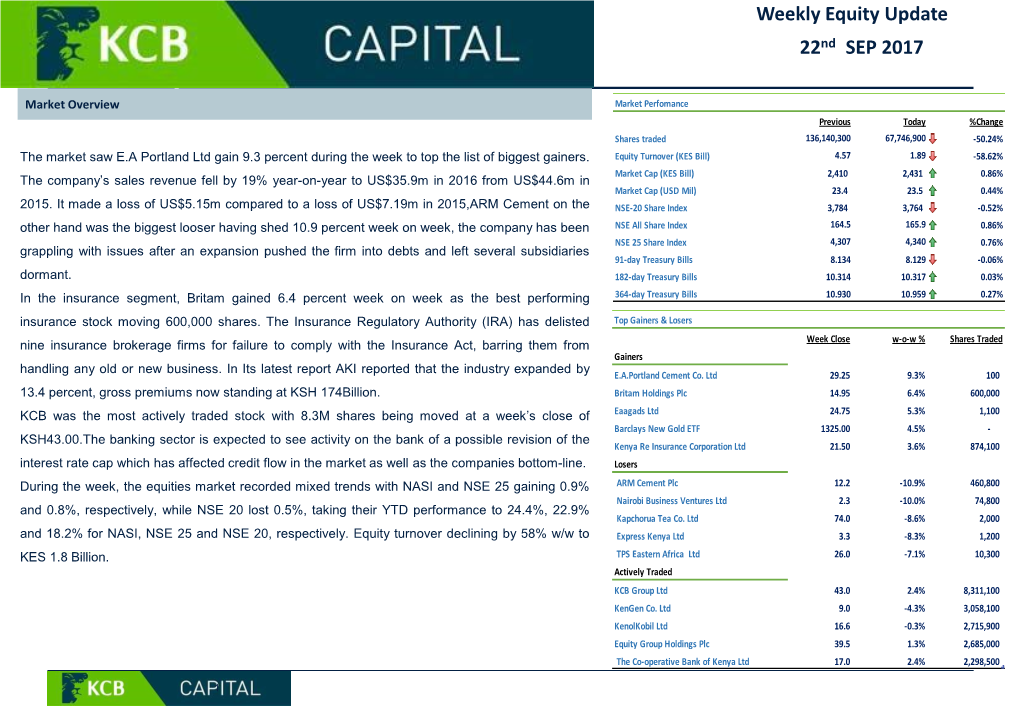

Weekly Equity Update 22Nd SEP 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ANNUAL FINANCIAL STATEMENTS 2020 Our Reporting Suite

Standard Bank Group Bank Standard Standard Bank Group ANNUAL FINANCIAL ANNUAL FINANCIAL STATEMENTS STATEMENTS FINANCIAL ANNUAL STATEMENTS 2020 2020 Our reporting suite Our integrated report Our primary report to stakeholders, providing a holistic view of our ability to create sustainable shared value in the short, medium and long term. We produce a full suite of reports to cater for the diverse needs of our stakeholders. Our integrated report contextualises and connects to information in the following reports, which provide additional disclosure and satisfy compliance reporting requirements: Governance Risk and Annual Environmental, Report to Subsidiary and capital financial social and society annual reports remuneration management statements governance (RTS) Our subsidiaries report report Sets out the (ESG) report Assesses the provide an account group’s full group's social, to their stakeholders Discusses Sets out An overview of the the group’s audited annual group's processes economic and through their own governance the group’s financial and governance environmental annual reports, approach and approach to risk statements, structures, including (SEE) impacts. available on their priorities, as well as management. including the task-force on respective websites. the remuneration report of the climate-related • The Standard policy and group audit financial disclosures Bank of South committee. Africa (SBSA) implementation (TCFD). Intended report. readers • Liberty Our clients, • Other subsidiary employees reports, including Intended readers and broader legal entities in Our shareholders, debt providers and regulators society Africa Regions. We urge our stakeholders to make use of our reporting site at The invitation to the annual general meeting (AGM) and https://reporting.standardbank.com/. -

