Greenheart Group Limited 綠森集團有限公司

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Investor Presentation

INVESTOR PRESENTATION May 2012 Private & Confidential | Greenheart Group Disclaimer This document and subsequent discussion may contain certain forward-looking statements with respect to the financial conditions, results of operations and business of Greenheart Group Limited and its subsidiaries (“the Group”). These forward-looking statements represents the Group’s expectations or beliefs concerning future events and involving known and unknown risks and uncertainties which could cause actual results, performance or events to differ materially from those expressed or implied in such statements. ISCLAIMER D This document does not constitute, or form any part of, and is not to be construed as an offer, invitation or solicitation to buy or sell any securities of any of the companies referred to herein and any opinions expressed are subject to change without notice. The value of any investments referred to herein and the income derived there from may fall or rise against the investors’ interest and past performance is not a guide to the future. No representation or warranty, express or implied, is given by the Group or any of its directors, partners, officers, employees or professional advisers as to the accuracy, completeness or fairness of the information or the opinions contained in this document and no responsibilities or liabilities is accepted for any such information or opinions or errors or omissions. This document is being supplied to you solely for information and may not be reproduced or redistributed in whole or in part to any other person for any purpose. In addition, this document is being provided to you on the basis that it is kept confidential any information contained herein or otherwise made available in connection with the Group must remain confidential. -

Strengthening the Business Case for Sustainable Forest Management Barriers and Opportunities As Seen from Cameroon, Ghana, Indonesia, Myanmar and Suriname

Strengthening the business case for sustainable forest management Barriers and opportunities as seen from Cameroon, Ghana, Indonesia, Myanmar and Suriname Strengthening the business case for sustainable forest management Barriers and opportunities as seen from Cameroon, Ghana, Indonesia, Myanmar and Suriname Petra Westerlaan This report was commissioned by Stichting Bewust met Hout within the framework of the Dutch international corporate social responsibility Covenant ‘Promoting Sustainable Forest Management’, Working Group 4, ‘Strengthening the Business Case for Sustainable Forest Management’ Financial support has been recieved from the Ministry of Foreign Affairs of the Netherlands. The views expressed herein are the sole responsibility of the author and do not necessarily reflect the views of Tropenbos International, Stichting Bewust met Hout or the Ministry of Foreign Affairs of the Netherlands. Texts may be reproduced for non-commercial purposes, citing the source Citation: Westerlaan, P. 2019. Strengthening the business case for sustainable forest management. Barriers and opportunities as seen from Cameroon, Ghana, Indonesia, Myanmar and Suriname. Tropenbos International and Stichting Bewust met Hout: Wageningen, the Netherlands Author: Petra Westerlaan Layout: Juanita Franco (Tropenbos International) Photos: Cover - Borneo, Indonesia, ©Adobe Stock ; page 15 - Guyana, C. Benneker (TBI); page 21 - DR Congo, J. Bolongo (TBI); page 29 - Cameroon, R. Boot (TBI); page 37 - Ghana, M. Wit (TBI); page 46 - Indonesia, ©Adobe Stock; page -

Summary of Timber and Pulp Assessments – July 2020

Summary of timber and pulp assessments – July 2020 Overview SPOTT assesses 100 timber and pulp producers and traders on their public disclosure regarding their organisation, policies, and practices related to environmental, social and governance (ESG) best practice, to facilitate corporate engagement and increase industry transparency. SPOTT encourages stakeholders to engage with producers, as company policies and commitments may not always translate into effective implementation on the ground. SPOTT scores timber and pulp producers using up to 175 ESG indicators across 10 categories: Average score: 22.6% Sustainability policy and leadership 24.1% Landbank, FMUs and mills 26.2% Certification standards 14.0% Deforestation and biodiversity 26.7% HCV, HCS and impact assessment 24.2% Soils, fire and GHG emissions 14.7% Water, chemical and waste management 18.0% Community, land and labour rights 28.0% Smallholders and suppliers 14.3% Governance and grievances 21.2% Average scores ZSL recognises that companies are at different stages of their sustainability journey. SPOTT assesses the transparency and content of company disclosure regarding: Organisation: operations, assets and management structure Policy: policies, commitments and processes to guide operations on the ground Practice: activities undertaken to actively progress towards Organisation Policy Practice targets and implement policies and commitments on the ground 22.0% 25.3% 19.5% Key findings • The average score of companies is 22.6% in July 2020, compared to 20.4% during the last assessment of timber and pulp companies in July 2019. This represents an increase despite more stringent indicator requirements this year to include a greater focus on company reporting of practices and progress towards commitments. -

