How to Identify and Use Human Capital Analytics

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Analytics in Higher Education: Benefits, Barriers, Progress, and Recommendations (Research Report)

EDUCAUSE CENTER FOR APPLIED RESEARCH Analytics in Higher Education Benefits, Barriers, Progress, and Recommendations EDUCAUSE CENTER FOR APPLIED RESEARCH Analytics in Higher Education: Benefits, Barriers, Progress, and Recommendations Contents Executive Summary 3 Key Findings and Recommendations 4 Introduction 5 Defining Analytics 6 Findings 8 Higher Education’s Progress to Date: Analytics Maturity 20 Conclusions 25 Recommendations 26 Methodology 27 Acknowledgments 29 Author Jacqueline Bichsel, EDUCAUSE Center for Applied Research Citation for this work: Bichsel, Jacqueline. Analytics in Higher Education: Benefits, Barriers, Progress, and Recommendations (Research Report). Louisville, CO: EDUCAUSE Center for Applied Research, August 2012, available from http://www.educause.edu/ecar. Analytics in Higher Education Executive Summary Many colleges and universities have demonstrated that analytics can help significantly advance an institution in such strategic areas as resource allocation, student success, and finance. Higher education leaders hear about these transformations occurring at other institutions and wonder how their institutions can initiate or build upon their own analytics programs. Some question whether they have the resources, infrastruc- ture, processes, or data for analytics. Some wonder whether their institutions are on par with others in their analytics endeavors. It is within that context that this study set out to assess the current state of analytics in higher education, outline the challenges and barriers to analytics, and provide a basis for benchmarking progress in analytics. Higher education institutions, for the most part, are collecting more data than ever before. However, this study provides evidence that most of these data are used to satisfy credentialing or reporting requirements rather than to address strategic ques- tions, and much of the data collected are not used at all. -

Using Data Analytics to Detect Fraud

Using Data Analytics to Detect Fraud Gerard M. Zack, CFE, CPA, CIA, CCEP President, Zack, P.C. Introduction to Data Analytics ®2014 Association of Certified Fraud Examiners, Inc. 1 of 16 ®2014 Association of Certified Fraud Examiners, Inc. Course Objectives . How data analytics can be used to detect fraud . Different tools to perform data analytics . How to walk through the full data analytics process . Red flags of fraud that appear in the data . Data analytics tests that can be used to detect fraud . How to analyze non-numeric data, such as text and timelines, for signs of fraud ®2014 Association of Certified Fraud Examiners, Inc. 2 of 16 Introduction to Data Analytics . Data analytics, as it applies to fraud examination, refers to the use of analytics software to identify trends, patterns, anomalies, and exceptions within data. ®2014 Association of Certified Fraud Examiners, Inc. 3 of 16 Introduction to Data Analytics . Especially useful when fraud is hidden in large data volumes and manual checks are insufficient . Can be used reactively or proactively ®2014 Association of Certified Fraud Examiners, Inc. 4 of 16 Introduction to Data Analytics . Effective data analysis requires: • Translating knowledge of organization and common fraud indicators into analytics tests • Effectively using technological tools • Resolving errors in data output due to incorrect logic or scripts • Applying fraud investigation skills to the data analysis results in order to detect potential instances of fraud ®2014 Association of Certified Fraud Examiners, Inc. 5 of 16 Introduction to Data Analytics . Data analysis techniques alone are unlikely to detect fraud; human judgment is needed to decipher results. -

Google Analytics User Guide

Page | 1 What is Google Analytics? Google Analytics is a cloud-based analytics tool that measures and reports website traffic. It is the most widely used web analytics service on the Internet. Why should we all use it? Google Analytics helps you analyze visitor traffic and paint a complete picture of your audience and their needs. It gives actionable insights into how visitors find and use your site, and how to keep them coming back. In a nutshell, Google Analytics provides information about: • What kind of traffic does your website generate – number of sessions, users and new users • How your users interact with your website & how engaged they are – pages per session, average time spent on the website, bounce rate, how many people click on a specific link, watch a video, time spent on the webpage • What are the most and least interesting pages – landing and exit pages, most and least visited pages • Who visits your website – user`s geo location (i.e. city, state, country), the language they speak, the browser they are using, the screen resolution of their device • What users do once they are on your website – how long do users stay on the website, which page is causing users to leave most often, how many pages on average users view • When users visit your website – date & time of their visits, you can see how the user found you. • Whether visitors came to your website through a search engine (Google, Bing, Yahoo, etc.), social networks (Facebook, Twitter, etc.), a link from another website, or a direct type-in. -

