Report on the Finance Fair C

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Market Study on Micro Finance Services in Zambia 2014

Agri-ProFocus Zambia A Market Study on Microfinance Services in Zambia A Market Study on Microfinance Services in Zambia FINAL REPORT December 2014 ©Agri-ProFocus Zambia (APF), 2014. All rights reserved. Agri-ProFocus Zambia encourages the use and distribution of material presented in this report provided that the original text is not altered, that the original source is properly and fully acknowledged, and that the objective of redistribution is not for commercial gain. Correct citation. Agri-ProFocus Zambia (APF), 2014. A Market Study on Microfinance Services in Zambia. APF, Lusaka, Zambia. Table of Contents Acknowledgements .................................................................................................................................... IV Executive Summary .................................................................................................................................... V Abbreviations ................................................................................................................................................ VI List of tables ............................................................................................................................................... VII 1.0 Introduction ....................................................................................................................................... 0 1.1 Background to the Study .................................................................................................... 0 1.2 Methodology ................................................................................................................................ -

EML Contracts Profile 2017.Cdr

50 ANNIVERSARY 1965 - 2015 www.eml-eis.com VALUE SERVICE QUALITY LOYALTY PRICE Contracting Reliable Quality Service since 1968 in the field of Electrical Contracting SUPPORT Zambia. COMPANY 2017-8 PROFILE 1 company details Name of the Company: Electrical Maintenance Lusaka Ltd. Address: Head Office Plot 195 Luanshya Road, East End Off Great North End Lusaka, 10101 Zambia Contact Details: +260 211 227824 +260 237014 - FAX [email protected] [email protected] [email protected] website: www.eml-eis.com 50 ANNIVERSARY 1965 - 2015 Contracts Department history 2 HISTORY: FOUNDER AND OWNER Mr George Narder achieved electrical and mechanical engineering qualifications in Italy following which he worked in Switzerland for 6 years. In 1963 he arrived in Zambia as part of a testing and commissioning team for the newly built Kariba Power Station and has lived in Zambia ever since. Mr Narder started an electrical engineering business in 1965, registered as Electrical Maintenance Lusaka LTD (EML). He has managed and run the company as its CEO for more than 50 years. Under his direct entrepreneurial management, EML has grown into one of the largest and most respected electrical and electronic engineering companies in Zambia. The company benefits from more than 60 years of his passion, knowledge and expertise. EML is proud to have participated in many facets of the social and Mr George Narder, Comm economic development of the country ELECTRICAL MAINTENANCE LUSAKA (EML) MOTO “Always with our customers” To continue improving on our 50 years of reliable quality service to the Zambian industry. our vision our mission e strive to remain one of Zambia’s ur added value is to provide quality leading and most diverse electrical products, service and training for all cWontracting, manufacturing, retail and electricalO requirements across the country, training companies. -

Accelerating Digital Transformation in Zambia DIGITAL ECONOMY DIAGNOSTIC REPORT

Accelerating Digital Transformation in Zambia DIGITAL ECONOMY DIAGNOSTIC REPORT Accelerating Digital Transformation in Zambia DIGITAL ECONOMY DIAGNOSTIC REPORT © 2020 International Bank for Reconstruction and Development / The World Bank 1818 H Street NW Washington DC 20433 Telephone: 202-473-1000 Internet: www.worldbank.org This work is a product of the staff of The World Bank with external contributions. The findings, interpretations, and conclusions expressed in this work do not necessarily reflect the views of The World Bank, its Board of Executive Directors, or the governments they represent. The World Bank does not guarantee the accuracy of the data included in this work. The boundaries, colors, denominations, and other information shown on any map in this work do not imply any judgment on the part of The World Bank concerning the legal status of any territory or the endorsement or acceptance of such boundaries. RIGHTS AND PERMISSIONS The material in this work is subject to copyright. Because The World Bank encourages dissemination of its knowledge, this work may be reproduced, in whole or in part, for noncommercial purposes as long as full attribution to this work is given. Any queries on rights and licenses, including subsidiary rights, should be addressed to the Office of the Publisher, The World Bank, 1818 H Street NW, Washington, DC 20433, USA; fax: 202-522-2422; e-mail: [email protected]. Cover Design: Brian Majoni Layout Design: Diego Catto Photo Credit: AfriDelivery, BongoHive, Women’s Entrepreneurial Access Center -