Growing Intelligently JUNE 14, 2011 FORWARD-LOOKING STATEMENTS

CORPORATE PRESENTATION FIRST QUARTER 2011 RESULTS Growing Intelligently JUNE 14, 2011 FORWARD-LOOKING STATEMENTS This presentation contains projections and forward-looking statements which reflect management’ s expectations regarding Sino-Forest’s future growth, results of operations, performance, business prospects and opportunities. Such statements are not guarantees of future performance of Sino-Forest and are subject to risks and uncertainties that could cause actual results and the Corporation’s plans and objectives to differ materially from those expressed in the forward-looking statements. Such risks and uncertainties include, but are not limited to --- our ability to acquire rights to additional standing timber, ability to meet the expected plantation yields, the cyclical nature of the forest products industry and price fluctuation in and the demand and supply of logs, reliance on authorized intermediaries, key customers, suppliers and third party service providers, our ability to operate our production facilities on a profitable basis, changes in currency exchange rates and interest rates, and PRC economic, political and social conditions, changes in political and forestry policies in PRC, Suriname and New Zealand, changes in climate conditions affecting the growth of trees conditions, other factors not currently viewed as material could cause actual results to differ materially from those described in the forward-looking statements. All amounts are expressed in U.S. dollars. Sino-Forest Corporation First Quarter 2011 2 CONTENT -

Multi-Perspective Analysis of Drivers of Deforestation, Forest Degradation En

BACKGROUND STUDY FOR REDD+ IN SURINAME: MULTI-PERSPECTIVE ANALYSIS OF DRIVERS OF DEFORESTATION, FOREST DEGRADATION AND BARRIERS TO REDD+ ACTIVITIES Strengthening national capacities of Suriname for the elaboration of the national REDD+ strategy and the design of its implementation framework Background study for REDD+ in Suriname: Multi-Perspective Analysis of Drivers of Deforestation, Forest Degradation and Barriers to REDD+ Activities Acknowledgements This report was prepared by the consultancy firm UNIQUE forestry and land use for the National Institute for Environment and Development in Suriname (NIMOS) and the Foundation for Forest Management and Production Control (SBB). The study benefits from collaboration between the consultant team and the staff at SBB, NIMOS and the United Nations Development Programme (UNDP). We extend our appreciation to all those who contributed their time and knowledge, especially those stakeholders who were consulted during the inception mission and leading up to the validation workshop (see annex 2) and in the national workshop on 8 December 2016. Please cite as follows: NIMOS, SBB and UNIQUE (2017). Background study for REDD+ in Suriname: Multi-perspective analysis of drivers of deforestation, forest degradation and barriers to REDD+ activities. Paramaribo, Suriname. Disclaimer The content of this report does not necessarily reflect the official policy or position of any agency of the Government of Suriname. The purpose of the report is to feed the REDD+ readiness process with background information that will be further analysed and considered when developing the national REDD+ strategy for Suriname. Views and opinions expressed in this report, as well as assumptions made within the analysis, are those of the consultants or their informants and should not be seen as definite facts. -

