JAPAN Eisai 1.03 JAPAN JGC Corp 0.02 JAPAN Activia Properties 0.01 JAPAN Eneos Holdings 0.05 JAPAN JSR Corp 0.11 JAPAN Advance Residence Investment 0.01 JAPAN Ezaki Glico 0.01 JAPAN JTEKT 0.07 JAPAN Advantest Corp 0.53 JAPAN Fancl Corp 0.03 JAPAN Justsystems 0.01 JAPAN Aeon 0.61 JAPAN Fanuc 0.87 JAPAN Kagome 0.02 JAPAN AEON Financial Service 0.01 JAPAN Fast Retailing 3.13 JAPAN Kajima Corp 0.1 JAPAN Aeon Mall 0.01 JAPAN FP Corporation 0.04 JAPAN Kakaku.com Inc. 0.05 JAPAN AGC 0.06 JAPAN Fuji Electric 0.18 JAPAN Kaken Pharmaceutical 0.01 JAPAN Aica Kogyo 0.07 JAPAN Fuji Oil Holdings 0.01 JAPAN Kamigumi 0.01 JAPAN Ain Pharmaciez <0.005 JAPAN FUJIFILM Holdings 1.05 JAPAN Kaneka Corp 0.01 JAPAN Air Water 0.01 JAPAN Fujitsu 2.04 JAPAN Kansai Paint 0.05 JAPAN Aisin Seiki Co 0.31 JAPAN Fujitsu General 0.01 JAPAN Kao 1.38 JAPAN Ajinomoto Co 0.27 JAPAN Fukuoka Financial Group 0.01 JAPAN KDDI Corp 2.22 JAPAN Alfresa Holdings 0.01 JAPAN Fukuyama Transporting 0.01 JAPAN Keihan Holdings 0.02 JAPAN Alps Alpine 0.04 JAPAN Furukawa Electric 0.03 JAPAN Keikyu Corporation 0.02 JAPAN Amada 0.01 JAPAN Fuyo General Lease 0.08 JAPAN Keio Corp 0.04 JAPAN Amano Corp 0.01 JAPAN GLP J-REIT 0.02 JAPAN Keisei Electric Railway 0.03 JAPAN ANA Holdings 0.02 JAPAN GMO Internet 0.01 JAPAN Kenedix Office Investment Corporation 0.01 JAPAN Anritsu 0.15 JAPAN GMO Payment Gateway 0.01 JAPAN KEWPIE Corporation 0.03 JAPAN Aozora Bank 0.02 JAPAN Goldwin 0.01 JAPAN Keyence Corp 0.42 JAPAN As One 0.01 JAPAN GS Yuasa Corp 0.03 JAPAN Kikkoman 0.25 JAPAN Asahi Group Holdings 0.5 JAPAN GungHo Online Entertainment 0.01 JAPAN Kinden <0.005 JAPAN Asahi Intecc 0.01 JAPAN Gunma Bank 0.01 JAPAN Kintetsu 0.03 JAPAN Asahi Kasei Corporation 0.26 JAPAN H.U. -

Discussion Regarding a Business Alliance with the Bank of Yokohama

August 27, 2014 To whom it may concern: Sumitomo Mitsui Trust Holdings, Inc. (Securities Code: 8309 TSE, NSE) Sumitomo Mitsui Trust Bank, Limited Discussion Regarding a Business Alliance with the Bank of Yokohama Sumitomo Mitsui Trust Bank, Limited (“SMTB”, President: Hitoshi Tsunekage) hereby announces that on August 27, 2014, it entered into, with the Bank of Yokohama, Ltd. (“BOY”, Representative Director and President: Tatsumaro Terazawa), a memorandum of understanding (the “MOU”) on conducting discussions regarding a business alliance related to asset management and sales of investment products for individual customers, including the joint establishment of a new asset management company (“New AM Company”). 1. Background and Purpose of the MOU The BOY Group has a branch network that is centered in Kanagawa Prefecture and the southwest part of Tokyo and aims to become a bank that customers would be willing to select, by helping them with solutions that can assist customers' problem solving. The Sumitomo Mitsui Trust Group, one of the largest financial groups in Japan with respect to the amount of assets under management and assets under custody, provides customers with high-value-added services by utilizing its significant expertise and comprehensive capabilities and by leveraging its unique business model that combines banking, asset management and administration, and real estate businesses. BOY and SMTB (the “Two Banks”) will support the asset building of BOY’s customers by utilizing SMTB’s expertise in asset management and other related areas to provide BOY customers with long-term, diversified, and stable asset management services. Further, the New AM Company is scheduled to manage investment products contributing to long-term, diversified, and stable asset management, and the Two Banks may consider increasing the number of alliance partners. -

