Aeon Delight / 9787

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Aeon Report Report 20172017 Creating a Future Where Communities Flourish Trees Grow And

Aeon Report Report 20172017 Creating a future where communities flourish trees grow and AEON Report 2017 1 Aeon Basic Principles Pursuing peace, respecting humanity, and contributing to local communities, always with the customer’s point of view as its core. Peace The Customer People Community The word (Aeon) has its origins in a Latin root meaning “eternity.” The customers’ beliefs and desires comprise the central core of our philosophy. At Aeon, our eternal mission as a corporate group is to benefit our customers, and our operations are thus customer-focused to the highest degree. “Peace” Aeon is a corporate group whose operations are dedicated to the pursuit of peace through prosperity. “People” Aeon is a corporate group that respects human dignity and values personal relationships. “Community” Aeon is a corporate group rooted in local community life and dedicated to making a continuing contribution to the community. On the basis of the Aeon Basic Principles, Aeon practices its “Customer-First” philosophy with its everlasting innovative spirit. Editorial Policy Aeon Co., Ltd. believes its business activities contribute to a from the aspects of the environment and society. In addition, sustainable society. To further deepen its stakeholders’ with regard to its seven priority issues, including the four understanding of its business activities, from the current society-related priority issues newly specified in a materiality fiscal year Aeon has decided to publish an Integrated Report assessment conducted during fiscal 2016, this section reports that incorporates the Aeon Environmental and Social Report. in detail on management approaches, progress toward key The first half of the Report introduces the orientation of performance indicators and individual activities. -

Retail Foods

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: 12/22/2016 GAIN Report Number: JA6522 Japan Retail Foods Retail Sector Approved By: Rachel Nelson, ATO Director Prepared By: Sumio Thomas Aoki, Senior Marketing Specialist Interns Amani Kidd, Takaaki Takeichi, Dianna Santodonato Report Highlights: Despite a high level of spending from a record influx of inbound tourists to Japan, the Japanese retail sector overall suffered in 2015 in response to lingering effects of the April 2014 consumption tax hike, a relatively weaker yen, and lower consumer spending overall. Competition for shelf space in intense, and convenience stores are a dynamic and powerful player in this sector. Post: Tokyo ATO Table of Contents Executive Summary Section1. Japan Retail Food Summary Structure and Overall Value International Competition and Imports Regional Sales Retailer Trends Advantages and Challenges table Section II. Roadmap for Market Entry Entry Strategy Market Structure Supermarkets Specialty Supermarkets Convenience Stores, Gas stations, Kiosks Department Store Food Sales Company Profiles Section III. Competition Section IV. Consumer Trends and Best Product Prospects Section V. Post Contact and Further Information Executive Summary The Japanese yen weakened in 2015, averaging 122.05 yen per 1 U.S. dollar. Consumer confidence rose slightly at the end of the year to 42.6 percent in December, from 39.2 percent at the beginning of the year, however consumption was weaker in 2015 than 2014. This reflected a lingering effect of the first consumption tax increase in 17 years. -