Caleb M Fundanga: Important Building Stones for Successful Organisations in Zambia

Caleb M Fundanga: Important building stones for successful organisations in Zambia Remarks by Dr Caleb M Fundanga, Governor of the Bank of Zambia, on the occasion of the opening of Investrust Bank PLC 2007 Management Strategic Planning Session, Mfuwe, 11 April 2007. * * * • The Managing Director • Heads of Departments • Members of the Investrust Bank Plc Management Team First of all, I wish to take this opportunity to say congratulations on your 10th anniversary attained on 19th September, 2006. Considering that the Bank opened its doors at a very difficult time when confidence in locally owned banks was at its lowest, reaching 10 years is no mean achievement. The Bank of Zambia is proud to be associated with your achievements and can assure you of our full support now and the future. It was only on 30th March 2007 that Bank of China also celebrated 10 years of operations in Zambia. It is a great privilege and honour for me to officiate at this wonderful and history making occasion in your bank. History making in the sense that you have gathered in this conference to chart a path for your Financial Institution to ensure its sustained growth. Decisions you will make in this gathering are critical to all your stake holders. The public is keenly following your growth and performance. Allow me to remind you of the following issues which I believe are important building stones for successful organizations. 1. Dynamic leadership Your role in Investrust Bank Plc is very crucial. As the Management team, you are providing leadership. Your way of doing things must be exemplary, inspirational, and analytical, with drive and with integrity. -

Issuer Investrust Bank

SENS ANNOUNCEMENT (the “Notice” or “Announcement”) ISSUER INVESTRUST BANK PLC (“INVESTRUST”) [Incorporated in the Republic of Zambia] Company registration number:119900021906 Share Code: INVESTRUST ISIN: ZM0000000235 Authorised by Brian Msidi – Company Secretary SPONSOR Stockbrokers Zambia Limited [Founder member of the Lusaka Securities Exchange] [Regulated and licensed by the Securities and Exchange Commission of Zambia] Contact Person: Chitalu Andrew Kabalika Contact Number: +260-211-232456 Website: www.sbz.com.zm APPROVAL The captioned Notice or Announcement has been approved by: i. the Lusaka Securities Exchange ii. the Securities and Exchange Commission iii. Stockbrokers Zambia Limited DISCLAIMER AND RISK WARNING The Notice or Announcement contained herein contains information that may be of a price sensitive nature. Investors are advised to seek the advice of their investment advisor, stockbroker, or any professional duly licensed by the Securities and Exchange Commission of Zambia to provide securities advice. ISSUED: 02 December 2020 INVESTRUST BANK PLC [Incorporated in the Republic of Zambia] Company registration number: 119900021906 Share Code: INVESTRUST ISIN: ZM0000000235 [“INVESTRUST” or “the Bank” or “the Company”] APPOINTMENT OF CHIEF FINANCIAL OFFICER In accordance with Section 3.59 of the Lusaka Securities Exchange Listing Rules, the Board of Directors of Investrust Bank Plc (“the Board”) wishes to announce the appointment of Mrs Matongo Syamujaye as Chief Financial Officer of the company with effect from 6th November, 2020. Mrs Syamujaye is a Fellow member of the Zambia Institute of Chartered Accountants and a Fellow of the UK’s Association of Chartered Certified Accountants with over 16 years’ experience in the Financial Services in Senior Management positions and was until recently the Acting Chief Financial Officer of the Bank. -