Annual Information Form for the Year Ended December 31, 2010 March 31, 2011

SINO-FOREST CORPORATION Annual Information Form for the year ended December 31, 2010 March 31, 2011 TABLE OF CONTENTS Page THE CORPORATION ……. .......................................................................................................................... 1 CORPORATE STRUCTURE .......................................................................................................................... .1 GENERAL DEVELOPMENT OF THE BUSINESS ..................................................................................... ..4 Overview……… ………………………… ........................................................................................... 4 Strategic Business Units ..................................................................................................................... ..4 Wood Fibre Operations ................................................................................................................... 4 Plantation Fibre ...................................................................................................................... 4 Trading of Wood Logs ........................................................................................................... 4 Manufacturing and Other Operations ............................................................................................. 4 Historical Milestones ............................................................................................................................ 5 DESCRIPTION OF THE BUSINESS ............................................................................................................. -

Latin American Experiences in Natural Forest Management Concessions

Forestry Policy and Institutions Working Paper 35 Latin American Experiences in Natural Forest Management Concessions 2016 Latin American Experiences in Natural Forest Management Concessions Steve Gretzinger Zak Resources Food and Agriculture Organization of the United Nations Rome, 2016 Disclaimer The Forestry Policy and InstitutionsWorking Papers report on issues in the work programme of Fao. These working papers do not reflect any official position of FAO. Please refer to the FAO Web site (www.fao.org/forestry) for official information. The purpose of these papers is to provide early information on ongoing activities and programmes, to facilitate dialogue and to stimulate discussion. The Forest Economics, Policy and Products Division works in the broad areas of strenghthening national institutional capacities, including research, education and extension; forest policies and governance; support to national forest programmes; forests, poverty alleviation and food security; participatory forestry and sustainable livelihoods. For further information please contact: For further information, please contact: Cesar Sabogal Forestry Officer Forestry Department, FAO Viale Delle terme di Caracalla 00153 Rome, Italy Email: [email protected] Website: www.fao.org/forestry Comments and feedback are welcome. For quotation: FAO.2016. Latin American Experiences in Natural Forest Management Concessions, by, Steve Gretzinger. Forestry Policy and Institutions Working Paper No. 35. Rome. Table of Contents Acronyms .............................................................................................................................................. -

Summary of Timber and Pulp Assessments – July 2018

Summary of timber and pulp assessments – July 2018 Overview SPOTT assesses 50 timber and pulp producers on the public disclosure of their policies, operations and commitments to environmental, social and governance (ESG) best practice, to facilitate corporate engagement and increase industry transparency. SPOTT encourages stakeholders to engage with producers, as company policies and commitments may not always translate into effective implementation on the ground. SPOTT scores timber and pulp producers using up to 110 ESG indicators across 10 categories: Average score: 31.1% Sustainability policy and leadership 42.2% Landbank, FMUs and mills 39.3% Deforestation and biodiversity 39.5% HCV, HCS and impact assessment 23.5% Soils, fire and GHG emissions 21.2% Water, chemical and waste management 20.0% Community, land and labour rights 41.9% Certification standards 15.8% Smallholders and suppliers 15.8% Governance and grievances 26.8% 29 / 50 16 / 50 5 / 50 companies companies companies score score score < 33% 33-66% > 66% Key findings • The average score of companies is 31.1% in July 2018, compared to 38.9% during the last assessment of timber and pulp companies in November 2017. • 5/50 (10%) companies have an overall score of at least 66% (higher transparency), compared to 3/24 (13%) in November 2017. • 29/50 (58%) companies have a score below 33% (lower transparency), compared to 11/24 (46%) in the last assessment round. • 17/24 (71%) companies assessed in 2017 saw an increase in their scores in 2018 – the average change in score was +3.9%. • 7/24 (29%) companies assessed in 2017 saw a decrease in their scores in 2018 – the average change in score was -3.6%. -