Bank Supervision Annual Report 2019 1 Table of Contents

CENTRAL BANK OF KENYA BANK SUPERVISION ANNUAL REPORT 2019 1 TABLE OF CONTENTS VISION STATEMENT VII THE BANK’S MISSION VII MISSION OF BANK SUPERVISION DEPARTMENT VII THE BANK’S CORE VALUES VII GOVERNOR’S MESSAGE IX FOREWORD BY DIRECTOR, BANK SUPERVISION X EXECUTIVE SUMMARY XII CHAPTER ONE STRUCTURE OF THE BANKING SECTOR 1.1 The Banking Sector 2 1.2 Ownership and Asset Base of Commercial Banks 4 1.3 Distribution of Commercial Banks Branches 5 1.4 Commercial Banks Market Share Analysis 5 1.5 Automated Teller Machines (ATMs) 7 1.6 Asset Base of Microfinance Banks 7 1.7 Microfinance Banks Market Share Analysis 9 1.8 Distribution of Foreign Exchange Bureaus 11 CHAPTER TWO DEVELOPMENTS IN THE BANKING SECTOR 2.1 Introduction 13 2.2 Banking Sector Charter 13 2.3 Demonetization 13 2.4 Legal and Regulatory Framework 13 2.5 Consolidations, Mergers and Acquisitions, New Entrants 13 2.6 Medium, Small and Micro-Enterprises (MSME) Support 14 2.7 Developments in Information and Communication Technology 14 2.8 Mobile Phone Financial Services 22 2.9 New Products 23 2.10 Operations of Representative Offices of Authorized Foreign Financial Institutions 23 2.11 Surveys 2019 24 2.12 Innovative MSME Products by Banks 27 2.13 Employment Trend in the Banking Sector 27 2.14 Future Outlook 28 CENTRAL BANK OF KENYA 2 BANK SUPERVISION ANNUAL REPORT 2019 TABLE OF CONTENTS CHAPTER THREE MACROECONOMIC CONDITIONS AND BANKING SECTOR PERFORMANCE 3.1 Global Economic Conditions 30 3.2 Regional Economy 31 3.3 Domestic Economy 31 3.4 Inflation 33 3.5 Exchange Rates 33 3.6 Interest -

Cfc Stanbic Holdings Limited

Annual report 2014 CfC Stanbic Holdings Limited 1 Contents About CfC Stanbic 01 About this report Transparency and Holdings 40 accountability 02 Integrated thinking 41 Corporate information East Africa is our home, 42 Board of Directors and we are focused on Our business 46 Corporate governance report driving her growth. 03 04 Corporate profile 48 Report of the Board Audit With a heritage of over 05 Our vision and values Committee 100 years, we are a leading integrated financial services 06 How we create value 49 Report of Directors group in the East Africa region. 08 Our group strategic construct 50 Statement of Directors’ We have an on-the-ground 10 Our operating context responsibilities presence in 5 countries in East Africa and a member of 12 Realising the East Africa 51 Report of independent Standard Bank Group, opportunity auditor fit-for-purpose representation 14 Measuring our strategic outside Africa and a strategic progress partnership with ICBC. This 52 Annual financial statements unique footprint supports our 54 Consolidated and company strategy to connect African Our performance statement of profit or loss markets to each other and to 16 18 Chairman’s statement pools of capital globally. 55 Consolidated and company 20 Economic review statement of comprehensive 21 Business unit reviews income • PBB case study 56 Consolidated and company • CIB case study statement of financial 22 Financial review position 26 Five year review 57 Consolidated statement of changes in equity 58 Company statement of Ensuring our sustainability 28 changes in equity 30 Sustainability report 59 Consolidated and company 32 Risk management report statement of cash flows 60 Notes to the financial statements 140 Shareholder information 143 Group shareholding 144 Notice of Annual General Meeting 145 Proxy form About this report Materiality determination Our annual report aims to present a balanced and succinct analysis of As a financial services group focused on our strategy, performance, governance and prospects. -