Nine Common Types of Data Mining Techniques Used in Predictive Analytics

1 Nine Common Types of Data Mining Techniques Used in Predictive Analytics By Laura Patterson, President, VisionEdge Marketing Predictive analytics enable you to develop mathematical models to help better understand the variables driving success. Predictive analytics relies on formulas that compare past examples of success and failure, and then use these formulas to predict future outcomes. Predictive analytics, pattern recognition and classification problems are not new. Long used in the financial services and insurance industries, predictive analytics is about using statistics, data mining and game theory to analyze current and historical facts in order to make predictions about future events. The value of predictive analytics is relatively obvious. The more you understand customer behavior and motivations the more effective your marketing. The more you know why some customers are loyal, how to attract and retain different customer segments, the more you can develop relevant compelling messages and offers. Predicting customer buying and product preferences and habits requires an analytical framework that enables you to discover meaningful patterns and relationships within customer data in order to do better message targeting, drive customer value and loyalty. Predictive models have been used in business to assess the risk or potential associated with a particular set of conditions as a way to guide decision making. Predictive models analyze past performance to assess how likely a customer is to exhibit a specific behavior in the future in order to improve marketing effectiveness. Marketing and sales professionals are beginning to capture and analyze many different types of customer data: attitudinal, behavioral, and 2 transactional related to purchasing and product preferences in order to make predictions about future buying behavior. -

Dimmwitted: a Study of Main-Memory Statistical Analytics

DimmWitted: A Study of MainMemory Statistical Analytics Ce Zhang†‡ Christopher Re´ † †Stanford University ‡University of WisconsinMadison {czhang, chrismre}@cs.stanford.edu ABSTRACT these methods are the core algorithm in systems such as ML- We perform the first study of the tradeoff space of access lib, GraphLab, and Google Brain. Our study examines an- methods and replication to support statistical analytics us- alytics on commodity multi-socket, multi-core, non-uniform ing first-order methods executed in the main memory of a memory access (NUMA) machines, which are the de facto Non-Uniform Memory Access (NUMA) machine. Statistical standard machine configuration and thus a natural target for analytics systems differ from conventional SQL-analytics in an in-depth study. Moreover, our experience with several the amount and types of memory incoherence that they can enterprise companies suggests that, after appropriate pre- tolerate. Our goal is to understand tradeoffs in accessing the processing, a large class of enterprise analytics problems fit data in row- or column-order and at what granularity one into the main memory of a single, modern machine. While should share the model and data for a statistical task. We this architecture has been recently studied for traditional study this new tradeoff space and discover that there are SQL-analytics systems [9], it has not been studied for sta- tradeoffs between hardware and statistical efficiency. We tistical analytics systems. argue that our tradeoff study may provide valuable infor- Statistical analytics systems are different from traditional mation for designers of analytics engines: for each system SQL-analytics systems. -

Data Analytics and Decision-Making in Education: Towards the Educational Data Scientist As a Key Actor in Schools and Higher Education Institutions

1 Data Analytics and Decision-Making in Education: Towards the Educational Data Scientist as a Key Actor in Schools and Higher Education Institutions Tommaso Agasisti Alex J. Bowers Politecnico di Milano School of Management Teachers College, Columbia University [email protected] [email protected] ABSTRACT:1 1990s, school principals, teachers, parents, stakeholders In this chapter, we outline the importance of data usage for and policy-makers started looking at quantitative data as improving policy-making (at the system level), an indispensable source for making decisions, formulating management of educational institutions and pedagogical diagnoses about strengths and weaknesses of institutions, approaches in the classroom. We illustrate how traditional and assessing the effects of initiatives and policies, etc. data analyses are becoming gradually substituted by more (Bowers, 2008; Mandinach, Honey, Light, & Brunner, sophisticated forms of analytics, and we provide a 2008; Wayman, 2005; Wayman, Stringfield, & classification for these recent movements (in particular Yakimowski, 2004). The diffusion of organizations and learning analytics, academic analytics and educational data initiatives such as Education for the Future mining). After having illustrated some examples of recent (http://eff.csuchico.edu) in the USA, or the DELECA – applications, we warn against potential risks of inadequate Developing Leadership Capacity for data-informed school analytics in education, and list a number of barriers that improvement project (http://www.deleca.org) in Europe, impede the widespread application of better data use. As give testimony to a growing attention to the clever, implications, we call for a development of a more robust intensive and informed use of data for improving schools’ professional role of data scientists applied to education, activities and results. -

Data Mining and Big Data Analytics (2 Credits)