Court File No.: CV-11-431153-00CP

Court File No.: CV-11-431153-00CP ONTARIO SUPERIOR COURT OF JUSTICE BETWEEN: THE TRUSTEES OF THE LABOURERS’ PENSION FUND OF CENTRAL AND EASTERN CANADA and THE TRUSTEES OF THE INTERNATIONAL UNION OF OPERATING ENGINEERS LOCAL 793 PENSION PLAN FOR OPERATING ENGINEERS IN ONTARIO Plaintiffs - and - SINO-FOREST CORPORATION, ERNST & YOUNG LLP, ALLEN T.Y. CHAN, W. JUDSON MARTIN, KAI KIT POON, DAVID J. HORSLEY, WILLIAM E. ARDELL, JAMES P. BOWLAND, JAMES M.E. HYDE, EDMUND MAK, SIMON MURRAY, PETER WANG, GARRY J. WEST, PÖYRY (BEIJING) CONSULTING COMPANY LIMITED, CREDIT SUISSE SECURITIES (CANADA), INC., TD SECURITIES INC., DUNDEE SECURITIES CORPORATION, RBC DOMINION SECURITIES INC., SCOTIA CAPITAL INC., CIBC WORLD MARKETS INC., MERRILL LYNCH CANADA INC., CANACCORD FINANCIAL LTD. and MAISON PLACEMENTS CANADA INC. Defendants Proceeding under the Class Proceedings Act, 1992 STATEMENT OF CLAIM (NOTICE OF ACTION ISSUED JULY 20, 2011) 2 TO: Sino-Forest Corporation 1208-90 Burnhamthorpe Rd W Mississauga, ON L5B 3C3 AND TO: David Horsley Sino-Forest Corporation 1208-90 Burnhamthorpe Rd W Mississauga, ON L5B 3C3 AND TO: Allen Chan Sino-Forest Corporation 1208-90 Burnhamthorpe Rd W Mississauga, ON L5B 3C3 AND TO: William Ardell Sino-Forest Corporation 1208-90 Burnhamthorpe Rd W Mississauga, ON L5B 3C3 AND TO: James Bowland Sino-Forest Corporation 1208-90 Burnhamthorpe Rd W Mississauga, ON L5B 3C3 AND TO: James Hyde Sino-Forest Corporation 1208-90 Burnhamthorpe Rd W Mississauga, ON L5B 3C3 AND TO: Edmund Mak Sino-Forest Corporation 1208-90 Burnhamthorpe Rd W -

Summary of Timber and Pulp Assessments – July 2019

Summary of timber and pulp assessments – July 2019 Overview SPOTT assesses 97 timber and pulp producers and traders on the public disclosure of their policies, operations and commitments to environmental, social and governance (ESG) best practice, to facilitate corporate engagement and increase industry transparency. SPOTT encourages stakeholders to engage with producers, as company policies and commitments may not always translate into effective implementation on the ground. SPOTT scores timber and pulp producers using up to 131 ESG indicators across 10 categories: Average score: 20.4% Sustainability policy and leadership 21.6% Landbank, FMUs and mills 25.2% Deforestation and biodiversity 24.5% HCV, HCS and impact assessment 20.0% Soils, fire and GHG emissions 15.0% Water, chemical and waste management 13.8% Community, land and labour rights 26.3% Certification standards 12.6% Smallholders and suppliers 17.4% Governance and grievances 17.0% Key findings • The average score of companies is 20.4% in July 2019, compared to 31.1% during the last assessment of timber and pulp companies in July 2018. This decrease is mainly explained by the larger number of companies assessed, including 21 companies that do not have a website and therefore demonstrate no transparency. • The average score of 491 companies also assessed in 2018 is 33.3% compared to 31.1% last year. • The average score of 24 companies also assessed in 2017 and 2018 is 39.8% compared to 38.9% in 2018, and 37.1% in 2017. • 24/49 (49%) companies assessed in 2018 saw an increase in their scores in 2019 – the average change in score was +7.1%. -