ANNUAL INTEGRATED REPORT and FINANCIAL STATEMENTS 2017 Stanbic Holdings Plc

ANNUAL INTEGRATED REPORT AND FINANCIAL STATEMENTS 2017 STATEMENTS AND FINANCIAL REPORT INTEGRATED ANNUAL Stanbic Holdings Plc Holdings Stanbic Stanbic Holdings Plc Annual Integrated Report and Financial Statements 2017 Our report Our 2017 Annual Integrated Report is a demonstration of our commitment to, and strategies for, creating value for our customers, people, shareholders and community. This report aims to inform stakeholders about our financial and non-financial performance in 2017. This includes a look at how we create value over time and how our new strategy is structured to address the challenges, risks and opportunities Stanbic faces in a fast-changing world. We are committed to the principles of integrated reporting as they align with long-term value creation and the role we play as a bank in society, in moving Kenya forward. Our scope and content Unless otherwise stated, all information included in this report refers to the year ended 31st December 2017. It covers the operations of Stanbic Holdings Plc and the ways we are creating value for our stakeholders – in the context of our operating environment. All financial information presented, including the comparative periods, is in accordance with the International Financial Reporting Standards (IFRS) applicable to our operations and businesses. The non-financial sections of this report are guided by the International Integrated Reporting Council’s (IIRC) International Integrated Reporting Framework. We have determined the content of this report after extensive engagement with our customers, people, shareholders and community. Our materiality review We consider a material theme to be any matter that has the capacity to affect our shared value creation from the standpoint of the “Group” and its main stakeholders. -

Weekly Equity Update 15Th SEP 2017

Weekly Equity Update 15th SEP 2017 Market Overview Market Perfomance Previous Today %Change Shares traded 188,327,000 136,140,300 -27.71% During the week, the equities market was on a downward trend with NSE 20, NASI and NSE 25 Equity Turnover (KES Bill) 5.72 4.57 -20.13% losing 1.5%, 0.7% and 0.4%, respectively, taking their YTD performance to 23.4%, 22.0% and Market Cap (KES Bill) 2,427 2,410 -0.70% Market Cap (USD Mil) 23.5 23.4 -0.32% 18.8% for NASI, NSE 25 and NSE 20 The market was weakened by shrinking large caps counters. NSE-20 Share Index 3,840 3,784 -1.46% Week’s volumes declined to 136.14Mn from 188.93Mn on low trades on telecommunication and banking NSE All Share Index 165.7 164.5 -0.70% NSE 25 Share Index 4,324 4,307 -0.40% sectors. Market turnover thinned by 20.75% to KES 4.57Bn from KES 5.76Bn. Foreign activity was at 51.6% 91-day Treasury Bills 8.130 8.134 0.05% with a net outflow of KES 1.55Bn. 182-day Treasury Bills 10.313 10.314 0.01% Safaricom closed the week with 8.74Mn shares trading at an average of KES 25.25 for a total value of KES 364-day Treasury Bills 10.920 10.930 0.09% Top Gainers & Losers 221.45Mn as the counter closed its book. Foreign activity, at 71.3%, continues to play a major role in the Week Close w-o-w % Shares Traded value drop with the telecom shedding KES 20.03Bn in market value on a w/w basis. -