Course: Data mining and Big Data analytics (2 credits) Instructors: Fosca Giannotti and Dino Pedreschi Learning goals The course provides an introduction to data mining and knowledge discovery from data, i.e., the analytical process of extracting useful information from large raw data generated and collected by various ICTs. The key data mining methods of clustering, classification and pattern mining are illustrated, together with practical tools for their execution. Next, we focus on Big Data, the digital traces of human activities at societal scale, which provide a powerful social microscope that together with social mining – the methods for discovering knowledge from these data – can help us understand and forecast many complex socio-economic phenomena. The key methods for Big Data sensing and acquisition are discussed, together with basics of social media mining and sentiment analysis, mobility data mining, social network mining, retail market data mining, and sport data mining. We conclude with an introduction to big data visualization. Syllabus 1. Data mining and the knowledge discovery process. Overview of data mining and machine learning techniques. Exemplar case studies in clustering, classification and pattern mining. 05.10.2015 (Dino & Fosca) 2. Data. Data types and formats. Exploratory data analysis and data understanding. Visual data exploration with KNIME. Data preparation. 06.10.2015 (Dino) 3. Clustering. Taxonomy of clustering concepts: distance-based (separation, centroids, contiguity), density-based, partitional vs. hierarchical. Methods for centroid-based clustering (k-means), hierarchical clustering (single, complete and average linkage), density-based clustering (DBSCAN). Practical clustering with KNIME. 07.10.2015 (Dino) 4. Classification and prediction models. Model learning and model validation. -

Evaluating Business Intelligence / Business Analytics Software for Use in the Information Systems Curriculum

Information Systems Education Journal (ISEDJ) 13 (1) ISSN: 1545-679X January 2015 Evaluating Business Intelligence / Business Analytics Software for Use in the Information Systems Curriculum Gary Alan Davis [email protected] Charles R. Woratschek [email protected] Computer and Information Systems Robert Morris University Moon Township, PA 15108 USA Abstract Business Intelligence (BI) and Business Analytics (BA) Software has been included in many Information Systems (IS) curricula. This study surveyed current and past undergraduate and graduate students to evaluate various BI/BA tools. Specifically, this study compared several software tools from two of the major software providers in the BI/BA field. The participants in the study evaluated each software tool according to three key criteria: 1) functionality, 2) ease of use, and 3) learning effectiveness. The “learning effectiveness” criterion was used to determine which BI/BA tools provided the most effective learning of BI/BA concepts in the IS classroom. The three criteria were used to develop recommendations for including specific BI/BA software tools in the IS curriculum. Based on the findings of the study, the authors recommend that colleges and universities consider the use of the IBM-Cognos suite of tools as a viable means for teaching BI/BA concepts in their Information Systems curricula. The results of the study are relevant to any college or university that currently includes (or is considering the inclusion of) Business Intelligence / Business Analytics concepts in its Information Systems curriculum. Keywords: Business Intelligence, Business Analytics, Software Evaluation, Information Systems Curriculum 1. INTRODUCTION students who are attending/have attended BI/BA-related courses. -

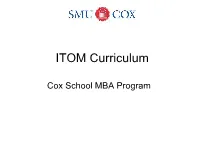

ITOM Advising

ITOM Curriculum Cox School MBA Program ITOM MBA Curriculum MBA CORE 6231 6205 6202 (Dec. SPECIAL TOPICS IN ITOM DIGITAL STRATEGY Modeling) 6203 (Ops Mgmt.) 6227 6206 BITCOIN & CRYPTO BUSINESS INTELLIGENCE 6226 OPERATIONS ANALYTICS 6207 SUPPLY CHAIN MGMT 6225 PROJECT MGMT 6208 BIG DATA 6224 SERVICE OPS 6212 DATA VISUALIZATION 6222 BUSINESS FORECASTING 6214 SPREADSHEET 6220 MODELS REVENUE MANAGEMENT 6215 6217 6218 6219 DATABASE DESIGN DATA MINING BUS. ANALYTICS SOCIAL MEDIA CONSULTING ANALYTICS ITOM 6205. Digital Strategy Amit Basu The Internet and other digital technologies have empowered customers and provided companies with significant opportunities. Other companies and industries face stronger competitive challenges from reduced barriers to entry and increased availability of information. This course introduces students to the technological and strategic issues relating to the use of digital technologies from a business perspective. Topics include Internet technologies, strategic implications of e-business, pricing strategy, information-intense products, online marketplaces, and issues of Internet privacy and security. ITOM 6215. Database Design for Business Applications Stewart Rogers This course covers fundamental issues in database creation and design. The course begins with mapping data collection in organizations onto a database with the objective of storing data consistently over time then proceeds to study methods for information extraction from databases. The use of homework assignments and an implementation project reinforce the design issues and the practical skills covered in the course. ITOM 6206. Business Intelligence Bryan Smith In this class, students gain hands-on experience with Data Warehouses and the peripheral systems commonly associated with them. The technical skills developed in the course are essential to success as a business analyst in a traditional enterprise. -