A Case Study of Investrust Bank Plc B

ASSESSMENT OF CUSTOMER SERVICE STRATEGIES ON CUSTOMER RETENTION IN LOCAL COMMERCIAL BANKS: A CASE STUDY OF INVESTRUST BANK PLC By RAJESHVARY JOSHI COMPUTER NUMBER 715809897 A Dissertation Submitted To The University Of Zambia In Partial Fulfilment Of The Requirements For The Award Of The Degree Of Master Of Business Administration (MBA). THE UNIVERSITY OF ZAMBIA IN COLLABORATION OF THE ZIMBABWEAN OPEN UNIVERSITY LUSAKA 2018 i COPY RIGHT DECLARATION All rights reserved. No part of this thesis may be reproduced, stored in any retrieval system, or transmitted in any form or by any means, electronic, mechanical photocopying, recording, scanning or otherwise without the prior written permission of the author or the University of Zambia and Zimbabwean Open University (UNZAZOU). ©RAJESHVARY JOSHI (2018). i DECLARATION I, Rajeshvary Joshi do solemnly declare that this dissertation represents my own work and it has not been previously submitted for a degree at this or any other university. All the work of other people has been duly acknowledged. Signed: .................................................. Date: ..................................................... ii CERTIFICATE OF APPROVAL This dissertation of Rajeshvary Joshi (computer number 715809897) is approved as fulfilling part of the requirements for the award of the degree of Masters of Business Administration by the University of Zambia in collaboration of Zimbabwean Open University. Signed------------------------------------------------- Date-------------------------------------------- Signed------------------------------------------------ Date-------------------------------------------- Signed---------------------------------------------- Date-------------------------------------------- iii DEDICATION This project is dedicated to my late mother, Mrs. Sharda Devi Joshi. She was a pillar of strength for me throughout my life. Although you are not here to see me finish the race I will always value the motivation you gave me, you kept me going at all times even though you were battling for your life. -

An Investigation Into the Effectiveness of Business Continuity Plans for Commercial Banks in Zambia

An investigation into the effectiveness of Business Continuity Plans for Commercial Banks in Zambia AN INVESTIGATION INTO THE EFFECTIVESS OF BUSINESS CONTINUITY PLANS FOR COMMERCIAL BANKS IN ZAMBIA By MUSONDA SIMWAYI In partial fulfillment of the requirements for the Masters Degree in Disaster Risk Management At the University of the Free State Department of Agricultural Economics Centre for Disaster Risk Management Education and Training DiMTEC Study Leader: Mr A.J. Jordaan 2008 An investigation into the effectiveness of Business Continuity Plans for Commercial Banks in Zambia A Dissertation submitted to the University of the Free States in Partial fulfillment of requirements for the Masters Degree in Disaster Risk Management 2008 i An investigation into the effectiveness of Business Continuity Plans for Commercial Banks in Zambia COPYRIGHT NOTICE This documentation on commercial banks in Zambia and the Information on Business Continuity Plans in the current report and any information contained therein is strictly confidential and production or distribution in any form, including verbally, is strictly prohibited. No part of this document may be reproduced or transmitted in any form or by any means without prior written permission from the Disaster Management, Training and Education Centre (DiMTEC), University of the Free State in South Africa. ii An investigation into the effectiveness of Business Continuity Plans for Commercial Banks in Zambia DEDICATION This work is dedicated to my wife Josephine Muleya and my children Mable Namwayi, Mumba Namwayi, Suwilanji Simwayi and Lenganji Simwayi for their sacrifices during my studies. It is also dedicated to my late father, Moffat Simwayi, for his encouragement and humility throughout the time we shared together. -