ANNUAL INTEGRATED REPORT 2019 Standard Bank Group CONTENTS

ANNUAL INTEGRATED REPORT 2019 REPORT INTEGRATED ANNUAL Standard Bank Group ANNUAL INTEGRATED REPORT 2019 Standard Bank Group Bank Standard WorldReginfo - eae09c23-c191-467e-b839-ed7c772a024b CONTENTS INTRODUCTION 2 About our integrated report 4 Our reporting suite 6 Who we are Our leaders discuss the dynamics in our markets, LEADERSHIP INSIGHT and how these are influencing our priorities and our progress in becoming a truly human, truly digital 10 Chairman’s statement and fully integrated financial services group. 12 Group chief executive’s review OUR VALUE CREATION STORY The emerging trends and issues that matter most 18 Our operating context to our stakeholders, how these are reflected in 24 Our material issues our strategy, and how we are organised to deliver 26 Our strategy measurable progress against our strategy in the short to medium term, creating sustainable value 28 Our execution model over the long term. 32 Our strategic progress 34 Our value proposition DELIVERING OUR STRATEGY Our progress for the year and prospects for 38 Client focus the year ahead according to our strategic 52 Employee engagement value drivers. 62 Risk and conduct 72 Financial outcome 84 SEE impact HOLDING OURSELVES ACCOUNTABLE How we drive good governance outcomes, 96 Governance overview and assess and reward our leaders, to ensure we continue to create and protect 106 Remuneration overview sustainable value. ADDITIONAL INFORMATION 122 Pro forma financial information 122 Standard Bank Group Limited credit ratings 122 Restatements 123 Glossary ibc Contact -

Stanbic Holdings Plc Financial Results Presentation for the Year Ended 31 December 2020 2 Table of Contents

STANBIC HOLDINGS PLC FINANCIAL RESULTS PRESENTATION FOR THE YEAR ENDED 31 DECEMBER 2020 2 TABLE OF CONTENTS 1. 2020 OVERVIEW • Reflecting on our Growth journey • Operating Environment • Purposeful In Our Response • Trusted Financial Partner 2. MANAGING RISK AND CONDUCT • Doing the right business, the right way 3. DELIVERING SUSTAINABLE RETURNS • Financial Highlights • Summary Income Statement • Revenue • Operating Expenses and Credit Impairment • Summarised Group Balance Sheet • Customer Loans and Advances • Customer Deposits • Funding, Liquidity And Capital • Summary Performance of CIB, PBB, SIAL, SBGS 4. OUTLOOK *Group - Stanbic Holdings Plc Stanbic[ADD PRESENTATION Holdings TITLE Plc INFinancial SLIDE MASTER Results MODE] Presentation / PAGE 2 for the year ended 31 December 2020 2020 OVERVIEW 1 • Reflecting on our growth journey • Operating Environment • Purposeful In Our Response • Trusted Financial Partner 4 REFLECTING ON OUR GROWTH JOURNEY Branches SHARE CAPITAL • 2008- 12 Branches with Zero Cash Deposit Machines • 2020- 26 Branches that all have Cash Deposit Machines KES millions 51,731 ATMs • 2008- 40 ATMs 40,141 • 2020- 54 ATMs Cash Deposit Machines (CDMs) 27,241 • 2015- 1st CDM installed in 2015 at Garden city branch 19,248 • 2020- 55 CDMs across the country Agent Outlets • 2019- 1st outlet went live in 2019 2008 2012 2016 2020 • 2020- 148 outlets Stanbic[ADD PRESENTATION Holdings TITLE Plc INFinancial SLIDE MASTER Results MODE] Presentation / PAGE 4 for the year ended 31 December 2020 5 OPERATING ENVIRONMENT Macroeconomic indicators -

The Relationship Between Bank Performance and Market Returns in Listed Banks in Kenya