M.S. in Data Analytics

M.S. in Data Analytics What can I do with this major? Related Career Titles Search for potential position titles within multiple career industries. What is M.S. in Data Analytics? Possible Position Titles • • • Industries Data Analyst The Master of Science in Data Analytics is an application-based Systems Analyst Bioinformatics master’s program that allows Finance Data Architect motivated, ambitious students to Business Analyst Government Agencies learn the statistical and Digital Data Analytics Manager Healthcare computation tools to assemble, Financial Analyst Higher Education structure, and analyze large data Business Intelligence Developer Insurance sets; learn to manage large ETL Developer Information Technologies projects involving big data; and effectively communicate findings, Solutions Architect Robotics/Manufacturing visually, orally and in writing. The Telecommunications Systems Analytics Director Data Analytics program is designed Business Intelligence Manager to meet the increasing need for highly skilled data analysts who can analyze the growing amount of data confronting a variety of Professional Organizations disciplines, and transform it into Affiliate yourself with groups to network and learn about the field usable information for use in decision-making. The program is a Data Management Association International (DAMA) university-wide collaboration that Data Science Association delivers rigorous training in International Institute of Business Analysis (IIBA) statistical analysis and Digital Analytics Association -

Market Analysis: Data Science and Data Analytics

Market Analysis: Data Science and Data Analytics Prepared for Graceland University September 2018 In the following report, Hanover assesses demand for bachelor’s and master’s degree programs in data science, specifically highlighting demand trends for programs in the region including Iowa and Missouri. The report includes an examination of student and labor market demand, and an analysis of potential competitor programs. www.hanoverresearch.com Table of Contents Market Analysis: Data Science and Data Analytics Executive Summary Page 3 Degree Completions Analysis Page 5 Labor Market Analysis Page 6 Real-Time Job Postings Analysis Page 7 Competitor Analysis Page 8 Program Analysis Page 9 Research Centers & Funding Page 11 Program Benchmarking Page 13 2 Executive Summary Market Analysis: Data Science and Data Analytics Recommendations Regional Benchmark Analysis – Bachelor’s Based on an analysis of degree completions, and market competitors: Comparison of bachelor’s degree completions related to data science and relevant labor market to all completions and all occupations in the Plains Region Graceland University should continue exploring offering a data science program. Student demand for data science programs has been increasing 2024 rapidly at both the bachelor’s and master’s levels, and relevant occupations - Emerging Program High Growth Program are expected to grow faster than average. 2014 8.4%, 17.3% Before launching new data science programs, Graceland should develop a Rate, strategy to differentiate its offerings from an increasingly crowded 6.3% market. To stand out, Graceland could consider emphasizing unique features Regional Average, and specialization tracks when advertising or recruiting. Growth All Occupations Low Growth Program Established Program Key Findings and Program Demand Forecast Market For bachelor’s and master’s in data science programs in the Plains Region -1.6% Labor Regional Average, All Programs Student demand for bachelor’s and master’s programs in data science-related fields has been growing regionally and nationally. -

Analytics for Education

Analytics for Education JIME http://jime.open.ac.uk/2014/07 Sheila MacNeill [email protected] Lorna M. Campbell [email protected] Martin Hawksey [email protected] Centre for Interoperability Standards (CETIS), UK Abstract: This article presents an overview of the development and use of analytics in the context of education. Using Buckingham Shum's three levels of analytics, the authors present a critical analysis of current developments in the domain of learning analytics, and contrast the potential value of analytics research and development with real world educational implementation and practice. The article also focuses on the development of education content analytics and considers the legal and ethical implications of collecting and analysing educational data. Looking to the future, the authors also highlight new developments including exploration of data from massive open online courses (MOOCs). Keywords: Analytics, learning analytics, educational data mining, big data, paradata, educational data, learning technology Over the past five years a number of factors, not least the changing economic climate and its impact on the educational sector, have led to increased awareness of the need for greater research, analysis and understanding of all aspects of data relating to education. Researchers in the emerging fields ofeducational data mining (EDM) and learning analytics have been active in exploring the potential of data created through the processes of teaching and learning. In parallel with these developments, interest has also increased in the potential of "big data" and the application of business intelligence approaches to the educational sector. For example, can the recommendation systems commonly used by companies such as Amazon and Netflix be employed in educational contexts? The emergence of MOOCs (massive open online courses) can be seen as a key area where big data approaches can be applied to learning data sets due to the massive scale of participation.