Global Equity Fund Description Plan 3S DCP & JRA MICROSOFT CORP

Global Equity Fund June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA MICROSOFT CORP 2.5289% 2.5289% APPLE INC 2.4756% 2.4756% AMAZON COM INC 1.9411% 1.9411% FACEBOOK CLASS A INC 0.9048% 0.9048% ALPHABET INC CLASS A 0.7033% 0.7033% ALPHABET INC CLASS C 0.6978% 0.6978% ALIBABA GROUP HOLDING ADR REPRESEN 0.6724% 0.6724% JOHNSON & JOHNSON 0.6151% 0.6151% TENCENT HOLDINGS LTD 0.6124% 0.6124% BERKSHIRE HATHAWAY INC CLASS B 0.5765% 0.5765% NESTLE SA 0.5428% 0.5428% VISA INC CLASS A 0.5408% 0.5408% PROCTER & GAMBLE 0.4838% 0.4838% JPMORGAN CHASE & CO 0.4730% 0.4730% UNITEDHEALTH GROUP INC 0.4619% 0.4619% ISHARES RUSSELL 3000 ETF 0.4525% 0.4525% HOME DEPOT INC 0.4463% 0.4463% TAIWAN SEMICONDUCTOR MANUFACTURING 0.4337% 0.4337% MASTERCARD INC CLASS A 0.4325% 0.4325% INTEL CORPORATION CORP 0.4207% 0.4207% SHORT-TERM INVESTMENT FUND 0.4158% 0.4158% ROCHE HOLDING PAR AG 0.4017% 0.4017% VERIZON COMMUNICATIONS INC 0.3792% 0.3792% NVIDIA CORP 0.3721% 0.3721% AT&T INC 0.3583% 0.3583% SAMSUNG ELECTRONICS LTD 0.3483% 0.3483% ADOBE INC 0.3473% 0.3473% PAYPAL HOLDINGS INC 0.3395% 0.3395% WALT DISNEY 0.3342% 0.3342% CISCO SYSTEMS INC 0.3283% 0.3283% MERCK & CO INC 0.3242% 0.3242% NETFLIX INC 0.3213% 0.3213% EXXON MOBIL CORP 0.3138% 0.3138% NOVARTIS AG 0.3084% 0.3084% BANK OF AMERICA CORP 0.3046% 0.3046% PEPSICO INC 0.3036% 0.3036% PFIZER INC 0.3020% 0.3020% COMCAST CORP CLASS A 0.2929% 0.2929% COCA-COLA 0.2872% 0.2872% ABBVIE INC 0.2870% 0.2870% CHEVRON CORP 0.2767% 0.2767% WALMART INC 0.2767% -

Vanguard Total World Stock Index Fund Annual Report October 31, 2020

Annual Report | October 31, 2020 Vanguard Total World Stock Index Fund See the inside front cover for important information about access to your fund’s annual and semiannual shareholder reports. Important information about access to shareholder reports Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your fund’s annual and semiannual shareholder reports will no longer be sent to you by mail, unless you specifically request them. Instead, you will be notified by mail each time a report is posted on the website and will be provided with a link to access the report. If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. You may elect to receive shareholder reports and other communications from the fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you invest directly with the fund, by calling Vanguard at one of the phone numbers on the back cover of this report or by logging on to vanguard.com. You may elect to receive paper copies of all future shareholder reports free of charge. If you invest through a financial intermediary, you can contact the intermediary to request that you continue to receive paper copies. If you invest directly with the fund, you can call Vanguard at one of the phone numbers on the back cover of this report or log on to vanguard.com. Your election to receive paper copies will apply to all the funds you hold through an intermediary or directly with Vanguard. -

Annual Report 2007

Fully Global, Truly Local Annual Report 2007 Fiscal year ended February 20, 2007 A leading-edge, global-level operating and management infrastructure raises the quality and satisfaction of shopping with ÆON. 155 ÆON companies in Japan and overseas apply a “glocal (global + local) strategy”: global-class management systems tailored to local needs in a drive to be the best local retailer wherever we operate. Our business is based on large-scale shopping centers serving their respective communi- ties with tailored services comprising GMS (general merchandise store) retail, supermarkets, drugstores, home centers, convenience stores, specialty stores, shopping-mall development, financial services, entertainment, food services and more. ÆON is growing through internal expansion and strategic tie-ups that add new services, synergy and sales. Being the best local retailer means being the best at meeting local needs, with shuttle buses, environmental action and direct community involvement. Contents Highlights for the year 2 Financial section 29 The President’s message 4 Board of directors and executive officers 67 The Chairman’s message 6 Corporate responsibility 68 Review of operations 12 Corporate history 73 Environmental and social contribution activities 24 Major group companies 77 Shareholder information 77 ÆON ANNUAL REPORT 2007 1 Applying unique management know-how to develop and manage shopping malls centered on each community, ÆON is building a uniquely positioned retail network in Japan and overseas. In fact, ÆON shopping mall facilities -