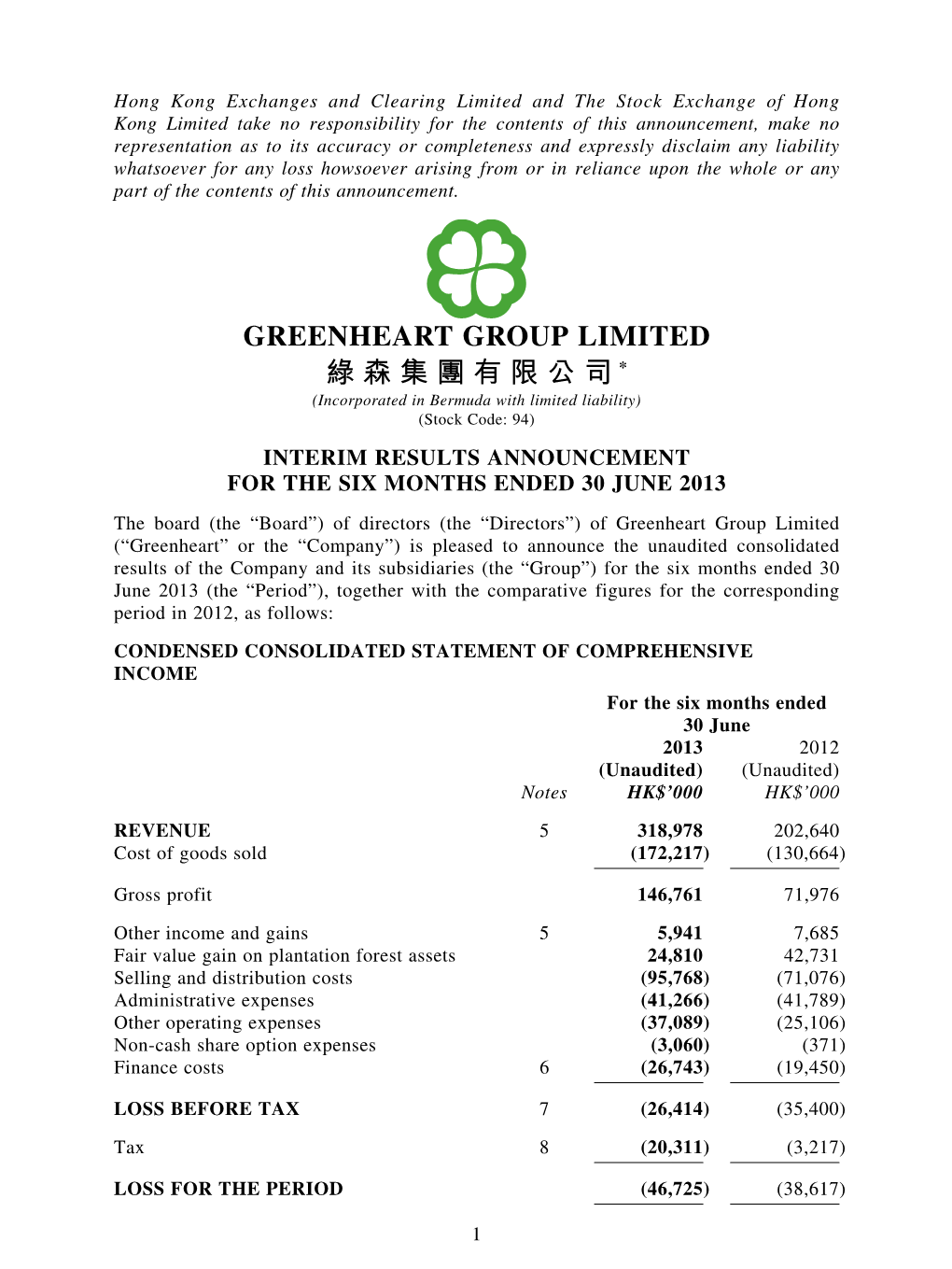

GREENHEART GROUP LIMITED 綠心集團有限公司 (Incorporated in Bermuda with Limited Liability) (Stock Code: 94)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. GREENHEART GROUP LIMITED 綠心集團有限公司 (Incorporated in Bermuda with limited liability) (Stock Code: 94) ANNUAL RESULTS ANNOUNCEMENT FOR THE YEAR ENDED 31 DECEMBER 2017 The board (the “Board”) of directors (the “Directors”) of Greenheart Group Limited (“Greenheart” or the “Company”) is pleased to announce the audited consolidated results of the Company and its subsidiaries (together the “Group”) for the year ended 31 December 2017 (the “Year”), together with the comparative figures, as follows: CONSOLIDATED STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME For the year ended 31 December 2017 2017 2016 Notes HK$’000 HK$’000 REVENUE 6 606,896 543,708 Cost of sales (486,257) (403,988) Gross profit 120,639 139,720 Other income 7 696 2,469 Other gains and losses 7 (34,710) (5,571) Fair value gain on plantation forest assets 130,801 65,109 Selling and distribution costs (104,292) (120,710) Administrative expenses (52,308) (60,517) Finance costs 8 (20,010) (21,480) PROFIT (LOSS) BEFORE TAX 9 40,816 (980) Income tax expense 10 (478) (26,849) PROFIT (LOSS) FOR THE YEAR 40,338 (27,829) 1 2017 2016 Notes HK$’000 HK$’000 OTHER COMPREHENSIVE INCOME Item that may be reclassified subsequently -

March 26, 2012 Order Dated March 26, 2012