EML Company Profile 2017.Cdr

50 ANNIVERSARY 1965 - 2015 www.eml-eis.com VALUE SERVICE QUALITY LOYALTY PRICE EML at a Glance Electrical Maintenance Lusaka Ltd has had a 50 year presence in Zambia and is currently SUPPORT the most diverse electrical and electronic engineering company in Zambia. EML has a strong focus on continuous improvement which is reflected in our sustained customer support, growth, referrals and stability COMPANY 2017 PROFILE 1 company details Name of the Company: Electrical Maintenance Lusaka Ltd. about Address: Head Office Plot 195 Luanshya Road, East End Off Great North End Lusaka, 10101 Zambia 50 Contact Details: +260 211 227824 ANNIVERSARY +260 237014 - FAX 1965 - 2015 [email protected] [email protected] [email protected] website: www.eml-eis.com SS Factory Contracts Department Sales and Admin goals & objectives 2 about products To continue delivering high quality, state of the art products through our well established, loyal international partnerships. manufacturing To continue to deliver superior products through our modern production facility and ensure that quality is maintained at an uncompromised high standard. construction To continue to deliver quality electrical infrastructure on time and within budget. Our priority is to maintain the highest level of safety throughout all our company’s operations. human resources To continue to attract, support and reward our staff while providing an environment of development and growth. customers To ensure our customers always receive the most professional and friendly service paired with the highest quality products in a fast evolving market. 3 history HISTORY: FOUNDER AND OWNER Mr George Narder achieved electrical and mechanical engineering qualifications in Italy following which he worked in about Switzerland for 6 years. -

GOVERNMENT of the REPUBLIC of ZAMBIA Bidding Document For

Ministry of Health GOVERNMENT OF THE REPUBLIC OF ZAMBIA Tender No. MoH/GFATM/ORD/003/2019 Bidding Document for the TENDER FOR THE PROVISION OF INSURANCE BROKERAGE SERVICES FOR THE MINISTRY OF HEALTH Head, Procurement & Supplies Unit Ministry of Health Ground Floor, Ndeke House Haile Selassie Avenue, Longacres P. O. Box 30205 Lusaka, ZAMBIA Telephone: +260-211-251404 Facsimile: +260-211-253949 JUNE, 2019 ii Table of Contents Preface: Invitation for Bids Part I – Bidding Procedures...................................................... Error! Bookmark not defined. Section I. Instructions to Bidders ..................................................................................5 Section II. Bidding Data Sheet.....................................................................................27 Section III. Bidding Forms .........................................................................................33 Part II – Activity Schedule ........................................................ Error! Bookmark not defined. Section IV. Activity Schedule.....................................................................................44 Part III – Conditions of Contract and Contract Forms .....................................................47 Section V. General Conditions of Contract ................................................................49 Section VI. Special Conditions of Contract ................................................................64 Section VII. Contract Forms .......................................................................................67 -

The Experience of Zambia

39659 SERVICES T R A D E & Public Disclosure Authorized DEVELOPMENT THE EXPERIENCE OF ZAMBIA Editors Aaditya Mattoo • Lucy Payton Public Disclosure Authorized Public Disclosure Authorized Public Disclosure Authorized SERVICES TRADE and development SERVICES TRADE and development The Experience of Zambia Edited by Aaditya Mattoo and Lucy Payton A copublication of Palgrave Macmillan and the World Bank © 2007 The International Bank for Reconstruction and Development / The World Bank 1818 H Street NW Washington DC 20433 Telephone: 202-473-1000 Internet: www.worldbank.org E-mail: [email protected] All rights reserved 1 2 3 4 10 09 08 07 A copublication of The World Bank and Palgrave Macmillan. Palgrave Macmillan Houndmills, Basingstoke, Hampshire RG21 6XS and 175 Fifth Avenue, New York, N. Y. 10010 Companies and representatives throughout the world Palgrave Macmillan is the global academic imprint of the Palgrave Macmillan division of St. Martin’s Press, LLC and of Palgrave Macmillan Ltd. Macmillan® is a registered trademark in the United States, United Kingdom and other countries. Palgrave® is a registered trademark in the European Union and other countries. This volume is a product of the staff of the International Bank for Reconstruction and Development / The World Bank. The findings, interpretations, and conclusions expressed in this volume do not necessarily reflect the views of the Executive Directors of The World Bank or the governments they represent. The World Bank does not guarantee the accuracy of the data included in this work. The boundaries, colors, denominations, and other information shown on any map in this work do not imply any judgement on the part of The World Bank con- cerning the legal status of any territory or the endorsement or acceptance of such boundaries. -