In-Progress Review Draft

IN-PROGRESS REVIEW DRAFT Pre-release copy of significant commercial value to industry Document contains incomplete & in-progress research for comment For named reviewer/firm only; do not duplicate or distribute RECIPIENT FIRM TARGET MARKET OPPORTUNITIES IN ASIA FOR BEEF Part of Asia Market Success, April 2016 INHERENT LIMITATIONS This work was commissioned by the Department of Agriculture and qualifications and limitations included in the Coriolis Document Forest Food Council photo or (3) are low resolution, complete Food Western Australia (DAFWA), with funding through the State and Coriolis Commentary, and are subject to significant uncertainties product/brand for illustrative purposes used under fair dealing/fair Government’s Royalties for Regions program and prepared by and contingencies, some of which, if not all, are outside the control of use for both “research and study” and “review and criticism”. Our Coriolis. This work is based on secondary market research, analysis of Coriolis; and usage of them complies with Australian law or their various license information available or provided to Coriolis by our client, and a range agreements (© Dollar Photo Club). of interviews with industry participants and industry experts. Coriolis e. any Coriolis Commentary accompanying the Coriolis document is have not independently verified this information and make no an integral part of interpreting the Coriolis document. Consideration representation or warranty, express or implied, that such information of the Coriolis document will be incomplete if it is reviewed in the COPYRIGHT is accurate or complete. absence of the Coriolis Commentary and Coriolis conclusions may be misinterpreted if the Coriolis document is reviewed in absence of the Copyright © Western Australian Agriculture Authority, 2016 Projected market information, analyses and conclusions contained Coriolis Commentary. -

Japan Retail Foods Retail Foods Japan

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: 12/26/2017 GAIN Report Number: JA 7520 Japan Retail Foods Japan Retail Foods Approved By: Morgan Perkins, Director Prepared By: Sumio Thomas Aoki, Senior Marketing Specialist Marika Miyamoto, Intern Report Highlights: The total value of all retail food and beverage (F&B) sales was 52.2 trillion yen or $474.9 billion dollars. In the Japanese retail industry, supermarkets (with floor space under 1500 m2) which include specialty shops and local stores, still represent the bulk of the retail food market. Food & beverage sales through drug stores as well as the internet are increasing. Ready to eat meals or take home food items represent a growth area that has helped supermarkets, convenience stores and other retail outlets throughout the food & beverage industry to increase revenue. Post: Tokyo ATO Table of Contents Executive Summary Section I. Japan Retail Food Summary A. Structure and Overall Value B. International Competition and Imports C. Regional Retailer Trends Overview D. Retailer Trends and Overview E. Advantages and Challenges Section II: Road Map for Market Entry A. Entry Strategy B. Market Structure C. Company Profiles Section III: Consumer Trends and Best Product Prospects A. Consumer Trends Section IV: Post Contact and Further Information Executive Summary According to the Ministry of Internal Affairs and Communications, Japan’s GDP was US$4,383.6 billion in 2015, making it the world’s third largest economy, with a 5.9% share of the world GDP. -

Vanguard FTSE International Index Funds Annual

Annual Report | October 31, 2020 Vanguard FTSE International Index Funds Vanguard FTSE All-World ex-US Index Fund Vanguard FTSE All-World ex-US Small-Cap Index Fund See the inside front cover for important information about access to your fund’s annual and semiannual shareholder reports. Important information about access to shareholder reports Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your fund’s annual and semiannual shareholder reports will no longer be sent to you by mail, unless you specifically request them. Instead, you will be notified by mail each time a report is posted on the website and will be provided with a link to access the report. If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. You may elect to receive shareholder reports and other communications from the fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you invest directly with the fund, by calling Vanguard at one of the phone numbers on the back cover of this report or by logging on to vanguard.com. You may elect to receive paper copies of all future shareholder reports free of charge. If you invest through a financial intermediary, you can contact the intermediary to request that you continue to receive paper copies. If you invest directly with the fund, you can call Vanguard at one of the phone numbers on the back cover of this report or log on to vanguard.com. -