SCHEDULE “A” Court File No.: CV-11-431153-00CP ONTARIO SUPERIOR COURT OF JUSTICE BETWEEN : THE TRUSTEES OF THE LABOURERS’ PENSION FUND OF CENTRAL AND EASTERN CANADA, THE TRUSTEES OF THE INTERNATIONAL UNION OF OPERATING ENGINEERS LOCAL 793 PENSION PLAN FOR OPERATING ENGINEERS IN ONTARIO, SJUNDE AP-FONDEN, DAVID GRANT and ROBERT WONG Plaintiffs - and - SINO-FOREST CORPORATION, ERNST & YOUNG LLP, BDO LIMITED (formerly known as BDO MCCABE LO LIMITED), ALLEN T.Y. CHAN, W. JUDSON MARTIN, KAI KIT POON, DAVID J. HORSLEY, WILLIAM E. ARDELL, JAMES P. BOWLAND, JAMES M.E. HYDE, EDMUND MAK, SIMON MURRAY, PETER WANG, GARRY J. WEST, PÖYRY (BEIJING) CONSULTING COMPANY LIMITED, CREDIT SUISSE SECURITIES (CANADA), INC., TD SECURITIES INC., DUNDEE SECURITIES CORPORATION, RBC DOMINION SECURITIES INC., SCOTIA CAPITAL INC., CIBC WORLD MARKETS INC., MERRILL LYNCH CANADA INC., CANACCORD FINANCIAL LTD., MAISON PLACEMENTS CANADA INC., CREDIT SUISSE SECURITIES (USA) LLC and MERRILL LYNCH, PIERCE, FENNER & SMITH INCORPORATED (successor by merger to Banc of America Securities LLC) Defendants Proceeding under the Class Proceedings Act, 1992 FRESH AS AMENDED STATEMENT OF CLAIM (NOTICE OF ACTION ISSUED JULY 20, 2011) 2 TO: Sino-Forest Corporation 1208-90 Burnhamthorpe Rd W Mississauga, ON L5B 3C3 AND TO: David Horsley Sino-Forest Corporation 1208-90 Burnhamthorpe Rd W Mississauga, ON L5B 3C3 AND TO: Allen Chan Sino-Forest Corporation 1208-90 Burnhamthorpe Rd W Mississauga, ON L5B 3C3 AND TO: William Ardell Sino-Forest Corporation 1208-90 Burnhamthorpe Rd W Mississauga, ON L5B 3C3 AND TO: James Bowland Sino-Forest Corporation 1208-90 Burnhamthorpe Rd W Mississauga, ON L5B 3C3 AND TO: James Hyde Sino-Forest Corporation 1208-90 Burnhamthorpe Rd W Mississauga, ON L5B 3C3 AND TO: Edmund Mak Sino-Forest Corporation 1208-90 Burnhamthorpe Rd W Mississauga, ON L5B 3C3 AND TO: W.