Interim FY 2011 Financial Results

The 11th MEDIUM TERM MANAGEMENT PLAN FRONTIER 70 InterimInterim FinancialFinancial ResultsResults forfor FY2011FY2011 Frontier 70 NovemberNovember 25,25, 20112011 The 11th MEDIUM TERM MANAGEMENT PLAN FRONTIER 70 Table of Contents ≫≫ Progress in Medium Term Management Plan ≫ Summary of Financial Results “Frontier 70” Summary of Financial Results 3 Medium Term Management Plan 13 Net Interest Income 4 Development Projects and Strong Financial Needs 14 Loan Portfolio 5 Branch Network Strategy 15 Securities Portfolio 6 Business in Growing Sectors 16 Fees and Commissions Income 7 International Business 17 Expenses 8 Housing Loans 18 Net Credit Costs 9 Investment-type Financial Products 19 Capital Base 10 Chibagin Securities 20 Earnings Projections for FY 2011 11 Systems Investment 21 Capital Policy 22 1 The 11th MEDIUM TERM MANAGEMENT PLAN FRONTIER 70 Summary of Financial Results ≫Summary of Financial Results ≫≫Progress in Medium Term Management Plan “Frontier 70" 2 The 11th MEDIUM TERM MANAGEMENT PLAN FRONTIER 70 Summary of Financial Results Interim Interim Net interest income ⇒(P4) <\Bil.> FY10 FY11 Change Interim Interim 1 Gross business profits 81.2 78.1 (3.0) <\Bil.> FY10 FY11 Change 2 Net interest income 69.5 67.9 (1.5) Net interest income 69.5 67.9 (1.5) 3 Net fees and commissions income 7.3 7.0 (0.3) ⇒ (P7) Domestic 68.0 66.5 (1.4) 4 Trading income 0.7 0.6 (0.1) Loans and deposits 60.8 59.6 (1.1) Profit from other business transactions 5 3.5 2.5 (1.0) Loans 65.1 62.5 (2.5) Gains (losses) related to bonds 6 2.4 1.7 (0.6) Deposits 4.3 -

(Ex Controversies and CW) Index Equity Fund

Report and Financial Statements For the year ended 31st December 2020 State Street AUT Japan Screened (ex Controversies and CW) Index Equity Fund (formerly State Street Japan Equity Tracker Fund) State Street AUT Japan Screened (ex Controversies and CW) Index Equity Fund Contents Page Manager's Report* 1 Portfolio Statement* 5 Director's Report to Unitholders* 25 Manager's Statement of Responsibilities 26 Statement of the Depositary’s Responsibilities 27 Report of the Depositary to the Unitholders 27 Independent Auditors’ Report 28 Comparative Table* 31 Financial statements: 32 Statement of Total Return 32 Statement of Change in Net Assets Attributable to Unitholders 32 Balance Sheet 33 Notes to the Financial Statements 34 Distribution Tables 45 Directory* 46 Appendix I – Remuneration Policy (Unaudited) 47 Appendix II – Assessment of Value (Unaudited) 49 * These collectively comprise the Manager’s Report. State Street AUT Japan Screened (ex Controversies and CW) Index Equity Fund Manager’s Report For the year ended 31st December 2020 Authorised Status The State Street AUT Japan Screened (ex Controversies and CW) Index Equity Fund (the “Fund”) is an Authorised Unit Trust Scheme as defined in section 243 of the Financial Services and Markets Act 2000 and it is a UCITS Retail Scheme within the meaning of the FCA Collective Investment Schemes sourcebook. The unitholders are not liable for the debts of the Fund. The Fund's name was changed to State Street AUT Japan Screened (ex Controversies and CW) Index Equity Fund on 18th December 2020 (formerly State Street Japan Equity Tracker Fund). Investment Objective and Policy The objective of the Fund is to replicate, as closely as possible, and on a “gross of fees” basis, the return of the Japan equity market as represented by the FTSE Japan ex Controversies ex CW Index (the “Index”) net of unavoidable withholding taxes.