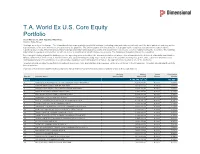

T.A. World Ex U.S. Core Equity Portfolio As of March 31, 2021 (Updated Monthly) Source: State Street Holdings Are Subject to Change

T.A. World Ex U.S. Core Equity Portfolio As of March 31, 2021 (Updated Monthly) Source: State Street Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. Your use of this website signifies that you agree to follow and be bound by the terms and conditions -

AEON REPORT 2019 Contents

AEON REPORT 2019 Contents 03 The DNA of Aeon 08 Growth Path of the Aeon Group 10 Aeon’s Value Creation Model 12 CEO Message 14 CFO Message 16 Shareholder Returns 17 Progress under the Aeon Group Medium-Term Management Policies 24 Message from the Director in Charge of CSR and Communication 26 Response to Climate Change by Scenario Analysis 30 Natural Capital 32 Manufactured Capital 34 Human Resources 36 Message from Executive Officer in Charge of Human Resources 38 Social and Relationship Capital 40 Dialogue with Stakeholders 42 Board of Directors and Executive Officers 44 Messages from Outside Directors 46 Corporate Governance 52 Compliance (Corporate Ethics) 54 Risk Management 55 Information Security 56 Financial and Non-Financial Highlights 58 An Overview of Aeon 59 Global Expansion 60 Corporate Data Editorial Policy We believe that our business activities contribute to the formation of a sustainable soci- ety. To further stakeholders’ understanding of its business activities, since 2017 Aeon has been issuing the Aeon Report, which includes the Aeon Environmental and Social Report. However, in 2019, we issued two separate reports: the Aeon Report, which focuses on business management direction and strategies, and the Sustainability Data Book, which includes details of sustainability initiatives in the areas of the environment and society. This report presents different facets of Aeon’s business management, such as busi- ness management direction and strategies, while also including non-financial informa- tion on CSR activities and so forth. Further, this report was prepared with reference to the International Integrated Reporting Framework of the International Integrated Reporting Council (IIRC). -

Retail Supermarket Globalization: Who’S Winning?

RETAIL SUPERMARKET GLOBALIZATION: WHO’S WINNING? October 2001 CORIOLISRESEARCH Coriolis Research Ltd. is a strategic market research firm founded in 1997 and based in Auckland, New Zealand. Coriolis primarily works with clients in the food and fast moving consumer goods supply chain, from primary producers to retailers. In addition to working with clients, Coriolis regularly produces reports on current industry topics. Recent reports have included an analysis of the impact of the arrival of the German supermarket chain Aldi in Australia, answering the question: “Will selling groceries over the internet ever work?,” and this analysis of retail supermarket globalization. ! The lead researcher on this report was Tim Morris, one of the founding partners of Coriolis Research. Tim graduated from Cornell University in New York with a degree in Agricultural Economics, with a specialisation in Food Industry Management. Tim has worked for a number of international retailers and manufacturers, including Nestlé, Dreyer’s Ice Cream, Kraft/General Foods, Safeway and Woolworths New Zealand. Before helping to found Coriolis Research, Tim was a consultant for Swander Pace (now part of Kurt Salmon) in San Francisco, where he worked on management consulting and acquisition projects for clients including Danone, Heinz, Bestfoods and ConAgra. ! The coriolis force, named for French physicist Gaspard Coriolis (1792-1843), may be seen on a large scale in the movement of winds and ocean currents on the rotating earth. It dominates weather patterns, producing the counterclockwise flow observed around low- pressure zones in the Northern Hemisphere and the clockwise flow around such zones in the Southern Hemisphere. It is the result of a centripetal force on a mass moving with a velocity radially outward in a rotating plane.