Strathmore University SU+ @ Strathmore University Library Electronic Theses and Dissertations 2018 The Relationship between bank performance and market returns in listed banks in Kenya John Ndegwa Strathmore Business School (SBS) Strathmore University Follow this and additional works at https://su-plus.strathmore.edu/handle/11071/6067 Recommended Citation Ndegwa, J. (2018). The Relationship between bank performance and market returns in listed banks in Kenya (Thesis). Strathmore University. Retrieved from http://su- plus.strathmore.edu/handle/11071/6067 This Thesis - Open Access is brought to you for free and open access by DSpace @Strathmore University. It has been accepted for inclusion in Electronic Theses and Dissertations by an authorized administrator of DSpace @Strathmore University. For more information, please contact [email protected] The Relationship between bank performance and market returns in listed banks in Kenya By: John Ndegwa Submitted in partial fulfilment of the requirements for the Degree of Master of Business Administration at Strathmore University. Strathmore University Business School Strathmore University Nairobi, Kenya May, 2018 DECLARATION I declare that this work has not been previously submitted and approved for the award of a degree by this or any other University. To the best of my knowledge and belief, the dissertation contains no material previously published or written by another person except where due reference is made in the thesis itself. John Ndegwa Admission Number: MBA/15411 31/05/18 (Signature) ………………………………… (Date) …………………………………… Approval This research proposal has been submitted with my approval as the supervisor. Signature ………………………………….. Date …………………………… Dr. Thomas Kibua Strathmore University i ABSTRACT The aim of this study was to examine the relationship between bank financial performance and stock price returns. -

Notice of Annual General Meeting for Stanbic Holdings Plc

Notice of Annual General Meeting for Stanbic Holdings Plc NOTICE is hereby given to Shareholders that, in accordance with Articles 71(a), 71(b), 71(c) Notes: and 71(d) of the Stanbic Holdings Plc’s Articles of Association, the Sixty-Sixth Annual General 1. Any shareholder wishing to participate in the meeting should register for the Annual Meeting (AGM) of the Company will be held as a virtual meeting by electronic means on Thursday General Meeting (AGM) by dialling *483*822# for all networks and following the various 20th May 2021 at 11:00 a.m. to transact the following business: prompts regarding the registration process. In order to complete the registration process, Shareholders will need to have their ID/Passport Numbers which were used to purchase 1. The Secretary to read the notice convening the meeting and to confirm the presence of a their shares and/or their CDSC Account Number to hand. For assistance, Shareholders quorum. should dial the following helpline number: 0709170000 from 8 a.m. to 5 p.m. on a working day. 2. To receive and adopt the Audited Financial Statements for the year ended 31st December 2020, and the Directors’ and Auditor’s Report thereon. 2. Registration for the AGM opens on Monday 26th April 2021 at 9:00 a.m. and will close on Wednesday 19th May 2021 at 11:00 a.m. 3. To consider and if thought fit, approve the recommendation by the Board for payment of a first and final dividend of KShs3.80 per ordinary share, for the year ended 31st December 3. -

Annual Report and Financial Statements 2019

ANNUAL REPORT 2019 REPORT ANNUAL STANBIC HOLDINGS LIMITED ANNUAL REPORT AND FINANCIAL STATEMENTS 2019 STANBIC HOLDINGS LIMITED STANBIC Stanbic Holdings Plc Annual Report and Financial Statements For the year ended 31 December 2019 Table of contents Page Corporate information 1 Report of the Directors 2 - 3 Statement of Directors’ responsibilities 4 Directors' renumeration report 5 - 6 Corporate Information Report of the independent auditor 7 - 11 Consolidated and company statement of profit or loss 12 Consolidated and company statement of other comprehensive income 13 Consolidated and company statement of financial position 14 Consolidated statement of changes in equity 15 - 16 Company statement of changes in equity 17 Financial Statements Consolidated and company statement of cash flows 18 Notes to the financial statements 19 - 156 Stanbic Holdings Plc Corporate information For the year ended 31 December 2019 Chairman: Kitili Mbathi (Appointed on 09 May 2019) Fred N. Ojiambo, MBS, SC (Retired on 09 May 2019) Chief Executive: Greg Brackenridge* Chief Executive of Stanbic Bank Kenya Limited: Charles Mudiwa*** Non-Executive Directors: Rose W. Kimotho Edward W. Njoroge (Retired on 09 May 2019) Ruth T. Ngobi Peter N. Gethi Christopher J. Blandford – Newson** Rose B. Osoro Dorcas Kombo * South African ** South African and British *** Zimbabwean Company Secretary: Lillian N. Mbindyo P.O. Box 72833 00200 Nairobi Auditor: PricewaterhouseCoopers LLP PwC Tower Waiyaki Way/Chiromo Road P.O. Box 43963 00100 Nairobi Registered Office: Stanbic Bank Centre Chiromo Road, Westlands P.O. Box 72833 00200 Nairobi Principal Bankers: Stanbic Bank Kenya Limited Chiromo Road, Westlands P.O. Box 72833 00200 Nairobi, GPO 1 Stanbic Holdings Plc Report of the Directors For the year ended 31 December 2019 The Directors submit their report together with the audited financial statements for the year ended 31 December 2019, which disclose the state of affairs of Stanbic Holdings Plc (the “Group” or the “Company”). -