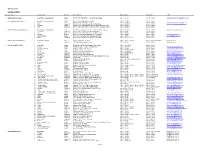

Branch Network Statistics

Bank Supervision Bank Branch Network No. Institution Branch Name Province Street Address Phone Number Fax Number e-Mail 1 AB Bank Zambia Limited 1 Head Office / Lusaka Branch Lusaka Plot No. 7393, Chainda Place, Off Cairo Road, Lusaka 260 211 220835 260 211 220840 [email protected] 2 Access Bank Zambia Limited 1 Head Office / Lusaka Branch Lusaka Plot 682, Cairo Road Northend, Lusaka 260 211 227931-7 260 211 227931 2 Acacia Lusaka Plot No. 22768, Acacia Park, Lusaka 260 211 255965-6 260 211 255981 [email protected] 3 Kitwe Copperbelt Plot No. 493/494, Union Building, Zambia Way, Kitwe 260 212 228673/4 260 212 228675 [email protected] 4 Longacres Lusaka Stand No. 2166, Haile Selassie Avenue, Longacres Shopping Centre 261 211 252217 261 211 252207 5 Ndola Copperbelt Plot No. 3055, Shops 9,10 & 11, Mpelembe House, Broadway, Ndola 262 212 620886/7 262 212 620888 3 African Banking Corporation (Z) Ltd 1 Head Office / Lusaka Branch Lusaka Plot 746B, Pyramid House, Cnr Church & Nasser Road, Ridgeway 260 211 257970-6 260 211 227969 [email protected] 2 Kasumbalesa Copperbelt Plot No. 1884, Kasumbalesa Road, Chililabombwe 260 212 643002 260 212 643003 3 Kitwe Copperbelt Stand No. 9, Plot 1082, Piano house, City Square, Kitwe 260 212 220744 260 212 230383 4 Livingstone Southern Shop No. 3, Mosi-O-tunya Shopping Centre, Livingstone 260 213 320681 260 213 320681 [email protected] 5 Lumumba Road Lusaka Plot No. 5013, Lumumba Road, Opposite City Market 260 211 230796 260 211 230794 [email protected] 6 Ndola Copperbelt Plot No. -

(ROSC) Corporate Governance Public Disclosure Authorized

Report on the Observance of Standards and Codes (ROSC) Corporate Governance Public Disclosure Authorized Corporate Governance Public Disclosure Authorized Country Assessment Zambia December 2006 Public Disclosure Authorized Public Disclosure Authorized Overview of the Corporate Governance ROSC Program WHAT IS CORPORATE GOVERNANCE? THE CORPORATE GOVERNANCE ROSC ASSESSMENTS Corporate governance refers to the structures and processes for the direction and control of com - Corporate governance has been adopted as one panies. Corporate governance concerns the relation - of twelve core best-practice standards by the inter - ships among the management, Board of Directors, national financial community. The World Bank is the controlling shareholders, minority shareholders and assessor for the application of the OECD Principles of other stakeholders. Good corporate governance con - Corporate Governance. Its assessments are part of tributes to sustainable economic development by the World Bank and International Monetary Fund enhancing the performance of companies and (IMF) program on Reports on the Observance of increasing their access to outside capital. Standards and Codes (ROSC). The OECD Principles of Corporate Governance The goal of the ROSC initiative is to identify provide the framework for the work of the World weaknesses that may contribute to a country’s eco - Bank Group in this area, identifying the key practical nomic and financial vulnerability. Each Corporate issues: the rights and equitable treatment of share - Governance ROSC assessment reviews the legal and holders and other financial stakeholders, the role of regulatory framework, as well as practices and com - non-financial stakeholders, disclosure and trans - pliance of listed firms, and assesses the framework parency, and the responsibilities of the Board of relative to an internationally accepted benchmark.