Quarter 2 2018

Meeting details Share code: HDC Company name: Hudaco Industries Limited Meeting type: AGM Date: 5 April 2018 Resolution Resolution Notes Type Allan Gray Meeting Number Recommendation Outcome 1 Approve company's executive Advisory For Passed remuneration policy 2 Approve company's Advisory For Passed remuneration report 1.1 Appoint / Re-elect directors S J Connely Ordinary For Passed 1.2 Appoint / Re-elect directors N Mandindi Ordinary For Passed 2 Elect a director appointed M R Thompson Ordinary For Passed since the previous AGM 3 Re-appoint auditors G Thornton Ordinary For Passed (partner: Mrs VR de Villiers) 4.1 Appoint / Re-elect audit D Naidoo Ordinary For Passed committee 4.2 Appoint / Re-elect audit N Mandindi Ordinary For Passed committee 4.3 Appoint / Re-elect audit M R Thompson Ordinary For Passed committee 5 Authorise directors to issue Authority to allot Ordinary Against Passed shares for cash and issue 5% of the shares in issue 6 Authorise directors to Ordinary For Passed implement approved resolutions 1 Approve directors' fees Special For Passed 2 Authority to provide financial Financial Special For Passed assistance assistance to subsidiaries 3 Authorise repurchase of Repurchase up Special For Passed ordinary shares to 5% of issued share capital Meeting details Share code: EQS06 Company name: enX Group Limited Meeting type: Noteholders Meeting Date: 10 April 2018 Resolution Resolution Notes Type Allan Gray Meeting Number Recommendation Outcome 1 Approve the addition/removal Special For Passed of guarantors 2 Approve deletion -

Stanbic Holdings Plc – FY'2020

Stanbic Holdings Plc – FY’2020 5th March, 2021 VValuation Summary • We are of the view that Stanbic Holdings Plc is a “SELL” with a target price of Kshs 78.3, representing a downside of 2.9%, from the current price of Kshs 84.5 as of 5th March 2021, inclusive of a dividend yield of 4.5%, • Stanbic Holdings Plc is currently trading at a P/TBV of 0.8x and a P/E of 6.4x vs an industry average of 0.7x and 5.3x, respectively. Key Highlights FY’2020 • The Central Bank of Kenya (CBK) revealed that loans amounting to Kshs 1.6 tn had been restructured as of December 2020, representing 54.2% of the banking sector’s loan book of Kshs 3.0 tn. This is in line with the CBK’s emergency measures announced on March 18th 2020 to provide relief to borrowers during the pandemic. The effect of the pandemic on banks’ loan books was also evidenced in the gross Non-Performing Loans (NPL) ratio increasing by 2.1% points to 14.1% in December 2020, compared to 12.0% as at December 2019; • Stanbic Bank Kenya’s parent firm Stanbic Africa Holdings Limited (SAHL) announced it has raised its stake in Stanbic Holdings Kenya to 71.2% from 69.1% by acquiring an additional 8.1 mn shares in November 2020. The share purchase is in line with the parent firm’s objective of raising its stake in Stanbic holdings to just under 75.0%, amounting to the acquisition of a maximum of 14.9 mn shares by the end of 2021 after receiving exemption from the Capital Markets Authority to proceed with the transaction.